#Equal access to bank credit

Text

Good news for women!

By Cecilia Macaulay

BBC News

Sierra Leone has passed what has been described as a "ground-breaking" law to improve women's rights.

President Julius Maada Bio made an apology to women for their poor treatment in the past: "For so long we haven't been fair to you," he said.

The law states that 30% of public and private jobs must be reserved for women.

The Minister of Gender and Children's Affairs says women have been "crying" out "for years" for this change.

"It means a lot to women in Sierra Leone," Manty Tarawalli told the BBC's Newsday radio programme, adding that no other sub-Saharan African country had passed such a law.

The law lets girls who are still at school know "there are opportunities for them in Sierra Leone for employment for business" and for them to contribute to the economy, Ms Tarawalli said.

Under the new Gender Equality and Women's Empowerment Act (GEWE), women also benefit from ringfenced senior positions in the workplace, at least 14-weeks of maternity leave, equal access to bank credit and training opportunities.

There are harsh repercussions for employers who do not stick to the new gender ratios, including hefty fines of £2,000 ($2,500), and even potential prison time for institutions like banks that do not give women fair access to financial support. It is thought this will make it easier for women to start their own businesses.

The government says the employment law will apply to any business with more than 25 employees, but a final decision has not yet been made.

Ms Tarawalli said the move was "important" but that "more steps will have to be taken before the country can say fairness has been achieved across the genders".

Discrimination against women in the workplace is a "big issue," according to the minister, and the new law will "change the status quo," she said.

For Sierra Leone to become a middle-income country it must engage the 52% of the population who are women in the economy, Ms Tarawalli added.

Prior to the law, the United Nations sexual and reproductive health agency (UNFPA) said that "progress has been made in expanding opportunities for women and girls" but warned that "gender inequality and denial of women's rights are still prevalent at all levels in Sierra Leonean society".

As for gender equality in the continent as a whole, UN Women also says thatprogress has been made, but "the majority of women work in insecure, poorly paid jobs, with few opportunities for advancement".

#Sierra Leone#President Julius Maada Bio#Jobs reserved for women#Minister of Gender and Children's Affairs#Gender Equality and Women's Empowerment Act (GEWE)#14 week maternity leave#Equal access to bank credit#Jail men who don’t give women fair access to financial support

204 notes

·

View notes

Text

Women's Not So Distant History

This #WomensHistoryMonth, let's not forget how many of our rights were only won in recent decades, and weren’t acquired by asking nicely and waiting. We need to fight for our rights. Here's are a few examples:

📍 Before 1974's Fair Credit Opportunity Act made it illegal for financial institutions to discriminate against applicants' gender, banks could refuse women a credit card. Women won the right to open a bank account in the 1960s, but many banks still refused without a husband’s signature. This allowed men to continue to have control over women’s bank accounts. Unmarried women were often refused service by financial institutions entirely.

📍 Before 1977, sexual harassment was not considered a legal offense. That changed when a woman brought her boss to court after she refused his sexual advances and was fired. The court stated that her termination violated the 1974 Civil Rights Act, which made employment discrimination illegal.⚖️

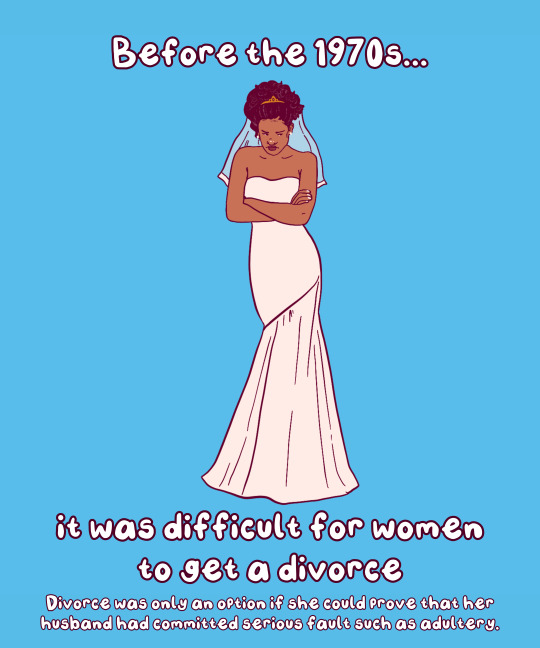

📍 In 1969, California became the first state to pass legislation to allow no-fault divorce. Before then, divorce could only be obtained if a woman could prove that her husband had committed serious faults such as adultery. 💍By 1977, nine states had adopted no-fault divorce laws, and by late 1983, every state had but two. The last, New York, adopted a law in 2010.

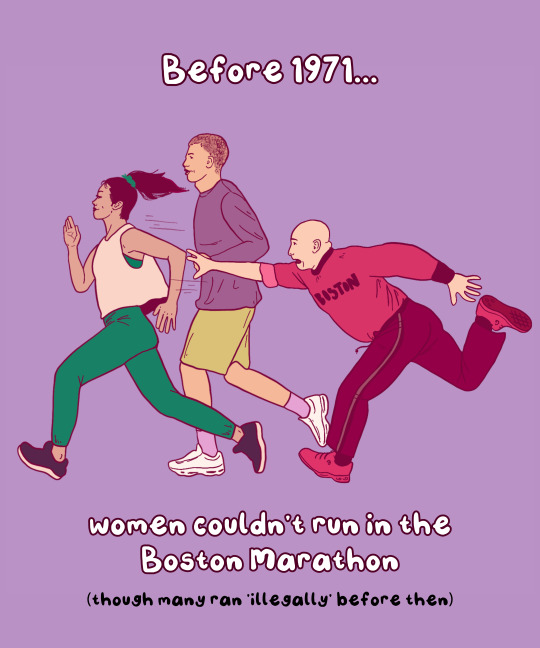

📍In 1967, Kathrine Switzer, entered the Boston Marathon under the name "K.V. Switzer." At the time, the Amateur Athletics Union didn't allow women. Once discovered, staff tried to remove Switzer from the race, but she finished. AAU did not formally accept women until fall 1971.

📍 In 1972, Lillian Garland, a receptionist at a California bank, went on unpaid leave to have a baby and when she returned, her position was filled. Her lawsuit led to 1978's Pregnancy Discrimination Act, which found that discriminating against pregnant people is unlawful

📍 It wasn’t until 2016 that gay marriage was legal in all 50 states. Previously, laws varied by state, and while many states allowed for civil unions for same-sex couples, it created a separate but equal standard. In 2008, California was the first state to achieve marriage equality, only to reverse that right following a ballot initiative later that year.

📍In 2018, Utah and Idaho were the last two states that lacked clear legislation protecting chest or breast feeding parents from obscenity laws. At the time, an Idaho congressman complained women would, "whip it out and do it anywhere,"

📍 In 1973, the Supreme Court affirmed the right to safe legal abortion in Roe v. Wade. At the time of the decision, nearly all states outlawed abortion with few exceptions. In 1965, illegal abortions made up one-sixth of all pregnancy- and childbirth-related deaths. Unfortunately after years of abortion restrictions and bans, the Supreme Court overturned Roe in 2022. Since then, 14 states have fully banned care, and another 7 severely restrict it – leaving most of the south and midwest without access.

📍 Before 1973, women were not able to serve on a jury in all 50 states. However, this varied by state: Utah was the first state to allow women to serve jury duty in 1898. Though, by 1927, only 19 states allowed women to serve jury duty. The Civil Rights Act of 1957 gave women the right to serve on federal juries, though it wasn't until 1973 that all 50 states passed similar legislation

📍 Before 1988, women were unable to get a business loan on their own. The Women's Business Ownership Act of 1988 allowed women to get loans without a male co-signer and removed other barriers to women in business. The number of women-owned businesses increased by 31 times in the last four decades.

Free download

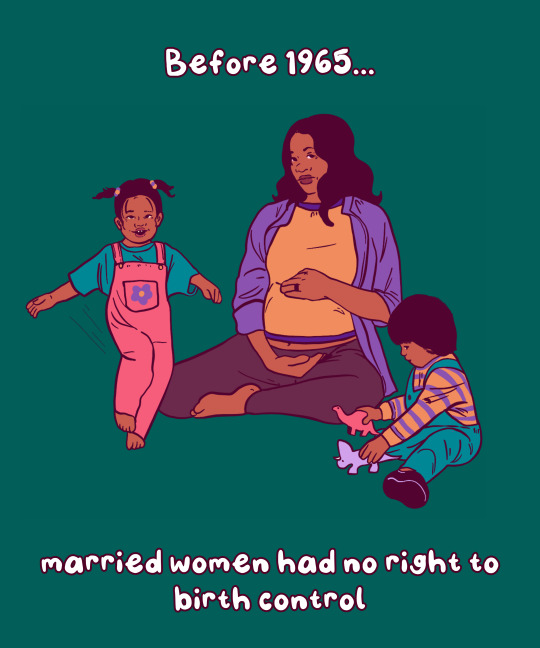

📍 Before 1965, married women had no right to birth control. In Griswold v. Connecticut (1965), the Supreme Court ruled that banning the use of contraceptives violated the right to marital privacy.

📍 Before 1967, interracial couples didn’t have the right to marry. In Loving v. Virginia, the Supreme Court found that anti-miscegenation laws were unconstitutional. In 2000, Alabama was the last State to remove its anti-miscegenation laws from the books.

📍 Before 1972, unmarried women didn’t have the right to birth control. While married couples gained the right in 1967, it wasn’t until Eisenstadt v. Baird seven years later, that the Supreme Court affirmed the right to contraception for unmarried people.

📍 In 1974, the last “Ugly Laws” were repealed in Chicago. “Ugly Laws” allowed the police to arrest and jail people with visible disabilities for being seen in public. People charged with ugly laws were either charged a fine or held in jail. ‘Ugly Laws’ were a part of the late 19th century Victorian Era poor laws.

📍 In 1976, Hawaii was the last state to lift requirements that a woman take her husband’s last name. If a woman didn’t take her husband’s last name, employers could refuse to issue her payroll and she could be barred from voting.

📍 It wasn’t until 1993 that marital assault became a crime in all 50 states. Historically, intercourse within marriage was regarded as a “right” of spouses. Before 1974, in all fifty U.S. states, men had legal immunity for assaults their wives. Oklahoma and North Carolina were the last to change the law in 1993.

📍 In 1990, the Americans with Disability Act (ADA) – most comprehensive disability rights legislation in U.S. history – was passed. The ADA protected disabled people from employment discrimination. Previously, an employer could refuse to hire someone just because of their disability.

📍 Before 1993, women weren’t allowed to wear pants on the Senate floor. That changed when Sen. Moseley Braun (D-IL), & Sen. Barbara Mikulski (D-MD) wore trousers - shocking the male-dominated Senate. Their fashion statement ultimately led to the dress code being clarified to allow women to wear pants.

📍 Emergency contraception (Plan B) wasn't approved by the FDA until 1998. While many can get emergency contraception at their local drugstore, back then it required a prescription. In 2013, the FDA removed age limits & allowed retailers to stock it directly on the shelf (although many don’t).

📍 In Lawrence v. Texas (2003), the Supreme Court ruled that anti-cohabitation laws were unconstitutional. Sometimes referred to as the ‘'Living in Sin' statute, anti-cohabitation laws criminalize living with a partner if the couple is unmarried. Today, Mississippi still has laws on its books against cohabitation.

#art#feminism#women's history#women's history month#iwd2024#international women's day#herstory#educational#graphics#history#70s#80s#rights#women's rights#human rights

15K notes

·

View notes

Text

Unveiling Financial Injustice: Denied Banking Access in Marginalized Communities

#denied banking access#financial disparities#banking inequality#equal banking rights#jay z#one united bank#bank black#black owned business#navy federal credit union

1 note

·

View note

Text

I don't really understand why the already extremely niche genre of heisting games is currently being front run by "futuristic" heists when the entire idea runs counter to the appeal of heisting.

Heisting games at their core are about big well thought out hits on banks and mcguffins in worlds where it "Makes sense" for that to be possible. It's about STEALING **THINGS**.

I mean. Most heists are based on movie heists which are almost all based in the 80s and 90s because those are periods of time in which Super Mega Finger Print Eye Scan Bio Lock safety measures don't exist, and 99.99% of assets are PHYSICAL- as in, cash, or jewelry, or drugs- physical things you can hold in your hand-something for you to STEAL that would be irreplaceable if stolen.

The shift payday 3 and the upcoming den of wolves or whatever seem to be so focused on- of "Modernizing" heisting, or in den's case future-izing, doesn't make sense.

Today everything is digital, it's all credit cards and fake assets that a bank says exist.

You CAN steal in this environment, but let's be honest, it's lame.

Modern "heist level" theft is just corps scamming poor people or companies stealing hours.

You have to apply a layer of fiction that makes it fail the "makes sense" aspect of a hit by saying "Oh, this CRYPTO WALLET is worth TEN BILLION and we'll be able to sell it EASILY" I don't care. Where's the cash. Where's the Thing I'm stealing. I know crypto idiots get scammed all the time, but where's the physical item I grab and it's money, I'm phishing a password, where's the fun thing I'm taking.

I go in and plug a usb in or steal a hard drive and then get told it was a major super big successful heist- who cares, where's the Thing I stole.

We live in a time of so many safeties put around assets, so much value being digitized- so as a dev you have to justify why stealing something can even be done when it's just numbers in a database we have no access to, and then the justification often falls apart because if we have access... then take it all? How is our ownership being respected when we make such a hit when we stole /nothing/?

We went from stealing millions of dollars worth of gold to stealing the credit card info of everyone with a PSN account and I'm supposed to say both of these scenarios are equally fun in a heisting game.

So you end up with scifi concepts like cracking bio-locks to steal an SSD that is somehow not backed up anywhere and has the sole copy stored in a physical safe at a warehouse because?????

And then with dens, we're getting into scifi brainhack level territory and the objects we steal are being further obfuscated from reality- LET ME STEAL THINGS.

MAKE THE FUCKING GAME IN A PERIOD OF TIME WHERE THINGS EXIST THAT CAN BE STOLEN.

IT'S A HEISTING GAME, I WANT TO STEAL **THINGS** NOT *IDEAS* AND *BIZARRELY ONE OF A KIND UNBACKED UP CODE* AND WHATEVER ELSE NUMBER-IN-COMPUTER NONSENSE.

Sigh.

I hope den is good. GTFO was fun.

10 notes

·

View notes

Text

my thoughts on the 1975 in malaysia + how to help!

(help links at bottom, reblog please)

seeing lots of people mad at queer malaysians for being mad at matty. they have every right to be mad at him, because yes we think what he did was moving and i honestly believe it was, but the repercussions of what they did will likely effect queer malaysian people negatively. the malaysian gov are using the 1975 as a scapegoat for, in turn, making it even harder to exist as a queer person in malaysia.

if they’re speaking out and saying it isn’t going to effect them as positive as our western view believes it will, it’s important we accept that and research how we can truly help the queer community over there.

however, matty and ross’ actions have been seen worldwide and i’m seeing a lot of people coming forward and saying they weren’t aware malaysian government was as bad as it is for queer people. this is important.

what the boys did has sparked a worldwide discussion and shone a light for how dangerous it truly is for queer malaysian people. the kiss itself may not help the situation over there (which i don’t think it was intended to do), but it will guide more people into discovering the inhumane laws for our community in malaysia, and ultimately, guide us over in our respective countries to helping the queer people in south east asia.

—

here’s how we can help the queer community over in malaysia:

(all found on the1975 reddit forum so credit to 505cherry on reddit, but i wanted to post the separate links for ease)

https://pluho.org/donate/ (mental health support)

https://justiceforsisters.wordpress.com/about/ (support for trans malaysian women)

^ (provides support for queer people and allies, inc. queer voices, stories and views)

BANK DETAILS FOR DONATIONS TO QUEER LAPIS (use remitly app to send):

564717527444

MAYBANK

PERTUBUHAN JARINGAN KEBAJIKAN KOMUNITI

choose express speed --> for delivery method put bank deposit --> choose Maybank --> then put the account details from above --> put PERTUBUHAN JARINGAN KEBAJIKAN in the first name box, and KOMUNITI in the last one

credit to Alternative-Map-181 on reddit for those instructions

—

https://linktr.ee/ptfmalaysia (provides HIV/AIDS education, prevention, care and support programmes)

^ (support group for queer, gay and bi youth, creating a safe space with guidance)

https://legaldignity.org/donation/ (promotes fair and equal access to justice for all lgbtq+ people)

—

important: i take no credit for finding any of these links, i saw it being shared from the 1975 reddit on twitter but i haven’t seen any information on tumblr so i wanted to spread it further! thank you so much to the reddit user (505cherry) who shared these organisations with us.

#lgbtq support#how to help#the 1975#matty healy#queer community#lgbtq+#lgbt pride#the 1975 malaysia#matty 1975#ross macdonald#adam hann#george daniel#support the lgtbq community#gay#safe space

78 notes

·

View notes

Note

how do you reconcile being a feminist, single, and a high-value woman? maybe I'm misunderstanding the concept but I always thought HVW and hypergamy were all very centered on seeking a male partner.

Hi love! Great question. I think your curiosity offers a great opportunity to dive a bit more into my personal views and philosophy.

I believe that the goal of feminism is to protect all women and provide them legal protection, structural resources, and social power to live equitably in society. In my eyes, a high-value woman is one who is unapologetically self-respecting and sets her life up in a way to allows her to work towards goals that meet her needs in all areas of life.

Hypergamy, by its modern definition, is the idea that women "date up" to intertwine their sexual relationships with men to those who offer more or equally high social, financial, or sexual capital to them. The traditional idea of hypergamy was exclusively referred to as "marrying up" as marriage was the only way women could achieve most resources (like a bank account, credit card, housing, and certain medical care – it's so terrifying, honestly).

In the latter case, hypergamy is nearly synonymous with centralizing men. Before women gained certain freedoms (in the U.S. this was mostly in the 1960-70s), centralizing men was a survival mechanism, not a preference or act of self-imposed oppression.

I believe in the modern world where women can have their own bank accounts, careers, and access to birth control (the latter one is an anxiety-inducing topic at this point in time, ugh), women are given the choice to be hypergamous either while centralizing or decentralizing men.

I believe that you can uphold hypergamous standards in your dating life without centralizing men in your life. For me, personally, my relationship or dating status has no bearing on how happy or successful I am in my life. No man (or lack of one in my life) will ever determine my self-worth or reflect my progress in life. My metrics of fulfillment and accomplishment stem from thriving in my professional life, staying in good health, practicing consistently healthy habits (WFPB diet, regular exercise, mental health hygiene, sexual wellness, mindfulness, self-care, etc.), and maintaining nourishing friendships. Dating and my interactions with men (in non-platonic ways) are fun ways I enrich my life, so I believe this mentality embodies the modern – albeit hyper-progressive – definition of hypergamy. Remaining single allows me to enjoy all of the ways men can uplevel my life – socially, financially (to the degree some nighttime activities, such as dinners, drinks, car services, club fees, etc. are paid for – no sugaring activities or anything), and sexually without the aspects of dating men that would contradict my sense of self-respect or autonomy. I'm not personally designed to be a man's therapist or feel like I should have to include a man's needs in all of my life or day-to-day decisions because we're sexually involved with each other. I have a strict vetting process regarding who I will entertain in my dating/sexual life to ensure they're adding value to my life and there's mutual compatibility considering the type of arrangement we're both seeking.

Personally, I believe the only way to maintain equity in dating is to remain single, which allows me to meet all of my other standards in life. I will never sacrifice my life goals for a man, but I do not believe that means you have to approach dating or sexual relationships from a black-and-white perspective. However, if I'm going to date men (which can be a headache for certain), I believe they need to enrich my life in some way – whether that's interesting conversations, gaining business acumen, social relationships, fun sexual experiences, or just learning about different cultures/world perspectives.

From my observations, women who use hypergamy as an excuse to centralize their life or aspirations around a man are glamorizing regressive/oppressive ideologies (like submitting to a partner or relying on men financially) as a last attempt to uphold the patriarchy as women wake up to the fact that having to do all of society's emotional labor plus having to contort ourselves in a world designed for men, namely in our professional lives, is not the truest form of feminism out there (not to mention it's lack of intersectionality, but that's a whole other rant lol). I don't use the "hypergamy" tag on my posts anymore for this reason, though. I believe that many people are conflating the textbook concept of hypergamy with regressive political agendas, which I will never promote let alone subscribe to.

This is all just my take, so I hope it all makes sense and resonates with some members of this amazing community. Every woman should figure out what approaches to all of these matters would make her the most genuinely happy and fulfilled regardless of society's expectations or cultural norms.

Sending love xx

#femmefatalevibe#patriarchy#feminist#intersectional feminism#feminism#womens rights#high value woman#it girl#femme fatale#dark feminine energy#dark femininity#the feminine urge#dream girl#queen energy#female power#female excellence#self concept#life design#sex and relationships#interpersonal relationships#high value mindset#self improvement#glow up#girl advice#girl blogging#higher self#life path#life lessons

44 notes

·

View notes

Text

🌟 NESARA / GESARA: The Dawn of a New World 🌟

"The End of Poverty, The End of Debt, The Beginning of a New Golden Age!"

Prepare for a world where poverty, hunger, and debt are relics of the past, replaced by global prosperity and lasting peace for all!

💥 NESARA Joins Forces with GESARA 💥

In a monumental shift, NESARA, a comprehensive economic reform plan for the United States, has united its destiny with GESARA, its global counterpart. This momentous announcement heralds a profound transformation that will impact not only the United States but also a coalition of 206 sovereign nations worldwide. The linchpin of this transformation is the new financial system enshrined within GESARA.

🌍 A Global Gold-Standard Monetary System 🌍

Once GESARA takes center stage, the International Monetary Fund (IMF) will declare the inception of a "global gold-standard monetary system." In this new era, all remaining fiat currencies will be exchanged for gold-backed currency, a significant step away from paper money. The march toward digital currencies will gain momentum under this revitalized financial system.

📈 A Transition Rooted in Simplicity 📈

To ensure a seamless transition, meticulous preparations have been made. The new financial system has been operational for months, securely hosted on a quantum server impervious to hacking or unauthorized access. Crucially, wealth proliferation is a cornerstone of this transformation. Newly minted wealth holders are more inclined to contribute to humanitarian efforts, ultimately fostering wealth for all.

📊 Wealth-Building Mechanisms 📊

This transformation might witness a shortage of skilled workers, which, paradoxically, is a wealth-building catalyst. The resulting surge in wages and salaries counterbalances the price drop stemming from tax reductions, sometimes up to 80% of final product costs, thus ushering in deflation. Lower energy costs, thanks to free-energy technologies, further contribute to this financial renaissance.

🌄 The Future: A Glorious Reality 🌄

Our future is poised to be a grand tapestry of innovation and abundance. Technologies once suppressed by the cabal, some dating back centuries, are finally being unleashed. For instance, the pristine waters of Antarctica will revitalize arid regions and infuse life into all flora and fauna. A world with personalized credit cards, Replicators that produce everything, and newfound awareness of the power of the mind to manifest our desires awaits. Real healthcare capable of rejuvenating our bodies, regrowing limbs or organs, and even reversing the aging process by decades is on the horizon.

💰 Liberation from Financial Chains 💰

Money and traditional banking, tools historically employed by the cabal to manipulate and control us within a debt-based economy, are slated for obsolescence. Coinage, however, will endure. With the elimination of national debts globally, taxes will be lowered for individuals and corporations. Instead, a flat sales tax of approximately 15% on new items will be implemented.

🏰 The Dissolution of the Global Elite's Pyramid 🏰

The current pyramid structure dominated by the global elite, governments, and corporations has reached its limit. This structure perpetuates class divisions and scarcity. True spiritual evolution arises when one's identity transcends material attachments. With the advent of free energy, advanced transportation, and Replicators accessible to all, true equality emerges. No one will be enslaved, people will pursue their passions with ample free time for reflection and creativity. Hoarding becomes unnecessary.

🚀 A Vision of Advanced Civilization 🚀

In advanced civilizations, concerns about food, shelter, and transportation are relics of the past. As NESARA and GESARA unfurl, we stand on the brink of a world where prosperity, freedom, and innovation thrive, and the human spirit soars unburdened by material concerns.

#EyesOpenAmerica

#bank of america#bank crash#breaking news#bad government#world news#qfs#bank clash#wells fargo#new york#donald trump#chase bank#banks#bad omens#republicans#democracy#decentralisation#decentralised finance#decentralized#democrats#washington dc#quantum financial system#stay woke#be aware#marine life#veterans#patriotic#usa news#usa#carbal#rebel

7 notes

·

View notes

Text

People who are active in a time bank earn credits through hours of community work then spend those credits in return for services from other community members. For example, they can take classes from other members, learning new skills such as a language or how to play a musical instrument. Give your time as you will—whether it be yard work, helping with transportation, picking up food, or cooking meals. All these exchanges are valued only in terms of the time spent doing them, making an important statement to participants about their self-worth.

This is an innovative approach to stimulating neighbor-to-neighbor acts of kindness. One hour equals one credit—regardless of the service you give. No money is exchanged, only time. This affirms the value of community members’ talents and contributions and helps reweave the social fabric essential to community vitality.

Indeed, people have used time banking for a wide array of projects aimed at repairing, rebuilding, or replenishing their communities. The practice helps the vulnerable, promotes intercultural learning, reduces isolation, and in some cases cuts out-of-pocket costs by tapping into communities’ often abundant but untapped social capacity. It gives members access to skill-building activities and job opportunities. Through these exchanges of time, members get to know their neighbors and make friends while helping to build caring, vibrant communities.

There are several different models of time bank exchanges. One common model is a neighbor-to-neighbor time bank, in which individuals join a time bank so they can earn and spend time credits by helping each other. Each hour of service contributed by an individual earns a one-time credit that can be used in several different ways: 1) to receive services from other members of the time credit exchange; 2) to purchase with credits items such as school supplies, food, and clothing; and 3) to take classes, such as dance or music lessons, yoga, and so on. Depending on how the time bank is set up, an individual could also donate saved time credits to someone else.

Another time bank model involves the creation of targeted or specialized exchange networks that focus more on time credits. An example is cross-age peer tutoring, in which older children tutor younger students, accumulating time credits that they can then trade for school materials and equipment such as donated computers.

—

🚨 want more materials like these? this resource was shared through BFP’s discord server! everyday, dozens of links and files are requested and offered by youth around the world! and every sunday, these youth get together for virtual teach-ins. if you’re interested in learning more, join us! link in our bio! 🚨

16 notes

·

View notes

Text

Securities Financing and Stock Loans

What Is Securities Financing

Securities financing is the act of loaning a stock, derivative or other security to an investor, person or company. Securities lending requires the borrower to put up cash, security or a letter of credit. When a security or stock is loaned the title and the ownership are also transferred to the borrower because they have loaned the investor money against the securities. Stock loans are also known as SBL’s or securities backed loans in the financial stock loan lending business.

Understanding Securities Financing

Securities financing is generally conducted between stock brokers and dealers and not individual investors. These days though financial times have developed as there are many individual investors that hold a great portion of their wealth in stocks and shares and so require a stock loan to finance other financial purchases at short notice. These funds can be to finance art, property, jewellery and even classic cars at auction. In essence the money thats being borrowed from stock lending companies can be used for anything as the investor has put up their stocks and shares as collateral to obtain the funds. In short securities lenders are basically asset based lenders.

To finalize the transaction, a securities lending agreement, known as loan agreement, must be completed. This sets forth the terms of the loan including duration, lender’s fees and the nature of the collateral loans.

What Is A Non-Recourse Stock Loan?

A non-recourse stock loan is a type of loan that uses shares in a publicly-traded company to secure the loan. It is an excellent way for individuals and business owners to tap into the value of their stock easily and quickly without having to wait too long for the money. Its an ideal way for clients wanting securities finance to obtain fast and easy stock loans.

Stock loans can be a critical financing source for entrepreneurs. A stock loan is a resource they can quickly access to fund business operations. Its essential to approach the best lenders with the lowest rates that can provide to most ideal stock loan solutions.

The loan amount is determined by a loan to value (LTV) ratio which means the loan amount may be equal to 60% of the value of the shares needed to secure the loan.

In addition to other criteria, the maximum loan amount available to a borrower depends on:

Market conditions

Historical stock price and volume performance

Total number of shares owned by the investor

Market sector

Why Would Someone Want A Stock Loan?

The ability to convert a majority of the current market value of securities into cash without selling them outright is an attractive option for many shareholders. With that value unlocked from their shares, individuals and business owners can get the liquidity they need with ease and without visiting the bank by using a collateral loan from a private stock lending institution.

Many people ask what are securities in finance? Securities in finance are essential so investors can access the stock market and invest for the longer term while hoping they can make a profit from their stocks rising. Its important to have an investment plan and portfolio risk assessment so that you have a target to aim for.

What Are The Benefits of A Stock Loan?

Interest-only — No ambiguous or hidden charges; stock loans are an interest-only, transparent loan option. There are no never-ending charges that seem to extend the credit unnecessarily.

Accessible — Stock loans are available to almost anyone. You don’t need a credit check to access one for your individual or business needs. The process is painless and straightforward, and your money is delivered to you most conveniently. They are a great option for stock clients looking for loan stock.

Liquidity — Stock loans are a fantastic option when an individual or business owner needs fast stock financing option. It turns equity into cash with ease.

Privacy — It provides borrowers with a trustworthy source of capital. All transactions are private and kept in strict confidence for all clients when lending stocks or requesting stock loans.

Competitive — Stock loans offer you competitive and flexible interest rates. You typically receive better terms than you would get from a traditional marginal loan by using asset based lenders.

Stock Loan Application Process

Within 24 hours of contacting the stock lender an Agent will contact you to review the stock and eligibility for a loan.

If approved, they will consult with you to determine a customized solution that works best for you. A non-binding Term Sheet will be sent to you outlining the details of the loan such as loan amount, interest rate, fees and loan term.

Once the Stock Loan Term Sheet is approved by you a Non-Recourse Stock Master Loan Agreement and Stock Pledge Agreement will be prepared based on the 3–5 day average of your stock’s price and sent to you for review and approval.

A current brokerage statement or TA statement will be requested as proof of ownership and status of the securities prior to TERM SHEET and funding.

The loan funds are disbursed either via DVP (Delivery Versus Payment) or wired into your bank account.

You can make interest-only payments monthly, quarterly or semi-annually. Any dividends from the securities are credited to the loan payment first and any excess is returned to you.

At the end of the loan term loan if all interest payments are made and the portfolio has maintained the required LTV, the same amount of shares originally pledged are returned to you. The loan term may also be extended or refinanced for an additional term and LTV based upon market conditions.

The time frame from start to funding may be as little as 3–7 business days.

Stock Markets and Lending Zones

Country Exchange Exchange Abbreviation

Athens Athens Stock Exchange ASE

Australia Australian Securities Exchange ASX

Canada Canadian National Stock Exchange CNSX

Canada Toronto Stock Exchange TSX

European Union EU NYSE Euronext NYX

Germany Frankfurt Stock Exchange FWB

Hong Kong Hong Kong Stock Exchange HKEX

Indonesia Indonesia Stock Exchange IDX

Japan Tokyo Stock Exchange TSE

Malaysia Bursa Malaysia KLSE

Philippines Philippine Stock Exchange PSE

South Korea Korea Exchange KRX

Singapore Singapore Exchange SGX

Thailand Stock Exchange of Thailand SET

Turkey The Borsa Istanbul BIST

United Kingdom London Stock Exchange LSE

2 notes

·

View notes

Note

How did Lincoln's economic policy set the GOP on their path towards corporate domination?

To be fair, I do approve of much of Lincoln's economic policy - the first income tax, the use of greenbacks, land grant colleges, etc. - so it's more that there are a couple areas of economic policy where I think Lincoln's administration had that effect, and the extent to which I think it's fair to hold Lincoln accountable for the long-term implications varies:

Procurement: to be fair, Lincoln inherited a Federal government that really didn't have a modernized procurement system. However, between that and the pretty thorough corruption of Secretary of War Simon Cameron and others within the Federal government, a lot of businessmen got rich selling substandard goods to the Union army and navy at a markup in exchange for kickbacks - so much so that the term "shoddy" became generalized and popularized as a result. (Previously, "shoddy" had specifically referred to reprocessed wool.)

Bonds: in order to finance the Union war effort, the Lincoln administration sold an enormous amount of bonds - and Treasury Secretary Salmon P. Chase basically turned the Union's bond drive over to Jay Cooke, a politically-connected Philadelphia banker. To give him credit, Cooke was very good at selling bonds both to ordinary bankers and the man on the street, but Cooke's personal commission meant that he (and the men he hired as his sub-agents) became staggeringly wealthy and thus a major donor to the Chase presidential campaign in 1868. Cooke ultimately was bankrupted when his Northern Pacific Railway went bust in the Panic of 1873.

Banking: while the National Banking Act of 1863 had many good elements - nationalizing the currency, and establishing Federal charters that allowed the Federal government to regulate banks on capital and reserve requirements - it also had the effect of further concentrating currency and credit in Northeastern banks (which could more easily meet those requirements due to being better-capitalied to begin with), which was a bit of a problem when you realize that the U.S didn't have a central bank to ensure that all regions of the country had decent access to currency and credit.

Railroads: the Pacific Railroad Acts of 1862 and 1864 provided for the Federal subsidization of transcontinental railroads through the granting of Federal land. While this got the railroads built, it didn't come without a healthy side-order of corruption: understanding that they stood to make a fortune if the railroad acts went through, railroad companies gave out a lot of free stock to U.S Congressmen, who in turn made sure the Acts passed and the Federal government was generous with land grants, loans, etc. This wouldn't blow up until the Credit Mobilier scandal of 1872, but the roots go back in the 1860s.

As you might expect, a lot of the bankers and railroad executives who had gotten rich off the Civil War became major donors and activists and party leaders and elected officials of the Republican Party. This had a significant impact on the party's political and policy direction: by 1868, the Republican Party's national platform mixed calls for civil rights and equal suffrage with demands that Civil War debt be redeemed in gold rather than paper money (which contributed to post-war deflation and represented a repudiation of the Greenback Acts), and that progressive taxation be done away with.

18 notes

·

View notes

Text

LUCY’S THIN BLUE LINE

Lucy and Law Enforcement ~ Part 2

On “The Lucy Show,” Lucy Carmichael not only had multiple run-ins with the police - she actually became one for a couple of episodes! Here’s a look at Carmichael and Cops!

“Lucy and Viv Become Tycoons” (1963) ~ When Lucy and Viv open their own business at home, they are visited by Sergeant Robbins (Bern Hoffman) to check on their permits and operating practices. In 1960, Hoddman appeared in the Lucille Ball / Bob Hope film The Facts of Life.

“Lucy Drives a Dump Truck” (1963) ~ Driving a truck to a nearby town, Lucy and Viv are pulled over by a Brewster policeman played by Richard Reeves, a veteran of nine episodes of “I Love Lucy” including playing a policeman in “Equal Rights” (1953). This is his only appearance on “The Lucy Show.”

“Lucy and the Safe Cracker” (1963) ~ When Mr. Mooney gets locked in the safe (again), Lucy contacts a safe cracker (Jay Novello) and Sergeant Wilcox (James Flavin) is on the scene. Coincidentally, Flavin played the Immigration Officer searching for Mario Orsatti (Jay Novello) in “Visitor from Italy” (1956). He will return to “The Lucy Show” two episodes later to play Sgt. Wilcox again in another bank-themed episode. He appeared in four films with Lucille Ball, including playing a police sergeant in Without Love (1945). During his long career he played so many officers of the law that his IMDB photo is of him in a police uniform!

“Lucy and the Bank Scandal” (1963) ~ Sergeant Wilcox (James Flavin) investigates a case of embezzelment at the Danfield Bank. Lucy suspects Mr. Mooney and digs up his yard to find the stolen cash.

“Lucy is Her Own Lawyer” (1964) ~ Officer Joe (Joe Mell) the Baliff, swears in Lucy Carmichael as well as Mr. Mooney and Nelson the dog! Mell returns as a Baliff in “Lucy the Meter Maid” (1964) and a Bank Guard in “Lucy the Stockholder” (1965).

“Lucy the Meter Maid” (1964) ~ Lucy joins the Danfield Police Force as meter maid. When Viv doesn’t feed the meter, Lucy issues her a summons and they land up in court. Once again, Joe Mell plays the Baliff.

“Lucy Makes a Pinch” (1964) ~ Still on the Force, Lucy is recruited to be part of a stake out. The episode features three of Danfield’s finest (left to right): Murdock (Jack Searl), Captain Bradford (Alan Carney), and Detective Bill Baker (Jack Kelly). As a child actor, Jack Searl was featured in the 1932 film Officer Thirteen, about motorcyle cops. Alan Carney played a policeman in the 1963 comedy classic It’s a Mad, Mad, Mad, Mad World. In 1955, Jack Kelly appeared on a TV series titled “City Detective.”

“Lucy the Coin Collector” (1964) ~ When Lucy drops a rare coin down the sewar grate, she is consoled by a cop on the beat (Ray Kellogg). his is the second of his seven episodes of “The Lucy Show.” He also did two episodes of “Here’s Lucy.” Just as in his other screen credits, most most times he played policemen, as he does here.

“Lucy and the Ceramic Cat” (1965) ~ While Lucy breaks into Bigelow’s Department Store, Viv stands guard, diverting the cop on the beat (John J. ‘Red’ Fox). Fox was best known for playing policemen, which is what he did on five of his eight appearances on “The Lucy Show” as well as three of his five episodes of “Here’s Lucy.”

“Lucy, the Stockholder” (1965) ~ After buying a single share of the Danfield Bank for $32, Lucy the stockholder pays the bank a visit. She warns the lackadaisical guard (Joe Mell) that she has a nine year-old nephew who is quicker on the draw than him.

“Lucy and the Undercover Agent” (1965) ~ Trying to get access to performer Carol Channing, Lucy charms Military Police (MP) officer Sol Schwartz. The character name was specifically chosen so Lucy can sing “Hello, Solly” to the tune of “Hello, Dolly”.

“Salute to Stan Laurel” (1965) ~ In a special tributing the late comedian, Lucille Ball is part of a silent movie sketch featuring Buster Keaton and Harvey Korman as a policeman in the park.

“Lucy Meets Mickey Rooney” (1965) ~ A silent movie sketch based on Charlie Chaplin’s The Kid features the Keystone Kops (Sid Gould, above). Keystone Kops are fictional, humorously incompetent policemen featured in silent film slapstick comedies produced by Mack Sennett for his Keystone Film Company between 1912 and 1917.

“Lucy Goes to a Hollywood Premiere” (1966) ~ Mr. Mooney is questioned by Officer Collins (Robert Foulk) of the Beverly Hills Police Department. He doesn’t have a permit to sell maps to the movie stars’ homes and is hauled down to the police station. Foulk played the Brooklyn policeman on the subway platform in “Lucy and the Loving Cup” (1956). He will go on to play six characters on “Here’s Lucy,” two of them policemen.

“Lucy the Gun Moll” (1966) ~ Robert Stack plays Federal Agent Briggs in this satire on Desilu’s “The Untouchables.” Stack played G-Man Eliot Ness on the series and only agreed to the satire if the names were changed.

“Lucy and the Submarine” (1966) ~ Whe Lucy sneaks onto a submarine, she must get by a stoic Navy Shore Patrolman (SP) played by Steven Marlo. Marlo makes the first of his two appearances on “The Lucy Show.”

“Lucy and the Ring-a-Ding Ring” (1966) ~ Ray Kellogg plays the cop on the beat who discovers Mr. Mooney trying to get a nearly unconscious Lucy into his car because she has his wife’s ring stuck on her finger.

“Viv Visits Lucy” (1967) ~ To find a wayward Danfield boy, Lucy and Viv go to the Sunset Strip, where they are mistaken for hippie biker chicks by the police. Ray Kellogg plays the Motorcycle Officer (right) and John J. 'Red’ Fox plays Patrolman Harry McLeod (left).

“Lucy Puts Main Street on the Map” (1967) ~ Mel Torme is Mel Tinker, the deputy and Roy Barcroft plays his father, Police Chief Tinker, the law enforcement team in small town Bancroft. During his long career on screen, Barcroft played a sheriff 18 times between 1943 and 1966, including in Billy the Kid Versus Dracula (1966).

“Lucy Meets the Law” (1967) ~ Lucy thinks she’s being arrested for littering when she is actually being mistaken for a red-haired jewel thief. Claude Akins (Lieutenant Finch) is perhaps best remembered for playing Sheriff Lobo in “B.J. And the Bear” (1978-79) and its sequel “The Misadventures of Sheriff Lobo” (1979-81).

Jody Gilbert plays the jail matron aka ‘Tinkerbell’. Gilbert will also appear in two episodes of “Here’s Lucy,” in one of which she also plays a prison matron.

Ken Lynch (Officer Peters, left) started playing policemen on TV in 1950 and continued to do so for much of his career. Joseph Perry (Officer Miller, right) started his screen acting career in 1956. Perry played a policeman on “My Living Doll” (1965) filmed at Desilu. He appeared on the police-themed shows “Policewoman,” “Police Story,” “Barney Miller,” “Hill Street Blues,” “CHiPs,” “The Rookies” “The Mod Squad,” “87th Precinct,” “The FBI,” “The Rookies,” and “The Sheriff of Cochise” a Desilu Production.

“Lucy Sues Mooney” (1967) ~ Irwin Charone (Bailiff) makes the third of his five appearances on “The Lucy Show.”

Two uncredited background actors play Officers of the Court.

“Lucy and the Stolen Stole” (1968) ~ Lucy and Mr. Mooney go shopping for Mrs. Mooney's birthday and wind up being arrested for possession of a stolen fur stole. The boys in blue are played by Ray Kellogg, Roy Shapiro, and John J. 'Red' Fox as Officer Shapiro.

“Lucy Gets Involved” (1968) ~ At Phil’s Fat Boy Burgers, a policeman (John J. 'Red' Fox) interrogates motorcyclist Tommy Watkins (Phil Vandervoort) with Mr. Burton (Jackie Coogan) overhearing.

“Lucy and Sid Caesar” (1968) ~ A forger who looks like Sid Caesar is passing bad checks at the bank. Lucy and Mr. Mooney try to figure out how to tell the real Sid Caesar from the forger. They enlist the help of the authorities (left to right): Irwin Charrone, John J. ‘Red’ Fox, and Ben Gage. Gage was mentioned on “I Love Lucy” in 1955. He appeared on “Our Miss Brooks” (filmed at Desilu Studios) and in Desilu’s “Star Trek.” His last two screen appearances were in “Policewoman” and “Police Story.”

#Police#Lucille Ball#Lucy#The Lucy Show#TV#CBS#Sid Caesar#Ben Gage#Irwin Sharrone#John J. 'Red' Fox#Ray Kellogg#Roy Shapiro#Ken Lynch#Joseph Perry#Jody Gilbert#Claude Akins#Mel Torme#Roy Barcroft#Steven Marlo#Bern Hoffmann#Richard Reeves#James Flavin#Joe Mell#Jack Searle#Alan Carney#Jack Kelly#Robert Stack#Robert Foulk#Gale Gordon#Harvey Korman

6 notes

·

View notes

Text

Digital Privacy for 🇺🇸 Protests

This isn’t my normal content, but I was once a CS student, and am still obnoxiously tech-aware. I understand, to some extent, how data-harvesting works and what it’s used for. I am aware of instances where subpoenas of data from commercially available tech products have been used to convict people in court. Each of us has a large data trail following us around, and, to my knowledge, some of that data has been used in recent years against citizens who fully believed they "weren’t doing anything wrong" or that they "had nothing to hide" in cases where basic rights were ignored.

That said, if you’re planning to protest and want to minimize your chances of harassment from powers-that-be, I urge you to consider making plans to increase your digital privacy. Some of these methods are more complicated and costly than others, but I want to present them in the hopes that even one of the suggestions can improve your chances of not being unduly punished for exercising your legal right to peaceful protest.

If this is too much information for you to read, concise suggestions are available in this Boston Magazine article. (They don't have information on burner phones, though. Still, DO please read their section on locking your phone with a secure PIN.) I just want to thoroughly go through the "what" and "why."

This is not legal advice, it is not guaranteed to be accurate or comprehensive, and it furthermore represents only one person's understanding of digital security, as compiled from multiple sources over multiple years. It may not be up to date, especially if it is viewed after any length of time from its original posting. Please use this as a jumping-off point to do your own research. No matter how strongly I word something, assume it is an opinion and not a fact. Do not use any information in this guide to break or circumvent any laws or in the service of breaking or circumventing any laws.

Leave your phone at home

Pros

Costs no money*, requires little setup.

Completely eliminates being digitally tracked (as long as you're not carrying other tech gadgets).

Cons

*People who rely on phones for basic utilities may have to acquire additional analogue devices, which will cost money and time. (For instance, a (non-bluetooth enabled) wristwatch, a medical ID bracelet, a paper map, etc.)

People who have never lived in their current city without a smartphone may not have practice navigating physical spaces without GPS.

People who normally rely on digital payment methods and don't have credit/debit cards may have to make plans to carry cash instead, which may be difficult for people who don't have regular access to banking.

People who need to contact others for a ride may need to ask a stranger or a store clerk if they can borrow their phone. (Believe it or not, this was a common question asked of cashiers before the early 2000s. Many stores had no problem allowing customers to make short phone calls on the company phone, but it might be a strange request nowadays.)

Turn your phone off at protests

Pros

Costs no money, requires the least setup.

The VAST MAJORITY of tracking methods are blocked when a cell phone is turned off. (Unless you are a person-of-interest to a major player like the NSA, this is probably sufficient to stop you from being tracked.)

Cons

Same as for "leave your phone at home," but on a temporary basis.

In order for this to be a useful privacy measure, one must take great care to keep the phone off until one is physically far away from the site of the protest. This means that people who need to contact others for a ride, but don't want to do as suggested above, may need to walk a considerable distance away from the protest before turning their phone back on.

Put your phone in a "Faraday Bag"

Pros

Equally secure to not carrying your phone, theoretically.

Cons

One must find and purchase this item, making it a non-zero cost solution.

Some online listings for speciality items like this misrepresent their capabilities. It is up to the purchaser to test the item thoroughly before relying on its use. (It could be counterfeit or just poorly made, in other words.)

Once more, in order for this to be a useful privacy measure, the need to physically remove oneself from the protest before taking the phone out of the bag and returning to normal use may prove challenging for those requiring a phone to contact a ride home.

Turn on "Airplane Mode"

Pros

Costs no money, ties for requiring the least setup.

Cons

I have been informed that Apple phones do not disable Wifi when Airplane Mode is engaged. If one forgets to also disable Wifi, phones may connect to available public Wifi hotspots, which may include honeypots set up by malicious actors.

I will freely admit that I am, perhaps, overly-cautious, but I am suspicious of trusting Airplane Mode to work properly on all phones. Computers are ultimately programmed by human beings, who are certainly fallible. I think it is far wiser to simply turn one's phone off.

If one uses their phone to take photos or videos at the protest, but hasn't turned off auto-sync with cloud services (Google Photos, iCloud, etc.), those photos may be accessible by companies who can be subpoenaed to provide them to a court.

DON'T DO THIS: Turn off wireless communications, such as Wifi, GPS/location services, bluetooth, etc.

Pros

None. This is security theater.

To be clearer, this will prevent apps from tracking users, but the operating system will still know their location, etc. Apple and Google can be subpoenaed and don't have spotless records at protecting the privacy of their user-base in cases like this.

Cons

See "Pros."

Additionally, the note about photos and videos from the "Airplane Mode" section also applies.

Keep using one's phone as normal, but at least use encrypted messaging

Pros

Pictures and videos sent to others using the same encrypted messaging service (which may include protestors' faces) will be encrypted, and will be more difficult for others to obtain via digital sniffing.

Messages sent and calls made through these services will similarly be encrypted and therefore more difficult for others to intercept.

Cons

The location of the phone will be known to the user's cell service provider as well as to any data-gathering apps (including social media, etc.) they have installed. This information can be subpoenaed in court.

Additionally, the note about photos and videos from the "Airplane Mode" section also applies.

Get a burner phone

Pros

Allows a person to leave their usual phone at home, while still having the ability to call others in case of an emergency.

Cons

Costs a not-insignificant amount of money and time, and requires research and tech knowledge.

If the person with the burner phone calls another person in the case of an emergency, the recipient of that call will have a record of having received the call from that burner phone, and the burner phone will have a record of having been at the protest, if it was in use at the time. This implicates your emergency contact as an accomplice to a protestor.

Doing this properly involves a number of steps. One must feel comfortable:

Navigating, without one's primary phone, to a place where pay-as-you-go, no-contract phones are sold. For instance, Walmart carries these sorts of phones through Straight Talk Wireless.

Purchasing a phone and a card representing "minutes" in cash.

Activating the phone using a payphone or courtesy phone (these exist at some airports reliably and at some gas stations unreliably) or at an internet cafe, college, or library with courtesy computers (even more rare than payphones).

Not allowing the sales representative to make an account with your identifying information. (To my knowledge, it is possible to opt out of making an account with Straight Talk Wireless, but they will almost certainly suggest it to you if you set up via phone call. I have no experience, so I could be wrong in either case.)

Setting up the phone in a way that is consistent with privacy practices (see this Reddit post for details, although note that its author uses somewhat rough language).

Turning the burner phone off and removing the battery and/or placing it in a Faraday bag before returning home, to work, or to any other location that is tied to your identity. (The Nokia 2760 Flip, available at Walmart as of this posting, seems to allow the user to remove the battery, which I would ultimately recommend. Its utility for anything other than calls and texting seems questionable, however.)

Feel free to reblog with any additional information I've missed, or corrections for incomplete or incorrect information represented herein. I'm not an expert amongst experts; I'm just someone with a passing interest in technological security.

a

8 notes

·

View notes

Text

Short Term Loans Direct Lenders: A Crucial Tool for Resolving Financial Problems

Benefits-dependent people who also have poor credit histories including defaults, arrears, foreclosure, late payments, skipped payments, due payments, CCJs, IVAs, skipping installments, bankruptcy, and other issues. They are nevertheless qualified to apply for the short term loans lenders. Additionally, they must abide by all short term loans direct lenders and regulations since they must be repaid on time or else they will incur additional fees for an extension of the repayment period. In comparison to other loans, the interest rate charged is a little higher because it is short-term and unsecured. However, by conducting a thorough online search, excessive interest rates may be reduced.

To simply qualify for short term loans UK direct lender, you must meet a few simple requirements: you must be a permanent resident of the United Kingdom, be at least 18 years old, have an active checking account, and work a regular job earning at least £500 per month. You must now complete and submit a brief online application form with all necessary information. After you've finished filling out all the necessary information, getting cash is easier, and the same day you apply, it is securely put into your bank account.

The main resource you wish to use for your life's necessities is money. However, it gets very challenging to deal with bills on time when it is shortened and there is no solution to plan without further ado. That is why it is required repeatedly. Short term loans UK are available to help you receive the money you need even if you don't have any money left in your pocket. It's good to know that you are not required to set up any sort of lender-aligned security to pledge. This is due to the fact that these simple financial solutions are available whenever needed, free from bank hassles.

Financial Issues: Same Day Loans in the UK are a Crucial Solution

Even though you qualify for same day loans UK, you could be able to borrow between £100 and £1,000 with a 14 to 31 day repayment period. Due to their short duration and unsecured status, unsecured loans can be used to pay for a variety of expenses, including electricity bills, grocery store bills, unanticipated car repairs, travel costs, outstanding bank overdrafts, throwing a party to celebrate your birthday with friends, small home improvements, laundry costs, and a long list of other expenses.

Typically, the lenders listed on Payday Quid will set up equal monthly installments so that you are aware of the precise amount you will be paying back each month. Simply ensure that you have funds accessible in your account for collection on that particular day.

You are in charge when taking out a same day loans UK from one of our lenders. The majority of individuals choose the day that they get paid from work, which is typically the last Friday of the month or the 25th of each month. You can specify precisely which day you would want your repayments to be taken. The technique that same day loans UK lenders use to deduct the amount owed from your debit account each month on the appointed day is called continuous payment authority.

4 notes

·

View notes

Text

Short-Term Business Loans: Types and How They Work?

You may have avoided taking out business loans if you prefer to keep your company lean. It is not something you want to have to deal with years or even decades down the line with loan payments.

However, you don't have to take out a long-term loan if you think a one-time payment could help your company. You may acquire the money you need right away with short-term business loans, and you can usually finish paying them back in 18 months or less.

There are a few things to understand regarding short-term business loans before looking into the finest ones. Loan Simplified can help you get a short-term business loan for your business as per your business requirements. To learn more about short-term business loans, keep reading our blog.

What is a short-term business loan?

Short-term business loans refer to the funds your business borrows and repays faster than traditional loans. Usually, these loans have repayment terms of three to 18 months. These loans are designed to provide businesses with quick and temporary access to capital. With short-term loans, businesses can fulfill immediate financial needs, making them an attractive option for businesses encountering cash flow issues.

The following are some crucial details regarding this kind of company funding to be aware of:

Short-term loans from banks and credit unions might take days or weeks to fund.

Short-term loans are usually provided quickly by online lenders. You might be able to get quick short-term business loans in just one to three business days, depending on the lender.

Due to their typically more lenient qualifying standards, online lenders are available to startups and business owners with poor credit.

Conversely, business loan interest rates are typically higher for short-term loans due to their ease of access.

Compared to a traditional loan, you might have to return your loan more frequently—typically on a daily or weekly basis.

Types of Short-Term Business Loans

Working capital loans: The working capital loans are primarily used by individuals, businesses, startups, and MSME’s to meet their business expansion, cash flow maintenance, and related activities. Working capital loans are primarily short-term loans, with maximum loan amounts of Rs. 40 lakh and maximum 12-month repayment terms that may exceed business requirements. When comparing banks' and NBFCs' interest rates to regular business loans or long-term loans, they are slightly higher.

Term Loan: A term loan is one that has a predetermined repayment schedule and must be paid back over time in equal installments. There are three types of term loans: short-term, intermediate-term, and long-term. These two varieties have repayment terms that vary from 12 months to 5 years. Short-term loans are defined as term loans with a length of less than 12 months, while long-term loans are defined as term loans with a tenure of five years or more. The maximum amount of the collateral-free business loans is Rs. 2 crore, though it may be higher based on the needs of the company.

Letter of Credit: A letter of credit is a type of credit limit significantly used for trading business where a bank or lender offers a funding guarantee to the enterprise dealing in international trade. It can be used for both export and import purposes. Firms have to deal with unknown suppliers and require assurance of payment before performing any transaction. A letter of credit is used as it offers assurance to the suppliers.

Loans for Points of Sale (POS): Using daily or upcoming credit or debit card transactions, a business owner operating an enterprise can pay suppliers a lump sum payment in advance using a system known as POS Loans or Merchant Cash Advance. Small and medium-sized business owners frequently face a temporary financial crisis; therefore, merchants choose to use POS loans in order to lessen the liquidity pressure in the company. When POS loans are compared to other business loan types, the interest rate offered under them is somewhat higher.

Bill Discounting: It is a funding facility in which the seller gets an amount in advance at discounted rates from the lender. Banks take the bill drawn by the borrower and give him less by deducting some amount in the form of a discount. In order to increase the income of the financial institutions, this encourages customers to participate in the form of interest rates, paid interest, and monthly fees.

Conclusion

Small-term business loans are quite effective when you are in immediate need of money for your business. It is beneficial for those business owners who require a lump sum of money now but don’t want to be saddled with long-term loans. Loan Simplified can help you get short-term business loans from reliable institutions and fulfill your emergency requirements. Don’t let business uncertainties stop your growth; connect with us to get solutions for your business loans.

0 notes

Text

Fintechzoom Best Travel Credit Card

Have you ever dreamt of luxurious airport lounges, priority boarding that whisks you past the crowds, or free checked bags that lighten your load? Travel credit cards can turn those dreams into reality! But with a plethora of options, choosing the Fintechzoom Best Travel Credit Card can feel overwhelming. Fear not, fellow traveler! This guide will be your compass, navigating the key features, rewards, and considerations to find the perfect travel companion for your wanderlust.

Why Choose the Right Travel Credit Card?

The right travel credit card can be a game-changer. Here's why:

- Earn Rewards: Rack up points, miles, or cashback on everyday purchases, translating them into dream vacations or travel upgrades.

- Unlock Perks: Enjoy exclusive benefits like airport lounge access, travel insurance, and priority boarding, making your journeys smoother and more comfortable.

- Save Money: Certain cards offer statement credits for travel purchases, effectively reducing your travel costs.

What Makes a Travel Credit Card the Best?

Not all travel cards are created equal. Let's delve into the key features to consider when searching for your Fintechzoom Best Travel Credit Card:

Rewards Programs (Points, Miles, Cashback):

Travel credit cards typically offer points, miles, or cashback. Points and miles are generally more valuable for frequent travelers, allowing them to redeem them for flights, hotels, and travel experiences. Cashback, on the other hand, provides a more straightforward benefit, offering a percentage of your purchases back as cash.

Sign-up Bonuses:

Many travel cards entice new applicants with generous sign-up bonuses. These bonuses can jumpstart your rewards journey, often awarded after meeting a minimum spending requirement within a set timeframe.

Travel-Related Perks:

Travel perks can significantly enhance your experience. Look for cards offering airport lounge access, priority boarding, free checked bags, travel insurance, and elite status with hotel or airline programs.

Fees (Annual Fees, Foreign Transaction Fees):

Some travel cards come with annual fees. While these fees can seem like a deterrent, the rewards and perks often outweigh the cost, especially for frequent travelers. Another vital consideration is foreign transaction fees, which can chip away at your rewards if you travel internationally.

Top Travel Credit Cards Recommended by Fintechzoom

Fintechzoom has analyzed the market and identified some of the top contenders for the title of Fintechzoom Best Travel Credit Card. Here are a few standouts:

1. Chase Sapphire Preferred® Card:

The Chase Sapphire Preferred® Card boasts a generous rewards program, with points earned on travel and dining purchases. It also waives foreign transaction fees, making it ideal for globetrotters. Plus, comprehensive travel insurance provides peace of mind on your journeys.

2. Capital One Venture Rewards Credit Card:

The Capital One Venture Rewards Credit Card stands out for its flexibility. You can redeem miles for travel booked through Capital One Travel or transfer them to various travel partners. The card also offers a straightforward rewards structure and travel and purchase protections.

3. The Platinum Card® from American Express:

Luxury travel aficionados, rejoice! The Platinum Card® from American Express caters to discerning travelers with a plethora of premium travel and lifestyle benefits. Airport lounge access, hotel elite status, and statement credits for travel and entertainment are just a few highlights. However, be prepared for a hefty annual fee.

4. Citi Premier® Card:

For those who enjoy dining and entertainment, the Citi Premier® Card offers bonus points in these categories. It also provides versatile travel rewards that can be redeemed for flights, hotels, and other travel expenses. Additionally, travel insurance provides added security.

5. Bank of America® Premium Rewards® Credit Card:

The Bank of America® Premium Rewards® Credit Card offers a compelling combination of premium travel benefits, flexible redemption options, and Visa Signature perks like airport lounge access and travel discounts.

This list just scratches the surface! Remember, the Fintechzoom Best Travel Credit Card depends on your individual needs and travel style.

Fintechzoom Best Travel Credit Card

Detailed Comparison of the Best Travel Credit Cards

To assist you in making an informed decision, let's delve deeper into a detailed comparison of these top travel cards:

Rewards and Points System

One of the most critical aspects of a travel credit card is how you earn and redeem rewards. Here's a closer look at how the top cards compare:

- Chase Sapphire Preferred® Card: Earn 2x points on travel and dining, 1x on all other purchases. Points are worth 25% more when redeemed for travel through Chase Ultimate Rewards.

- Capital One Venture Rewards Credit Card: Earn 2x miles on every purchase. Miles can be redeemed for travel or transferred to travel loyalty programs.

- The Platinum Card® from American Express: Earn 5x points on flights and hotels booked through American Express Travel. Points can be redeemed for travel, statement credits, gift cards, and more.

- Citi Premier® Card: Earn 3x points on travel, including gas stations, 2x points on dining and entertainment, and 1x points on all other purchases. Points can be transferred to airline partners or redeemed for travel.

- Bank of America® Premium Rewards® Credit Card: Earn 2x points on travel and dining, and 1.5x points on all other purchases. Points can be redeemed for travel, cash back, or gift cards.

Travel Perks and Benefits

The best travel credit cards offer a variety of perks that can enhance your travel experience:

- Airport Lounge Access: Cards like The Platinum Card® from American Express provide access to exclusive airport lounges, where you can relax and enjoy complimentary food and drinks before your flight.

- Priority Boarding and Free Checked Bags: Many travel cards offer priority boarding and free checked bags, saving you time and money at the airport.

- Travel Credits: Some cards offer annual travel credits that can be used to offset travel expenses such as airline tickets, baggage fees, and in-flight purchases.

- Travel Insurance: Comprehensive travel insurance can provide peace of mind by protecting you against trip cancellations, interruptions, and emergencies.

Annual Fees and Other Charges

Understanding the fees associated with travel credit cards is crucial:

- Chase Sapphire Preferred® Card: Annual fee of $95. There are no foreign transaction fees.

- Capital One Venture Rewards Credit Card: Annual fee of $95. There are no foreign transaction fees.

- The Platinum Card® from American Express: Annual fee of $695. There are no foreign transaction fees.

- Citi Premier® Card: Annual fee of $95. There are no foreign transaction fees.

- Bank of America® Premium Rewards® Credit Card: Annual fee of $95. There are no foreign transaction fees.

Customer Service and Support

Quality customer service is essential for resolving issues quickly, especially when you're traveling:

- Chase Sapphire Preferred® Card: 24/7 customer support and excellent fraud protection.

- Capital One Venture Rewards Credit Card: 24/7 customer support and travel assistance services.

- The Platinum Card® from American Express: Premium customer service with concierge services available.

- Citi Premier® Card: 24/7 customer service and travel assistance.

- Bank of America® Premium Rewards® Credit Card: 24/7 customer service and fraud protection.

Here's a table summarizing the key features of each recommended card to help you compare:

FeatureChase Sapphire Preferred® CardCapital One Venture Rewards Credit CardThe Platinum Card® from American ExpressCiti Premier® CardBank of America® Premium Rewards® Credit CardRewards ProgramPointsMilesPointsPointsPointsBonus Offer60,000 points after spending $4,000 on purchases in the first 3 months from account opening75,000 miles after spending $4,000 on purchases in the first 3 months from account opening100,000 points after you spend $6,000 on purchases in the first six months from Card Membership80,000 points after you spend $4,000 on purchases in the first 3 months from account opening75,000 points after spending $2,000 in purchases in the first 3 months of card membershipAnnual Fee$95$95$695$95$95Foreign Transaction FeeNoneNoneNoneNoneNoneAirport Lounge AccessPriority Pass Select membershipNoPriority Pass Select membership, Centurion Lounges, Delta Sky Clubs (when flying Delta)Admirals Clubs, Priority Pass Select membershipPriority Pass Select membershipTravel CreditsUp to $100 annual statement credit towards travel purchasesNoneUp to $200 Uber credits annually, up to $200 airline fee credit annuallyUp to $100 hotel credit every year, up to $100 entertainment credit every yearUp to $100 Global Entry or TSA PreCheck application fee credit every four yearsFintechzoom Best Travel Credit Card

Remember, this table is a starting point. Be sure to visit the issuer's website for the latest details and terms and conditions.

Frequently Asked Questions (FAQs) on Fintechzoom Best Travel Credit Card

What is special about the Fintechzoom Best Travel Credit Card?There's no single Fintechzoom Best Travel Credit Card. Fintechzoom identifies top contenders based on a comprehensive analysis of rewards programs, travel perks, fees, and overall value. The "best" card ultimately depends on your travel habits and financial goals.How do I apply for the Fintechzoom Best Travel Credit Card?Fintechzoom doesn't directly issue credit cards. They analyze and recommend cards offered by various issuers. Once you've identified a card that aligns with your needs, you'll need to navigate to the card issuer's website and apply directly through them. The application process typically involves filling out an online form and submitting a credit check.Are there any hidden fees with these travel credit cards?It's crucial to read the fine print before applying for any travel credit card. Be aware of potential fees beyond the annual fee, such as balance transfer fees, foreign transaction fees (if not waived), and cash advance fees.Can I use Fintechzoom travel cards internationally?Fintechzoom doesn't offer its travel cards. The cards recommended by Fintechzoom, however, are typically issued by major credit card networks like Visa or Mastercard and can be used internationally. However, always double-check with the issuer regarding foreign transaction fees, which can apply if you use your card outside your home country.How do I redeem rewards earned with Fintechzoom travel cards?Remember, Fintechzoom doesn't issue cards. Redemption options vary depending on the specific card you choose. Most cards allow you to redeem rewards for travel purchases booked directly through the card issuer's travel portal or transferred to travel partner programs for flights, hotels, and other experiences. You can typically find redemption details on the card issuer's website or mobile app.

Conclusion

Finding the Fintechzoom Best Travel Credit Card is an exciting journey that unlocks a world of travel rewards and benefits. By carefully considering your travel goals, spending habits, and budget, you can identify the perfect card to elevate your travel experiences. Remember, there's no one-size-fits-all solution. Research thoroughly, compare options, and don't hesitate to leverage resources like BestCreditCards3.com for in-depth reviews and comparisons. Happy travels!

Read the full article

0 notes

Text

Konstantin Tserazov: “Armenia: FinTech Can Unlock the Truly Potential of Economy and Finance”

The key issue for foreign investors is the opportunity to invest capital and repatriate profits. The free flow of capital is equally important when individuals from various countries come to reside or work.

Armenia has proven itself to be a financially convenient country in which businesses and individuals can easily send and receive money. The development of FinTech in Armenia has made a significant impact, propelling the country to an international level as an attractive destination for tourists, migrants, and investors.

Deeper Integration with the West

The Armenian financial system's flexibility is clearly evident on its path towards deeper integration with the West. Remarkable news in this regard came on April 3, 2024: Ameriabank was sold to the Bank of Georgia Group PLC, a UK-based entity. The new key shareholder has investors such as BlackRock, the world's largest investment fund, and JPMorgan Chase, the number one U.S. bank in terms of asset valuation, backing it. Thus, Ameriabank gains access to the world of global finance via its investors. However, it's not just about attracting global investors; it's also about developing the local economy.

In May, this financial institution began offering online home loans aimed at the Armenian Diaspora abroad. Loans are available for local property purchases, renovations, or construction, regardless of the applicant's origin or location. Income from abroad is considered for loan applications, and permanent residency or registered income in Armenia is not required. Loans are available in local currency (Armenian Drams, AMD), U.S. dollars, or euros for terms of 5 to 30 years.

Digitalization and the application of FinTech have led to 98% of the bank's transactions being conducted online. FinTech ensures that all key aspects of loan operations are performed digitally.

Mergers and acquisitions (M&A) are on the rise in Armenia's banking sector. For instance, Ardshinbank recently struck a deal to take control over HSBC's Armenian branch.

..Not Only Towards the West