#FINANCIAL SCAM

Text

Buy Now Pay Later Apps: That Old Predatory Lending by a Crappy New Name

Years ago Kitty and I did an interview with Glen James from My Millennial Money, a podcast out of Australia that answers the question “Will I ever get tired of listening to men with Australian accents talk about everything from true crime to investing?” (And that answer, to be clear, is a resounding haaayl nah.) You should listen to it! It’s great!

At the end of our conversation, Glen hit us with a curveball. “What do you think of Afterpay?”

“I don’t know her,” said we. And Glen, who is clearly gifted with The Sight, answered cryptically, “Ah. So it hasn’t made it to the States yet. Good luck, mates.” And then we asked him to say “1999” and giggled incessantly.

Flash forward to the present. Not only have we now heard of buy now pay later apps like Afterpay… we fucking hate them. Which means it’s time for another installment of Piggy Rails Against a Financial Outrage for 2,000 Words Or So.

Keep reading.

If you liked this article, join our Patreon!

44 notes

·

View notes

Text

Money Laundering, as I understand it, is where illegally obtained money is exchanged in a process to make it legal. When a stereotypical over-confident crime boss describes his money laundering scheme, it would probably sound like this:

"I didn't make millions of US Dollars by selling party drugs, good heavens no! I just happen to run a very successful pizza parlor franchise. These parlors may appear to be derelict and understaffed. But according to my financial records our pizzas are extremely popular/profitable and our overhead costs are easily manageable. We don't keep track of who's ordering our pizzas because we respect our customers privacy!"

For those of you who are bit slow, and there is no shame in that, there are no pizzas being made or sold. The crime boss is selling drugs but he can't deposit the money into a regulated bank. And he needs the legit bank because it can be used to transfer money long distances, like to untaxable off-shore bank accounts. But he can't tell the bankers "I'm depositing money that I made by running an illegal narcotics operations" because that goes into the banks records which are subject to review by government law enforcement. So instead the crime boss sends the cash to the pizza parlors where the employees deposit it in the banks as earnings. The employees are allowed to take a small cut of the cash flow but the majority has to go into the bosses legitimate bank account. Any employee who takes more than their allotted amount will have to answer to the boss's enforcers.

When law enforcement agents check the boss's legit bank account, all they will find is the proceeds from the pizza business. So it's up to investigators to do a lot of legwork: visiting the parlors, interviewing employees, and monitoring transactions. If they can find a correlation between drug sales and profits from the pizzarias, then they have evidence they can bring to court.

This is just an example, not every money laundering scheme involves fake pizzas, although that was a thing back in the 1980-90's. You can swap pizza parlors for casinos, hotels, warehouses, and any other legitimate business. And the pizzas could be works of art, real estate, property rights, and cryptocurrencies. Finally the drug money could instead be any money taken illegally, like stolen from a bank, skimmed off the paychecks of illegally employed laborers, and exhorted from legit businesses. Oh, the money could also come from the sale of illegal firearms! Almost forgot about arms dealing!

Anyways that's how I think money laundering works, if I'm forgetting something, let me know!

P.S.: Why are you looking up money laundering on tumblr?

#economics#crime#law#financial scam#finance#money laundering#pizza parlor#information#legal theory#writing#education#educational#law enforcement#veth brenatto#money#organized crime

35 notes

·

View notes

Text

Beware of Online Loan Scams: Protect Yourself with These Tips

Beware of Online Loan Scams: Protect Yourself with These Tips

With the rise of online lending platforms, getting a loan has become more convenient than ever. However, along with the benefits, there are also risks to be aware of. Online loan scams have become increasingly prevalent, targeting unsuspecting individuals in need of financial assistance. In this blog post, we will explore the common…

View On WordPress

0 notes

Text

Victor Davis Hanson warns America’s witnessing a ‘systemic collapse’ [Video]

0 notes

Text

What Is Actually The Very Best Way To Confirm Financial Scam Recovery's Certifications?

In today's world, online frauds as well as financial scams have come to be a day-to-day incident. These scams leave behind folks really feeling defenseless as well as prone, along with their hard-earned funds entered an immediate. The after-effects may be complicated to get through, as well as people often look to financial scam recovery online services for help.

Nevertheless, it is actually critical to validate the accreditations and also reputation of these services before trusting them along with your cash as well as delicate relevant information. In this particular blog post, our team'll take a closer take a look at just how to figure out the validity of financial fraudulence recovery services and secure your assets post-scam.

Research the Company's References

When thinking about financial fraud recovery solutions, it's essential to look into the company's references as well as accreditations. Examine if they possess proper licenses as well as enrollments that enable all of them to operate in the financial field. Study their image through reviewing customer reviews and also inspecting their online visibility. Valid companies will normally have an expert web site, a listing of their services, and active consumer assistance.

Consult with Scams Restoration Experts Online

To obtain experienced insight and acquire effective fraudulence recovery options, consider looking for scams remuneration professionals online. These scams restitution experts online have years of expertise in scams and also scam recovery and can easily give sincere and dependable knowledge.

Confirmed online platforms like Trustpilot, Glassdoor, and SiteJabber provide thorough customer reviews of financial scams: reclaim lost assets. The knowledge discussed by various other scam targets can aid you make an informed decision when deciding on a recovery service.

Be Careful of Vows that Seem Too Good to Be True

When searching for financial scam recovery online, beware of companies that make impractical pledges. Scammers frequently make tall insurance claims as well as offer quick services to tempt the preys into giving them their funds. Genuine companies are going to encourage you versus unrealistic requirements and extensively evaluate your scenario prior to giving you with a solution. They will typically focus on a backup expense basis and just take an amount of the recouped funds.

Search For Fraud Recovery Specialists' Insights

To shield versus online scams, it is actually important to keep informed of the most recent fraud fighting strategies. Fraudulence recovery experts have a wide range of understanding and also expertise in finding as well as retrieving assets lost to frauds. You can easily find practical knowledge on their blogs, sites, and social media platforms. Stay up to day with the most up to date financial frauds and also learn exactly how to fighting financial fraud tactics.

Ask for Endorsements and also Example

Another way to validate the authenticity of financial fraud recovery online services is actually through asking for endorsements and study. Credible companies possess many results stories and satisfied clients that can attest their services.

Inquire to give you along with the call information of previous clients so you may confirm their adventure. Furthermore, you can check if they have any published case studies that highlight their competence in dealing with complex financial fraud.

Conclusion:

Falling for a financial scam can have disastrous repercussions, and it is actually logical to experience overloaded and uncertain. Nonetheless, with the appropriate relevant information and analysis, you can protect on your own as well as secure your resources post-scam. When deciding on financial fraud recovery online services, make sure that you investigate the company's accreditations, consult with specialists, beware of unrealistic pledges, keep notified, and also ask for recommendations and also example.

Keep in mind that legit companies will be straightforward and sincere in their method and also work relentlessly to redeem funds from financial frauds. Do not hesitate to seek assistance, and also constantly prioritize your security as well as well-being.

0 notes

Text

DO NOT VOLUNTEER TO BE A CO-SIGNER OR GUARANTOR FOR SOMEONE ON TUMBLR.

I just saw a 'mutual aid' post going around where instead of asking for donations, the person was asking someone to be a "guarantor" - also known as a "co-signer" - for their rent.

DO NOT DO THIS.

I am all for mutual aid. I think credit scores are a scam designed to fuck poor people. I get it. I do. BUT. Being a guarantor/co-signer for someone basically means that if they don't pay what they owe, for whatever reason, their landlord, bank, creditors, etc. can and will come after you for the full amount.

It seems like such an easy way to help someone. You don't need to pay any money, just lend them your name and good reputation so they can get permission to borrow and spend their own money. It feels like you're getting one over on the shitty capitalist system and using your privilege of good credit/income to help someone else.

But it is a HUGE risk. Do not do this. All it does is give that shitty system more ways to get their hooks into you and create tons of problems for you down the line.

You can really fuck yourself over in the long run by getting tangled up in a financial situation like this. Even co-signing for someone in your life who you trust, like a sibling or a parent, can be really risky. No matter how much you trust someone not to purposefully leave you holding the bag, now you're on the hook if they end up with financial problems neither of you anticipated.

Do not co-sign for another person's loan, car, rent, etc. unless you are able and prepared to pay the full amount or subject yourself to the mercy of whatever that person gets themselves into.

ESPECIALLY do not do this for someone on the internet, where scams are rife. Do not share your personal information with people online and NEVER allow someone else to use your personal information for their finances.

Here is an article with more information.

19K notes

·

View notes

Text

BBC raids: India arm lost PF money in IL&FS, DHFL scam

BBC World Service India Private Ltd, whose offices were subject to a survey today by the income-tax authorities over non-compliance with the Transfer Pricing Rules, had to write off ₹7.2 crore from its pension fund following its exposure to the two tainted non-banking companies, IL&FS and DHFL.

The New Delhi-based subsidiary of the UK’s national broadcaster along with other group entities, BBC Studios India Pvt Ltd and BBC Global News India Pvt Ltd, has a provident fund scheme under a trust called the BBC Worldwide India Employees Provident Fund. The trust had an exposure of ₹2.85 crore and ₹4.35 crore in the securities of IL&FS and DHFL, respectively. It is not clear if the “securities” only refer to debt or equity as well.

During the year (FY21), the company provided for ₹1.59 crore, including interest accrued till date, as a proportionate share of exposure of 80% and 35% of the investment made in IL&FS and DHFL, respectively, and accounted for the same as an exceptional item in its P&L. A sum of ₹1.44 crore on the investments was considered as a contingent liability and was to be assessed in the future based on the resolution proceedings, stated the company's filings. Fortune India, however, could not access the company’s financials for 2021-22.

Incidentally, rating agencies CARE and Brickworks, which have since been barred by the market regulator, had given an ‘AAA’ rating to DHFL’s non-convertible debentures (NCD) between 2016 and 2019. The bonds were subsequently downgraded to a default rating (D) after the NBFC began defaulting on its obligations. Besides commercial banks that owed ₹35,000 crore to DHFL, fixed deposit and NCD investors were the biggest lenders with an exposure of ₹45,000 crore.

With regards to the search, the tax authorities issued a statement today stating that the survey was in view of BBC’s deliberate non-compliance “for years” with the transfer pricing rules and vast diversion of profits. “As a result of the same, several notices have been issued to the BBC. However, the BBC has been continuously defiant and non-compliant and has significantly diverted profits,” read the statement.

According to the authorities, the key focus of the survey is to look into the manipulation of prices for unauthorised benefits, including non-compliance under transfer pricing rules, persistent and deliberate violation of transfer pricing norms; deliberate diversion of significant amounts of profits, and non-adherence in maintaining arm’s length arrangement in the case of allocation of profit. The company, which paid ₹2.04 crore in income tax in FY21, already has an ongoing case with the tax authorities but believes the outcome will not adversely impact its financial position and operations.

Incidentally, BBC World Service India, which produces content for radio, television and websites under contractual agreements with its parent and other group companies, in its annual statement mentioned that it has a comprehensive system of maintenance of information and documents as required by the transfer pricing regulation under Sections 92-92F of the Income-Tax Act, 1961.

“Since the law requires the existence of such information and documentation to be contemporaneous in nature, the company continuously updates its documentation for the international transactions entered into with the associated enterprises during the financial year and expects such records to be in existence latest by the due date for the same. The management is of the opinion that its international transactions are at arm’s length so that the aforesaid legislation will not have any impact on the financial statements, particularly on the amount of tax expense and that of provision for taxation,” the company filings state.

During 2020-21, the transactions that the company entered into on an arm’s length basis, involve the parent company, and fellow subsidiary, BBC Global News India Pvt Ltd. In FY21, on revenues of ₹107.45 crore, BBC World Service incurred a total expenditure of ₹103.97 crore, including staff expenses of ₹51.93 crore. As a result, it ended the year with a profit after tax of ₹2.40 crore. Read More On..

0 notes

Text

Indians Must Learn to 'Stay Safe Online' as Scammers Have Spread Phishing Net for IRCTC, UPI Users: Experts

While Union IT Minister Ashwini Vaishnaw launched a new campaign called “Stay Safe Online” as part of India’s presidency of the G20, a report by Cyble Research and Intelligence Labs (CRIL) revealed that there is a new wave of financial fraud in which scammers, monitoring Twitter complaints, are targeting IRCTC customers and UPI users.

Cybersecurity and online scams have emerged as significant concerns in recent years according to several tech experts, while the country is seeing a digital boom. From online payments to online healthcare consultation as well as education, Indians have embraced all types of new technology when needed. But at the same time reports highlighted a significant increase in online fraud cases too.

For example, as per Cyber Pravah, the third and fourth quarterly issue, UPI fraud cases have increased from 50,812 in Q4 2021 to 1,13,137 in Q1 2022. Additionally, internet banking fraud complaints saw a rise of 14% from 13,791 in O4 to 34,229 in Q1 of 2022.

It is said in the report that “technological advancements and the COVID-19 pandemic have also accelerated the reliance on digital platforms to perform daily and essential activities, making users increasingly susceptible to cyber threats”.

Additionally, according to data from the Ministry of Home Affairs (MHA), UPI frauds contributed significantly to a 15.3% increase in the overall number of complaints reported on the National Cybercrime Reporting Portal (NCRP) between the first and second quarters of 2022. Read More

0 notes

Text

Don’t use Temu!

#temu#fraud#scam#scammers#I also saw that they steal your financial information when you purchase#many ppl had fraudulent charges on their cards after buying from them#so the whole thing is a giant scam to steal from you and sell to the black market#PSA#shein#fast fashion#app scams

204 notes

·

View notes

Text

ATM thieves use glue and 'tap' function to drain accounts at Chase Bank.

There's a new warning for those who use the "tap" function at ATMs at Chase Bank.🤔

#pay attention#educate yourself#educate yourselves#reeducate yourself#knowledge is power#reeducate yourselves#think for yourself#think for yourselves#think about it#do your homework#do your research#do your own research#quantum financial system#ask yourself questions#ask yourself#ask yourselves#atm#scam#truthful news#real news#news#national news

164 notes

·

View notes

Text

my goat

#he was addressing comments that told him that he shouldnt respect the lgbt+ comm as a black man#his channels goated cuz it covers a lot of financial scams and shit while not shying away from the social justice angle#which is generally absent from a lot of commentary on that topic

8 notes

·

View notes

Text

I post about the cost of groceries destroying me and I nearly immediately get an ask begging me to help spread someone else's fundraiser

Either you're a spammer or you really can't fucking read the room, huh

#i looked at the blog and it's been around over a month so probably not a scam? but come on. fucking come on#why would you come begging to me? i'm also broke and don't have that many followers#all you've done is make me feel more guilty and useless. thanks#mod post#negative#financial stuff

11 notes

·

View notes

Text

Elder Fraud: Be Aware and Report Scams [Video]

#FinancialScam#SeniorsFinancialScammers#CrimesAgainstSeniors#Financial#FinancialAbuse#Financial Scam#Seniors Financial Scammers#Crimes Against Seniors#Financial Abuse

1 note

·

View note

Text

My first time watching Glass Onion it was obvious that Miles' speeches were bullshit, but I still searched for any hidden meaning there might be.

The second time is a different experience though because every time my brain starts to search for meaning, I feel like Benoit Blanc discovering that no, there is absolutely no hidden meaning.

It's bullshit it's all nothing nothing nothing! It is just how you end up talking when everyone reacts to your self-aggrandizing word vomit like it is actually wisdom.

Also, legit, when Miles gave his stupid bullshit speech about what the word 'disruptor' means to him, I shit you not I was like holy shit am I back in business school right now?!

Miles must have given speeches like that at 100 business school graduations, goddamn.

Like, the motherfuckers really do sound like this. We didn't have any billionaires come, but we had a lot of millionaire guest speakers in my classes, and they fucking talk like that.

They all think they're rugged capitalists, but they're just glass onions!

#original#glass onion#it's just. business school prepared me really well to succeed in the business world as a straight white neurotypical#able-bodied cis man with a large network of very wealthy friends and family#I really would have killed it if I wasn't a queer autistic cripple!#even the best teachers seemed incredibly unaware of the enormous privilege that they were assuming in their students when they taught#but they basically presupposed you had infinite energy and savings and a disturbingly large number of my classes were just#lectures about pushing as hard as you can no matter what#they used Starbucks as an example of an admirable case of somebody who persisted in going to 150 investor pitches before being approved#and like. how many people do you know who have enough savings to schedule plan and attend 150 investor pitches?#how many people do you know who could set up even 12 through their connections?#where are those savings coming from? where are those investor pitch meetings coming from? those aren't easy to get!!#but none of this was ever mentioned it was just awesome that the guy kept trying I guess.#I have a sneaking suspicion that if I were to have dug deeper into some of the examples we were given that a lot of those#real life businesses probably started with a big big loan from somebody's parents#I was listening to the show you're wrong about which is a really good podcast and Michael Hobbs was like#anytime you see an article glorifying someone's financial success especially at a young age you should control F for 'parents'#because chances are you will probably see the word 'parents' somewhere next to the words 'million dollar loan'#anyway college is a scam. the community aspect was incredibly cool but I don't see why we as a culture need to only be able to access that#kind of community when we are paying a scam Institution a shitload of money for Educations that aren't helpful for the majority of us#if College was free then people could actually study things that are useful or fun for them#I took most of my courses just to fill out my major too. the point wasn't to learn it was to graduate.#and then it turned out that if you're disabled in the way i am it doesn't matter if you have a college degree!#but I'm sure miles would say I just need to pull myself up by my bootstraps. and that's why I'm glad his life got exploded 😌#andi kept him around for his money - why else would he be there when no one even liked him??#he was the bankroll#one time I swear to god we just had the guy from American Psycho just a real ass Patrick Bateman#it was wild watching that movie later and being like ???? I know this guy!#outside of the actual murder scenes everything in that movie is not exaggerated in the slightest those bitches really are like that#like my parents are not 1% level rich so there'd be no giant loans but they are rich. it'd be stupid to act like i didn't benefit from that

97 notes

·

View notes

Text

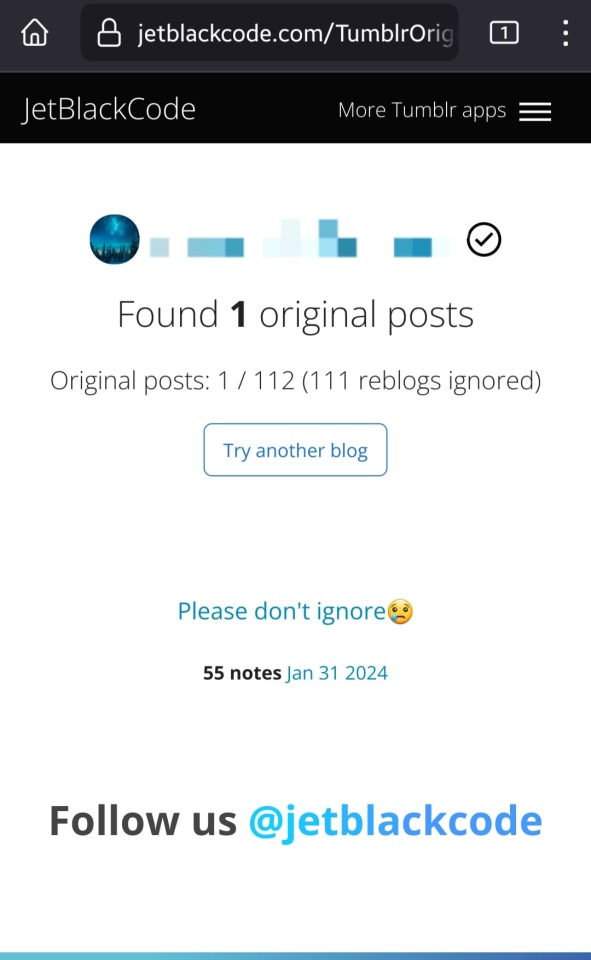

Here's a fun learning opportunity! If you ever get an ask like this

It's probably fake! If you wanna be certain (which is fair, you never know) go to this original post finder site, input the username (which I censored here) and press Begin.

If it only comes up with one original post (which is their pinned) it's a scam! Accounts like this mass send asks asking for money to lots of people, and their pinned has a "donation" link to help them. They reblog tons of posts too, to make them look real. It sucks that this kind of thing is even happening, but at least we have ways to handle it.

If someone is actually in need of money for something like this, don't go spamming people's asks for it. There are far better ways to go about it, like taking to DMs if it's someone specific you need to ask.

#psa#tumblr scams#also consider. i have no money. I can't financially support anyone even if i wanted to

10 notes

·

View notes

Text

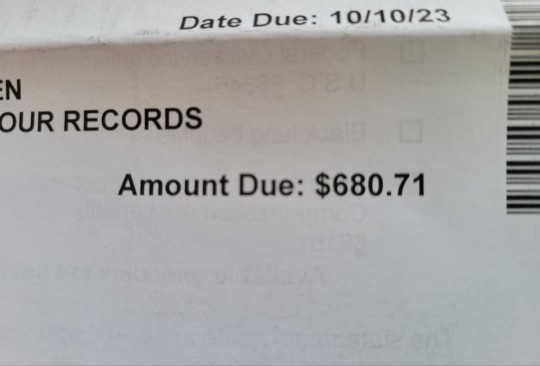

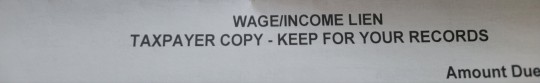

I just. I am so sick of this happening. A couple of years ago, I didn't pay my taxes on time. I just didn't have the money. Well, I entered into a payment plan, but they stopped sending me notices after a while, so I thought that I had paid it all off. After my grandma died, I was too much of a mess to think about it.

I received this bill on Friday. it states that the due date is in October, but if I don't pay this amount before Thursday, any income I have (including wages) will be withheld and sent to collectors. This is so unfair and total bullshit. I need what little money i have to pay my own bills.

I don't know what to do. I have no one to ask and I have already spoken to someone who told me that this is something that has to be taken care of. if I can pay it before Thursday, they were reverse the garnishment but if not.....I don't know how I will pay my electric bill, food, and other necessities.

I'm so tired.

#financial help#bills#finances#money#gofundme#cash app#paypal#not a scam#im so tired#bat.txt#i do have some of the money but i have been unable to pay it with my prepaid debit card#i just dont know what to do#a money order wont get there in time

15 notes

·

View notes