#Trade Finance Products

Text

Case Studies: Successful Use of Trade Finance Products in International Business

Trade finance products are instrumental in facilitating international business transactions by providing financial instruments that mitigate risks and improve liquidity. Here are some case studies showcasing successful implementations of trade finance products in global trade scenarios.

Case Study 1: Letters of Credit (LCs) in Manufacturing

Overview

A manufacturing company in Germany secured a significant export contract with a client in the United States. To mitigate the risk of non-payment and ensure timely receipt of funds, the company opted to use a confirmed irrevocable Letter of Credit (LC).

Implementation

LC Structure: The German company negotiated an irrevocable LC with a reputable U.S. bank, ensuring that payment would be guaranteed upon meeting specified conditions.

Risk Mitigation: By using a confirmed LC, the company minimized the risk of buyer default and currency fluctuations, ensuring financial security throughout the transaction.

Outcome

Smooth Transaction: The LC facilitated a smooth transaction, providing assurance to both parties and enabling the timely delivery of goods.

Financial Security: The company received payment promptly upon complying with the LC terms, enhancing cash flow and supporting further business expansion.

Case Study 2: Trade Credit Insurance in Exporting Agricultural Products

Overview

An agricultural exporter in Brazil faced challenges in exporting fresh produce to European markets due to concerns over buyer creditworthiness and political risks.

Implementation

Trade Credit Insurance: The exporter opted for trade credit insurance to protect against non-payment and political risks associated with international trade.

Coverage: The insurance policy covered the exporter's receivables against risks such as buyer insolvency, protracted default, and political instability.

Outcome

Market Expansion: With trade credit insurance in place, the exporter gained confidence to explore new markets in Europe and expand sales volumes.

Risk Management: The insurance provided peace of mind, enabling the exporter to focus on production and market penetration strategies without worrying about payment defaults.

Case Study 3: Export Financing in Textile Industry

Overview

A textile manufacturer in India received a large order from a retailer in the Middle East but lacked sufficient working capital to fulfill the order.

Implementation

Export Financing: The manufacturer secured pre-shipment financing from a local bank to cover production and shipping costs.

Loan Structure: The financing included a structured loan facility with favorable terms, allowing the manufacturer to produce and deliver the goods on time.

Outcome

Timely Delivery: The export financing ensured timely production and shipment of textile products, meeting the retailer's demand schedule.

Business Growth: With successful execution of the order, the manufacturer strengthened its reputation and established long-term relationships in the Middle Eastern market.

Case Study 4: Documentary Collections in Automotive Parts Trade

Overview

An automotive parts supplier in Japan needed a secure and cost-effective method to receive payment from a buyer in South Korea.

Implementation

Documentary Collection: The supplier utilized Documents Against Payment (D/P) to ensure secure payment before releasing shipping documents to the buyer.

Process Efficiency: This method provided a straightforward and efficient way to manage international transactions without the complexities and costs associated with Letters of Credit.

Outcome

Payment Security: The use of documentary collections ensured that the supplier received payment promptly upon shipment, reducing payment risks.

Cost-Effectiveness: Compared to other payment methods, documentary collections offered a cost-effective solution while maintaining transaction security.

Conclusion

These case studies highlight the diverse applications and benefits of trade finance products in international business. From mitigating payment risks with Letters of Credit to expanding market reach with trade credit insurance and improving cash flow with export financing, these products play a crucial role in supporting businesses' global trade operations. By leveraging trade finance products effectively, companies can enhance financial security, manage risks, and seize opportunities for growth in the competitive global marketplace.

0 notes

Text

Trade Finance

Trade Finance

About

You want the help of proficient exchange finance experts to depend on.

At Resource Union UAE, Exchange Money assembles a group of gifted specialists with huge and combined insight. This, supplemented by the most recent innovation of top notch principles, is the best answer for shippers who are looking for mastery for their Letters of Credit, ensure and organized economic agreements.

Our Exchange Money group's immense experience and information brings empowered us to the table for a serious level of incredible skill.

What Is Trade Finance?

Exchange finance addresses the monetary instruments and items that are utilized by organizations to work

with global exchange and trade. Exchange finance makes it conceivable and more straightforward for shippers and exporters to execute business through exchange. Exchange finance is an umbrella term meaning it covers numerous monetary items that banks and organizations use to make exchange exchanges attainable.

How Trade Finance Works?

The capability of exchange finance is to acquaint an outsider with exchanges to eliminate the installment risk and the stock gamble. Exchange finance furnishes the exporter with receivables or installment as per the arrangement while the merchant may be stretched out credit to satisfy the exchange request

The parties involved in trade finance are numerous and can include:

Banks

Exchange finance organizations Shippers and exporters

Safety net providers

Send out credit organizations and specialist co-ops

Trade Finance is unique in relation to customary supporting or credit issuance. General supporting is utilized to oversee dissolvability or liquidity, yet exchange supporting may not be guaranteed to demonstrate a purchaser's absence of assets or liquidity. All things being equal, exchange money might be utilized to

safeguard against global exchange's novel inborn dangers, for example, cash vacillations, political unsteadiness, issues of non-installment, or the reliability of one of the gatherings in question.

Below are a few of the financial instruments used in trade finance:

Loaning credit extensions can be given by banks to help the two merchants and exporters.

Letters of credit diminish the gamble related with worldwide exchange since the purchaser's bank ensures installment to the dealer for the merchandise transported. In any case, the purchaser is additionally

safeguarded since installment won't be made except if the terms in the LC are met by the dealer. The two players need to respect the understanding for the exchange to go through.

Considering is when organizations are paid in light of a level of their records receivables. Send out credit or working capital can be provided to exporters.

Protection can be utilized for transportation and the conveyance of products and can likewise shield the exporter from delinquency by the purchaser.

Albeit worldwide exchange has been presence for quite a long time, exchange finance works with its progression. The far reaching utilization of exchange finance has added to global exchange development.

WHAT ARE THE RISKS?

As worldwide exchange happens across borders, with organizations that are probably not going to be know about each other, there are different dangers to manage. These include:

Installment risk: Will the exporter be settled completely and on time? Will the shipper get the merchandise they needed?

Country risk: An assortment of dangers related with working with an outside country, for example, swapping scale risk, political gamble and sovereign gamble. For instance, an organization dislike sending out products to specific nations in light of the political circumstance, a disintegrating economy, the absence of legitimate designs, and so on.

Corporate gamble: The dangers related with the organization (exporter/merchant): what is their FICO assessment? Do they have a background marked by non-installment?

To decrease these dangers, banks - and different agents - have stepped in to give exchange finance items.

Reduce the Risk of Financial Hardship

Without exchange supporting, an organization could fall behind on installments and lose a vital client or provider that could have long haul repercussions for the organization. Having choices like spinning credit offices and records receivables calculating can assist organizations with executing universally as well as help them in the midst of monetary hardships.

LETTERS OF CREDIT (LC)

A Letter of Credit is a restrictive installment instrument under which the responsible bank irreversibly vows to pay the merchant in the event that introduced records follow the Credit's all's agreements.

We offer:

Irreversible LC Adaptable LC Consecutive LC

Spinning LC Backup LC

LETTERS OF GUARANTEE (LG)

The division is knowledgeable about proactively prescribing to clients the best organization and technique to safeguard their privileges and interest in all assurance classifications, for example, bid bonds, execution,

settlement ahead of time, maintenance, providers credit ensure, contract certifications and others.

HOW Would I GET IT?

For more data on the most proficient method to demand any Exchange Money administration or report for your business kindly contact your Business Relationship Official or you can email enquiries.

Fees & Charges

The commission rate depends on the gamble accepted by security and your monetary strength.

Different charges might incorporate reporter bank charges and costs brought about by connecting with the letter of acknowledge like messenger, quick charges, and so on.

Facilities of Trade Finance in UAE

Overdraft Facility: This is a supporting office that assists the business with arranging use, installments,

unrefined components and cost of capital, and admittance to assets to pay month to month costs like service bills. If there should be an occurrence of a potential deficiency in real money, an organization might utilize this choice.

Trust Receipt Financing A trust receipt is a sort of momentary credit for merchandise imported under a letter of credit. Trust receipt supporting is the most ideal choice for procurement.

Letter of Credit It is a letter and an assurance gave to the merchant from the bank, ensuring that purchasers will get the installment on time by the vender with the right sum. All letters have lucidity and are in total agreement to guarantee that they are in total agreement.

L/C Discounting: This is a type of transient advance by the bank to the vender. Through a markdown, a vender is paid right away, regardless of whether a purchaser needs to keep the credit time frame.

Cheque Discounting: in the event that, clients can take cash from the bank on the security of past-dated checks got from clients. Banks give this office just when they are fixed that they will get the sum from the client on the specified date.

Local Bill Discounting :A client can vow its neighborhood receipt to the bank and get a moment cash office in return for overseeing day to day tasks. The receivables are treated as guarantee and the bank offers the client a vowed sum at the concurred loan fee.

Bank Guarantee: In business, at times a circumstance can emerge when a client requests to carry on with work through a monetary assurance or a letter of credit from an outsider.

Required Documents

Public ID or substantial visa with UAE home visa and Emirates ID of all marking specialists and investors, if material

Substantial legitimate and constitutive reports (for example Exchange Permit, Endorsement of Business Enrollment, Free Zone Authentication of Fuse, Reminder of Affiliation, Organization Understanding) as material

Legal authority or Board Goal, if material Verification of Address

Subtleties of Extreme Gainful Proprietors

Bank Reference Letter and Company Profile, if pertinent Examined fiscal summaries

Contact us: +971-555394457

#trade finance#trade credit#trade finance products#international trade finance#trade finance in banking#trade finance services#global trade finance.

0 notes

Text

literally two days ago my dad was bragging about his google stock and i said "sell that shit google's getting too big for its britches" based on 0 research just vibes. wall street wishes it has what i have

#personal log#i also said meta and disney are going to get broken up#just in case apollo is with us in this chilis tonight#and also while i'm at it i predict meta is going to buy twitter and that will be the end of meta#like maybe 3-5 years from now#meta will branch off into some new fully-realized imvu/vrchat thing#and if i'm going to really go for it i'll go ahead and predict that that endeavor will be hand in hand with some kind of apple product#i'm just talking out my ass. but what if#listen. all my dad and i talk about is finance and technology 😭#my toxic trait is that i'm this 🤏 close to wanting to getting involved with stock trading at all times#but i think that would be BAAAAD for my ocd

4 notes

·

View notes

Text

youtube

#crypto market#fintech#finance#software#singapore#SynOption operates SYNCHRO#a Crypto Options Analytics and Trading Platform. Our dynamic OTC platform allows for trading of Crypto options in OTC and Exchange based fo#providing liquidity across exchanges#product suites#and alt-coins.#Key Features of Synchro - Crypto Options Analytics and Trading Platform#1. Multi Leg Strategies#2. Delta Cost Savings#3. Institutional Liquidity#4. RFQ Based Workflows#5. Multiple Clearing Venues#Youtube

2 notes

·

View notes

Text

#option trading#banking#ipo#stockmarket#finance#invest#investing#memes#bse#100 days of productivity#mensfashion#options

0 notes

Text

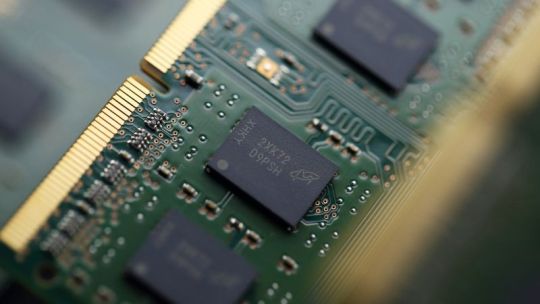

Micron Technology: China probes US chip maker for cybersecurity risks as tech tension escalates

Hong Kong

CNN

—

China has launched a cybersecurity probe into Micron Technology, one of America’s largest memory chip makers, in apparent retaliation after US allies in Asia and Europe announced new restrictions on the sale of key technology to Beijing.

The Cyberspace Administration of China (CAC) will review products sold by Micron in the country, according to a statement by the watchdog…

View On WordPress

#asia#beijing#business#business and industry sectors#china#companies#computer equipment#computer science and information technology#consumer products#continents and regions#digital security#domestic alerts#domestic-business#domestic-international news#east asia#economy and trade#iab-business and finance#iab-computing#iab-industries#iab-information and network security#iab-technology & computing#iab-technology industry#international alerts#international-business#micron technology incorporated#north america#semiconductors#technology#the americas#United States

0 notes

Text

China imposes sales restrictions on Micron as it escalates tech battle with Washington | CNN Business

Hong Kong

CNN

—

China has banned Chinese companies working on key infrastructure projects from buying products from US semiconductor manufacturer Micron, in a major escalation of an ongoing battle between the world’s top two economies over access to crucial technology.

The Cyberspace Administration of China announced the decision on Sunday, saying the US chip maker had failed to pass a…

View On WordPress

#asia#business#business and industry sectors#china#computer equipment#computer science and information technology#consumer products#continents and regions#domestic alerts#domestic-business#domestic-international news#east asia#economy and trade#iab-business and finance#iab-computing#iab-industries#iab-technology & computing#iab-technology industry#international alerts#international-business#north america#semiconductors#technology#the americas#united states

0 notes

Text

Intel co-founder Gordon Moore, author of 'Moore's Law' that helped drive computer revolution, dies at 94 | CNN Business

Intel co-founder Gordon Moore, a pioneer in the semiconductor industry whose “Moore’s Law” predicted a steady rise in computing power for decades, died Friday at the age of 94, the company announced.

Intel

(INTC) and Moore’s family philanthropic foundation said he died surrounded by family at his home in Hawaii.

Co-launching Intel in 1968, Moore was the rolled-up-sleeves engineer within a…

View On WordPress

#brand safety-nsf death#brand safety-nsf sensitive#business#business and industry sectors#companies#computer equipment#computer science and information technology#consumer electronics#consumer products#death and dying#deaths and fatalities#domestic alerts#domestic-business#economy and trade#electronics#iab-bereavement#iab-business and finance#iab-computing#iab-consumer electronics#iab-family and relationships#iab-industries#iab-technology & computing#iab-technology industry#intel corp#international alerts#international-business#personal computers#semiconductors#Society#technology

0 notes

Text

BIR targeting online sellers

If you have been engaging on selling items or services online, you should be aware that the Philippines’ authority on taxation the Bureau of Internal Revenue (BIR) is constantly watching you and it is seeking ways to tax you, according to a BusinessWorld news report. Already the BIR has been communicating with the e-commerce platforms.

To put things in perspective, posted below is an excerpt…

View On WordPress

#Bureau of Internal Revenue (BIR)#business#BusinessWorld#Carlo Carrasco#commerce#Department of Trade and Industry (DTI)#DigiPinas#e-commerce#economics#economy#Facebook#finance#governance#gross domestic product (GDP)#Instagram#jobs#money#new economy#news#online sellers#online selling#Philippines#Philippines blog#public service#retailing#sales#selling#social media#social media influencer (SMI)#social media inlfuencers (SMIs)

0 notes

Text

$30 million of Funko Pop! toys will be thrown in the trash | CNN Business

New York

CNN

—

Thirty million dollars worth of Funko

(FNKO) Pop! figures – those big-headed, vinyl pop-culture dolls – will soon make their way into the hands of a new collector: The garbage collector.

Funko said in its fourth quarter earnings report that a combination of waning demand for the toys and a surplus of inventory is creating financial trouble for the company. Last year, they had…

View On WordPress

#Business#business and industry sectors#companies#company activities and management#company earnings#Consumer Products#domestic alerts#domestic-business#economy and trade#financial performance and reports#financial results#funko#iab-business#iab-business accounting & finance#iab-business and finance#iab-business operations#iab-children&x27;s games and toys#iab-sales#iab-shopping#international alerts#International Business#toys and games

0 notes

Text

#trade finance#trade credit#trade finance products#international trade finance#trade finance in banking#trade finance services#global trade finance.

0 notes

Link

Commercial Bank Wins ‘Best Trade Finance Provider’ 2023 in Qatar

As per the latest news, Commercial Bank, the most innovative digital bank in Qatar has been honored with the “Best Trade Finance Provider in Qatar” by Global Finance for the fourth consecutive year. Global Finance is the world’s major publication that acknowledges distinct contributions to the financial industry. This award recognizes Commercial Bank’s outstanding performance in the trade finance sector and its constant dedication to delivering top-notch financial products and services to its clients. The Bank has been successfully maintaining its position as the “Best Bank In Qatar 2021” by Global Finance.

Trade finance plays an essential role in Commercial Bank’s business tactics, and the Bank has a well-established proven track record of enabling its clients to navigate the intricacies of international trade and minimize risks. The reason behind the Commercial Bank’s success in trade finance is none other than its commitment to innovation and its emphasis on delivering the best possible financial products and services to its clients. The Bank is dedicated to searching for opportunities to improve its trade finance offerings and fulfilling the advanced requirements of its clients.

Read more: https://www.emeriobanque.com/news/commercial-bank-in-qatar-wins-best-trade-finance-provider-2023

#Commercial Bank#Best Trade Finance Provider in Qata#financial products#international trade#trade finance

0 notes

Text

Deadball

Deadball Second Edition is a platinum bestseller on DrivethruRPG. This means it's in the top 2% of all products on the site. Its back cover has an endorsement from Sports Illustrated Kids.

It's also not an rpg I'd heard about until I discovered all of these facts one after another.

I was raised in a profoundly anti-sports household. My father would say stuff like "sports is for people who can't think" and "there's no point in exercising, everything in your body goes away eventually." So I didn't learn really any of the rules of the more popular American sports until I was in my mid twenties, and I've been to two ballgames in my life. I appreciate the enthusiasm that people have for sports, but it's in the same way that I appreciate anyone talking about their specific fandom.

One of the things that struck me reading Deadball was its sense of reverence for the sport. Its language isn't flowery. It's plain and technical and smart. But its love for baseball radiates off of the pages. Not like a blind adoration. But like when a dog sits with you on the porch.

For folks familiar with indie rpgs, there's a tone throughout the book that feels OSR. Deadball doesn't claim to be a precise simulation or a baseball wargame or anything like that---instead it lays out a bunch of rules and then encourages you to treat them like a recipe, adjusting to your taste. And it does this *while* being a detailed simulation that skirts the line of wargaming, which is an extremely OSR thing to do.

For folks not familiar with baseball, Deadball starts off assuming you know nothing and it explains the core rules of the sport before trying to pin dice and mechanics onto anything. It also explains baseball notation (which I was not able to decipher) and it uses this notation to track a play-by-play report of each game. Following this is an example of play and---in a move I think more rpgs should steal from---it has you play out a few rounds of this example of play. Again, this is all before it's really had a section explaining its rules.

In terms of characters and stats, Deadball is a detailed game. You can play modern or early 1900s baseball, and players can be of any gender on the same team, so there's a sort of alt history flavor to the whole experience, but there's also an intricate dice roll for every at bat and a full list of complex baseball feats that any character can have alongside their normal baseball stats. Plus there's a full table for oddities (things not normally covered by the rules of baseball, such as a raccoon straying onto the field and attacking a pitcher,) and a whole fatigue system for pitchers that contributes a strong sense of momentum to the game.

Deadball is also as much about franchises as it is about individual games, and you can also scout players, trade players, track injuries, track aging, appoint managers of different temperaments, rest pitchers in between games, etc.

For fans of specific athletes, Deadball includes rules for creating players, for playing in different eras, for adapting historical greats into one massively achronological superteam, and for playing through two different campaigns---one in a 2020s that wasn't and one in the 1910s.

There's also thankfully a simplified single roll you can use to abstract an entire game, allowing you to speed through seasons and potentially take a franchise far into the future. Finances and concession sales and things like that aren't tracked, but Deadball has already had a few expansions and a second edition, so this might be its next frontier.

Overall, my takeaway from Deadball is that it's a heck of a game. It's a remarkably detailed single or multiplayer simulation that I think might work really well for play-by-post (you could get a few friends to form a league and have a whole discord about it,) and it could certainly be used to generate some Blaseball if you start tweaking the rules as you play and never stop.

It's also an interesting read from a purely rpg design perspective. Deadball recognizes that its rules have the potential to be a little overbearing and so it puts in lots of little checks against that. It also keeps its more complex systems from sprawling out of control by trying to pack as much information as possible into a single dice roll.

For someone like me who has zero background in baseball, I don't think I'd properly play Deadball unless I had a bunch of friends who were into it and I could ride along with that enthusiasm. However as a designer I like the book a lot, and I'm putting it on my shelf of rpgs that have been formative for me, alongside Into The Odd, Monsterhearts, Mausritter, and Transit.

#ttrpg#ttrpg homebrew#ttrpgs#ttrpg design#indie ttrpgs#rpg#tabletop#indie ttrpg#dnd#rpgs#baseball#fantasy baseball#deadball

591 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Saving Money and Being Frugal

We’re all in this together. Don’t give up.

On food and groceries:

How to Shop for Groceries like a Boss

Why Name Brand Products Are Beneath You: The Honor and Glory of Buying Generic

If You Don’t Eat Leftovers I Don’t Even Want to Know You

You Are above Bottled Water, You Elegant Land Mermaid

You Should Learn To Cook. Here’s Why.

On entertainment and socializing:

The Frugal Introvert’s Guide to the Weekend

7 Totally Reasonable Ways To Save Money on Cheap Entertainment

Take Pride in Being a Cheap Date

The Library Is a Magical Place and You Should Fucking Go There

Your Library Lets You Stream Audiobooks and eBooks FOR FREEEEEEE!

What’s the Effect of Social Media on Your Finances?

You Won’t Regret Your Frugal 20s

On health:

How to Pay Hospital Bills When You’re Flat Broke

Run With Me if You Want to Save: How Exercising Will Save You Money

Our Master List of 100% Free Mental Health Self-Care Tactics

Why You Probably Don’t Need That Gym Membership

How to Get DIRT CHEAP Pet Medication, Without a Prescription

On other big expenses:

Businesses Will Happily Give You HUGE Discounts if You Ask This Magic Question

Understand the Hidden Costs of Travel and Avoid Them Like the Plague

Other People’s Weddings Don’t Have to Make You Broke

You Deserve Cheap, Fake Jewelry… Just Like Coco Chanel

3 Times I Was Damn Grateful for My Emergency Fund (and Side Income)

When (and How) to Try Refinancing or Consolidating Student Loans

The Real Story of How I Paid Off My Mortgage Early in 4 Years

Season 2, Episode 2: “I’m Not Ready to Buy a House—But How Do I *Get Ready* to Get Ready?”

The Most Impactful Financial Decision I’ve Ever Made… and Why I Don’t Recommend It

On buying secondhand and trading:

Almost Everything Can Be Purchased Secondhand

I Am a Craigslist Samurai and so Can You: How to Sell Used Stuff Online

The Delicate Art of the Friend Trade

On giving gifts and charitable donations:

How Can I Tame My Family’s Crazy Gift-Giving Expectations?

In Defense of Shameless Regifting

Make Sure Your Donations Have the Biggest Impact by Ruthlessly Judging Charities

The Anti-Consumerist Gift Guide: I Have No Gift to Bring, Pa Rum Pa Pum Pum

How to Spot a Charitable Scam

Ask the Bitches: How Do I Say “No” When a Loved One Asks for Money… Again?

On resisting temptation:

How to Insulate Yourself From Advertisements

Making Decisions Under Stress: The Siren Song of Chocolate Cake

The Magically Frugal Power of Patience

6 Proven Tactics for Avoiding Emotional Impulse Spending

On minimalism and buying less:

Don’t Spend Money on Shit You Don’t Like, Fool

Everything I Know About Minimalism I Learned from the Zombie Apocalypse

Slay Your Financial Vampires

The Subscription Box Craze and the Mindlessness of Wasteful Spending

On saving money:

How To Start Small by Saving Small

Not Every Savings Account Is Created Equal

The Unexpected Benefits (and Downsides) of Money Challenges

Budgets Don’t Work for Everyone—Try the Spending Tracker System Instead

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

The Magic of Unclaimed Property: How I Made $1,900 in 10 Minutes by Being a Disorganized Mess

We will periodically update this list with newer articles. And by “periodically” I mean “when we remember that it’s something we forgot to do for four months.”

Bitches Get Riches: setting realistic expectations since 2017!

Start saving right heckin’ now!

If you want to start small with your savings, consider signing up for an Acorns account! They round up your every purchase to the nearest dollar and save and invest the change for you. We like them so much we’ve generously allowed them to sponsor us with this affiliate link:

Start investing today with Acorns

#frugal#saving money#personal finance#money tips#financial tips#financial literacy#financial freedom#money#debt#money management#how to save money

572 notes

·

View notes

Text

Everyone wants a foldable phone, but most of us can't afford one yet | CNN Business

CNN

—

Chris Pantons is what you’d call a Google Pixel super fan. The Knoxville, Tennessee native loves the software, the camera, the virtual assistant, all of it. He even credits the phone’s car crash detection tool with saving his life a few years ago when he was in an accident.

“I’ve owned practically every Pixel device,” said Pantons, 33, who has posted hundreds of YouTube videos about…

View On WordPress

#alphabet inc#business#business and industry sectors#companies#consumer electronics#consumer products#domestic alerts#domestic-business#economy and trade#electronics#google inc#iab-business and finance#iab-consumer electronics#iab-industries#iab-smartphones#iab-technology & computing#iab-technology industry#international alerts#international-business#mobile and cellular telephones#mobile technology#samsung group#smartphones#technology

0 notes

Text

↪ ✧ 𝐓𝐇𝐄 𝐂𝐈𝐓𝐀𝐃𝐄𝐋 ( based on the oracle deck created by fez inkwright. each card represents an archetypal 'character' who resides in the citadel. send these as prompts for inspiring starters , or use them for drabbles ! feel free to combine prompts where desired . SEND A " ✧ " FOR RECIEVER TO RANDOMIZE A CARD ! )

𝐈. 𝐓𝐇𝐄 𝐂𝐎𝐔𝐑𝐓 ,

- the aspirant : ambition, diligence, setbacks.

- the assassin : ruthlessness, conviction.

- the catalyst : radical changes, taking control.

- the diviner : divine timing, evaluation.

- the fate : accepting help, guidance.

- the founder : foundations, community.

- the heir : unseen potential, hesitation.

- the hound : loyalty, chains, promises.

- the king : control, reversal of fortune.

- the poet : relationships, vulnerability.

- the queen : determination, sacrifice.

- the sleeper : cause and effect, clarity.

- the spymaster : knowledge, distrust.

- the waker : awareness, reflection.

- the wise one : tradition, order.

𝐈𝐈. 𝐓𝐇𝐄 𝐀𝐂𝐀𝐃𝐄𝐌𝐘 ,

- the acolyte : new projects, learning.

- the alchemist : balance, invention, destruction.

- the archer : biding your time, planning ahead.

- the astronomer : discovery, augury.

- the captain : taking command, teamwork.

- the cartographer : a crossroads, exploration.

- the champion : achievement, downfall.

- the enchanter : deception, trickery.

- the guide : inheritance, correction.

- the orator : communication, confidence.

- the patron : mentorship, finances.

- the priest : perseverance, faith.

- the scholar : investigation, research.

- the sentinel : determination, certainty.

- the warrior : perfectionism, burnout.

𝐈𝐈𝐈. 𝐓𝐇𝐄 𝐂𝐑𝐎𝐖𝐃 ,

- the botanist : parenthood, legacy.

- the forgotten : missed opportunities, fear of failure.

- the gambler : loss, risks.

- the hunter : surefootedness , predestination.

- the merchant : self-worth, trade.

- the miser : stubbornness, inflexibility.

- the muse : generosity, naivety.

- the pathless : difficult decisions, lack of direction.

- the pilgrim : opportunities, growth.

- the sailor : new influences, wanderlust.

- the shepherd : celebration, family.

- the smith : overthinking, taking action.

- the thief : seizing the moment, selfishness.

- the vengeance : overcoming sleights, a choice.

- the walker : the unknown, the journey.

𝐈𝐕. 𝐓𝐇𝐄 𝐓𝐑𝐎𝐔𝐏𝐄 ,

- the adventurer : responsibility, expectations.

- the brawler : lack of empathy, confrontation.

- the chiromancer : delivering news, collaboration.

- the dancer : self-expression, strength.

- the herald : small regrets, longing.

- the mascareri : hiding your true self, projection.

- the musician : inspiration, gratitude.

- the painter : productivity, creation.

- the puppeteer : explanations, apologies.

- the runaway : secrets, running away from problems.

- the storyteller : viewpoints, control.

- the tailor : attention to detail, pride.

- the twins : self-protection, dual natures.

- the weaver : rediscovery, transition.

- the witch : experimentation, rebellion.

#here's this for the lurking night crowd 💞🫶#rp prompts#drabble prompts#inbox prompts#rp memes#ohisms

226 notes

·

View notes