#bearish reversal pattern

Explore tagged Tumblr posts

Text

How to Trade the Bearish Engulfing Pattern: Complete Guide with Strategies and Examples

Candlestick patterns are powerful tools in the arsenal of a technical trader. Among the most reliable reversal patterns is the Bearish Engulfing Pattern—a strong signal that can hint at the start of a downward trend. In this guide, we’ll explain how to identify this pattern, why it works, and most importantly, how to trade it effectively with multiple strategies and examples. 📌 What is a Bearish…

#Bearish candle formation#Bearish engulfing candlestick pattern explained#Bearish Engulfing Pattern#Bearish engulfing pattern trading strategy#Bearish reversal pattern#Bearish trend confirmation#Can you trade bearish engulfing in forex?#Candlestick pattern for bearish reversal#candlestick patterns#Confirmation signals for bearish engulfing#EMA confluence with candlestick patterns#Engulfing candle trading rules#Entry and exit with candlestick patterns#Forex bearish engulfing strategy#How to confirm a bearish engulfing signal?#How to trade the bearish engulfing pattern#Is the bearish engulfing pattern reliable?#learn technical analysis#Multi-timeframe candlestick pattern strategy#Price action trading setup#Reversal Candlestick Patterns#Risk management for pattern trading#stock markets#Stock trading with bearish engulfing pattern#support and resistance levels#Swing trading with bearish engulfing#technical analysis#Trading bearish engulfing with moving averages#Trading Strategies#Using bearish engulfing with RSI

0 notes

Text

Uncovering Bearish Reversal Patterns: Using Precision to Navigate Market Downturns

Investigate effective tactics and important indications for recognizing and capitalizing on bearish reversal patterns in trading.

0 notes

Text

Uncovering Bearish Reversal Patterns: Using Precision to Navigate Market Downturns

Investigate effective tactics and important indications for recognizing and capitalizing on bearish reversal patterns in trading.

0 notes

Text

Uncovering Bearish Reversal Patterns: Using Precision to Navigate Market Downturns

Investigate effective tactics and important indications for recognizing and capitalizing on bearish reversal patterns in trading.

0 notes

Text

Uncovering Bearish Reversal Patterns: Using Precision to Navigate Market Downturns

Investigate effective tactics and important indications for recognizing and capitalizing on bearish reversal patterns in trading.

0 notes

Text

10 Candlestick Patterns for Effective Trading

Candlestick patterns are a powerful tool for traders to analyze price movements and predict future market behavior. Developed in Japan over 300 years ago, these patterns are widely used in modern technical analysis. This article will explore ten essential candlestick patterns that can help traders make informed decisions and enhance their trading strategies. What are Candlestick…

#Bearish Patterns#Bullish Patterns#Candlestick Patterns#Downtrend#Entry and Exit Points#Forex#Forex Traders#Forex Trading#Market Reversal#Price Movements#Risk Management#Stop-Loss#Take-Profit#Technical Analysis#Trading Psychology#Trading Strategies#Trading Strategy#Trend Direction#Trend Identification#Uptrend

1 note

·

View note

Text

Unlock the Secrets of Trading with Top Chart Patterns! Explore the world of chart patterns with Funded Traders Global. From understanding the basics of technical analysis to recognizing common chart patterns like head and shoulders, double tops, and flags, our blog equips you with the knowledge to enhance your trading skills. Discover advanced patterns like pennants, wedges, and harmonic patterns, and gain practical tips for effective trading. Improve your risk management, pinpoint entry and exit points, and combine chart patterns with technical indicators. Start your journey towards trading success today with Funded Traders Global!

#Advanced Chart Pattern#and Descending Triangles#and mini trading#Ascending#Basics of Technical Analysis#Benefits of Recognizing in Chart Pattern#Bullish and Bearish Flags Pattern#candlestick#candlestick Pattern#career in forex trading#chart patterns#classic reversal pattern#common chart patterns#cup and handle pattern#Double top and double bottom patterns#drawdown#financial markets#Forex trading financial freedom#FTG#ftg prop firm#ftg trading#Funded Traders Global#Gaps#Harmonic Patterns#Head and Shoulders Pattern#how to scale into a forex trade#Macro#Master the Market with These Top Chart Patterns for Trading#mastering Forex trading#micro

0 notes

Text

0 notes

Text

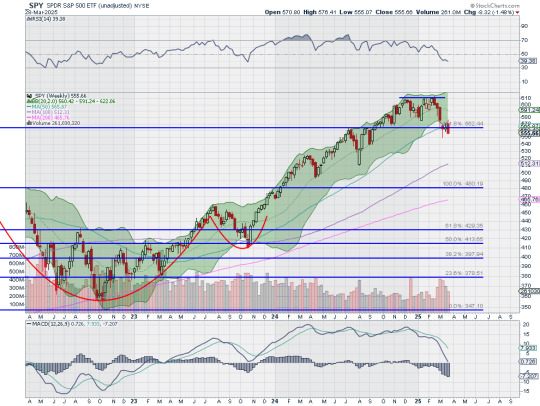

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with the March FOMC meeting and options expiration in the books, that equity markets shifted to stability after 3 weeks of downward price action. Elsewhere looked for Gold ($GLD) to continue its ascent into space while Crude Oil ($USO) consolidated at the bottom of a broad range. The US Dollar Index ($DXY) looked to have found support in its drift lower while US Treasuries ($TLT) looked weaker in their consolidation. The Shanghai Composite ($ASHR) looked to digest the recent move higher while Emerging Markets ($EEM) consolidated in a narrow range.

The Volatility Index ($VXX) looked to remain slightly elevated putting some pressure on equity markets. Their charts remained at risk of more downside, especially on the longer timeframe. On the shorter timeframe both the $QQQ and $SPY looked to be stabilizing as they held the bounce during the week. The $IWM was a bit weaker.

The week played out with Gold retesting 3000 before a run up to new all-time highs while Crude Oil found some strength and moved higher in the consolidation range. The US Dollar held in a narrow range while Treasuries fell back to a 5 week low before catching a bid Friday. The Shanghai Composite found support and moved sideways while Emerging Markets dropped out of the short consolidation.

The Volatility Index started by moving lower but reversed Wednesday to end the week slightly higher. This saw the bounce rally in equities grind to a halt early in the week and they dropped back through Friday. This resulted in the SPY and the QQQ and the IWM printing new 2 week lows. What does this mean for the coming week? Let’s look at some charts.

The SPY came into the week pausing in a bounce off the 61.8% retracement of the leg higher since August 2023 and reclaiming the 161.8% extension of the retracement of the 2022 drop. It gapped up Monday to touch the 200 day SMA and over the 20 day SMA but then printed and Evening Star reversal pattern and started lower Wednesday. It gathered steam in the move lower Friday to end the week at a 2 week low. It looks as if the bounce might confirm as a bear flag and confirmation would give a target to 513. It has a RSI dropping back from a stall at the midline in bearish territory with the MACD curling to cross down and negative.

The weekly chart shows a bearish engulfing candle, also suggesting more downside, holding under the 50 week SMA. The RSI has gone level at the bottom of the bullish zone with a peak into the bearish zone with the MACD dropping but positive. There is resistance above at 556.50 followed by 565.50 and 569 then 571 and 574.50 before 581 and 585. Support lower is at 549.50 then 545.75 and 542.50 before 540 and 537. Pullback in Uptrend.

With just one trading day left in the 1st Quarter of 2025, equity markets showed renewed weakness after a positive start to the week. Elsewhere look for Gold to continue its record breaking drive higher while Crude Oil rises in consolidation. The US Dollar Index looks to continue to drift to the downside while US Treasuries pullback in their consolidation. The Shanghai Composite looks to consolidation in the short term uptrend while Emerging Markets continue a short term consolidation.

The Volatility Index looks to remain slightly elevated making the path easier for equity markets to the downside. Their charts look vulnerable on both timeframes. On the shorter timeframe the SPY if a bit stronger than the QQQ and IWM. On the longer timeframe all look set up for more downside. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview March 28, 2025

11 notes

·

View notes

Text

Uncovering Bearish Reversal Patterns: Using Precision to Navigate Market Downturns

Investigate effective tactics and important indications for recognizing and capitalizing on bearish reversal patterns in trading.

0 notes

Text

Mastering forex signals for trend following: a comprehensive guide

The foreign exchange market, or Forex, is a dynamic and ever-changing arena where traders seek to capitalize on currency price movements. One popular trading strategy is trend following, which involves identifying and following the prevailing market direction. Forex signals play a crucial role in assisting traders to navigate the complexities of trend following. In this comprehensive guide, we will explore the intricacies of Forex signals for trend following, helping you understand how to leverage them effectively for successful trading.

Understanding Trend Following

Trend following is a strategy that seeks to capitalize on the directionality of market prices. The basic premise is simple: identify the prevailing trend and place trades in the same direction. Trends can be upward (bullish), downward (bearish), or sideways (range-bound). Successful trend following involves entering a trade at the beginning of a trend and exiting when the trend shows signs of reversal.

The Role of Forex Signals

Forex signals serve as triggers for traders, indicating opportune moments to enter or exit a trade. These signals are generated through a thorough analysis of market data, including technical indicators, fundamental factors, and sometimes a combination of both. For trend following, signals become particularly crucial as they guide traders on when to jump on a trend and when to step aside.

Key Components of Forex Signals for Trend Following

1. Technical Indicators:

Moving Averages: These are fundamental tools in trend following. A moving average smoothens price data to create a single flowing line. Traders often look for crossovers, where short-term moving averages cross above long-term ones, as a signal to enter a trade.

Relative Strength Index (RSI): RSI measures the speed and change of price movements. A high RSI may indicate overbought conditions, suggesting a potential reversal, while a low RSI may indicate oversold conditions, signaling a potential buying opportunity.

Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

2. Fundamental Analysis:

While trend following is predominantly a technical strategy, incorporating fundamental analysis can enhance the accuracy of signals. Economic indicators, interest rates, and geopolitical events can significantly impact currency trends.

3. Price Action:

Pure price action analysis involves studying the historical price movements of a currency pair. Identifying patterns, such as higher highs and higher lows in an uptrend, can provide strong signals for trend following.

Choosing a Reliable Signal Provider

With the plethora of signal providers available, it's essential to choose a reliable one. Consider the following factors:

Track Record: A provider's historical performance is a crucial indicator of their reliability. Look for providers with a consistent track record of accurate signals.

Transparency: Transparent signal providers disclose their methods, including the criteria for generating signals and their risk management strategies.

Risk-Reward Ratio: A good signal provider should have a clear risk-reward ratio for each signal, helping you manage your trades effectively.

Implementing Forex Signals for Trend Following

Once you've selected a signal provider or developed a reliable system, the implementation phase is critical. Here are some tips:

Risk Management: Set clear risk parameters for each trade. This includes defining the percentage of your trading capital you're willing to risk on a single trade.

Position Sizing: Adjust the size of your positions based on the strength of the signal and the volatility of the market.

Stay Informed: While signals provide valuable insights, staying informed about broader market trends and events is crucial. Unexpected news can impact the Forex market.

Continuous Evaluation: Regularly assess the performance of your chosen signals and be prepared to adjust your strategy if market conditions change.

Conclusion

Forex signals for trend following can be powerful tools in a trader's arsenal, helping to identify and capitalize on market trends. However, success in Forex trading requires a comprehensive understanding of both the strategy and the market itself. By combining technical indicators, fundamental analysis, and a disciplined approach to risk management, traders can use Forex signals to navigate the complex world of trend following with confidence. Remember, no strategy guarantees success, and ongoing learning and adaptation are essential for long-term success in the Forex market.

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

28 notes

·

View notes

Link

#CandlestickAnalysis#candlestickpatterns#chartpatterns#ForexTrading#markettrends#MomentumTrading#priceaction#ReversalPatterns#riskmanagement#StockMarket#supportandresistance#technicalanalysis#TradingSignals#TradingStrategy#TrendContinuation

2 notes

·

View notes

Text

A Beginner's Guide to Cryptocurrency Sentiment Analysis for Maximizing Profits

Emotions are a natural aspect of existence, directing many of our decisions, whether as humans or in animals. These emotional choices don't always work out as planned, but they frequently have unanticipated consequences. Financial decisions that are driven by emotions can have serious repercussions, particularly in the cryptocurrency market. This blog examines the significance of sentiment research in cryptocurrency trading, demonstrating how monitoring public sentiments can provide traders with an advantage in a chaotic market.

Sentiment Analysis

Sentiment analysis is a computer approach for detecting and categorizing emotions and opinions conveyed in textual data. Using this method, one may parse text to ascertain if a message is positive, negative, or neutral.

Sentiment analysis helps in comprehending the views, attitudes, and responses of the public toward a range of subjects, goods, or occasions by examining and interpreting the emotional tone of written text. To obtain insights into consumer feelings and industry trends, it is commonly utilized in domains including financial analysis, social media monitoring, and market research.

Crypto-Related Sentiment Analysis

Sentiment research is essential for comprehending and forecasting market activity in the cryptocurrency space. This is how it's relevant:

News and Social Media Impact: Sentiment analysis monitors the voice of news stories, tweets, and forum comments to determine how the general population feels about cryptocurrency. This aids in determining the potential impact of current affairs and social media trends on market values.

Sentiment Indicators for the Market: Traders can discern bullish (positive) or bearish (negative) movements by assessing the general sentiment. An increase in favorable attitudes toward a cryptocurrency, for example, may portend an impending price increase.

Early Warning Signals: By examining abrupt alterations in public opinion or sentiment patterns, sentiment research can offer early alerts of impending market shifts or reversals.

Investor insights: By assessing the general sentiment of the market, traders and investors may make more informed judgments about their trading tactics.

How Sentiment Analysis Works in Crypto?

1. Data Sources for Sentiment Analysis

A. Social Media Platforms

These platforms provide a real-time gauge of popular sentiment. Sentiment research tools may detect trends early on and provide a clear picture of the market mood by examining posts, comments, and hashtags. Examples: Facebook, Twitter, Reddit.

B. News Sources:

Information about current affairs and events impacting the market may be found in reports and news articles. One approach to track how the public's perception of the present is evolving and how this is impacting market behavior is to keep an eye on the tone of news items. Websites featuring financial news and cryptocurrency news portals are two examples.

C. Community Conversations and Forums:

Forums and discussion boards can be used as a proxy for the community's atmosphere. They give a comprehensive examination of in-depth discussions and opinions from cryptocurrency enthusiasts, providing illuminating details on the overall mood of the market. The specialized Bitcoin forums CryptoCompare and Bitcointalk are two examples.

D. On-Chain Data for Market Trends:

On-chain data provides insight into the inner workings of the market. Sentiment research provides a more comprehensive understanding of market dynamics by revealing hidden trends and investor behaviors via the examination of transaction patterns and wallet movements. As an illustration: Blockchain data, transaction volumes, wallet activity.

2. Sentiment Indicators

A. Fear and Greed Index:

This index measures the amount of fear and greed in the market. It is a barometer of mood. It provides a quick glimpse into the psychology of the market by combining elements including volatility, market momentum, and emotion on social media. Severe anxiety or avarice frequently portends important shifts in the market.

B. Bullish/Bearish Sentiment Indicators:

These indicators measure the ratio of bullish (positive) to bearish (negative) sentiment. They provide hints for forecasting future price movements and market shifts and assist in determining whether the market is bought by optimism or burdened by pessimism.

Methods of Conducting Crypto Sentiment Analysis

Manual Sentiment Analysis: Hand-reading textual data from news articles, tweets, Reddit posts, and forums allows individuals to interpret sentiment, considering context and tone, providing nuanced understanding, and capturing subtleties that automated tools might miss.

Automated Sentiment Analysis: The tool uses Natural Language Processing and machine learning algorithms to analyze text data, categorize sentiment as positive, negative, or neutral, and is efficient, scalable, and consistent in applying sentiment rules.

Natural Language Processing (NLP): The AI branch enables interaction between computers and human language using Natural Language Processing (NLP) techniques to extract sentiment, identify patterns, and handle diverse linguistic styles, enhancing understanding.

Machine learning algorithms: Labeled datasets are used to train algorithms for sentiment classification, often using supervised learning techniques. These models can adapt and improve over time, delivering high accuracy with well-trained models.

Sentiment Analysis Tools and Platforms: Specialized software and platforms analyze sentiment data from various sources, providing dashboards and reports for market tracking. User-friendly interfaces and pre-built algorithms simplify sentiment analysis without technical expertise.

Is Sentiment Analysis the Key to Crypto Success?

Early Detection of Market Trends: Traders can predict market movements by using sentiment research to identify trends early on. Through the surveillance of public opinion on various platforms, traders may adopt calculated positions to optimize profits or minimize losses.

Enhanced Decision Making: Sentiment analysis enhances traditional analysis by providing insights into public opinion and behavior, adding a psychological dimension to market conditions. Combining sentiment with other methods allows traders to make informed decisions, with real-life case studies demonstrating its predictive power.

Risk Management: Sentiment analysis aids traders in avoiding emotional decisions influenced by hype or fear, enabling them to stay calm during market volatility, preventing impulsive actions that could lead to losses, as well as avoiding FOMO and other emotional trading pitfalls. Bottom Line

Let's take a look at Wagescoin (WGS), a cryptocurrency that rewards users for participating in activities and adding value to the network, to demonstrate how sentiment analysis may be used. Sentiment data about Wagescoin from social media, news, and forums may be analyzed to determine how people feel about the project as a whole, spot possible buy/sell opportunities, and make wise trading decisions.

Crypto sentiment research is a useful tool for identifying market trends and making sound trading decisions. Through the examination of public opinion on social media, news sites, and discussion boards, traders can learn more about the psychological factors influencing price fluctuations.

Sentiment analysis should not be used in isolation, even if it can supplement technical or fundamental research and offer early insights.

Traders should integrate sentiment insights with more comprehensive market data and research for the best outcomes. Sentiment research has the potential to improve strategic decision-making and aid in navigating the unstable cryptocurrency market when applied appropriately.

For More Info:

Website : https://wgscoin.com/

Telegram : https://t.me/wagescoin

TikTok : www.tiktok.com/@wagescoin

3 notes

·

View notes

Text

Bitcoin, the leading cryptocurrency, has recently faced a significant downturn, trading around $56,697.32. Despite this bearish phase, there are signs of a potential rebound. The Relative Strength Index (RSI) stands at 28.41, indicating oversold conditions typically seen as buying opportunities. Candlestick patterns with long lower shadows suggest buying pressure at lower levels, hinting at a price reversal.

Influential analyst CryptoJack is optimistic, predicting Bitcoin will surpass $100,000 despite the current downturn. He believes Bitcoin is near its bottom, aligning with technical indicators suggesting an oversold market.

Market data from CoinMarketCap shows Bitcoin’s market cap at $1.12 trillion, a 2.63% increase in one day, while the 24-hour trading volume has decreased by 38.03% to $31.91 billion, indicating consolidation. Traders are cautious, but the oversold RSI and bullish patterns support the possibility of a rebound. Watching for signs of reversal could signal the start of a recovery phase.

4 notes

·

View notes

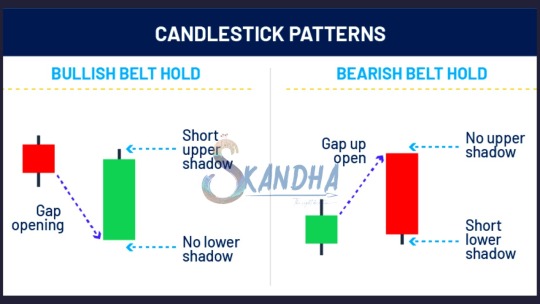

Text

A belt hold pattern suggests that a trend may be reversing and indicates investor sentiment may have changed. When looking at them historically, there will often be a clear trend in one direction, followed by a clear trend in the other direction as the color of the candlestick changes.

There are two types of belt hold candlestick: one bullish and one bearish.

#skandhatrade #belthold #support #resistance #stock #chart #Trade #signal #patterns

#trend #Technicals #analysis #strategies #candlestick #priceaction #entry #supply #demand

To Learn More DM us

We Offer Paid Courses And Training Contact us Via

Email : [email protected]

https://forms.gle/8rWzz1gUuerxwVM49

Website: https://skandhatrade.com/

To Register for Learning:

2 notes

·

View notes

Text

SOL Risks $120 Retest Despite Bullish Onchain Data

Key takeaway: SOL (SOL) projects a bearish outlook on the daily chart after forming a bearish engulfing, and if the trend holds, SOL price could fall to $120. On the 1-day time frame, SOL shows a head-and-shoulders pattern, which is a bearish reversal signal. A breakdown below its $140 neckline level, confirmed by a volume spike, could lead to a bearish continuation. Solana 1-day chart. Source:…

0 notes