#the International Monetary Fund

Text

#John Perkins#Former CIA operative and Economic Hit Man#Book: New Confessions of an Economic Hit Man#EHM are assigned to overthrow sovereign countries Govt with bribes lies and deceit since 1951.#On behalf of the US Intelligence agencies#Using the World Bank#The US Federal Reserve#The International Monetary Fund#And the strength of the Military to protect those interests once a country has been colonized or mortgaged to the World Bank.#Read the Book for a better explanation

4 notes

·

View notes

Text

تقييم دور الولايات المتحدة الأمريكية في إصلاح النظام المالي العالمي بعد الأزمة المالية العالمية - دراسة باستخدام نظرية الاستقرار بالهيمنة

تقييم دور الولايات المتحدة الأمريكية في إصلاح النظام المالي العالمي بعد الأزمة المالية العالمية – دراسة باستخدام نظرية الاستقرار بالهيمنة

تقييم دور الولايات المتحدة الأمريكية في إصلاح النظام المالي العالمي بعد الأزمة المالية العالمية – دراسة باستخدام نظرية الاستقرار بالهيمنة

تقييم دور الولايات المتحدة الأمريكية في إصلاح النظام المالي العالمي بعد الأزمة المالية العالمية – دراسة باستخدام نظرية الاستقرار بالهيمنة

الكاتب : بوزرب خيرالدين . منصوري عبد الله.

الملخص:

أظهرت الأزمة المالية العالمية أن الأسس التي يقوم عليها النظام المالي…

View On WordPress

#financial crisis#the Dodd-Frank Act#the global financial system#the International Monetary Fund#الأزمة المالية العالمية#النظام المالي العالمي#صندوق النقد الدولي#قانون دود فرانك.

0 notes

Text

تقييم دور الولايات المتحدة الأمريكية في إصلاح النظام المالي العالمي بعد الأزمة المالية العالمية - دراسة باستخدام نظرية الاستقرار بالهيمنة

تقييم دور الولايات المتحدة الأمريكية في إصلاح النظام المالي العالمي بعد الأزمة المالية العالمية – دراسة باستخدام نظرية الاستقرار بالهيمنة

تقييم دور الولايات المتحدة الأمريكية في إصلاح النظام المالي العالمي بعد الأزمة المالية العالمية – دراسة باستخدام نظرية الاستقرار بالهيمنة

تقييم دور الولايات المتحدة الأمريكية في إصلاح النظام المالي العالمي بعد الأزمة المالية العالمية – دراسة باستخدام نظرية الاستقرار بالهيمنة

الكاتب : بوزرب خيرالدين . منصوري عبد الله.

الملخص:

أظهرت الأزمة المالية العالمية أن الأسس التي يقوم عليها النظام المالي…

View On WordPress

#financial crisis#the Dodd-Frank Act#the global financial system#the International Monetary Fund#الأزمة المالية العالمية#النظام المالي العالمي#صندوق النقد الدولي#قانون دود فرانك.

0 notes

Text

تقييم دور الولايات المتحدة الأمريكية في إصلاح النظام المالي العالمي بعد الأزمة المالية العالمية - دراسة باستخدام نظرية الاستقرار بالهيمنة

تقييم دور الولايات المتحدة الأمريكية في إصلاح النظام المالي العالمي بعد الأزمة المالية العالمية – دراسة باستخدام نظرية الاستقرار بالهيمنة

تقييم دور الولايات المتحدة الأمريكية في إصلاح النظام المالي العالمي بعد الأزمة المالية العالمية – دراسة باستخدام نظرية الاستقرار بالهيمنة

تقييم دور الولايات المتحدة الأمريكية في إصلاح النظام المالي العالمي بعد الأزمة المالية العالمية – دراسة باستخدام نظرية الاستقرار بالهيمنة

الكاتب : بوزرب خيرالدين . منصوري عبد الله.

الملخص:

أظهرت الأزمة المالية العالمية أن الأسس التي يقوم عليها النظام المالي…

View On WordPress

#financial crisis#the Dodd-Frank Act#the global financial system#the International Monetary Fund#الأزمة المالية العالمية#النظام المالي العالمي#صندوق النقد الدولي#قانون دود فرانك.

0 notes

Text

Random reading recommendation 1 (find this under my pinned post, under “reading”)

https://www.imf.org/-/media/Files/Publications/SDN/2024/English/SDNEA2024001.ashx

International Monetary Fund - Gen-AI: Artificial Intelligence and the Future of Work PDF.

ABSTRACT: Artificial intelligence (AI) has the potential to reshape the global economy, especially in the realm of labor markets. Advanced economies will experience the benefits and pitfalls of AI sooner than emerging market and developing economies, largely because their employment structure is focused on cognitive- intensive roles. There are some consistent patterns concerning AI exposure: women and college-educated individuals are more exposed but also better poised to reap AI benefits, and older workers are potentially less able to adapt to the new technology. Labor income inequality may increase if the complementarity between AI and high-income workers is strong, and capital returns will increase wealth inequality. However, if productivity gains are sufficiently large, income levels could surge for most workers. In this evolving landscape, advanced economies and more developed emerging market economies need to focus on upgrading regulatory frameworks and supporting labor reallocation while safeguarding those adversely affected. Emerging market and developing economies should prioritize the development of digital infrastructure and digital skills.

#c suite#powerful woman#ceo aesthetic#personal growth#strong women#that girl#productivity#getting your life together#balance#Reading#books#adulting#reading recommendations#pdf#imf#international monetary fund#Finance

66 notes

·

View notes

Text

by Judith Miller

Last fall, Egypt was on the brink of economic collapse. A decade of debt-fueled spending on a pharaonic-scale had emptied its Central Bank coffers. By February, Cairo’s public debt was 89% of its gross domestic product. External debt had soared to 46% of GDP. The pound, its currency, was one of the world’s worst performing. Unable to import supplies and repatriate profits, foreign companies were leaving, or threatening to leave Egypt in droves. Annual inflation was over 35%, and double that for some food staples. Egypt seemed on the verge of a sovereign default—its first ever.

Then came Oct. 7.

Officials, businessmen, and financial analysts say that however horrific the war has been for Israelis and for Palestinians in Gaza, Oct. 7 has helped save Egypt from economic ruin and growing political unrest. To be sure, Egypt is paying heavily for the ongoing Israel-Hamas war on its border. Its three main sources of revenue—hard currency from the Suez Canal, tourism, and remittances from Egyptian workers abroad—have plummeted by between 30% and 40%. But without Hamas’ horrific massacre, which killed 1,200 people and took another 240 hostage, and Israel’s much criticized retaliation in Gaza, Egypt would probably not have gotten the international financial lifeline that has rescued it yet again from economic ruin, just in time.

“Just after the attack, the government began strategizing, successfully it’s turned out, about how to use the crisis to secure a bailout,” said Ahmed Aboudouh, an Egyptian expert at Chatham House, a London-based think tank. “Oct. 7 helped save Egypt’s economy, at least temporarily.”

Last February, the Abu Dhabi Developmental Holding Company (ADQ), Abu Dhabi’s sovereign wealth fund, unveiled plans to develop a city by the sea on part of the 65-square-mile peninsula of Ras el-Hekma, one of the few undeveloped areas on the Mediterranean coast, part of a sale worth $35 billion in investment and debt relief, the largest foreign direct investment deal in Egyptian history. Egypt will retain a 35% stake in the project. Since Sheikh Tahnoun bin Zayed al-Nahyan, the chairman of ADQ, is Emirati President Mohammed bin Zayed al-Nahyan’s brother and the UAE’s national security adviser, the Ras el-Hekma purchase was far more than a financial transaction. It was part of an Egyptian bailout.

Egyptians bristle at the loss of their nation’s diplomatic clout. By reviving its regional profile, Oct. 7 has bestowed another gift on Egypt.

Then in March, Cairo secured a critical $8 billion loan from the International Monetary Fund, with strong American support. The IMF infusion, in turn, opened other foreign faucets. The European Union promptly agreed to provide another $8 billion in grants and loans, ostensibly to help Egypt’s economy, but in reality, to assure Egypt’s help in preventing Arab and African migrants from reaching European shores. In total, the IMF, Europe, and the Gulf have now poured well over $50 billion of foreign currency into Egypt’s cash-strapped coffers. “The U.S., Europe, and the Gulf clearly agreed that the Sissi government could not be permitted to fail,” said Steven Cook, an expert on Egypt at the New York-based Council on Foreign Relations. “Geopolitics has taken over.”

Only months before, the IMF had not completed the review of Egypt’s loan agreement approved in December 2022, thereby withholding a tranche of the $3 billion rescue package, as the government had failed to deliver on agreed benchmarks. While the fund attributed its about-face in March to the increasing damage being done to Egypt’s economy by the Israel-Hamas war—or what it euphemistically called a “more challenging external environment”—absent American pressure on the fund and on Egypt to agree belatedly to financial reforms it had previously rejected, the IMF loan and even the Ras el-Hekma deal would not have gone through. Since Washington is the fund’s largest shareholder with a 16.5% stake, it holds sway over its key lending decisions.

The Biden administration, too, was obviously unwilling to risk the economic collapse and political destabilization of the Arab Middle East’s largest country and the first Arab state to make peace with neighboring Israel in the midst of one of the region’s deadliest wars in modern history and with other conflicts around it still raging—especially since Egyptian mediation with Hamas was crucial to White House policy. “Egypt has proven, yet again,” said Aboudouh, “that it is, as its elite believes, too big to fail.”

7 notes

·

View notes

Text

#free gaza#free palestine#gaza strip#irish solidarity with palestine#palestine#gaza#news on gaza#al jazeera#boycott israel#israel#International Monetary Fund

13 notes

·

View notes

Note

mr. powell!

Haven’t you people ever heard of closing the god damn door?

#I resent the infowars article#jay speaks#federal reserve#the fed#IMF#international monetary fund#jerome powell#economics#climate change

14 notes

·

View notes

Text

Fiona Harvey. Environment Editor

The Guardian

Sun 18 Jun 2023

The world must rethink its approach to the climate crisis, by investing trillions of dollars instead of billions in the developing world, and moving beyond conventional ideas of overseas aid, one of the world’s most influential climate economists has urged.

“We need a complete rethink of the whole nexus of climate, debt and development,” Avinash Persaud told the Observer, before a key summit. “What we are seeing today is new – countries affected by climate disaster, this is happening now. Countries are drowning.”

He called for a tripling of the finance available from the World Bank and similar institutions, and a huge influx of cash from the private sector, driven by the careful use of public funds and regulation to remove the current barriers to investment. “This is the biggest financial opportunity in the world,” he said.

Persaud is economic adviser to Mia Mottley, the prime minister of Barbados, who is co-hosting a meeting of world leaders this week with French president Emmanuel Macron. More than 50 heads of state and government are expected to attend the summit in Paris this Thursday and Friday, including Lula da Silva of Brazil, Germany’s Olaf Scholtz and the Chinese premier Li Qiang.

Rishi Sunak is likely to snub the conference. Joe Biden is sending his climate envoy, John Kerry.

In Paris, Mottley and Persaud will set out the “Bridgetown agenda”, named after the Barbados capital where it was first mooted last year. They will call for debt relief for some of the poorest nations facing climate catastrophe, a tripling of funding from the world’s multilateral development banks, including the World Bank, and new taxes to fund climate action, including, potentially, a levy on shipping.

They will also call for reforms to the way the World Bank, International Monetary Fund and other institutions operate, to make it easier for them to “de-risk” private sector investment in developing countries, such as by providing guarantees or long-term loans.

“The private sector has to be involved,” Persaud said. “The numbers needed would swamp developing countries’ balance sheets, but private companies can do it.”

23 notes

·

View notes

Text

In their February paper, “US Dollar Primacy in an Age of Economic Warfare,” presented at the West Point Symposium on “Order, Counter-Order, Disorder” Michael Kao and Michael St. Pierre argue for using a stronger US dollar as geopolitical leverage:

Not only are the effects of interest rates hikes magnified in other countries due to a myriad of structural and idiosyncratic economic fragilities previously discussed, the confluence of wide USD adoption with cyclical USD strength … make the USD a potent geopolitical lever masquerading as a domestic fight against inflation. National Power lends the USD dominance in adoption, while an opportunistic fight against inflation lends the USD cyclical strength for geopolitical leverage.

The US and US-led institutions are already trying to sideline China in countries struggling to make debt payments. And these efforts are likely to continue as interest rates rise and more countries in the Global South are unable to repay loans. A recent UNDP paper stated that 52 developing countries are suffering from severe debt problems.

China is the world’s largest bilateral creditor, and this is especially true for countries that are part of Beijing’s Belt and Road Initiative and/or for countries that possess strategically important natural resources. Washington estimates that Chinese lending ranges from $350 billion to a trillion dollars.

In recent years, western officials and media have ratcheted up criticism of China’s lending practices, claiming Beijing is putting its boot on the neck of countries, holding back their development, and is seizing assets offered as collateral.

Deborah Bräutigam, the Director of the China Africa Research Initiative at the Paul H. Nitze School of Advanced International Studies, has written that this is “ a lie, and a powerful one.” She wrote, “our research shows that Chinese banks are willing to restructure the terms of existing loans and have never actually seized an asset from any country.”

Even researchers at Chatham House admit there’s nothing nefarious about China’s lending, explaining that it has instead created a debt trap for China. That is becoming more evident as nations are unable to repay, largely due to the economic fallout from the pandemic, the Nato proxy war against Russia in Ukraine, inflation, and rising interest rates.

These confluence of events hitting developing countries are entangling China in multilateral talks that include US-backed institutions like the IMF. Beijing’s preference has always been to try and tackle debt repayment issues at a bilateral level, typically by extending maturities rather than accepting write-downs on loans.

But US Treasury Secretary Janet Yellen and company continue to parrot the talking point that China’s lending is harming countries, and in countries unable to repay their international debts, the West and China are increasingly at odds.

Back in 2020, the G-20 countries created the Common Framework for Debt Treatments to provide relief to indebted countries, which included “fair burden sharing” among all creditors. Beijing’s reluctance to agree to such burden sharing is illustrated by the case of Zambia.

Zambia became the first African country to default on some of its dollar-denominated bonds during the Covid-19 pandemic when it failed to make a $42.5 million bond payment in November 2020.

More than a third of the country’s $17 billion in debt is owed to Chinese lenders. Zambia worked out a deal with the IMF for a $1.3 billion bailout package but can’t access the relief until its underlying debt is restructured – including Chinese debts. But the IMF prescription for Zambia is a blow to Beijing. Here are some details of the arrangement from The Diplomat:

Zambia will shift its spending priorities from investment in public infrastructure – typically financed by Chinese stakeholders – to recurrent expenditures. Specifically, Zambia has announced it will totally cancel 12 planned projects, half of which were due to be financed by China EXIM Bank, alongside one by ICBC for a university and another by Jiangxi Corporation for a dual highway from the capital. The government has also canceled 20 undistributed loan balances – some of which were for the new projects but others for existing projects. While such cancellations are not unusual on Zambia’s part, Chinese partners account for the main bulk of these loans…

While some of these cancellations may have been initiated by Chinese lenders themselves, especially those in arrears, Zambia may not have needed to cancel so many projects. Since 2000, China has canceled more of Zambia’s bilateral debt than any sovereign creditor, standing at $259 million to date.

Nevertheless, the IMF team justified the shift because they – and presumably Zambia’s government – believe that spending on public infrastructure in Zambia has not returned sufficient economic growth or fiscal revenues. However, no evidence is presented for this in the IMF’s report.

Zambia will also cut fuel and agriculture subsidies. So instead of infrastructure investment and social spending, the country gets austerity. The IMF deal also relegates China to the backseat, as it allows for 62 concessional loan projects to continue, only two of which will involve China. The vast majority of the projects will be administered by multilateral institutions and involve recurrent expenditure rather than infrastructure-focused projects.

Despite all the evidence to the contrary, Yellen on a trip to Zambia in February warned that Chinese lending “can leave countries with a legacy of debt, diverted resources, and environmental destruction” and called out Beijing for being a “barrier” to ending the major copper producer’s debt crisis and noted that it had “taken far too long already to resolve.”

The US effort to sideline China in Zambia comes at the same time that Washington is trying to tighten control over resources in the region. Note that back in December the US signed deals with the Democratic Republic of Congo and Zambia (the world’s sixth-largest copper producer and second-largest cobalt producer in Africa) that will see the US support the two countries in developing an electric vehicle value chain.

Beijing is insisting that multilateral lenders also accept haircuts on loans rather than just China being expected to do so. This is a position that most debtor nations agree with. On the other side, the IMF and its partners are worried that its bailout money would merely go to Chinese creditors – many of which are state banks that are increasingly troubled by bad debts.

Gong Chen, founder of Beijing-based think tank Anbound, says that if countries are unwilling or unable to repay their debts to China, it would be devastating:

Widespread debt evasion and avoidance would have a significant impact on China’s financial stability,” he said, “and we are concerned that some countries may try to avoid paying back their debt by utilizing geopolitics and the ideological competition between East and West.

Yellen and company tried to apply more pressure on Beijing at the recent G20 meeting of finance officials in India, but that fell flat on its face much like the West’s efforts to hijack the meeting and turn it into a roundtable on Russian sanctions.

Meanwhile, Zambia has halted work on several Chinese-funded infrastructure projects, including the Lusaka-Ndola road, and canceled undisbursed loans in line with the IMF prescription for its debt problem.

Chinese companies are now attempting to work around these roadblocks by shifting more toward public-private partnerships. For example, a Chinese consortium is now planning to build a $650 million toll road from the Zambian capital to the mineral-rich Copperbelt province and the border with the Democratic Republic of the Congo.

The situation in Zambia does not bode well for other nations needing debt relief, as the delays while the West and China clash mean more pressure on government finances, companies and populations.

And if the West’s primary goal in offering debt relief is to sideline Beijing, as it appeared in Zambia, then that will mean a drastic scaling back of infrastructure projects replaced by austerity. From Sovdebt Oddities:

More broadly, as noted by Mark Sobel, the current international financial architecture is ill-equiped to deal with a major recalcitrant creditor benefiting from outsized (geo)political leverage. While it remains illusional to insulate sovereign restructurings from geopolitical considerations, there is a risk that they would turn into a game of chicken between China on the one hand and the IMF and Paris Club on the other hand. The problem being that if none of the players yields, it will just mean more economic and social hardship for the debtor country stuck in the middle.

Sure enough, the same situation is playing out in two nations that are key points on China’s Belt and Road project: Pakistan and Sri Lanka.

Here is Islamabad’s debt situation, courtesy of Pakistani economist Murtaza Syed at The International News:

For each of the next five years, Pakistan owes the world $25 billion in principal repayments. It will also need at least $10 billion to finance the current account deficit, bringing total external financing needs to $35 billion a year between now and 2027. We have foreign exchange reserves of just $3 billion. For each of the next five years, the government needs to pay 5 percent of GDP to service the debt it owes to residents and foreigners. Our total tax take is only 10 percent of GDP.

Around fourth-fifths of this external debt is owed to the official sector, split roughly evenly between multilaterals (like the IMF, World Bank and ADB) and bilaterals (countries like China, Saudi Arabia and the United States). The remaining one-fifth is commercial, again roughly evenly split between Eurobond/Sukuk issuances and borrowing from Chinese and Middle Eastern banks. By region, we owe roughly one-third of our external debt to China and 10 percent to the old-boys network of the Paris Club, which includes Europe and the US.

Additionally, last year, the Pakistan rupee plunged nearly 30 percent compared to the US dollar. All indications are that the IMF is using bailout negotiations to pressure Pakistan to move away from China and revive its partnership with the US. Some background from WSWS:

Former prime minister Imran Khan’s government was promptly removed in April 2022 after he reversed IMF-demanded subsidy cuts in the face of country-wide protests. Khan had previously implemented two rounds of some of the toughest austerity in the country’s history. In the final year of his government, Khan shifted the country’s foreign policy towards a closer alliance with Russia and deepened ties with China, prompting concern and anger in Washington.

Sharif’s Muslim League (PML-N) and the People’s Party (PPP) assumed power in a coalition with the approval of the military, long the most powerful political actor in the country and the linchpin of the alliance between the Pakistani bourgeoisie and US imperialism. The express aim of the new government was to implement IMF austerity, which it has done.

The IMF-prescribed austerity imposed by Pakistani elites also targets Beijing. China is Pakistan’s largest single creditor as the country is perhaps the most important country in China’s Belt and Road plans because it would provide China with a potential corridor to the seaport at Gwadar on the Indian Ocean. The supply line would reduce the distance between China and the Middle East by thousands of miles via insecure sea lanes to a shorter and more secure distance by land. Beijing’s spending in Pakistan reflects this, as the $53 billion China has spent on the Belt and Road Initiative (BRI) in the country is tops of all BRI countries.

Yet many of the BRI plans are unrealized, and Pakistan’s current economic situation makes it unlikely they’ll be finished anytime soon. China has dramatically scaled back investment, which fits with its more cautious approach to BRI projects. Meanwhile, decades-high inflation, economic mismanagement, and last year’s biblical floods have led to Islamabad burning through its foreign exchange reserves in order to make debt payments. The US blames China.

“We have been very clear about our concerns not just here in Pakistan, but elsewhere all around the world about Chinese debt, or debt owed to China,” US State Department Counselor Derek Chollet told journalists at the US Embassy in Islamabad after he met with Pakistani officials in February.

Additionally, Cholett said Washington is warning Islamabad about the “perils” of a closer relationship with Beijing.

According to the Times of India, many Pakistani officials have come around to the US way of thinking and are also blaming the China-Pakistan Economic Corridor Project (CPEC), a $65 billion network of roads, railways, pipelines, and ports connecting China to the Arabian Sea, for worsening the country’s debt crisis. From Indian Express:

Pakistan expanded its electricity generation capacity under the China-Pakistan Economic Corridor Programme (CPEC) but the expansion came at a high cost both in terms of high returns guaranteed to the Chinese independent power producers (IPPs) and the expensive foreign currency debt. Pakistan has been unable to make the capacity payments to IPPs under the long-term power purchase agreements with the electricity sector debt rising to a staggering $ 8.5 billion.

Last December, the government agreed to repay this debt in installments. However, this may have displeased the IMF, which had expected the government, in August 2022, to renegotiate the purchase power agreements. Pakistan tried to renegotiate but the Chinese refused.

The IMF extended the current program on the condition that it would not go to the Chinese IPPs. More from Nikkei Asia:

Observers say Pakistan’s handling of the electricity issue is likely to irk China, noting that Sharif’s government committed to the IMF to reopen power contracts without taking the Chinese companies into confidence. Pakistan has also reneged on a promise to set up an escrow account to ensure smooth payments to Chinese IPPs.

The IMF is demanding that Pakistan rationalize payments to the Chinese IPPs in line with earlier concessions extracted from local private power producers…

The IMF now wants Pakistan to negotiate an increase in the duration of bank loans from 10 years to 20 years, or to reduce the markup on arrears owed to Chinese IPPs from 4.5% to 2%.

Notably, the IMF appears to have been less willing to make concessions than the previous 22 times Pakistan has sought its support since 1959. Oddly enough Beijing is pushing for a deal between Islamabad and the IMF, and China recently extended a $2 billion loan to Pakistan. From the Middle East Institute:

It is interesting to note, for example, that Chinese officials reportedly urged Islamabad to repair ties with the IMF — if true, an indication that Beijing regards resumption of the Fund’s lending program as key to mitigating Pakistan’s risk of default.

It is also revealing that Pakistan seems keener to take on new financing from China than China may be to furnish it. Even as the economy wobbles under a heavy debt burden and other acute challenges, Pakistani officials have sought support from China to upgrade the Main Line 1 (ML-1) railroad, a project which, if not undertaken, they claim could result in the breakdown of the entire railway system.Yet, the IMF wants Pakistan to rein in CPEC activity. And China’s own domestic economic challenges and priorities might make it hesitant to respond to Islamabad’s appeals. On the other hand, the ML-1 project might meet Beijing’s more exacting standards and increasing emphasis on “high quality” BRI infrastructure projects.

The recent rapprochement between Iran and Saudi Arabia could leave Pakistan out in the cold and even more reliant upon the US. From Andrew Korybko:

With the Kingdom likely to focus more on mutually beneficial Iranian investments than on dumping billions into seemingly never-ending Pakistani bailouts that haven’t ever brought it anything in return, Islamabad will predictably become more dependent on the US-controlled IMF. China will always provide the bare minimum required to keep Pakistan afloat in the worst-case scenario, but even it seems to be getting cold feet nowadays for a variety of reasons, thus meaning that US influence might further grow.

About that, last year’s post-modern coup restored American suzerainty over Pakistan to a large degree, which now makes that country a regional anomaly in the geopolitical sense considering the broader region’s drift away from that declining unipolar hegemon. The very fact that previously US-aligned Saudi Arabia patched up its seemingly irreconcilable problems with Iran as a result of Chinese mediation reinforces this factual observation. Pakistan now stands alone as the broader region’s only US vassal.

Pakistan is not only the most highly indebted to China of its BRI partners, but along with Sri Lanka, is also among the largest recipients of Chinese rescue lending. The ruling elite Pakistan is increasingly concerned that the social crisis could spiral out of control and result in something similar to what happened in Sri Lanka last year when a popular uprising toppled the government.

Due to haggling between the West and China, Sri Lanka has been waiting since September to finalize a bailout after a $2.9 billion September staff level IMF deal. And yet many of the recommendations in the agreement have already been implemented—to disastrous effect.

The country is dealing with its worst economic crisis since independence in 1948, including a shortage of reserves and essential items. In February, the IMF said Sri Lanka’s bailout package was set to be approved as soon as the country obtained adequate assurances from bilateral creditors, i.e., China.

Beijing now appears ready to meet more of the IMF’s demands, although details have yet to be released. In a letter in January, the Export-Import Bank of China offered a two-year debt moratorium, but the IMF said that wasn’t enough. According to Reuters, total Sri Lankan debt to Chinese lenders totals roughly 20 percent of the country’s total debt.

Sri Lanka is another focal point of the BRI due to its geographical position in the middle of the Indian Ocean. China’s goal was to transform the country into a transportation hub as much of its energy imports from the Middle East and mineral imports from Africa pass through Sri Lanka. Beijing has already achieved much of these goals. For example, in 2017 a 70 percent stake of the Hambantota port was leased to China Merchants Port Holdings Company Limited for 99 years for $1.12 billion.

The West blames China’s BRI initiative in Sri Lanka for saddling the country with unsustainable debt, but is that really the case? Political economists Devaka Gunawardena , Niyanthini Kadirgamar, and Ahilan Kadirgamar write at Phenomenal World:

The problems associated with the IMF’s policy package have been caught in geopolitical rhetoric. The US alleges that Sri Lanka is the victim of a Chinese debt trap. In fact, Sri Lanka is in an IMF trap. The structural consequences of over four decades of neoliberal policies have exploded into view with the receding welfare state, a ballooning import bill, and investment in infrastructure without returns, all of which relied on inflows of speculative capital. Framing Sri Lanka’s crisis within a narrative of geopolitical competition obscures the core dilemmas of the global economy. Will the evident breakdown force a reckoning with the present order, or will it be used as an excuse to inflict more suffering?

Thus far, it looks like the latter.

#economics#china#zambia#sri lanka#pakistan#international monetary fund#world bank#capitalism#belt and road initiative#new silk road#us imperialism#china-pakistan economic corridor program#chinese investment in africa

29 notes

·

View notes

Text

Lula and Georgieva hold a “good conversation”

Brazilian President Luiz Inácio Lula da Silva Monday suggested International Monetary Fund (IMF) Managing Director Kristalina Georgieva should move on with the reform of the credit agency, among other issues they discussed during their “good conversation” in Brasilia where they also reviewed “social inclusion” and the “Poverty in the world” project.

Lula said the IMF needs to be “more representative of today's world” and “capable of helping countries” that require financial support “under better conditions.” Also present at Monday's gathering were Brazil's Finance Minister Fernando Haddad, and former President and current President of the BRICS Bank, Dilma Rousseff.

Continue reading.

#brazil#brazilian politics#politics#economy#international monetary fund#luiz inacio lula da silva#foreign policy#Kristalina Georgieva#mod nise da silveira#image description in alt

3 notes

·

View notes

Photo

Kenya is in chaos. The death toll mounts as the police crackdown on protests against the new US-IMF backed tax regime intensifies. The people are angry, desperate. They know that this new tax will only further impoverish them, that it is yet another way for the rich to line their pockets. The future looks bleak. But the people will not be silenced. They are fighting for their rights, for their future. Even in the face of violence and brutality, they refuse to give up. And they may yet win. The US-IMF may have overplayed their hand this time. The people of Kenya are ready to fight, and they will not be defeated.

#Kenya#Communist Party of Kenya (CPK)#Debt crisis#Independent Medico Legal Unit (IMLU)#International Monetary Fund (IMF)#Kenya Medical Association (KMA)#Kenya protests#Kenyan Finance Act#Raila Odinga#William Ruto#fault

8 notes

·

View notes

Text

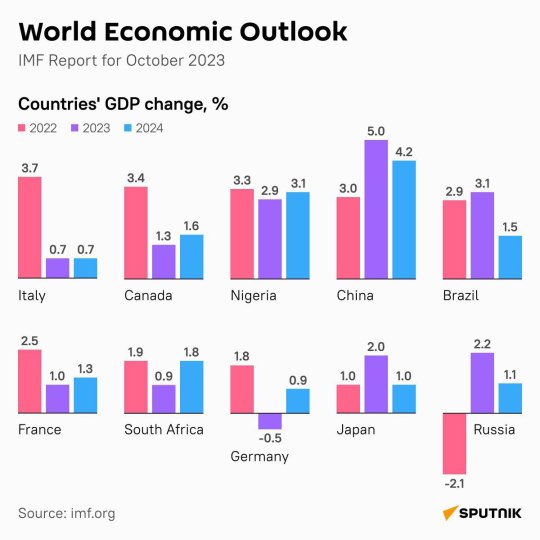

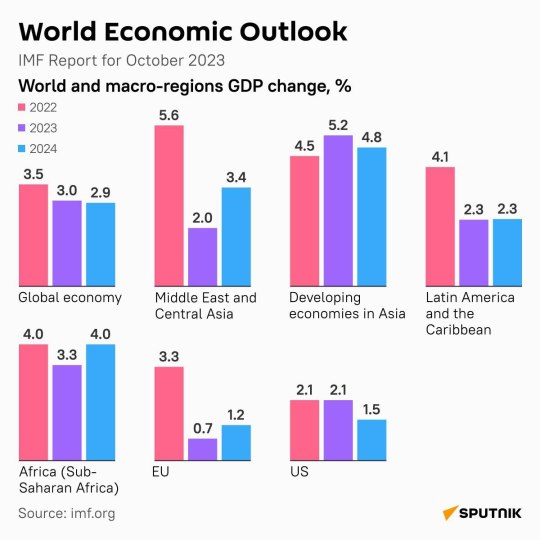

🌍 🚨 GLOBAL ECONOMIC OUTLOOK FOR 2024, ACCORDING TO THE INTERNATIONAL MONETARY FUND (IMF)

The International Monetary Fund published its global economic outlook for 2024.

According to the IMF, Global economic growth for 2024 is expected to be around 2.9%, 3.4% for West and Central Asia, 4.8% for developing economies in Asia, 2.3% for Latin America and the Caribbean, and 4.0% for sub-Saharan Africa.

The European Union (EU) can expect around 1.2% growth according to the IMF.

In particular, Germany is expected to be in recession, clocking in an expected -0.5%, while Spain is expected to grow 1.7%, France 1.3%, and Italy 0.7%.

Africa's strongest economy, Nigeria, is expected to grow by 3.1% in 2024.

On the Eurasian landmass, Indian growth is expected at 6.3%, China 4.2%, Saudi Arabia 4.0% and Russia, despite the tightening of sanctions, is expected to grow 1.1%.

In North America, US growth is expected at 1.5% and Canada at 1.6%.

Japan is expected to grow 1.0%.

#source

@WorkerSolidarityNews

#international monetary fund#imf#global economic outlook#global economy#economy#economics#world news#international news#international affairs#global news#global politics#politics#geopolitics#breaking news#current events#us news#us politics#world politics#news#WorkerSolidarityNews

4 notes

·

View notes

Text

Learning about the good and necessary kind of IMF. (For my undergrad degree I spent a lot of time learning about the evil one.)

#intermolecular forces#😇#international monetary fund#👿#chemistry#hw lb#gillianthecat goes back to school

6 notes

·

View notes

Text

US Militarizes IMF Loan to Pakistan For Ukraine Arms, Ousting Pakistani Prime Minister

#usa#america#ukraine#pakistan#international monetary fund#imf#military#military industrial complex#army#navy#air force#airforce#jerkmillionaires#jerkbillionaires#jerktrillionaires#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#eat the rich#eat the fucking rich#joe biden#biden administration#biden

5 notes

·

View notes