#this is about quickbooks

Text

I just think that if you pay a subscription for a service it should be illegal to then have pop-ups asking you to pay for more stuff. I want to kill intuit with hammers

#this is about quickbooks#intuit most evil of companies#unfortunately if you want to have your accounting work with pretty much any other person#like accountants or tax people#you just....have to have intuit!#and every time I log in they're like WOUDL YOU LIKE TO PAY A MILLION DOLLARS TO HAVE US DO YOUR TAXES#no intuit I would not!#I have your stupid service so I can have smart humans do my taxes!#I guess I could personally do my accounting by hand#but....my god I would fuck up so much#the ONE year I did my own taxes I got audited lol#(this is not to scare people about doing their own taxes - if you have a normal ass job you can do it)#(my taxes are decently complicated)#(and pls use the government's new service instead of evil intuit's dark patterning)#lauren says things#anyway

64 notes

·

View notes

Text

"You can learn how to use this software for free* and land a job using it!"

*You have to first pay for a subscription to this software that you do not yet know how to use (you do not have enough money to pay for that subscription. That is why you are trying to learn how to use a software that will give you more job opportunities).

1 note

·

View note

Text

Oh my resume is about to look so fucking good

#being able to include on there that i taught myself how to use multiple computer/office programs#with a complete binder full of detailed notes on each one#im already 20 pages into learning quickbooks over the last 3 days#my color coding note taking system makes it easy to hyperfocus on the task#because i cant just sit and listen or blindly take notes#if i go take the time to color code different sections and use different pen thicknesses for different things#then im actually absorbing what im learning from the video instead of immediately forgetting about it#my brain thinks in patterns and numbers#.bdo#that adhd and autism combo is wild

7 notes

·

View notes

Note

hiii accountant here. i used to do our bookkeeping when i was a baby in undergrad but then we hired a contract bookkeeper after i started doing actual accounting work so i know both sides. quickbooks online (QBO) is what like 99% of small/medium businesses use (these are the ppl most likely to outsource their bookkeeping work, big companies will have their own software or use SAP or smth and more likely have in-house teams). without experience/qualifications think you’d be best off trying to get a position at a place that just does bookkeeping services for other companies, i’d check job ads for bookkeepers to see what sort of qualifications they ask for but having a certificate or something that says you know your way around QBO is good. any 101 intro accounting course will cover fundamentals about the work as well

great tysm!!!!

39 notes

·

View notes

Text

Femme Fatale Guide: How To Master Your Money & Tips On Financial Literacy

Understanding and taking control of your finances improves your quality of life in many ways. Making strides toward better financial literacy can save you a lot of stress, unnecessary fees and helps you play a more active role in taking control over this aspect of adulthood. Once you understand the game of money, saving, and investing, it becomes infinitely simpler to devise a plan to set yourself up for a more financially-free future. Here are some practical tips to keep your finances streamlined, secure, and systemized to help you gain more financial literacy and win in this area of life.

Overview:

Track Your Income & Expenses

Set Financial Goals & Realistic Limitations

Invest Higher-Quality Items To Save Later

Educate Yourself On Different Types of Banking & Investment Accounts

Establish Credit, But Know Yourself

Create An Emergency Fund

Leverage Credit Card Benefits

Understand The Power of A Roth IRA (or Backdoor Roth IRA) & HSA

Automate Whenever Possible

Get Familiar With Taxes & Write-offs

Stay Informed About Employer Benefits

Purchase Seasonally & With Discount Codes (When Available)

Protect Yourself

Read Books

Seek Expert Advice

TIPS ON MASTERING FINANCIAL LITERACY:

Track Your Income & Expenses: Always have a record of all of the money going in and out of your accounts. Use the tool on your banking account app(s) to confirm your monthly income and expenses. Tools like Mint also are great to track your spending to see where every dollar is going all in one place. Aside from personal use, for small business owners, Quickbooks is my favorite invoicing and expense-tracking option.

Set Financial Goals & Realistic Limitations: Once you know your exact monthly income, budget your essentials, savings, investments, and fun money accordingly. Make sure necessities like rent, food, health insurance, electricity, WiFi, toiletries, etc. are accounted for before anything else. Depending on your financial situation, experts (not me – I try to educate myself as best as I can, but am no expert!) recommend trying to save and invest between 15-30% of your pre-tax income. Give yourself the liberty to spend the rest (say 15-20%) of your income, so you don’t feel deprived and stay on track with your goals.

Invest Higher-Quality Items To Save Later: Initially purchasing a higher-quality item often cuts your overall expenses in a certain area over the long run. (Ex: Well-made clothing, shoes, furniture, kitchen appliances, coffee maker, hair dryer, etc.). If you invest upfront on an item you regularly use, there’s a lower chance that it will deteriorate, rip, break, or otherwise become unusable for the next few years. When you opt for the cheaper option, this practice might save you a few bucks in the short term, but you will probably end up having to replace it a few times over time and spend more in the long run. This tip might seem counterintuitive to some, but it truly does save you a lot of money (and frustration). However, I will place a caveat here and say that this advice comes from a place of privilege. Never purchase something you can’t afford. If you have the means, spend a bit more upfront - it is better for your future wallet, allows you to indulge in a better quality of life, and helps you let go of any scarcity mindset/financial limiting beliefs.

Educate Yourself On The Different Types of Banking & Investment Accounts: Know the differences between and the use purpose of different accounts: Checking, Savings, CDs, 401K, Roth IRA, HSA, etc. Always opt for a high-yield savings account option to help preserve your money’s value over time with rising living costs and inflation.

Establish Credit, But Know Yourself: Your credit score is like your adult report card. It’s essential for so many aspects of life, like renting or buying a home, insurance, cell phone plans, etc., so it’s important to start building your credit as early as you can. However, if you know you’re the type of person to overspend with a credit card, look into secured credit card options (you deposit the money that acts as a credit limit, so it’s like a debit card with credit-building benefits).

Create An Emergency Fund: Pay yourself first. Have between 3-12 months of expenses available in a high-yield savings account at all times. If you have a family or are self-employed, aim for 6-12 months of necessary savings to stay sane. Saving this amount of money takes time. Be patient, and cut back on frivolous expenses if needed for the short term.

Leverage Credit Card Benefits: If you have enough self-control, always use a credit card instead of a debit card – but spend in the same way you would as though the money is coming directly out of your bank account. This gives you additional flight and other purchasing perks, such as cashback and exclusive discounts. Using a credit card provides additional security, too.

Understand The Power of A Roth IRA (or Backdoor Roth IRA, depending on your income) & HSA: Compound interest is your best friend financially. Depending on your income, invest as much as you can into a Roth IRA account or set up a backdoor Roth IRA through your brokerage firm (I use Vanguard!). HSA (Health Saving Accounts) accounts offer so many benefits – they can serve as a tax write-off, lower your overall healthcare costs, and be leveraged to use as an additional retirement investment account, too (I use Fidelity).

Automate Whenever Possible: Automate a portion of your paycheck to savings and your investments, so you never see this money. Pay yourself first before spending (on anything but necessities).

Get Familiar With Taxes & Write-offs: This mainly applies to anyone self-employed or a small business owner (been in the game for 5 years!). However, this point can also potentially be beneficial for students who can leverage an education credit for tax purposes. Explore all of your options to see what write-offs are available in your specific situation. Understand how your income and expenses influence your tax bracket. Investing in a CPA can save you a considerable amount of money and all of your sanity if you’re not a salaried employee. Look over the standardized section C document, and speak with a professional to help maximize your write-off potential (legally and honestly, of course). My CPA is my lifeline!

Stay Informed About Employer Benefits: Always maximize your 401K match (whatever percentage that is at your company), any wellness perks (like a gym membership or massage credit), or any meals and car services credits for late nights/work trips.

Purchase Seasonally & With Discount Codes (When Available): Try to purchase items off-season when you can (e.g. purchase classic winter closet staples in the summer when they’re on sale). Utilize plug-ins like Honey or Cently on your browser to have discount codes for any site readily available.

Protect Yourself: Stay on top of fraud alerts. Freeze your credit bureau accounts if necessary.

Read Books: Educate yourself on saving, investing, budgeting, building a business, etc. See the ‘Finance’ section of my Femme Fatale Booklist for some recommendations. I also love Graham Stephan’s Youtube channel – his videos are highly useful and practical for beginners in this life arena!

Seek Expert Advice: Use licensed professionals (CPAs, brokerage firms, your bank, etc.) as a resource, too, for your personal goals.

This is a lot to take in, so try to implement one action item (or a few) at a time, so you can work towards your goals without getting overwhelmed. Also, for reference, I’m in the United States, so all of these tips are focused on how the system works in my country - if you know of any international equivalents, feel free to drop them in the comments to guide others.

Hope this helps xx

#life advice#finance#adulting#femme fatale#dark femininity#dark feminine energy#it girl#hypergamy#high value woman#divine feminine#high value mindset#hypergamous#the feminine urge#success mindset#productivity#spending habits#entreprenuership#level up#self improvement#ideal self#female power#female excellence#personal growth#investing#girl advice#that girl#femmefatalevibe

1K notes

·

View notes

Text

title: miss me in your bones | chapter 2

chapter 1

pairing: dbf/neighbor!joel miller/female reader

rating: explicit (18+ MDNI)

word count: 1961

summary:

When Joel Miller started his own contracting business, he didn’t expect all the administrative tasks that came with it. As a result, his budding business is in desperate need of help.

Good thing his best friend’s daughter is home for the summer from college. And sure, he’s always been attracted to you, but he can keep that under control.

It’s just one summer, right?

author’s note: slow burn? i don’t know her. if you enjoyed this chapter, please consider reblogging or commenting! and if you're so inclined, you can also send me coffee

AO3 | Joel Miller Masterlist

content warnings/tags: explicit sexual content (18+ MDNI), age gap (21f and 36m), no cordyceps outbreak, Joel is not a father, Joel's feelings of guilt about being attracted to his best friend's daughter, sexual tension, voyeurism, mutual masturbation, mild jealousy, pineapple as a pizza topping. let me know if there are any missing!

By the end of your first day in Joel’s office, you’ve managed to sort all the stray papers into more manageable categories and have booted up the ancient laptop he had gathering dust on the desk.

You’re sitting cross legged on the floor of the office when he comes home, surrounded by the fruits of your labor. He knocks on the doorframe to announce his arrival.

“How’s it goin’?” Joel asks. He’s rumpled from his day, shirt wrinkled and still damp from sweat earned in the Texas heat.

Christ.

“It’s good! I’ve got most of these organized. Do you have any finance software you’re using?” You ask.

His brow furrows. “Uh…no. Should I?”

“You’re running a business, you gotta have some way of doing invoices and tracking expenses versus payments.”

“I’ve got a notebook for that.” He looks around the room. “Somewhere.”

The stare you give him is unimpressed. “I’ll start with Excel, but I expect a subscription to Quickbooks by the end of the week,” you tell him. He gives you a quick nod.

“Listen, you gettin’ hungry? I was goin’ to order pizza,” he says. You shift around, sitting up on your knees.

“Pizza sounds good.”

Joel doesn’t reply. He stands there with his hands at his sides, dark eyes fixed on where you’re kneeling in front of him on the floor. You’re aware of the image you must make, denim shorts riding up your thighs as you spread your knees the tiniest bit further, watching as Joel’s eyes track the movement and his Adam’s Apple bobs with a strained swallow.

The tension in the room is palpable, pressing on your chest and making it difficult to breathe. After what seems like forever, Joel shakes his head and holds a hand out to you, tight smile on his lips.

“Come on, let’s get that pizza going and you can tell me what else I’m doing wrong,” he says. You grip his hand, palm warm and rough against yours as he hauls you to your feet with little effort. The action brings your bodies close together, your chest brushing his as he looks down at you. “Pepperoni and pineapple?”

“You remember,” you reply, voice more breathy than it ought be around this man.

“‘Course I do, darlin’,” he says, taking a broad step back, his hand slipping from yours. “How could I forget?”

________

You’re sitting across from Joel at his kitchen table, eating your slice of pizza as you make notes on a piece of paper of all the things that Joel needs to get his office and business in order.

“Why don’t you just come with me to the supply store? Go wild,” he says, biting into his own slice of pizza.

“Don’t threaten me with a good time if you don’t mean it, Mr. Miller.”

“Told ya to call me Joel.”

You blink at him. “Sorry. Joel.”

Joel lets the sound of his name on your lips wash over him. He wants to hear it more.

“We can go tomorrow mornin’. I don’t have any consults ‘til later. That work?”

“Sure.” You wipe your mouth with a napkin and stand, bringing your plate to the sink and tossing away your garbage. “I better head home. I’ll see you in the morning.”

“Have a good night,” Joel says. You look at him over your shoulder as you leave the kitchen, smile bright.

“Oh, I will.”

Joel’s brow furrows as he wonders what that means. Did you have plans? Would you be going out somewhere? With someone?

And why does he care?

________

The thing about being Joel Miller’s neighbor is that you know the man isn’t one for keeping his blinds closed. When you were seventeen, you remember peeking into his bedroom, conveniently located across from your window, and seeing a shirtless Joel getting ready in the morning, or watching him step into a pair of fitted Wranglers, his deft fingers buttoning the denim at his work-toned waist.

When you get back home, you slide the sheer white curtains covering your bedroom window apart. Joel’s room is currently dark and empty, but that gives you time to prepare. Your dad is at his weekly poker game with some guys from the garage, leaving you a house that will be empty until the early morning hours.

You toss your bag on your bed and rifle through your still-packed luggage, digging out the baby pink lingerie set you’d packed on a whim.

Hey, you never know. And boy are you glad that you brought it.

Because you had a plan.

You were going to seduce Joel Miller.

The signs were all there. The man was attracted to you, and god knows you’ve had it bad for your dad’s best friend since you were still a teen. What’s a little harm in acting on your impulses?

Especially when they could lead to reward.

You strip out of your shorts and t-shirt, switching your more practical underwear for the lingerie - a thong consisting of barely enough fabric to be considered clothing and a sweet matching balconette bra with an overlay of lace that makes your tits look fantastic. You check yourself out in the mirror before pulling your clothes back on.

Now you wait.

________

Joel heads to his bedroom around 9 pm, the day finally catching up to him and leaving him yawning with exhaustion. His mind wanders back to you, conjuring up the image of you on your knees, looking up at him through your lashes. He palms his cock with a groan as he enters his room.

He flicks on the lamp, bathing the room with a warm glow. Movement across the yard catches his eye and he’s surprised to see you in bed, laying on your belly with a book spread open in front of you and your feet kicking behind you. Your window is open and you’ve got something playing on speaker that he can’t recognize.

You turn over, arching your back as you hold the book above you. Joel’s eyes trace the curve of your body, the way your shirt tightens across your breasts and lifts just enough to show a strip of your tummy over your denim shorts. He can feel his cock getting harder now, the press of it more urgent against the fly of his pants as he stands near the window, mesmerized by you.

You set the book aside, standing beside your bed with your back to the window. Your fingers curl under the hem of your shirt and lift it over your head, tossing it to the ground. He gets a brief glimpse of your baby pink bra strap before his eyes are drawn to watch as you shimmy your shorts over your hips and down your thighs.

Joel’s breathing hitches, caught in his throat as he takes in the sight of you in only a thong, your ass on full display for his hungry eyes. He shifts closer to the window, trying to keep himself out of the direct line of sight.

You stretch your arms above your head, turning as you do so, and Joel gets his first glimpse of your breasts and the way they’re barely contained by the cups of the bra you’re wearing, pink lace highlighted by smooth, luscious skin.

Joel’s mouth goes dry as he watches you crawl back on the bed, ass swaying with your movements as you get yourself comfortable on your back.

Your hands start out by cupping your breasts, pulling the little fabric cups down just far enough to expose your tight little nipples. You pinch the buds between your fingers, your back arching into the sensation. Joel has to press a hand to the wall to support himself.

Your mouth drops open in a moan as you play with your tits, twisting and pinching and groping yourself. Joel hardly dares to blink as your hands finally move on, trailing down your torso until your fingers dip beneath the waistband of the scrap of fabric trying to act as panties. Your back arches sharply and Joel commits the visage of your first touch to your needy little pussy to his memory.

He unbuttons his pants, shoving them down his thighs along with his boxers until they sit around his knees. He doesn’t want to look away for even a second to remove them further. This will have to do.

Your fingers circle your clit and he desperately wishes it was him feeling the slick slide of your cunt. Would you like it fast? Slow? Rough or gentle? He wants to find out every rhythm that makes you see stars.

You scramble to pull your panties off, tossing them to the floor in a rush to get your hands back to work. Your right hand stays pressed between your thighs while your left returns to pinching and pulling at your little nipples. Joel spits in his hand, fisting his cock with a harsh grip and giving it a single tug that has his knees going weak. He has to dig his teeth into his lip to fight back the groan that wants to escape.

You spread your legs obscenely wide, giving him a better view of the way your hand moves across your pussy. The fast circles you use to treat your clit, followed by the slow swipes to bring yourself back from the edge. He can practically see the way your empty cunt flutters around nothing, begging to be filled.

By him. Begging to be filled by him.

Christ, this is depraved. He shouldn’t be watching this. He shouldn’t be looking at his best friend’s daughter and thinking about how it would feel to sink his cock so deep inside he wouldn’t know where your body started and his ends.

His hand starts to move faster, twisting on the upstroke so that his palm glides over the sensitive, leaking tip of his cock. Your hips are moving frantically now, chasing your hand and the pleasure it’s giving you. You slip a finger inside and Joel can hear the moan you let out. He has to bite his lip so goddamn hard he tastes copper on his tongue so that he doesn’t echo your shouts of pleasure.

Your one finger becomes two, plunging inside of you with abandon as your chest heaves with ragged breaths. Joel can feel his orgasm building at a fever pitch and he silently begs for you to reach yours before he does.

Like the universe hears his plea, your legs snap shut around your hand and you shake with your release. He can see the quiver of your thighs and the way your mouth drops open in a moan.

“Joel!” You cry out. For a moment, he worries he’s been caught. But your eyes are closed, head pressed to the mattress as you ride out your orgasm.

Joel barely has enough time to cup his free hand over his cock, catching the streams of come in his palm as his orgasm hits him like a train, the sound of his name on your lips doing him in.

He sags against the wall as he tries to catch his breath. Finally, he uses his clean hand to pull his jeans back up his hips so that he can go to the bathroom and clean up.

When he returns to the bedroom, your curtains are notably closed. Joel swallows nervously.

Fuck. How the hell is he supposed to look you in the eye tomorrow, knowing what you look like when you come? Knowing what his name sounds like cried out from your lips?

He flops back on the bed, staring up at the ceiling with sleep creeping at the edges of his vision.

That’s tomorrow’s problem.

Joel Miller taglist:

@huffle-punk @johnwatsn @hopelessromantic727 @whereasport @pedr0swh0r3 @yellingloudly @dragon-of-winterfelll @thedeadsingwithdirtintheirmouths @mydailyhyperfixations @liati2000 @ghostofjoharvelle @cutesyscreenname @morgaussy @letsgroovetonighttt @endlessthxxghts @fake-bleach @brilliantopposite187 @mattmurdock1021 @str84pedro @justsomeoneovertherainbow @loquaciousferret @milly-louise @not-a-unique-snowflake-blog @kirsteng42 @caatheeriinee07 @eternallyvenus @midnightswithdearkatytspb @evyiione @leeeesahhh @tloubarbie @afterglowsb-tch13 @loveliestofthoughts @theviewfromtheritz @brittmb115 @uncassettodiricordi @pedritosgfreal @adriennemichelle98 @mxtokko @gingersince97 @switchbladedreamz @casa-boiardi @tonysterco @rvjaa @ladymunson @sexpoisoned @trisaratops-mcgee @decemberdolly @spookyemorockbabe @reader-without-a-story @katmoonz @simping-soldat @mswarriorbabe80 @orphanbird95 @shatteredbaby @tusk89 @gingersince97 @mssbridgerton @internetobsessed1234-blog @sloanexx @manazo

#joel miller#joel miller x reader#joel miller fic#joel miller smut#joel miller x female reader#joel miller fanfiction#no use of y/n#joel miller x you#joel tlou#joel x reader#joel x female reader#joel miller tlou#tlou fic

304 notes

·

View notes

Text

imagine i post the long awaited sequel to vantablack but there's no smut in it and it's just about marius drinking stale microwaved coffee and catching up on his quickbooks bc tbh thats all i think about and it's where my passion actually lies.

24 notes

·

View notes

Note

um girl can you do Jamie’s backstory or more facts ab him/his life he’s so private

sure!! i'm not gonna do too much on hockey related stuff bc it's all pretty basic and easy to find like highly-touted prospect, great skater, played for the toronto marlies, played for the toronto marlboros, erie otters, team canada, etc etc. here's an article that summarizes his pre-NHL hockey career.

first here's a pic of jamie & his mom tina, dad gary, and big brother charlie from jamie's ig. i'm sure you've seen it before. link

jamie grew up around yonge & lawrence in north toronto which is a very safe, family friendly and wealthy area. source 1, source 2

he went to st. michael's college school to play high school hockey before he was eligible for the OHL draft. this is a well-known private school in toronto that many NHL alumni have attended including tyler seguin, jason spezza, and tim horton himself. source 1, source 2

while playing for the erie otters, he attended fairview high school in fairview, pa. source 1

his billet family in erie described him as kind-hearted, quick-witted, and competitive. his coach in erie described him as a great teammate, selfless, and a great person. source 1

his mom tina appears to be the manager of finance & operations for the toronto marlboros. source 1

here is her twitter account

she went to havergal college which is a fancy independent girls school (pre-K to gr12) in toronto. she graduated in 1988 so she was born in around 1970. source 1

jamie's dad gary is very successful in the IT sector - previously he was vice-president of commercial and channel sales for Printing and Personal Systems with HP Canada. source 1, source 2

at one point he was on the canadian channel chiefs council (C4) board of directors. source 1

he is now the director of sales at intuit quickbooks canada. source 1, source 2, source 3 (source 3 is a video, you can see a couple pics of jamie in the background)

jamie's brother charlie is a biomechanical engineer who attended queen's university in kingston, ontario. source 1 (jamie used to have a pic of him w charlie at charlie's grad on ig but i think he archived it)

this was jamie's grandpa: richard. source 1, source 2

and this was his grandma: isabel. source 1, source 2

so in conclusion, jamie comes from a wealthy background and is kinda your typical toronto hockey boy, but everyone loves him and consistently talks about how lovely and sweet he is so his parents did a great job!

#most rich boys i know are complete assholes so it's refreshing that he apparently is not#j. drysdale#deep dive#hockey gossip#hockey tea#nhl gossip#ask!#philadelphia flyers#wasian prince proof btw!

28 notes

·

View notes

Text

A doctors’ organization at the center of the ongoing legal fight over the abortion drug mifepristone has suffered a significant data breach. A link to an unsecured Google Drive published on the group’s website pointed users last week to a large cache of sensitive documents, including financial and tax records, membership rolls, and email exchanges spanning over a decade. The more than 10,000 documents lay bare the outsize influence of a small conservative organization working to lend a veneer of medical science to evangelical beliefs on parenting, sex, procreation, and gender.

The American College of Pediatricians, which has fought to deprive gay couples of their parental rights and encouraged public schools to treat LGBTQ youth as if they were mentally ill, is one of a handful of conservative think tanks leading the charge against abortion in the United States. A federal lawsuit filed by the College and its partners against the US Food and Drug Administration seeks to limit nationwide access to what is now the most common form of abortion. The case is now on a trajectory for the US Supreme Court, which not even a year ago declared abortion the purview of America’s elected state representatives.

The leaked records, first reported by WIRED, offer an unprecedented look at the groups and personnel central to that campaign. They also describe an organization that has benefited greatly by exaggerating its own power, even as it has struggled quietly for two decades to grow in size and gain respect. The records show how the College, which the Southern Poverty Law Center (SPLC) describes as a hate group, managed to introduce fringe beliefs into the mainstream simply by being, as the founder of Fox News once put it, “the loudest voice in the room.”

The Leak

A WIRED review of the exposed data found that the unsecured Google Drive stored nearly 10,000 files, some of which are compressed zip files containing additional documents. These records detail highly sensitive internal information about the College’s donors and taxes, social security numbers of board members, staff resignation letters, budgetary and fundraising concerns, and the usernames and passwords of more than 100 online accounts. The files include Powerpoint presentations, Quickbooks accounting documents, and at least 388 spreadsheets.

One spreadsheet appears to be an export of an internal database containing information on 1,200 past and current members. It contains intimate personal information about each member, including various contact details, as well as where they were educated, how they heard of the group, and when membership dues were paid. The records show past and current members are mostly male and, on average, over 50 years old. As of spring 2022, the College counted slightly more than 700 members, according to another document reviewed by WIRED.

The breach exposes some material dating back to the group’s origin. It includes mailing lists gathered by the group of thousands of “conservative physicians” across the country. (One document outlining recruitment efforts states in bold, red letters: “TARGET CHRISTIAN MDs.”) The ongoing recruitment of doctors and medical school students seen as holding Christian views has long been its top priority. The leaked records indicate that more than 10,000 mailers were sent to physicians between 2013 and 2017 alone.

While the group’s membership rolls are not public, the leak has outed most if not all of its members. A cursory review of the member lists surfaced one name of note: a recent commissioner of the Texas Department of State Health Services, who after joining in 2019 asked that his membership with the group remain a secret. (WIRED was unable to reach the official for comment in time for publication.)

The SPLC’s “hate group” designation, which the College forcefully disputes, haunted its fundraising efforts, records reveal. A barrage of emails in 2014 show that the label cost the group the chance to benefit from an Amazon program that would eventually distribute $450 million to charities across the globe. Amazon would deny the College’s application, stating that it relied on the SPLC to determine which charities fall into certain ineligible categories.

A strategy document would later refer to a “unified plan” among the College and its allies to “continue discrediting the SPLC,” which included a campaign aimed at lowering its rating at Charity Navigator, one of the web’s most influential nonprofit evaluators. One of the group’s admins noted that despite SPLC’s label, another charity monitor, GuideStar, listed the College as being in “good standing.”

The College’s GuideStar page no longer says this and appears to have been defaced. It now reads, “AMERICAN COLLEGE OF doodoo fartheads,” with a mission statement saying: “we are evil and hate gays :(((”

The Google Drive containing the documents was taken offline soon after WIRED contacted the American College of Pediatricians. The College did not respond to a request for comment.

The Talk

Leaked communications between members of the group and minutes taken at board meetings over the course of several years speak loudly about the challenges the group faced in pursuing its deeply unpopular agenda: returning America to a time when the laws and social mores around family squared neatly with evangelical Christian beliefs.

Many of the College’s most radical views target transgender people, and in particular, transgender youth. The leak, which had been indexed by Google, includes volumes of literature crafted specifically to influence relationships between practicing pediatricians, parents, and their children. It includes reams of marketing material the College aims to distribute widely among public school officials. This includes pushing schools to adopt junk science painting transgender youth as carriers of a pathological disorder, one that’s capable of spontaneously causing others–à la the dancing plague–to adopt similar thoughts and behaviors.

This is one of the group’s most dubious claims. While unsupported by medical science, it is routinely and incuriously propagated through literature targeted at schools and medical offices around the US. The primary source for this claim is a research paper drafted in 2017 by Lisa Littman, a Brown University scholar who, while a medical doctor, had not specialized in mental health. The goal of the paper was to introduce, conceptually, “rapid onset gender dysphoria”—a hypothetical disorder, as was later clarified by the journal that published it. Littman would also clarify personally that her research “does not validate the phenomenon” she’d hypothesized, since no clinicians, nor individuals identifying as trans, had participated in the study.

The paper explains that its subjects were instead all parents who had been recruited from a handful of websites known for opposing gender-affirmative care and “telling parents not to believe their child is transgender.” A review of one of the sites from the period shows parents congregating to foster paranoia about whether there’s a “conspiracy of silence” around “anime culture” that was brainwashing boys into behaving like girls; insights plucked in some cases straight from another, more notorious forum (widely known for reveling in the suicides of the people it has bullied).

A 2021 prospectus describing the group’s focus, ideology, and lobbying efforts encapsulates a wide range of “educational resources” destined for the inboxes of physicians and medical school students. The materials include links to a website instructing doctors on how to speak to children in a variety of scenarios about a multitude of topics surrounding sex, including in the absence of their parents. Practice scripts of conversations between doctors and patients advise, among other things, ways to elicit a child’s thoughts on sex with the help of an imaginative metaphor.

While the material is not expressly religious, it is clearly aimed at painting same-sex marriage as aberrant and immoral behavior. Physicians lobbied by the group are also told to urge patients to purchase Christian-based parenting guides, including one designed to help parents broach the topic of sex with their 11- and 12-year-old kids. The College suggests telling parents to plan a “special overnight trip,” a pretext for instilling in their children sexual norms in line with evangelical practice. The group suggests telling parents to buy a tool called a “getaway kit,” a series of workbooks that run around $54 online. The workbooks methodically walk the parents through the process of springing the topic, but only after a day-long charade of impromptu gift-giving and play.

These books are full of games and puzzles for the parent and child to cooperatively take on. Throughout the process, the child slowly digests a concept of “sexual purity,” lessons aided by oversimplified scripture and well-trodden Bible school parables.

Another document the group shared with its members contains a script for appointments with pregnant minors. Its purpose is made evidently clear: The advice is engineered specifically to reduce the odds of minors coming into contact with medical professionals not strictly opposed to abortion. A practice script recommends the doctor inform the minor that they “strongly recommend against” abortion, adding “the procedure not only kills the infant you carry, but is also a danger to you.” (Medically, the term “fetus” and “infant” are not interchangeable, the latter referring to a newborn baby less than one year old.)

The doctors are urged to recommend that the minor visit a website that, like the aforementioned website, is not expressly religious but will only direct visitors to Catholic-run “crisis pregnancy centers,” which strictly reject abortion. The same site is widely promoted by anti-abortion groups such as National Right to Life, which last year held that it should be illegal to terminate the pregnancy of a 10-year-old rape victim.

The Professionals

The effort to ban mifepristone, legislation the Supreme Court paused last month pending further review, faces significant legal hurdles but could ultimately benefit from the appellate court’s disproportionately conservative makeup. Most of the legal power in the fight was supplied by a much older and better funded group, the Alliance Defending Freedom, which has established ties with some of the country’s most elite political figures—former vice president Mike Pence and Supreme Court justice Amy Coney Barrett among them.

A contract in the leaked documents dated April 2021 shows the ADF agreeing to legally represent the College free of charge. It stipulates that ADF’s ability to subsidize expenses incurred during lawsuits would be limited by ethical guidelines; however, it could still forgive any lingering costs simply by declaring the College “indigent.”

In contrast to the College’s some 700 members, the American Academy of Pediatrics (AAP)–the organization from which the College’s founders split 20 years ago–has roughly 67,000. The rupture between the two groups was a direct result of a statement issued by the AAP in 2002. Modern research, the AAP said, had conclusively shown that the sexual orientation of parents had an imperceptible impact on the well-being of children, so long as they were raised in caring, supportive families.

The College would gain notoriety early on by assailing the positions of the AAP. In 2005, a Boston Globe reporter noted how common it had become for the American College of Pediatricians “to be quoted as a counterpoint” to anything said by the AAP. The institution, he wrote, had a rather “august-sounding name” for being run by a “single employee.”

Internal documents show that the group’s directors quickly encountered hurdles operating on the fringe of accepted science. Some claimed to be oppressed. Most of the College’s research had been “written by one person,” according to minutes from a 2006 meeting, which were included in the leak. The College was failing to make a splash. In the future, one director suggested, papers rejected by medical journals “should be published on the web.” The vote to do so was unanimous (though the board decided the term “not published” was nicer than “rejected”).

A second director put forth a motion to create a separate “scientific section” on the group’s website, strictly for linking to articles published in medical journals. The motion was quashed after it dawned on the board that they didn’t “have enough articles” to make the page “look professional.”

The College struggled to identify the root cause of its runtedness. “To get enough clout,” one director said, “it would take substantial numbers, maybe 10,000.” (The College’s recruitment efforts would yield fewer than 7 percent of this goal in the following 17 years.) Yet another said the marketing department advised that “the College needs to pick a fight with the AAP and get on Larry King Live.” Another, the notes say, felt the organization was too busy trying to “walk the fence” by neglecting to acknowledge that “we are conservative and religious.”

74 notes

·

View notes

Text

you are lying on your cv about knowing excel. i am lying about knowing quickbooks. we are not the same.

8 notes

·

View notes

Text

Without fear involved I don’t even understand how it’s possible to care about work. Like literally I have to force myself to work, and the only driving force is fear of getting in trouble from my employer and losing my livelihood. I genuinely don’t understand how or why anyone can muster motivation to stare at excel or quickbooks all day and not sustain deep psychological damage. I refuse to believe that’s something most humans are capable of.

If they are invested beyond the coercion of capitalist employment, they are some level of brainwashed or in deep denial about their reality.

2 notes

·

View notes

Text

scott the woz spending the first 30 mins of his childhood videogames video talking about the arthur quickbook games and then literally every single spongebob game possible. hes just like me fr

17 notes

·

View notes

Text

Navigating Real-Time Operations: The Power of Operational Dashboards

Operational dashboards are dynamic visual interfaces that provide real-time insights into an organization's day-to-day activities and performance. These dashboards are particularly valuable for monitoring short-term operations at lower managerial levels, and they find application across various departments. They stand as the most prevalent tools in the realm of business intelligence.

Typically, operational dashboards are characterized by their comprehensive nature, offering junior managers detailed information necessary to respond to market dynamics promptly. They also serve to alert upper management about emerging trends or issues before they escalate. These dashboards primarily cater to the needs of managers and supervisors, enabling them to oversee ongoing activities and make rapid decisions based on the presented information. Operational dashboards often employ graphical representations like graphs, charts, and tables and can be customized to display information pertinent to the specific user.

Examples of data typically showcased on an operational dashboard include:

Sales figures

Production metrics

Inventory levels

Service levels

Employee performance metrics

Machine or equipment performance data

Customer service metrics

Website or social media analytics

It is crucial to emphasize that operational dashboards are distinct from other dashboard types, such as strategic and analytical dashboards. These different dashboards serve varied purposes and audiences and contain dissimilar datasets and metrics.

Here are a couple of examples.

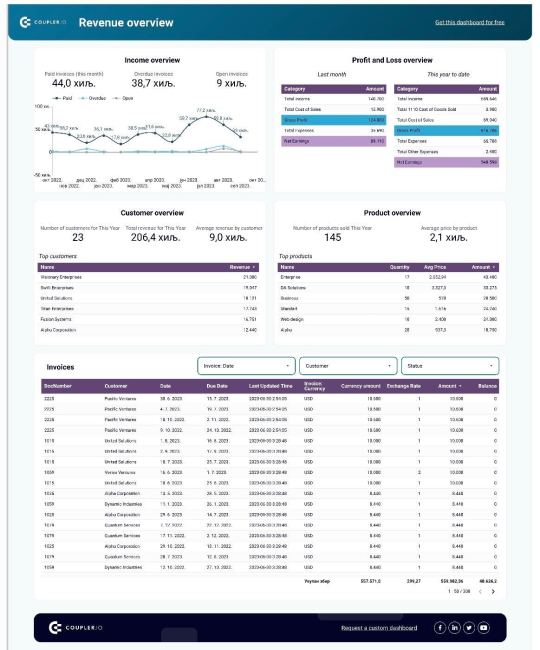

Below, you can see a Revenue overview dashboard for QuickBooks. It provides month-by-month overviews of invoices, products, customers, profit and loss. Such a dashboard can be used on a daily basis and help monitor and manage operating activities.

This data visualization is connected to a data automation solution, Coupler.io. It automatically transfers fresh data from QuickBooks to the dashboard, making it auto-updating. Such a live dashboard can be an important instrument for enabling informed decision-making.

This Revenue overview dashboard is available as a free template. Open it and check the Readme tab to see how to use it.

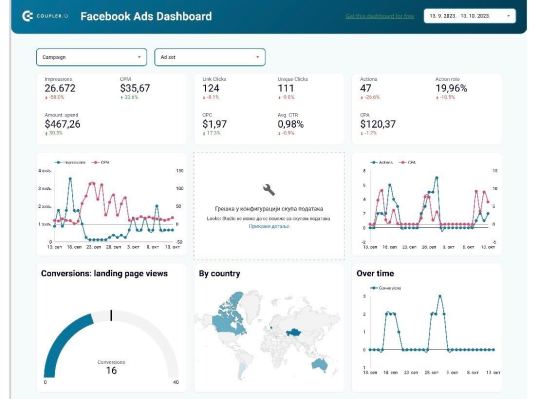

Here’s another example of an operational dashboard, the Facebook Ads dashboard. It allows ad managers to closely track their ad performance. This dashboard is also powered by Coupler.io, so it depicts ad data in near real-time. This allows marketers to quickly define what works and what doesn’t and make adjustments on the go.

Facebook Ads dashboard is available as a free template. You can grab it and quickly get a copy of this dashboard with your data.

In conclusion, operational dashboards are indispensable tools for organizations seeking to thrive in a dynamic business landscape. These real-time visual displays offer invaluable insights into day-to-day operations, equipping managers and supervisors with the information to make swift, informed decisions. As the most widely used business intelligence instruments, operational dashboards empower businesses to adapt to market changes, identify emerging trends, and maintain a competitive edge. Their versatility and capacity to monitor a wide range of metrics make them an essential asset for managing the intricacies of modern operations.

#marketing dashboards#digital marketing#dashboards#data analytics#data visualization#operational dashboards

2 notes

·

View notes

Text

Payroll Accuracy: Tips for Error-Free Payroll Processing

The processing of payroll is an essential operational task inside an organisation, as it guarantees the accurate and timely compensation of personnel. Nevertheless, the intricacy of payroll computations and the dynamic nature of tax legislation might provide a significant challenge in undertaking this endeavour. Mistakes in payroll administration can lead to employee dissatisfaction, non-compliance with regulations, and potential legal ramifications. In order to mitigate such complexities, it is imperative to give precedence to the precision of payroll calculations. Discover the strategic advantages of outsourcing your payroll to VNC Global - an excellent Payroll management company in Singapore. Choose VNC Global for secure and cost-effective payroll management.

This blog post aims to examine key strategies that can facilitate accurate payroll processing and enhance search engine optimisation (SEO) endeavours.

● Stay Informed About Tax Laws:

Keeping up-to-date with tax rules is crucial for maintaining payroll accuracy due to the frequent changes in tax regulations. It is imperative to consistently assess and examine the tax regulations at the federal, state, and municipal levels in order to guarantee adherence and conformity. It is advisable to utilise tax compliance software or seek guidance from tax professionals in order to ensure the maintenance of an updated payroll system.

● Implement Robust Payroll Software:

It is advisable to allocate resources towards the acquisition of dependable payroll software capable of managing intricate computations and streamlining diverse payroll procedures. These technologies have the potential to reduce errors that are commonly associated with human calculations and data entry. Some commonly used payroll software alternatives are ADP, Gusto, and QuickBooks.

● Maintain Accurate Employee Records:

It is vital to ensure the up-to-dateness and accuracy of all employee information, encompassing tax forms, personal particulars, and bank account details. The presence of erroneous personnel data can result in payment inaccuracies and non-compliance concerns. It is imperative to consistently assess and revise employee records. Experience the peace of mind that comes with organized financial records. Connect with VNC Global - the most trusted provider of Bookkeeping services for small businesses in Singapore and transform your business together.

● Use a Standardized Payroll Process:

Establishing a standardised procedure for payroll processing entails the development of a comprehensive framework that delineates the sequential stages involved, commencing from the first data entry phase and culminating in the distribution of the payroll. Ensuring uniformity in payroll operations can aid in mitigating the probability of errors.

● Double-Check Calculations:

Despite the utilisation of sophisticated payroll software, it remains imperative to conduct a thorough verification of computations in order to identify and rectify any potential errors. Incorrect payments can occur as a result of a minor error during data entry or due to a software malfunction. It is imperative to conduct a comprehensive examination of each paycheck prior to initiating the payroll processing procedure.

● Cross-Train Payroll Staff:

To mitigate the risk of excessive dependence on a sole payroll administrator, it is advisable to implement cross-training measures for the payroll staff. It is advisable to implement a cross-training programme for the payroll workforce, ensuring that multiple employees have the necessary skills and knowledge to effectively manage payroll tasks. Implementing this measure will effectively mitigate potential interruptions that may arise due to personnel turnover or absence.

● Conduct Regular Audits:

It is recommended to conduct regular audits of the payroll system in order to rapidly identify and resolve any problems or anomalies that may arise. These audits have the potential to identify any potential concerns prior to their escalation into severe difficulties. Maximize your time and resources by outsourcing your Accounting services for small businesses in Singapore to VNC Global. Request a quote to simplify your financial tasks.

● Seek Professional Help:

It is advisable to explore the option of engaging the services of a professional payroll service provider in order to outsource your payroll processing. These organisations possess expertise in payroll and tax compliance, hence diminishing the probability of errors.

Final Thoughts:

The maintenance of payroll accuracy is of utmost importance in ensuring employee satisfaction, adhering to tax requirements, and mitigating potential legal complexities. One can effectively decrease errors in payroll processing by acquiring knowledge of tax rules, utilising dependable software, upholding precise record-keeping practises, and adhering to standardised procedures. Furthermore, the implementation of routine audits and the utilisation of professional assistance, when deemed essential, can significantly augment the level of accuracy. Ensuring payroll accuracy is crucial not only for the welfare of employees but also for the prosperity of the organisation.

Effortlessly manage your payroll with a tailored payroll system in Singapore. Reach out now to VNC Global’s accurate Payroll management system in Singapore and see how we can enhance your payroll processes.

#Payroll management company in Singapore#Bookkeeping services for small businesses in Singapore#Accounting services for small businesses in Singapore#Payroll management system in Singapore#VNC Global

3 notes

·

View notes

Text

ah I forgot our cringe ass government actually went through with decreasing the reporting threshold to $600. if you are unaware. it used to be $20,000. in 2022 it was still $20,000. now it is $600.

I've never had to deal with the 1099-K before, even though I've made for example, like, over $1000 from etsy last year iirc. I reported it as self employment income to like, social services in order to apply for govt benefits, and that came with some confusion for proof-of-income requirements because they'd ask me for a 1099-K and I'd be like, I wasn't issued one I did not meet the threshold, and as far as like the IRS goes I don't.. THINK? I ended up paying taxes on it? I'm also like unsure because I still had W2's from like, the tail end of my food service job I quit early 2022, and my haunted house job later, so that's what I was filing and I got money BACK on that

I was already apprehensive about tax filing for the 2023 year since (thus far) all I have to report is self employment income but like. Fantastic I'm going to have to deal with two 1099-K's (from ebay and etsy), like I have never done the loss/gains shit, and idfk I was already sending income tax checks to the IRS based on my cumulative profits quickbooks calculated for me, which was both shops, because that was easy enough and I forgot about the stupid fucking $600 thing, upside down face emoji, so I feel like, I really don't know what's gonna happen like I'm gonna be slapped with a taxes owed bill for 2023 and like I already am barely making enough money to break even on like, being alive and keeping my pets alive, the last round of stuff I ordered from vograce came out of pocket because profits were already spent on necessities lol

like what the fuck is $600/year from marketplace transactions that is nothing, I hate this fucking country

6 notes

·

View notes

Text

QuickBooks vs Sage: A Comprehensive Comparison for Small Businesses

Introduction

As a small business owner, choosing the right accounting software can be a daunting task. With so many options out there, it's hard to know which one is the best fit for your needs. Two of the most popular options on the market are QuickBooks and Sage. But how do they compare?

In this QuickBooks vs Sage comprehensive comparison, we'll take a look at both QuickBooks and Sage's features, pricing, pros and cons to help you make an informed decision about which software is right for your small business. So let's dive in!

QuickBooks Overview

QuickBooks is one of the most popular accounting software solutions for small businesses. It was developed and marketed by Intuit, a company that specializes in financial and tax preparation software. QuickBooks is known for its user-friendly interface and extensive features that cater to various business needs.

One of the key benefits of using QuickBooks is its ease of use. The software can be easily installed on your computer or accessed through the cloud-based version, making it accessible anytime, anywhere. Additionally, QuickBooks has a simple dashboard that allows users to track their expenses, income, and profits with just a few clicks.

Another great feature of QuickBooks is its ability to integrate with other applications such as PayPal and Square. This integration makes it easier for businesses to manage their finances without having to switch between multiple platforms.

Moreover, QuickBooks offers several versions tailored to suit different types of businesses including self-employed individuals, small business owners and accountants who work with multiple clients at once. These versions come with varying features such as invoicing capabilities, inventory management tools among others.

If you are looking for an accounting solution that offers easy accessibility combined with extensive functionality then QuickBooks could be the perfect fit for you.

Sage Overview

Sage is another popular accounting software that caters to small and medium-sized businesses. It offers a variety of features that help in managing finances, invoicing customers, and tracking expenses.

One of the key advantages of Sage is its flexibility. It provides users with various customization options to tailor the software's interface according to their needs and preferences. Additionally, it has an intuitive dashboard that displays all important financial information at a glance.

Apart from standard accounting functionalities like bookkeeping and bank reconciliation, Sage also offers advanced inventory management features such as order fulfillment tracking and automated reordering.

Another notable aspect of Sage is its integration capability with other business tools like Microsoft Office 365, Salesforce CRM, and Shopify eCommerce platform. This allows for seamless data exchange between different software applications used by businesses.

Sage is a robust accounting solution suitable for businesses looking for advanced features beyond basic bookkeeping. Its customizable interface and integration capabilities make it stand out among competitors in the market.

QuickBooks vs Sage Feature Comparison

When it comes to comparing QuickBooks vs Sage, one of the most important things to look at is their features. Both software solutions offer a range of tools and functions that can help small businesses manage their finances effectively.

QuickBooks has always been known for its strong focus on accounting features. It offers a comprehensive suite of tools designed to handle everything from invoicing and billing to expense tracking and payroll management. In addition, QuickBooks also provides robust reporting capabilities that enable business owners to get insight into the financial health of their company in real-time.

On the other hand, Sage boasts an impressive array of specialized features that cater specifically to certain industries such as construction, manufacturing, or distribution. These industry-specific functionalities allow businesses operating in these sectors to streamline operations by automating tasks like inventory tracking or job costing.

While both platforms have plenty of useful features for small businesses, it's important to consider which ones are more relevant based on your specific needs. Take some time to evaluate your business requirements before making a decision between QuickBooks vs Sage.

QuickBooks vs Sage Pricing Comparison

When it comes to pricing, both QuickBooks and Sage offer a range of plans that cater to different business needs and budgets. However, there are some notable differences between the two.

QuickBooks offers four main pricing plans: Simple Start, Essentials, Plus, and Advanced. Prices start at $25 per month for Simple Start and go up to $180 per month for Advanced. Each plan includes features like invoicing, expense tracking, and basic reporting tools.

On the other hand, Sage has three main pricing tiers: Accounting Start ($10/month), Accounting ($25/month), and Accounting Premium ($71.67/month). While these prices may seem lower than QuickBooks' offerings on the surface level, it's important to note that each tier is limited in terms of features compared to what QuickBooks offers.

Additionally, both QuickBooks and Sage offer add-ons such as payroll processing or inventory management for an additional cost. It's important for businesses to carefully consider their needs when deciding which plan is right for them.

Ultimately, while there are differences in price between the two platforms depending on your business size and needs; finding out which one works best will depend entirely upon your specific budgeting goals as well as overall objectives

Pros and Cons

When comparing QuickBooks and Sage, it's important to consider the pros and cons of each software. First, let's take a look at some of the advantages of using QuickBooks.

One of the major benefits of QuickBooks is its user-friendly interface. Even if you are not an accounting expert, you can easily navigate through this software. It has a simple dashboard that provides a clear overview of your financial records. Also, it offers robust features such as invoicing, expense tracking and payroll management.

On the other hand, Sage also has its own set of pros. One advantage is its customization capability which allows users to tailor-fit their accounting processes based on their business needs. Additionally, Sage enables multi-user access which supports collaboration among team members in real-time.

However, there are also some cons to consider for both software options. For example, QuickBooks may be too basic for larger businesses with more complex accounting requirements while Sage may have a steeper learning curve compared to other accounting platforms.

Ultimately, deciding between QuickBooks or Sage will depend on your business size and specific needs when it comes to bookkeeping and accounting processes.

Conclusion

After weighing the advantages and disadvantages of QuickBooks vs Sage, it is evident that both software programs have their unique features and benefits. Ultimately, the choice between them depends on a business's specific needs.

QuickBooks is an excellent choice for small businesses looking for easy-to-use bookkeeping software with robust accounting features, mobile accessibility, and affordable pricing options. On the other hand, Sage offers more extensive customization options and advanced reporting capabilities.

Before making any decision about which bookkeeping software to use in your business, you should conduct thorough research into each program's features. However, regardless of which option you choose; investing in either QuickBooks or Sage will give your small business a competitive edge when it comes to managing finances effectively.

3 notes

·

View notes