#book and bond

Text

Letters To America

Willie Nelson

4 Diamond Book

💎💎💎💎

“When I started counting my blessings, my whole life turned around.” - Willie Nelson

Willie Nelson is an American Icon. He has written a few books before this that I have not read, but after this book I am looking forward to diving into them. I listened to the audio book narrated by Turk Pipkin. That disappointed me because I prefer memoirs narrated by the author- they seldom sound like they are reading. Turk sounded like he was reading- or narrating a documentary . He has a pleasant voice but… it wasn’t Willie.

With the above said, I found Willie’s Letters To America to be a beautiful sentiment. Through the words in these letters written to the country, to family, to the state of Texas among others we get a good sense of how Willie feels and thinks.

His feelings, expressed through these letters are an inspiring collection of the country music legend’s reflections on his life and his country.

Through his heartfelt and often humorous writing, Nelson captures the essence of the American spirit and shares with readers his unique perspective on life as he has lived it.

The book is comprised of letters to different people, places, and things that have been important to Nelson throughout his life.

Each of these letters offers readers profound insight into Nelson’s view of the world. He speaks of his love for his fans, his appreciation for the beauty of the land, and his passion for music. He also shares his concerns about the state of the nation, and his hopes for the future.

Nelson’s writing is sincere and honest, and his words are full of wisdom and optimism. His stories are filled with warmth and tenderness, and his love for his family, friends, and country are evident on every page.

Willie Nelson’s “Letters To America” is a must-read for anyone who wants to understand and appreciate the beauty and complexity of this great nation. This book is sure to leave readers feeling inspired and hopeful for the future.

#autobiography#shezanenigma#celebrity#humor#country music#outlaw#letters to america#book & bond#book review#book and bond#highwaymen#waylon and willie#on the road again#red headed stranger#relatable#audible#audiobook#reflection#memoir#favorite#goodreads#2022 booklist#wildgirl#adventure#shawna loree#5 diamonds

4 notes

·

View notes

Photo

THE FUTURE RULES!

#for the bonds & chains book :]#chainsaw man spoilers#chainsaw man#makima#aki hayawaka#the gun devil#my art

17K notes

·

View notes

Text

Vlad meets Lex. He realizes some things.

Vlad meets Lex Luthor at a gala, and Lex is schmoozing hard.

Lex has heard about Vlad's weirdass business deals, knows something isn't right, and he want whatever untraceable power Vlad's got at his disposal.

Lex has done his research, and knows that Vlad got the equipment for cloning, but that no child was ever announced. So Lex starts bragging, going on and on about Kon and talking about the kid like he's a Thing.

And Vlad, listening to this, has some unfortunate realizations about how he was treating Ellie.

So Vlad excuses himself and does some digging of his own, and holy shit do the dead have a lot to gossip about regarding how Superman used to treat the boy, and Vlad...doesn't want to be compared to either of those buffoons.

He's better than both of them combined.

And he's gonna prove it.

He's gonna be the daddest dad that ever dadded.

He'll be way better than Jack, and if he's a better father than Jack then Daniel and Jasmine and Maddie will follow! He just has to learn how to be a good parent.

Easy.

He proceeds to buy every parenting book he can find, and signs himself up for parenting classes.

Ellie, minding her own business, feels a shiver go down her back.

#dpxdc#dcxdp#dp x dc#dc x dp#story prompt#phanfic#vlad's obsession has switched from wooing maddie with money to wooing her with good parenting skills#redemtion fic#vlad slowly starts to have his obsession switch from maddie to just being a good father#ellie fuckin books it#various justice league members have seen a dracula-esque man chasing a white haired kid through their cities#the only one who could have feasibly done anything was J'onn#he read teh general vibe of “LET ME FATHER YOU” and decided to leave it alone#he did tell batman though#maybe he and that strange dracula meta can bond#the man could use more friends

2K notes

·

View notes

Text

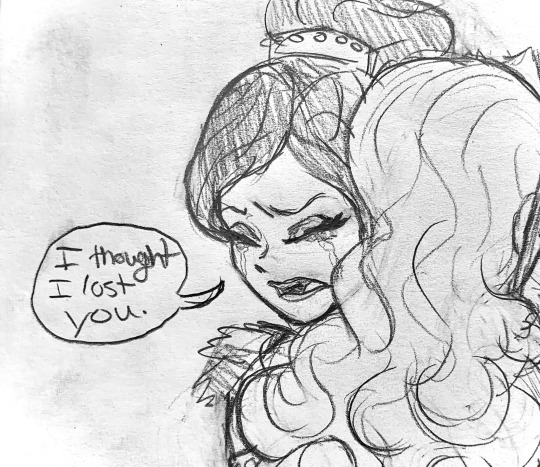

there are two parental bonds inside you:

one soft and loving towards each other

the other fierce and protective of each other

may i please have @somerandomdudelmao blessing on one of these versions? 🙏

i don't know which one to put my focus on and the vibes for each would change the way i'd ink and color them

#tmnt#rottmnt#teenage mutant ninja turtles#rise of the teenage mutant ninja turtles#cass apocalyptic series#cass fanart tag#my art#rise of the turtles#rise of the tmnt#future leo#rottmnt casey jr#casey jr#if someone else could ink and color these for me that's be great#i like sketching and then my energy fizzles out and i want to move on to another sketch OTL#the vibes are either a children's book parental bonding or a survival horror parental bonding no in-between#oh hey it's my first time drawing cj :D

2K notes

·

View notes

Text

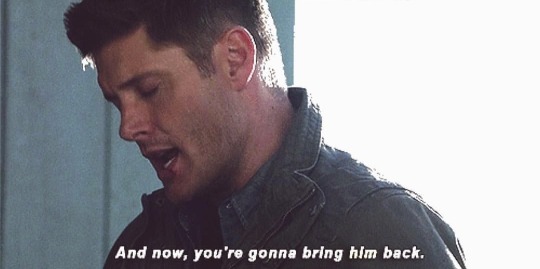

Dean: Dean Winchester doesn’t beg for anyone

Also Dean:

#praying is the same as begging in my book#proceeds to pray to cas every night#dean Winchester the man that you are#profound bond#intricate rituals#supernatural#dean winchester#destiel#castiel#deancas#spn#misha collins#jensen ackles#spn crack

546 notes

·

View notes

Text

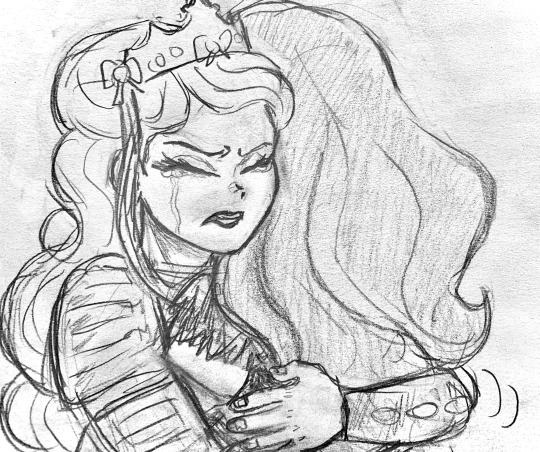

danmarch 🐉💎

#honkai star rail#dan heng#march 7th#danmarch#fanart#hsr#what else do i tag. i have no idea#anyway. im breaking my VERY LONG oc art streak to post my one(1) contribution to star rail#i care them very much#ive been playing this game so religiously and they have not left my team#tragic past(emo) vs tragic past(girly pop)#theres NO WAY with marchs very teenage girl mind that she does not have a crush on the hot cool mysterious yet caring dragon guy#who stays in the room right next to her#and the fact that he teases her so much........#the whole ass belabog quest he throws in little harmless march roasts every so often#he fucking CARE her#i bets shes like a filipino mom with that camera. every oppertunity (picture!!!!)#and dan heng gets dragged into it#he is honing his photography skills against his will#any nice place? shes like (lemme pose can you get a photo of me?)#dan heng just sighs#they bond over silently judging stelle rummaging through the garbage#cast each other that best friend glance as half her body is sticking out of a trash bin#i like to think you see them hanging out on the train together#with dan heng reading some obscure 8th century book on civilization pattern and development#and march is humming and putting stickers and aesthetic shit in her scrapbook#taping a piece of antimatter legion loot in the middle of a page#and with bubbly handwriting (we beat some bad guys today!!! <333 so fun!!)

525 notes

·

View notes

Text

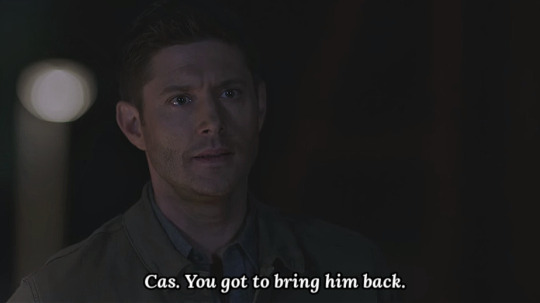

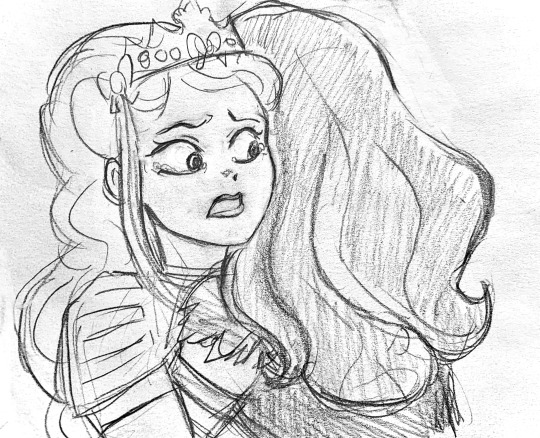

5 times Apple hugged Raven…

————————

…and the one time Raven hugged back.

(see my previous eah comic here)

#sorry that this is so sloppy#i just couldn’t let this idea stay in my head too long before it got lost in all the rubble#my god drawing eah characters in their basic outfits is bad enough#and then their other ones just get Worse#looking at you raven dragon games#i half assed that because no way am i gonna try to do all that#sorry#also just pretend that i intentionally left the booking glass out of every drawing after the first one it’s in#let’s just act like apple was so shocked raven hugged her that she dropped it#eah#eah fanart#ever after high#raven queen#apple white#rapple#could be platonic or romantic#i didn’t make it with a shipping intent but#it’s totally cool if you see it that way#and understandable. lol#either way the bond these two have is literally what defines ever after high at its heart#they are just important to me#duncart

410 notes

·

View notes

Text

i'm so used to there just being random unidentified bones laying around everywhere in these damn books that it finally occurred to me, just now, to wonder where the bones on new rho came from. y'know, the bones palamedes always tried to teach nona necromancy on.

they're his.

palamedes, who always loved teaching, living on borrowed time in a body that's not his own. palamedes, mentoring, teaching- parenting, by sixth standards, mind you. and that boy is sixth, through and through.

and the entire point of teaching nona necromancy in the first place was to try and determine if nona is, well, nonagesimus, right? so it has to be bones, it can't not be bones. bones are, like, her whole thing.

but they're not in the nine houses, anymore. things are different, on new rho.

they burn bones here. dig up the cemeteries. a society terrified of zombies will evolve to dispose of its dead differently.

the only bones he has access to now are his own. (camilla wouldn't let anyone take them- skull or hand, doesn't matter. they're still him, and she doesn't let go, remember? it's her one thing.)

palamedes woke up every morning wearing someone else's body to then gently place the shrapnel of his own in the cupped palms of a girl who's the closest thing he'll ever have to a daughter and try to teach her- how did the angel put it, again? normal school, as much as possible, for as long as possible.

(but hey, in a roundabout way, at least it's a chance for him to touch camilla again, right? nevermind that she's not there to feel any of it because he's in the driver's seat, that he can only stay for fifteen minutes at a time. it's atoms that belong to camilla touching atoms that used to belong to him, and that's close enough. he'll take what he can get, these days- if she can be their flesh, he can be the end. so what if holding his own bones is a mindfuck? so what if looking at them makes him nauseous? surely he can suck it up and deal with it for fifteen minutes. it's the least he can do— his poor camilla was the one who had to scrape the bloody pulp of them off the floors of canaan house.)

(speaking of, here's a fun fact: we actually only see nona practicing with the bones one time, on-page. camilla's final line in that scene, before palamedes takes over, is none other than: 'keep going. there are some bones left.' ow!)

remember, too, that the only part of dulcinea, the real dulcinea, that palamedes ever physically touched, was her tooth- the one that ianthe gave him, pulled from the ashes cytherea burnt her down to. he only ever touched dulcie once, and it wasn't until after she was already gone, but that doesn't matter- it still happened, and you can't take loved away.

in this same roundabout, bittersweet, by-proxy sort of way, palamedes has been physically touched by nona, too: the atoms she currently occupies, touching atoms that he used to occupy, and never will again.

the main interaction we've seen between palamedes and his mother took place back on the sixth, with her acting as mentor and him as pupil: the two of them studying a set of hand bones, juno encouraging him every step of the way.

we know that harrowhark's "most vivid memory of her mother was of her hands guiding harrow's over an inexpertly rendered portion of skull, her fingers encircling the fat baby bracelets of harrow's wrists, tightening this cuff to indicate correct technique."

they're still small for a nineteen year old, but the wrists are bigger, in this new set of memories nona's making. and it's not an inexpertly rendered portion of skull anymore- it's a hand, now, albeit one crafted from [a piece of skull reassembled (painstakingly—passionately—laboriously reassembled) from fragments, manually, and not by a bone magician, from the skull of someone who, soon after death or symptomatically during, had exploded.] and the identity and origin of these bones is no mystery at all. they belong to palamedes, and he's consented to their use for this purpose, and that matters.

but the details are just set dressing, really. the foundation of the memory is the same.

palamedes and his mother, juno and her son.

harrow and her mother; pelleamena and her daughter.

nona and her father-mother-teacher; palamedes and his daughter.

#these fucking books. every 2-3 business days i'll find some new detail to be insane about#this post took me like three hours to write. what the fuck#palamedes sextus#nona the ninth#the locked tomb#nona#palamedes the sixth#tlt#ntn#camilla hect#tlt spoilers#pal honey. im :( :( :(#spiritually that man is a MOM okay! there's a reason tamsyn specifically assigned him the same imagery in this scene#that she's been using to represent crucial bonding moments between mother/mother figure and child/child figure#that and the 'sextus you'll make a very irritating wife someday' joke and cam's 'i'll talk to your mother later' face#ie: talk to palamedes about nona#that boy is momcoded i don't make the rules!

1K notes

·

View notes

Text

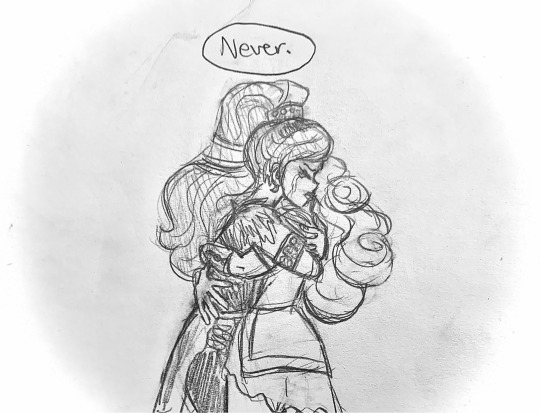

happy pride to binder moiraine my most beloved <3 lan and moiraine exploring gender together <3 rj i am ignoring your extreme binaries xoxo

(click image for optimal quality!)

#my art#binder moiraine was my most self indulgent hc for her but its so real to me now#the gender binary is so intense in the books#anyway them#u cant tell me that the bond doesnt come with some weird gender questioning and experiences liiiike you just cant#moiraine damodred#moiraine sedai#lan mandragoran#wot#the wheel of time#binder moiraine#fanart#lan and moiraine#platonic soulmates

1K notes

·

View notes

Text

another reason i think that xie lian felt an instant connection on the ox cart is because he and hua cheng both grew up in xianle.

there are maybe 4 people still alive that grew up in that culture. based on my own experience, you can pick up on things like accent, cadence, references, and humor that suggest a person is from the same place as you without consciously noticing it. that sense of comfort and similarity probably played into their instant chemistry.

#thinking about how they are bonded together by being the only people who remember their dead culture... augh it kind of makes me want to cr#as much fighting as fengqing do they are really the only people who will EVER understand each other's childhoods#which. aughhhh#there's a lovely modern au fic by heavensturtle called ''i'm just there to admire you.'' where they talk about chinese diaspora go read it#fics that mention paradise manor being in the xianle style also make me want to bawl. especially when fxmq notice it#other people that remember xianle: qi rong. jun wu. mei nianqing. yeah. none of those people are easy to talk to#buried deep in the xianle quartets heads are things like xianxia silly bands and xianxia nickelodeon and xianxia hi chew that LITERALLY#NOBODY ELSE IN THE ENTIRE WORLD REMEMBERS. DOES THAT NOT MAKE YOU FEEL INSANE#the immortality in tgcf and how it affects memory and sense of self and relationships. ourgh#i speak#tgcf meta#tgcf#tgcf spoilers#i guess?#tian guan ci fu#tgcf books#heaven official's blessing#hob#xie lian#hua cheng#hualian#feng xin#mu qing#fengqing#xianle trio#xianle quartet

664 notes

·

View notes

Text

My favourite campfire interaction with Lenny so far:

Lenny: "Is that a journal I see you writing in?"

Arthur: "Something like that."

Lenny: "That's good!"

No judgement or mockery in his voice, just curiosity and a bit of glee when Arthur said yes <3

#he seemed so happy hes so supportive#:))#lenny loves books and arthur loves writing so it's something nice for them to bond over#rdr2#red dead redemption 2#mick squeaks#arthur morgan#lenny summers#liveblogging

322 notes

·

View notes

Text

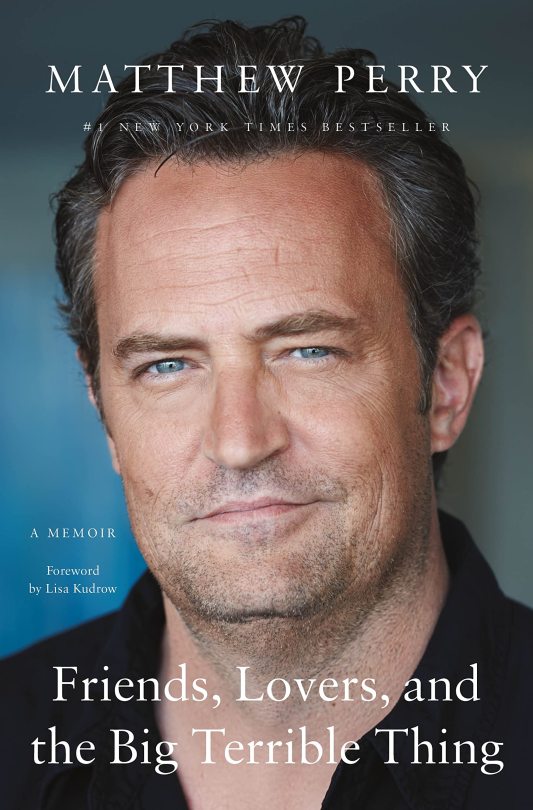

Book Review: Friends, Lovers, and the Big Terrible Thing

Friends, Lovers, and the Big Terrible Thing

By, Matthew Perry

💎💎💎💎💎

5 Diamond Book

Friends, Lovers, and the Big Terrible Thing by Matthew Perry is an honest and heartfelt memoir that delves into his life, from his decades-long battle with drinking and addiction to his success as Chandler Bing in Friends and after.

The book is an inspiring read, and it's clear that Perry has a deep understanding of himself and his life. He gives us an honest and vulnerable look into his struggles with alcohol, drugs, depression and low self-esteem. He talks candidly about his childhood, his family and his relationships with friends and lovers. He also sheds light on his acting career and how he managed to cope with his addiction and still be a successful actor.

Perry's writing is honest, funny, and thought-provoking and his journey to sobriety has been one of success, failure and success again. He is open about his past, and his insight into his experience is remarkable.

The book is written in a very personal and honest manner, which makes it very easy for the reader to relate to. Perry is open about his struggles and does not try to hide or sugarcoat anything. He is also very honest about the mistakes he has made, and how he has worked to put them behind him. Readers will appreciate the candor and humor with which he shares his story.

Overall, Friends, Lovers, and the Big Terrible Thing is an inspiring and honest memoir that is sure to give readers hope and insight into the battles of addiction and low self-esteem. Perry’s journey is one of resilience and hope, and his story will resonate with many. It is an inspiring and uplifting read for anyone who is struggling with addiction or knows someone who is. or someone who just likes Matthew Perry.

#book and bond#shezanenigma#shawna loree#wildgirl#adventure#celebrity#matthew perry#friends#Friends#Lovers#friends lovers and the Big Terrible Thing#memoir

0 notes

Text

People talking about Grover vibing with Ares over war and the violence of nature (or whatever happened in that scene) and how it was unexpected but still cool are forgetting that in the book he played a hunting game at the casino where the deer hunted people and very loudly demanded humans die over pollution and then shot at Percy with the plastic gun when they tried to get him to leave, like Grover's been wild since day one.

#It's one of the scenes from the books I have literally never forgotten in the last like decade and change since I first read the series#grover also deluded a cyclops into believing he was his bride for like a couple weeks at minimum#like grover bonding and gaslighting people who have way more power over him to get what he wants isn't new information#grover underwood#he's percy's bestie - ofc he's a little unhinged#happy talks pjo

497 notes

·

View notes

Text

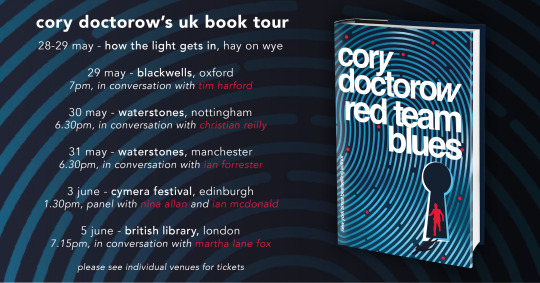

The long, bloody lineage of private equity's looting

Tomorrow (June 3) at 1:30PM, I’m in Edinburgh for the Cymera Festival on a panel with Nina Allen and Ian McDonald.

Monday (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Fans of the Sopranos will remember the “bust out” as a mob tactic in which a business is taken over, loaded up with debt, and driven into the ground, wrecking the lives of the business’s workers, customers and suppliers. When the mafia does this, we call it a bust out; when Wall Street does it, we call it “private equity.”

It used to be that we rarely heard about private equity, but then, as national chains and iconic companies started to vanish, this mysterious financial arrangement popped up with increasing frequency. When a finance bro’s presentation on why Olive Garden needed to be re-orged when viral, there was a lot off snickering about the decline of a tacky business whose value prop was unlimited carbs. But the bro was working for Starboard Value, a hedge fund that specialized in buhying out and killing off companies, pocketing billions while destroying profitable businesses.

https://www.salon.com/2014/09/17/the_real_olive_garden_scandal_why_greedy_hedge_funders_suddenly_care_so_much_about_breadsticks/

Starboard Value’s game was straightforward: buy a business, load it with debt, sell off its physical plant — the buildings it did business out of — pay itself, and then have the business lease back the buildings, bleeding out money until it collapsed. They pulled it with Red Lobster,and the point of the viral Olive Garden dis track was to soften up the company for its own bust out.

The bust out tactic wasn’t limited to mocking middlebrow family restaurants. For years, the crooks who ran these ops did a brisk trade in blaming the internet. Why did Sears tank? Everyone knows that the 19th century business was an antique, incapable of mounting a challenge in the age of e-commerce. That was a great smokescreen for an old-fashioned bust out that saw corporate looters make off with hundreds of millions, leaving behind empty storefronts and emptier pension accounts for the workers who built the wealth the looters stole:

https://prospect.org/economy/vulture-capitalism-killed-sears/

Same goes for Toys R Us: it wasn’t Amazon that killed the iconic toy retailer — it was the PE bosses who extracted $200m from the chain, then walked away, hands in pockets and whistling, while the businesses collapsed and the workers got zero severance:

https://www.washingtonpost.com/news/business/wp/2018/06/01/how-can-they-walk-away-with-millions-and-leave-workers-with-zero-toys-r-us-workers-say-they-deserve-severance/

It’s a good racket — for the racketeers. Private equity has grown from a finance sideshow to Wall Street’s apex predator, and it’s devouring the real economy through a string of audactious bust outs, each more consequential and depraved than the last.

As PE shows that it can turn profitable businesses gigantic windfalls, sticking the rest of us with the job of sorting out the smoking craters they leave behind, more and more investors are piling in. Today, the PE sector loves a rollup, which is when they buy several related businesses and merge them into one firm. The nominal business-case for a rollup is that the new, bigger firm is more “efficient.” In reality, a rollup’s strength is in eliminating competition. When all the pet groomers, or funeral homes, or urgent care clinics for ten miles share the same owner, they can raise prices, lower wages, and fuck over suppliers.

They can also borrow. A quirk of the credit markets is that a standalone small business is valued at about 3–5x its annual revenues. But if that business is part of a large firm, it is valued at 10–20x annual turnover. That means that when a private equity company rolls up a comedy club, ad agency or water bottler (all businesses presently experiencing PE rollup), with $1m in annual revenues, it shows up on the PE company’s balance sheet as an asset worth $10–20m. That’s $10–20m worth of collateral the PE fund can stake for loans that let it buy and roll up more small businesses.

2.9 million Boomer-owned businesses, employing 32m people, are expected to sell in the next couple years as their owners retire. Most of these businesses will sell to PE firms, who can afford to pay more for them as a prelude to a bust out than anyone intending to operate them as a productive business could ever pay:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

PE’s most ghastly impact is felt in the health care sector. Whole towns’ worth of emergency rooms, family practices, labs and other health firms have been scooped up by PE, which has spent more than $1t since 2012 on health acquisitions:

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

Once a health care company is owned by PE, it is significantly more likely to commit medicare fraud. It also cuts wages and staffing for doctors and nurses. PE-owned facilities do more unnecessary and often dangerous procedures. Appointments get shorter. The companies get embroiled in kickback scandals. PE-backed dentists hack away at children’s mouths, filling them full of root-canals.

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

The Healthcare Private Equity Association boasts that its members are poised to spend more than $3t to create “the future of healthcare.”

https://hcpea.org/#!event-list

As bad as PE is for healthcare, it’s worse for long-term care. PE-owned nursing homes are charnel houses, and there’s a particularly nasty PE scam where elderly patients are tricked into signing up for palliative care, which is never delivered (and isn’t needed, because the patients aren’t dying!). These fake “hospices” get huge payouts from medicare — and the patient is made permanently ineligible for future medicare, because they are recorded being in their final decline:

https://pluralistic.net/2023/04/26/death-panels/#what-the-heck-is-going-on-with-CMS

Every part of the health care sector is being busted out by PE. Another ugly PE trick, the “club deal,” is devouring the medical supply business. Club deals were huge in the 2000s, destroying rent-controlled housing, energy companies, Mervyn’s department stores, Harrah’s, and Old Country Joe. Now it’s doing the same to medical supplies:

https://pluralistic.net/2021/05/14/billionaire-class-solidarity/#club-deals

Private equity is behind the mass rollup of single-family homes across America. Wall Street landlords are the worst landlords in America, who load up your rent with junk fees, leave your home in a state of dangerous disrepair, and evict you at the drop of a hat:

https://pluralistic.net/2021/08/16/die-miete-ist-zu-hoch/#assets-v-human-rights

As these houses decay through neglect, private equity makes a bundle from tenants and even more borrowing against the houses. In a few short years, much of America’s desperately undersupplied housing stock will be beyond repair. It’s a bust out.

You know all those exploding trains filled with dangerous chemicals that poison entire towns? Private equity bust outs:

https://pluralistic.net/2022/02/04/up-your-nose/#rail-barons

Where did PE come from? How can these people look themselves in the mirror? Why do we let them get away with it? How do we stop them?

Today in The American Prospect, Maureen Tkacik reviews two new books that try to answer all four of these questions, but really only manage to answer the first three:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

The first of these books is These Are the Plunderers: How Private Equity Runs — and Wrecks — America by Gretchen Morgenson and Joshua Rosner:

https://www.simonandschuster.com/books/These-Are-the-Plunderers/Gretchen-Morgenson/9781982191283

The second is Plunder: Private Equity’s Plan to Pillage America, by Brendan Ballou:

https://www.hachettebookgroup.com/titles/brendan-ballou/plunder/9781541702103/

Both books describe the bust out from the inside. For example, PetSmart — looted for $30 billion by RaymondSvider and his PE fund BC Partners — is a slaughterhouse for animals. The company systematically neglects animals — failing to pay workers to come in and feed them, say, or refusing to provide backup power to run during power outages, letting animals freeze or roast to death. Though PetSmart has its own vet clinics, the company doesn’t want to pay its vets to nurse the animals it damages, so it denies them care. But the company is also too cheap to euthanize those animals, so it lets them starve to death. PetSmart is also too cheap to cremate the animals, so its traumatized staff are ordered to smuggle the dead, rotting animals into random dumpsters.

All this happened while PetSmart’s sales increased by 60%, matched by growth in the company’s gross margins. All that money went to the bust out.

https://www.forbes.com/sites/antoinegara/2021/09/27/the-30-billion-kitty-meet-the-investor-who-made-a-fortune-on-pet-food/

Tkacik says these books show that we’re finally getting wise to PE. Back in the Clinton years, the PE critique painted the perps as sharp operators who reduced quality and jacked up prices. Today, books like these paint these “investors” as the monsters they are — crooks whose bust ups are crimes, not clever finance hacks.

Take the Carlyle Group, which pioneered nursing home rollups. As Carlyle slashed wages, its workers suffered — but its elderly patients suffered more. Thousands of Carlyle “customers” died of “dehydration, gangrenous bedsores, and preventable falls” in the pre-covid years.

https://www.washingtonpost.com/business/economy/opioid-overdoses-bedsores-and-broken-bones-what-happened-when-a-private-equity-firm-sought-profits-in-caring-for-societys-most-vulnerable/2018/11/25/09089a4a-ed14-11e8-baac-2a674e91502b_story.html

KKR, another PE monster, bought a second-hand chain of homes for mentally disabled adults from another PE company, then squeezed it for the last drops of blood left in the corpse. KKR cut wages to $8/hour and increased shifts to 36 hours, then threatened to have workers who went home early arrested and charged with “patient abandonment.” Many of these homes were often left with no staff at all, with patients left to starve and stew in their own waste.

PE loves to pick on people who can’t fight back: kids, sick people, disabled people, old people. No surprise, then, that PE loves prisons — the ultimate captive audience. HIG Capital is a $55b fund that owns TKC Holdings, who got the contract to feed the prisoners at 400 institutions. They got the contract after the prisons fired Aramark, owned by PE giant Warburg Pincus, whose food was so inedible that it provoked riots. TKC got a million bucks extra to take over the food at Michigan’s Kinross Correctional Facility, then, incredibly, made the food worse. A chef who refused to serve 100 bags of rotten potatoes (“the most disgusting thing I’ve seen in my life”) was fired:

https://www.wzzm13.com/article/news/local/michigan/prison-food-worker-i-was-fired-for-refusing-to-serve-rotten-potatoes/69-467297770

TKC doesn’t just operate prison kitchens — it operates prison commissaries, where it gouges prisoners on junk food to replace the inedible slop it serves in the cafeteria. The prisoners buy this food with money they make working in the prison workshops, for $0.10–0.25/hour. Those workshops are also run by TKC.

Tkacic traces private equity back to the “corporate raiders” of the 1950s and 1960s, who “stealthily borrowed money to buy up enough shares in a small or midsized company to control its biggest bloc of votes, then force a stock swap and install himself as CEO.”

The most famous of these raiders was Eli Black, who took over United Fruit with this gambit — a company that had a long association with the CIA, who had obligingly toppled democratically elected governments and installed dictators friendly to United’s interests (this is where the term “banana republic” comes from).

Eli Black’s son is Leon Black, a notorious PE predator. Leon Black got his start working for the junk-bonds kingpin Michael Milken, optimizing Milken’s operation, which was the most terrifying bust out machine of its day, buying, debt-loading and wrecking a string of beloved American businesses. Milken bought 2,000 companies and put 200 of them through bankruptcy, leaving the survivors in a brittle, weakened state.

It got so bad that the Business Roundtable complained about the practice to Congress, calling Milken, Black, et al, “a small group is systematically extracting the equity from corporations and replacing it with debt, and incidentally accumulating major wealth.”

Black stabbed Milken in the back and tanked his business, then set out on his own. Among the businesses he destroyed was Samsonite, “a bankrupt-but-healthy company he subjected to 12 humiliating years of repeated fee extractions, debt-funded dividend payments, brutal plant closings, and hideous schemes to induce employees to buy its worthless stock.”

The money to buy Samsonite — and many other businesses — came through a shadowy deal between Black and John Garamendi, then a California insurance commissioner, now a California congressman. Garamendi helped Black buy a $6b portfolio of junk bonds from an insurance company in a wildly shady deal. Garamendi wrote down the bonds by $3.9b, stealing money “from innocent people who needed the money to pay for loved ones’ funerals, irreparable injuries, etc.”

Black ended up getting all kinds of favors from powerful politicians — including former Connecticut governor John Rowland and Donald Trump. He also wired $188m to Jeffrey Epstein for reasons that remain opaque.

Black’s shady deals are a marked contrast with the exalted political circles he travels in. Despite private equity’s obviously shady conduct, it is the preferred partner for cities and states, who buy everything from ambulance services to infrastructure from PE-owned companies, with disastrous results. Federal agencies turn a blind eye to their ripoffs, or even abet them. 38 state houses passed legislation immunizing nursing homes from liability during the start of the covid crisis.

PE barons are shameless about presenting themselves as upstanding cits, unfairly maligned. When Obama made an empty promise to tax billionaires in 2010, Blackstone founder SteveS chwarzman declared, “It’s a war. It’s like when Hitler invaded Poland in 1939.”

Since we’re on the subject of Hitler, this is a good spot to bring up Monowitz, a private-sector satellite of Auschwitz operated by IG Farben as a slave labor camp to make rubber and other materiel it supplied at a substantial markup to the wermacht. I’d never heard of Monowitz, but Tkacik’s description of the camp is chilling, even in comparison to Auschwitz itself.

Farben used slave laborers from Auschwitz to work at its rubber plant, but was frustrated by the logistics of moving those slaves down the 4.5m stretch of road to the facility. So the company bought 25,000 slaves — preferring children, who were cheaper — and installed them in a co-located death-camp called Monowitz:

https://www.commentary.org/articles/r-tannenbaum/the-devils-chemists-by-josiah-e-dubois-jr/

Monowitz was — incredibly — worse than Auschwitz. It was so bad, the SS guards who worked at it complained to Berlin about the conditions. The SS demanded more hospitals for the workers who dropped from beatings and overwork — Farben refused, citing the cost. The factory never produced a steady supply of rubber, but thanks to its gouging and the brutal treatment of its slaves, the camp was still profitable and returned large dividends to Farben’s investors.

Apologists for slavery sometimes claim that slavers are at least incentivized to maintain the health of their captive workforce. This was definitely not true of Farben. Monowitz slaves died on average after three months in the camp. And Farben’s subsidiary, Degesch, made the special Zyklon B formulation used in Auschwitz’s gas chambers.

Tkacik’s point is that the Nazis killed for ideology and were unimaginably cruel. Farben killed for money — and they were even worse. The banality of evil gets even more banal when it’s done in service to maximizing shareholder value.

As Farben historian Joseph Borkin wrote, the company “reduced slave labor to a consumable raw material, a human ore from which the mineral of life was systematically extracted”:

https://www.scribd.com/document/517797736/The-Crime-and-Punishment-of-I-G-Farben

Farben’s connection to the Nazis was a the subject of Germany’s Master Plan: The Story of Industrial Offensive, a 1943 bestseller by Borkin, who was also an antitrust lawyer. It described how Farben had manipulated global commodities markets in order to create shortages that “guaranteed Hitler’s early victories.”

Master Plan became a rallying point in the movement to shatter corporate power. But large US firms like Dow Chemical and Standard Oil waged war on the book, demanding that it be retracted. Borkin was forced into resignation and obscurity in 1945.

Meanwhile, in Nuremberg, 24 Farben executives were tried for their war crimes, and they cited their obligations to their shareholders in their defense. All but five were acquitted on this basis.

Seen in that light, the plunderers of today’s PE firms are part of a long and dishonorable tradition, one that puts profit ahead of every other priority or consideration. It’s a defense that wowed the judges at Nuremberg, so should we be surprised that it still plays in 2023?

Tkacik is frustrated that neither of these books have much to offer by way of solutions, but she understands why that would be. After all, if we can’t even close the carried interest tax loophole, how can we hope to do anything meaningful?

“Carried interest” comes up in every election cycle. Most of us assume it has something to do with “interest payments,” but that’s not true. The carried interest loophole relates to the “interest” that 16th-century sea captains had in their cargo. It’s a 600-year-old tax loophole that private equity bosses use to pay little or no tax on their billions. The fact that it’s still on the books tells you everything you need to know about whether our political class wants to do anything about PE’s plundering.

Notwithstanding Tkacik’s (entirely justified) skepticism of the weaksauce remedies proposed in these books, there is some hope of meaningful action. Private equity’s rollups are only possible because they skate under the $101m threshold for merger scrutiny. However, there is good — but unenforced — law that allows antitrust enforcers to block these mergers. This is the “incipiency standard” — Sec 7 of the Clayton Act — the idea that a relatively small merger might not be big enough to trigger enforcement action on its own, but regulators can still act to block it if it creates an incipient monopoly.

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

The US has a new crop of aggressive — fearless — top antitrust enforcers and they’ve been systematically reviving these old laws to go after monopolies.

That’s long overdue. Markets are machines for eroding our moral values: “In comparison to non-market decisions, moral standards are significantly lower if people participate in markets.”

https://web.archive.org/web/20130607154129/https://www.uni-bonn.de/Press-releases/markets-erode-moral-values

The crimes that monsters commit in the name of ideology pale in comparison to the crimes the wealthy commit for money.

Catch me on tour with Red Team Blues in Edinburgh, London, and Berlin!

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/02/plunderers/#farbenizers

[Image ID: An overgrown graveyard, rendered in silver nitrate monochrome. A green-tinted businessman with a moneybag in place of a head looms up from behind a gravestone. The right side of the image is spattered in blood.]

#pluralistic#kkr#lootersprivate equity#plunderers#books#reviews#monsters#nazis#godwin's law#godwins law#auschwitz#ig farben#pe#business#barbarians#united fruit#carried interest#corporate raiders#junk bonds#michael milliken#ensemble cast#carlyle group#monowitz#leon black

1K notes

·

View notes

Text

I love how poetic it is that Elain is represented as the spring/flowers and they bloom with the sun (Lucien) but die in the darkness (Azriel).

While Azriel's shadows run away from Elain, but dance and are happy with Gwyn's presence.

Mates are made to be complementary, their essence brings life to their mate, not erases it.

#acotar#acosf#sjm books#sjm#azriel#gwyneth berdara#lucien vanserra#elain archeron#gwynriel#pro gwynriel#elucien#pro elucien#anti e/riel#anti ewriel#gwyn x azriel#elain x lucien#mating bond

368 notes

·

View notes

Text

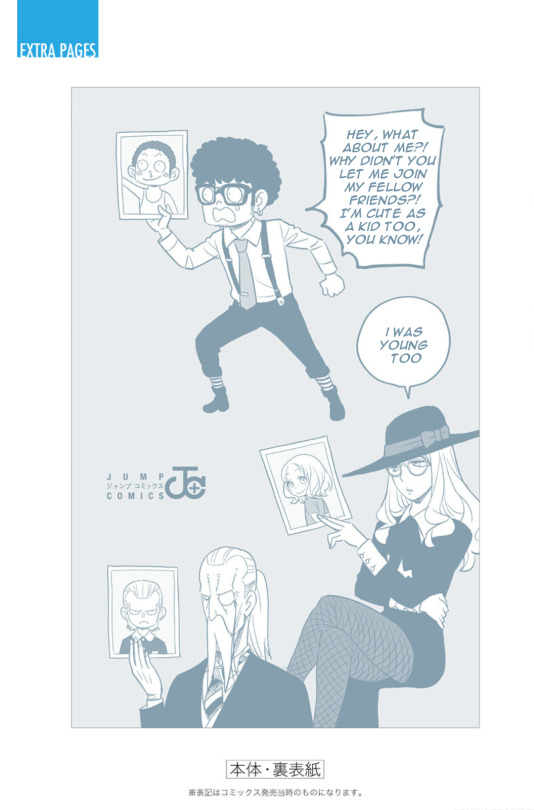

Volume 10 extra pages

look at how cute they all are🥺

#spy x family#i love them so much T___T#anya handing out peanuts#baby bond#yuri is not amused (TM)#also yuri reading educational books while anya reading manga#also henderson as a kid pls ksldjhgfk#chimera san also makes an appearance#did they all play card together?#i want more stories about them being kids#though not the sad ones T_T#official media#[redacted]#yuri briar#yor forger#anya forger#franky franklin#sylvia sherwood#henry henderson#bond forger#manga spoilers#translation

6K notes

·

View notes