#online payment processing

Text

Navigating High-Risk: The Advantages of Using High-Risk Payment Processors for High-Transaction…

#Navigating High-Risk: The Advantages of Using High-Risk Payment Processors for High-Transaction…#high risk payment processors#payment processor#high-risk payment processing#payment processing#high risk payment processing#high risk payment processor#high risk payment gateway#high-risk payment gateway#online payment processing company#payment gateway#online payment processing#high-risk payment processing for cbd business#payment processor for high risk merchants#payment processors#merchant account for high risk business

1 note

·

View note

Text

Navigating the World of Online Payment Processing

The world of commerce has undergone a remarkable transformation with the rise of e-commerce, and at the heart of this evolution is online payment processing. From purchasing products and services online to managing subscriptions and making digital donations, online payment processing has become an integral part of our daily lives. In this comprehensive guide, we will delve into the intricacies of online payment processing, exploring its significance, the key players in the industry, security measures, and the latest trends shaping the future of digital payments.

The Significance of Online Payment Processing

Online payment processing is the engine driving e-commerce and digital transactions. Its importance extends far beyond the convenience it offers. Here are some of the key reasons why online payment processing is crucial:

Global Reach: It enables businesses to reach customers worldwide, breaking down geographical barriers and expanding their customer base.

Convenience: Customers can make payments and purchases from the comfort of their homes or on the go, making the shopping experience more convenient.

Security: Secure payment processing ensures that sensitive financial information is protected, reducing the risk of fraud and unauthorized access.

Efficiency: The automation of payment processing streamlines financial transactions, reducing manual labor and processing times.

Business Growth: Online payment processing supports the growth of online businesses, enabling them to scale their operations and reach new markets.

Diverse Payment Options: It offers a wide range of payment methods, allowing customers to choose the option that best suits their preferences and needs.

The Key Players in Online Payment Processing

Online payment processing involves several key players, each with distinct roles and responsibilities. Understanding these players is crucial to grasp the intricacies of the payment ecosystem:

1. Merchants

Merchants are businesses or individuals who sell products or services online. They integrate payment gateways into their websites or applications to accept payments from customers.

2. Payment Gateways

Payment gateways are intermediaries that facilitate the transfer of payment data between the merchant and the financial institution. They verify the transaction, handle the encryption of data, and ensure that the payment is securely processed.

3. Acquiring Banks

Acquiring banks, also known as merchant banks, are financial institutions that work with merchants to provide them with the necessary accounts and tools for accepting payments. They play a critical role in authorizing and settling transactions.

4. Issuing Banks

Issuing banks are the financial institutions that issue credit and debit cards to consumers. They are responsible for authorizing transactions initiated by cardholders and ensuring there are sufficient funds for the purchase.

5. Card Networks

Card networks, such as Visa, MasterCard, and American Express, establish the rules and infrastructure that govern payment card transactions. They facilitate communication between acquiring and issuing banks.

6. Customers

Customers are the individuals or businesses making purchases or payments online. They provide their payment information to complete transactions.

Ensuring Security in Online Payment Processing

Security is a paramount concern in online payment processing. As the digital landscape evolves, so do the threats to security. Here are some of the key security measures and technologies in place to safeguard online transactions:

1. Data Encryption

Data encryption ensures that sensitive payment information, such as credit card numbers, remains secure during transmission. Secure Sockets Layer (SSL) encryption is a common technology used to protect data.

2. Tokenization

Tokenization replaces sensitive card data with tokens, which are useless to cybercriminals if intercepted. This adds an extra layer of security to payment processing.

3. Two-Factor Authentication

Two-factor authentication (2FA) requires customers to provide additional verification, such as a one-time code sent to their mobile device, to complete a transaction.

4. Fraud Detection

Advanced fraud detection systems use artificial intelligence and machine learning to analyze transaction data in real-time and identify potentially fraudulent activities.

5. Regular Updates

Payment processing systems should be regularly updated to patch vulnerabilities and ensure that they are up to date with the latest security standards.

6. Compliance with Regulations

Adhering to industry and regional regulations, such as the Payment Card Industry Data Security Standard (PCI DSS), is essential to maintain security.

Trends Shaping the Future of Online Payment Processing

Online payment processing is an ever-evolving field. Several trends are shaping the future of digital payments:

1. Contactless Payments

Contactless payments, made through mobile wallets and near-field communication (NFC) technology, have gained popularity due to their speed and convenience. The use of smartphones for payments is on the rise.

2. Biometric Authentication

Biometric authentication, such as fingerprint and facial recognition, is increasingly used for secure and convenient payment authorization.

3. Cryptocurrency

Cryptocurrencies like Bitcoin are gaining acceptance as a means of payment, offering fast and borderless transactions.

4. In-App Payments

In-app payments within mobile applications provide a seamless purchasing experience for users, making it easier to complete transactions without leaving the app.

5. Enhanced Security Measures

Continual advancements in security measures, including machine learning-based fraud detection and risk analysis, will help reduce the risk of fraudulent transactions.

6. Cross-Border Payments

As businesses expand globally, cross-border payment solutions are becoming more vital. Payment processors are adapting to accommodate international transactions and currencies.

7. Payment Integration

E-commerce platforms and online businesses are increasingly integrating payment solutions directly into their platforms, streamlining the payment process for customers.

Choosing the Right Online Payment Processing Solution

Selecting the right online payment processing solution is crucial for businesses. Here are some key considerations to keep in mind:

1. Integration

Choose a payment solution that seamlessly integrates with your e-commerce platform or website. This ensures a smooth checkout experience for your customers.

2. Security

Security

is a non-negotiable aspect of online payment processing. Ensure that the solution you choose complies with industry standards, such as PCI DSS, and offers robust encryption and fraud prevention measures.

3. Payment Options

Consider the range of payment options the solution supports. The more options you provide, the more accessible your business will be to a broader customer base.

4. Scalability

Opt for a payment processing solution that can scale with your business. As your business grows, the payment solution should be able to handle increased transaction volumes.

5. Reporting and Analytics

Access to reporting and analytics tools can provide valuable insights into customer behavior, transaction trends, and financial performance. Choose a solution that offers comprehensive reporting capabilities.

6. Customer Support

A responsive customer support team can be invaluable in resolving issues quickly and ensuring that your payment processing runs smoothly. Consider the quality of customer support provided by the payment solution.

7. Costs and Fees

Different payment processors may have varying fee structures. Ensure that you understand the pricing model and any additional fees associated with the solution. Consider how the costs align with your business's budget.

8. Reputation

Research the reputation of the payment processing solution. Read reviews, ask for recommendations, and assess its track record in terms of reliability and security.

The Evolution of Online Payment Processing

Online payment processing has come a long way from its early days, and its journey continues. As technology advances and consumer preferences shift, the landscape of digital payments will keep evolving. Businesses that embrace the latest trends and invest in secure and convenient payment solutions are better positioned to thrive in the digital age.

The significance of online payment processing in today's world cannot be overstated. It has revolutionized the way we shop, transact, and do business, making life more convenient for consumers and enabling the growth of countless online enterprises. As we look to the future, the trends in online payment processing, from contactless payments to cryptocurrency, will shape the way we make payments and conduct financial transactions. By staying informed, adapting to these trends, and choosing the right payment processing solution, businesses can ensure a seamless and secure payment experience for their customers and position themselves for success in the evolving digital economy.

#Memberships#Reservations#Events#Appointments#Donations#Payments#Emails#Messaging#Accounting#Reporting#Event Planning#Membership Management#Email Tracking#Marketing#Online Payment Processing#Association Management Software#Customer Relationship Management#Fitness Center Management#Membership Management Software

0 notes

Text

Accept payments, generate receipts, publish tickets- Jambo

Jambo is the best invoicing and ticketing platform where members can add expenses to events, and print and book online event tickets, This platform can publish and distribute tickets to members for the events booked. Also, can generate a membership certificate and post it in your group’s feed to notify other members of the new member’s addition.

#Online Event Payment#invoicing platform#ticketing platform#Event payment Invoicing App#Online Payment Processing#Event Planner Invoice

0 notes

Text

Here is my cultural shock of the day: it wasn't until I started working for an American company that I learned people expected to pay for their online purchases only once the product shipped.

A demand that I found patently absurd the first time I encountered it, because never once, in my whole life, has online shopping worked that way for me.

#I was like... 'Yeah of course we took your money? You made a purchase?'#'You pay first. THEN we package and ship things.'#cannot imagine how business only charge at the moment of shipping.#isn't that a logistical nightmare?#there are costs associated with packaging things. You need labor and packing supplies.#and there are costs associated with processing payments!! processing payments is hard!!#I know many online platforms don't release the money to the vendor until things are delivered#but I still PAY when I PLACE the order#wild!!

21 notes

·

View notes

Text

#eCheck#Electronic checks#ACH (Automated Clearing House)#Digital payments#Payment processing#Merchant services#Payment solutions#Secure transactions#Business payments#Online payments#Payment gateway#Payment technology#Financial services#E-commerce#Retail business#Small business#USA businesses#American merchants#Payment methods#Payment processing company#Payment processing solutions#Electronic payment options#Payment security#Card processing#Payment terminals#Mobile payments#Payment software#Point of sale (POS)#Payment integration#Business growth

6 notes

·

View notes

Text

Hate the concept of "business days" for online services. What the fuck do you mean my payment will be processed in 3-5 business days its a fucking program that does it?? The bot needs weekends too now?? Fuck off

#personal#like i know theres not an actual employee youve hired to process every individual order or payment or claim#i know there might be a support team but there is not a dedicated team for this particular action#im looking at you paypal#youre a fucking online payments service. you do not need to TAKE WEEKENDS OFF IM SO FUCKING ANGRY#i bought this gorgeous secondhand piece of clothing from a fb marketplace buy/sell/swap group#my payment was sent on the morning of a saturday. the seller wont ship until my payment comes through to them (fair)#but paypal. my detested. now they wont ship it first thing monday as expected because apparently you take weekends off#so they wont receive my payment until atleast wednesday if you decide to be kind. so they wont ship until atleast thursday. if im lucky#and i wont recieve the item until next week when it could have been here and the entire transaction could have been over by friday.#at the latest.#it makes no sense????#its like. i get ubereats giftcards for myself when i need a pick me up right. i purchase them.online and i get them recieved digitally#to my email within seconds right? except for the one time. they were sold out. of DIGITAL GIFTCARDS#that they GENERATE THE CODES FOR UPON PURCHASE. how do you sell out of a digital product made on request#it doesnt make sense. again if there were teams of real people that moderated this kind of shit yeah obviously they need a break#you get more leeway and patience from me if you have an actual team. but this doesnt#why the fuck are you holding my payment paypal??? huh??? id better see it go through monday morning since youve held it for three days#youre an online fucking company you dont nees to wait for busineas days. send my.fucking money where ive sent it days ago already#im so so pissed#if anyone has a real answer as to why online companies with no human staff in that department need to take a weekend. please lmk

4 notes

·

View notes

Text

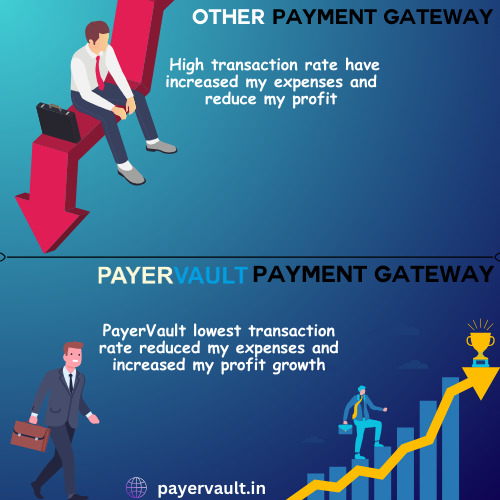

Ready to revolutionize your business's online transactions? Payervault offers seamless payment solutions at the lowest charges. Get started today! 💻💳 #Payervault #PaymentGateway #OnlineBusiness"

Visit the website to learn more- https://payervault.in/

#finance#payments#payment solutions#business consulting#payment gateway#payment collection#paying#payouts#payment processing#payment services#payment systems#ecommerce#online#online shops offer#online store#online shopping#small business

2 notes

·

View notes

Text

Why Your Restaurant Needs A Pos System?

Implementing a Point of Sale (POS) system is essential for the success of your restaurant. A POS system streamlines operations by automating tasks like order processing, inventory management, and payment processing. It improves accuracy, reduces errors, and enhances efficiency in tracking sales and managing inventory. Additionally, POS systems offer valuable insights through detailed reports, helping you make informed decisions to optimize your restaurant's performance. With features like table management and customer data tracking, a POS system enhances the overall dining experience and customer satisfaction.

3 notes

·

View notes

Text

Get Rs.10 FREE PayTM Cash Instantly

Get Rs.10 FREE PayTM Cash Instantly

Free Rs. 10 Free PayTM cash By Just Giving Misscall (Hurry Up! )

Rs 10 Free PayTM cash , Instant Rs 10 Free PayTM Cash , Rs 10 Free PayTM Cash By Miss Call , Earn Rs 10 Free PayTM Cash – Hi Guys , Here is Another Method To Earn Free PayTM Cash Loot , All You Have to Do is Just Give Miss call On Number & You Will Have Rs.10 Instant Free PayTM cash

We Have…

View On WordPress

#Bill Payments#Earn Free PayTM Cash#Easy Earnings#Extra Money#Financial Benefits.#Financial Flexibility#freebies#Get Rs.10 FREE PayTM Cash Instantly#Hassle-Free Earnings#Instant Credit#Missed Call Offer#Mobile Recharge#No Strings Attached#online shopping#PayTM Wallet#Pocket Money#Quick Process#Student Expenses#Supplement Income

2 notes

·

View notes

Text

my mortgage got sold to a scummy debt collection agency before i was able to even make my first payment, it's so fucking annoying

i had to block their number bc they kept calling me, like no bitch you will never catch me answering the phone ever. communication will only take place over the mail, perhaps a secure website depending on what services they're using.

i'm glad to be paying a mortgage instead of rent, because at least the money is actually going towards something, but it hurts to give money directly to these companies -_-

#personal#i need to see what their online payment process is#bc i'm not making a fucking account on some random site#like ideally i can just do an echeck

1 note

·

View note

Text

Praying for Ticketmaster and Live Nation's downfall ✨

#it's criminal how those extra 'fees' can nearly double the price of your total payment#'processing fee'??? you better be joking!!#it's online#except for tax it should basically be free!!!!#I hope they lose every upcoming lawsuit 🙏#live nation#ticketmaster#Taylor swift

2 notes

·

View notes

Text

#Finance Management Software#Small business financial management#bank balance check online#Financial Management Software#ACH payment processing software#Bank PDF Statements#automated income verification#finance#fintech#kyc

2 notes

·

View notes

Text

High-Risk Merchant Account for International Payment to Break Through the Barriers with Global Merchandize

International Payment Gateway can be a significant choice when choosing to expand your business into global market. Customers now have access to more efficient and smooth payment methods as a result of the phenomenal rise of E-commerce.

The evolution of the eCommerce sector is being pushed by its unique integration of modern solutions, best-in-class adaptable technology, and substantial…

View On WordPress

#credit card processing#High Risk Merchant Account#international payment gateway#Online Payment Gateway#Payment Gateway Malaysia

3 notes

·

View notes

Text

Secure Online Payments Made Easy with OnePay

Welcome to the world of modern business, where convenience is king and adaptation is the key to success. If you're a business owner, big or small, you've probably heard about the importance of accepting card payments and processing transactions online. But what exactly does that entail? Don't worry, we're here to break it down for you in the simplest terms possible. Think of it as your trusted guide to navigating the world of payments with ease and confidence. Let's get started!

Understanding Card Payments

First things first, let's break down what card payments entail. When a customer pays with a credit or debit card, the transaction involves several steps:

Authorization: The customer swipes, inserts, or taps their card at the point of sale (POS) device or enters their card details online.

Authentication: The card issuer verifies the transaction's legitimacy and the availability of funds.

Settlement: The funds are transferred from the customer's account to the merchant's account.

Why Accept Card Payments?

Accepting card payments offers numerous benefits for your business:

Convenience: Customers prefer the ease and security of paying with cards.

Increased Sales: Studies show that businesses that accept cards typically see higher transaction volumes.

Global Reach: With online payments, you can reach customers beyond your local area or even your country.

Security: Card transactions come with built-in fraud protection, reducing the risk for both you and your customers.

Accepting Payments Online

Nowadays, having an online presence is crucial for any business. Here's how you can start accepting payments online

Choose a Payment Gateway: A payment gateway is an online service that authorizes card payments. Popular options include PayPal, Stripe, and Square.

Integrate with Your Website: Most payment gateways offer easy-to-implement plugins or APIs to seamlessly integrate with your website or e-commerce platform.

Secure Checkout: Ensure that your checkout process is secure and user-friendly to instill trust in your customers.

Stay Compliant: Familiarize yourself with relevant regulations such as PCI DSS (Payment Card Industry Data Security Standard) to protect sensitive cardholder data.

Simplifying the Process

While the technical aspects of card payments and online transactions may seem daunting, there are tools and services available to simplify the process for you:

All-in-One Solutions: Consider using platforms like Shopify or WooCommerce that provide integrated payment processing along with e-commerce functionalities.

Customer Support: Choose payment providers that offer responsive customer support to assist you whenever you encounter challenges.

Educational Resources: Take advantage of online guides, tutorials, and customer forums provided by payment service providers to learn and troubleshoot effectively.

Conclusion

Accepting card payments and processing transactions online doesn't have to be overwhelming. By understanding the basics, leveraging reliable payment gateways, and utilizing available resources, you can simplify the process and focus on growing your business. Embrace the opportunities that digital payments offer, and watch your business thrive in today's interconnected world.

1 note

·

View note

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Text

Searching for Easy Payment Solutions? Our Sales Manager, Michael Nelson, Can Help

Like it or not, if you own a business, you’re going to need some kind of payment processing.

But our industry doesn’t do much to clarify things for merchants, and for the most part, it fails to provide easy payment solutions, keeping everything as convoluted as possible.

That being said, we understand how difficult it can be for business owners like you to try to understand what payment processing is, how it works, what exactly it is you’re paying for, and what provider you should choose to get the best service and the best deal.

With that in mind, at Lucid Payments, we’re on a mission to protect the best interests of business owners, provide easy payment solutions, and give you greater clarity on your payment processing.

And if there’s one member of our team who best embodies these goals, it has to be our long-time Sales Manager, Michael Nelson.

Our customers are constantly raving about the services Michael provides, as he loves to go above and beyond for them in whatever way he can.

As a show of our appreciation, we want to take this opportunity to highlight Michael’s dedication to our customers and introduce him to merchants like you.

So, if you’re searching for easy payment solutions, and you need someone to answer your questions and help you get everything set up, keep reading to learn how Michael can help.

Looking for Easy Payment Solutions? Michael Can Help

Whether you’re in the market for online payment solutions, payment solutions for retail, or something else entirely, Michael can make everything easy for you.

But before we go any further into that, let’s take a moment to get to know Michael a bit better.

Michael has been doing sales in one form or another for the last 25 years, he’s been with Lucid Payments for the last six years, and he currently lives in Sylvan Lake, Alberta.

Aside from his work in sales, before Michael joined Lucid Payments, he worked as a DJ for 27 years and ran his own IT business, which involved things like setting up networks and installing surveillance cameras.

Michael is also a single dad with four kids and the proud owner of a Chihuahua named Gringo.

When he’s not helping business owners, hanging out with family, or walking the dog, Michael loves to spend time cruising around on his Onewheel and dancing at music festivals.

Why Michael Chose to Work for Lucid Payments

Before starting with Lucid Payments, Michael had an awful experience working for another payment processor, not least because he felt like they weren’t being honest with him.

This was having a decidedly negative effect on Michael’s ability to do his job, and if they weren’t being honest with him, then you can bet they were doing the same thing with their customers.

“I worked for them for about three months,” he said. “And I walked away from it because I was ready to pull out my hair. I couldn’t even get answers to simple questions.”

Then he spoke to our VP of Operations, Steven Cumiskey, and that one phone call was enough to change Michael’s perspective on our industry.

Steven was able to answer almost all the questions Michael had, and the couple of things that he didn’t know offhand, he got back to him about the next day.

“I’ve used the term smoke and mirrors as my description of this industry,” said Michael. “But Lucid Payments offered all the clarity I was missing.”

What’s more, our mission, which is to protect the best interests of business owners, give them greater clarity, and provide simplified payment processing, really resonated with Michael.

“That’s exactly how I live my life,” he said. “When somebody needs something, I’m going to try and figure out a way to help them. And if I can’t, I’m going to try and find somebody I know who can.”

As a business owner himself, the most fulfilling part of Michael’s role with Lucid Payments has been helping other business owners.

Whether it’s helping them set up their equipment, showing them how to operate it, explaining how our industry works, going over their statements to explain what they’re paying for, or helping them save money on their payment processing, there’s nothing Michael loves more.

How Michael Has Helped Our Customers

Throughout his more than six years with Lucid Payments, Michael has helped countless customers.

Whether it’s issues with equipment, poor customer service, or just being tired of paying too much, if you’ve got a problem with your payment processing, or you’re looking for easy payment solutions, chances are, he can help.

And to give you a better idea of how he can help, here are some examples of what Michael has been able to accomplish for our customers:

Chief’s Pub & Eatery

Before choosing to work with Lucid Payments, Chief’s Pub & Eatery used to have lots of technical issues with the outdated payment terminals that were provided by their previous processor.

Michael recently switched them over to newer and more reliable machines, which has solved all of these problems for them, and we were even able to save them over 60 per cent on their monthly processing costs.

Mullets Barbershop

When they opened their first location about three years ago, Michael was able to help Mullets Barbershop get their payment processing set up and made sure they understood everything.

Since then, they’ve opened four more locations, and as a result of how happy they’ve been with the service Michael’s provided, they’ve chosen to work exclusively with Lucid Payments for their payment processing.

Party Chef

Party Chef, which combines a restaurant and local artisanal market, had a rough start when they launched a couple of years ago.

When they first opened, they went with a processor from Ontario, and within the first two days, they were already having issues accepting Mastercard and debit payments.

The following week, they agreed to go with Lucid Payments, and Michael was able to solve these problems by switching them to a more reliable and efficient payment terminal.

Shortly after that, they wanted to launch their website, so Michael worked with them on the initial setup, and he’s always available to answer any questions they have.

“I highly recommend Michael for his exceptional local service, strong communication skills, and willingness to go above and beyond to assist. He is always readily available to provide support and ensures that his clients receive the attention they need. Whether it’s a quick question or a more complex issue, Michael is consistently reliable and responsive,” said Party Chef’s owner, Lydia Neergaard.

“His dedication to helping others is evident in his proactive approach to problem-solving and his genuine interest in addressing clients’ needs. I have been consistently impressed with his professionalism and commitment to delivering top-notch service. I am grateful for his assistance and would not hesitate to recommend him to others.”

What Our Customers Have to Say About Michael

We’re constantly getting compliments from satisfied customers who can’t help but rave about the experience they’ve had working with Michael.

Whether it’s his helpful and friendly demeanour, dedication, expertise, or ability to provide easy payment solutions, our customers have no shortage of good things to say about him.

One look at our Google reviews, many of which mention Michael by name, should be enough evidence of that. Here are some of the compliments he’s received so far:

Still searching for easy payment solutions? You can call Michael at (403) 396-6941, email him at [email protected], or contact us for more information.

#easy payment processing#payment processing options#payment processing#paying online#online payment options

0 notes