#subscription billing automation

Explore tagged Tumblr posts

Text

https://www.acuitilabs.com/q2c-customerportal/

#Q2C Customer Portal#Subscription Management Software#SAP BRIM Integration#S4HANA Cloud Billing#Self-Service Subscription Platform#Acuiti Labs Billing Solutions#Subscription Billing Automation#Customer Self-Management Tools#B2B Subscription Management#Mobile Subscription Management App#Scalable Subscription Software#Subscription Lifecycle Management#Invoicing and Payment Automation

1 note

·

View note

Text

Transform Subscription Models with SAP Subscription Billing by Acuiti Labs

Acuiti Labs helps businesses unlock growth with SAP Subscription Billing—designed for modern subscription management. From flexible pricing to full lifecycle automation, we offer tailored SAP billing solutions and a risk-free POC to accelerate your subscription transformation.

#SAP Subscription Billing#SAP Subscription Management#SAP Billing Solution#Acuiti Labs#Subscription Lifecycle#Recurring Billing#Cloud Billing#Quote-to-Cash#Subscription Automation

0 notes

Text

Leading Subscription Billing Software for NetSuite – Automate & Optimize Revenue

Looking for the leading subscription billing software for NetSuite? SuiteWorks Tech offers a robust, native NetSuite solution designed to automate your entire subscription lifecycle. From recurring billing and automated invoicing to proration, renewals, and revenue recognition, this powerful tool simplifies complex billing structures for SaaS, product, and service-based businesses. Fully integrated with NetSuite, the solution eliminates manual work, reduces errors, and boosts revenue efficiency. Whether you're managing monthly plans, annual contracts, or usage-based models, SuiteWorks Tech ensures accuracy, compliance, and scalability. Make subscription billing seamless and future-proof your billing process with SuiteWorks' trusted NetSuite-native solution.

#netsuite#Leading Subscription Billing Software for NetSuite#NetSuite Subsciption Billing#Automated Billing for NetSuite

0 notes

Text

Explore the importance of cloud billing software for businesses. Discover the key reasons why integrating billing software is crucial for enhancing efficiency, accuracy and financial management in your organization. From faster invoicing to improving customer experience, learn how this essential tool can streamline processes and drive growth. Unlock insights into the benefits and features of online billing & accounting software to make informed decisions for optimizing your business operations.

#billing software#invoicing software#accounting software#online billing#invoice generator#small business billing#cloud billing software#automated billing#subscription billing#payment processing software

0 notes

Text

Wizards! Gnomes! Centaurs! Ghosts! Frogs! All important topics to know about in today’s society!

Want your friends to learn about them, potentially against their will, multiple times a day? We can do that

Want your enemies to constantly be confronted with truths they don’t want? We’ll get em for ya

Simply want some spots of joy in your day with some silly little goofs sent directly to either your phone or email? We’ve got you covered

Want to sign up for multiple topics? Multiple people? Both? Good news, it’s cheaper that way

Subscriptions include messages multiple times a day, weekly updates on how your target is responding (if it’s not just for you yourself!), automated responses to sell it as a real service, features like surveys and a voicemail line for the recipients to further the bit and give more updates for you, and everything keeps going until YOU say stop, with unsubscribe options only bringing up errors if anyone tries to leave!

Come check it out, join as a free member to be kept up to date with everything new coming to NeurotiCity, and sign up for a list or two while you’re at it! It’s good cheap fun, and every subscription supports your local disabled bisexual comedian work to pay off some medical and general emergency bills that have stacked up so

Not interested in signing up but think the bit’s fun? Check out our instagram @ neuroticity! Or even just reblog this post in case one of your followers LOVES wizard facts!

3K notes

·

View notes

Text

Shifting $677m from the banks to the people, every year, forever

I'll be in TUCSON, AZ from November 8-10: I'm the GUEST OF HONOR at the TUSCON SCIENCE FICTION CONVENTION.

"Switching costs" are one of the great underappreciated evils in our world: the more it costs you to change from one product or service to another, the worse the vendor, provider, or service you're using today can treat you without risking your business.

Businesses set out to keep switching costs as high as possible. Literally. Mark Zuckerberg's capos send him memos chortling about how Facebook's new photos feature will punish anyone who leaves for a rival service with the loss of all their family photos – meaning Zuck can torment those users for profit and they'll still stick around so long as the abuse is less bad than the loss of all their cherished memories:

https://www.eff.org/deeplinks/2021/08/facebooks-secret-war-switching-costs

It's often hard to quantify switching costs. We can tell when they're high, say, if your landlord ties your internet service to your lease (splitting the profits with a shitty ISP that overcharges and underdelivers), the switching cost of getting a new internet provider is the cost of moving house. We can tell when they're low, too: you can switch from one podcatcher program to another just by exporting your list of subscriptions from the old one and importing it into the new one:

https://pluralistic.net/2024/10/16/keep-it-really-simple-stupid/#read-receipts-are-you-kidding-me-seriously-fuck-that-noise

But sometimes, economists can get a rough idea of the dollar value of high switching costs. For example, a group of economists working for the Consumer Finance Protection Bureau calculated that the hassle of changing banks is costing Americans at least $677m per year (see page 526):

https://files.consumerfinance.gov/f/documents/cfpb_personal-financial-data-rights-final-rule_2024-10.pdf

The CFPB economists used a very conservative methodology, so the number is likely higher, but let's stick with that figure for now. The switching costs of changing banks – determining which bank has the best deal for you, then transfering over your account histories, cards, payees, and automated bill payments – are costing everyday Americans more than half a billion dollars, every year.

Now, the CFPB wasn't gathering this data just to make you mad. They wanted to do something about all this money – to find a way to lower switching costs, and, in so doing, transfer all that money from bank shareholders and executives to the American public.

And that's just what they did. A newly finalized Personal Financial Data Rights rule will allow you to authorize third parties – other banks, comparison shopping sites, brokers, anyone who offers you a better deal, or help you find one – to request your account data from your bank. Your bank will be required to provide that data.

I loved this rule when they first proposed it:

https://pluralistic.net/2024/06/10/getting-things-done/#deliverism

And I like the final rule even better. They've really nailed this one, even down to the fine-grained details where interop wonks like me get very deep into the weeds. For example, a thorny problem with interop rules like this one is "who gets to decide how the interoperability works?" Where will the data-formats come from? How will we know they're fit for purpose?

This is a super-hard problem. If we put the monopolies whose power we're trying to undermine in charge of this, they can easily cheat by delivering data in uselessly obfuscated formats. For example, when I used California's privacy law to force Mailchimp to provide list of all the mailing lists I've been signed up for without my permission, they sent me thousands of folders containing more than 5,900 spreadsheets listing their internal serial numbers for the lists I'm on, with no way to find out what these lists are called or how to get off of them:

https://pluralistic.net/2024/07/22/degoogled/#kafka-as-a-service

So if we're not going to let the companies decide on data formats, who should be in charge of this? One possibility is to require the use of a standard, but again, which standard? We can ask a standards body to make a new standard, which they're often very good at, but not when the stakes are high like this. Standards bodies are very weak institutions that large companies are very good at capturing:

https://pluralistic.net/2023/04/30/weak-institutions/

Here's how the CFPB solved this: they listed out the characteristics of a good standards body, listed out the data types that the standard would have to encompass, and then told banks that so long as they used a standard from a good standards body that covered all the data-types, they'd be in the clear.

Once the rule is in effect, you'll be able to go to a comparison shopping site and authorize it to go to your bank for your transaction history, and then tell you which bank – out of all the banks in America – will pay you the most for your deposits and charge you the least for your debts. Then, after you open a new account, you can authorize the new bank to go back to your old bank and get all your data: payees, scheduled payments, payment history, all of it. Switching banks will be as easy as switching mobile phone carriers – just a few clicks and a few minutes' work to get your old number working on a phone with a new provider.

This will save Americans at least $677 million, every year. Which is to say, it will cost the banks at least $670 million every year.

Naturally, America's largest banks are suing to block the rule:

https://www.americanbanker.com/news/cfpbs-open-banking-rule-faces-suit-from-bank-policy-institute

Of course, the banks claim that they're only suing to protect you, and the $677m annual transfer from their investors to the public has nothing to do with it. The banks claim to be worried about bank-fraud, which is a real thing that we should be worried about. They say that an interoperability rule could make it easier for scammers to get at your data and even transfer your account to a sleazy fly-by-night operation without your consent. This is also true!

It is obviously true that a bad interop rule would be bad. But it doesn't follow that every interop rule is bad, or that it's impossible to make a good one. The CFPB has made a very good one.

For starters, you can't just authorize anyone to get your data. Eligible third parties have to meet stringent criteria and vetting. These third parties are only allowed to ask for the narrowest slice of your data needed to perform the task you've set for them. They aren't allowed to use that data for anything else, and as soon as they've finished, they must delete your data. You can also revoke their access to your data at any time, for any reason, with one click – none of this "call a customer service rep and wait on hold" nonsense.

What's more, if your bank has any doubts about a request for your data, they are empowered to (temporarily) refuse to provide it, until they confirm with you that everything is on the up-and-up.

I wrote about the lawsuit this week for @[email protected]'s Deeplinks blog:

https://www.eff.org/deeplinks/2024/10/no-matter-what-bank-says-its-your-money-your-data-and-your-choice

In that article, I point out the tedious, obvious ruses of securitywashing and privacywashing, where a company insists that its most abusive, exploitative, invasive conduct can't be challenged because that would expose their customers to security and privacy risks. This is such bullshit.

It's bullshit when printer companies say they can't let you use third party ink – for your own good:

https://arstechnica.com/gadgets/2024/01/hp-ceo-blocking-third-party-ink-from-printers-fights-viruses/

It's bullshit when car companies say they can't let you use third party mechanics – for your own good:

https://pluralistic.net/2020/09/03/rip-david-graeber/#rolling-surveillance-platforms

It's bullshit when Apple says they can't let you use third party app stores – for your own good:

https://www.eff.org/document/letter-bruce-schneier-senate-judiciary-regarding-app-store-security

It's bullshit when Facebook says you can't independently monitor the paid disinformation in your feed – for your own good:

https://pluralistic.net/2021/08/05/comprehensive-sex-ed/#quis-custodiet-ipsos-zuck

And it's bullshit when the banks say you can't change to a bank that charges you less, and pays you more – for your own good.

CFPB boss Rohit Chopra is part of a cohort of Biden enforcers who've hit upon a devastatingly effective tactic for fighting corporate power: they read the law and found out what they're allowed to do, and then did it:

https://pluralistic.net/2023/10/23/getting-stuff-done/#praxis

The CFPB was created in 2010 with the passage of the Consumer Financial Protection Act, which specifically empowers the CFPB to make this kind of data-sharing rule. Back when the CFPA was in Congress, the banks howled about this rule, whining that they were being forced to share their data with their competitors.

But your account data isn't your bank's data. It's your data. And the CFPB is gonna let you have it, and they're gonna save you and your fellow Americans at least $677m/year – forever.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/11/01/bankshot/#personal-financial-data-rights

#pluralistic#Consumer Financial Protection Act#cfpa#Personal Financial Data Rights#rohit chopra#finance#banking#personal finance#interop#interoperability#mandated interoperability#standards development organizations#sdos#standards#switching costs#competition#cfpb#consumer finance protection bureau#click to cancel#securitywashing#oligarchy#guillotine watch

466 notes

·

View notes

Text

Never thought I'd be here making a post about how to get involved in local government, but here we are.

If you're anything like me, you're overwhelmed, exhausted, and anxious beyond all reason about America. The question I've been trying to ask myself is: what can I, a full-time engineer, actually get done with the minimal time and spoons I have to offer?

First - Set up a specific email for ALL traffic on the state of the world. I have a dedicated inbox that I only open when I have carved out time to deal with the circumstances.

Second - The absolute single biggest thing I recommend is subscribing to GovTrack.us (direct link).

Once logged in, I subscribed to all of their analysis items (i.e. legislative recap, commentary, etc) as well as (more importantly) setting up the tracker lists to follow my House and Senate representatives.

The reason I commend this so highly is that, rather than having to figure out what the hell is going on, these guys just tell me exactly how my representatives are voting on everything, so if I disagree with something, I know WHAT to call ABOUT.

Here's an example of what I get in my inbox (my reps blacked out for privacy). All of the red text are links to GOV webpages that have the details of the bill/motion/event so you can read more.

This ALONE has made me so much more informed about what's going on. Subscribing to these representatives too, and their mailing lists, has also been helpful.

Third - I cancelled my Amazon Prime subscription and routed that same $10 a month I was already spending to the ACLU. Why? They're the folks that are actively suing the administration to do something about this, and they need funding to do that. We've all seen that the courts are the most effective, if only way to take action right now.

Since I started supporting my local chapter, I get emails every few days with direct links to pre-written messages I can send to my representatives, like the one below.

The "act now" isn't a petition - it's an automated system that emails your representatives (and I know it works, because I've gotten emails back from their offices).

There's a lot more I want to do. I'm trying to get involved in local environmental advocacy programs, and want to reach out to the federal lands most urgently impacted by layoffs and lease cancellations. But this is a start.

64 notes

·

View notes

Text

Become Your Best Version Before 2025 - Day 13

Financial Planning and Budgeting

Hello Goddesses! I know that talking about money, can feel scary or boring, but after working on our stress management tools yesterday, it's perfect timing to address something that's often a huge source of stress for many of us: finances.

First things first: if thinking about money makes you want to hide under your blanket, you're not alone. But taking control of your finances isn't about becoming a math genius or never buying another coffee again. It's about making friends with your money so it can help you live your best life.

Let's break this down into bite-sized pieces that won't give you a headache:

Start Where You Are

Remember when you first learned to ride a bike? You didn't start by doing tricks, you started with training wheels. Money management is the same way! First step: just look at your current situation. Open those banking apps you've been avoiding. Take a deep breath and look at your statements. Knowledge is power, even if it's a bit scary at first.

The Money Map Exercise

Grab a piece of paper (or open your notes app) and let's do something simple:

Write down all your income sources

List your regular monthly expenses (yes, including those sneaky subscriptions!)

Don't forget those irregular expenses like annual fees or seasonal costs

Look at what's left (or what's missing)

Congratulations! You've just created your first basic budget outline.

The 50/30/20 Guideline

Here's a popular way to think about your money:

50% for needs (rent, groceries, utilities)

30% for wants (fun stuff, shopping, entertainment)

20% for future you (savings, debt payment, investments)

These numbers might not work for everyone, especially depending on where you live. The important thing is to have some kind of plan that works for YOU.

Smart Money Habits You Can Start Today

The 24-Hour Rule: For non-essential purchases over a certain amount (you decide the number!), wait 24 hours before buying. You'd be surprised how many "must-haves" become "maybe nots" overnight!

Bill Calendar: Set up a simple calendar with all your bill due dates. Future you will be so grateful!

Automate Your Savings: Even if it's just $5 a week, set up automatic transfers to a savings account. It's like hiding money from yourself!

Track Your Spending: For just one week, write down every single purchase. No judging, just observing. You might find some surprising patterns!

The Emergency Fund Challenge

Let's start building that safety net! Even $500 in savings can make a huge difference in an emergency. Start with a goal of saving just $25 this week. Too much? Start with $10. Too little? Make it $50. The amount isn't as important as getting started.

Money Goals That Make Sense

Instead of vague goals like "save more," try specific ones like:

Save enough for three months of basic expenses by December 2025

Pay off one credit card by summer

Create a "fun fund" for that hobby you've been wanting to try

Your financial journey is exactly that, YOURS. You don't need to compare yourself to anyone else. The person on Instagram showing off their investment portfolio might still be paying off massive debt. Focus on your own path!

Your mission for today:

Look at your bank statement (I know, scary, but you can do it!)

Pick ONE money habit from this post to try this week

Set ONE specific financial goal for 2025

See you tomorrow for Day 14! Remember, every financial decision you make today is a gift to your future self.

#personal finance#money management#budgeting tips#financial wellness#money goals#personal development#growth mindset#self love#be confident#be your best self#be your true self#become that girl#becoming that girl#becoming the best version of yourself#better version#confidence#it girl#self care#self confidence#be yourself#self worth#self improvement#self acceptance#self appreciation#girl blogger#girlblogging#girl blog aesthetic#that girl#self help#self development

86 notes

·

View notes

Text

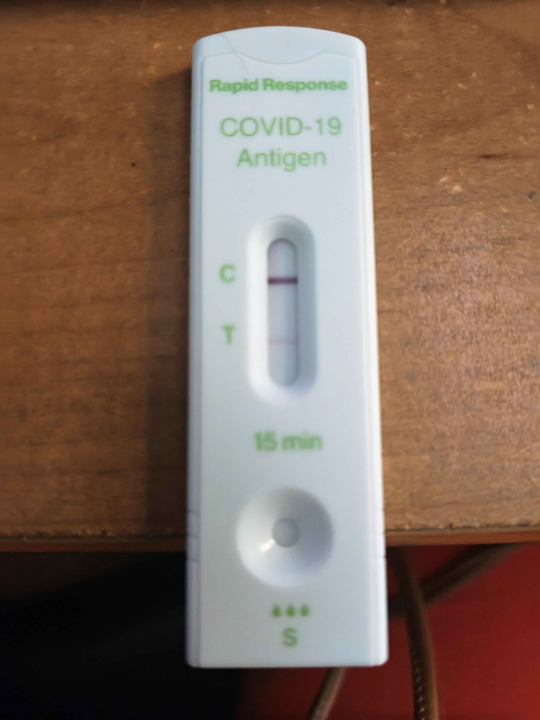

Overdue

(Mirrored from MxRP Discord) Once again I'm forced to do this, and I'm sorry about it. I really hoped to have my shit sorted out before things got to this point, but life has had different plans for me.

I caught Covid last month a few days before Christmas, and I've been messed up ever since. My productivity is way down. My energy gone. Right now I'm having a lot of trouble doing anything useful. I'm happy I got things done for the new years update before things got this severe though, and I hope you're enjoying seeing how Nextbubble is shaping up.

For a long time now, my income hasn't been good enough to do much more than pay my rent and buy my food. This is a particularly difficult problem for me to solve as someone who suffers from the afflictions that I do, and the competitive and highly automated nature of the field that I work in. I have an ongoing ODSP case, my doctor has to send in some paperwork, so hopefully I'll get on that and can stop worrying about what the next month is going to look like for me if I get accepted. But there's a chance I won't, and will have to go through a lengthy and frustrating arbitration process. Could take years.

That brings us to the current situation. I felt terrible ever asking for more than I needed in the moment to scrape by. This resulted in some of my bills falling behind for months. Now, my phone line and that of my mother is due to be disconnected tomorrow if I don't come up with the due amount (We're on the same account). Along with that, my internet connection will be going down likely within the week if I don't pay that as well. Plus I still have my upcoming rent to consider, and food to stock our fridge.

If you have something to spare, I would very much appreciate the help via my ko-fi. For long-term support, there's always the MxRP patreon, or ko-fi subscriptions.

Thanks for reading. More DB updates to come post covid recovery.

19 notes

·

View notes

Text

i took a sleeping pill to feel productive (great psychiatric situation here) and i went to work on the finances. i repayed my savings from when i bummed rent from it to cover the other half coming a little late (then spent the rest on my vacation…). savings is honored friendship restored 🤝. then i set everything to autopay. my savings, phone, internet, and newspapers subscription was already automated. but you know how it is with the rest of it, the last poverty frontier lol, you have to make the decision in the moment about what you can live without, and who will give you the longest grace… i am gently deciding to be confident that this winter i will be able to pay all of my utilities every month and not have to choose between them lol. and after that, with my veggie box, also be able to eat pretty much whatever i want. i also put my credit card (not huge!!) on autopay.

re sign my lease is looming over my head! gotta do it soon. i need to figure out this small medical bill that’s in collections but i can’t remember the trick (i should haggle right??)

i want to make a girlie budget spreadsheet to oppose my evil anorexic spending tracking spreadsheets but i feel the sleep turn may be coming

8 notes

·

View notes

Text

Benefits of Fast Online Payments — Quick Pay

In today’s digital economy, fast online payments are no longer just a convenience—they are a necessity. From e-commerce stores to freelancers and service providers, everyone is shifting toward quicker, safer, and smarter payment solutions. Among the many options available, Quick Pay has emerged as a leading platform offering seamless online payment experiences for both businesses and customers.

If you're a business owner or entrepreneur looking to scale your operations and improve customer satisfaction, understanding the benefits of fast online payments is crucial. And when it comes to delivering these benefits efficiently, Quick Pay stands out with its cutting-edge features and reliable service.

1. Enhanced Customer Experience

The first and most obvious benefit of fast online payments is an improved customer experience. Today’s consumers expect instant transactions. A slow or complicated checkout process can lead to cart abandonment and loss of revenue.

With Quick Pay, customers can complete payments in just a few clicks. The user-friendly interface, minimal redirects, and fast processing ensure that your clients enjoy a hassle-free payment journey, increasing the chances of repeat business.

Quick Pay Advantage:

One-click checkout

Mobile-optimized experience

Multiple payment options: UPI, cards, wallets, net banking

2. Faster Cash Flow for Businesses

One of the major benefits of fast online payments is accelerated cash flow. Unlike traditional bank transfers that may take days, fast payment systems like Quick Pay ensure that your money reaches you quickly—often on the same day.

For small businesses and startups, this is a game-changer. You no longer have to wait endlessly for payments, allowing better cash management, investment in growth, and operational efficiency.

Quick Pay Benefit:

Same-day settlements (T+0 and T+1 options)

Instant payment notifications

Transparent tracking of incoming funds

3. Higher Conversion Rates

Online businesses thrive on conversion rates. A complicated or slow payment process can discourage potential customers right at the final step. By offering a quick and secure payment gateway like Quick Pay, businesses can increase their checkout success rate dramatically.

Speed combined with security builds trust and reduces the bounce rate.

Quick Pay Features That Help:

Secure payment environment (PCI DSS compliant)

Optimized checkout for mobile and desktop

Auto-fill and tokenized payments for returning users

4. Increased Trust and Credibility

When customers notice that your website or app uses a reputed and fast payment solution like Quick Pay, it instantly boosts your brand’s credibility. Shoppers feel more secure transacting on your platform, knowing that their personal and financial data is in safe hands.

This trust translates into higher engagement, more referrals, and long-term brand loyalty.

Quick Pay Security Standards:

End-to-end encryption

Two-factor authentication

Fraud detection and chargeback control

5. Support for Recurring Payments

Many businesses today rely on subscription models—whether it's digital services, SaaS platforms, or fitness memberships. A major benefit of fast online payments is the ability to automate recurring billing.

Quick Pay makes recurring payments smooth and effortless. Customers don’t need to re-enter their details every time, and businesses enjoy predictable revenue without delays.

With Quick Pay, You Get:

Automated recurring billing setup

Smart invoicing and reminders

Custom billing cycles

6. Lower Operational Costs

Handling cash or bank transfers manually involves time, risk, and additional staff. Online payments automate this entire process, reducing overhead costs. Quick Pay’s all-in-one dashboard helps manage your transactions, analytics, and customer data in one place.

Over time, businesses save money on labor, reconciliation, and administrative tasks.

Quick Pay’s Business Dashboard Offers:

Real-time transaction tracking

Sales reports and analytics

Easy refund and dispute management

7. Wider Customer Reach

Fast online payments open up a global customer base. Whether you're selling in your local city or shipping products across the world, a payment gateway like Quick Pay ensures that you never miss a sale due to geographical or banking limitations.

Quick Pay supports multi-currency payments and international cards, making it easier to scale your business globally.

Quick Pay Global Features:

Support for major global currencies

Acceptance of Visa, Mastercard, AmEx, and more

Integration with international platforms like Shopify, WooCommerce, and others

8. Seamless Integrations with Online Platforms

The benefits of fast online payments are amplified when your payment gateway easily integrates with your website, mobile app, or POS system. Quick Pay offers ready-made plugins and robust APIs for smooth integration.

This reduces developer time, lowers setup costs, and gets you live faster.

Quick Pay Integration Highlights:

Easy plugins for WordPress, Shopify, Magento

Android/iOS SDKs for mobile apps

API documentation and 24/7 tech support

9. Better Customer Retention

A smooth payment experience not only helps you close a sale but also encourages customers to return. Fast refunds, saved payment options, and friendly interfaces make users feel valued.

Quick Pay includes customer retention features like:

Smart retry on failed transactions

Branded payment pages

Custom thank-you messages and emails

10. Real-Time Analytics and Insights

Understanding how your customers pay can guide better business decisions. Quick Pay’s powerful analytics tools offer deep insights into payment trends, user behavior, and settlement reports—all in real time.

This data can be used to optimize your marketing campaigns, identify high-value customers, and plan inventory.

What Quick Pay Analytics Offers:

Dashboard with payment trends and patterns

Conversion rate tracking

Refund and dispute summary

Why Choose Quick Pay?

When it comes to maximizing the benefits of fast online payments, Quick Pay checks all the boxes:

✅ Fast and secure transactions ✅ Same-day settlements ✅ Easy integrations ✅ Scalable for small to enterprise businesses ✅ Exceptional customer support

Whether you're a growing startup, a large enterprise, or a freelancer, Quick Pay empowers your business to accept payments quickly, securely, and with minimal friction.

Final Thoughts

The world is moving fast, and so should your payments. Embracing the benefits of fast online payments can revolutionize your business operations, boost customer satisfaction, and drive consistent revenue.

With its reliable technology, business-friendly features, and unmatched customer support, Quick Pay is the ideal partner for modern businesses looking to thrive in the digital age.

Ready to Get Started?

Visit www.usequickpay.com to create your free account and start accepting payments within minutes.

#finance#online payments#payments#branding#economy#quickpay#bestpaymentgateway#FastOnlinePayments#QuickPayIndia#DigitalPaymentsSolution

2 notes

·

View notes

Text

Streamlining Telecom Billing with SAP BRIM by Acuiti Labs

Acuiti Labs empowers telecom businesses with SAP BRIM to transform outdated telecom billing systems. Our solution automates mobile service invoicing, enhances telecommunication revenue management, and reduces revenue leakage—delivering scalability, transparency, and better customer experiences.

#telecom billing systems#mobile service invoicing#telecommunication revenue management#sap brim#sap billing#acuiti labs#q2c for telecom#billing automation#subscription billing#revenue optimization

0 notes

Text

Unlock the Full Potential of NetSuite with SuiteWorks Technologies

SuiteWorks Technologies, we are dedicated to delivering top-tier NetSuite Services that help businesses streamline their operations, improve efficiency, and achieve their goals. With a decade of experience and a team of certified NetSuite professionals, we have established ourselves as a trusted partner for businesses looking to leverage the full power of NetSuite.

0 notes

Text

New Features of SAP Subscription Billing: Efficiency & Flexibility

Explore the latest SAP Subscription Billing features designed to enhance billing flexibility, automation, and customer experience for subscription businesses.

2 notes

·

View notes

Text

Efficient Credit Card Processing for Subscription-Based Models

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the rapidly evolving digital realm, businesses demand a dependable and effective credit card processing system, especially when engaged in subscription-based models. Credit card acceptance isn't just a matter of convenience; it's a strategic necessity that fuels expansion and ensures smooth financial transactions. In this article, we will delve into the universe of credit card processing, with a particular focus on its pivotal role in subscription-based enterprises.

The Significance of Credit Card Processing It's not just a payment choice; it stands as the gateway to success for subscription-based models. Envision a scenario where your customers confront complex payment procedures, leading to exasperation and eventual abandonment. Proficient payment processing eradicates these hurdles, positioning itself as a critical component of your subscription-based business strategy.

Why Credit Card Processing is Crucial Payment processing in subscription-based models is a fundamental element of customer satisfaction and retention. It guarantees seamless transactions, providing your customers with a fuss-free experience when subscribing to your services. Furthermore, modern payment processing systems incorporate robust security measures, safeguarding sensitive customer data and thwarting fraudulent activities. The automation of recurring billing is indispensable for subscription-based models, guaranteeing punctual payments and minimizing churn rates. Additionally, accepting credit cards broadens your business horizons, breaking down geographical barriers and enabling you to tap into a global audience.

Embracing Credit Cards for High-Risk Ventures For high-risk businesses, securing a reliable payment processing solution is of paramount importance. Whether your operations fall within the CBD industry, credit repair services, or e-commerce niches, you need a high-risk credit card processing system capable of addressing the unique challenges posed by your sector.

Merchant Accounts for High-Risk Enterprises High-risk merchant accounts are tailored explicitly for businesses with an elevated likelihood of chargebacks or fraud. If your subscription-based model falls within this category, obtaining a high-risk merchant account becomes indispensable for sustainable growth.

youtube

The E-commerce Advantage In the era of online shopping, e-commerce payment processing is absolutely indispensable. Online enterprises, whether they reside in traditional markets or high-risk domains, rely on efficient e-commerce payment gateways to expedite transactions and ensure customer contentment.

In conclusion, the universe of subscription-based models revolves around proficient credit card processing. It's not just about accepting payments; it's about crafting a smooth and secure experience for your clientele. Whether you operate in a high-risk industry or e-commerce, the right payment processing system can be the cornerstone for sustainable growth and global outreach.

#high risk merchant account#high risk payment gateway#high risk payment processing#merchant processing#payment processing#credit card payment#credit card processing#accept credit cards#payment#youtube#Youtube

23 notes

·

View notes

Text

2024's Finest: The Top 6 eSignature Software for Seamless Online Document Signing

Introduction:

In the fast-paced digital landscape of 2024, the way we conduct business and handle official paperwork has evolved significantly. The days of traditional ink-on-paper signatures are dwindling, making way for the era of electronic signatures. From signing contracts to validating legal documents, the world of eSignature software has become a pivotal aspect of modern business operations. In this comprehensive guide, we will delve into the top 6 eSignature software that are reshaping the landscape of online document signing, offering seamless experiences and advanced features that set them apart in 2024. SimpliciSign: Streamlining eDocument Signing with Precision SimpliciSign joins the ranks of the top eSignature software by offering precision and efficiency in eDocument signing. Explore the features that make SimpliciSign stand out, including its seamless integration capabilities and user-friendly interface. With SimpliciSign, experience a streamlined approach to electronic signatures that enhances your overall document signing process. SimpliciSign offers cheapest rates in the market of eSignature softwares. Free Trial is also available. SimpliciSign has features like: -With the subscription of : $4.99 per user /month + $0.50/per invite, Unlimited once you are billed $35 in a month.

-Biometric Authentication-Optical Character Recognition(OCR) -Multi-signing Capability-Overlay Forms-Assign Sign Order-Fully Legal Binding Agreements DocuSign: Pioneering Excellence in eSignature Technology DocuSign, a pioneer in the eSignature industry, has maintained its prominent role as a key player for an extended period. Delve into the reasons behind DocuSign's leadership in the electronic signatures sector, exploring its intuitive interface and cutting-edge features that have firmly established its reputation. With a focus on robust security measures and seamless compatibility across diverse document types, businesses globally place their trust in DocuSign to fulfill their online document signing requirements. Key features of DocuSign: -Pricing Starts from $15 /month -Global Reach-Workflow Automation-Integration Adobe Sign: Unleashing the Power of Digital Signatures Adobe Sign harnesses the influence of the renowned Adobe brand in the realm of eSignatures. Immerse yourself in the realm of digital signatures and uncover how Adobe Sign seamlessly merges with widely-used document creation tools such as Adobe Acrobat. Discover the distinctive attributes that position Adobe Sign as a premier option for those seeking to enhance their online document signing journey, seamlessly combining convenience with the reliability associated with Adobe's trusted name in the industry of eSignatures. Key features of Adobe Sign: -Plans start from $22.99/month -Integration with Adobe Products-Mobile Accessibility-Compliance

Dropbox/HelloSign: Simplifying Signatures for Modern Businesses In the pursuit of a straightforward approach without sacrificing functionality, HelloSign stands out as a leading choice. This eSignature application prioritizes user-friendly interfaces and intuitive workflows, catering to businesses of varying sizes. Delve into how HelloSign simplifies the electronic signing process for contracts and legal documents, highlighting its commitment to efficiency and delivering a seamless and hassle-free signing experience. Key features of Dropbox/HelloSign: -Plans start from $19.99/month -User-Friendly API-Team Collaboration-Audit Trail

SignEasy: Redefining Convenience in Online Document Signing

SignEasy has established itself as a niche player by placing a premium on convenience. Explore the distinctive features that position SignEasy as a standout option for individuals and businesses in search of a direct solution for electronic signatures. With its design optimized for mobile use and seamless integrations with well-known cloud storage platforms, SignEasy is reshaping our approach to online document signing in the digital age. Key features of SignEasy: -Pricing Starts from $20 per user/month -Cross-Platform Availability:-Offline Signing-Intuitive Interface OneSpan Sign: Elevating Security in the eSignature Landscape

In the domain of electronic signatures, prioritizing security is of utmost importance, and OneSpan Sign excels in this regard. Investigate how this eSignature application incorporates advanced security measures to guarantee the integrity and authenticity of each digital signature. From robust encryption to multi-factor authentication, uncover the reasons why organizations opt for OneSpan Sign when emphasizing the highest standards of security in their processes for online document signing. Key features of SignEasy: -Professional Plan starts with $22 Per User/month -Advanced Security Features-Compliance-Mobile Capabilities

Conclusion:As we navigate the dynamic landscape of 2024, the demand for efficient, secure, and user-friendly eSignature software continues to rise. From the pioneering technology of SimpliciSign to the simplicity of HelloSign and the security-focused approach of OneSpan Sign, these top 6 eSignature software are leading the way in reshaping how we sign contracts and legal documents electronically. Embrace the future of online document signing with these innovative solutions, and stay ahead of the curve in 2024.

2 notes

·

View notes