#Activist Investor

Text

Why activist investors are going to have a busy year

If you think they have gone soft, think again

“After a dismal year, when activist funds lost 16% of their value as stockmarkets slumped, many observers were expecting a spring offensive. Fund managers had a busy end to 2022, taking advantage of those sunken stockmarket valuations. New corporate-governance rules introduced last September make it easier for dissident investors to obtain board seats, by compelling firms to include all nominees on proxy ballots and allowing shareholders to mix and match those proposed by the company and by its detractors, rather than pick alternative slates.”

https://finance.yahoo.com/news/why-activist-investors-going-busy-125902816.html

#Activistinvestor #hedgefunds #Privateequity #funds #funds #investments #governance #investor #industrial #healthcare #energy #chemicals #ESG ht GS

🪄https://twitter.com/mohossain/status/1123767861074374656?s=46&t=GtuOmoaTjOwevz2JidiiDQ #ennovance #mergers #acquisitions #deals #activistinvestor

0 notes

Text

[puts on my business hat]: I can't believe watcher is leaving youtube to create their own streaming service in a market where some of the biggest companies are trying to get out of the streaming business bc they've discovered how unprofitable of a business model it is.

#netflix and amazon both have ads now#warner bros is still recovering from the max launch and trying to merge with paramount plus?#disney just fought off an activist investor whose gripe (of MANY) was about the money sink disney plus turned into#would be super curious to know what VC they got to invest in their platform#also wondering why they didn't try to partner with an already existing streamer#so many questions so few answers#watcher

54 notes

·

View notes

Text

#personal#internets#at this rate I've unfollowed both of the kinda.. 'controvercial' blogs I've been following#since there was a good chunk of actually good takes about how bad media is now and society and braindead internet 'activists' that-#-had it too good in their western countries and NEEDED to invent the reason to bully and excile people#could honestly resonate with it despite some other posts causing genuine pain. but mostly about terribly handled media#like you know that thing when corporations do terrible ass rep to pretend that they care for minorities#or artificially fabricate online backlash against their new actors to show investors that people show interest for their product because-#-of all the clicks on their article?#like discussion of this kind sorta keeps me sober#as a person with BPD I get contaminated by opinions VERY easily and as an autist I will believe everything if it is put together 'logically#that's why I HAVE to be exposed to every possible opinion so I am forced to make out my own rather than being swayed anywhere#but at this point those blog became kinda.. bad? like they don't just have 'opinions' but they hate just to hate#but now my dashboard and recs are full of exclusively things I can fully agree with and I am scared that it will rot my brain#like.. emotions are always the same. where is the 'wait WHAT' effect? where is anger? where is self-reflection?#but ALSO I realized that 'those' blogs are no better than those western 'warriors' I despise and they become narrow-minded too in the end#they advertise themselves as 'open to debate' only to always sway debate into trying to win and not into actually discovering the truth#I cannot trust any side because they're all narrow-minded and hostile but I cannot trust people without any side because-#-they're fence-sitters without morals that side with the winner#is there a secret third thing? like is there a way to not take a side but to still HAVE ideals and opinions?#my problem is that if I am not exposed to people that trash everything I value I forget why AM I valuing [a thing] to BEGIN with#and that won't do will it

26 notes

·

View notes

Link

Having to build a search-ranking algorithm that can withstand relevancy attacks funded by every legitimate business, every scammer, every influencer, every publisher, every religion and every cause on the entire planet Earth might just be an unattainable goal. As Elizabeth Lopatto put it:

[The] obvious degradation of Google Search [was]caused in part by Google’s own success: whole search engine optimization teams have been built to make sure websites show on the first page of search since most people never click through to the second. And there’s been a rise of SEO-bait garbage that surfaces first.

Search was Google’s crown jewel, its sole claim to excellence in innovation. Sure, the company is unparalleled in its ability to operationalize and scale up other peoples’ ideas, but that’s just another way of saying, “Google is a successful monopolist.” Since the age of the rail barons, being good at running other peoples’ companies has been a prerequisite for monopoly success. But administering other peoples’ great ideas isn’t the same thing as coming up with your own.

With search circling the drain, Google’s shareholders are losing confidence. In the past year, the company caved to “activist investors,” laying off 12,000 engineers after a stock buyback that would have paid all 12,000 salaries for the next 27 years.

- Google's AI Hype Circle: We have to do Bard because everyone else is doing AI; everyone else is doing AI because we're doing Bard.

#ai#ai hype#large language models#confident liars#bard#google#enshittification#llms#chatbots#monopoly#search quality#activist investors#tech layoffs#stock buybacks

32 notes

·

View notes

Text

Austin Veith - Essential Considerations for Launching Your Startup.

Starting a startup is a challenging but rewarding journey, and it's essential to have a clear vision and strategic mindset, just like Austin Veith, a successful entrepreneur. Several key considerations should be at the forefront when embarking on this entrepreneurial adventure.

Market Research is crucial. Understand your target audience, their preferences, and buying behaviors. What are your competitors doing, and how can you differentiate your startup from them? Comprehensive market research is essential to making informed decisions.

Craft a Solid Business Plan: Austin Veith stresses the importance of a well-structured business plan. It serves as a roadmap, outlining your goals, strategies, financial projections, and the steps needed to achieve success. Investors and partners often require a clear business plan before getting involved.

Financial Management: Budgeting and financial planning are critical. Ensure you have the necessary capital to start and sustain your business. Keep a close eye on your expenses, and have a strategy for revenue generation and profitability.

Legal Considerations: Register your business, obtain any required licenses or permits, and address legal obligations, like intellectual property protection. Consulting with legal experts, as Austin Veith advises, can help you navigate complex legal matters.

Build a Strong Team: Surround yourself with skilled and motivated individuals who share your vision. Austin Veith believes that a passionate and dedicated team is invaluable for a startup's success. Effective teamwork is crucial for overcoming challenges and achieving your goals.

Product Development and Testing: Create a minimum viable product (MVP) and test it in the market. Gathering feedback from early users will help you refine your offering and meet customer expectations more effectively.

Marketing and Branding: Develop a strong brand identity and marketing strategy. Austin Veith underscores the need for a compelling online presence and a marketing plan that reaches your target audience. Social media and content marketing can be potent tools.

Measuring Success: Define key performance indicators (KPIs) to gauge your startup's progress. Regularly evaluate your performance against these benchmarks and be ready to make adjustments as needed.

In conclusion, starting a startup is a journey filled with ups and downs. Austin Veith's experience and success serve as a testament to the importance of careful planning, adaptability, and unwavering commitment. By keeping these considerations in mind, you can increase your chances of building a thriving and sustainable startup.

0 notes

Text

Israeli gov-led Zoom calls, WhatsApp chat logs, and other docs provide a window into the massive effort to shape online discourse and silence pro-Palestinian voices.

As the Israel-Hamas war began to heat up in late October, Courtney Carey, a Dublin-based employee of the Israeli website building company Wix, posted the Irish words “SAOIRSE DON PHALAISTIN” -- “Freedom for Palestine” -- on her LinkedIn page.

Within 24 hours of Carey’s LinkedIn post appearing, Alon Ozer, a Miami-based investor, took a screenshot of the post and shared it with a WhatsApp group of more than 300 like-minded investors, tech executives, activists, and at least one senior Israeli government official. Ozer took care to note that Carey worked for Wix.

Oded Hermoni, a tech journalist-turned-venture capitalist, piped up to assure everyone that Batsheva Moshe, Wix’s general manager for Israel and a member of the group chat, had been “on it since Sat[urday] night.”

Moshe then chimed in to assure her peers that the issue with Carey had been “taken care of since it was published.”

“I believe there will be an announcement soon re our reaction,” she added.

Wix terminated Carey the following day.

Read the whole article as it's an investigation into Israel’s information war

#yemen#jerusalem#tel aviv#current events#palestine#free palestine#gaza#free gaza#news on gaza#palestine news#news update#war news#war on gaza#anti zionisim

2K notes

·

View notes

Text

First there was DeSantis & now there's activist investor Nelson Peltz trying to take over Disney's board bc he "doesn't get" why there should be movies with all-female or all-black casts. All-time pair of unbelievably worse guys making us say "well you do not, under any circumstances, gotta hand it to Disney, but,"

502 notes

·

View notes

Text

The most logical modern AU take for Kabru is that he would be an environmental justice activist/studying environmental racism and/or civil liberties. It's the best analogue for his home being ravaged and his people's lives being lost (aside from the more obvious but even bleaker war refugee parallel) and is the best analogue to wanting to seal the dungeon and having to navigate the societal forces keeping it open: it's like fighting to shut down a mine that's dumping heavy metals into the water but also keeping the local disenfranchised population employed and lining the pockets of investors. This is absolutely what he would be doing in the real world.

#Dungeon Meshi#Kabru#Kabru of Utaya#dungeonposting#reminder that Kabru's actions essentially boil down to 'sabotaging the military actions of a first-world power to prevent their takeover'#in the name of sovereignty for oppressed peoples no less

206 notes

·

View notes

Text

Benedict Cumberbatch and Sophie Hunter at The Earthshot Prize Innovation Summit → September 24 2024

The Earthshot Prize is an environmental challenge that catalyzes urgent optimism & action by discovering, accelerating, awarding, spotlighting & scaling solutions to repair & regenerate the planet. The summit will convene business leaders, philanthropists, investors and government leaders alongside Earthshot Prize Finalists and Winners to strengthen the power of the global Earthshot community.

Sophie talked about her production Salt of the Earth that premiered recently in Venice, "an act of story-telling created through deep collaboration with scientists, activists and local initiatives" that "shone a light on an overlooked and disregarded but vital ecosystem: salt marshes."

Benedict talked about supporting Green Rider, a campaign and grassroots union network of creatives campaigning for a fairer, more sustainable, eco-friendly film industry. Green Rider is developing strong examples of how cast can supercharge climate action through the industry and create a blueprint that others can easily follow.

Source: AliMarieHurtado, official stream

#benedict cumberbatch#sophie hunter#earthshot prize#salt of the earth#dailymarvelkings#benedictedit#cumberbatchedit#benophieedit#*edit#together on stage again!#a benophie appearance on a whole new level <3#what an inspiring joint speech#about causes they're passionate about#you can hear it in their voices#he is looking at her so gently#and with hearts in his eyes :)

67 notes

·

View notes

Text

🇬🇧🇵🇸 🚨

U.K. PRO-PALESTINE PROTESTORS VANDALIZE BNY MELLON HEADQUARTERS IN MANCHESTER

📹 After learning that British bank and investor BNY Mellon, which has its British headquarters in Manchester, is investing £10 million into an Israeli weapons firm, activists vandalize the BNY Mellon building, accusing the firm of supporting a genocide.

#source

@WorkerSolidarityNews

#britain#uk#uk news#manchester#uk politics#uk activists#pro-palestine protests#palestine#palestine news#palestinians#gaza#gaza news#gaza strip#gaza war#israel palestine conflict#arab israeli conflict#genocide#genocide of palestinians#gaza genocide#israel#middle east#war#politics#news#geopolitics#world news#global news#international news#breaking news#current events

139 notes

·

View notes

Text

On Wednesday, Senate Health, Education, Labor and Pensions (HELP) Chair Bernie Sanders (I-Vermont) and Rep. Pramila Jayapal (D-Washington) reintroduced a proposal to make higher education free at public schools for most Americans — and pay for it by taxing Wall Street.

The College for All Act of 2023 would massively change the higher education landscape in the U.S., taking a step toward Sanders’s long-standing goal of making public college free for all. It would make community college and public vocational schools tuition-free for all students, while making any public college and university free for students from single-parent households making less than $125,000 or couples making less than $250,000 — or, the vast majority of families in the U.S.

The bill would increase federal funding to make tuition free for most students at universities that serve non-white groups, such as Historically Black Colleges and Universities (HBCUs). It would also double the maximum award to Pell Grant recipients at public or nonprofit private colleges from $7,395 to $14,790.

If passed, the lawmakers say their bill would be the biggest expansion of access to higher education since 1965, when President Lyndon B. Johnson signed the Higher Education Act, a bill that would massively increase access to college in the ensuing decades. The proposal would not only increase college access, but also help to tackle the student debt crisis.

“Today, this country tells young people to get the best education they can, and then saddles them for decades with crushing student loan debt. To my mind, that does not make any sense whatsoever,” Sanders said. “In the 21st century, a free public education system that goes from kindergarten through high school is no longer good enough. The time is long overdue to make public colleges and universities tuition-free and debt-free for working families.”

Debt activists expressed support for the bill. “This is the only real solution to the student debt crisis: eliminate tuition and debt by fully funding public colleges and universities,” the Debt Collective wrote on Wednesday. “It’s time for your member of Congress to put up or shut up. Solve the root cause and eliminate tuition and debt.”

These initiatives would be paid for by several new taxes on Wall Street, found in a separate bill reintroduced by Sanders and Rep. Barbara Lee (D-California) on Wednesday. The Tax on Wall Street Speculation would enact a 0.5% tax on stock trades, a 0.1% tax on bonds and a 0.005% tax on trades on derivatives and other types of assets.

The tax would primarily affect the most frequent, and often the wealthiest, traders and would be less than a typical fee for pension management for working class investors, the lawmakers say. It would raise up to $220 billion in the first year of enactment, and over $2.4 trillion over a decade. The proposal has the support of dozens of progressive organizations as well as a large swath of economists.

“Let us never forget: Back in 2008, middle class taxpayers bailed out Wall Street speculators whose greed, recklessness and illegal behavior caused millions of Americans to lose their jobs, homes, life savings, and ability to send their kids to college,” said Sanders. “Now that giant financial institutions are back to making record-breaking profits while millions of Americans struggle to pay rent and feed their families, it is Wall Street’s turn to rebuild the middle class by paying a modest financial transactions tax.”

#us politics#news#truthout#sen. bernie sanders#progressives#progressivism#Democrats#senate health education labor and pensions committee#College for All Act of 2023#tax Wall Street#tax the rich#tax the 1%#tax the wealthy#college for all#student debt#student loan debt#tuition-free college#Historically Black Colleges and Universities#pell grants#Higher Education Act#Rep. Barbara Lee#rep. pramila jayapal#2023

466 notes

·

View notes

Text

BG3 Villains modern corporate au

Gortash: tech bro/genius entrepreneur. His "rags to riches" story has been covered in dozens of think pieces and business profiles. Probably was on one of those 30 under 30 lists, or something, at some point. He plays the "outsider" card to great effect (terrible haircut, fancy sneakers, no tie,...) and is quite popular, despite the numerous reports on the terrible working conditions in his company and his ideas not being near as profitable as he makes them out to be (or not being entirely his at all). Despite all his wealth, he's still ultimately beholden to his VC investors, Bane Inc. (I don't want to say he's like el*n musk, because i despise that man but... He's exactly like el*n musk except more charismatic and with jason isaacs' voice)

Orin (and Durge): nepobabies. Super rich family, Succession-style, where maybe dad Bhaal was the one to make a fortune and all his kids ride on the coattails of his success, fighting amongst themselves to be the one who gets to succeed him. Durge is the heir apparent, smart, charismatic, and with a true killer instinct, until Orin leaks some scandalous info that gets them cancelled and fired from the company. (Gorion's Ward is the kid that left the family to go and be a social worker or activist)

Ketheric: old school CEO, inherited a small family company, he used to be a good boss and look out for his employees. After a bitter divorce, and a fallout with his daughter after she came out, he buried himself in his work, became obsessed with success to try and win his family back. He sold the company to a large multinational in order to run Aylin's rival company out of business, screwed over his employees (and himself), and has been unsuccessfully trying to reconcile with Isobel ever since.

Auntie Ethel: runs a very successful MLM essential oils scheme

Raphael: bastard son of star lawyer Mephistopheles, tries his best to follow in his father's footsteps, to become a cutthroat lawyer. He even starts screwing his secretary, Harleep (Mephisto's spy, of course), to emulate his father's toxic behaviour. Deep down, he dreams of Broadway (and is part of an amateur musical theatre company)

The Emperor: former activist, now part of a political large lobby, still convinced he's on the right side of things. Tries to get all his activist friends and colleagues to join the lobby, after all the pay is so much better, and is puzzled when they refuse and call him a sell-out.

Vlaakith: career politician. Has been in office for what feels like forever, there's no removing her. There are better, younger politicians in her party who have great potential, but she sabotages them in order to remain in power.

#baldur's gate 3#enver gortash#ketheric thorm#orin the red#the dark urge#auntie ethel#vlaakith#raphael#long post

132 notes

·

View notes

Text

Born on 23 April 23, 1964 in Princeton, NJ, William Felix Browder is an American-born English financier and political activist. He is the CEO and co-founder of Hermitage Capital Management, the investment advisor to the Hermitage Fund, which at a time was the largest foreign portfolio investor in Russia.

48 notes

·

View notes

Text

Red Lobster was killed by private equity, not Endless Shrimp

For the rest of May, my bestselling solarpunk utopian novel THE LOST CAUSE (2023) is available as a $2.99, DRM-free ebook!

A decade ago, a hedge fund had an improbable viral comedy hit: a 294-page slide deck explaining why Olive Garden was going out of business, blaming the failure on too many breadsticks and insufficiently salted pasta-water:

https://www.sec.gov/Archives/edgar/data/940944/000092189514002031/ex991dfan14a06297125_091114.pdf

Everyone loved this story. As David Dayen wrote for Salon, it let readers "mock that silly chain restaurant they remember from their childhoods in the suburbs" and laugh at "the silly hedge fund that took the time to write the world’s worst review":

https://www.salon.com/2014/09/17/the_real_olive_garden_scandal_why_greedy_hedge_funders_suddenly_care_so_much_about_breadsticks/

But – as Dayen wrote at the time, the hedge fund that produced that slide deck, Starboard Value, was not motivated by dissatisfaction with bread-sticks. They were "activist investors" (finspeak for "rapacious assholes") with a giant stake in Darden Restaurants, Olive Garden's parent company. They wanted Darden to liquidate all of Olive Garden's real-estate holdings and declare a one-off dividend that would net investors a billion dollars, while literally yanking the floor out from beneath Olive Garden, converting it from owner to tenant, subject to rent-shocks and other nasty surprises.

They wanted to asset-strip the company, in other words ("asset strip" is what they call it in hedge-fund land; the mafia calls it a "bust-out," famous to anyone who watched the twenty-third episode of The Sopranos):

https://en.wikipedia.org/wiki/Bust_Out

Starboard didn't have enough money to force the sale, but they had recently engineered the CEO's ouster. The giant slide-deck making fun of Olive Garden's food was just a PR campaign to help it sell the bust-out by creating a narrative that they were being activists* to save this badly managed disaster of a restaurant chain.

*assholes

Starboard was bent on eviscerating Darden like a couple of entrail-maddened dogs in an elk carcass:

https://web.archive.org/web/20051220005944/http://alumni.media.mit.edu/~solan/dogsinelk/

They had forced Darden to sell off another of its holdings, Red Lobster, to a hedge-fund called Golden Gate Capital. Golden Gate flogged all of Red Lobster's real estate holdings for $2.1 billion the same day, then pissed it all away on dividends to its shareholders, including Starboard. The new landlords, a Real Estate Investment Trust, proceeded to charge so much for rent on those buildings Red Lobster just flogged that the company's net earnings immediately dropped by half.

Dayen ends his piece with these prophetic words:

Olive Garden and Red Lobster may not be destinations for hipster Internet journalists, and they have seen revenue declines amid stagnant middle-class wages and increased competition. But they are still profitable businesses. Thousands of Americans work there. Why should they be bled dry by predatory investors in the name of “shareholder value”? What of the value of worker productivity instead of the financial engineers?

Flash forward a decade. Today, Dayen is editor-in-chief of The American Prospect, one of the best sources of news about private equity looting in the world. Writing for the Prospect, Luke Goldstein picks up Dayen's story, ten years on:

https://prospect.org/economy/2024-05-22-raiding-red-lobster/

It's not pretty. Ten years of being bled out on rents and flipped from one hedge fund to another has killed Red Lobster. It just shuttered 50 restaurants and declared Chapter 11 bankruptcy. Ten years hasn't changed much; the same kind of snark that was deployed at the news of Olive Garden's imminent demise is now being hurled at Red Lobster.

Instead of dunking on free bread-sticks, Red Lobster's grave-dancers are jeering at "Endless Shrimp," a promotional deal that works exactly how it sounds like it would work. Endless Shrimp cost the chain $11m.

Which raises a question: why did Red Lobster make this money-losing offer? Are they just good-hearted slobs? Can't they do math?

Or, you know, was it another hedge-fund, bust-out scam?

Here's a hint. The supplier who provided Red Lobster with all that shrimp is Thai Union. Thai Union also owns Red Lobster. They bought the chain from Golden Gate Capital, last seen in 2014, holding a flash-sale on all of Red Lobster's buildings, pocketing billions, and cutting Red Lobster's earnings in half.

Red Lobster rose to success – 700 restaurants nationwide at its peak – by combining no-frills dining with powerful buying power, which it used to force discounts from seafood suppliers. In response, the seafood industry consolidated through a wave of mergers, turning into a cozy cartel that could resist the buyer power of Red Lobster and other major customers.

This was facilitated by conservation efforts that limited the total volume of biomass that fishers were allowed to extract, and allocated quotas to existing companies and individual fishermen. The costs of complying with this "catch management" system were high, punishingly so for small independents, bearably so for large conglomerates.

Competition from overseas fisheries drove consolidation further, as countries in the global south were blocked from implementing their own conservation efforts. US fisheries merged further, seeking economies of scale that would let them compete, largely by shafting fishermen and other suppliers. Today's Alaskan crab fishery is dominated by a four-company cartel; in the Pacific Northwest, most fish goes through a single intermediary, Pacific Seafood.

These dominant actors entered into illegal collusive arrangements with one another to rig their markets and further immiserate their suppliers, who filed antitrust suits accusing the companies of operating a monopsony (a market with a powerful buyer, akin to a monopoly, which is a market with a powerful seller):

https://www.classaction.org/news/pacific-seafood-under-fire-for-allegedly-fixing-prices-paid-to-dungeness-crabbers-in-pacific-northwest

Golden Gate bought Red Lobster in the midst of these fish wars, promising to right its ship. As Goldstein points out, that's the same promise they made when they bought Payless shoes, just before they destroyed the company and flogged it off to Alden Capital, the hedge fund that bought and destroyed dozens of America's most beloved newspapers:

https://pluralistic.net/2021/10/16/sociopathic-monsters/#all-the-news-thats-fit-to-print

Under Golden Gate's management, Red Lobster saw its staffing levels slashed, so diners endured longer wait times to be seated and served. Then, in 2020, they sold the company to Thai Union, the company's largest supplier (a transaction Goldstein likens to a Walmart buyout of Procter and Gamble).

Thai Union continued to bleed Red Lobster, imposing more cuts and loading it up with more debts financed by yet another private equity giant, Fortress Investment Group. That brings us to today, with Thai Union having moved a gigantic amount of its own product through a failing, debt-loaded subsidiary, even as it lobbies for deregulation of American fisheries, which would let it and its lobbying partners drain American waters of the last of its depleted fish stocks.

Dayen's 2020 must-read book Monopolized describes the way that monopolies proliferate, using the US health care industry as a case-study:

https://pluralistic.net/2021/01/29/fractal-bullshit/#dayenu

After deregulation allowed the pharma sector to consolidate, it acquired pricing power of hospitals, who found themselves gouged to the edge of bankruptcy on drug prices. Hospitals then merged into regional monopolies, which allowed them to resist pharma pricing power – and gouge health insurance companies, who saw the price of routine care explode. So the insurance companies gobbled each other up, too, leaving most of us with two or fewer choices for health insurance – even as insurance prices skyrocketed, and our benefits shrank.

Today, Americans pay more for worse healthcare, which is delivered by health workers who get paid less and work under worse conditions. That's because, lacking a regulator to consolidate patients' interests, and strong unions to consolidate workers' interests, patients and workers are easy pickings for those consolidated links in the health supply-chain.

That's a pretty good model for understanding what's happened to Red Lobster: monopoly power and monopsony power begat more monopolies and monoposonies in the supply chain. Everything that hasn't consolidated is defenseless: diners, restaurant workers, fishermen, and the environment. We're all fucked.

Decent, no-frills family restaurant are good. Great, even. I'm not the world's greatest fan of chain restaurants, but I'm also comfortably middle-class and not struggling to afford to give my family a nice night out at a place with good food, friendly staff and reasonable prices. These places are easy pickings for looters because the people who patronize them have little power in our society – and because those of us with more power are easily tricked into sneering at these places' failures as a kind of comeuppance that's all that's due to tacky joints that serve the working class.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/23/spineless/#invertebrates

#pluralistic#bust-outs#private equity#pe#red lobster#olive garden#endless shrimp#class warfare#debt#looters#thai union group#enshittification#golden gate#monopsony#darden#alden global capital#Fortress Investment Group#food#david dayen#luke goldstein

6K notes

·

View notes

Text

The Indian state has already begun to evict indigenous communities from their homes. In late 2020, tribal communities received notice that labeled their homes as illegally occupying forest land. Their homes were demolished. This bears an eerie resemblance to Israel's targeting of Bedouin communities of Naqab, where Israel gave the lands of these communities to Jewish settlers and the military. The logic of Bedouin dispossession was premised on the fact that as nomads, they had no right to the land.

In Kashmir, these communities were living on lands that the Indian state wanted to use for the development of tourist infrastructure. Part of the plan is to transfer agricultural land to Indian state and private corporations. Kashmir has already lost 78,700 hectares of agricultural land to non-agricultural purposes between 2015–19. This decline in agricultural land—which a majority of Kashmiris still rely upon as the foundation of their economy—will disempower farmers, result in a loss of essential crops, make Kashmir less agriculturally self-sufficient, and create grounds for economic collapse in the near future. It is of course, only when Kashmiris are economically devastated that India's job in securing their land will be made even easier.

Alongside the destruction of agricultural land, the Indian government has also been charged with "ecocide" in Kashmir, which, "masked under the development rhetoric . . . destroys the environment without care, extracting resources and expanding illegal infrastructure as a way of contesting the indigenous peoples' right of belonging and using the territory for their own gain." During the lockdown in late 2019, the valley saw unprecedented forest clearances. In June 2020, the Jammu & Kashmir Forest Department became a government-owned corporation, allowing it to sell public forest land to private entities, including to Indian corporations. The rush to secure and extract Kashmir's resources has typically come at an immense cost to the region's vulnerable ecology, prompting local activists' fears that a lack of accountability will almost certainly exacerbate the climate crisis in South Asia. Just as Israel has secured control over Palestinian resources, India's stranglehold of Kashmir's natural resources and interference with the environment will ultimately make Kashmiris dependent on the Indian state for their livelihoods.

All of these shifts in land use reflect the "Srinagar Master Plan 2035," which "proposes creating formal and informal housing colonies through town planning schemes as well as in Special Investment Corridors," primarily for the use of Indian settlers and outside investors. Indeed, the Indian government has signed a series of MOU's with outside investors to alter the nature of the state by building multiplexes, educational institutions, film production centers, tourist infrastructure, Hindu religious sites, and medical industries. Kashmiri investors are no competition for massive Indian and external corporations and have a fundamental disadvantage in investing in land banks that the government has apportioned toward these purposes. Back to back lockdowns have resulted in massive economic losses for Kashmir's industries, including tourism, handicrafts, horticulture, IT, and e-commerce. Furthermore, "as with other colonial powers, Indian officials are participating in international investment summits parroting Kashmir as a 'Land of Opportunity', setting off a scramble for Kashmir's resources, which will cause further environmental destruction." India has always kept a close eye on Kashmir's water resources and its capabilities to generate electricity, while intentionally depriving Kashmir of the electricity it produces.

As more economic and employment opportunities are opened up to Indian domiciles, Kashmiris will also be deprived of what little job security they had. In sum, "neoliberal policies come together with settler colonial ambitions under continued reference to private players, industrialization and development, with the 'steady flow of wealth outwards.'"

Azad Essa, Hostile Homelands: The New Alliance Between India and Israel

27 notes

·

View notes

Text

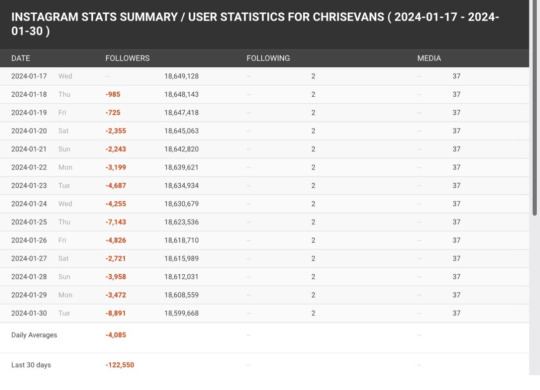

CHRIS’ BRAND IS IN CRISIS

A steady and constant decline…

Since he came back to social media to sell dog food for the back Friday (a very tactless error in my opinion), Chris has been hemorrhaging followers on Instagram. At this point, he has lost more 500,000 followers. And it keeps going down. I have already written a post about my thoughts regarding those numbers. Here is a link if anyone is interested in checking it out.

Here is the latest chart showing his numbers of followers…

We can still observe the same trends, his drop is constant and steady but more interestingly his loss of followers was even steeper on January 25th and today. And this is rather concerning for him and his team because the 25th was the day his next movie project was announced. And we know yesterday and today were all about the ASP stunts in DC. And he even got press coverage for it and a nice little article from one of his sponsors: People’s Magazine.

I have speculated that his team probably didn't buy any bots or not as many as usual when the Coen movie was announced, because they likely wanted to monitor if that news would bring him any natural follows. I suspect the movie announcement didn't bring him any or very few. Or it might have even cost him some real follows. Who knows?

We see the exact same trend today after yesterday’s stunt in DC. It’s actually even a little worse. So we can deduce that his acting career is not helping him at the moment, his brand as a political activist isn’t helping him either. And let’s not even mention his shenanigans with his kinda “wife”. To sum things up, his brand is in crisis.

His “political activism” is starting to become offensive…

I already wrote an article that mentioned his performative activism. If people want to check it out.

Real or not, Chris has attached himself to a trolling fat-shaming, racist, antisemitic, Nazi sympathizing clout-chaser. And the optics are absolutely horrifying. Here are some of the receipts provided by Anni's Little Shop of Horrors

So his political activism looks not only hypocritical and performative now, it also appears as a rather infuriating provocation. This ASP stunt was very ill-conceived. I am not sure it was his decision to do so. Maybe the investors demanded he did more with the company. But the end result is disastrous all the same.

He and his team should have read the room after the horrible comments he got after that infamous ASP chat about racism and antisemitism. That was his clue to stay away from any kind of political involvement for the time being. But he and his team have doubled down. Like they have done so with the shitshow with Abba since the very beginning. They have managed to alienate so many fans and they continue to do so. It’s not stubbornness at this point, it’s the exact definition of insanity: doing the same things and expecting different results.

Time for a new brand and a reinvention…

I wrote and I still think Chris is going to be just fine. But his past brand has been really damaged and his rebrand isn't working out so resorting to old tactics and tricks is unlikely to help him regain the fans he lost or to make him gain any new ones.

Interesting enough, he or his team have just cleaned his Instagram once more. And now apart from an ASP promo and one R1 still, it's all about Dodger. The focus on his Dog dad persona might not prove more efficient in regaining his fans though. They have used that poor dog way too much in those shenanigans with Abba, and they have let her use him as well.

I don’t think Christopher’s haven would provide much help at the moment because he already burnt that bridge. And Marvel being a sinking ship at the moment, I am not sure that even his alter ego Captain America could help him. So it’s probably time for a change. The real kind!

Gandhi famously said:

"We but mirror the world. All the tendencies present in the outer world are to be found in the world of our body. If we could change ourselves, the tendencies in the world would also change. As a man changes his own nature, so does the attitude of the world change towards him. This is the divine mystery supreme. A wonderful thing it is and the source of our happiness. We need not wait to see what others do.”

69 notes

·

View notes