#Finance and Accounting Transformation

Explore tagged Tumblr posts

Text

Ethical Considerations in Finance and Accounting Transformation

Ethical considerations are a cornerstone for responsible and sustainable operations in the ever-changing world of finance and accounting transformation. As firms adopt digital innovations and technical developments to speed up financial procedures, the ethical implications of these revolutionary shifts become critical.

One important ethical aspect is data privacy and security. With the rising reliance on cloud-based solutions and data analytics, it is critical to ensure the confidentiality and integrity of financial information. Finance professionals must implement effective cybersecurity safeguards to protect sensitive data from unauthorized access or breaches, while also preserving stakeholder trust and complying to legal compliance rules.

Transparency in financial reporting is another important ethical consideration. As firms use modern technology for real-time reporting and analytics, financial data quality becomes critical to retaining trust. Businesses must provide clear and thorough insights into their financial performance to stakeholders in order to create trust and confidence in the decision-making process, according to ethical financial practices.

The application of artificial intelligence (AI) and machine learning raises ethical concerns about bias and fairness. To avoid discriminatory outcomes, finance and accounting algorithms must be built and managed. Striking a balance between automation and ethical decision-making guarantees that technology improves rather than distracts from fairness in financial operations.

In addition, finance and accounting professionals must evaluate the employment implications of transformation activities. As automation and robotics streamline common operations, there is a need for the workforce to be reskilled and upskilled. Ethical duty entails sensitively managing this shift, ensuring that employees are prepared with the skills required in the growing landscape, and that the transformation contributes positively to the workforce's overall well-being.

Lastly, ethical concerns are critical to the success of finance and accounting transformation programs. Organizations that seek for openness, data security, fairness, and responsible workforce management not only achieve operational efficiency but also uphold their commitment to ethical business practices. Adopting a finance and accounting transformation service can provide essential direction in integrating technical breakthroughs with ethical norms, ensuring a responsible and sustainable financial future as the finance industry navigates these ethical considerations.

0 notes

Text

Key Drivers of Finance and Accounting Transformation in Modern Businesses

Finance and accounting transformation has moved from being a strategic choice to an essential requirement in the fast-paced world of modern company. This change is being driven by a dynamic combination of changing regulatory environments, technological improvements, and the need for a competitive advantage.

The rapid development of technology is one of the main forces behind the revolution of accounting and finance. The way businesses manage financial data is being revolutionized by automation, artificial intelligence, and data analytics. These technologies enable businesses to simplify financial procedures, lower the possibility of human error, and make data-driven decisions. Efficient technology utilization greatly improves the accuracy and timeliness of financial reporting and analysis.

The constantly changing regulatory environment is another important factor. Businesses are adopting finance and accounting transformation services that guarantee consistency with the most recent standards and laws as a result of the increasingly complex and demanding compliance requirements. Businesses are facing a growing obligation to comply with complicated reporting requirements and give shareholders and government agencies clear financial information.

Furthermore, the drive for competitive advantage promotes the demand for transformation in accounting and finance. Organizations that effectively execute these modifications attain a competitive advantage through increased adaptability, expedited decision-making skills, and enhanced strategic understanding. Organizations may now more quickly take advantage of growth opportunities, respond to client needs, and adjust to changes in the market.

Service providers that specialize in finance and accounting transformation are essential in assisting companies in leveraging these drivers. They provide the knowledge, tools, and tactics required to successfully negotiate the complex financial environment of today's commercial world. These services are the essential operators that allow organizations to succeed in a world where change is the only constant.

0 notes

Text

Am new here❤️

#igbtq#igbtq community#asexual#transgender#ace#ace pride#acespec#transformers#transgirl#transisbeautiful#big round butt#success#marketing#accounting#finance#intersex

19 notes

·

View notes

Text

trying to avoid rb-ing the other post on ao3's finances and why you shouldn't donate to them, except when i get mutual aid requests to share, but omg y'all i found something even funnier just now:

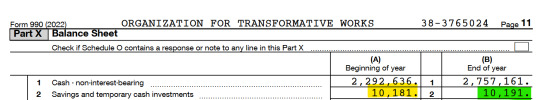

you know how otw is only earning miniscule amounts of interest even though they have an almost $2.8 million USD surplus, because they only have about $10k of that surplus in an interest-bearing account? well, i just realized that in 2022 (the most recent year we have their tax documents for), they did in fact transfer some more money into that interest-bearing account, but they only transferred...ten dollars

YOU CAN'T MAKE THIS SHIT UP

[ID: Screenshot of the top of page 11 of the 2022 Form 90 for the Organization for Transformative Works. The key information is the amount that they have in non-interest-bearing accounts, which was $2,292,636 at the beginning of 2022 and $2,757,161 at the end of the year; and their savings and temporary cash investments, which was $10,181 at the beginning of 2022 and $10,191 at the end of the year. /end ID]

#otw finances#ao3#otw#archive of our own#organization for transformative works#iirc at one point in their history they were keeping most of their money in paypal accounts...........#so yeah it's always been this bad#they've literally been talking for YEARS about investing more of it and i think at one point had a volunteer working on it or something?#but no results apparently. they are so fucking bad at this#id in alt text#id included

5 notes

·

View notes

Text

Boosting Efficiency in Annual Planning Through Outsourced FP&A

In a fast-evolving market, businesses need to stay agile to adapt to changing conditions. Finance and accounting outsourcing is a strategic enabler that strengthens business agility through more responsive and dynamic Financial Planning and Analysis (FP&A).

Outsourced finance partners support agile planning by providing timely insights and flexible reporting structures. This allows businesses to quickly adjust budgets, forecasts, and financial strategies in response to market trends or internal shifts.

A responsive finance function is crucial to ensure decisions are based on accurate, real-time data. Outsourced teams enhance this capability by leveraging advanced tools and experienced personnel, reducing lag time in financial reporting and analysis.

With better scenario planning, companies can test multiple business outcomes and prepare for best-case or worst-case scenarios. Outsourced FP&A services facilitate these models by using sophisticated financial techniques and tools.

One of the major benefits is improved financial agility—the ability to make quick, data-driven decisions that can pivot operations toward new goals. Outsourced FP&A teams deliver that edge by maintaining proactive financial oversight.

Ultimately, finance and accounting outsourcing empowers businesses to become more nimble and future-ready. By improving access to key data and analytical insight, it equips leadership teams to respond effectively and confidently to change.

#finance and accounting outsourcing#annual planning#FP&A cycle#process optimization#finance transformation

0 notes

Text

Business consultants play a crucial role in helping investment banks transition smoothly through this transformative journey. Their strategic guidance, innovation identification, and implementation of digital solutions have become key to driving digital change.

Strategic Guidance: When investment banks consider overhauling their business models, consultants provide valuable inputs. They help banks evaluate emerging technologies like AI, Blockchain, and Big Data and guide them on which tech stack will best suit their specific needs.

Innovation Identification: Consultants identify opportunities for innovation that banks can leverage. They study new technology trends, analyze the competitive landscape, and perform customer analysis to suggest where digital innovation can be beneficial.

Digital Solution Implementation: After strategizing, consultants assist banks with the implementation of the selected digital solutions. They ensure seamless integration of new technologies with existing systems, minimizing disruption to ongoing operations.

#innovation#Digital Transformation#california#advanced analytics#investment banking#data strategy#san jose california#accounting#business growth#california news#Investment Banking#small business consulting services#business consulting#entreprenuership#business#business analysis#business intelligence consultancy#businessdevelopment#businessstrategy#marketing#finance#businessowner#consultants#san jose state#consultancy#smallbusinessowner#business consultant#investment#womeninbusiness#business analytics

0 notes

Text

What is a Financial Coach, and What do They do Exactly?

Discover the multifaceted role of a financial coach and how they serve as invaluable guides on the path to financial stability and prosperity. Explore the diverse services they offer and the transformative impact they can have on your financial well-being.

#Financial coach#Personal finance guidance#Budgeting assistance#Debt management strategies#Wealth building techniques#Financial education#Investment planning#Retirement preparedness#Financial empowerment#Money mindset transformation#Financial goal setting#Financial literacy#Financial wellness support#Savings tactics#Accountability in finances#Money management skills enhancement#Financial independence coaching#Comprehensive financial planning#Benefits of financial coaching#Gateway of Healing#dr.chandnitugnait

0 notes

Text

"The existence and consumption of coffee has many advantages in human society, but perhaps the lesser reported advantage is what it can offer the environment.

There is arguably no other monocrop so capable of thriving in an intact, natural ecosystem, and in Ethiopia, where coffee is a major export, the adoption of climate-compatible and conservation strategies among coffee growers recently proved a major success, with over 5,000 acres of land reforested, 45% increases in household income, and a 70% increase in exported coffee.

Coffee is a major lifeblood of Ethiopia’s economy (we’re talking about a quarter of the whole), accounting for around half of the livelihood of 15 million people, 95% of whom are small landholding growers.

In the ecologically critical Ilu Ababor Zone of nation’s western region of Oromia, where Coffea arabica is native, Farm Africa led a project on sustainable agriculture among coffee growers inside 19 local forest management cooperatives totaling around 4,000 people between 2021 and 2024.

The results were better than a hot cup of coffee on a cold early morning, as the residents took to the skills, incentives, and even stakeholder meetings with great interest and dedication according to a report on the project entitled Coffee for Conservation.

Of the project aims regarding forest management and conservation, the objective was to instruct the landholders and growers in ways to get everything they needed from their forest homes without felling too many native trees.

For example, locals were shown how to cultivate fast-growing trees optimal for firewood in small plots, as well as methods on how to maximize the growth cycle of these fuel trees. Six tree nurseries were opened and staffed by around 60 people taught to sell seedlings for reforestation of native woodland in the area.

By the end of the project, over 300,000 seedlings had been planted over 5,000 acres of forest, and they enjoyed a five-year survival rate of 85%. Climate-smart practices such as cultivating bamboo for making the mats on which the coffee beans are dried, removed the need to truck in bamboo from other regions, while 66% of homes were able to be convinced to switch to energy-efficient wood stoves to reduce fuel consumption.

Most of the landholders growing coffee or managing the forest had plots for vegetable and fruit production to feed their families and those of their communities through trade. Percentages of these Ethiopians who adopted climate-smart farming techniques increased from 49% to 76%, while 10% more began growing fruit and vegetables. Income generated from the increased production amounted to around 280% more than what was made before the project, adjusted for inflation.

Coffee production, marketing, and returns, have all improved. 73% more coffee from the Ilu Ababor region is now export-quality than in 2021, and 44% meets the standards for specialty grade, which is up by 20% from 2021.

Connections with national financing intuitions have allowed some of the co-ops to buy proper equipment for drying and storage, as well as support by city marketing agencies who could work directly on behalf of the Ilu Ababor growers to carve out a space in the national and international markets.

“Prior to the project, our limited knowledge meant we had to sell our coffee to local traders at lower prices,” said Abde Musa, a member of the Abdi Bori forest management cooperative. “Now we’ve taken control and are the ones negotiating and determining the coffee prices.”

Co-op leaders received training in business management, quality control, and certification processes, which majorly improved their incomes. One of the 19 co-ops in particular grossed $58,500 on their coffee sales.

Project wide, incomes and access to financial services almost doubled, with the latter now reaching almost 100% of the community.

Lastly, deforestation plummeted in the area to just 0.08 acres a year.

There’s so much good news to read in the report on the project’s success beyond the headline data, like the Abdi Bori co-op’s incredible rise which saw coffee revenue increase by a multiple of 20 from 2018 to 2023, or Solomon Mekonnen’s story of turning his land into a forest farm that produces export-grade coffee, firewood, and organic honey, or the tremendous involvement of women at all levels of the education and participation.

It’s a document that captures the very real phenomenon that African problems are best solved with African solutions."

-via Good News Network, May 17, 2025

#ethiopia#africa#coffee#agriculture#agroforestry#sustainable agriculture#co op#deforestation#reforestation#fair trade#small farmers#farmers#climate adaptation#climate action#good news#hope

2K notes

·

View notes

Text

AuxDrive: Transforming Business Operations in the Digital Age

Unlocking Efficiency: How AuxDrive is Revolutionizing Business Operations

In a world driven by digital transformation, businesses must embrace tools and technologies that streamline operations, enhance productivity, and ensure success in the competitive market. AuxDrive is leading the charge in this revolution, providing a comprehensive solution that empowers businesses to unlock efficiency and drive growth in the digital age.

The Digital Revolution

The business landscape is undergoing a digital revolution. Traditional models are being reshaped by technology, and companies must adapt or risk becoming obsolete. This transformation isn't limited to large corporations; even small and medium-sized enterprises are harnessing the power of digital tools to stay competitive and relevant.

The Need for Efficiency

In this fast-paced digital landscape, efficiency is no longer a choice but a necessity. Manual and time-consuming processes can hinder progress and lead to increased operational costs. Businesses need solutions that can automate tasks, reduce errors, and provide real-time insights to drive data-driven decisions.

The AuxDrive Advantage

AuxDrive understands the challenges of modern businesses and offers an innovative solution to address them. By combining automation, data analytics, and user-friendly interfaces, AuxDrive streamlines operations, enhances productivity, and empowers businesses to thrive in the digital age.

Efficiency Through Automation

AuxDrive eliminates repetitive and manual tasks that consume valuable time and resources. Whether it's data entry, document processing, or communication with customers, AuxDrive automates these processes, reducing the risk of errors and allowing employees to focus on high-value tasks.

Data-Driven Decisions

In the digital age, data is king. Businesses that can access and analyze data effectively have a significant competitive advantage. AuxDrive offers customizable dashboards that provide real-time insights into operations. From tracking key performance metrics to identifying bottlenecks, businesses can make informed decisions promptly.

Scalability and Adaptability

In a rapidly changing business environment, scalability is essential. AuxDrive is designed to grow with your business. As your operational needs expand, AuxDrive can accommodate increased demands without disruption, ensuring a seamless transition as your organization evolves.

A User-Friendly Experience

AuxDrive prioritizes user experience. The platform is designed to be intuitive, ensuring that employees, regardless of their technical backgrounds, can navigate the system with ease. This user-friendly approach makes AuxDrive accessible and valuable to a wide range of users within your organization.

Unlocking the Future

The digital age is full of opportunities and challenges. While embracing digital tools can revolutionize your business, it's essential to address concerns like data security, infrastructure changes, and staff training. AuxDrive understands these challenges and provides the necessary support to ensure a smooth transition into the digital age.

Conclusion: Thriving in the Digital Age

In the digital age, businesses that embrace efficiency, automation, and data-driven decision-making will thrive. AuxDrive offers a powerful solution that combines these elements, empowering businesses to transform their operations and secure a competitive edge in the digital era.

Ready to Thrive in the Digital Age?

If your business is ready to unlock efficiency, streamline operations, and make data-driven decisions, AuxDrive is the ideal partner for your digital transformation journey. Contact us today to explore how AuxDrive can revolutionize your business operations in the digital age. Visit Auxdrive.net for more information and start your journey towards a more efficient and prosperous future.

#business#fintech#business strategy#payment systems#payment services#payment solutions#merchant services#finance#high risk merchant account#customerexperience#workflow#automated workflows#workflow automation#automation#efficiency#growth#productivityboost#transformation

0 notes

Text

The Evolution of Financial Technology: How CAs Are Embracing the Digital Age

The Evolution of Financial Technology: How CAs Are Embracing the Digital Age

Introduction

In an era characterized by rapid technological advancements, the field of finance is undergoing a transformative journey. The emergence of financial technology, or fintech, is reshaping the way businesses manage their finances, and Chartered Accountants (CAs) are at the forefront of this evolution.

In this blog post, we'll explore how CAs are embracing fintech and leveraging its potential to enhance financial management, analysis, and advisory services.

1. Fintech's Impact on Financial Services

Fintech encompasses a wide range of technologies that leverage data analytics, artificial intelligence, blockchain, and automation to improve financial services. For CAs, this means new tools to streamline processes, enhance decision-making, and offer innovative solutions to clients.

2. Automation of Routine Tasks

CAs are increasingly using automation tools to handle repetitive tasks such as data entry, reconciliations, and transaction processing. This not only reduces the risk of human error but also frees up CAs to focus on higher-value tasks like strategic planning and analysis.

3. Advanced Data Analytics

Data analytics tools enable CAs to extract meaningful insights from large volumes of financial data. These insights can help businesses identify trends, anticipate risks, and make informed decisions to drive growth.

4. Real-Time Financial Reporting

Fintech enables CAs to provide clients with real-time financial reporting, giving businesses immediate access to critical information. This enhances transparency and empowers business owners to respond quickly to changing market conditions.

5. Enhancing Audit Efficiency

Fintech tools are revolutionizing the audit process. CAs can use AI-powered algorithms to analyze vast amounts of data, detect anomalies, and identify potential instances of fraud more efficiently.

6. Personalized Financial Planning

CAs can leverage fintech to offer personalized financial planning services. With access to detailed financial data, CAs can create tailored strategies that align with a client's unique goals and circumstances.

7. Strengthening Cybersecurity

As businesses become more reliant on digital tools, cybersecurity becomes paramount. CAs are playing a critical role in advising clients on cybersecurity measures to protect sensitive financial information.

8. Virtual CFO Services

Fintech enables CAs to offer virtual CFO services to startups and small businesses. Through digital platforms, CAs can provide expert financial advice and guidance remotely, making their expertise accessible to a wider range of clients.

9. Embracing Blockchain Technology

Blockchain's potential for secure and transparent record-keeping is of interest to CAs. They can explore applications in supply chain finance, smart contracts, and even audit trail verification.

10. Continuous Learning in Fintech

CAs recognize the importance of staying updated with fintech trends. Many are investing in continuous learning to master the use of new tools and technologies that can optimize their services.

Conclusion

The integration of fintech into the realm of finance is reshaping the landscape in profound ways. CAs are embracing these technologies to elevate their roles from traditional number-crunchers to strategic advisors, equipped with tools that enhance efficiency, accuracy, and insight. As fintech continues to evolve, CAs will remain pivotal in guiding businesses through the ever-changing financial landscape, leveraging technology to drive growth, innovation, and success. Find the top verified CA in your City

Feel free to let me know if you'd like more blogs on different topics or if you have specific requirements for the content.

#Fintech Evolution#Chartered Accountants and Technology#Digital Transformation in Finance#Automation in Financial Services#Data Analytics in Accounting#Blockchain Applications in Finance#Financial Advisory in the Digital Age#Find CA in Pune#FInd CA in Your City#CA near me#CA in Pune#Expenect#Verified CA#Best CA in Pune#CA in Kharadi#CA in Chinchwad

1 note

·

View note

Text

🔒8th Lord Through the Houses 🤐

Note: These are all my personal observations and patterns I've noticed over the years. Take what resonates with you more and leave the rest. Lemme know in the comments if it hits home!

8th lord in 1st - THE APOCALYPSE SURVIVORS - Their survival instincts are higher than Burj Khalifa. In some cases, these natives can undergo a physical transformation either through plastic surgery, liposuction, or major surgeries due to accidents/ diseases. They can keep their identity a secret and prefer not to share things about themselves. Good placement for pursuing a career as a detective or in intelligence services. In rare cases, physical deformity. Can be irreligious/ agnostic/ atheist. Spouse would defend and help them overcome obstacles in life.

8th lord in 2nd - THE FRANK-EINSTEIN - Can have dental problems or weak dental health. Can't keep others' secrets. Can have thyroid issues in some cases. 8th lord rules in-laws and spouse's resources. After marriage, both of you could share your bank accounts and properties. Not just that, you can get sudden gains from others when you least expect it. Rags to riches. Hidden source of income. Ex: Sugar baby, startup founder, multiple sources of income, etc.

8th lord in 3rd - THE SCREAM QUEEN/KING - Can expose others' secrets to friends/ neighbors and be distant from siblings. Might gossip about their sibling or neighbors, or just anyone they know personally. A troubled relationship with the spouse's family, and they might be living in the same city as you. Spouse's family can have messy or dirty little secrets.

8th lord in 4th - ROSEMARY'S RELATIVES - Father can have health issues. In some cases, a troubled relationship with the father. In-laws can be nagging and could interfere with the native's marital life. Sexual satisfaction. Can move away due to issues with in-laws. Big changes affecting the native's mother psychologically.

8th lord in 5th - THE SAW SURVIVORS - Objectified/ sexualized by their peers or colleagues. In some cases, an unplanned pregnancy or STDs. Love life can feel like a storm sometimes. Prone to attract red flags. Can wait to have kids. In some cases, one child is enough for them, or they can be child-free. Speaks cryptically. Share their secretive knowledge with others. Childhood trauma - physical/ sexual abuse is possible, in some cases.

8th lord in 6th - THE OVERTIME OVERLORDS - These natives can be interested in astronomy. They can pursue a career, banking and finance, occultist, mortician, astronomy, medicine, academic research, law enforcement, etc. Might love to look at the planets through a telescope. Wonders what's beyond our solar system. Unorthodox path.

8th lord in 7th - THE CABIN CREW - In-laws can be irritating/ dominating. These natives would share their secrets with their spouse, which can be used as a weapon against them over time. They should be careful of what they're sharing with their spouse. Sexual life involves kinks and such. If married young, it can end in a messy divorce. In love life, prone to attract partners who become crazy exes after a breakup.

8th lord in 8th - THE DRACULA'S MINION - Spouse can be wealthier than the native. Spouse would spend money on whatever these natives ask, or even if they didn't ask, the spouse would buy expensive things for them as a gift. Close relationship with in-laws/spouse's family. Reads people with their X-ray vision. Carry their deepest secrets to the grave. Spouse's ancestry could be a mystery or discovered late in life, can have mixed ancestry too. After marriage, these natives would live like a king/ queen. Longevity for the spouse's life span.

8th lord in 9th - THE SHADOWBORN - Spouse either lives too close to you or too far away. Can feel lost in life, religion or spirituality at some point, all at once. Would meet their well-wisher or a spiritual guide in their late 20s or early 30s. The spouse might help them regain control of their life. Spouse would be their backbone and stick through thick and thin.

8th lord in 10th - THE PHANTOM FACT FINDER - Mixed reputation in society. People would reveal their true colors within weeks of meeting these natives. People or friends just disappear when these natives really need someone to help them. Professions related to agriculture, geology, environmental studies in general, medicine, ER doctor, hospice, etc, would suit these natives. These natives love to uncover hidden truths, conspiracies and can even become a whistleblower.

8th lord in 11th - THE SPINE CHILLER - Trust issues in friendships/ social circle. Their small mistake or a little secret can be twisted and taken out of context by others and can destroy their social life. Prone to attract stalkers or people who dig deep into the native's life to gain something. Friends either transform or destroy them.

8th lord in 12th house - THE GRIM REAPER - Can experience OBEs. Spend a lot of their alone time on spirituality and learning about death, about the universe, reincarnation, different religious scriptures, etc. Can marry a foreigner or live abroad after marriage. Know what others think of them, intuitively. Spirit guides can visit them through dreams. Can dream of loved ones' death long before it happens. Carry their secret to the grave or pass on their knowledge through writing. Connects well with older people and foreigners.

Note: I've given a name to each position. Let me know if you like this approach. If so, I'll continue using named positions from now on.

✨🔍Wanna dive deeper into your chart's layers? 🌙💬 Check out my pinned post for pricing and more info 💫💸

#astro notes#spirituality#spiritual awakening#birth chart#astro observations#spiritual journey#astrology readings#zodiac signs#astrology#vedic astrology#western astrology#astro blog#astro tumblr#astro community#astro posts#astrologer#astrology signs#astrology observations#astrology community#astrology notes#astrology blog#chart analysis#chart ruler#chart reading#astro placements#natal placements#8th house

763 notes

·

View notes

Text

SUN IN THE SOLAR RETURN CHART:

THIS YEAR MY LIFE IS REVOLVING Around....

Guess what?.. I just realized I never made a post on this 🤦. Ok let's go on:

Every other planet revolves around the sun and where your sun is placed in your solar return chart shows what themes are taking center place for the year. In an unfiltered way, I mean what will your life revolve around in that particular year.

SUN IN SR CHART 1st house

This year, your life revolves around

📦"you"

📦 Around refining your personality,

📦 Around your growth.

📦 Living your life to the fullest,

📦 shining,

📦making "you" your priority.

SUN IN SR CHART 2nd house

This year, your life probably revolves around

📦 Stability and finances.

📦Getting your sh*t together financially.

📦 Spending

📦 Saving

📦 Spoiling yourself.

📦Weight gain

📦Food😂

SUN IN SR CHART 3rd house

This year, your life probably revolves around

📦Short journeys,

📦 Learning or teaching,

📦Education, information related stuff, writing

📦Maybe siblings.

📦 Multitasking.

📦 School life

SUN IN SR CHART 4th house.

This year, your life probably revolves around

📦Emotional security and balance

📦 Home life and parents.

📦 Housing related activities such as moving, building a house.

📦 Family.

📦 Home retreat.

📦Alone time.

📦 Caring for your home

SUN IN SR CHART 5th house.

This year, your life probably revolves around

📦Entertainment and fun.

📦Seeking every possible way to be happy.

📦 Your child, as there's a high possibility you might be come a parent. If you already have one then this is your sign to focus on them.

📦 Educational activities (likely to be short term)

📦Being in the spotlight and always noticed by others.

©Victoryai

SUN IN SR CHART 6th house.

This year your life probably revolves around

📦Day to day activities.

📦Routine

📦Monotony

📦Stress

📦 Organization and comportment.

📦 Healthy living

📦 Conflict.

📦Health concerns

SUN IN SR CHART 7th house.

This year your life probably revolves around

📦 Relationships

📦 People

📦 Partnerships

📦Love

📦Compromise

📦 Spouse 🤷

📦Attractiveness

SUN IN SR CHART 8th house.

This year,your life probably revolves around

📦 Transformation

📦 Inheritance

📦 Valuables of others.

📦 What you share with another, property, money, joint accounts.

📦 Intense sh*t

📦Intimacy.

📦 Reaping what you did not sow

SUN IN SR CHART 9th house.

This year, your life probably revolves around

📦 Education

📦 College or university life.

📦Long Journeys

📦 Religion

📦Faith and Optimism

📦 Knowledge

📦Travel

📦 Mentors

SUN IN SR CHART 10th house

This year, your life probably revolves around

📦 Responsibilities

📦Career/job

📦 Work-life balance

📦 Promotion

📦 Authority

📦Fame and popularity

📦 Public attention.

SUN IN SR CHART 11th house

This year your life probably revolves around

📦 Networking

📦 Certain communities

📦Radical ideas 💡

📦 Innovative and Unique thinking

📦Friends/friend group.

📦 Internet

📦 Social media interactions.

📦Online presence.

SUN IN SR CHART 12th house

This year your life probably revolves around

📦 Isolation

📦Peace of mind

📦Dreams

📦Sleep

📦 Depression 💔

📦 Spirituality.

📦Other realms and forces

📦 Addiction

📦Confusion

📦 Letting go 🌬️

©victoryai

#astrology#astrology observations#astro observations#solar return#lunar return#solar return observations#ascendant in solar return chart#astrology community#astro community#©victoryai

537 notes

·

View notes

Text

The Role of Technology in Modern Finance and Accounting Transformation

The world of finance and accounting has significantly changed recently, largely due to technological improvements. The management of financial processes, strategic decision-making, and compliance are all being transformed by modern finance and accounting. In this article, we'll look at technology's crucial contribution to this transition and its wide-ranging effects.

Automation of Repetitive Tasks: By automating routine and rule-based processes, technology, and notably robotic process automation (RPA), has changed the finance and accounting industry. Software robots may now quickly and accurately complete time-consuming and error-prone tasks including data entry, invoice processing, and reconciliation. This increases efficiency and frees up finance specialists to concentrate on more critical tasks.

2. Advanced Data Analytics: Large-scale financial data availability has resulted in data analytics tools and methods that assist firms in gaining insightful information. Data analytics is a tool used by modern finance and accounting teams to identify patterns, trends, and anomalies. For example, predictive analytics can predict future financial trends and help with proactive planning.

3. Cloud-Based Solutions: How financial data is stored and accessed has changed as a result of cloud computing. Real-time access to financial data is made possible by cloud-based financial management systems, which also increase flexibility and encourage collaboration among remote personnel. They also provide scalability, making it possible for firms to adjust to changing customer needs.

4. Blockchain for Transparency and Security: Blockchain technology is being used more and more in financial transactions to increase transparency and security. The risk of fraud is decreased, and the accuracy of financial records is ensured by creating a tamper-proof ledger of financial transactions. The decentralized structure of blockchain also makes auditing procedures simpler.

5. Streamlined Reporting: With the use of technology, contemporary financial reporting has grown more efficient and adaptable. Financial experts may create tailored reports and dashboards that offer current financial health insights for a firm, supporting more agile decision-making.

6. Cybersecurity: Cybersecurity has grown crucial in finance and accounting as a result of the growing reliance on technology. Through encryption and multi-factor authentication, technology not only improves security but also makes it easier to quickly identify and counter cyberthreats.

Conclusion:

It is impossible to underestimate the impact of technology on the modernization of accounting and finance. Efficiency, accuracy, and the ability to make decisions have all significantly improved. Organizations can modernize their finance and accounting functions, lower costs, boost compliance, and position themselves for success in an increasingly digital world by automating repetitive tasks, leveraging data analytics, adopting cloud solutions, and utilizing emerging technologies like blockchain and AI.

0 notes

Text

🛸🖤Midheaven in the signs🖤🛸

❗️All the observations in this post are based on personal experience and research, it's completely fine if it doesn't resonate with everyone❗️

✨️Paid Services ✨️ (Natal charts and tarot readings) Open!

🫧Join my Patreon for exclusive content!🫧

🛸If you like my work you can support me through Ko-fi. Thank you!🛸

🖤Masterlist🖤

🛸Midheaven in Aries: Self-confidence and extroversion are their main tools; self-sufficient, they seek to prove themselves at all levels. Professional careers that involve movement, individual action and proving their leadership abilities are favorable to them.

🛸Midheaven in Taurus: Their perseverance and determination help them achieve their goals. They take into account their gifts, resources and abilities and how to exploit them. Professional careers that allow them to manifest beauty and practicality are favorable to them, such as agriculture, sculpture, architecture, agronomy, painting and finance.

🛸Midheaven in Gemini: Great communication skills. Flexible, analytical, receptive, agile, versatile, adaptable, with great observational capacity, they can carry out several tasks at once without problems. Professional careers linked to the processes of communication and contact with society are favorable to them, such as journalism, commerce, diplomacy and education.

🛸Midheaven in Cancer: Planners and protectors; Individualistic, sensitive, firm and intuitive. Another point to keep in mind is to practice fluidity in your daily life. Professional careers that help channel assistance to others are favorable for you, such as psychology, gynecology, cooking and psychotherapy.

🛸Midheaven in Leo: You pursue success relentlessly, and sometimes you do not allow yourself to enjoy it. You have clear objectives and the perseverance and tenacity necessary to achieve them. Noble, generous, motivating, trustworthy, with leadership skills; you must learn to control arrogance. Professional careers with great autonomy are favorable for you, such as political positions, business management and dramaturgy.

🛸Midheaven in Virgo: You maintain a constant and methodical effort to achieve your objectives; critical, detail-oriented, positive, organized, innovative and with a great willingness to learn. You must avoid neuroses and the accumulation of objects. Professional careers oriented towards collaboration and with an appreciation of details, such as mechanics, languages, nutrition and crafts, are favorable for you.

🛸Midheaven in Libra: They plan and execute their strategy calmly, taking care of the details and feasibility. They are sociable, adaptable and diplomatic, and they like harmony. Professional careers that offer variety and where they can comfortably develop their sense of justice and balance are favorable to them. A classic example is the study of law, diplomacy, public relations and the arts.

🛸Midheaven in Scorpio: They have a tendency to manipulate others to achieve their interests. Ambitious, determined, direct, brave, skillful and capable of facing difficult transformation processes. Professional careers that privilege research and strategy are favorable to them, such as psychoanalyst, psychiatrist, private investigator, chemist and anthropologist.

🛸Midheaven in Sagittarius: They are constantly moving. Intuitive, open, creative, with strong convictions and ideals. They are favourable to professional careers that work directly by appealing to the philosophy of life of individuals, such as religion, philosophy, or spiritual guidance. They also excel in astronomy, ecology and sports.

🛸Midheaven in Capricorn: Ambitious, practical, predictable and modest. Protective, efficient, serious, concentrated, focused, they can fall into nonconformity and obstinacy, in relation to the results they obtain. They are favourable to professional careers that require their knowledge of administration and organization, such as architecture, politics, administration of companies or public institutions, and geology.

🛸Midheaven in Aquarius: They wish to build a better world for everyone, but they feel the need to constantly test the scope of their knowledge. This position indicates a constant search for wisdom. Cooperators, avant-garde, they must cultivate the freedom of spirit to achieve the awakening of consciousness they long for. They are favourable to professional careers that promote the use of technologies and the mass dissemination of ideas, such as journalist, writer, community manager, publicist and others.

🛸Midheaven in Pisces: Patient, sensitive, simple and compassionate, they seek to understand the meaning of life, so they have philosophical and religious concerns, as well as a deep desire to live with simplicity. They must learn that spirituality is not a concept at odds with success. Professional careers related to the management and expression of feelings, such as the arts, psychology, research and public relations, are favorable to them.

#astrology#astrology moodboard#astrology placements#astro observations#astro blog#birth chart#astro notes#astrology observations#astro placements#placements#astro community#horoscope#zodiac#zodiac observations#astro com#astro seek#virgo#taurus#leo#scorpio#cancer#earth placements#water placements#air placements#fire placements#gemini#aries#sagittarius#midheaven#tarot reading

564 notes

·

View notes

Text

on ao3's current fundraiser

apparently it’s time for ao3’s biannual donation drive, which means it’s time for me to remind you all, that regardless of how much you love ao3, you shouldn’t donate to them because they HAVE TOO MUCH MONEY AND NO IDEA WHAT TO DO WITH IT.

we’ve known for years that ao3 – or, more specifically, the organization for transformative works (@transformativeworks on tumblr), or otw, who runs ao3 and other fandom projects – has a lot of money in their “reserves” that they had no plans for. but in 2023, @manogirl and i did some research on this, and now, after looking at their more recent financial statements, i’ve determined that at the beginning of 2024, they had almost $2.8 MILLION US DOLLARS IN SURPLUS.

our full post last year goes over the principles of how we determined this, even though the numbers are for 2023, but the key points still stand (with the updated numbers):

when we say “surplus”, we are not including money that they estimate they need to spend in 2024 for their regular expenses. just the extra that they have no plan for

yes, nonprofits do need to keep some money in reserves for emergencies; typically, nonprofits registered in the u.s. tend to keep enough to cover between six months and two years of their regular operating expenses (meaning, the rough amount they need each month to keep their services going). $2.8 million USD is enough to keep otw running for almost FIVE YEARS WITHOUT NEW DONATIONS

they always overshoot their fundraisers: as i’m posting this, they’ve already raised $104,751.62 USD from their current donation drive, which is over double what they’ve asked for! on day two of the fundraiser!!

no, we are not trying to claim they are embezzling this money or that it is a scam. we believe they are just super incompetent with their money. case in point: that surplus that they have? only earned them $146 USD in interest in 2022, because only about $10,000 USD of their money invested in an interest-bearing account. that’s the interest they earn off of MILLIONS. at the very least they should be using this extra money to generate new revenue – which would also help with their long-term financial security – but they can’t even do that

no, they do not need this money to use if they are sued. you can read more about this in the full post, but essentially, they get most of their legal services donated, and they have not, themselves, said this money is for that purpose

i'm not going to go through my process for determining the updated 2024 numbers because i want to get this post out quickly, and otw actually had not updated the sources i needed to get these numbers until the last couple days (seriously, i've been checking), but you can easily recreate the process that @manogirl and i outlined last year with these documents:

otw’s 2022 audited financial statement, to determine how much money they had at the end of 2022

otw’s 2024 budget spreadsheet, to determine their net income in 2023 and how much they transferred to and from reserves at the beginning of 2024

otw’s 2022 form 990 (also available on propublica), which is a tax document, and shows how much interest they earned in 2022 (search “interest” and you’ll find it in several places)

also, otw has not been accountable to answering questions about their surplus. typically, they hold a public meeting with their finance committee every year in september or october so people can ask questions directly to their treasurer and other committee members; as you can imagine, after doing this deep dive last summer, i was looking forward to getting some answers at that meeting!

but they cancelled that meeting in 2023, and instead asked people to write to the finance committee through their contact us form online. fun fact: i wrote a one-line message to the finance committee on may 11, 2023 through that form, when @manogirl and i were doing this research, asking them for clarification on how much they have in their reserves. i have still not received a response.

so yeah. please spend your money on people who actually need it, like on mutual aid requests! anyone who wants to share their mutual aid requests, please do so in the replies and i’ll share them out – i didn’t want to link directly to individual requests without permission in case this leads to anyone getting harassed, but i would love to share your requests. to start with, here's operation olive branch and their ongoing spreadsheet sharing palestinian folks who need money to escape genocide.

oh, and if you want to write to otw and tell them why you are not donating, i'm not sure it’ll get any results, but it can’t hurt lol. here's their contact us form – just don’t expect a response! ¯\_(ツ)_/¯

#ao3#otw#archive of our own#organization for transformative works#ao3 is not your savior#and they don't need your money#otw finances

3K notes

·

View notes

Text

Modernizing Finance: The Shift Toward Outsourced AP Services

As businesses strive to keep pace with the evolving financial landscape, accounts payable outsourcing has emerged as a powerful tool to streamline operations, enhance efficiency, and drive cost savings. With the increasing complexity of financial management, more companies are turning to outsourcing to stay competitive and future-proof their operations.

One of the driving factors behind the rise of AP automation is the need for faster and more accurate processes. Automation reduces manual errors, accelerates invoice approvals, and improves the overall efficiency of the accounts payable process. As businesses grow, automation ensures that AP tasks are scalable without sacrificing accuracy or speed.

Vendor payments management is another area where outsourcing shines. Companies can rely on specialized providers to ensure timely and accurate payments to vendors, minimizing the risk of disputes and strengthening supplier relationships. This reliability is crucial in an environment where businesses need to optimize their cash flow while maintaining strong partnerships.

Another reason accounts payable outsourcing is gaining popularity is its role in cost reduction. By eliminating the need to hire and maintain an in-house AP team, businesses can significantly reduce overhead costs. Outsourcing also allows companies to access advanced technologies and expertise without having to invest in expensive software or additional staff.

Furthermore, outsourced finance services offer scalability, which is essential for businesses planning to expand. As your business grows, outsourcing partners can quickly adapt to increased volumes, allowing you to focus on strategic initiatives rather than managing an expanding finance department.

In conclusion, accounts payable outsourcing is more than just a trend—it’s the future of finance. By embracing AP automation, improving vendor payments, reducing costs, and scaling with ease, companies are positioning themselves for long-term success.

#accounts payable outsourcing#digital finance transformation#AP trends#business outsourcing#future of work

0 notes