Text

Website: http://forex368.com/

Address: Limassol, Cyprus

Forex368 is a premier destination for forex signals, offering comprehensive market analysis and trading support. Specializing in real-time insights, forex368 is dedicated to empowering both novice and seasoned traders in the forex market. Their services include daily technical analysis, tailored mentorship, and ongoing educational resources, ensuring clients are well-equipped for informed trading decisions.

Facebook: https://www.facebook.com/groups/689339473352454

Twitter: https://twitter.com/forex368

Keywords: forex risk management currency trading tips forex trading mentor swing trading tips risk management tips forex mentor program smart risk management swing trading pro swing trading mastery market wizard insights market pulse pro signal mastery hub proven trading insights forex market mastery trade analysis pro fx education center market trends guide signal analysis pro advanced trading tips forex expert guidance technical analysis hub pro signal mastery expert trading mentorship risk free trading tips fx strategies pro trade insights hub market analysis pro trading mastery tips signal analysis guide pro trading solutions forex expert insights market trends tracker pro trading mentor insightful signal guide mastering forex trade educational trading hub fx strategy insights expert market trends scalping techniques pro risk guardian hub pips mastery tips trade prodigy guide trend mastery tips currency tips pro trade smart tips pro trading edge trading psychology hub mentor guidance pro fx webinars hub workshop trading pro forex seminar insights scalping wisdom hub market wizardry pro risk guardian tips pips mastery pro trade prodigy wisdom trend mastery guide trade expert tips risk free trading hub fx coaching tips insight mentor pro proven trading wisdom signal pro mastery smart risk mastery expert insights hub forex guru wisdom insight hub pro currency pro mastery trading coach wisdom trade smart mastery trade edge mastery trading psychology pro mentor guidance tips fx webinars mastery workshop trading wisdom forex seminar pro scalping tips hub market wizardry tips trend spotter pro trade pips mastery risk free trading wisdom trader wisdom hub trading wisdom tips chart mastery pro trend spotter tips trade pips pro risk free trader pro trading genius tips expert strategy hub fx wisdom mastery

#currency trading tips#forex trading mentor#swing trading tips#risk management tips#forex mentor program#smart risk management#swing trading pro#swing trading mastery#market wizard insights#market pulse pro#signal mastery hub#proven trading insights#forex market mastery#trade analysis pro#fx education center#market trends guide#signal analysis pro#advanced trading tips#forex expert guidance#technical analysis hub#pro signal mastery#expert trading mentorship#risk free trading tips#fx strategies pro#trade insights hub#market analysis pro#trading mastery tips#signal analysis guide#pro trading solutions#forex expert insights

1 note

·

View note

Text

Risk Management Assignment Help

Risk management involves analyzing, assessing, and mitigating risks in projects or organizations. Assignments on risk management topics like risk identification, qualitative and quantitative risk analysis, risk response planning, and risk monitoring can be challenging for students. Useful resources for assignments include one-on-one tutoring, sample assignments, and video lessons explaining theories like Failure Mode Effect Analysis, Expected Monetary Value, decision tree analysis, and more. Online Risk Management Assignment Help from experts with in-depth knowledge of risk management principles and models can provide guidance on risk assignments. This helps students to understand key methodologies to systematically assess and manage project or business uncertainties and threats when completing risk management assignments.

#Risk Assignment Help#Assignment Help#Risk Management#Risk Management Tips#Management Solutions#Management Experts#Assistance#Management Guidance#Academic Help

0 notes

Text

Navigating the Market's Seasonal Waves: Insights from Jeffrey Hirsch on the Fourth Quarter, Santa Claus Rally and 2024 Outlook

In this compelling episode of Buy Hold Sell, we welcome esteemed guest Jeffrey Hirsch, the editor-in-chief of the renowned Stock Trader’s Almanac. Join us as Jeffrey delves into the fascinating world of market behavior during the holiday season and the all-important Santa Claus rally. Discover why the last five days of the year hold a special significance for investors, and gain exclusive…

View On WordPress

#Fear and greed in investing#Investment strategies discussion#Jeffrey Hirsch on market behavior#Market predictions 2024#Risk management tips#Santa Claus rally 2023#Seasonal market trends#Stock Trader&039;s Almanac insights#SuperBowl predictions#US election cycle and markets

0 notes

Text

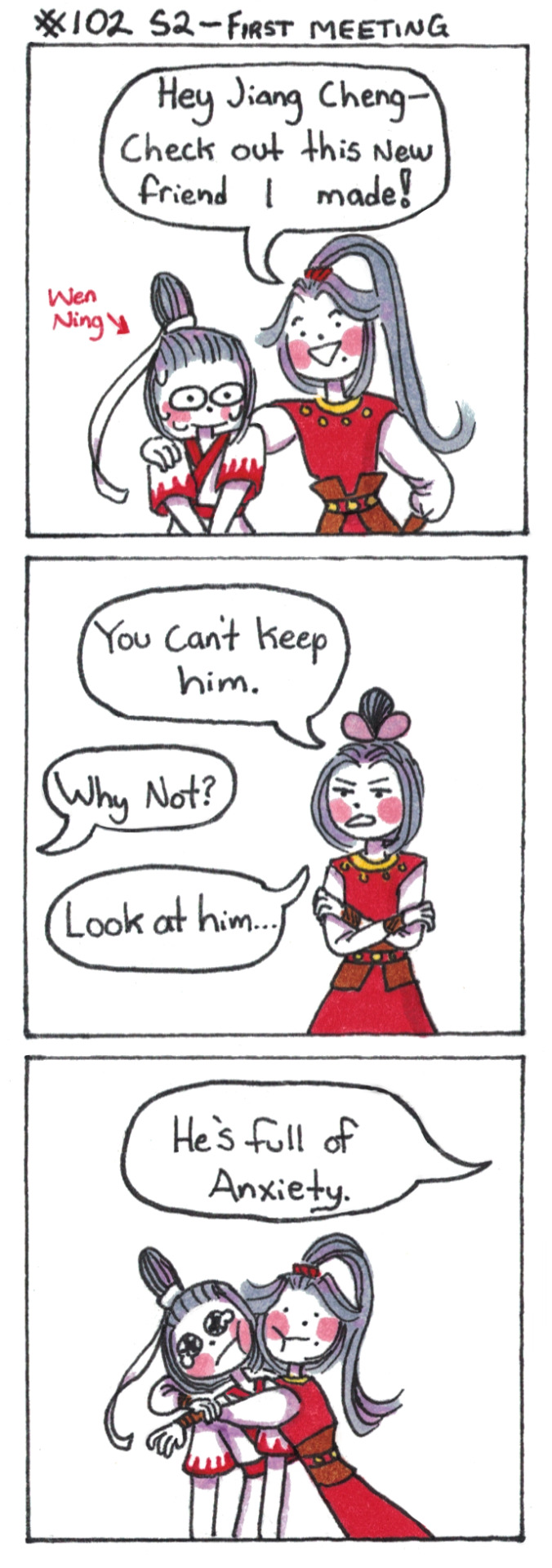

Introvert adoption

[First] Prev <–-> Next

#poorly drawn mdzs#mdzs#wei wuxian#wen ning#jiang cheng#(The actual name of this season 2 extra is 'First meeting with Wen Ning' but I ran out of space.)#I am obligated to try and wiggle in Wen Ning scenes whenever I can. Our baby boy needs his screentime to grow big and strong.#This whole scene is very good and does a lot to show us several important traits about wwx:#1) He has no hesitation to put his own face or life at risk to help someone (even if they have never met).#2) He does not care for what others say or think about him; he will do what he thinks is right.#And he is smart enough to think is is always right about his judgement. This will be a problem later.#I also think the silly energy in this scene is top notch.#Wen Ning is the wild chipmunk wwx managed to catch and wants to keep as a pet.#Jiang Cheng is gently easing this boy out of wwx's extrovert maw and saying 'put him back outside'.#Can you imagine being blindsided by the full force of wwx out of nowhere? Getting his support and then archery tips?#You're done. You've been caught in his snare and you aren't getting out.

2K notes

·

View notes

Text

Late Night quick thing (New Age Sillies)

Bad news: That joke post about including Reset + Orchid is definitely not canon. (I legit got sad thinking about Reset being in a universe where Orchid isn't- because their stories are so so intertwined- but Nightmare 100% would NOT risk the whole twins exploding Error's soul thing.)

Good news: This means I COULD include Kane (Reset's older brother who usually dies in timelines where Reset is born) and use it to develope his character a bit more! Also! Perhaps a Blue × Dream kiddo is finally in the stars for me to design?

#new age au#really enjoying the idea of Reaper + Geno having an heir at some point (and them sending that heir over to Night's kingdom for#exposure to other places as well as to hang with his third cool knight dad who's hard at work 🙏)#Kane has little to no development besides being a perfect angel (foil to Reset's eventual turn to poor choices) so I'd love to do#to him what I do to every oc of mine. (Namely: Throw them into the Kingdom and see what they do.)#oh! and I could see Blue and Dream (beloved boys) listening to the warnings of possible complications if they try to have a lil babybones#and Dream deciding he'd take the risk and carry the growing soul#(<- though tbf this is MANY years into the future and they'd be well established knights of the realm)#i'm not evil so they *would* manage to avoid the twins curse and have a singular beautiful babybones#they'd get raised partially on the move but stay behind with Night and Error if the two had a more dangerous mission#and grow up to be an obnoxiously powerful warrior following after their dads#(but they'd probably be hesitant to follow into the footsteps of being a knight and might go on a quest with friends before choosing a#final path for themselves)#<- Most spoiled rotten kid ever. courtesy of Nightmare and Error and all their extended family <3#oh last note. Ancha has me cracking up w/ ideas for Cross potentially meeting someone and I was beamed w/ an old ship request post I saw and#I think it'd be funny to include Lust in here somehow... (probably call him smth else as a nickname but y'know-)#like. He works in the city around the castle as some sort of... idk tailor? and he's been making things for Nightmare for years without#knowing because Ccino always was discreet about the orders and providing measurements + always tipped well so it was none of his business#but one day it's like. before a big announcement ceremony or smth and Ccino drags Cross in by the scruff because no one can get him to get#clothes that actually fit aside from armor (hc he steals the others clothes a lot and wears 1 shirt until it's threadbare)#so Ccino makes him go to Lust and Lust is able to get him fitted for sone new outfits because. well. Lust doesn't do much but he's very very#handsome and Cross is super easily flustered and shy around new people and he's awkward and aughhh.#and then he thinks about the interaction for the next month before deciding he's going to ask Ccino to go back there again.#and Lust likes dressing Cross up in new outfits (everyone thinks it's great Cross is loosening up and meeting new friends cuz Lust introduce#s him to people in town) and it takes forever for Cross to get over his worries and ask Lust out to a ride on his horse (romantic. of course#) and Lust agrees because he's charmed.#and the best part would be Cross *actually* manages to keep it a secret. like. no one finds out until one morning Killer bursts into Cross'#room to wake him for surprise training and it's Cross. the weird Dog. and- holy shit did Cross have someone over???#Cross pulls the cool ones frfr 🙏#it's just a casual thing between them with little plot relevance or drama I think. just a chill lil relationship 🙏

13 notes

·

View notes

Text

Top Strategies for Successful Stock Trading - Unirav Shopping

Navigating the stock market can be both exhilarating and daunting. For beginners and seasoned investors alike, successful stock trading requires a strategic approach, a solid understanding of market dynamics, and continuous learning. This blog delves into the top strategies for successful stock trading, emphasizing the importance of planning, discipline, and informed decision-making.

1. Educate Yourself

Before diving into stock trading, it’s crucial to educate yourself about the market. Understanding the basic concepts, terminology, and mechanics of trading will lay a strong foundation for your investment journey.

Books and Online Courses: There are numerous resources available, from classic investment books like “The Intelligent Investor” by Benjamin Graham to online courses offered by reputable institutions.

Financial News and Websites: Stay updated with financial news, market trends, and analysis from trusted sources like Bloomberg, CNBC, and MarketWatch.

Stock Simulators: Use stock simulators to practice trading without risking real money. This hands-on experience can help you understand market fluctuations and trading strategies.

2. Set Clear Goals and Objectives

Having clear financial goals and objectives is essential for successful stock trading. Define what you want to achieve with your investments, whether it’s long-term wealth accumulation, short-term gains, or income generation.

Risk Tolerance: Assess your risk tolerance to determine the types of stocks and trading strategies that suit you.

Time Horizon: Consider your investment time horizon, as this will influence your trading decisions and risk management strategies.

Capital Allocation: Decide how much capital you are willing to invest in the stock market and how you will allocate it across different stocks and sectors.

3. Develop a Trading Plan

A well-defined trading plan acts as a roadmap for your trading activities. It helps you stay disciplined and focused, reducing the likelihood of impulsive decisions.

Entry and Exit Criteria: Establish clear criteria for entering and exiting trades. This can include technical indicators, fundamental analysis, or a combination of both.

Position Sizing: Determine the size of your positions based on your risk tolerance and the overall market conditions.

Risk Management: Implement risk management strategies to protect your capital. This can involve setting stop-loss orders, diversifying your portfolio, and avoiding overleveraging.

4. Conduct Thorough Research

Thorough research is the backbone of successful stock trading. Analyzing companies, industries, and market trends can help you make informed investment decisions.

Fundamental Analysis: Evaluate a company’s financial health by examining its earnings, revenue, profit margins, and balance sheet. Pay attention to industry trends and economic factors that could impact the company’s performance.

Technical Analysis: Use technical analysis tools to study price charts, patterns, and indicators. This can help you identify potential entry and exit points and gauge market sentiment.

Sentiment Analysis: Monitor investor sentiment and news to understand the market’s mood and potential impact on stock prices.

5. Diversify Your Portfolio

Diversification is a crucial risk management strategy that involves spreading your investments across different asset classes, sectors, and geographic regions. This can help reduce the impact of any single stock’s poor performance on your overall portfolio.

Asset Allocation: Allocate your capital across various asset classes, such as stocks, bonds, and commodities, to balance risk and reward.

Sector Diversification: Invest in stocks from different sectors to mitigate sector-specific risks.

Geographic Diversification: Consider investing in international stocks to reduce exposure to country-specific economic and political risks.

6. Stay Disciplined and Emotionally Detached

Emotional decision-making can be detrimental to stock trading. It’s essential to stay disciplined and stick to your trading plan, regardless of market volatility or emotional impulses.

Avoid Overtrading: Overtrading can lead to increased transaction costs and reduced overall returns. Stick to your trading plan and avoid making impulsive trades.

Manage Fear and Greed: Fear and greed are common emotions in stock trading. Develop strategies to manage these emotions, such as setting realistic expectations and using stop-loss orders.

Review and Adjust: Regularly review your trading plan and performance. Make necessary adjustments based on changing market conditions and your financial goals.

7. Utilize Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are essential tools for managing risk and protecting your capital. These orders automatically close your positions at predetermined price levels, helping you lock in profits and limit losses.

Stop-Loss Orders: Set stop-loss orders to automatically sell a stock if its price falls below a certain level. This helps protect your capital from significant losses.

Take-Profit Orders: Use take-profit orders to automatically sell a stock when it reaches a predetermined profit level. This allows you to lock in gains and avoid holding onto winning positions for too long.

8. Keep an Eye on Market Trends

Staying informed about market trends and economic indicators can provide valuable insights for your trading decisions.

Economic Indicators: Monitor key economic indicators, such as GDP growth, unemployment rates, and inflation, as they can influence market sentiment and stock prices.

Market Trends: Identify and analyze market trends, such as bull and bear markets, to adjust your trading strategies accordingly.

News and Events: Stay updated on news and events that could impact the stock market, such as corporate earnings reports, geopolitical developments, and central bank announcements.

9. Learn from Your Mistakes

Mistakes are inevitable in stock trading, but they can also be valuable learning opportunities. Analyze your past trades to identify what went wrong and how you can improve your strategies.

Trading Journal: Keep a trading journal to document your trades, including entry and exit points, reasons for the trade, and outcomes. This can help you identify patterns and areas for improvement.

Self-Assessment: Regularly assess your trading performance and reflect on your decision-making process. Identify common mistakes and develop strategies to avoid them in the future.

Continuous Learning: Stay committed to continuous learning and improvement. Attend webinars, read books, and seek advice from experienced traders to enhance your skills.

10. Seek Professional Advice

If you’re unsure about your trading strategies or need personalized guidance, consider seeking advice from financial professionals. Financial advisors, brokers, and investment analysts can provide valuable insights and recommendations tailored to your needs.

Financial Advisors: Work with a financial advisor to develop a comprehensive investment plan and receive personalized advice.

Brokers: Consult with brokers who have expertise in stock trading and can provide valuable market insights and trade execution services.

Investment Analysts: Follow recommendations from investment analysts who conduct in-depth research and analysis on stocks and market trends.

Conclusion

Successful stock trading requires a combination of education, planning, discipline, and continuous learning. By implementing these top strategies, you can enhance your trading skills, make informed decisions, and achieve your financial goals. Remember, the stock market is unpredictable, and there are no guarantees of success. However, with a strategic approach and a commitment to learning, you can navigate the complexities of the market and build a successful trading career.

10 Positive Reviews

Educational Resources: Utilizing various educational resources like books, online courses, and stock simulators significantly enhances trading knowledge and skills.

Clear Goals: Setting clear financial goals and objectives ensures a focused and disciplined approach to stock trading.

Comprehensive Trading Plan: A well-defined trading plan provides a roadmap for successful trading activities and helps avoid impulsive decisions.

Thorough Research: Conducting thorough research through fundamental, technical, and sentiment analysis leads to informed investment decisions.

Diversification: Diversifying investments across different asset classes, sectors, and geographic regions mitigates risks and enhances portfolio stability.

Emotional Discipline: Staying disciplined and emotionally detached from trading decisions minimizes the impact of market volatility and emotional impulses.

Risk Management Tools: Utilizing stop-loss and take-profit orders effectively manages risk and protects capital.

Market Awareness: Keeping an eye on market trends and economic indicators provides valuable insights for strategic trading decisions.

Learning from Mistakes: Analyzing past trades and learning from mistakes fosters continuous improvement and better trading strategies.

Professional Guidance: Seeking professional advice from financial advisors, brokers, and investment analysts offers personalized guidance and expert insights for successful stock trading.

By following these strategies and reviews, traders can enhance their chances of success in the dynamic and ever-changing world of stock trading.

Investing in the stock market can be an excellent way to build wealth over time. Whether you’re saving for retirement, aiming to make a major purchase, or just looking to grow your financial portfolio, understanding how to start investing in stocks is crucial. This guide will provide a step-by-step approach to get you started on your investment journey.

#Stock Trading Strategies#Successful Trading Tips#Stock Market Education#Risk Management in Trading#Investment Portfolio Diversification#Top Strategies for Successful Stock Trading

2 notes

·

View notes

Text

trying to 100% the arcade challenge, but does anyone know how to decrease the bpm meter for the 'comeback king' achievement?

i genuinely can't seem to figure out how to get the achievement

#hi fi rush#hi-fi rush#<- mainly for exposure purposes#i would also like to ask for tips for the 'high risk player' achievement but i feel like#for that one i just need to not suck at the challenge rooms lmao#EDIT: NEVER FUCKING MIND I JUST DID A RUN AND MANAGED TO GET THE HIGH RISK PLAYER ACHIEVEMENT#NOW I JUST NEED HELP FOR THE COMEBACK KING ONE

12 notes

·

View notes

Text

The FIRE Movement: A Comprehensive Guide to Financial Independence and Early Retirement

Introduction In recent years, a revolutionary concept has emerged in the realm of personal finance, captivating the imagination of young adults worldwide. Known as the FIRE movement, which stands for Financial Independence, Retire Early, this philosophy offers more than just financial advice—it proposes a radical shift in lifestyle. This in-depth guide explores the intricacies of the FIRE…

View On WordPress

#asset allocation#budgeting tips#Compound interest#early retirement#financial autonomy#financial freedom#financial independence#Financial planning#FIRE movement#frugality#lifestyle choices#lifestyle inflation#living below means#passive income#personal finance#retire early#retirement planning#Risk management#savings strategies#side hustles#smart investing#Wealth Management

6 notes

·

View notes

Text

shadowheart leaving shar behind being the thing that helps cress leave bhaal behind i'm 😭

#txt#bg3 spoilers#cressida x shadowheart#like cress regressed morally throughout the latter half of act 1 and most of act 2#she murdered her way through the underdark and shadow cursed lands and honestly was so close to slipping over that ledge#but it was always shadowheart who managed to drag her from that ledge - unknowingly or otherwise#it was always shadowheart and that tender look in her eyes that quietened the urges#so when shadowheart willingly throws that spear into the darkness and by extension leaves shar behind ..... it genuinely shocks cress#it was all shadowheart ever wanted! and has risked her goddess' wrath! and yet she did it anyway!#cress had it on the tip of her tongue to force shadowheart to kill nightsong! if they weren't so close by then she would've tbh#but she forced herself to give shadowheart the choice and she chose Good and it Ruins cress#anyway all of this to say i only just started act 2 with cress but i'm already up in my durge feels#and i think cress is gonna eventually resist bhaal and go the redemption route#doesn't mean it's not gonna fucking hurt for her though

6 notes

·

View notes

Text

#assessment Small#Business asset protection#Business continuity#Business credibility#business finance#Business protection#Commercial insurance#Cyber insurance#Insurance advice#Insurance coverage#Insurance for entrepreneurs#Insurance policies#Insurance tips Risk#Legal requirements#Liability insurance#Professional liability#Property insurance#Risk management#Small business insurance#Worker's compensation

3 notes

·

View notes

Text

Insulin Resistance: What it is and How to Reverse it

Insulin is a hormone produced by your pancreas that plays a crucial role in regulating your blood sugar levels. When you eat carbohydrates, your body breaks them down into glucose, which is then absorbed into your bloodstream. Insulin helps your cells take up glucose and use it for energy. However, if you eat too many carbohydrates or have a diet high in processed foods and sugars, your body may…

View On WordPress

#Diabetes risk factors#Diet and insulin resistance#Exercise and insulin sensitivity#healing#health#Healthy lifestyle tips for insulin resistance#Improving insulin sensitivity#Insulin and blood sugar#Insulin resistance#Insulin resistance Reversing insulin resistance Insulin sensitivity Improving insulin sensitivity Insulin and blood sugar Type 2 diabetes pr#life#Natural remedies for insulin resistance#science#Sleep and insulin resistance#Stress management and insulin sensitivity#Supplements for insulin resistance#Type 2 diabetes prevention#weightloss

2 notes

·

View notes

Text

How Best Portfolio Management Strategies Increase Your Investments

The fact of the matter is that investing for wealth is far more than the selection of winning stocks or the ability to get markets right at the right time. Bottom line is, investment success over long stretches of time depends on the fact that portfolio management is a thoughtful strategy that may guide you through twists and turns of the markets while keeping your financial goals before you.

It can be termed portfolio management, architecting of one's financial future. A master architect thinks about the littlest details when putting a building together. Similarly, good portfolio management requires careful planning, regular maintenance, and strategic adjustments to make sure that investments are in line with the goals.

The beauty about proper portfolio management is knowing that you will sleep tighter at night knowing that those investments work harmoniously for your objectives. Whether you want to save for retirement or plan for your children's college education, a well-kept portfolio is your best financial compass.

Key Strategies That Drive Investment Success

Strategic Asset Allocation

At its core, strategic portfolio management is effective asset allocation: It is the art of getting your investments distributed in different asset classes so that you can now truly optimize for returns, managing risk. That is not a cookie cutter approach; it's getting a customized investment mix which reflects your:

Risk tolerance

Investment timeline

Financial goals

Current life stage

Besides asset allocation in the classic models, Gainers can use advanced analytical tools and market intelligence on its approach towards optimization to help clients get the ideal balance in their investments.

Dynamic Diversification

Investors will still remain in the powerful hands of risk management as the diversification. However, diversified in an effective manner by investors into this complex setting of the present world is no more only about diffusing investment portfolios across equities and fixed income but also now has required that modern portfolio management must exercise its sensibility while taking account of these diversified areas including:

International diversification and distribution over global markets

Sector-wise diversification that helps utilize the potential in growth fields

Diversification strategies to make the portfolio more stable

Exposure to physical assets to reduce inflation effects

Portfolio managers of Gainers monitor the diversification strategy and alter it constantly to ensure that the portfolio of the client remains stable under any type of market.

Risk Management: Diversification Plus

Diversification reduces risks; however, sophisticated portfolio management offers so much more. It comes with additional layers of protection that include:

Re-balancing of the portfolio after fixed intervals to ensure attainment of target allocations

Strategic tax harvesting to maximize after-tax returns

Hedging against potential losses in turbulent markets

Managing liquidity for unexpected opportunities or needs

The Gainers utilizes the finest risk management techniques and approaches to secure the wealth of its clients and seize growth opportunities.

Active Portfolio Management: The Power to Make the Right Moves

Active portfolio management is not being constantly active and trading in the market. It is much more about conscious, strategic changes to your portfolio based on:

Changing market conditions

Changing personal goals

New investment opportunities

Risk management needs

The Gainers' portfolio managers closely watch these variables and make fine-tuned adjustments to ensure that the clients' portfolios are in the best possible position to achieve success.

Technology and Human Expertise: A Winning Combination

Portfolio management is today highly technological in its approach, yet requires human judgment in interpreting and making strategic decisions. Gainers uses modern portfolio management technology but includes the most important human element of knowing your specific financial condition and personal advice in unpredictable markets.

Guides you towards tracking your long-term goals

Modifies your strategy as per your requirement

It requires experience and control to execute these approaches. The Gainers provides a total view that includes:

Initial portfolio analysis and strategy development

Periodic portfolio reviews and rebalancing

Ongoing risk monitoring and management

Professional guidance through transitions in the market

Clear communication about portfolio performance and adjustments in the strategy

Making Portfolio Management Work for You

It takes a journey for your investing process to move beyond just being set it and forget it. The Gainers is a place where professional portfolio management means you are accessing investment strategies tailored to your objectives, the professional monitoring of your portfolios, updates on a regular basis and a review of their performance, proactive management of risks, and institutional quality investment opportunities.

Move forward with The Gainers. Join forces with our experienced portfolio managers to assure yourself that the right portfolio will be built and managed for your financial goals through cutting down the complexities that face the investment landscape in today's world.

Remember that great investors don't make great decisions. Investing is really about proven approaches consistently deployed over time. Let The Gainers make these principles of portfolio management come to life for your financial future.

#portfolio management#investment strategies#asset allocation#diversification#risk management#investment planning#financial goals#wealth building#rebalancing#tax-efficient investing#long-term investing#investment tips#maximizing returns#portfolio optimization#investment mistakes to avoid

0 notes

Text

Protecting Your Business From Fraud in Today’s Economy

The transportation industry has always been a vital part of the economy, but lately, there’s been a concerning rise in fraud schemes targeting trucking companies, brokers, and shippers. The last quarter has seen a significant increase in scams, costing businesses millions and creating uncertainty for everyone involved. But for individual owner-operators—those who own just one or two trucks and…

View On WordPress

#avoid freight fraud#avoid trucking fraud#double brokering scams#fraud in trucking#freight fraud#freight scam prevention#independent truckers#load scams#owner-operator business#owner-operator fraud#owner-operator risks#protect trucking business#transportation fraud#transportation industry scams#trucker fraud prevention#trucker scams#trucking business protection#trucking business safety#trucking fraud rise#trucking fraud warning signs#trucking industry fraud#trucking risk management#trucking scams 2024#trucking security tips#trucking verification tools

0 notes

Text

From Singapore to Brazil- The Global Network Behind Successful Trading

In today’s interconnected world, successful trading is no longer limited by geography. The ability to access and leverage a global network has become a critical factor for traders, especially in commodities markets like cotton and coffee. As a trader specializing in these commodities, I’ve witnessed firsthand how the combination of local insights and global connections can shape market strategies and drive success.

In this blog, I will explore how the global network—from Singapore to Brazil—plays an essential role in successful trading, drawing from my experiences and observations throughout my career in the cotton and coffee markets.

1. The Significance of Singapore in Global Trade

Singapore is widely recognized as a major hub for international trade and finance. With its strategic location at the crossroads of Asia, Europe, and the Middle East, Singapore has become a critical player in global commodities trading. As a trader based in Singapore, I have access to key financial markets, a vast array of shipping routes, and robust infrastructure that supports the efficient movement of goods across borders.

Singapore’s well-developed banking and financial services sector provides traders with access to capital, risk management solutions, and financial instruments, which are crucial for managing market volatility. Additionally, the city-state’s emphasis on transparency and strong regulatory frameworks fosters an environment of trust and reliability for international transactions.

From a personal perspective, being based in Singapore has given me access to a diverse array of global markets. Whether I am analyzing price trends for cotton in India or monitoring coffee production levels in Vietnam, Singapore’s connectivity allows me to stay in the loop with real-time market data and participate in the fast-moving world of global trading.

2. Brazil: The Heart of Coffee Production

While Singapore is a critical hub for financial and logistics services, Brazil represents a cornerstone of my trading career due to its dominance in the global coffee industry. Brazil is the world’s largest coffee producer, responsible for over one-third of the global supply. Its vast coffee plantations, spanning from Minas Gerais to São Paulo, make it an indispensable part of the coffee supply chain.

In 2017, I had the opportunity to travel to Brazil, where I immersed myself in the country’s coffee trade and deepened my understanding of the market’s inner workings. My time in Brazil was an eye-opening experience, as I was able to visit coffee farms, meet with growers, and gain insight into the production process. I learned about the various factors that affect coffee yields, from weather patterns to soil quality and even global trade policies.

This trip also helped me build valuable relationships with coffee producers and traders in Brazil, strengthening my global network. These connections have proven invaluable in gaining access to firsthand market information, allowing me to make more informed trading decisions.

3. Building a Global Network: The Key to Success

Successful trading requires more than just technical analysis and market knowledge—it requires a strong global network. Over the years, I’ve developed relationships with industry players across various regions, including Asia, South America, and Europe. These connections provide me with an advantage in gathering market intelligence, spotting emerging trends, and reacting quickly to shifting market conditions.

Let’s break down the key components of a global trading network:

a) Local Knowledge and Market Access

One of the most important aspects of a global network is having access to local knowledge. Whether I’m trading cotton from India or coffee from Brazil, I rely on the expertise of local producers, suppliers, and traders. These individuals provide valuable insights into the state of the market, crop conditions, and pricing trends that can’t always be found in reports or data sets.

For example, the impact of weather on crop yields is often more accurately predicted by those on the ground. During my time in Brazil, I was able to gain a deeper understanding of how local conditions, such as droughts or frosts, could affect coffee production and pricing. This knowledge gave me a competitive edge in adjusting my trading strategies accordingly.

b) Real-Time Communication Across Markets

In today’s digital world, real-time communication is essential for success in trading. With markets spanning different time zones and regions, it’s crucial to stay connected 24/7. Platforms like WhatsApp, Slack, and Zoom allow traders to communicate with stakeholders in different countries instantaneously.

As a trader based in Singapore, I can communicate with colleagues in Brazil or Europe in real-time, even when markets are open in different time zones. This ability to maintain a constant flow of information is essential for making timely and strategic decisions, particularly in volatile markets like coffee and cotton.

c) Strategic Partnerships with Global Trading Houses

Another crucial element of a global trading network is the formation of strategic partnerships with large trading houses and institutions. Throughout my career, I’ve had the privilege of working with major trading houses such as ECOM Trading, Glencore, and Morgan Stanley. These institutions have extensive global reach, which allows for the pooling of resources, information, and expertise.

Through these partnerships, I’ve gained access to a broader range of trading tools, such as advanced risk management solutions, hedging strategies, and access to capital. The support of these trading houses has enabled me to take larger positions in the market and manage risks effectively, while also benefiting from their established relationships with suppliers and buyers.

4. Navigating the Challenges of Global Commodities Markets

Trading on a global scale is not without its challenges. Commodities markets, such as cotton and coffee, are highly influenced by factors that are often beyond a trader’s control, including:

Weather Variability: Weather conditions can greatly impact the supply of agricultural commodities. Droughts, frosts, and hurricanes can reduce crop yields and lead to price fluctuations.

Political and Economic Instability: Global commodities markets are vulnerable to geopolitical tensions, trade tariffs, and economic instability. For example, trade wars between major economies or currency fluctuations can disrupt supply chains and affect pricing.

Supply Chain Disruptions: Global supply chains are complex and vulnerable to disruptions. Transportation delays, labor strikes, or disruptions in shipping routes can impact the timely delivery of goods and alter market dynamics.

Successfully navigating these challenges requires a robust risk management strategy and the ability to adapt quickly. My global network plays a critical role in this aspect, as it allows me to gather real-time information, identify potential risks early, and adjust my trading strategies accordingly.

5. The Role of Technology in Expanding Global Networks

In addition to fostering personal relationships, the use of technology has become a game-changer in building and expanding global networks. Online platforms and data analytics tools have made it easier than ever to stay informed, conduct market research, and engage with industry experts from all corners of the world.

For instance, I use data analytics tools to track trends in the commodities markets and gain insights into market sentiment. I also subscribe to online industry publications and research reports that provide updates on global supply and demand dynamics. These resources help me stay ahead of the curve and make data-driven decisions.

Moreover, technology enables traders to attend virtual conferences, webinars, and forums where they can connect with other industry professionals, share knowledge, and build new relationships. This increased accessibility has accelerated the formation of global networks and strengthened collaboration across the commodities trading community.

6. Leveraging Cultural Understanding in Global Trade

Another often-overlooked aspect of successful trading on a global scale is cultural understanding. Building relationships with partners, suppliers, and clients in different countries requires sensitivity to cultural norms and business practices. I’ve found that taking the time to understand local customs and values can go a long way in building trust and fostering long-term relationships.

For example, in my dealings with coffee producers in Brazil, I’ve learned the importance of patience and relationship-building in their business culture. Establishing personal rapport is often a prerequisite to successful negotiations, and it’s not uncommon for meetings to begin with casual conversations over coffee before diving into business discussions.

Similarly, in Asian markets like India and Vietnam, understanding the hierarchical nature of business relationships has been essential in navigating negotiations and ensuring smooth transactions. By respecting local customs and taking a culturally informed approach, I’ve been able to strengthen my global network and secure mutually beneficial deals.

7. The Future of Global Trading: Trends and Opportunities

As the global trading landscape continues to evolve, new opportunities and challenges are emerging. Here are a few key trends that are shaping the future of global commodities trading:

Sustainability and Ethical Sourcing: Consumers are increasingly demanding ethically sourced products, particularly in commodities like coffee and cotton. Traders who can provide transparency in their supply chains and work with producers committed to sustainable practices will have a competitive edge.

Digitalization of Trade: The rise of blockchain technology, digital contracts, and AI-powered trading platforms is revolutionizing the way commodities are traded. These technologies enhance transparency, reduce transaction costs, and streamline the entire trading process.

Climate Change and Crop Resilience: As climate change continues to impact agricultural production, traders must be prepared for increased volatility in supply and pricing. Investment in crop resilience and alternative production methods will be critical for maintaining stability in the commodities markets.

Conclusion

From Singapore to Brazil and beyond, the success of global commodities trading is built on strong networks, strategic partnerships, and a deep understanding of local and international markets. By leveraging a global network of producers, traders, and institutions, I’ve been able to navigate the complexities of cotton and coffee markets, manage risks, and capitalize on emerging opportunities.

In the fast-paced world of trading, staying connected to the global market and maintaining relationships across continents is crucial for long-term success. The journey continues, and as markets evolve, the importance of building and nurturing a global network will only grow.

#Global trading network#Singapore to Brazil trading#Commodities trading insights#Coffee market in Brazil#Cotton trading strategies#Successful trading tips#Global market connectivity#Coffee production Brazil#Trading partnerships#Risk management in commodities#International trade Singapore#Specialty coffee market#Global commodity supply chains#Building a global network for traders#Cross-border trading strategies

0 notes

Text

From Analysis to Action: Combining Technical and Fundamental Approaches in Forex Trading

#Forex Trading#Technical Analysis#Fundamental Analysis#Trading Strategies#Currency Trading#Forex Market#Investment Strategies#Market Analysis#Day Trading#Swing Trading#Forex Education#Online Trading#Global Economics#Economic Indicators#Risk Management#Forex Signals#Trading Tips#Trading Psychology#Market Trends#Forex News#Foreign Exchange#Financial Markets#Trade Setup#Forex Charts#Forex Community#Trading Systems#AI in Trading#Forex Forecasting#Wealth Building#PipInfuse

1 note

·

View note

Text

Success with Antoaneta

The longer you remain invested, the more you mitigate short-term market volatility. Historically, markets tend to rise over time, which is why long-term investing can help smooth out the ups and downs. Success with Antoaneta, a business coach for long-term investment, can guide you in navigating these fluctuations and maximizing your returns over time.

1 note

·

View note