#family rental loans

Text

Single Family Rental Property Loan Can Help To Leverage Your Investment!

For further profit and wealth people invest in real estate, such as lands and properties. Real estate is the cornerstone of shelter and wealth, its significance spans from towering commercial complexes and personal abodes too. Investment in real estate can be various types including, commercial and residential. Commercial estate includes industries, retail outlets and office spaces. Whereas, residential estate includes suburban homes and cozy apartments. It reflects the varied lifestyles and preferences of individuals and families. Loans are the financial tool for businesses and individuals; it provides access to capital for a wide range of purposes. Whether it’s covering unexpected expenses, starting business or funding a home purchase, it serves as a lifeline in times of need.

Allows buyers to leverage their investment

From educational pursuits and business ventures to personal endeavors, loans give financial assistance for a multitude of purposes. In the real estate sector, multifamily loans are the vital and financial instrument. These loans cater to townhouses, condominium complexes, buildings, apartments and other multifamily dwellings. They are the cornerstone for property owners, developers and investors. To finance the purchase of the multifamily properties they are the primary things. Developers and investors seeking to acquire such properties often rely on financing to cover the substantial upfront costs. This loan provides a necessary capital, as this allows buyers to leverage their investment and spread the purchase price over an extended period.

Manage the rental property properly

Single family rental property loan is the instrument that is made to facilitate the acquisition and management of individual residential properties intended for rental purposes. For building passive income streams through rental property ownership, real estate entrepreneurs and investors utilize it. This loan supports in refinancing of existing rental properties. Property owners choose this to refinance their rental properties to take advantage of lower interest rates. They also utilize it because to improve cash flow by adjusting loan terms. Refinancing can help investors to optimize their returns and help in their overall financial performance.

0 notes

Text

$2000 for the first ten people to comment on this post ✅

#fund#send help#student#fundraising#singlemom#mutuals#mutual aid#billsponsor#car rental#personal loans#business#scp foundation#archewell foundation#famous#family

3 notes

·

View notes

Text

The Benefits of Non-Status Van Lease: A Smart Business Choice

In the world of business, van leasing has become an increasingly popular choice for those seeking a cost-effective and efficient solution for their transportation needs. While traditional van leasing requires a good credit score and a clean financial history, non-status van lease offers an alternative for those who may not meet the usual requirements. In this article, we will explore the benefits of non-status van lease and why it might be the smart choice for your business.

Benefits of Non-Status Van Lease:

Accessible for all: Non-status van leasing is designed to cater to a wider range of customers, making it accessible for those who may not have a perfect credit score or a clean financial history. This makes it an excellent choice for small businesses, start-ups, and those with limited credit history.

Flexible terms: Non-status van lease offers flexible terms, allowing you to choose the lease duration that best suits your business needs. This ensures that you are not tied down to a long-term commitment that may not be suitable for your business growth.

No deposit: Unlike traditional van leasing, non-status van leasing does not require a deposit, which can be a significant financial burden for small businesses or start-ups. This makes it a more affordable option for those looking to save on upfront costs.

Wide range of vehicles: Non-status van leasing offers a wide range of vehicles, from small vans to large trucks, ensuring that you can find the right vehicle for your business needs. This flexibility allows you to choose the best vehicle for your specific requirements, without having to compromise on quality or functionality.

Maintenance and servicing: Non-status van leasing often includes maintenance and servicing as part of the lease agreement, ensuring that your van remains in top condition throughout the lease period. This reduces the cost and hassle of regular servicing and maintenance, allowing you to focus on running your business.

Conclusion:

Non-status van lease offers a smart and cost-effective solution for businesses seeking a reliable transportation option. With its accessible requirements, flexible terms, and wide range of vehicles, it is an excellent choice for those looking to save on upfront costs and enjoy the benefits of a professionally maintained van. So why not consider non-status van lease for your business needs and experience the benefits for yourself?

#cars#vans#finance#autos#leasing#leases#vehicles#credit#lease#rental#loan#loans#business#services#family#trade#news

0 notes

Text

Epic Level Up Group

For your next real estate investment project, we have an impressive combination of great rates and an incomparable line of products and services available. Let us help you with your next venture, whether it's a fix and flip, rental, new construction, or commercial bridge deal.

Contact Name: J.T. Morel

Address: 225 N Wood Ave 2nd floor, Linden, NJ 07036, USA

Phone: (848) 249-5626

Email: [email protected]

Website: https://www.epiclevelupgroup.com

Working hours:

Monday: 09:00 - 17:00

Tuesday: 09:00 - 17:00

Wednesday: 09:00 - 17:00

Thursday: 09:00 - 17:00

Friday: 09:00 - 17:00

Saturday: 09:00 - 17:00

Sunday: CLOSED

#Fix and Flip loans#New construction loans#Rental loans#Cash Out Refinance#Multi-family Loans#Commercial Loans

1 note

·

View note

Text

The other term we need to know if we want to understand the Shire is “clientelism”, perhaps more commonly refereed to as “patron-client relationships”. This is a social-political structure that emerges organically in many different contexts, and consists of a set of mutual, hierarchical obligations between powerful “patrons” and a network of “clients” who depend on them, economically, socially, or politically. It seems likely, from what we see of the Shire, that clientelism is the main organizing force within Hobbit politics. This would be far from unusual, in this sort of system.

To understand this, let’s look at a prototypical example of this; the relationship between the Baggins and the Gamgees.

Both Samwise Gamgee and his father, Hamfast Gamgee, are employed by Bilbo and Frodo Baggins, but the relationship is clearly far deeper than that. Throughout Lord of the Rings, Frodo treats Sam almost a feudal retainer, not just a person in a employee relationship, but someone who owes personal fealty to him, an attitude clearly reciprocated by Sam. There’s affection, friendship, and even love between them, but in the context of a hierarchical relationship. It’s never in question who “Mister Frodo” is, though it’s clear that this loyalty comes with expectations and obligations. Sam is not a slave, not is he bound by oaths of vassalage, or contract. He is loyal because he is expected to be, and because the Baggins repay loyalty with patronage, both to him, and his family.

The Gamgees are likely tenants of the Baggins, or at least dependent on them for access to agricultural capital. They likely send much of their income up to Bag End in rent, and provide services, as gardeners, batmen, valets, traveling companions, etc. They also provide support, in a social and civic sense, as we see. If Frodo had gone to the Free Fair to run for Mayor, the Gamgees and other tenants would have voted for him, and would have accompanied him in public, to demonstrate his status and prestige. But in return for this, they could expect generous gifts on holidays, loans of money on favorable terms, lax enforcement of rental arrears in time of drought and famine, and legal support in disputes.

...

For bachelors Bilbo and Frodo, these were personal, individual relationships. But the norm was likely closer to webs of debts, favors, and obligations, traded back and forth between families, cemented by marriage alliances and social ties. We’re told repeatedly that gift-giving and hosting feasts are two of the primary preoccupations of Hobbits. To modern ears, this may come across as utopian, or idyllic, but these sorts of status displays were a key part of many economic and social systems. In many Pacific Northwest Native American tribes, this was known as “potlatch“, and served as both a political and economic system, in which conspicuous displays of generosity were used to denote power and prestige. The Shire clearly has a monetary economy, but gift-giving remains important. The entire first chapter of Lord of the Rings is devoted to Bilbo’s 111st birthday party, which is a huge event that attracts intense attention from across Hobbit society, and involves massive displays of largess, solidifying the Baggins’ social position, and cementing ties with neighboring families and rival clans. Or at least, it would have been, if Bilbo hadn’t had an ulterior motive.

368 notes

·

View notes

Text

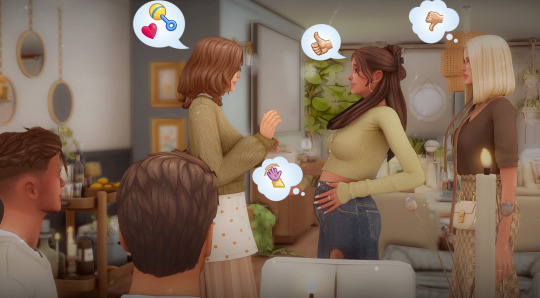

Hi! Here is my version 2 savefile! 😊

What is new?

- New townies more stories (a few of them don't have storylines, but will add later)

- Aparments/Townhouses are set as residential rentals

- I fixed some routing issues with some lots

- Added some details to New Crest

- I added lots to

~(2) Granite Falls

~(1) Selvadorada

~(2) San Myshuno

~(2) Sulani

~(3) Britechester

~(8) San Sequoia

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

I used MCCC to place other creators' townies in my save.

Creators used:

BrownieeTheGoat

Plumzet

Symplesimss

Simquoya

Kinzbomb

Please check them out they have amazing sims!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Warning! Pack Heavy!

Packs used:

EPs: All packs

GPs: All packs except for Vampires, ROM, JTB, and Werewolves

SPs: All Stuff Packs

Kits: All kits except for Bust the Dust and Modern Menswear

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

No CC was used in this save, but I did use mods however you do now need these mods to play in this save. I do recommend some mods for some builds to function and some storylines to work BUT YOU DO NOT NEED THEM, they are just for realism

MODS used:

MCCC

UI Cheats

Tool

Better Build Buy

Recommended MODS: (They are Optional, you don't need them for this save file only if you want more realism)

Simrealist: SNB, Real Estate Mod

Turbo Driver: Wicked Whims Basemental Mod, Basemental Gangs BlacklifeSims: Default Car Replacements

Khippie: Default Terrain Replacement

Littlemisssam: SimDa Dating App, More Visitors, Zooroo ATM Lumpinou: Contextual Social Interactions, First Impressions, MoodPack, No Strings Attached, Open Love Life, Road To Romance, Relationship & Pregnancy Overhaul, Talents&Weakness

Weerbesu:- Ui Cheats, More Columns Mod

Adeepindigo: Dental Mod, Healthcare Redux

Thepancake1 and MizoreYukii: Color Slider, Bed Cuddle

MizoreYukki: Sim City Loans, Drama Mod

RVSN: Retail Therapy

Food Mods: Littlebowbulb | QMBIBI | Srsly | ATS4 | Somik & Severinka | TheFoodGroup: Custom Drinks, Custom Food | Icemunmun | Apricot Rush Food Retextures ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ If you decide to download this savefile and run into any problems please message me so I can fix them and update the save file.

Also if you decide to download this save file, please don’t claim any of the lots or townies as your own, Please tag me in any post I would like to see your sims in this save! With all that said I really do hope you enjoy this safe file if you decide to download it!

Happy Simming!

~SN~ if anyone wants to contribute sims to this savefile, let me know I will make sure to add them and credit you...this was the hardest part for me and the reason it took so long to get version 2 out and I still didn't add enough sims, I will be adding more diverse couples/families, elders, teens, kids toddlers and infants.

Download [SimfileShare][Patreon]

#thesims4#thesims#ts4#the sims 4#the sims community#ts4 save file#sims 4 save file#showusyourbuilds#showusyoursims

323 notes

·

View notes

Text

Please Help A Mostly Queer/Disabled Homeless Family Pay Off Their Debt?

PAYPAL | AMAZON WISHLIST | KOFI | GOFUNDME

VENMO: @penaltywaltz | CASHAPP: $afteriwake23 | ZELLE: DM me for email address

03/05/24

So good news! We're in a 30-day shelter with a caseworker and help from the City of Encinitas Homeless Support Program to get housing with 30 days. It's a brand new shelter and we're all together in a room with the cats, and they're really eager to help get us out of our homeless situation.

Right now, we have about $1000 in money we can save up each month. If we can pay off the debts that my mom owes that she's in credit consolidation for, that frees up another $187 each month. If I can pay off my installment loan, which is four payments totaling $475, that frees up another $124 a month. I think my mom just paid off a credit card debt, but we have $100 debt that I think has gone to collections, $500 we need to pay on a card before that one goes to collections, and $300 for my PayPal 4 in 4 payments. We also have two payday loans I'd like to pay off before they're due at $600.

So if I can cover all that debt this month, we'll have well over $1,500 to put towards a rental payment in May, if we can get help with a security deposit and first month's rent through housing programs. We might be able to afford a two bedroom apartment in Fallbrook with that much. We'd need to come up with money to move our stuff out of storage as well, but a friend of mine has covered the big units until April 1st and may cover them an extra month if needed.

Any help would be amazing. We are so close to getting out of hotels/our car and into something stable. I'm setting the goal at $3000 for now because I don't have wifi at the shelter and can't check exactly how much my mom owes for her debt consolidation still.

But any extra will help with gas to get to places where we can get things we need (birth certificates, Lena's social security card with her dead name, Lena's psych eval, my mom's dental stuff, and doctor/therapy appointments) and food in case the snafu with my food stamps isn't fixed right away (we get three meals here, which is fine for me and Lena, but my mom is basically still on a soft food/liquid diet and they're still needing to get stuff for her and the gentleman here who has no teeth).

Please help if you can, and please reblog as well! We would all greatly appreciate it.

$2500/$5000

EDIT: We found out today that Lena is currently uninsured. The meds she was prescribed for her mood disorder are $1,500 out of pocket. She needs the medication badly. Please help?

#signal boost#mutual aid#mutual aid request#urgent#emergency#time sensitive#community aid#gofundme#venmo#paypal#zelle#cashapp#amazon wishlist#ko fi link#buy me a coffee#buy me a kofi#ko fi support#financial assistance#financial aid#direct action#crowdfunding#fundraising#please boost#please reblog#please share#please help#help needed#anything helps#bills#homeless support

279 notes

·

View notes

Text

I didn't want to do this, especially on Christmas Day when mostly everyone is with family and/or friends enjoying the holiday or at least hopefully chilling at home, but as I've moved cross-country and am between employment, it's looking like the rental reimbursement check I'm expecting from my former property management won't arrive in time for my next bill this coming Wednesday. I've already postponed payment on a loan last week and things will continue to cascade the longer that check takes to show up. If there's any possibility any of you out there can spare some funds and I can have enough small contributions, maybe I could make the $200 I need to pay and avoid missing another bill. You can find my ko-fi page HERE, my PayPal page HERE, and if you prefer to use Venmo (which also won't take any fees from me), you can DM me for my handle. I know this is a long shot, but I'm even though I'm blessed to be spending my holidays with friends kind enough to take care of me and give me a place to stay in my new location, I'm still stressing out over money. I should be getting my reimbursement eventually, but it's a matter of timing. Thank you for your consideration and have a Merry Christmas or a happy holiday or at least some restful time off, wherever y'all are.

#sorry for being extra cringe on main#i know so many people need help & i feel guilty adding to that & just asking things of anyone in general#but i'm lowkey freaking out so I'm yeeting this into the void as a hail mary pass#merry crisis

56 notes

·

View notes

Text

[“Herself a landlord, Karen paid attention to how someone looked at her unit. This point was repeated in the thick training manual landlords received at registration: “Do they check out each room?…Do they mentally visualize where the furniture will go, which room the children will sleep in, or how they’ll make best use of the kitchen layout? Or do they barely walk in the front door before asking to rent, showing a surprising lack of interest in the details? People who make an honest living care about their home and often show it in the way they look at the unit. Some who rent for illegal operations forget to pretend they have the same interest.”

The small act of screening could have big consequences. From thousands of yes/no decisions emerged a geography of advantage and disadvantage that characterized the modern American city: good schools and failing ones, safe streets and dangerous ones. Landlords were major players in distributing the spoils. They decided who got to live where. And their screening practices (or lack thereof) revealed why crime and gang activity or an area’s civic engagement and its spirit of neighborliness could vary drastically from one block to the next. They also helped explain why on the same block in the same low-income neighborhood, one apartment complex but not another became familiar to the police.

Screening practices that banned criminality and poverty in the same stroke drew poor families shoulder to shoulder with drug dealers, sex offenders, and other lawbreakers in places with lenient requirements. Neighborhoods marred by high poverty and crime were that way not only because poverty could incite crime, and crime could invite poverty, but also because the techniques landlords used to “keep illegal and destructive activity out of rental property” kept poverty out as well. This also meant that violence, drug activity, deep poverty, and other social problems coalesced at a much smaller, more acute level than the neighborhood. They gathered at the same address.

For people familiar with hunger and scarcity, addiction and prison, that often meant being isolated from job networks and exposed to vice and violence. But it also meant people could air problems; swap food, clothes, and information; and finish one another’s sentences about lousy jobs or social workers or prison (“They put gravy—”…“On everything!”). It meant that, should they be in the early stages of opiate withdrawal, they could take a walk around their trailer park to calm the shakes and run into a fellow junkie who could give them what they needed.

Some landlords neglected to screen tenants for the same reason payday lenders offered unsecured, high-interest loans to families with unpaid debt or lousy credit; for the same reason that the subprime industry gave mortgages to people who could not afford them; for the same reason Rent-A-Center allowed you to take home a new Hisense air conditioner or Klaussner “Lazarus” reclining sofa without running a credit check. There was a business model at the bottom of every market.”]

matthew desmond, from evicted: poverty and profit in the american city, 2016

174 notes

·

View notes

Text

RL Story

N.'s Mom wanted to sell the house. That’s why she wanted to talk to us. She didn’t need such a big house just for herself and financially it didn’t make sense to stay there. She knew N. and I were looking for a new home for us and our Baby.

She asked us, if we want to move/ live, here in the house? If so, she won’t sell it. After all the house partly belongs to Nico but also to Melanie. For me, this was not an option!! I didn't want to live in this house. I am a city girl. The city's my home! Here, I would be lost and lonely. Nico has to go abroad soon. Sometimes he’s gone for months. I would feel uncomfortable & isolated here with our Baby. I need my family near me. I don't want to be alone. Not here!

Nico’s Dad joined us after a while. Melanie was pissed as usual because her mother wanted to sell the house. But she also did not want to live here and that Nico and I get the house, this she wanted to prevent anyway. 🤨

Melanie really has some serious issues! I’ve never met such an exhausting person like her. But she didn’t argue with me that day! 😶🌫️

Anyway, their Dad will buy the house and the money will be split between Nico, his sister and their Mom. This was perfect for Nico and me, because we needed 40,000 euros for the apartment we wanted to buy/rent. We had to pay 60.000. 😬

I talked to my Garma. She wanted to help Nico and me. So she and my Grampa gave us 20 thousand. That's all they had. My parents could not give me money for our new home. We're not rich!! My parents never put money aside for Ana and me, for our future or so. On the contrary! My Mom and Dad were in debt. They took a loan/credit 10 years ago, so that we could move into a nicer, bigger home .My Dad didn’t want this. He & my Mom always had a fight about it, but my Mom prevailed. I wanted to do the same, because Nico was not willing to spend 40,000 euros just like that. But I disagreed. It was about our future, a home for us and our son. If I have to, I’ll go to the bank and ask for a loan. 🤷♀️

But Nico said, NO! He’s extremely stubborn and stingy when it comes to his money. Just like my Dad! 😒

N.'s Dad has enough money, as far as I know. And he also wanted to support us financially. But Nico rejected his Dad’s help. He hated him! 🤷♀️

Somehow this bothered me. We needed the money and his Dad was willing to give it to us. Besides, Nico could have paid the remaining 40,000 himself. He got money from his new soccer club. They paid him a large sum in the summer and yet, he was too stingy to invest a smal part of that money in our future.😩He wanted us to look for a cheaper home, but the problem was, there was NOTHING!! And if, then the rent was too high!! The apartment I wanted, was new! A complete new building and just prfect! The rent was half cheaper than other rental homes. But that’s why it cost 60,000 Euros. Still, in the long term, this was a good investment. It was a mix of rental and our own property. Anyway, I persuaded Nico and we will buy it. Just....our new home was not finished yet and we could not stay in our current apartment. We had to move out before New Year’s Eve. So we were actually homeless for a some months.😬 But my Mom and Nico’s Mom had a "solution" for us. What exactly this was, I tell another time.

Previous/Next

22 notes

·

View notes

Text

Everything You Must Know About The Single Family Rental Property Loan

In the world or field of real estate investment, there is a multitude of avenues through which investors can amass wealth and create passive income streams. Among these opportunities, multifamily properties and single-family rental properties stand out as particularly popular choices.

Tailored Financial Solutions

Multifamily loans are specifically designed for investors who seek to either acquire or refinance properties featuring multiple residential units. These loans are structured to meet the unique demands of multifamily property investments, offering flexible terms and competitive rates.

Varied Financing Options

The realm of multifamily loans encompasses a range of options, including conventional mortgages, government-backed loans, and commercial loans. Each option has its own set of eligibility criteria, down payment requirements, and loan conditions, providing investors with the flexibility to select the financing solution that aligns best with their investment objectives.

Single Family Rental Property Loans

Single family rental property loan is custom-designed to meet the needs of investors interested in individual residential properties for rental purposes. These loans offer personalized financing solutions to accommodate the unique requirements of single-family rental investments.

Streamlined Approval Processes

In comparison to multifamily loans, securing financing for single-family rental properties often involves a more streamlined approval process. These loans prioritize the potential rental income of the property over the borrower's personal income, resulting in quicker approvals and reduced documentation requirements.

Asset-Centric Financing

Single family rental property loan typically operate on an asset-based model, with the property itself serving as collateral for the loan. This enables investors to leverage the rental income and value of the property to secure financing, lessening their dependence on personal credit or income qualifications. Regardless of whether investors choose to focus on multifamily properties or single-family rental properties, securing appropriate financing is key to achieving success. By effectively utilizing these financing options, investors can seize opportunities to build wealth and establish enduring streams of passive income through rental property investments.

#single family rental property loan#loan for single family property#single family rental property loan USA#USA single family rental property loan

0 notes

Text

the rios twins

meet Kay and Luna Rios

fraternal twins and the daughters of a very, well, successful real estate mogul, kay and luna are ready to start preparing to take over the family business. they're looking to dip their toes into the real estate market and buy their first rental property. luckily, their dad has given them a small loan of $500,000.

I just wanted to share because I love them (and also hate them) <333

they are available on the gallery at my EA id: simmalooks --- I'll post their CC later tonight

<333 Emma

#simblr#sims 4 cc#sims cc#the sims#the sims 4#the sims cc#the sims community#ts4 simblr#ts4cc#my sims#sim dump#sims download#sims4#the sims 4 cas#ts4 cas#ts4

28 notes

·

View notes

Note

It's almost sad that when I tell my regulars I only make $14.50 an hour at a job where I do professional level graphic design and print work, they all get shocked and say I should be making more (I work at a locally owned print shop, and I love the job for the most part, I just hate how I'm rushed and hate certain clients).

WcDonads employees make more than I do. Gas station employees around here make more than I do. And I honestly feel quite jipped because I was told to go to college. Get a degree. Find a job in the field I go to school for and I'll be set (I'm one of those "zillenials," too young to be a millenial but too old to be gen z). Some people say i should be thankful, $14.50 is a lot, but cost of living where I'm at is at least $20/hr. Granted, my college is completely paid for so I don't have student loans to worry about and I'm happy I have graphic design and photography experience. But when I'm at work and I feel the bald patch from where my hair has been falling out from stress from workload, it makes me feel like I was tricked.

I'm so conflicted. Like I said. I like this job. When things aren't busy it's wonderful. But those are becoming fewer and farther between where stuff has completely reopened from Covid and more people want printing for events and sales.

And I've met wonderful people! And learned about small businesses in my community I would have never known about otherwise! I love getting to make nice designs and print beautiful art every day. One of my current friends I've met copying her artwork for her! My gifts to my family have been photo prints and even signs for my dad's workshop that I've gotten printed at a discount and they're all loved so much. And I don't have to wear a uniform - jeans and a t-shirt of my choice every day!

But I've also been yelled at over small shit like maps not being printed on time, or how the color on a flyer isn't as "vibrant as it is on screen," or told to hurry up on a yard sign that someone decided they needed today rather than next week, or have a someone chew me out because I haven't even had time to print three sheets of mailing labels because I've had to hold the hand of a very picky woman who wants her rental guest book to look "just right" yet can't be assed to learn how to use a computer on her own. I've had packages thrown at me when I've said people need to pay to ship them. People getting mad over $.20 black and white copies and $.49 color copies. People saying they're going to get their business cards from PistaVrint because it's cheaper. People come to us and act like we're tech support - "Why is my computer not opening Wicrosoft Mord?! Why is my email not sending?! Why is my phone doing this?!" Like I don't know! Take it to Bye Best!

My manager hardly gets paid any more than I do and she's been with the business for almost 30 years and drives an hour each day to come to work. I only got bumped to $14.50 after my boss overheard I was interviewing at a college print shop that would have paid me $18 an hour. He couldn't even wage match! And I didn't even get the job.

I don't have funds to move to another location where I could find a better paying job in my field, nor would I want to as my family and community are here.

There is a pillow factory here I never knew about. They're hiring various positions starting at $19 an hour. Evenings and weekends mostly off, only needed to work if they need to fill a very large order. My friend started there this week and while she says she's physically tired, the environment seems nice so far and I'm so burnt out here that I've already asked her if she can get a word in for me to start there. More pay? And way less customer interaction? I could do that! But it sucks that I feel like abandoning what I like to do because of my pay grade and the stress I feel. I wish it was all different.

Posted by admin Rodney.

55 notes

·

View notes

Text

Liberal California lawmakers are proposing new legislation that would grant illegal migrants zero-down, zero payment home loans. Assemblyman Joaquin Arambula, D-Fresno, who penned the bill, states, “The social and economic benefits of homeownership should be available to everyone.” This completely insolent maneuver is a slap in the face to all taxpaying citizens who can barely afford homes of their own.

The program would expand the California Dream for All Shared Appreciation Loans that began in 2023 with a $300 million budget intended to house 2,300 applicants. This fund failed in 11 days as the people who pass these laws have absolutely no concept of basic finance. This time around, they’re ensuring that only people who do not work full-time will be qualified as the new qualifications are that someone must earn under 120% of the median county income, and be the first GENERATION in their family to own a home on US soil.

The changes to the failed legislation is as follows:

LEGISLATIVE COUNSEL’S DIGEST

AB 1840, as amended, Arambula. California Dream for All Program: first-time homebuyers. eligibility.

Existing law establishes the California Housing Finance Agency in the Department of Housing and Community Development, and authorizes the agency to, among other things, make loans to finance affordable housing, including residential structures, housing developments, multifamily rental housing, special needs housing, and other forms of housing, as specified. Existing law establishes the California Dream for All Program to provide shared appreciation loans to qualified first-time homebuyers, as specified. Existing law establishes the California Dream for All Fund, which is continuously appropriated for expenditure pursuant to the program and defraying the administrative costs for the agency. Existing law defines “first-time homebuyer” for these purposes. Existing law authorizes moneys deposited into the fund to include, among other moneys, appropriations from the Legislature from the General Fund or other state fund.

This bill would specify that the definition of “first-time homebuyer” includes, but is not limited to, undocumented persons. an applicant under the program shall not be disqualified solely based on the applicant’s immigration status. By expanding the persons eligible to receive moneys from a continuously appropriated fund, this bill would make an appropriation. The bill would recast the fund so that appropriations from the Legislature from the General Fund or other state fund are deposited into the California Dream for All Subaccount, which the bill would create and make available upon appropriation by the Legislature for specified purposes.

In fact, this is not a “loan,” but another taxpayer-subsidized program, as qualified applicants will receive the funds to put 20% down on a home without making a payment on the loan or to the CHFA. The funds will only need to be repaid if the borrower sells or refinances the home, but the property may be held for an indefinite amount of time.

California has the largest homeless population in the nation who are discarded members of society, even the veterans who served our nation. The average price of a home in California is about $750,709 based on Zillow’s estimates, marking a 4.4% YoY increase, which makes a typical 20% downpayment around $150,141.80. Due to high prices, California boasts the second largest renter-occupied market in the nation behind New York, with 49.7% of the population opting to rent largely out of necessity.

This should receive bipartisan backlash and open the eyes of even the most liberal citizens. The government is using the resources it collects from you via taxation to push a political agenda through the use of illegal unvetted migrants who are toppling state budgets and destroying America from within.

25 notes

·

View notes

Text

hi all! cherry (she/her, 25)🍒 here to present the resident of 2a, nam daon! overall he's a neat/calm guy who really needs to stand up for himself but more under the cut. i don't mind either discord or ims for plotting, let me know what works best for you!

an #oopsie baby to parents in their early 40s. food is present on the table, he's wearing his sister's hand-me-downs until he's like nine. all in all, an ordinary family. a little bit of 'as long as we love each other we will make it' mentality.

family death tw within bullet point. old age takes a toll and daon's father passes after battling an illness. two long weeks later, his mother passes too, struck by severe grief over her late husband. given that he's sixteen, his sister dami becomes his guardian and he moves in with her, into an one bedroom apartment that's closer to her university.

for the most part, he's a quiet kid who tries avoiding situations that would trouble his sister. despite his (young) age he realizes that she's not his mom, she has her own life and that he doesn't want to be an additional burden to her; expenses are little, and daon spends most of his time either studying, reading or being on the 'puter. the type who'd lay on his futon and watch documentaries about a subject they're covering at school at the time... #nerd

university rolls around and unlike his sister who's a law girlie, he decides to go down the path of krn lang and literature! but his grades kinda suffer bc he also starts the employment era so the academically gifted teen turns into a mediocre man! skips out on classes a lot and fails to ✨network✨ though he graduates on time

for what.. employment era 2.0 but with a degree except it's the wrong degree in most people's opinions. works in some firm as proofreader . they move to a two bedroom apt and things are looking a little better!!! woah

but then his sister is like well my dearest bro... my boyf finally proposed and we got a bread in the oven... sry daon :/ and like the good brother he is, he again chooses to not be a burden n moves out. and he always has to get slapped twice so! he's also laid off. AI took his job </3

repeatedly down-scaling places he lives at until he's channeling yoon jongwoo and looking at a cheap goshiown, two steps away from a mental breakdown.

rental agency he's looking through, however, tells him they have an opening at the loop. the studio is rather nice for the money asked and he doesn't risk it, immediately signing the lease without a second thought. i imagine he tried to reach out for the person again but the agency was like what are u talking about. mysterious type of beat where he's confused but chooses not to question i, they will appear again sooner or later?? except they don!t

currently! been at the loop for a year. works as a teacher at a "nearby" hagwon (the teens present are just above middle class but not enough that they're rich; still, it doesn't stop them from channeling the same mean energy. and the pay is. well. not enough to warrant their meanness. yes he's getting mildly bullied by 17 year olds), probably on the 'puter as well trying to find some fiverr-type gigs for extra cash. jumpscared by reoccurring dreams from ten years ago, but also from his 'you're fired!' moments. blames it on working too much. thinks he should get a therapist or smth if only it wasn't so expensive. tripping out and popping paracetamols daily. he has absolutely nooo idea what's cooking up for him!!!

personality wise he's. well. timid. not soft spoken per se but you can tell there was never an angry man in the house with him. tries to avoid any kind of altercation, even when he knows he's in the right, because he doesn't want to deal with the consequences; physical, mental or financial. time is money type of mentality, hates sudden and out-of-nowhere plans because of budgeting; however, if you need a quick loan for something he will try and see what he can borrow. overall reliable and kind, mostly influenced by his sister raising him basically? unfortunately gets jealous of others easily, be it over their relationships or material possessions. internalizes literally everything possible and impossible. cancer sun cancer moon so. good luck

other tidbits is that his unit is literally constantly a mess from paperwork and other teaching material he prepares... please don't enter x needs glasses 24/7 because if you stand like ten meters away from him you're a blurry blob and he's squinting. v neat handwriting. can tie a cherry with his mouth. enjoys that indie type of movies that are like two hours and nothing happens but it's ✨aesthetic✨. will borrow you flour/eggs/milk if you knock and ask, even if it's like 3am. always says (an awkward) hi in the hallways even if there's no response. his everyday wear consists literally of just sweatpants and sweatshirts/oversized tees; if u look at him ud never guess he's a TEACHER... has multiple notebooks filled with poetry hidden somewhere around his unit back from hs/uni + bare bones book concepts he writes down and then grows to either hate or doesn't have the time to even give it a second glance :+) his creativity juice pitcher is empty and has been for yearss

plots wise i prefer to brainstorm or fill up your wanted connections bc i can fit him into pretty much anything so i don't have much to offer here </3

10 notes

·

View notes

Text

Pat Bagley, Salt Lake Tribune

* * * *

LETTERS FROM AN AMERICAN

January 19, 2024

HEATHER COX RICHARDSON

JAN 19, 2024

President Joe Biden today signed the continuing resolution that will keep the government operating into March.

Meanwhile, the stock market roared as two of the three major indexes hit new record highs. The S&P 500, which measures the value of 500 of the largest companies in the country, and the Dow Jones Industrial Average, which does the same for 30 companies considered to be industry leaders, both rose to all-time highs. The third major index, the Nasdaq Composite, which is weighted toward technology stocks, did not hit a record high, although its 1.7% jump was higher than that of the S&P 500 (1.2%) or the Dow (1.1%).

Investors appear to be buoyed by the fact the rate of inflation has come down in the U.S. and by news that consumers are feeling better about the economy. A report out today by Goldman Sachs Economics Research noted that consumer spending is strong and predicted that “job gains, positive real wage growth, will lead to around 3% real disposable income growth” and that “household balance sheets have strengthened.” It also noted that “[t]he US has led the way on disinflation,” and it predicted further drops in 2024. That will likely mean the sort of interest rate cuts the stock market likes.

The economic policies of the Biden-Harris administration have also benefited workers. The unemployment rate has been under 4% for more than two years, and wages have risen higher than inflation in that same period. Production is up as well, to 4.9% in the third quarter of 2023 (the U.S. growth rate under Trump even before the pandemic was 2.5%).

The administration has worked to end some of the most obvious financial inequities in the U.S., such as the unexpected “junk fees” tacked on to airline or concert tickets, or to car or apartment rentals. On Wednesday the Consumer Financial Protection Bureau announced a proposed rule for bank overdraft fees at banks that have more than $10 billion in assets.

While banks now can charge what they wish if a customer’s balance falls below zero, the proposed rule would allow them to charge no more than what it cost them to break even on providing overdraft services or, alternatively, an industry-wide fee that reflects the amount it costs to deal with overdrafts: $3, $6, $7, or $14. The amount will be established after a public hearing period.

Ken Sweet and Cora Lewis of the Associated Press note that while the average overdraft is $26.61, some banks charge as much as $39 per overdraft. The CFPB estimates that in the past 20 years, banks have collected more than $280 billion in overdraft fees. (One bank’s chief executive officer named his boat “Overdraft.”) Over the past two years, pressure has made banks cut back on their fees and they now take in about $8 billion a year from those overdraft fees.

Bankers say regulation is unnecessary and will force them to end the overdraft service, pushing people out of the banking system. Biden said that the rule would save U.S. families $3.5 billion annually.

The administration has also addressed the student loan crisis by reexamining the loan histories of student borrowers. An NPR investigation led by Cory Turner revealed that banks mismanaged loans, denying borrowers the terms under which they had signed on to them. Rather than honoring the government’s promise that so long as a borrower paid what the government thought was reasonable on a loan for 20 or 25 years (undergrad or graduate), the debt would be forgiven, banks urged borrowers to put the loan into “forbearance,” under which payments paused but the debt continued to accrue interest, making the amount balloon.

The Education Department has been reexamining all those old loans to find this sort of mismanagement as well as other problems, like borrowers not getting credit for payments to count toward their 20 years of payments, or borrowers who chose public service not receiving the debt relief they were promised.

Today the administration announced $4.9 billion of student debt cancellation for almost 74,000 borrowers. That brings the total of borrowers whose debt has been canceled to 3.7 million Americans, with an erasure of $136.6 billion. Nearly 30,000 of today’s relieved borrowers had been in repayment for at least 20 years but never got the relief they should have; nearly 44,000 had earned debt forgiveness after 10 years of public service as teachers, nurses, and firefighters.

Biden has been traveling the country recently, touting how the economic policies of the Biden-Harris administration have benefited ordinary Americans. In Emmaus, Pennsylvania, last Friday he visited a bicycle shop, a running shoe store, and a coffee shop to emphasize how small businesses are booming under his administration: in the three years since he took office, there have been 16 million applications to start new businesses, the highest number on record.

Biden was in Raleigh, North Carolina, yesterday to announce another $82 million in support for broadband access, bringing the total of government infrastructure funding in North Carolina during the Biden administration to $3 billion.

On social media, the administration compared its investments in the American people to those of President Franklin Delano Roosevelt’s New Deal in the 1930s, which were enormously popular.

They were popular, that is, until those opposed to business regulation convinced white voters that the government’s protection of civil rights, which came along with its protection of ordinary Americans through regulation of business, provision of a basic social safety net, and promotion of infrastructure, meant redistribution of white tax dollars to undeserving Black people.

The same effort to make sure that ordinary Americans don’t work together to restore basic fairness in the economy and rights in society is visible now in the attempt to attribute a recent Boeing airplane malfunction, in which a door panel blew off mid-flight, to diversity, equity, and inclusion (DEI) efforts. Tesnim Zekeria at Popular Information yesterday chronicled how that accusation spread across the right-wing ecosystem and onto the Fox News Channel, where Fox Business host Sean Duffy warned: “This is a dangerous business when you’re focused on DEI and maybe less focused on engineering and safety.”

As Zekeria explains, “this narrative has no basis in fact.” Neither Boeing nor its supplier, Spirit AeroSystems, is particularly diverse, either at the workforce level, where minorities make up 35% of Boeing employees and 26% of those at Spirit AeroSystems, or on the corporate ladder, where the overwhelming majority of executives are white men. Zekeria notes that right-wing media figures have also erroneously blamed last year’s train derailment in Ohio and the collapse of the Silicon Valley Bank on DEI initiatives.

The real culprit at Boeing, Zekeria suggests, was the weakened regulations on Boeing and Spirit thanks to more than $65 million in lobbying efforts.

Perhaps an even more transparent attempt to keep ordinary Americans from working together is the attacks former Fox News Channel personality Tucker Carlson has launched against Vice President Kamala Harris, calling her “a member of the new master race” who “must be shown maximum respect at all times, no matter what she says or does.” Philip Bump of the Washington Post noted yesterday that this construction suggests that Harris, who identifies as both Black and Indian, represents all nonwhite Americans as a united force opposed to white Americans.

But Harris’s actions actually represent something else altogether. She has crossed the country since June 2022, when the Supreme Court overturned the 1973 Roe v. Wade decision that recognized the constitutional right to abortion, talking about the right of all Americans to bodily autonomy. That the Supreme Court felt able to take away a constitutional right has worried many Americans about what they might do next, and people all over the country have been coming together in opposition to the small minority that appears to have taken over the levers of our democracy.

Driving the wedge of racism into that majority coalition seems to be a desperate attempt to stop ordinary Americans from taking back control of the country.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters from An American#Heather Cox Richardson#US Economy#Kamala Harris#reproductive rights#women's rights#income inequality#student loans#stock market

10 notes

·

View notes