#it makes it more interesting

Explore tagged Tumblr posts

Text

Come on.

Saying that Harry actually was so obsessed with Draco and knew everything about him but Draco didn't is literally the anti-thesis of the nature of their relationship.

And saying that Harry had a crush on Draco during Hogwarts is quite bold when Harry couldn't give two f about him until Draco became an active threat to his home and friends.

We literally had a scene where Harry saw Draco Malfoy cry to Myrtle and then he was like "oh maybe he's not a horrible bully, heartless coward that gets away with his shitty attitude. Maybe he's got a bit of a heart somewhere inside of him."

Harry has always thought that Draco was his archenemy because he knew where to hurt and he bullied him (btw just because Harry defended himself doesn't mean he's not a victim). Draco always thought that Harry was an obnoxious, loud, "big man", "perfect Potter" who can do no wrong.

But in this bathroom scene Harry was confronted with the fact that he was wrong about him.

And we don't know what Draco thought in this scene but something tells me he started to view Harry as a human instead of an objectified, glorified, cold and obnoxious boy who dared to defy the Dark Lord (cue of the fact that it was Parkinson who spread the story - not Draco and we all know he would have taken this opportunity against him).

We literally have the first development of their relationship right there!! It's not the sectumsempra that really impacted their views of each other (it did a bit), but it was with Draco crying how hard it was to accomplish this mission and Harry seeing his desperation that developed their relationship !!

(also, I read on live journal that before the release of HBP, drarry fans were literally begging for a scenario like this because they knew that to make drarry work Draco needed to be challenged with hardship and Harry needed to see that. Draco needed to change as a person and change his view on Harry and Harry only needed to change his views on him).

It's with Draco changing his attitude that makes Harry more inclined to pity him.

But Harry wasn't obsessed with him. Draco is the one who's been running after him, chasing him down in the hallways and disrupting his quidditch matches or his plans.

Harry just wanted to live his life, Draco is the one who kept bothering him.

And no. Harry is hyperaware of his environment because of the Dursleys where he had to watch out for every wrong move. That's why he notices a lot about Draco. He doesn't trust him so he keeps an eye on him to avoid him better.

Why do we have to undermine Harry's cleverness and skill to ship drarry when we literally have a canon development of their relationship?

#it's so weird#look I ship drarry too#but this doesn't mean that I have to dumbify Harry for that#can we just appreciate that their relationship are not equal and one has to do more efforts#like it's okay#it makes it more interesting#why Harry has to be dumbed down to appeal to Draco when it's always been Draco who was chasing after him??#like it's okay if you want someone to be crazy about Draco#but don't expect Harry to be one#and don't twist canon facts to make it seems it that way#because by twisting facts you literally distort the nature of their relationship and their dynamic#let's love drarry for who they are#harry potter#harry james potter#draco malfoy#drarry

29 notes

·

View notes

Text

experimental sunman yaaaay

(ruin spoilers under the cut)

#my art#daycare attendant#dca fandom#sundrop#sunnydrop#eclipse#<- for real this time#ruin spoilers#eyestrain#im still figuring out eclipse in my brain.... but overall they actually havent changed much abt my interpretation of the dca#since my hc for them is that they started off as eclipse while they were being used for the theater#and then they somehow separated into sun and moon after they were reprogrammed for the daycare#and then the virus came along and further separated the two from each other.....#which makes eclipse seem more like a 3rd person rather than the previous combined state of the two... so who knows how the hell they work#i really like the ambiguity tho :] i've always enjoyed it when the line between sun vs moon is super blurry and uncertain#it makes it more interesting#anyway. tumblr kept fucking up my post format on mobile so i had to fix this on desktop lol. if it breaks again though im shitting myself#ruin eclipse

343 notes

·

View notes

Text

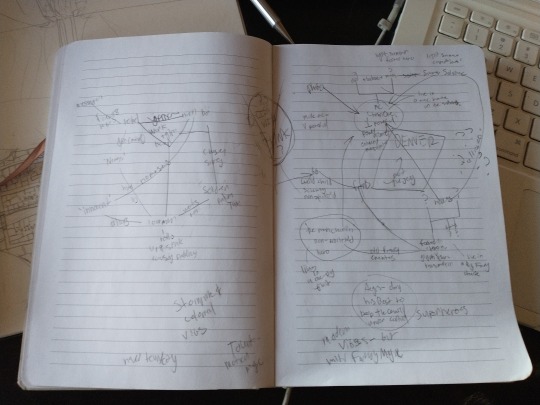

people who have tidy story-brainstorming notes equal parts baffle and impress me

#rose rambles#if my notes are not at least a little chaotic it simply does not work#wrose writes#it's either that or bullet pointed libreoffice scripts#and those are also still somewhat chaotic tbh#it makes it more interesting

2 notes

·

View notes

Text

watching wistoria episode 6 and like. i swear are all of these mfers in love with will or what bc wdym rosti just went “will is the one i love most in the world” LIKE???? also sion you can’t fool me i swear you have a crush on this man don’t try me 😭😭😭

#the whole point is for him to get with the girl he likes!!! too many of y’all tryna get in the way#not mad about it though#it makes it more interesting#i love it when like everyone is in love with the mc of something#wistoria wand and sword

5 notes

·

View notes

Text

(also feel free in the tags to clarify Why you made the choice you made!! :0c)

#polls#tumblr polls#For me I think the top ones would be the House. The Money. or the Friend Group. But I ultimately might would go for the house#JUST becuase it would be my Dream House which means it would already meet mostly all of my specifications#and what I might be looking for. which would save a lot of time searching or customizing/rennovating.#Also because I could use that as a way to leave the US lol.. like .. if I get to choose my dream location.. couldnt I just choose some othe#country?? But I wonder how that works. Can you legally 100% have full ownership of a property in a country yet not be a citizen of that#country?? Would you show up and be like 'erm.. i own this house.. so i shall now live in it' and theyd be like 'uh no. you cant live here#despite owning the house. leave.' ??#So I think the initial process of 1. scraping together funds to actually MOVE myself and my most valuable belongings physically#TO another country. and 2. figuring out how to STAY in that country . might end up being difficult.. BUT. if I could just work that#part of things out then.. dream house?? security for once in my life?? stability?? :0#Though the $1mil is enticing it's also like.. I feel .. with the way housing prices are now... that's not much???#it's a lot I guess if you plan on like.. investing half the money and staying in an apartment for 5 years while you grow your wealth#or something. but if you're a 'I Need Stability NOW' ready to settle down person who would be most interested in owning a property rather#than nice clothes or a car or whatever other investments you could make then.. eh..?? It seems like unless you're okay with living in#a small town or kind of far away from the city - even some SMALL houses in majorly populated areas in the US will be like#$600.000 - $900.000 or something. like that would be MOST of my money. Which I know you could just pay partially and make#payments on it but idk.. in the option of just outright owning the house it seems like it'd end up being cheaper.#Plus I would want to own it fully asap because I'd be afraid of losing it somehow otherwise. like it being taken for medical bills or#something. which I thought was supposed to be - not IMPOSSIBLE - slightly more complicated legally if you actually have#paid off the house in full. I guess the issue then would be utilities and property tax and such. But I feel like thats overcome-able??#Like I could just stipulate that my Dream House has a little furnished addition or something and then find someone#with money and be like 'Look you can live in this extremely nice area with amazing ameneties and updated everything and ALL you have#to do is give me money to cover the utilities and property tax.'' or something like that. Like the little furnished addition is nicer#than the actual house. they have their own pool and spa and movie room or something and Ill also cook all their meals for them#or whatever (how luxurious it would be depeneds on how high the property tax actually is/how much I would need to entice them into#why it's a good deal for them to pay it for me lol). idk... something like that.. ANYWAY#I asked a few people I know though and one of them answered they'd rather have a romantic partner. the other one said they'd like#to be able to choose someone to die lol.. So I'm curious what people value the most

20K notes

·

View notes

Text

Girl failed the med school exam like 8 times I dont think she'd do all too well when faced with the burnt crisp of her captain

#mouthwashing#anya mouthwashing#i think anya should be allowed by the fandom to not be the best at her job#i find her more interesting as someone trying to reach a goal but unable to make it#curly being kept alive is less so an impressive feat and more so the torment of keeping someone alive but never aleviating their pain#also itd make jimmys comments crueler in how hed target her insecurities

35K notes

·

View notes

Note

Your Adrin artwork looks like Rio from Money Heist so that’s who I’m picturing lol

and you know what he sexy as hell so you keep picturing that. its perfect

#ima see if i see it too#i love that#yes#rio from money heist is actually in my fanfic#it makes it more interesting#asks#awsf?#adrin

1 note

·

View note

Text

AuDHD is so funny sometimes like what do you mean my hyperfixations/special interests will last for years on end or possibly forever but they will cycle out every month or two with absolutely no transitional period or warning. like i will think about the same topic every day obsessively for 46 days in a row and on the 47th day with no visible cause adhd brain goes "ok! bored of that now" and autism brain goes "dw i got something queued up for ya" and i blast into full blown obsession on some other topic whose mental file folders haven't opened in 9 months. brain's out here treating hyperfixations like a crop rotation. once the dopamine runs out it cycles in another one but once something's in the rotation it never ever leaves. last summer we brought in one from when i was 11. it's so funny to me but frustrating too bc like. i cannot stress enough my inability to predict or control this. or how completely abrupt and random it can be

EDIT: seems this is more common among ND people than i thought, and probably not limited to AuDHD specifically :] i was just describing my own experiences and didn't expect this post to blow up, so don't take me for an authority, but i'm glad it resonated with so many of y'all

#actually adhd#actually autistic#audhd#aphelion.txt#ik 'adhd brain' vs 'autism brain' is a gross oversimplification especially given how much overlap there can be#but it at least helps me conceptualize wtf is going on in my head when i do this lol#and yeah i'm mostly referring to fandoms in this post but it can happen w more 'Traditional' special interests too#like my linguistics special interest which hasn't popped up in a couple years now but whenever it does#i will fill literal notebooks while studying 4 languages at once and simultaneously inventing a conlang#and then i'll be like Ok that was fun! and several months later im deleting like. 2gb of textbooks off my iphone to make room for an update#And sometimes yeah there is a precipitating event like 'Oh something new happened in X fandom with my blorbo!' but sometimes it's like#yeah. no. idk either. switch got flipped in my brain and X no longer sparks joy. only Y rn. how come it's Y? yeah idk i also wish i knew#i don't think any of this is actually an uncommon experience for people with these types of neurodivergencies it's just.#the severity of abruptness and TOTALITY of the switch that makes me feel like a weirdo sometimes lol#like I'M getting mental whiplash from this sometimes. idk how y'all are still following my blog

10K notes

·

View notes

Text

I read someone on here saying that this would have happened to Caitlyn at least once and - I strongly agree

#I also thought it was interesting that she seems to be avoiding her bed in act 2#makes sense though if you think about it a little :)#so falling asleep on her desk it is#more pain#you're welcome#mine#caitlyn kiramman#arcane#caitvi#piltover's finest

9K notes

·

View notes

Text

I see your "Laios is trans" but that dude is THE most apathetically agender person on the planet. Laios does not have time for gender. Laios does not even HAVE a gender identity, he removed it to make room for more Monster Facts.

25K notes

·

View notes

Text

More Stowaway AU

Pacifica dynamics with each Grunkle. Happy late Father’s Day and birthday to the grunks!

#Pacifica Northwest#Stanley Pines#Stanford Pines#Stan Pines#Gravity Falls#Stowaway AU#my art#doodles#there’s much more lovecraftian ass monsters and pirate specters than I’ve depicted I just really like making jokes about the dynamics#i love Paz and Stan beefing but like now it’s with love#Ford and Pacifica though that was a surprising discovery bc before I’d always have their relationship as positive neutral#maybe Paz a little tinyyyy bit scared of him bc he is Dipper coded but once he finds out about her paranormal connections he might#unintentionally treat her more science experiment and anomaly more than like a person which is very NOT a Dipper thing so Paz is freaked#but like in the Stowaway AU ok some of that happens but I think the more Ford gets to know her as a bullheaded but intelligent kid who’s#eager to impress he sees a bit of himself AND his brother within her personality and she’s had to go through so much shit but she’s still#here and talking her shit and she’s surprisingly interested in history and so intuitive and REALLY into paranormal shit like even if its not#all the cryptid and science shit he likes they find something to really bond over#and then everything else is just like hey! this kid is cool#and then in the middle of the night one day he’s like ‘Stanley I think I’m ready to be a father.’ and Stan goes BWUH?????

4K notes

·

View notes

Text

I think that “Anakin was a slave child who was groomed by Palpatine and raised by someone who wasn’t ready to take on a child, thereby leaving him in a social limbo state where he’s surrounded by people but only has a few close confidants, with the one he trusts the most actively trying to take advantage of him”

and

“Anakin was taught right from wrong from a young age, first by his mother and then by Kenobi, but any time he was presented with a choice, actively CHOSE WRONG EVERY SINGLE TIME”

are two sentences that can, should, and MUST coexist to fully understand Anakin Skywalker as a character

Edit: PART 2 of this post here

#watching people debate him is so interesting to me#pro-Anakin people get it right in that upbringing shapes how a person is: he’s a slave child and had to leave his mom#so of COURSE he’s going to have an iron grip on people attachment-wise#but they tend to deny Anakin his own autonomy and resolve him of every bad thing he did#when it’s like: no. he DID all of that. not just did it…but did it once then did it again#meanwhile anti-Anakin people (usually) tend to understand that Anakin made terrible choices#but again…they either deny him autonomy by making him an always-evil character#or by just downplay the relationship he has with Obi-Wan or Padme. Completely dehumanizing him.#Like the truth is in the middle: he’s a deeply complex person#(arguably more so than fandom can completely understand)#it doesn’t help it that these people either tend to be pro Jedi (anti-Anakin) or pro Sith (pro Anakin)#Pro Jedi people tend to be…Xenophobic is the nicest term for how they treat Anakin#But pro Sith people tend to claim that the Jedi are a cult (they aren’t) and Anakin was groomed by it (he wasn’t)#So they use Anakin as the sort of doll to put all of their beliefs into. Which again we circle around to dehumanizing this character#star wars tcw#star wars#anakin skywalker#star wars meta#Anakin Skywalker meta

6K notes

·

View notes

Text

A young gith and her dragonling

Close-up + timelapse:

(Available as a print here)

#the other one kind of blew up but this is the one I actually wanted to make#I'm quite honestly very unsatisfied with everything I make lately (more than usual anyways)#so I find very hard to not get stuck redrawing the same piece infinitely#this one would probably benefit from yet another retry but I don't think anything I can make with my current skill would be enough#anyways thought the timelapse would be interesting for this one#lae'zel#lae'zel of crèche k'liir#lae'zel art#lae'zel fanart#bg3 art#bg3 fanart#bg3#bg3 lae'zel#dragon#dragonling#baldur's gate#baldur's gate 3#baldurs gate 3#baldurs gate fanart#baldur's gate iii#fanart#art#artists on tumblr#digital art#my art

5K notes

·

View notes

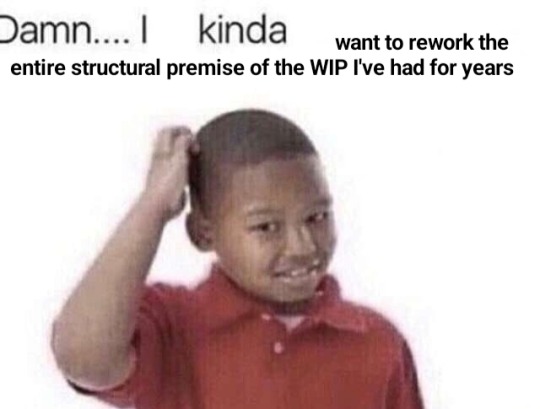

Text

#writing#writer things#writeblr#meme#aaahh#writing meme#heeeellpppp#id in alt text#can't continue being in progress if the foundation isn't sound anymore#this is about static house as something new and more interesting just came to me abd makes more sense too but aah to rework it all#i must i feel i must#it's happened with others too of course but stilll

20K notes

·

View notes

Text

Actually I have a post I want to make about Property Value.

Which is a topic that comes up a lot in discussions of rich people hoarding wealth, in NIMBY panics, and in the ever-increasing prices of homes. But I don't think we talk much about how the perniciousness of property value goes deeper and basically holds middle class people who own a home hostage.

So to set some context here: in 2025 the median US home sold for $416,000. Say you have a working class family who can't meet median, but who scraped and saved and penny-pinched their way to a $300,000 home.

Typically, when buying a first home, you pay 20% down directly, and take 80% out as a mortgage from the bank. For this family, that means $60,000 of their liquid money (and let's say it took them 10-15 years to save that amount), and a $240,000 loan from the bank.

That's $240,000 in debt the family is. Which will be repaid over 30 years, with interest, at a rate that usually means for the lifetime of the loan, they end up paying back double the original loan.

However this massive $240,000 debt is generally considered "okay" debt to have, because it's backed by the house. If things go truly sour, the bank can take the house (and what's a little homelessness between friends).

That $60,000 the family put down is considered equity, and equity is money you "have", but isn't accessible.

Scenario: Now let's say something happens. Someone in the family loses their job, and the only job they can find requires moving. Or a family member across the country can't care for themselves anymore and so this family needs to move to be closer to them. The family gets divorced. Someone in the family is allergic to material in the home. Someone in the family is being stalked or abused and needs to leave the town. Anything at all, which would require selling the home and moving.

Case 1: The family is able to sell it for exactly what they paid (same property value, no increase or decrease). You would think the math is clean. They are paid $300,000 for the house. $240,000 repays the bank loan. The remaining $60,000 of equity goes right back to them. And they can use it (which took 10+ years to save up) to move across the country and buy a different $300,000 house.

Except no, it does not work like that.

The seller of a home is on the hook to pay commission to their realtor and the buyer's realtor. This is usually ~6% of the home value. They have to pay legal costs. There are taxes. There are miscellaneous costs. It can easily be 6-9% of the selling price of the house.

The bank NEEDS its $240,000 back. So those costs come from the equity. This family is not getting their $60,000 back. They're getting $30,000-$45,000, and now no longer enough money for a downpayment in their move. They're back to renting. Back to penny pinching. They can get by, but homeownership is now out of their grasp once more. Maybe in another 5 years, they'll have enough (unless home prices have increased too much by then) then they'll maybe never be homeowners again.

Case 2: The property value has DECREASED... Family is only getting offers in the $260,000 range.

If the family accepts a $260,000 sale, well $240,000 goes to the bank. This is genuinely non-negotiable. And that leaves.... maybe not enough money to even close on the house. Not enough to pay the realtors and the fees.

That $60,000 is wiped out, and the family is incapable of moving. Never mind losing 10+ years of savings--they're below $0. They don't have the money to close. It's financially impossible to sell. They are stuck with the mortgage. They are stuck with the house. (Maybe they'll rent it, if they can. And now they're landlords by circumstance, which is often NOT profitable when you're not a trust fund baby renting out a totally-paid-for no-mortgage home.) But whatever the case, they cannot sell it. And if the reason for selling was a job loss... well, they can be homeless soon. And if the property value dropped below $240,000, they can be homeless AND owe a bank debt. A $60,000 nest egg wiped completely out, with a bank debt owed on top of that.

So how do people avoid financial destitution when moving?

The most sensible answer is building up equity by paying down the loan--but it's important to know that mortgages are super interest heavy in the early life of the loan. With a 5% interest rate (BETTER, btw, than current rates) this family would be paying $15,460 the first year, and only $3,540.88 is actually chipping at that $240,000 principle. The other $11,919.59 was pure interest to the bank.

So after 1 year, the family went from having $60,000 equity in the house to $63,540.88 equity in the house. This buys a little extra wiggle room when juggling closing costs. But not very much. Even after 3 years, the family has just a little over $70,000 of equity, and just under $230,000 still left on the loan. So if the family has to move for any reason (sickness! death! job loss!) in those 3 years, it's probably financially devastating.

But there is a second answer to avoiding financial ruin: and that is Property Value going up.

Any amount of property value increase is PURE equity. The bank only cares about the amount of money it gave you. If after 3 years, that house is now worth (and can sell for) $315,000 (which is appreciation of only 1.6% a year. Most home appreciation is closer to 3%), that's more equity increase than they got from 36 diligent months of mortgage payment.

If they can sell for $315,000, pay $230,000 of that to the bank, that leaves $85,000. $25,000 goes to paying the realtors and the closing costs and.... the family is back to their $60,000 downpayment. Not trapped. Able to sell. Able to buy a new $300,000 home in the place they moved. Able to just maintain homeownership status.

But wait, if their home appreciated to $315,000, didn't all the other homes do the same, so now $60,000 isn't enough

Smart eye, lad! You've identified why this is a TERRIBLE rat race for the people scraping money together to live, and is ONLY a profitable leisure activity for rich people who sell homes like collectables.

Now because the increase is pure equity, a similar family with decent property value increase can funnel that extra equity into affording to meet the new higher down payment (remember the downpayment is only 20%, so even if the new place is similarly higher in property value, you only need to match that increase 20% for the downpayment). Which gets their foot in the door. But now their new mortgage is higher than the old one. More expensive. More interest.

But there is a losing scenario here--if home property values increased everywhere else, but not where you live. Then this family is back to surrendering homeownership. Because even if they can sell their place, they can't buy the next home.

It forces them to care about their own Property Value increase because, if it doesn't increase while everywhere else does, it traps them.

So what do I mean by all this

If the value of all homes dropped 50% overnight, I assume most people here would celebrate. Affordable homes! Rich people upset and crying! So much to love.

But in reality, that 50% drop would likely continue to mean no home for most of us, because the people who could sell you the homes would be financially incapable.

For the family above with the $240,000 mortgage, that mortgage does not reach halfway-paid-off until year 20 of the 30 year mortgage (remember the interest frontloading). If a family still owes $230,000 in bank loans on a place that can only sell for $150,000, they can't sell it to you. That house is the bank's collateral securing the loan. Their mortgage is underwater. They're trapped. They cannot sell it. You cannot have it.

Something similar happened in the 2008 subprime mortgage crisis, and the only people who got out okay were ones who could stay the course, keep making the mortgage payments, and wait it out long enough for property value to recover.

Those who couldn't got foreclosed on. Those who couldn't were left in financial devastation.

So in conclusion?

Banks profit off of mortgages. Rich people profit off of hoarding housing stock and selling it as the property value increases. Real estate companies profit off of home sales. And the regular people, who managed to achieve home ownership, are shackled to the price-go-up system to avoid financial ruin. They're forced to care about their property value because it is the singular determinant of whether they're trapped in place, whether they'll be okay if they lose their job, whether they could move due to an important life event.

It's a profit system for the rich where the cogs are middle class people who could achieve homeownership, running a machine where every single crank locks the poorer and younger generations out of home ownership forever.

#on my next installment: how rising mortgage interest rates trap people in the exact same way!#how low mortgage rates BALLOONED home prices due to more people able to make competitive offers and how the following interest rate hikes#left prices massive AND new mortgages unaffordable and so many new people locked out of ownership forever#while trapping current owners in place because they could never afford a new mortgage at modern rates#chrissy speaks

4K notes

·

View notes