#wealthmanagers

Text

Grow Your Wealth: Expert Tips for Investing $1 Million and Achieving Financial Goals

#compounding #diversification #dollarcostaveraging #financialadvisors #growwealthovertime #highgrowthassets #investing1million #longtermperspective #lowriskinvestments #strategicplanning #substantialcapital #successfulinvestmentoutcomes #wealthmanagers

#Business#compounding#diversification#dollarcostaveraging#financialadvisors#growwealthovertime#highgrowthassets#investing1million#longtermperspective#lowriskinvestments#strategicplanning#substantialcapital#successfulinvestmentoutcomes#wealthmanagers

0 notes

Text

Wealth Managers

Wealth managers are financial professionals who specialize in helping individuals and families manage their wealth and achieve their financial goals.

0 notes

Text

Work does not increase wealth

#Work does not increase wealth#fuck work#just like that. a work “at will” slap in the face.#work#health wealth happiness#health is wealth#like a dragon infinite wealth#wealthmanagement#wealthbuilding#wealth#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#slave wages#wage slavery#anti slavery#slaves#slavery#slave#antiwork#eat the rich#eat the fucking rich#class war

17 notes

·

View notes

Text

Balance the three wealths.

#wealth#cash#money#rich#earn money online#goals#millionaire#money goals#motivation#investing stocks#wealthy#wealthmanagement

2 notes

·

View notes

Text

Explore Premier Wealth Management Services in Essex

Unlock the potential of your financial future with our premier wealth management Essex services. Our expert team specializes in bespoke wealth management strategies designed to preserve and grow your assets. We offer a comprehensive approach to wealth preservation, ensuring that your investments are optimized for both security and growth. With a deep understanding of the unique financial needs and goals of our clients, we provide personalized solutions that deliver peace of mind and long-term stability. Explore how our tailored wealth management services in Essex can help you achieve financial success and safeguard your legacy.

#WealthManagementEssex#EssexWealthManagement#WealthManagement#FinancialPlanningEssex#EssexFinance#InvestmentManagementEssex#WealthPreservationEssex#EssexFinancialAdvisors#WealthStrategiesEssex#EssexWealthAdvisors#Fol Wealth

2 notes

·

View notes

Text

Saving Strategies for Big Financial Goals

Dream big, save smart! 💰✨ Start your journey to financial freedom today with these easy saving strategies. 📊💯

👉🏻 Discover our step-by-step guide to smart saving strategies!

✅ Step 1: Define Your Financial Goals

✅ Step 2: Assess Your Current Financial Situation

✅ Step 3: Set up a Saving Plan

✅ Step 4: Monitor and Adjust

Take the first step towards financial security with a FREE consultation. Expert advice is just a call away!

🔗 To know more, visit - www.fintlivest.com

📞 Contact us – 8951741819 / 9637778041

👉 Follow for daily financial tips and strategies: Fintlivest

https://www.instagram.com/fintlivest

https://www.facebook.com/Fintlivest

https://www.youtube.com/@Fintlivest

https://in.pinterest.com/fintlivestservices/

#investment#insurance#investmentstrategy#personalfinance#wealthmanagement#financialplanning#budgeting#financialfreedom#smartinvesting#finance#savings

2 notes

·

View notes

Text

youtube

#Investing#SmallCapStocks#FinancialGrowth#MarketInsights#InvestmentStrategy#FinancialSuccess#StockMarket#TradingTips#InvestmentPortfolio#FinancialFreedom#KnowledgeIsPower#InvestmentEducation#StockAnalysis#Finance#InvestmentOpportunities#GrowthStocks#MarketTrends#WealthManagement#InvestmentAdvice#InvestmentCommunity#youtube#small youtuber#online business#entrepreneur#ecommerce#branding#marketing#accounting#bookkeeping#digitalmarketing

2 notes

·

View notes

Text

🌟 Discover the Power of an RRSP in British Columbia! 🌟

Are you looking to secure your financial future? An RRSP (Registered Retirement Savings Plan) is a fantastic way to save for retirement while enjoying some amazing tax benefits. Here’s what you need to know:

💡 What is an RRSP?

An RRSP is a retirement savings account that offers tax-deferred growth on your investments. Contributions you make are tax-deductible, which means you can reduce your taxable income and potentially get a bigger refund! 🎉

📈 Benefits of an RRSP:

Tax Savings: Contributions lower your taxable income.

Tax-Deferred Growth: Your investments grow without being taxed until withdrawal.

Retirement Security: Provides a steady income during retirement.

🔍 How Does It Work?

Contribute Regularly: Make regular contributions to maximize your savings.

Invest Wisely: Choose from a variety of investment options like Mutual Funds, Bonds, and GIC.

Withdraw Smartly: Plan your withdrawals strategically to manage your tax impact.

🏦 Why Choose Brace Financial Services?

At Brace Financial, we’re here to guide you every step of the way. Our experts will help you create a personalized RRSP strategy that fits your financial goals. Let's secure your future together! 💪

#bracefinancialservices#finance#financialadvisor#financialfreedom#canada#financial services#financialplanning#life insurance#surrey#financialwellness#RRSP#RetirementPlanning#TaxBenefits#FinancialFreedom#BraceFinancialServices#InvestSmart#RetirementSavings#SecureFuture#WealthManagement#TaxDeferredGrowth#FinancialAdvisor#PlanForTomorrow#SavingsGoals#BritishColumbia#CanadaFinance

2 notes

·

View notes

Text

mutual fund consultant

As a mutual fund consultant, you advise customers on how to invest in mutual funds while taking into account their goals and risk tolerance. You assess possibilities, make personalized recommendations, and remain current on market trends to make informed judgments.

#mutual fund consultant#mutual funds#gofundmecampaign#gofundmeplease#mutual#advisor#neardeathnote#money#businessplans#giveandtake#matchingfunds#mutuallikes#angeladvisor#funding#wealthmanagement#evadvisor#gofundmepage#taxcredit#invest#broker#gofundmehelp#smartinvesting#capital#income#investinyourfuture#education#grants#leadership#consultant#tax

2 notes

·

View notes

Text

Grow Your Wealth: Expert Tips for Investing $1 Million and Achieving Financial Goals

#compounding #diversification #dollarcostaveraging #financialadvisors #growwealthovertime #highgrowthassets #investing1million #longtermperspective #lowriskinvestments #strategicplanning #substantialcapital #successfulinvestmentoutcomes #wealthmanagers

#Business#compounding#diversification#dollarcostaveraging#financialadvisors#growwealthovertime#highgrowthassets#investing1million#longtermperspective#lowriskinvestments#strategicplanning#substantialcapital#successfulinvestmentoutcomes#wealthmanagers

0 notes

Text

10 Essential Tips for Effective Financial Management

Introduction

Effective financial management is the cornerstone of a stable and prosperous life. Whether you're an individual or a business owner, mastering the art of managing your finances can lead to greater financial security and opportunities. In this article, we will delve into the 10 essential tips for effective financial management, providing you with actionable advice to help you make informed financial decisions.

1. Create a Detailed Budget

Managing your finances starts with creating a detailed budget. A budget helps you track your income, expenses, and savings goals. By understanding where your money goes, you can make necessary adjustments to achieve your financial objectives.

2. Set Clear Financial Goals

To effectively manage your finances, set clear and achievable financial goals. These goals will serve as a roadmap for your financial journey, helping you stay motivated and focused.

3. Build an Emergency Fund

Life is full of unexpected surprises, and having an emergency fund is crucial. Aim to save at least three to six months' worth of living expenses in an easily accessible account.

4. Reduce Debt

High-interest debts can hinder your financial progress. Create a plan to reduce and eventually eliminate your debts. Start by paying off high-interest debts first.

5. Invest Wisely

Make your money work for you by investing wisely. Diversify your investments, consider long-term strategies, and seek advice from financial experts if needed.

6. Monitor Your Credit Score

Your credit score plays a significant role in your financial life. Regularly monitor it and take steps to improve it if necessary. A good credit score can lead to better borrowing terms and financial opportunities.

7. Save for Retirement

Don't wait until retirement is around the corner to start saving. The earlier you begin, the more you can accumulate. Explore retirement account options and contribute regularly.

8. Review and Adjust

Financial management is not a one-time task. Periodically review your budget, goals, and investments. Make adjustments as your financial situation changes.

9. Seek Professional Advice

If you find financial management overwhelming, consider seeking advice from a financial advisor. They can provide personalized guidance and strategies to optimize your finances.

10. Stay Informed

Stay updated on financial news, trends, and opportunities. Knowledge is power, and being informed will help you make better financial decisions.

10 Essential Tips for Effective Financial Management

In this section, we will briefly recap the ten essential tips for effective financial management:

Create a Detailed Budget

Set Clear Financial Goals

Build an Emergency Fund

Reduce Debt

Invest Wisely

Monitor Your Credit Score

Save for Retirement

Review and Adjust

Seek Professional Advice

Stay Informed

FAQs

Q: How do I start creating a budget?

A: Begin by listing all your sources of income and your monthly expenses. Categorize your expenses and identify areas where you can cut back.

Q: What's the ideal emergency fund size?

A: Aim for three to six months' worth of living expenses, but adjust based on your personal circumstances and risk tolerance.

Q: Can I manage my investments on my own?

A: While it's possible to manage your investments independently, seeking advice from a financial advisor can help you make more informed decisions.

Q: How often should I review my financial goals?

A: Regularly review your financial goals, at least once a year, and adjust them as needed to reflect changes in your life or financial situation.

Q: What's the best way to improve my credit score?

A: To boost your credit score, pay bills on time, reduce outstanding debts, and avoid opening too many new credit accounts.

Q: When should I start saving for retirement?

A: Start saving for retirement as early as possible to maximize your savings. The earlier you begin, the more you can accumulate over time.

Conclusion

Effective financial management is a skill that anyone can master with dedication and commitment. By following these 10 essential tips for effective financial management, you can take control of your finances, secure your future, and achieve your financial dreams. Remember that financial management is an ongoing process, so stay informed, adapt to changes, and always strive for financial excellence.

#FinancialManagement#MoneyManagement#PersonalFinance#FinancialGoals#Budgeting#InvestingTips#CreditScore#RetirementPlanning#DebtManagement#FinancialFreedom#Savings#FinanceTips#SmartInvesting#BudgetingTips#FinancialPlanning#WealthManagement#FinancialEducation#Finance101#FinancialAdvisor#MoneyMatters#MoneySmarts

4 notes

·

View notes

Text

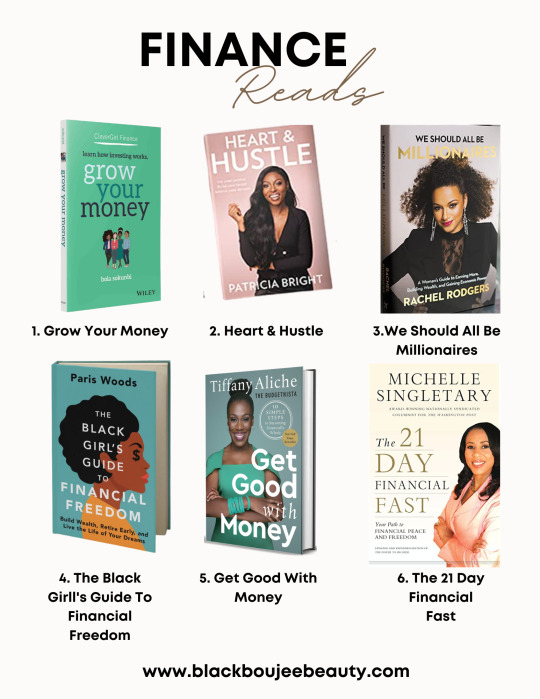

6 Finance Reads To Grow Your Wealth In 2023

Did you enjoy these books and want access to more like them? Head over to the BlackBoujeeBeauty Storefront and make sure to tag @blackboujeebeauty on Instagram so that we can tune into what you're reading this month and build healthy discussions around the related topics!

#blogging#blog#blog post#black girls who blog#blackgirlmagic#blacktumblr#trending#black girl luxury#blackgirlbloggers#black woman appreciation#wealth#moneymindset#wealthmanagement#manifestation#affirmations#wealth affirmations#luxury lifestyle#black women in luxury#personal development

10 notes

·

View notes

Text

Stocks have been rough.

#wealth#cash#money#rich#earn money online#goals#millionaire#money goals#motivation#investing stocks#stocks#stock trading#stock market#wealthy#wealthmanagement#wealthbuilding

2 notes

·

View notes

Link

Wealth management is no longer the same as it used to be! The rise of fintech companies has brought innovative investment solutions, making them more accessible and efficient than ever before.

Let's dive into the impact of fintech app development on wealth management in the UK and how it's changing the industry.

#fintech#financial#finserv#financialservices#wealthmanagement#investmentsolutions#mobileapp#appdevelopment#mobiosolutions#uk

8 notes

·

View notes

Text

Unlock the power of financial security! 📈 Here are 5 crucial reasons why financial planning is a must for a prosperous future. 🌟

1️⃣ Achieve Financial Goals

2️⃣ Emergency Preparedness

3️⃣ Debt Management

4️⃣ Investment Strategy

5️⃣ Retirement Security

Your journey to financial freedom starts with a FREE consultation. Let's build your future together!💯

🔗 To know more, visit - www.fintlivest.com

📞 Contact us – 8951741819 / 9637778041

👉 Follow for daily financial tips and strategies @fintlivest

https://www.instagram.com/fintlivest

https://in.pinterest.com/fintlivestservices/

https://www.facebook.com/Fintlivest

https://www.youtube.com/@Fintlivest

#investment#insurance#investmentstrategy#personalfinance#wealthmanagement#budgeting#financialplanning#financialfreedom#smartinvesting#finance

2 notes

·

View notes

Text

Navigating Financial Success with Advisory Services: A Certified Accountant's Guide to Maximizing Income

Introduction:

In the complex landscape of personal and business finance, securing your financial future and maximizing your income are paramount goals. To achieve these objectives, many individuals and businesses turn to Certified Accountants who provide essential advisory services. In this comprehensive guide, we'll explore the world of advisory services offered by certified accountants and how they can help you optimize your income. Whether you're an individual seeking financial guidance or a business owner looking to enhance your bottom line, this article will provide valuable insights to help you achieve financial success.

Understanding Advisory Services

1.1 What Are Advisory Services?

Advisory services, in the context of certified accountants, encompass a wide range of financial and strategic guidance aimed at helping individuals and organizations make informed decisions to achieve their financial objectives. These services extend beyond traditional accounting and auditing and focus on proactively improving financial outcomes.

1.2 Role of a Certified Accountant

A certified accountant, often referred to as a Certified Public Accountant (CPA), is a licensed professional with extensive expertise in accounting, taxation, and financial management. Certified accountants go beyond number-crunching; they provide invaluable insights and recommendations to enhance financial health.

How Advisory Services Maximize Income

2.1 Income Optimization Strategies

Certified accountants leverage their knowledge and experience to help clients identify and implement income optimization strategies, such as:

Tax Planning: Crafting tax-efficient strategies to minimize tax liabilities and maximize take-home income.

Investment Guidance: Providing advice on investment portfolios and strategies to generate additional income streams.

Expense Management: Analyzing expenses to identify cost-saving opportunities and increase disposable income.

2.2 Business Income Growth

For businesses, certified accountants play a crucial role in income growth by:

Financial Analysis: Conducting in-depth financial analysis to identify revenue-generating opportunities.

Budgeting and Forecasting: Creating budgets and financial forecasts to set income targets and measure performance.

Risk Management: Developing strategies to mitigate financial risks that may affect income.

Certified Accountants as Financial Advisors

3.1 The Dual Role

Certified accountants often serve as both financial advisors and accountants. In their advisory role, they:

Provide Comprehensive Financial Planning: Crafting personalized financial plans aligned with clients' goals.

Offer Investment Guidance: Recommending investment options and asset allocation to optimize income.

Retirement Planning: Helping clients plan for a secure financial future with income sustainability.

3.2 Certified Accountant vs. Traditional Financial Advisor

While both certified accountants and traditional financial advisors offer valuable financial guidance, certified accountants bring a unique perspective with their expertise in tax planning, accounting, and compliance. This allows for a holistic approach to income optimization.

Chapter 4: The Importance of Advisory Services

4.1 Personal Finance

For individuals, advisory services provided by certified accountants can lead to:

Improved financial decision-making.

Enhanced wealth accumulation and preservation.

Reduced tax burdens and increased disposable income.

4.2 Business Finance

For businesses, these services contribute to:

Sustainable growth and profitability.

Improved cash flow management.

Compliance with tax regulations and financial reporting standards.

Chapter 5: Choosing the Right Certified Accountant

When seeking advisory services to maximize income, consider the following factors:

Qualifications: Ensure the accountant is a certified professional with relevant credentials.

Experience: Assess their experience in providing advisory services.

Specialization: Look for an accountant with expertise aligned with your needs, whether it's personal finance, small business, or corporate finance.

References: Check client references and reviews to gauge their reputation.

Conclusion

Advisory services provided by certified accountants offer a holistic approach to income optimization for both individuals and businesses. These professionals bring unique insights and strategies to the table, ensuring that you make informed financial decisions and maximize your income potential. Whether you're aiming for personal financial success or striving to grow your business, partnering with a certified accountant can be the key to achieving your financial goals. In the ever-evolving financial landscape, the guidance of a certified accountant is your path to securing a prosperous future.

Remember that the right certified accountant can be your trusted partner in financial success, providing guidance, expertise, and strategies tailored to your unique financial situation and goals.

#AdvisoryServices#IncomeOptimization#CertifiedAccountant#FinancialGuidance#TaxPlanning#InvestmentStrategies#ExpenseManagement#BusinessGrowth#FinancialAdvice#PersonalFinance#Budgeting#RetirementPlanning#FinancialSuccess#WealthManagement#FinancialDecisions#FinancialHealth#IncomeStrategies#MoneyManagement#FinancialGoals#FinanceTips#Toronto#Canada

2 notes

·

View notes