#How to trade crypto futures?

Text

PrimeXBT Review: The Best Platform for Leverage Traders

Choosing the best trading platform is paramount for crypto traders.

In today’s post, we will dive into a detailed review of PrimeXBT.

PrimeXBT is a crypto exchange for all types of traders, from beginners to pros.

The exchange provides a world-class platform for trading crypto futures and CFD (Contract for Difference).

Impressively, CoinGecko ranks it 11th largest among derivatives…

View On WordPress

#How to trade crypto futures?#Is PrimeXBT safe?#PrimeXBT review#What is the best derivative exchange?

0 notes

Text

Unlocking Perpetual Futures Contracts: Essential 2024 Guide for Beginners

Are you ready to take your trading to the next level with a financial instrument that offers endless opportunities and flexibility?

Perpetual futures contracts have emerged as a revolutionary tool in the trading arena, particularly for cryptocurrency enthusiasts. These contracts, unlike traditional futures, do not have an expiration date, allowing traders to hold positions indefinitely. This feature provides a significant advantage, enabling continuous trading and the ability to take advantage of long-term market trends. The funding rate mechanism, which periodically adjusts to keep contract prices in line with the spot prices of the underlying assets, ensures a balanced and fair trading environment.

Leverage is a key feature of perpetual futures contracts, allowing traders to control larger positions with a smaller capital investment. This can significantly amplify profits, but also poses a risk of larger losses, making risk management a crucial aspect of trading these contracts. The real-time mark-to-market settlement process adjusts traders' margin balances continuously, ensuring that gains and losses are promptly accounted for. This mechanism helps prevent sudden liquidations and keeps traders informed about their margin requirements.

Despite the numerous benefits, perpetual futures come with their own set of risks, including market volatility and fluctuating funding rates. Traders must have a solid understanding of these risks and employ effective strategies to mitigate them.

Intelisync, a pioneer in blockchain technology and exchange development, offers advanced solutions to enhance the security and functionality of perpetual futures trading. Explore how Intelisync can enhance your trading experience and provide the tools you need to succeed in the dynamic world of perpetual futures.

Discover how Intelisync can transform your trading journey and provide you with the tools needed to succeed in the dynamic world of perpetual futures. Contact Intelisync today! Ready to revolutionize your trading journey? Contact Intelisync today and Learn more....

#Advantages of Perpetual Contracts#Crypto Market Liquidity#Cryptocurrency Trading#Funding Rate#Funding Rate Mechanism#Futures Trading Guide#How do Future contract work?#How does trading on perpetual contracts work?#Intelisync Blockchain solution#Main Features of Perpetual Futures#Margin Requirements#Market Volatility#PERP DEX Development: Intelisync’s Expertise in Perpetual Future Contracts#perpetual futures trading.#Perpetual Futures vs. Traditional Futures#Risks Associated with Perpetual Futures Contracts#Trading Strategies#What is Perpetual Futures Contracts

0 notes

Text

#funding rates#crypto funding rate#crypto#funding rate#funding rates crypto#funding rate explained#funding fee#funding rate binance#crypto trading#funding rate strategy#funding rates explained#what is funding rate#funding#funding rate crypto explained#crypto investing#binance futures funding#crypto funding rates explained#trading funding rate#how to check crypto funding rates#crypto market#trading crypto#funding rate binance futures in hindi#business#newblogflo#secretstime

0 notes

Text

#buy pancat cryptocurrency#What is Pancat Cryptocurrency and Why You Should Consider Buying It#A Beginner's Guide to Buying Pancat Cryptocurrency#The Risks and Benefits of Investing in Pancat Cryptocurrency#How to Choose the Right Exchange to Buy Pancat Cryptocurrency#How to Store Your Pancat Cryptocurrency: A Guide to Crypto Wallets#The Future of Pancat Cryptocurrency: Price Predictions and Trends#Pancat Cryptocurrency vs. Other Altcoins: A Comparison Guide#How to Buy Pancat Cryptocurrency Safely and Securely#The Top Strategies for Trading Pancat Cryptocurrency#The Impact of Pancat Cryptocurrency on the Cryptocurrency Market.

0 notes

Text

The AI hype bubble is the new crypto hype bubble

Back in 2017 Long Island Ice Tea — known for its undistinguished, barely drinkable sugar-water — changed its name to “Long Blockchain Corp.” Its shares surged to a peak of 400% over their pre-announcement price. The company announced no specific integrations with any kind of blockchain, nor has it made any such integrations since.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/03/09/autocomplete-worshippers/#the-real-ai-was-the-corporations-that-we-fought-along-the-way

LBCC was subsequently delisted from NASDAQ after settling with the SEC over fraudulent investor statements. Today, the company trades over the counter and its market cap is $36m, down from $138m.

https://cointelegraph.com/news/textbook-case-of-crypto-hype-how-iced-tea-company-went-blockchain-and-failed-despite-a-289-percent-stock-rise

The most remarkable thing about this incredibly stupid story is that LBCC wasn’t the peak of the blockchain bubble — rather, it was the start of blockchain’s final pump-and-dump. By the standards of 2022’s blockchain grifters, LBCC was small potatoes, a mere $138m sugar-water grift.

They didn’t have any NFTs, no wash trades, no ICO. They didn’t have a Superbowl ad. They didn’t steal billions from mom-and-pop investors while proclaiming themselves to be “Effective Altruists.” They didn’t channel hundreds of millions to election campaigns through straw donations and other forms of campaing finance frauds. They didn’t even open a crypto-themed hamburger restaurant where you couldn’t buy hamburgers with crypto:

https://robbreport.com/food-drink/dining/bored-hungry-restaurant-no-cryptocurrency-1234694556/

They were amateurs. Their attempt to “make fetch happen” only succeeded for a brief instant. By contrast, the superpredators of the crypto bubble were able to make fetch happen over an improbably long timescale, deploying the most powerful reality distortion fields since Pets.com.

Anything that can’t go on forever will eventually stop. We’re told that trillions of dollars’ worth of crypto has been wiped out over the past year, but these losses are nowhere to be seen in the real economy — because the “wealth” that was wiped out by the crypto bubble’s bursting never existed in the first place.

Like any Ponzi scheme, crypto was a way to separate normies from their savings through the pretense that they were “investing” in a vast enterprise — but the only real money (“fiat” in cryptospeak) in the system was the hardscrabble retirement savings of working people, which the bubble’s energetic inflaters swapped for illiquid, worthless shitcoins.

We’ve stopped believing in the illusory billions. Sam Bankman-Fried is under house arrest. But the people who gave him money — and the nimbler Ponzi artists who evaded arrest — are looking for new scams to separate the marks from their money.

Take Morganstanley, who spent 2021 and 2022 hyping cryptocurrency as a massive growth opportunity:

https://cointelegraph.com/news/morgan-stanley-launches-cryptocurrency-research-team

Today, Morganstanley wants you to know that AI is a $6 trillion opportunity.

They’re not alone. The CEOs of Endeavor, Buzzfeed, Microsoft, Spotify, Youtube, Snap, Sports Illustrated, and CAA are all out there, pumping up the AI bubble with every hour that god sends, declaring that the future is AI.

https://www.hollywoodreporter.com/business/business-news/wall-street-ai-stock-price-1235343279/

Google and Bing are locked in an arms-race to see whose search engine can attain the speediest, most profound enshittification via chatbot, replacing links to web-pages with florid paragraphs composed by fully automated, supremely confident liars:

https://pluralistic.net/2023/02/16/tweedledumber/#easily-spooked

Blockchain was a solution in search of a problem. So is AI. Yes, Buzzfeed will be able to reduce its wage-bill by automating its personality quiz vertical, and Spotify’s “AI DJ” will produce slightly less terrible playlists (at least, to the extent that Spotify doesn’t put its thumb on the scales by inserting tracks into the playlists whose only fitness factor is that someone paid to boost them).

But even if you add all of this up, double it, square it, and add a billion dollar confidence interval, it still doesn’t add up to what Bank Of America analysts called “a defining moment — like the internet in the ’90s.” For one thing, the most exciting part of the “internet in the ‘90s” was that it had incredibly low barriers to entry and wasn’t dominated by large companies — indeed, it had them running scared.

The AI bubble, by contrast, is being inflated by massive incumbents, whose excitement boils down to “This will let the biggest companies get much, much bigger and the rest of you can go fuck yourselves.” Some revolution.

AI has all the hallmarks of a classic pump-and-dump, starting with terminology. AI isn’t “artificial” and it’s not “intelligent.” “Machine learning” doesn’t learn. On this week’s Trashfuture podcast, they made an excellent (and profane and hilarious) case that ChatGPT is best understood as a sophisticated form of autocomplete — not our new robot overlord.

https://open.spotify.com/episode/4NHKMZZNKi0w9mOhPYIL4T

We all know that autocomplete is a decidedly mixed blessing. Like all statistical inference tools, autocomplete is profoundly conservative — it wants you to do the same thing tomorrow as you did yesterday (that’s why “sophisticated” ad retargeting ads show you ads for shoes in response to your search for shoes). If the word you type after “hey” is usually “hon” then the next time you type “hey,” autocomplete will be ready to fill in your typical following word — even if this time you want to type “hey stop texting me you freak”:

https://blog.lareviewofbooks.org/provocations/neophobic-conservative-ai-overlords-want-everything-stay/

And when autocomplete encounters a new input — when you try to type something you’ve never typed before — it tries to get you to finish your sentence with the statistically median thing that everyone would type next, on average. Usually that produces something utterly bland, but sometimes the results can be hilarious. Back in 2018, I started to text our babysitter with “hey are you free to sit” only to have Android finish the sentence with “on my face” (not something I’d ever typed!):

https://mashable.com/article/android-predictive-text-sit-on-my-face

Modern autocomplete can produce long passages of text in response to prompts, but it is every bit as unreliable as 2018 Android SMS autocomplete, as Alexander Hanff discovered when ChatGPT informed him that he was dead, even generating a plausible URL for a link to a nonexistent obit in The Guardian:

https://www.theregister.com/2023/03/02/chatgpt_considered_harmful/

Of course, the carnival barkers of the AI pump-and-dump insist that this is all a feature, not a bug. If autocomplete says stupid, wrong things with total confidence, that’s because “AI” is becoming more human, because humans also say stupid, wrong things with total confidence.

Exhibit A is the billionaire AI grifter Sam Altman, CEO if OpenAI — a company whose products are not open, nor are they artificial, nor are they intelligent. Altman celebrated the release of ChatGPT by tweeting “i am a stochastic parrot, and so r u.”

https://twitter.com/sama/status/1599471830255177728

This was a dig at the “stochastic parrots” paper, a comprehensive, measured roundup of criticisms of AI that led Google to fire Timnit Gebru, a respected AI researcher, for having the audacity to point out the Emperor’s New Clothes:

https://www.technologyreview.com/2020/12/04/1013294/google-ai-ethics-research-paper-forced-out-timnit-gebru/

Gebru’s co-author on the Parrots paper was Emily M Bender, a computational linguistics specialist at UW, who is one of the best-informed and most damning critics of AI hype. You can get a good sense of her position from Elizabeth Weil’s New York Magazine profile:

https://nymag.com/intelligencer/article/ai-artificial-intelligence-chatbots-emily-m-bender.html

Bender has made many important scholarly contributions to her field, but she is also famous for her rules of thumb, which caution her fellow scientists not to get high on their own supply:

Please do not conflate word form and meaning

Mind your own credulity

As Bender says, we’ve made “machines that can mindlessly generate text, but we haven’t learned how to stop imagining the mind behind it.” One potential tonic against this fallacy is to follow an Italian MP’s suggestion and replace “AI” with “SALAMI” (“Systematic Approaches to Learning Algorithms and Machine Inferences”). It’s a lot easier to keep a clear head when someone asks you, “Is this SALAMI intelligent? Can this SALAMI write a novel? Does this SALAMI deserve human rights?”

Bender’s most famous contribution is the “stochastic parrot,” a construct that “just probabilistically spits out words.” AI bros like Altman love the stochastic parrot, and are hellbent on reducing human beings to stochastic parrots, which will allow them to declare that their chatbots have feature-parity with human beings.

At the same time, Altman and Co are strangely afraid of their creations. It’s possible that this is just a shuck: “I have made something so powerful that it could destroy humanity! Luckily, I am a wise steward of this thing, so it’s fine. But boy, it sure is powerful!”

They’ve been playing this game for a long time. People like Elon Musk (an investor in OpenAI, who is hoping to convince the EU Commission and FTC that he can fire all of Twitter’s human moderators and replace them with chatbots without violating EU law or the FTC’s consent decree) keep warning us that AI will destroy us unless we tame it.

There’s a lot of credulous repetition of these claims, and not just by AI’s boosters. AI critics are also prone to engaging in what Lee Vinsel calls criti-hype: criticizing something by repeating its boosters’ claims without interrogating them to see if they’re true:

https://sts-news.medium.com/youre-doing-it-wrong-notes-on-criticism-and-technology-hype-18b08b4307e5

There are better ways to respond to Elon Musk warning us that AIs will emulsify the planet and use human beings for food than to shout, “Look at how irresponsible this wizard is being! He made a Frankenstein’s Monster that will kill us all!” Like, we could point out that of all the things Elon Musk is profoundly wrong about, he is most wrong about the philosophical meaning of Wachowksi movies:

https://www.theguardian.com/film/2020/may/18/lilly-wachowski-ivana-trump-elon-musk-twitter-red-pill-the-matrix-tweets

But even if we take the bros at their word when they proclaim themselves to be terrified of “existential risk” from AI, we can find better explanations by seeking out other phenomena that might be triggering their dread. As Charlie Stross points out, corporations are Slow AIs, autonomous artificial lifeforms that consistently do the wrong thing even when the people who nominally run them try to steer them in better directions:

https://media.ccc.de/v/34c3-9270-dude_you_broke_the_future

Imagine the existential horror of a ultra-rich manbaby who nominally leads a company, but can’t get it to follow: “everyone thinks I’m in charge, but I’m actually being driven by the Slow AI, serving as its sock puppet on some days, its golem on others.”

Ted Chiang nailed this back in 2017 (the same year of the Long Island Blockchain Company):

There’s a saying, popularized by Fredric Jameson, that it’s easier to imagine the end of the world than to imagine the end of capitalism. It’s no surprise that Silicon Valley capitalists don’t want to think about capitalism ending. What’s unexpected is that the way they envision the world ending is through a form of unchecked capitalism, disguised as a superintelligent AI. They have unconsciously created a devil in their own image, a boogeyman whose excesses are precisely their own.

https://www.buzzfeednews.com/article/tedchiang/the-real-danger-to-civilization-isnt-ai-its-runaway

Chiang is still writing some of the best critical work on “AI.” His February article in the New Yorker, “ChatGPT Is a Blurry JPEG of the Web,” was an instant classic:

[AI] hallucinations are compression artifacts, but — like the incorrect labels generated by the Xerox photocopier — they are plausible enough that identifying them requires comparing them against the originals, which in this case means either the Web or our own knowledge of the world.

https://www.newyorker.com/tech/annals-of-technology/chatgpt-is-a-blurry-jpeg-of-the-web

“AI” is practically purpose-built for inflating another hype-bubble, excelling as it does at producing party-tricks — plausible essays, weird images, voice impersonations. But as Princeton’s Matthew Salganik writes, there’s a world of difference between “cool” and “tool”:

https://freedom-to-tinker.com/2023/03/08/can-chatgpt-and-its-successors-go-from-cool-to-tool/

Nature can claim “conversational AI is a game-changer for science” but “there is a huge gap between writing funny instructions for removing food from home electronics and doing scientific research.” Salganik tried to get ChatGPT to help him with the most banal of scholarly tasks — aiding him in peer reviewing a colleague’s paper. The result? “ChatGPT didn’t help me do peer review at all; not one little bit.”

The criti-hype isn’t limited to ChatGPT, of course — there’s plenty of (justifiable) concern about image and voice generators and their impact on creative labor markets, but that concern is often expressed in ways that amplify the self-serving claims of the companies hoping to inflate the hype machine.

One of the best critical responses to the question of image- and voice-generators comes from Kirby Ferguson, whose final Everything Is a Remix video is a superb, visually stunning, brilliantly argued critique of these systems:

https://www.youtube.com/watch?v=rswxcDyotXA

One area where Ferguson shines is in thinking through the copyright question — is there any right to decide who can study the art you make? Except in some edge cases, these systems don’t store copies of the images they analyze, nor do they reproduce them:

https://pluralistic.net/2023/02/09/ai-monkeys-paw/#bullied-schoolkids

For creators, the important material question raised by these systems is economic, not creative: will our bosses use them to erode our wages? That is a very important question, and as far as our bosses are concerned, the answer is a resounding yes.

Markets value automation primarily because automation allows capitalists to pay workers less. The textile factory owners who purchased automatic looms weren’t interested in giving their workers raises and shorting working days.

‘

They wanted to fire their skilled workers and replace them with small children kidnapped out of orphanages and indentured for a decade, starved and beaten and forced to work, even after they were mangled by the machines. Fun fact: Oliver Twist was based on the bestselling memoir of Robert Blincoe, a child who survived his decade of forced labor:

https://www.gutenberg.org/files/59127/59127-h/59127-h.htm

Today, voice actors sitting down to record for games companies are forced to begin each session with “My name is ______ and I hereby grant irrevocable permission to train an AI with my voice and use it any way you see fit.”

https://www.vice.com/en/article/5d37za/voice-actors-sign-away-rights-to-artificial-intelligence

Let’s be clear here: there is — at present — no firmly established copyright over voiceprints. The “right” that voice actors are signing away as a non-negotiable condition of doing their jobs for giant, powerful monopolists doesn’t even exist. When a corporation makes a worker surrender this right, they are betting that this right will be created later in the name of “artists’ rights” — and that they will then be able to harvest this right and use it to fire the artists who fought so hard for it.

There are other approaches to this. We could support the US Copyright Office’s position that machine-generated works are not works of human creative authorship and are thus not eligible for copyright — so if corporations wanted to control their products, they’d have to hire humans to make them:

https://www.theverge.com/2022/2/21/22944335/us-copyright-office-reject-ai-generated-art-recent-entrance-to-paradise

Or we could create collective rights that belong to all artists and can’t be signed away to a corporation. That’s how the right to record other musicians’ songs work — and it’s why Taylor Swift was able to re-record the masters that were sold out from under her by evil private-equity bros::

https://doctorow.medium.com/united-we-stand-61e16ec707e2

Whatever we do as creative workers and as humans entitled to a decent life, we can’t afford drink the Blockchain Iced Tea. That means that we have to be technically competent, to understand how the stochastic parrot works, and to make sure our criticism doesn’t just repeat the marketing copy of the latest pump-and-dump.

Today (Mar 9), you can catch me in person in Austin at the UT School of Design and Creative Technologies, and remotely at U Manitoba’s Ethics of Emerging Tech Lecture.

Tomorrow (Mar 10), Rebecca Giblin and I kick off the SXSW reading series.

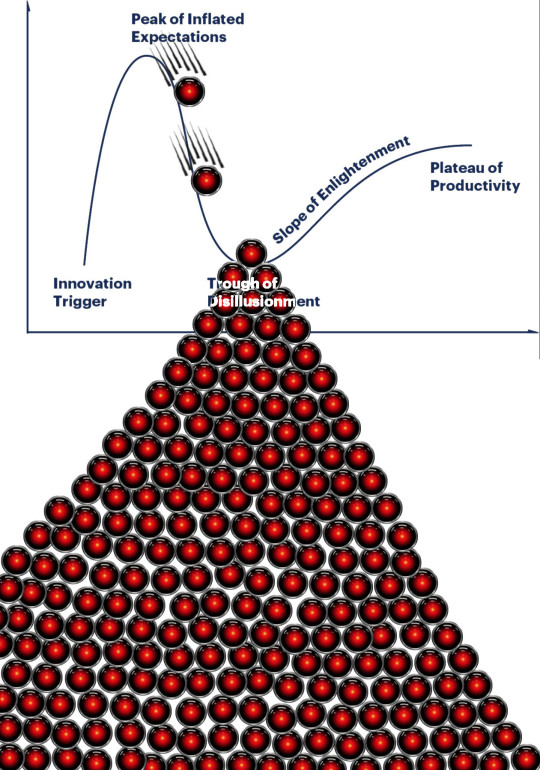

Image:

Cryteria (modified)

https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0

https://creativecommons.org/licenses/by/3.0/deed.en

[Image ID: A graph depicting the Gartner hype cycle. A pair of HAL 9000's glowing red eyes are chasing each other down the slope from the Peak of Inflated Expectations to join another one that is at rest in the Trough of Disillusionment. It, in turn, sits atop a vast cairn of HAL 9000 eyes that are piled in a rough pyramid that extends below the graph to a distance of several times its height.]

#pluralistic#ai#ml#machine learning#artificial intelligence#chatbot#chatgpt#cryptocurrency#gartner hype cycle#hype cycle#trough of disillusionment#crypto#bubbles#bubblenomics#criti-hype#lee vinsel#slow ai#timnit gebru#emily bender#paperclip maximizers#enshittification#immortal colony organisms#blurry jpegs#charlie stross#ted chiang

2K notes

·

View notes

Text

Im curious how many leftists envision a future without currency. Not a crypto future. Not a bartering or trading future. Not some new kind of currency or universal currency- No money. Nothing that requires people to owe something in order to recieve something, like all previously mentioned systems do.

I dont want to go into how that works, i just want to see how many leftists already have that vision

Also I would love if this was reblogged to get more votes!

44 notes

·

View notes

Text

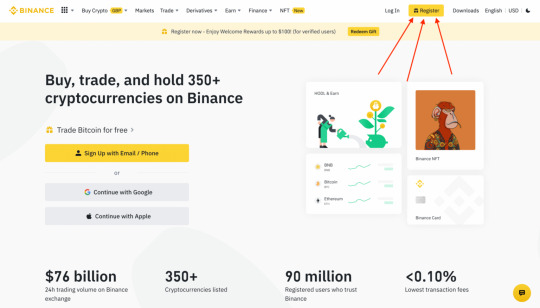

How To Create Binance Account in 2023

Binance is the largest crypto trading platform in the world with over 120 million active traders in the world. Crypto traders can buy Bitcoin (BTC), Ethereum (ETH), Cardano (ADA) and all major cryptocurrencies on Binance and also trade Binance Futures.

In this tutorial, you’ll learn how to setup a Binance trading account. So if you want to learn how to register on Binance, this guide is for you.

Here’s the steps on Binance registration :

Visit the official Binance website.

Click on the yellow register button.

Select your country.

Fill out the registration form with your details.

Type in the verification code in the box.

Click on “Buy Crypto” to start trading.

STEP 1: Visit the official Binance website here: www.binance.com

STEP 2: Click on the “Register“ button at the top right corner of the screen.

On the top right corner of the Binance website, you have a yellow register button, click on it and this will take you to the Binance registration page.

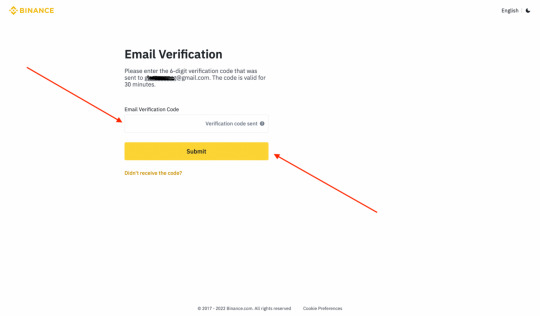

STEP 3: Fill out the registration form with your correct details.

Select your country, key in your personal email address and password to secure your trading account. Tick the box and click on the “create personal account” button to register your Binance account. You can also use the Phone number signup option.

STEP 4: A confirmation code will be sent to your mail. Type them in the box to fully activate your Binance trading account.

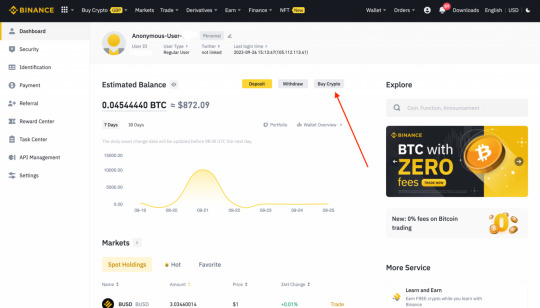

STEP 5: Click on the “Buy Crypto” button to purchase Bitcoin, Ethereum, Cardano and many other cryptocurrencies on Binance.

You’re Binance account is set and ready to start trading. You can now trade Binance Futures, deposit, withdraw and buy all major cryptocurrencies. Happy Binance trading!

Click Here To Register On Binance

52 notes

·

View notes

Text

How Effective is Crypto Algo Trading Bot in the Trading Journey

The cryptocurrency market is well-known for its volatility and quick price changes. Amidst this activity, crypto algo trading bots have appeared as effective tools for guiding the complexity of trading. These automated systems, driven by algorithms and advanced data analysis, offer the potential to improve trading efficiency and profitability. But how effective are they truly in a trader's journey?

Comprehending Crypto Algo Trading Bots

Crypto algo trading bots are computer programs developed to perform trades automatically based on predefined parameters. They work on various strategies, from simple trend-following to complex arbitrage opportunities. These bots can analyze market data at sparky speed, recognizing patterns and executing trades exactly, often exceeding human capabilities.

Key Advantages of Crypto Algo Trading Bots

Emotional detachment: One of the biggest advantages of algo trading is the elimination of human emotions. Fear and desire can often cloud judgment, leading to impulsive decisions. Bots operate in a pure sense, without emotional preferences, ensuring disciplined trading.

Speed and efficiency: Humans have limitations in processing data and responding to market changes. Algo bots can execute trades in milliseconds, capitalizing on quick opportunities that humans might miss.

All time function: The crypto market never sleeps. Algo bots can trade constantly, without the need for rest or breaks, maximizing potential profits.

Backtesting and optimization: Before deploying a bot, traders can backtest its performance on recorded data to assess its significance. This allows for the optimization of trading strategies and risk management parameters.

Diversification: Algo bots can manage numerous trading strategies simultaneously, diversifying risk and increasing the possibility for constant returns.

Impact and Success Stories

Multiple traders have reported significant benefits from using crypto algo trading bots. Some have achieved consistent profitability, outperforming manual trading strategies. These bots have been confirmed particularly effective in high-frequency trading, where speed is essential. Additionally, they can be valuable for arbitrage opportunities, using price differences across different exchanges.

However, it's essential to recognize that not all algo trading bots are created equal. The point of a bot depends on several aspects, including the underlying trading method, the quality of data used, and the bot's ability to adjust to market conditions.

Challenges and Concerns

While the potential advantages of crypto algo trading bots are important, it's crucial to approach them with real expectations. Overfitting to historical data can lead to suboptimal performance in future market conditions.

Moreover, developing and maintaining a good algo trading system requires specialized expertise and continuous monitoring. Traders should carefully evaluate the risks involved and consider their ability and help before launching into algo trading.

Conclusion

Crypto algo trading bots have the prospect of being effective tools in a trader's journey. They offer advantages in terms of speed, efficiency, and emotional detachment. While not a guaranteed path to riches, they can significantly improve trading performance when used wisely.

It's important to approach algo trading with a combination of confidence and notice. Thorough research, backtesting, and ongoing monitoring are essential for increasing the benefits and reducing risks. As with any investment, diversification is key. Combining algo trading with other strategies can help create a well-rounded investment portfolio.

In conclusion, crypto algo trading bots represent an exciting frontier in the world of trading. While challenges exist, the potential rewards are significant for those who approach this technology with knowledge and discipline.

Get a opportunity to grab a FREE DEMO - Crypto Algo Trading Bot Development

2 notes

·

View notes

Text

How to Optimize Your Crypto Investments

With the rapid pace of modern life, it seems that only professional traders can afford to leave their full-time jobs and concentrate solely on trading. For someone like me who values security and doesn't have the time to monitor the market 24/7, finding ways to generate income with minimal effort is appealing. This approach allows me to participate in crypto without the constant stress and time commitment required by active trading.

Several way to invest in crypto

There are several ways to create passive income from DeFi: staking, lending, farming, and real yield. However, today I want to share a strategy that requires minimal effort yet brings in profits: hunting for ICOs (Initial Coin Offering) and presales.

ICOs and presales offer a unique opportunity for investors. Tokens sold during these events are usually priced very low, as they are in the early stages of their lifecycle. By participating in these sales, you can purchase tokens at a fraction of their potential future value. The strategy is simple: buy the tokens, hold onto them, and wait for them to be listed on an exchange where their value typically increases.

For example, consider a meme project like BUSAI, which leverages AI technology and enjoys strong community support. BUSAI offers an attractive opportunity during its presale phase. The project blends meme culture with advanced AI, creating a unique ecosystem. By purchasing tokens during the presale, investors can benefit from low prices and potentially see significant returns once the tokens are listed.

Successful ICOs and Presale Tokens

Several notable case studies illustrate how presale tokens have significantly increased in value once listed on exchanges, providing substantial returns for early investors.

Ether (ETH)

The native token for Ethereum, Ether, is one of the most successful ICOs in history. During its ICO, Ether was sold at 2,000 ETH per 1 BTC. By March 2024, the value of Ether had surged to $3,496 per token, offering an incredible return on investment for early backers

NEO (NEO)

Often referred to as "China’s Ethereum," NEO had a remarkable ICO. The initial token price was around $0.03, and at its peak, NEO traded at approximately $180. Even though its current value is around $14.83, early investors saw substantial returns

BONK (BONK)

Bonk started as an airdrop, not a presale, and was distributed freely via social media. It surged over 25,000% in a year and briefly hit a $2 billion market cap after its Coinbase listing.

How to find Presale token?

Historically, platforms like Coinlist were excellent for finding such opportunities. However, in the past year, many projects listed there have underperformed, leading me to seek alternatives. The key to success with this strategy lies in thorough research and careful selection of projects.

While this method may not yield as much profit as active trading, it is well-suited for those with a lower risk appetite. It allows participation in the crypto market without the need for constant vigilance. However, no investment is entirely risk-free. Even with presales and IDOs, there is always the potential for loss. The crypto market is volatile, and projects can fail despite promising initial signs.

In summary, hunting for IDOs and presales is a viable strategy for earning passive income from crypto without dedicating too much time and effort. By carefully selecting projects like BUSAI, you can capitalize on early-stage investments and potentially enjoy substantial returns. However, always conduct thorough research and be aware of the inherent risks.

Source: Compiled

The Official Channel: Website | Twitter | Telegram

2 notes

·

View notes

Text

How Bitcoin is Probably Gearing Up for a New ATH

Bitcoin has consistently demonstrated its resilience and growth potential since its inception. As we observe its price movements and market dynamics, it becomes evident that Bitcoin might be gearing up for a new all-time high (ATH). Understanding the importance of ATHs in the context of Bitcoin and cryptocurrencies can provide valuable insights into the potential future trajectory of this digital asset.

Historical Performance and Previous ATHs

Bitcoin's journey has been marked by several significant ATHs, each catalyzing a surge in investor interest and mainstream media attention. The 2017 bull run saw Bitcoin reach an ATH of $19,783 on December 17, 2017, driven by a combination of retail investor frenzy and increasing awareness. Similarly, the 2020-2021 bull run pushed Bitcoin to a new ATH of $68,789 on November 10, 2021, fueled by institutional investments and macroeconomic factors.

Current Market Indicators

Several indicators suggest that Bitcoin is poised for another ATH:

Institutional Investments: Companies like MicroStrategy have acquired approximately 230,000 BTC as of 2024, worth billions of dollars.

Adoption Rates: PayPal reported over $5 billion in crypto trading volume in Q1 2024.

Technological Advancements: The Taproot upgrade, activated in November 2021, has enhanced Bitcoin's privacy and smart contract capabilities.

Regulatory Developments: The SEC's approval of spot Bitcoin ETFs in January 2024 has provided a more stable environment for growth.

Factors Contributing to the Potential ATH

Increased Adoption and Mainstream Acceptance: Major banks like JPMorgan and Goldman Sachs now offer Bitcoin-related services to their clients.

Technological Advancements: The Lightning Network's capacity has grown to over 5,000 BTC as of 2024, improving Bitcoin's scalability.

Macroeconomic Factors: With U.S. inflation rates hitting 7% in 2021, Bitcoin is increasingly seen as a hedge against economic instability.

Geopolitical Influences: Countries like El Salvador adopting Bitcoin as legal tender demonstrate its potential as a global, borderless currency.

The Importance of Dollar-Cost Averaging (DCA) into Bitcoin

Dollar-Cost Averaging (DCA) is a strategic investment approach where an individual invests a fixed amount of money into an asset at regular intervals, regardless of its price.

Benefits of DCA:

Mitigates market volatility

Reduces investment risk

Provides a disciplined approach to investing

Example of Successful DCA Strategy: An investor who consistently invested $100 weekly in Bitcoin from January 2019 to December 2023 would have seen a return on investment of over 300%, outperforming many who attempted to time the market.

Practical Advice for Implementing DCA:

Start with a fixed amount that fits your budget (e.g., $50-$500 per month)

Set a regular investment schedule (weekly or monthly)

Use reputable exchanges with automated purchasing options

Remain consistent regardless of market conditions

Expert Opinions and Predictions

Cathie Wood, CEO of Ark Invest: Predicts Bitcoin could reach $1 million per coin by 2030.

Plan B, creator of the Stock-to-Flow model: Forecasts Bitcoin reaching $100,000 by 2025.

Michael Saylor, CEO of MicroStrategy: Believes Bitcoin will replace gold as a store of value, potentially pushing its price to $500,000.

Potential Risks and Challenges

While the prospects for a new ATH are promising, potential risks include:

Market volatility: Bitcoin's price can fluctuate by over 10% in a single day.

Regulatory risks: Potential government crackdowns or unfavorable legislation.

Technological issues: The need for ongoing development to address scalability and security concerns.

Conclusion

Bitcoin's potential for reaching a new ATH is supported by a combination of historical patterns, current market indicators, and strategic investment approaches like DCA. As we move forward, staying informed and considering long-term investment strategies will be crucial for navigating the cryptocurrency landscape.

Key Takeaways:

Bitcoin has a history of reaching new ATHs, with the current record at $68,789.

Institutional adoption, technological advancements, and macroeconomic factors support potential growth.

Dollar-Cost Averaging can be an effective strategy for investing in Bitcoin.

While expert predictions vary, many see significant upside potential for Bitcoin.

Be aware of risks and challenges, including market volatility and regulatory uncertainties.

As you consider your investment strategy, remember that the cryptocurrency market is highly volatile. Always conduct thorough research and consider consulting with a financial advisor before making investment decisions.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#BTC#Crypto#Cryptocurrency#Blockchain#BitcoinATH#CryptoInvesting#CryptoNews#DigitalCurrency#FinancialFreedom#Investing#CryptoCommunity#BitcoinNews#CryptoAdoption#CryptoMarket#BitcoinPrice#CryptoGrowth#CryptoFuture#BTCtoTheMoon#BitcoinRevolution#BitcoinInvestment#CryptoTrends#HODL#BitcoinCharts#financial empowerment#unplugged financial#globaleconomy#financial experts#financial education#finance

4 notes

·

View notes

Text

How Cute Mascots are Changing the Face of Crypto

In the world of cryptocurrency, where innovation meets creativity, the rise of animal-themed coins with adorable mascots is reshaping investor interest and community engagement. These cute mascots aren't just symbols; they're integral to the branding and identity of crypto projects, exemplifying the intersection of whimsy and serious investment.

The Trend of Animal-Themed Coins

Animal-themed cryptocurrencies have gained popularity for their relatability and charm. From Dogecoin's iconic Shiba Inu to Shiba Inu coin's own mascot, the appeal of animal-themed coins lies in their ability to capture attention and create a sense of community. Investors are drawn not only to the potential financial gains but also to the cultural phenomenon and viral nature that these mascots embody.

BUSAI: The Panda-Powered Meme Coin

One standout example is BUSAI, a panda-powered meme coin that integrates artificial intelligence into its content creation. Pandas, known for their laid-back demeanor and universal appeal, serve as the perfect mascot for BUSAI. The project leverages panda-themed memes to engage users and build a community around its cryptocurrency.

Community Engagement and Brand Identity

Cute mascots like BUSAI's panda not only attract investors but also foster community engagement. They create a sense of belonging and playfulness within the crypto space, making the complex world of blockchain technology more approachable and enjoyable for newcomers and seasoned investors alike.

Impact on Investor Interest

The presence of a cute mascot can significantly impact investor interest and market dynamics. Beyond financial metrics, the emotional connection and cultural relevance that mascots bring can influence trading volumes and project visibility in the competitive crypto landscape.

The Future of Cute Mascots in Crypto

Looking ahead, the trend of cute mascots in cryptocurrency shows no signs of slowing down. As more projects recognize the power of branding through relatable and endearing mascots, we can expect to see a proliferation of animal-themed coins across different blockchain platforms. These mascots not only differentiate projects in a crowded market but also serve as ambassadors for the underlying values and community spirit of each cryptocurrency.

3 notes

·

View notes

Text

[Browser names in bold if you just wanna skip to the paragraph you want to tell me I'm completely wrong about because that's your browser]

So, in light of the possible future where some of the chromium-based browser might get kicked right in the content-blocking code with Manifest Version 3, I actually felt the need to look around for alternative browsers to our holy lord the Google Chrome if we can't even have uBlock anymore.

Obviously I'd love to have a browser that won't die in the next 2 years, so either backed by a company or backed by a large community would be neato. It's fine if it's chromium, as long as content blockers will keep functioning or at least have alternatives. I did consider MS Edge for a hot second, I read somewhere it's supposed to not yield to Google for the new APIs but couldn't find it again, but then I remembered that Microsoft is an anti-consumer oriented company that pours billions into AI and making our lives worse in general and that even if it does run on Linux I do not fucking care.

I went over a few of the obvious choices and while yes, Firefox is oh-so-different, the basic threat/security model of FF is still lacking. Trading one security issue(not being able to run full-fledged content-blockers) for another one seemed a bit like a letdown to myself.

And while yes, the company Mozilla puts a lot of money in advertising how privacy-oriented they are(on social media, with targeted ads, lol) the have gotten to a point where that's simply not completely true anymore.

I also looked at Brave, it has a few cool features and the notion of a crypto wallet built right into the browser gave me the ultimate anti-climax and the tab was closed with Mach 10(someone please make a video about what would actually happen with a finger going mach 10).

For now I arrived at Vivaldi for testing. It has a few decent built-in things like tracker/ad-blocking(via url lists, which works pretty decent on it's own but I decided to additionally also run uBlock since URL list don't catch everything).

It also has an absolutely overwhelming amount of customization that made me realise how "default chromium-based browser" is basically like plain rice and I've just gotten used to plain rice every day to the point where I didn't question if that's good or nah. Vivaldi made me realise that spices exist. I know it sounds ridiculous, it's just a stupid browser, after all, BUT...

Just look at this Tab Cycler.

Or this Spotlike-esque in-browser search

Oh you would like your tabs on the side, cuz that's what the cool kids do? WELL WHICH SIDE IS IT THEN????

Oh you said tiling your windows in your operating system's UI sucks so your browser should do it? Yup, if for some weird reason that resonates with you, it also does that.

Pause button so you can focus on something non-internetty? That little shit hides in the corner of the status bar.

A weirdly functional and also overly customizable side-bar? Got that as well.

Honestly, when I say an overwhelming amount of customization, I mean it. I've been playing around with this piece of shit for like 4 hours and I watched the intro videos to some of the things and I really feel like I haven't even scratched the surface.

Someone please tell me some dealbraker about this browser, it's almost 3AM and I need to sleep. Like holy fuck this thing feels like someone went "imagine if your browser was as much of a full-time job as emacs was".

And no, I'm not switching to Vivaldi (yet). I'll obviously give it a solid month before I'll make such an obviously life-changing decision. I might even do a cheeky install on my phone I guess.

#browser#chrome#mozilla#vivaldi#google chrome#microsoft edge still sucks so it doesn't get a real tag

2 notes

·

View notes

Text

Welcome to the groundbreaking world of cryptocurrency with Spookyswap Airdrop! This innovative concept is taking the crypto community by storm, offering an unparalleled opportunity for users to earn free tokens and take part in a thriving decentralized finance ecosystem.

What is Spookyswap Airdrop?

Spookyswap Airdrop is a unique distribution method that allows crypto enthusiasts to receive free tokens as a reward for engaging with the Spookyswap platform. By participating in various activities such as liquidity provision, token staking, and trading, users can earn exciting rewards without any cost or risk.

Why participate in the Spookyswap Airdrop?

With the Spookyswap Airdrop, you have the opportunity to tap into a world of financial possibilities. By earning free tokens, you can diversify your portfolio, explore new investment opportunities, and potentially unlock substantial returns. Additionally, participating in the airdrop allows you to become an active member of the Spookyswap community, connecting with like-minded individuals and staying at the forefront of the crypto revolution.

How to get started?

Getting started with the Spookyswap Airdrop is easy and hassle-free. Simply join the platform, complete the required actions, and start earning tokens! By following the simple steps outlined on our website, you'll be on your way to unlocking the benefits of this groundbreaking airdrop.

Don't miss out!

The Spookyswap Airdrop is a limited-time offer, so make sure you join today to secure your place in this exciting opportunity. Don't miss out on the chance to earn free tokens and be a part of the future of decentralized finance. Join Spookyswap Airdrop now and unlock a world of possibilities!

4 notes

·

View notes

Text

#funding rates#crypto funding rate#crypto#funding rate#funding rates crypto#funding rate explained#funding fee#funding rate binance#crypto trading#funding rate strategy#funding rates explained#what is funding rate#funding#funding rate crypto explained#crypto investing#binance futures funding#crypto funding rates explained#trading funding rate#how to check crypto funding rates#crypto market#trading crypto#funding rate binance futures in hindi#secretstime#newblogflo

0 notes

Text

Reading the Court Cards -Jobs and characteristics of each court card

Court cards can represent people or you in a reading. There are four groups of court cards with four different characters. Depending on how many court cards are in a reading and how they are facing each other can tell you a lot about your answer to your question. They can also represent characteristics in a reading. Many readers use court cards in love readings to figure out the zodiac, physical attributes and other characteristics of a future lover. Now let's go down the list of what each court card represents.

King of wands

Zodiac: All fire signs more commonly for Sagittarius I've noticed, also common to come up for Scorpio placements due to the s*xual nature of the king of wands.

Planet: Mars

Jobs: Father, Teacher, Politician, Marketing, Producer, Businessman, Relator, Agent, Motivational speaker or Manager.

Characteristics: S*xual person, athletic, outgoing, optimistic, innovative, competitive, magnetic, impulsive, protective, magnetic, obsessive, honest, charismatic, domineering

Queen of Wands

Zodiac: Leo in the traditional deck there are lions decorating her throne. Pisces as well.

Planet: Sun

Jobs: Counselors, Exotic dancers, Dancers, Artist, Performer, Art director, Interior design, Aerobics, Business women, Human Resources, restaurant, hotel, Actress, someone who works with animals.

Characteristics; Loud, proud, extroverted, confidently different, exaggerated expression, passionate, ambitious, warm, kind, fun, opinionated, rash, bossy.

Knight of Wands

Zodiac: Sagittarius, occasionally July leos/cancers

Planet: Jupiter

Jobs: Soldier, Construction worker, Marketing, Promoting, Electricians, travel guide, travel influencer, waiters, Day trading, working with cars, horse stables, stage actor, stage man, startup, sports, activism.

Characteristics: Charismatic, Adventurous, Energetic, moves around a lot, Fearless, foolish, happy go lucky, cocky, Superficial, Restless, Confident in his actions, believes more in people's actions than words. S*xual card as well.

Page of Wands

Zodiac: Aries

Planet: Mars

Jobs: Gym coach, trainer, sneaker designer, improv actor, entry level job, band member, stage hand, yoga instructor, taxi/Uber, someone who works with a lot of hot food, dog walker/caretaker, veterinarian assistant.

Characteristics: Outgoing, childish, lively, someone who needs a lot of stimulation, someone who falls in love easily, young soul, immature, optimistic, loves trying new things, takes chances, gambler, rash, easy going, impatient, doesn't keep mouth shut, naive.

King of Swords

Zodiac: Capricorn/Aquarius

Planet: Saturn

Jobs: lawyer, judge, mediator, CEO, tech industry, crypto, banker, telecommunications, accountant, insurance, brain surgeon, newspaper writer, tax office, news reporter, high government job, politician, math professor.

Characteristics: Cool tempered, business oriented, analytical, conservative, ambitious, authoritative, ruthless, dishonest but also blunt, high standards, disciplined, cruel, direct, introverted, mature, intellectual, integrity.

Queen of Swords

Zodiac: Libra can sometimes represent a 1st Deacon Virgo.

Planet: Uranus/Venus

Jobs: Lecturer, executive, working in prisons, editors, journalists, coding, business women, quantum physics, statistics, lawyer, politics, publishing, medicine field, chemist, mediator, divorce lawyer.

Characteristics: Crone, critical of herself and others, analytical, direct, intelligently charming, truthful, just, constructive, single women, witty, pessimistic, realist, sharp, independent, sophisticated, can get a read on people very easily, women whose into psychological tricks.

Knight of Swords

Zodiac: Gemini/libra

Planet: Mercury

Jobs: Radio station, media, stand up comedy, attorney, Translator, military, detective, game developer, para-educator, teacher, EMTs, administrator, analyst, people who work with weather. Jobs with a lot of communication or speed.

Characteristics: assertive, communicator, dashing, brave, speedy, talkative, opinionated, intelligent, determined, ambitious, sarcastic, comedic, impulsive, arrogant, self confident, dashing, over estimating themselves, goes into situations very quickly.

Page of Swords

Zodiac sign: All air signs

Planet: Mercury

Jobs: Entry level communication jobs, Customer service, apprenticeship, maybe tattoo apprenticeship cause swords could be needles, technician, spy, blogger, flight attendant, leasing agent, student, IT person.

Characteristics: Curious, childish, thinking outside of the box, puzzle solver, quick thinker, complains a lot, nit picks, good writer, frank, alert of their surroundings, quick learner, agile, innovative, abrasive, observer and takes mental notes on people and their environment, lively, scholarly.

King of Cups

Zodiac sign: Pisces/Aquarius

Planet: Neptune

Jobs: High level entertainment or art industry, Doctor, photographer, stay at home dad, therapist, psychiatrist, marine biologist, veterinarian, working around water or boats, fisherman, teacher, CEO, owner of a club or bar or restaurant.

Characteristics: Kind, fatherly, stays in control of their emotions, family person, passionate, romantic, delusional, liar, exaggerates, creative, intuitive, opportunist, may like alcohol or drugs, passive aggressive, caring, charming, empathetic, flexible.

Queen of Cups

Zodiac sign: Cancer

Planet: Moon

Jobs: Stay at home mother, nurse, nursing home worker, zoologist, creative therapist (music, art), nutritionist, cosmetics industry, detective, party planner, actor, LPN, herbalist, case worker, massage therapist, physical therapist, seamstress, someone who cares for others and is creative.

Characteristics: Warm, maternal, heart of gold, loyal friend, imaginative, not punctual, intuitive, empathetic, can notice "vibes" very easily, nurturing, creative, sensitive, psychic, emotion over logic, peace keeper, bystander unless it's their children or family, illusions, dreamy, soft.

Knight of Cups

Zodiac sign: Scorpio/1st decon pisces

Planet: Pluto

Jobs: Diplomat, babysitter, health care, musician, writer, stylist, fashion designer, hairdresser, may have a job in spirituality, politician, graphic designer, zoologist, doggy daycare, daycare worker, groomer(pets), costal guard, pharmacist, graduate.

Characteristics: mediator, emotional, charismatic, idealizes everything around them, good at taking care of themselves, loyal, supportive, creative, jealous, possessive, moody, affectionate, love language might be gift giving, dreamer, polite, good with animals.

Page of Cups

Zodiac sign: All water signs

Element: Moon

Jobs: student, life guard, entry level jobs, counseling, art therapy, mental health worker, fisherman, model, artist for commissions, seamstress, content creator, retail worker.

Characteristics: Sensitive, fashionable, vain, nice, sweet, easily gets in relationships, obsessive, dreamer, gentle, loves love, positive, childish, cries easily, imaginative, good with animals, may have lots of pets, intuitive, intuitive dreams, optimistic

King of Pentacles

Zodiac sign: Taurus, Capricorn and Aries

Planet: Saturn

Jobs: Finance, Big CEO, banker, accountant, Stockbroker, financial advisor, something to do with the earth (landscape, plants, building, oil...), Lawyer, carpenter, landscaper, bodybuilder, executive, consultant, real estate, investor, flipping houses.

Characteristics: Strong willed, steady, responsible, calm headed, stubborn, authoritative, hard worker, if he has money he will make sure his family are taken care of, presents well, persistent, professional, solid, successful, dependable, reliable, provider, protective, determined, loyal, work ethic, good taste in food, good with money.

Queen of Pentacles

Zodiac sign: Taurus, Capricorn

Planet: Earth

Jobs: interior decorator, real estate agent, finical manager, business manager, business women, CEO, investor, angel investor, jeweler, personal shopper, someone who works with nature and animals, mother, private cook, business in the home, designer, psychologist.

Characteristics: Down to earth, calm, stable, knows herself and her surroundings, organized, materialistic, micromanager, green thumb, nurturing, silent, luxurious, compassionate, devoted, doesn't do flimsy relationships (friends and romance), knows what she wants and how to get it, dresses to impress, business minded.

Knight of Pentacles

Zodiac sign: Virgo, Scorpio, gemini

Planet: Mercury

Jobs: Retail manager, quality control, explorer, herbalist, zoologist, biologist, blue collar worker, carpentry, potter, wood carver, soldier, landscape, works with horses, veterinarian, mechanic, security guard, works with safes and safe keeping stuff, works with metal and land, waiter.

Characteristics: Hard worker, grounded, efficient, diligent, ambitious, considerate, influential, has your best interest at heart, quiet, not a complainer, ambitious, good taste in food or cooking, patient, forgiving but if you cross this person most likely to play the long game, methodical, young person but old soul.

Page of Pentacles

Zodiac sign: all earth signs

Planet: Earth

Jobs: Cashier, entry level, beginning level business or accountant job, someone who makes a lot of money off small gigs, entrepreneurship, generally a good sign for careers as it means the person has a lot of potential and is going on the right path career wise.

Characteristics: Studious, focused on their goal, loyal, might be overworking themselves with too many goals and not enough balance, practical, methodical, rational, can indicate a person who is a little lazy but has potential, young at heart.

#beginner witch#free tarot#green witch#tarot blog#witch#witchblr#witchcraft#tarot witch#tarotblr#baby witch#grimoire#green wicca#witch tarot#tarot deck#tarot reading#tarot cards#tarotcommunity#tarot#court cards#divination#moon witch#money witchcraft#kitchen witch#witch coven#witches#witchcraft history#astroblr#astrology#astro placements#reading tarot

35 notes

·

View notes

Text

A week ago, Sam Bankman-Fried was the boy-wonder face of crypto: A 30-year-old who founded one of the biggest cryptocurrency exchanges in the world, a celebrated philanthropist worth an estimated $16 billion, and a major Democratic donor who quickly found favor in Washington. By Friday, he was at the center of an epic flameout that left his empire and his image as an uncannily sharp, altruistic billionaire in ruins.

In the annals of crypto disasters, the tale of Bankman-Fried may go down as one of the most jaw-dropping. He resigned from his crypto exchange, FTX, as it collapsed from a domino effect of a surge in customers trying to withdraw their funds, and the company filed for bankruptcy. The Wall Street Journal has reported that Bankman-Fried may have illegally taken about $10 billion in FTX customers’ funds for his trading firm, Alameda Research, whose future is also in peril. And Bankman-Fried is now worth close to nothing.

The downfall of FTX isn’t a typical story of crypto’s volatility or investor risk-taking; it didn’t crumble due to bad luck, but what now appears to be unsustainable layers of deception. On the surface, FTX appeared to be thriving — in the past year, it made several high-profile acquisitions and bailed out other failing crypto companies.In reality, it was drowning in debt. At least $1 billion in customer funds is reportedly missing. The stunning contrast between image and reality has resulted in Bankman-Fried facing a reputational fall from grace swifter than any in recent memory. According to reporting from several news outlets, the DOJ and SEC are investigating FTX, andhis friends and admirers in crypto, philanthropic, and political circles have quickly begun distancing themselves from the man widely dubbed the king of crypto.

Shot

___

Last night, Sam Bankman-Fried DMed me on Twitter.

That was surprising. I’d spoken to Bankman-Fried via Zoom earlier in the summer when I was working on a profile of him, so I reached out to him via DM on November 13, after news broke that his cryptocurrency exchange had collapsed, with billions in customer deposits apparently gone. I didn’t expect him to respond — typically, people under investigation by both the Securities and Exchange Commission and the Department of Justice don’t return requests for comment.

Bankman-Fried, though, apparently wanted to talk. About how FTX and his hedge fund Alameda Research had gambled with customer money without, he claims, realizing that’s what they were doing. About who gets lauded as a hero and who’s the fall guy. About regulators. (“Fuck regulators.”) About what he regrets (“Chapter 11,” the decision to declare bankruptcy) and about what he would have done differently with FTX and Alameda (“more careful accounting + offboard Alameda from FTX once FTX could live on its own”).

It was past midnight Bahamas time, where Bankman-Fried is reportedly still located, and we went back and forth on Twitter for more than an hour. He was, he said, still working to try to raise the funding needed to pay back all his depositors.

As we messaged, I was trying to make sense of what, behind the PR and the charitable donations and the lobbying, Bankman-Fried actually believes about what’s right and what’s wrong — and especially the ethics of what he did and the industry he worked in. Looming over our whole conversation was the fact that people who trusted him have lost their savings, and that he’s done incalculable damage to everything he proclaimed only a few weeks ago to care about. The grief and pain he has caused is immense, and I came away from our conversation appalled by much of what he said. But if these mistakes haunted him, he largely didn’t show it.

(Disclosure: This August, Bankman-Fried’s philanthropic family foundation, Building a Stronger Future, awarded Vox’s Future Perfect a grant for a 2023 reporting project. That project is now on pause.)

Chaser

39 notes

·

View notes