#drunk hcs

Explore tagged Tumblr posts

Text

regulus being an absolute menace when drunk, he has never heard of personal space, not with james. there is nothing that will stand between him and his man. like clingy does not cut it, he is fully attempting to climb james every chance he gets but james loves this so much, he's happy to be a tree for reg to climb, his lap's only purpose is to be a seat for reg and he does not need his hands for anything other than touching his boyfriend all the fucking time

#i love clingy ass drunk reg so much#and james is like yesss#i am a tree#u are a koala#that is what we are#jegulus#marauders#regulus black#james potter#james x regulus#starchaser#sunseeker#gay dead wizards#jegulus hc#harry potter#marauders era#marauders fandom#the marauders#marauders harry potter#james potter x regulus black#james and regulus#regulus x james#regulus and james#regulus arcturus black#james loves regulus#regulus black x james potter

2K notes

·

View notes

Text

Drunk ex!caleb would call you, of course you would not answer because we do not answer to exes so he would talk to the answer message.

“I-I” he would mumble as he would cover his face with his big hands and sat down into the stairs of a bar. “I don’t know what to do, I was born and you were there, I grew up with you and now I must grow old with your ghost”

He would stare at the sky as he became silent and closed his eyes to imagine your face “please just call me back”

#lads#lads mc#love and deep space#caleb#lads caleb#lnds#love and deepspace caleb#loveanddeepspace#lnds caleb#fluff#caleb love and deepspace#caleb hcs#caleb lads#caleb x mc#caleb x you#Caleb angst#I love ex drunk Caleb I’m sorry god#caleb x reader#caleb yaps#oceanic hcs

398 notes

·

View notes

Text

DeFi Lending Explained: The Alternative Banking System

DeFi Lending (Decentralized Finance Lending) is changing how we interact with money and access financial services. By removing traditional banks from the equation, DeFi Lending unlocks global, permissionless financial tools through robust lending and borrowing protocols.

While you may already be familiar with other components of the DeFi ecosystem — like trading platforms and crypto wallets — DeFi Lending protocols are a newer addition to crypto markets. They’ve quickly become one of its most powerful innovations, allowing users to earn yield on digital assets or borrow funds without intermediaries.

Unlike banks, which typically offer 0%–3% interest on savings accounts, permissionless platforms often provide yields of 10%–15% on stablecoins such as USDC and USDT, depending on algorithmic rates. Other altcoins can offer even higher returns, though they come with increased volatility and market risk.

DeFi Lending Explained

DeFi Lending protocols are new financial instruments reshaping the DeFi market into a more open, unbias, efficient, and accessible alternative to traditional finance. It kicked off in 2017 with MakerDAO on the Ethereum network — where smart contracts replace financial intermediaries, and anyone with a wallet could lend, borrow, and earn.

No bank branches. No credit checks. No paperwork.

At its core, crypto lending allows users to deposit digital assets into decentralized protocols and earn yield — often far higher than the 2% scraps traditional banks toss your way. That same pool of capital is tapped by borrowers, who leverage collateral and borrow against it — all without asking permission from a single institution. It's financial access, without the gatekeeping.

Most platforms utilize algorithmic interest rates that adjust based on supply and demand between lenders and borrowers — or more specifically, utilization rate — ensuring lenders are rewarded when demand is high and borrowers always know the cost of capital. Everything runs on smart contracts, meaning no bias, no delays, and no hidden fees.

You might know DeFi wallets or DEXs, but lending is the backbone of decentralized finance. It's where idle assets start working. It's how capital flows across blockchains. And it’s still early. As more protocols launch with permissionless lending, vaults, curators, and real-time credit scoring — like Credora’s system — are setting new standards. Decentralized lending is shaping up to be a full-blown alternative to the banking system — not just for the degens, but for institutions, the bankless, and everyone in between.

DeFi Lending isn’t just a product. It’s a movement — toward financial self-custody, global access, and open systems that don't care about your credit score or region.

How Does Decentralized Lending Work?

DeFi Lending operates on non-custodial, permissionless protocols that allow users to lend or borrow assets without needing approval from centralized institutions. Here’s how it works:

Depositors – Earn Interest by Supplying Crypto

Users can deposit their stablecoins or other cryptocurrencies into a protocol such as Morpho. These funds are added to a liquidity pool, which other users can borrow from. The interest earned depends on market demand and is often significantly higher than traditional bank savings rates. Think of it like a crypto-powered savings account — but with higher yields and no middlemen.

Vaults – Managed by Curators

Vaults, or liquidity pools, are managed by curators (market makers) who optimize yield strategies for depositors by directing liquidity into other protocols or pools. Think of it like how banks reinvest customer deposits — but in DeFi, it’s automated and transparent.

Borrowers – Crypto as Collateral

Borrowers must provide tokens as collateral valued higher than the loan amount and keep up with interest payments. This protects lenders and mitigates defaults. If the collateral’s value drops too far, the protocol auto-liquidates the position to preserve the vault. Interest payments contribute to vault growth, benefiting depositors.

Key Features of DeFi Lending

Different lending platforms introduce a wide range of features that traditional banks simply can’t match — from permissionless access to non-custodial control and real-time, algorithmic interest rates. Here’s what makes crypto lending a compelling alternative.

Want the full breakdown? Check out our deep dive: DeFi Lending vs Traditional Lending for a side-by-side comparison.

Permissionless Access

No approvals. No restrictions. No waiting. With just a wallet and Wi-Fi, anyone can tap into permissionless lending — regardless of geography or credit history. It’s financial access on your terms, running 24/7 on-chain. While banks sleep, DeFi stays open.

Non-Custodial Control

Unlike banks that take custody of your funds, decentralized lending protocols are non-custodial. That means you maintain control of your assets at all times. Your crypto stays in your wallet or in smart contracts — not behind a desk at a financial institution.

Higher Yields on Stablecoins

While banks offer a modest 0.1% to 3% APY on savings, DeFi Lending protocols routinely deliver 10%–15% APY on stablecoins like USDC and USDT. These dynamic rates are driven by real-time market demand and executed automatically through smart contracts — no middlemen, no fine print.

Transparent & Algorithmic Interest Rates

Rates in lending protocols adjust in real time based on supply and demand — not some opaque decision made in a bank’s boardroom. Most protocols use algorithmic models to set borrowing costs and lender rewards, so you always know what you’re signing up for.

Business Lending & Borrowing

DeFi is starting to reshape more than just personal finance, digital holdings and investors — it's unlocking new ground in financial transactions. Traditionally, businesses have relied on banks, paperwork-heavy applications, and long approval timelines just to access working capital. But with a crypto lending platform, the entire process can be streamlined. A business can use its crypto assets as collateral or even build a credit profile through on-chain activity, and get access to liquidity within minutes — not weeks.

This is a game-changer, especially for startups and businesses in emerging markets that are typically underserved by legacy banking systems. No more waiting for a greenlight from a credit officer halfway across the world. The implications are huge: faster growth cycles, decentralized funding models, and a level playing field for businesses that don’t fit the mold of traditional finance.

And the options keep growing. Some decentralized applications now offer undercollateralized lending through credit assessment platforms, flexible repayment terms, while others allow tokenized invoices or real-world assets to be used for capital. It’s early days, but business finance is going borderless — and the runway for innovation is wide open.

Top DeFi Lending Platforms

Lending apps have seen explosive growth in recent years. The total value locked (TVL) in DeFi protocols jumped from approximately $9.1 billion in July 2020 to $90.8 billion, according to DeFiLlama — a staggering 900% increase. It’s one of the fastest-growing lending and borrowing markets, highlighting both the demand and rising adoption of DeFi as a serious alternative to traditional banking.

Today, a handful of platforms dominate the DeFi Lending space, known for offering competitive rates, innovative features, and proven reliability. Here are some of the major players shaping the lending landscape:

Aave

One of the OGs in the space. Aave lets you lend and borrow a wide range of assets across multiple chains. Known for its flash loans, dynamic interest rates, and massive liquidity. It’s battle-tested and governed by its community via the AAVE token.

Compound

Another heavyweight. Compound helped pioneer algorithmic interest rates and non-custodial lending. Simple UI, efficient, and deeply integrated across DeFi. It’s been around long enough to earn its stripes — and your trust.

Morpho

A rising star blending the best of peer-to-peer lending with liquidity pools. Morpho optimizes rates for both sides of the market and recently launched Morpho Blue, a permissionless lending layer. Oh, and they just partnered with Credora to bring vault risk ratings into the mix — institutional vibes, DeFi roots.

MakerDAO

This one’s a bit different. Maker doesn’t offer lending pools — it lets you mint DAI (a decentralized stablecoin) by locking up crypto as collateral. It’s overcollateralized lending with a twist. Think of it as borrowing against yourself.

MORE Markets (Upcoming)

A fresh contender making waves on Flow blockchain. MORE Markets lets you lend, earn, and borrow in a sleek, permissionless setup. With curated vaults and rapid TVL growth, it's quickly becoming one of the most promising DeFi protocols outside the usual Ethereum crowd.

Risks & Challenges

Despite its benefits, DeFi Lending apps come with certain risks that users should keep in mind:

Smart Contract Vulnerabilities

DeFi Lending relies on smart contracts, and any bugs or vulnerabilities in the code can be exploited by attackers. While top protocols undergo extensive audits and offer bug bounties, security risks still exist — and exploits have happened.

Liquidation Risks

Crypto-backed loans require collateral. If the value of that collateral drops below a set threshold, the protocol may automatically liquidate it to protect lenders. This risk is heightened during high market volatility, especially with non-stablecoins and memecoins. Undercollateralized lending is also gaining traction — where the collateral posted is less than the loan amount — adding another layer of risk.

Impermanent Loss & Market Volatility

While stablecoins provide price stability, lending or borrowing more volatile cryptocurrencies exposes users to price swings that can affect returns or trigger liquidations.

Regulatory Uncertainty

Global regulators are still figuring out how to approach DeFi. Future rules could impact how lending protocols operate, where they're accessible, and what kind of user verification (KYC) is required.

How to Get Started

Interested in earning passive income through DeFi Lending or borrowing crypto? Here’s a simple step-by-step to get started:

Step 1: Choose a Lending Platform

Browse and select a protocol from our DeFi Lending Directory that fits your needs.

Step 2: Set Up a Crypto Wallet

Pick a secure, compatible wallet from our DeFi Wallet Directory to interact with the protocol.

Step 3: Deposit Funds

Transfer your stablecoins or crypto assets into your wallet, then deposit them into the lending platform to start earning interest.

Step 4: Monitor Your Investments

Keep an eye on your deposited funds, earned interest, and loan health to avoid liquidation risks and maximize returns.

Final Thoughts

DeFi Lending is more than a new way to move money — it’s a new way to move. It gives users something TradFi never could: open access, global reach, and real yield that isn’t tied to legacy infrastructure. Whether you're stacking stablecoins or putting idle assets to work, this isn’t just finance with better rates — it’s finance with no ceiling.

We're not talking about small tweaks to old systems. We're talking about a full-on reimagination of what financial freedom looks like — where wallets replace paperwork, and smart contracts handle what used to take banks days to approve. DeFi Lending isn’t about asking permission. It’s about showing up, connecting your wallet, and being part of a financial system that works for you — not against you.

As infrastructure matures and adoption ramps up, the lines between Web2 banking and Web3 finance will only blur further. But make no mistake — DeFi isn’t trying to copy banks. It's building a parallel system, one that’s faster, fairer, and designed for the digitally native world.

Whether you're an investor looking for better returns or a borrower seeking more flexible terms, DeFi Lending offers an unmatched crypto-native alternative to the traditional banking system.

Source: DeFi Lending Explained: The Alternative Banking System

1 note

·

View note

Text

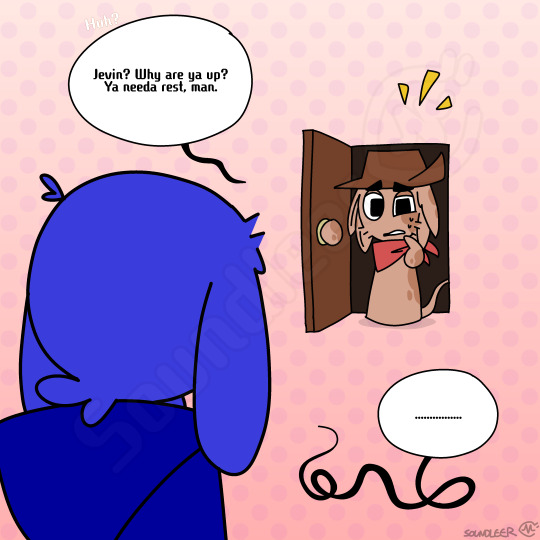

Phoenix left a bit to get a glass of water and miles was a mess after he left... this is the outcome

Bonus: the two witnessed the whole scene with receipt

#ace attorney#fanart#aa#narumitsu#逆転裁判#phoenix wright#miles edgeworth#wrightworth#klavier gavin#apollo justice#minor klapollo#hc : miles becoming clingy when hes drunk#opposite with phoenix lmao

725 notes

·

View notes

Note

Wei Wuxian should be able to get drunk for once. I think he'd either be singing bawdy drinking songs on the roof of the Jingshi or he'd be getting irrevocably lost no matter where he is. He's found in the bushes behind the mountains like a cryptid, and then he's like "I can't believe you all got lost" (extremely slurred) as if he didn't get embarrassed by something Lan Wangji had said and just somehow disappeared when everyone looked back at him

oh ABSOLUTELY im walking with u and nodding and agreeing, i can see him becoming an absolute menace to keep track of at his drunkest.

anyway heres wonderwall The Gang (Wangxian & their fave group of ducklings) in a city known for its STRONG wine and wuxian being like well. ur all grown now, youre technically not juniors anymore. we have to see whos lasting the longest against this stuff!, smash cut to a suspiciously wei ying-less group of the worlds drunkest cultivators being wrangled through the woods by designated driver hanguang-jun, with at least 2 of them clinging to his robes at all times.

#i ALSOOOO LOVE the hc that wuxians just. very affectionate when drunk. bc he lowkey is that way in canon#we dont really know if the alcohols affecting him a lot when him n wangji r drinking but he sure is affectionate#but i think thats Stage One of drunk wuxian. like b99 with the 1-drink-amy system#he goes Unaffected -> lovey dovey -> musical -> fucking off into the woods#also THE IMAGES ARE LOADING IN WE DID IT GANG!#mdzs#mo dao zu shi#wangxian#wei wuxian#lan wangji#sketch#doodle#jin ling#lan sizhui#lan jingyi#ouyang zizhen#sizhui came back to life somewhere between the Petname Drop and the ensuing panic he felt the Anxious Dad vibes radiating off wangji#wangji Attempts to question wwx as to why the fuck he RAN AWAY???? when he sobers up and all wwx has to offer to the conversation is#'well to be fair im a fragile man'#as if that explains anything#except post-canon wangxian understand eachother far too well so it does in fact explain everything#wwx when lwj is nice to him: ???husband is unyielding???husband is cruel??? husband wants me dead??? husband wants me to have heart attack?#JAIL for husband! JAIL FOR 1000 YEARS! but first! self imposed exile!#i was gonna make this longer so it made more sense and was actually good but its 00:38 so u see why i dont wanna? anyway#wwx drunk out of his mind on the roof of the jingshi with wen ning: BIG DIRTY STINKIN BASS! DIRTY STINKIN BASS! DIRTY DIRTY STINKIN BASS#lwj who just got back from a solo nighthunt internally: i wasnt aware he COULD get drunk? am i impressed? i think im impressed?#also the stick in his waistband. very much not chenqing. he dropped chenqing at some point and just pciked up a random stick and was like#yuh thatll do#and fun fact it will not in fact do

498 notes

·

View notes

Text

the reason dean doesn’t have tattoos is bc john wouldn’t let him. tattoos make you more easily identifiable and john ingrained slipping in and out of towns undetected into his kids. dean wants tattoos and piercings, but could only get away with bracelets, rings, and necklaces when john was around

#when will i write unhinged dean and charlie fic where they get blackout drunk and wake up tatted the hell up#ch: lady i’m tolstoy#hcs and musings

243 notes

·

View notes

Text

Drunk Sylus Headcanon

This is my first hc post let me know if you like it!

————————————————————————

Drunk Sylus Notes:

- He’s surprisingly average at handling his liquor (he admitted in an interaction) but he’s very knowledgeable when it comes to subject. He has great recommendations that can suit any of your moods or tastes. He even has a vault dedicated to many unique brews and expensive wines in his basement.

- When he’s drunk, he’s much more quiet and less witty than usual. It’s similar to when he’s really warn-out or tired, but this means, he’s much more direct, heavy-handed, and occasionally clumsy.

- He can be low-key needy, pouty and clingy at times. A vulnerable side, that only makes its appearance around you. He becomes like jello, needing to be wrapped around you. He needs you to feel grounded. He’s always called you kitten, but when he’s like this, the turn tables.

Drunk Sylus Scenario:

Sylus went to a bar to negotiate and build connections with potential business clients, meanwhile, you’re relaxing at his place. He had a few drinks to make the other party feel comfortable, or perhaps to coax them into letting down their guard. The entire time he couldn’t stop thinking about how you were at his place either sitting on his couch or laying in his bed. He’d much rather be with you.

Though, he’s usually very conscious of how much he drinks, he unknowingly drank at a faster pace this time. A few hours pass, and he finally gets home. The door swings open and nearly slams into the wall due to the lack of control of his body.

Surprised, you get up and see Sylus slowly rocking as he makes his way in.

“Sylus, you’re back. How was it?”

He looks at you with a lazy expression, his eyes half-hooded. He doesn’t say anything, instead he slowly staggers toward you.

“Sylus…?” Confused, you unconsciously back up onto the wall. As soon as you do, he traps you, throwing his hands on each side. For a few moments, he stays there drinking in your image. You feel your face start to heat up, not sure what to do as he takes you in.

But before you can even process it, he suddenly crashed his lips onto yours. His kiss hungry and messy. You could taste the liquor on his lips. Usually he’s good about signaling for your consent, but a ravening instinct had awoken in him as to not let his prey slip away.

After a while, he slowly departs from your lips. Hanging his head, he moves it to rest on your shoulder. You feel the heat emanating off his body.

“Mmm” He tries to say something, but it just turns into nonsensical mumbling.

“I…miss you…” He manages to say in a deep, breathy tone.

His big hands wrap around your waist, pulling you against his body.

“Don’t leave…”

His eyebrows furrowing as he speaks against your neck.

“You should be with me all the time.”

You chuckle finding his grumpiness cute. “Sylus, you’re the one that left me, silly. I’ve been here the whole time, waiting for you.”

“Mm.” He lets out a pouty growl, shaking his head against you as if to say,” I didn’t leave you.”

His eyebrows soften as he lifts his head up, grasping your chin in his hands to meet your eyes.

“Promise me, you’ll never leave me, kitten.”

He still had a drunken gaze, but somewhere deep in his eyes, you could see his desperate longing for you. His yearning for you. His anxiety that one day you’d leave him.

You smile softly, reassuringly, wrapping your hands around his.

“I’m not going anywhere, love. I promise. I’ll always wait for you.”

You interlace your fingers with his, smiling once again. “Come with me. It’s my turn to take care of you.”

#sylus#lads#lads sylus#love and deepspace#love and deepspace sylus#drunk#Sylus drunk hc#sylus x reader#sylus headcanons#sylus hc#headcanon#hc#sylus drunk#Sylus x reader fanfic#sylus fluff#fluff#reverse comfort

183 notes

·

View notes

Text

The O(ccasionally)samu D(runk)azai

#drunk dazai bc hes the actual alcoholic one#also bc i wanted a very flustered chuuya#YES EVEN IF THEYRE MARRIED ALREADY BC WHY NOT#i hc drunk dazai is still pretty alert but then if he realizes its someone he someone he can trust (chuuya etc) he just goes soft boy mode#soft honest boy ehehe#also occasionally emotional and vulnerable and validation/reassurance seeking and chuuya always knows#okay i will stop rambling this was rotting my mind the past few days#playing wasia project's ur so pretty on the background when i was drawing these#behold. my therapy (real)#bsd#skk#my art#sketch#sketches#bsd dazai#bsd chuuya#established skk

4K notes

·

View notes

Text

lightweight 🍻

——————————

bonus panels:

[jevin gets sober next morning and he is now extremely embarrassed]

[he never drank again after this incident. tunner couldn't help but adore that side of him]

#soundleer's art#sprunki#excuse my inconsistencies i was trying to adapt the comic i drew from traditional to digital jfhkfjkh#but yea i hc whenever it comes to alcohol jevin passes out after half a shot while tunner needed like 10 shots to get drunk lol#hell i realized why i love jevin so much he reminded me of lan wangji fjdjdbf#honestly stoic characters who are whiny and pouty when zooted has gotta be my favourite trope dhsjjddk#...okay this comic is kinda stupid and ooc now that i think about it oops#sprunki tunner#sprunki jevin#tunner x jevin

252 notes

·

View notes

Text

he’s not a lightweight but when he gets drunk all hell breaks loose

#art#digital art#kenshi takahashi#johnshi#johnny cage#mortal kombat#he won’t remember any of this when he wakes up#Johnny did give him food btw#it was the remains of a charcuterie board#this is purely my hc#I like to think he’s a pathetic man when drunk#actually just a pathetic man in general#I love kenshi takahashi

533 notes

·

View notes

Text

I headcanon kremy as a lightweight. Sure he’s spent his spent his life around booze in the casinos and gamblers dens and what not, but personally he’s always preferred a sensible cigarette over any other kind of substance, and he only drinks very casually or when someone important offers him a toast and it’s rude to say no. It doesn’t take much to get him drunk, and when he is, his carefully constructed suave persona is ruined and he becomes a giddy mess, slurring with an accent so thick that people can’t even tell what he’s saying. Idk idk I just think it’s cute the amount of times he fails the constitution saving throw even when he hasn’t had that much to drink esp compared to the other members

#kremy lecroux#once upon a witchlight#legends of avantris#It’s in stark contrast to Gideon who can put away drink like nobody’s business#when kremy is convinced to drink he always ends up all up in gideons face leaning on him and clinging to his arms#and Gideon is used to it he always takes such good care of drunk kremy#makes sure he gets to his room safe makes sure he doesn’t make any deals he’ll regret in the morning#and if he gets a quiet little thrill in his chest every time Kremy presses up against him mumbling his name in that thick agwe accent#nobody needs to know#ouaw#coalecroux#yeah I’ll tag it#also while we’re here in making shit up out of my ass land#I hc kremy’s mom as an alcoholic (let me have this one guys) which explains why he just more hesitant to not drink in the first place

210 notes

·

View notes

Text

trying to become a wine couple with shouto and the two of you sit on the floor in the living room each with a healthily poured glass in hand while you try (and fail) to describe the tasting notes.

"it's very..." you run your tongue over your lips, as though catching the last drop that clings to them might be a breakthrough. "...dry."

shouto swallows another mouthful, his nose twitching a little at the taste—he doesn't seem to like it, but he's trying (mostly for your sake.) he considers your point, and then adds thoughtfully: "i think it's pretty wet actually."

#he's sooooooooooooo#drunk wine kisses on the living room floor once you've drained the bottle#and it tastes SO much better when it's on his lips#bnha hcs

1K notes

·

View notes

Text

Oh my little love, I wish I was there to protect you.

#bloodweave#bg3#baldur's gate 3#astarion#gale dekarios#gale of waterdeep#hc bb gale sounds out hard to pronounce words so he can still use em#hc 39 year old astarion would fall for gale so fast#angst from my silly account?#is this time travel or just the boys thinking?#yes#time travel could have some silly moments tho#bb gale to older astarion : ur pretty 😳#bb drunk magistrate astarion to older gale: MARRY ME#I shoudl draw tha next#stuff by me#time travel au

343 notes

·

View notes

Text

Shit post on Konrad and Sanguinius' relationship: Konrad: I bring gifts, brother Sanguinius: This is a dead body. Why are you giving me a dead body?

Konrad: Oh that was supposed to be alive still, must have accidentally touched something vital then. Oops, I can get something fresher if you like

Sanguinius: Konrad... no, it's fine... just why? You're not answering my question.

Konrad: Don't you need blood? I thought it I'd bring food because I never see you eat any.

Sanguinius, oddly touched: Konrad, that's what the Karash is for, why do you think I don't offer it to my guests? It has human blood in it.

Konrad: So you're getting drunk on wine when you feed?

Sanguinius: .....Not really, do you have any idea how strong alcohol is on Baal? Karash is nothing compared to that. I'd have to consume over three barrel's worth for it to do anything to me.

Konrad, now curious: May I try some?

Sanguinius: I guess? You are taking this far better then Horus did-

Konrad: That's because Horus is a pussy. Anyway, *tries some, proceeds to choke* That isn't wine, that's straight up fermented blood, I like you're style. Still, eat the fucking body it'll do you good

#Feat: Konrad being a freak#and being somewhat normal#Konrad is showing he cares#Konrad also got drunk asf off of Karash#turns out fermented blood is really strong even to other primarchs#Also casual hc of mine that Sanguinius has a super high alcohol tolerance#Sanguinius is disturbed and touched at the same time#enjoy my rambles#shit post#konrad curze#sanguinius#warhammer 40k#warhammer 30k#primarchs#shitpost#incorrect quotes

192 notes

·

View notes

Text

bmw variety pack vol 2

#akia art#our life#olba#baxter ward#elizabeth last#olba mc#fanartist note i don't miss the eyeballs#not that i haven't been doing this all along but i rly feel like i just made stuff up this time 🤣#where's the lore abt what sort of drunk baxter is!!#i'm not even confident he's particular abt customizing his lock screen much less w a pic of his s/o#so i just drew whichever hcs i liked best LOL#they can be dweeby lovebirds it's more fun this way

409 notes

·

View notes

Text

sometimes Two-bit’s sister paints his nails (and she actually does a really good job) but he definitely forgets she did and ends up walking around w/ red nails for a week 💀

One time him and Marcia went on a pool date and she wouldn’t stop looking at his feet and giggling 😭

#tbh he was probably drunk when she painted them anyway so 😭#the outsiders#the outsiders headcanons#the outsiders hcs#two bit mathews

156 notes

·

View notes

Text

Eepy + sick late night Holywater duo doodlies/designs I drew the other day (✷‿✷)

Apologies for the messiness lmao- I've been a bit demotivated in the digital department, so I've been drawing in my sketchbook a lot. Honestly, it has been pretty fun, so I figured I could share these sketches (・∀・)

#the realm smp#trsmp#the realm fanart#tr!bbh#badboyhalo#tr!water#watermunch#holywater duo#godd i love drawing tr!water and drunkboyhalo#tr!water's design is very ocean themed since i think cc!water said that his character's dragon form was a sea drake#so i have this hc that tr!water's former treasure hoarde was either near or in the seas#also tr!bad's design before he got drunk was inspired by catholic church figures attire-#and now after becoming an alcoholic he probably just wears like a silk nightgown or a robe that's seen better days- just like tr!bad! :0#badboyhalo fanart#watermunch fanart

132 notes

·

View notes

Text

DeFi Lending Explained: The Alternative Banking System

DeFi Lending (Decentralized Finance Lending) is changing how we interact with money and access financial services. By removing traditional banks from the equation, DeFi Lending unlocks global, permissionless financial tools through robust lending and borrowing protocols.

While you may already be familiar with other components of the DeFi ecosystem — like trading platforms and crypto wallets — DeFi Lending protocols are a newer addition to crypto markets. They’ve quickly become one of its most powerful innovations, allowing users to earn yield on digital assets or borrow funds without intermediaries.

Unlike banks, which typically offer 0%–3% interest on savings accounts, permissionless platforms often provide yields of 10%–15% on stablecoins such as USDC and USDT, depending on algorithmic rates. Other altcoins can offer even higher returns, though they come with increased volatility and market risk.

DeFi Lending Explained

DeFi Lending protocols are new financial instruments reshaping the DeFi market into a more open, unbias, efficient, and accessible alternative to traditional finance. It kicked off in 2017 with MakerDAO on the Ethereum network — where smart contracts replace financial intermediaries, and anyone with a wallet could lend, borrow, and earn.

No bank branches. No credit checks. No paperwork.

At its core, crypto lending allows users to deposit digital assets into decentralized protocols and earn yield — often far higher than the 2% scraps traditional banks toss your way. That same pool of capital is tapped by borrowers, who leverage collateral and borrow against it — all without asking permission from a single institution. It's financial access, without the gatekeeping.

Most platforms utilize algorithmic interest rates that adjust based on supply and demand between lenders and borrowers — or more specifically, utilization rate — ensuring lenders are rewarded when demand is high and borrowers always know the cost of capital. Everything runs on smart contracts, meaning no bias, no delays, and no hidden fees.

You might know DeFi wallets or DEXs, but lending is the backbone of decentralized finance. It's where idle assets start working. It's how capital flows across blockchains. And it’s still early. As more protocols launch with permissionless lending, vaults, curators, and real-time credit scoring — like Credora’s system — are setting new standards. Decentralized lending is shaping up to be a full-blown alternative to the banking system — not just for the degens, but for institutions, the bankless, and everyone in between.

DeFi Lending isn’t just a product. It’s a movement — toward financial self-custody, global access, and open systems that don't care about your credit score or region.

How Does Decentralized Lending Work?

DeFi Lending operates on non-custodial, permissionless protocols that allow users to lend or borrow assets without needing approval from centralized institutions. Here’s how it works:

Depositors – Earn Interest by Supplying Crypto

Users can deposit their stablecoins or other cryptocurrencies into a protocol such as Morpho. These funds are added to a liquidity pool, which other users can borrow from. The interest earned depends on market demand and is often significantly higher than traditional bank savings rates. Think of it like a crypto-powered savings account — but with higher yields and no middlemen.

Vaults – Managed by Curators

Vaults, or liquidity pools, are managed by curators (market makers) who optimize yield strategies for depositors by directing liquidity into other protocols or pools. Think of it like how banks reinvest customer deposits — but in DeFi, it’s automated and transparent.

Borrowers – Crypto as Collateral

Borrowers must provide tokens as collateral valued higher than the loan amount and keep up with interest payments. This protects lenders and mitigates defaults. If the collateral’s value drops too far, the protocol auto-liquidates the position to preserve the vault. Interest payments contribute to vault growth, benefiting depositors.

Key Features of DeFi Lending

Different lending platforms introduce a wide range of features that traditional banks simply can’t match — from permissionless access to non-custodial control and real-time, algorithmic interest rates. Here’s what makes crypto lending a compelling alternative.

Want the full breakdown? Check out our deep dive: DeFi Lending vs Traditional Lending for a side-by-side comparison.

Permissionless Access

No approvals. No restrictions. No waiting. With just a wallet and Wi-Fi, anyone can tap into permissionless lending — regardless of geography or credit history. It’s financial access on your terms, running 24/7 on-chain. While banks sleep, DeFi stays open.

Non-Custodial Control

Unlike banks that take custody of your funds, decentralized lending protocols are non-custodial. That means you maintain control of your assets at all times. Your crypto stays in your wallet or in smart contracts — not behind a desk at a financial institution.

Higher Yields on Stablecoins

While banks offer a modest 0.1% to 3% APY on savings, DeFi Lending protocols routinely deliver 10%–15% APY on stablecoins like USDC and USDT. These dynamic rates are driven by real-time market demand and executed automatically through smart contracts — no middlemen, no fine print.

Transparent & Algorithmic Interest Rates

Rates in lending protocols adjust in real time based on supply and demand — not some opaque decision made in a bank’s boardroom. Most protocols use algorithmic models to set borrowing costs and lender rewards, so you always know what you’re signing up for.

Business Lending & Borrowing

DeFi is starting to reshape more than just personal finance, digital holdings and investors — it's unlocking new ground in financial transactions. Traditionally, businesses have relied on banks, paperwork-heavy applications, and long approval timelines just to access working capital. But with a crypto lending platform, the entire process can be streamlined. A business can use its crypto assets as collateral or even build a credit profile through on-chain activity, and get access to liquidity within minutes — not weeks.

This is a game-changer, especially for startups and businesses in emerging markets that are typically underserved by legacy banking systems. No more waiting for a greenlight from a credit officer halfway across the world. The implications are huge: faster growth cycles, decentralized funding models, and a level playing field for businesses that don’t fit the mold of traditional finance.

And the options keep growing. Some decentralized applications now offer undercollateralized lending through credit assessment platforms, flexible repayment terms, while others allow tokenized invoices or real-world assets to be used for capital. It’s early days, but business finance is going borderless — and the runway for innovation is wide open.

Top DeFi Lending Platforms

Lending apps have seen explosive growth in recent years. The total value locked (TVL) in DeFi protocols jumped from approximately $9.1 billion in July 2020 to $90.8 billion, according to DeFiLlama — a staggering 900% increase. It’s one of the fastest-growing lending and borrowing markets, highlighting both the demand and rising adoption of DeFi as a serious alternative to traditional banking.

Today, a handful of platforms dominate the DeFi Lending space, known for offering competitive rates, innovative features, and proven reliability. Here are some of the major players shaping the lending landscape:

Aave

One of the OGs in the space. Aave lets you lend and borrow a wide range of assets across multiple chains. Known for its flash loans, dynamic interest rates, and massive liquidity. It’s battle-tested and governed by its community via the AAVE token.

Compound

Another heavyweight. Compound helped pioneer algorithmic interest rates and non-custodial lending. Simple UI, efficient, and deeply integrated across DeFi. It’s been around long enough to earn its stripes — and your trust.

Morpho

A rising star blending the best of peer-to-peer lending with liquidity pools. Morpho optimizes rates for both sides of the market and recently launched Morpho Blue, a permissionless lending layer. Oh, and they just partnered with Credora to bring vault risk ratings into the mix — institutional vibes, DeFi roots.

MakerDAO

This one’s a bit different. Maker doesn’t offer lending pools — it lets you mint DAI (a decentralized stablecoin) by locking up crypto as collateral. It’s overcollateralized lending with a twist. Think of it as borrowing against yourself.

MORE Markets (Upcoming)

A fresh contender making waves on Flow blockchain. MORE Markets lets you lend, earn, and borrow in a sleek, permissionless setup. With curated vaults and rapid TVL growth, it's quickly becoming one of the most promising DeFi protocols outside the usual Ethereum crowd.

Risks & Challenges

Despite its benefits, DeFi Lending apps come with certain risks that users should keep in mind:

Smart Contract Vulnerabilities

DeFi Lending relies on smart contracts, and any bugs or vulnerabilities in the code can be exploited by attackers. While top protocols undergo extensive audits and offer bug bounties, security risks still exist — and exploits have happened.

Liquidation Risks

Crypto-backed loans require collateral. If the value of that collateral drops below a set threshold, the protocol may automatically liquidate it to protect lenders. This risk is heightened during high market volatility, especially with non-stablecoins and memecoins. Undercollateralized lending is also gaining traction — where the collateral posted is less than the loan amount — adding another layer of risk.

Impermanent Loss & Market Volatility

While stablecoins provide price stability, lending or borrowing more volatile cryptocurrencies exposes users to price swings that can affect returns or trigger liquidations.

Regulatory Uncertainty

Global regulators are still figuring out how to approach DeFi. Future rules could impact how lending protocols operate, where they're accessible, and what kind of user verification (KYC) is required.

How to Get Started

Interested in earning passive income through DeFi Lending or borrowing crypto? Here’s a simple step-by-step to get started:

Step 1: Choose a Lending Platform

Browse and select a protocol from our DeFi Lending Directory that fits your needs.

Step 2: Set Up a Crypto Wallet

Pick a secure, compatible wallet from our DeFi Wallet Directory to interact with the protocol.

Step 3: Deposit Funds

Transfer your stablecoins or crypto assets into your wallet, then deposit them into the lending platform to start earning interest.

Step 4: Monitor Your Investments

Keep an eye on your deposited funds, earned interest, and loan health to avoid liquidation risks and maximize returns.

Final Thoughts

DeFi Lending is more than a new way to move money — it’s a new way to move. It gives users something TradFi never could: open access, global reach, and real yield that isn’t tied to legacy infrastructure. Whether you're stacking stablecoins or putting idle assets to work, this isn’t just finance with better rates — it’s finance with no ceiling.

We're not talking about small tweaks to old systems. We're talking about a full-on reimagination of what financial freedom looks like — where wallets replace paperwork, and smart contracts handle what used to take banks days to approve. DeFi Lending isn’t about asking permission. It’s about showing up, connecting your wallet, and being part of a financial system that works for you — not against you.

As infrastructure matures and adoption ramps up, the lines between Web2 banking and Web3 finance will only blur further. But make no mistake — DeFi isn’t trying to copy banks. It's building a parallel system, one that’s faster, fairer, and designed for the digitally native world.

Whether you're an investor looking for better returns or a borrower seeking more flexible terms, DeFi Lending offers an unmatched crypto-native alternative to the traditional banking system.

Source: DeFi Lending Explained: The Alternative Banking System

1 note

·

View note