#incipient

Text

chapter 6 is finally here (i'm so sorry for taking a million years)

enter present mic!!! we've had some good dadzawa, but i know everyone's been looking forward to that good good papamic content too ;)

tags! @hyperobsessed @vee-sea @finnthemann @pancakemoment @epickiya722 @kamiiin @vesterport @nielution @justtorzaplease

#bnha#mha#my hero academia#boku no hero academia#bakugou katsuki#katsuki bakugou#incipient#incipient fic#incipiupdates#incipient fic updates#bakugou angst fic#dadzawa#eraser head#present mic#erasermic#shouta aizawa#hizashi yamada#papamic

11 notes

·

View notes

Text

Incipient

//adjective//

Definition:

1. in an initial stage; beginning to happen or develop.

2. of a person) developing into a specified type or role.

#word of the week#writer#writing#writer community#writeblr#weekly words#dictionary#definition#author#writers weekly words#i#words#i words#incipient#adjective#adjectives

2 notes

·

View notes

Text

0 notes

Text

Incipient

Incipient [in-SIP-ee-ənt] Part of speech: adjective Origin: Latin, late 16th century 1. In an initial stage; beginning to happen or develop. 2. (Of a person) Developing into a specified type or role. Examples of incipient in a sentence “His incipient excitement built up the week before he started the new job.” “We started out as colleagues, but we’re incipient friends.” #wordoftheday

youtube

View On WordPress

#daily#definition#dictionary#educational#Incipient#Knowledge#learning#lesson#schoolhouse#vocabulary#word#Youtube

0 notes

Text

cousins amiright🙄

#digital art#art#ticcitavvi artwork#artwork#digital artwork#fanart#Mlp#my little pony#Flurry heart#Saccharine artifice#Incipient verse#Next gen#mlp next gen

25 notes

·

View notes

Note

Happy Wednesday! Loving your writing! Looking forward to reading more of Arsonist Neil. I especially like the relationship between Aaron and Andrew! Keep up the good work!

WIP Wednesday (5/15) | Arsonist Neil / Firefighter Andrew AU (Part 170)

After that night, the two of them talk constantly. When Andrew's at work, they stick to texting. Because there’s far too many busybodies wandering around for him to be discussing murder or 10’s life on the run. Or anything really.

And Andrew still loathes the idiot for the gift basket that gave him away. Because now Renee asks about his boyfriend anytime he’s got his phone in his hand and Boyd asks him stupider things like, ‘Do you call your boyfriend ‘dude’?’ which always earns him a glare.

Despite his annoyingly persistent coworkers, Andrew enjoys having this. He’s got a routine built around someone else, something he hasn’t had since he shared a dorm with the idiots he claimed as family. He chats with 10 and goes to put out a fire. He texts with 10 and cuts a kid out of a metal fence— yes, his job truly is thrilling. He talks to 10 before bed and wakes up ready to talk to him again. To hear his sleepy voice and ask how his night was.

He supposes that everyone around him is sort of right about the boyfriend thing. Sort of.

If 10 were into him, Andrew would perhaps classify them as... something. But he’s not. And dating over the phone really isn’t a thing. He thinks.

‘It’s called long distance,’ Renee says when he tells her that. And he snaps back that the distance isn’t that long. But he certainly won’t tell her that 10 is living in a hotel here in town because he’s a traveling arsonist who enjoys getting on Andrew’s nerves. That would be insane, even if it's the truth.

#thank you so much this was so sweet to hear! <3333 i wasn't sure if this was actually a req for wipw or not but you get some! :D#andreil#aftg#WIP Wednesday#Arsonist Neil / Firefighter Andrew#🕊️#answered#incipient-user#love

31 notes

·

View notes

Text

Convicted monopolist prevented from re-offending

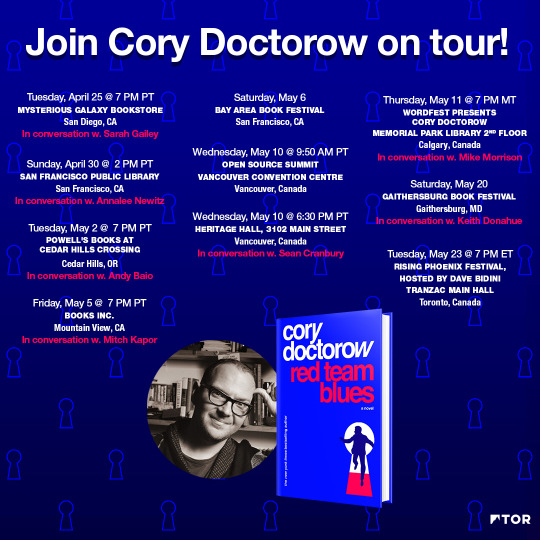

This Sunday (Apr 30) at 2PM, I’ll be at the San Francisco Public Library with my new book, Red Team Blues, hosted by Annalee Newitz.

In blocking Microsoft’s acquisition of Activision-Blizzard, the UK Competition and Markets Authority has made history: they have stepped in to prevent a notorious, convicted monopolist from seizing control over a nascent, important market (cloud gaming), ignoring the transparent, self-serving lies Microsoft told about the merger:

https://assets.publishing.service.gov.uk/media/644939aa529eda000c3b0525/Microsoft_Activision_Final_Report_.pdf

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/04/27/convicted-monopolist/#microsquish

Cloud gaming isn’t really a thing right now, but it might be. That was Microsoft’s bet, anyway, as it plonked down $69b to acquire Activision-Blizzard — a company that shouldn’t exist, having been formed out of a string of grossly anticompetitive mergers that were waved through.

Activision-Blizzard is a poster-child for the failures of antitrust law over the past 40 years, a period in which monopolies were tolerated and even encouraged by the agencies that were supposed to prevent monopolies from forming and break up the ones that slipped past their defenses. Activision-Blizzard is a giant, moribund company whose “innovation” consists of endless sequels to its endless sequels, whose market power allows it to crush its workers while starving competitors of market oxygen, ensuring that gamers and game workers have nowhere else to go.

Microsoft is another one of those poster-children, of course. After being convicted of antitrust violations, the company dragged out the legal process until George W Bush stole the presidency and decided not to pursue them any further, letting them wriggle off the hook.

The antitrust rough ride tamed Microsoft…for a while. The company did not use the same dirty tricks to destroy, say, Google as it had used against Netscape. But in the years since, Microsoft has demonstrated that it regrets nothing about its illegal conduct and has no hesitations about repeating that conduct.

This is especially true of cloud computing, where Microsoft is using exclusivity deals and illegal “tying” (forcing customers to use a product they don’t want in order to use a product they desire) to lock customers into its cloud offering:

https://www.reuters.com/technology/google-says-microsofts-cloud-practices-anti-competitive-slams-deals-with-rivals-2023-03-30/

Locking customers into Microsoft’s cloud also means locking customers into Microsoft surveillance. Microsoft’s cloud products spy in ways that are extreme even by the industry’s very low standards. Office 365 isn’t just a version of Office that you never stop paying for — it’s a version of Office that never stops spying on you, and selling the data to your competitors:

https://pluralistic.net/2020/11/25/the-peoples-amazon/#clippys-revenge

Microsoft’s Activision acquisition was entirely cloud-driven. The company clearly believes the pundits who say that the future of gaming is in the cloud: rather than playing on a device with the power to handle all the fancy graphics and physics, you’ll use a low-powered device that streams you video from a server in the cloud that’s doing all the heavy lifting.

If cloud gaming comes true (a big if, considering the dismal state of broadband, another sector that’s been enshittified and starved by monopolists), then Microsoft owning the Xbox platform, the Windows OS, and the Game Pass subscription service already poses a huge risk that the company could grow to dominate the sector. Throw in Activision-Blizzard and the future starts to look very grim indeed.

It’s a nakedly anticompetitive merger. As Mark Zuckerberg unwisely wrote in an internal memo, “it is better to buy than to compete.”

(These guys can not stop incriminating themselves. FTX got mocked for its group-chat called “Wirefraud,” but come on, every tech baron has a folder on their desktop called “mens rea” full of files with names like “premeditation-11.docx.”)

Naturally, the FTC sued to stop the merger (after 40 years, the FTC has undergone a revolution under chair Lina Khan and is actually protecting the American people from monopoly):

https://www.vice.com/en/article/ake97g/ftc-sues-to-block-microsoft-acquisition-of-call-of-duty-publisher-activision-blizzard

The FTC was always in for an uphill battle. “Cloud gaming,” the market it is seeking to defend from monopolization, doesn’t really exist yet, and enforcing US antitrust law against monopolies over existent things is hard enough, thanks to all those federal judges who attended luxury junkets where billionaire-friendly “economists” taught them that monopolies were “efficient”:

https://pluralistic.net/2021/08/13/post-bork-era/#manne-down

But the FTC isn’t the only cop on the beat. Antitrust is experiencing a global revival, from the EU to China, Canada to Australia, and South Korea to the UK, where the Competition and Markets Authority is kicking all kinds of arse (see also: “ass”). The CMA is arguably the most technically proficient competition regulator in the world, thanks to the Digital Markets Unit (DMU), a force of over 50 skilled engineers who produce intensely detailed, amazingly sharp reports on how tech monopolies work and what to do about them.

The CMA is very interested in cloud gaming. Late last year, they released a long, detailed report into the state of browser engines on mobile phones, seeking public comment on whether these should be regulated to encourage web-apps (which can be installed without going through an app store) and to pave the way for cloud gaming:

https://pluralistic.net/2022/12/13/kitbashed/#app-store-tax

The CMA is especially keen on collaboration with its overseas colleagues. Its annual conference welcome enforcers from all over the world, and its Digital Markets Unit is particularly important in these joint operations. You see, while Parliament appropriated funds to pay those 50+ engineers, it never passed the secondary legislation needed to grant the DMU any enforcement powers. But the DMU isn’t just sitting around waiting for Parliament to act — rather, it produces these incredible investigations and enforcement roadmaps, and releases them publicly.

This turns out to be very important in the EU, where the European Commission has very broad enforcement powers, but very little technical staff. The Commission and the DMU have become something of a joint venture, with the DMU setting up the cases and the EU knocking them down. It’s a very heartwarming post-Brexit story of cross-Channel collaboration!

And so Microsoft’s acquisition is dead (I mean, they say they’ll appeal, but that’ll take months, and the deal with Activision will have expired in the meantime, and Microsoft will have to pay Activision a $3 billion break-up fee):

https://mattstoller.substack.com/p/big-tech-blocked-microsoft-stopped

This is good news for gaming, for games workers, and for gamers. Microsoft was and is a rotten company, even by the low standards of tech giants. Despite the sweaters and the charity (or, rather, “charity”) Bill Gates is a hardcore ideologue who wants to get rid of public education and all other public goods:

https://pluralistic.net/2021/04/13/public-interest-pharma/#gates-foundation

Microsoft has a knack for nurturing and promoting absolutely terrible people, like former CEO Steve Ballmer, who has played a starring role in Propublica’s IRS Files, thanks to the bizarre tax-scams he’s pioneered:

https://pluralistic.net/2023/04/24/tax-loss-harvesting/#mego

So yeah, this is good news: Microsoft should have been broken up 25 years ago, and we should not allow it to buy its way to ongoing dominance today. But it’s also good news because of the nature of the enforcement: the CMA defended an emerging market, to prevent monopolization.

That’s really important: monopolies are durable. Once a monopoly takes root, it becomes too big to fail and too big to jail. That’s how IBM outspend the entire Department of Justice Antitrust Division every year for twelve years during a period they call “Antitrust’s Vietnam”:

https://onezero.medium.com/jam-to-day-46b74d5b1da4

Preventing monopoly formation is infinitely preferable to breaking up monopolies after they form. That’s why the golden age of trustbusting (basically, the period starting with FDR and ending with Reagan) saw action against “incipient” monopolies, where big companies bought lots of little companies.

When we stopped worrying about incipiency, we set the stage for today’s Private Equity “rollups,” where every funeral home, or veterinarian, or dentists’ practice is bought out by a giant PE fund, who ruthlessly enshittify it, slashing wages, raising prices, stiffing suppliers and reducing quality:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

Limiting antitrust enforcement to policing monopolies after they form has been an absolute failure. The CMA knows that an ounce of prevention is worth a pound of cure — indeed, we all do.

From Apr 26–28, Barnes and Noble is offering a 25% discount on preorders for my upcoming novels (use discount code PREORDER25): The Lost Cause (Nov 2023) and The Bezzle (Red Team Blues #2) (Feb 2024).

Catch me on tour with Red Team Blues in Mountain View, Berkeley, San Francisco, Portland, Vancouver, Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: A promotional image from the Call of Duty franchise featuring a soldier in a skull-mask gaiter giving a thumbs up on a battlefield. It has been altered so that he is giving a thumbs-down gesture. Superimposed on the image is a modified Microsoft 'Clippy' popup; Clippy's speech-bubble has been filled with grawlix characters; the two dialog-box options both read 'No.']

Image: Microsoft, Activision (fair use)

#pluralistic#labor#digital markets unit#gaming#brexit#cma#competition and markets authority#antitrust#monopoly#incipiency#microsoft#activision#blizzard#activision-blizzard#cloud gaming#cloud#mergers

129 notes

·

View notes

Text

presenting my conclusions at the annual yuri finance review. Gentlewomen, This Quarter's Totals Aren't Looking Good. How Can We Revitalize The Market's Enthusiam for Wild Sexual Adventures (Lesbian Style). This Company Is In Peril. no sirs that is not Sexual peril. just regular peril.

#news from the cupola#she spreadsheet on my analysis until I conclude. Synergistically?#point of this post being. Oh I dunno.#shoutout to the person who wrote jane roland/diana villiers in 2010 and shoutout to almost nobody else at this time.#I need to do something. Hnnnnngh admiral roland sir.#<- entire post signs of incipient madness.

17 notes

·

View notes

Text

[You're obsesssed and distressed 'cause you can't make any sense. Of the ludicrous nonsense and incipient senescence. That will deem your common sense useless. This aint no recess!]

#s23e13 isle-talian#guy fieri#guyfieri#diners drive-ins and dives#ludicrous nonsense#incipient senescence#common sense#recess

12 notes

·

View notes

Text

Dust Volume 10, Number 6, Part I

Infinite River

We’re halfway through the year and swamped with mid-year activities (look for our round-up next week), but the records continue to pile-up and we continue to make time for as many as possible. This month, the slush pile yielded a wide range of music, from Burkina-Faso-ian griot to microtonal composition to snarling black metal to improvisation and jazz.

Our reviews are split in two parts because of Tumblr's arbitrary limits on sound samples. See Part II here. Contributions included Jennifer Kelly, Bryon Hayes, Andrew Forell, Christian Carey, Jonathan Shaw, Bill Meyer, Jim Marks, Justin Cober-Lake and Alex Johnson. Happy summer!

Avalanche Kaito — Talitakum (Glitterbeat)

Another of those cross-cultural, Afro-European collaborations that are so often great—see recent works by Chouk Bwa & The Ångströmers, Ndox Electrique and Group Doueh/Cheveux—Avalanche Kaito sets Burkina Faso griot to a rattling, pummeling noise punk beat. I like “Lago” best, where a clatter of mixed percussion and serrated, distortion crusted guitar dart in and around a keening call and response. Near the end of a recent long-distance drive, I listened to it 14 times in a row without wearing it out. Still the title track is fantastic as well, its guitars stabbing in like Fugazi, its drums boxy and agitated, its spatter-painted words dicing the beat into eighths and sixteenths. The “Kaito” in the band name comes from grioteer Kaito Winse. The Avalanche comes from the falling-down-the-stairs-but-still-on-beat mix of strident punk and West African syncopation.

Jennifer Kelly

Ayal Senior — Ora (Medusa Editions)

Toronto’s 12-string warrior Ayal Senior workshopped the songs that became Ora at a monthly residency he has at the Tranzac Club, a haven for the city’s most adventurous musical minds. His comrades Kurt Newman (pedal steel, electric guitar) and Andrew Furlong (bass) joined him on the journey, and together they slowly worked the sonic skeletons into fleshy bodies of song. The trio brought scene veterans Blake Howard and Jay Anderson on board to add drums and percussion when they laid the sounds to tape. Their flourishing rhythms complete the image: five beams of light passing through the prism of Senior’s celestial vision. The guitarist bills Ora as the spiritual successor to 2022’s Az Yashir, yet while that record embraced a post-COVID sea change, Ora is bathed in the light of tranquility. Senior’s folk devotionals draw warmth from the presence of his pals, taking on raga and kosmische adornments as they languidly unfurl. These hymns are beauty incarnate, guitar-centric mantras in service of the cosmic mystery that surrounds us all.

Bryon Hayes

Beams — Requiem for a Planet (Be My Sibling)

Beams is an alt.country ensemble, playing rock and folk instruments in delicate, otherworldly ways. The voices especially — Anna Mērnieks-Duffield primarily but fleshed out in harmonies by Heather Mazhar and Keith Hamilton—float in translucent layers, mixing eerily with the meat-and-potatoes sonics of guitar, bass and drums. As the title suggests, Beams main subject is the earth itself, its fragility, its rising temperature, its trajectory towards unlivability. Yet though there are lessons here, in songs like “Heat Potential,” Beams steers clear of polemics. “It’s All Around You,” especially envelopes and enfolds. Its string-swooping, gorgeously harmonized arrangements lift you up and out of the mess we’re in. “Childlike Empress” with its well-spaced blots of keyboard sound, its ghostly, tremulous singing, is an eerie elegy for the world’s natural beauty. The album is its own thing, but it might remind you of certain twang-adjacent Feelies side projects, Speed the Plough and Wild Carnation especially.

Jennifer Kelly

DELTAphase — Synced (Falling Elevators)

Process. DELTAphase founder Wilhelm Stegmeier contacts a disparate group of musicians and provides them with a key, beat, tempo for seven pieces of music and allows them complete stylistic and compositional freedom. Each of 10 musicians contributed to one or more of the seven pieces, without knowing who else was involved. Stegmeier, seeking synchronicities and serendipity, collates and adds to the contributions and collages them within the given parameters. Result. The musicians, Merran Laginestra, Beate Bartel, Thomas Wydler, Brendan Dougherty, Lucia Martinez, Antonio Bravo, Andreas Voss, Eleni Ampelakiotou, Dominik Avenwedde, Kilian Feinäugle and Stegmeier come from classical, jazz, electronic and post rock backgrounds, and the music occupies liminal interstices between and across genres. There’s lots of layered percussion, electronic backgrounds and guitar interplay from the squalling electric duel on “Phase Lock” to Bravo’s jazzy riffing on “One by One” which also features Laginestra’s impressionistic piano. That combination is a standout on an album that can occasionally meander into cul-de-sacs. Remote collaboration has become a commonplace since the pandemic but the caliber of the musicians here and Stegmeier’s skill in pulling their contributions together make Synced a fascinating exploration of compositional process.

Andrew Forell

Taylor Deupree — Sti.ll (Greyfade)

A recent microtrend involves making acoustic realizations of electronic compositions, the latest being a new version of Taylor Deupree’s lauded 2002 electroacoustic recording Stil. Sti.ll follows suit, with a reworking for acoustic instruments by Deupree and Joseph Branciforte. The bespoke Greyfade book that accompanies Sti.ll is handsome and contains a QR code to download the digital recording. The acoustic versions can sometimes fool you into thinking that you are listening to the original synth sounds, which is part of the game. “Stil.” is nearly twenty-minutes long, for vibraphone and bass drum. The vibes play both textural passages and, simultaneously, repeating dyadic melodies. The bass drum errs on the side of gentle effects rather than thwacking. Another standout track is “Temper,” for multiple clarinets and a shaker. The composition moves through a series of repeated intervals, descending fourth, ascending minor third, et cetera, with harmonic underpinning from the other clarinets and constant pulsation contributed by the shakers. Hard for clubbing, but these pieces would work quite well in a concert.

Christian Carey

Emma dj — Lay2g (Danse Noire)

Paris based Finnish producer Emma dj has the tendency to get distracted by novelty which interrupts the flow of this set and disrupts individual tracks often enough to leave the listener frustrated. If that’s the point, all well and good, but I suspect it’s not, which makes you wonder if this is all in service of the producer rather than the audience. That’s fine if there’s challenge in the music, which here, there is not. He collides bits and pieces of dance punk, chiptunes, video game soundtrack and the detritus of underground sub-sub genres into a messy mélange — a potluck casserole thrown together for a class reunion no one’s attending. It’s particularly annoying for the moments when, by design or serendipity, Emma produces a dish worth eating like “RR.dnk” for instance that sprays warped synth stabs against cowbell hi-hat, thumping kick drum and a stumbling bass line without succumbing to the over seasoning of vocal samples, jokey blips and burps or overwrought exhortations to dance. With a little more focus and balance, he may well produce something pretty good but this is only halfway there.

Andrew Forell

Incipient Chaos — S/T (I, Voidhanger)

There are times when some listeners just want a record of snarling, muscular black metal — thematics and scannable cultural politics be damned. If that sounds good to you, this new self-titled LP from French band Incipient Chaos rages and rips with all the right sorts of aggressivity. It seems that one takes chances with one’s ethics (if not one’s immortal soul) doing this sort of impulse listening in black metal: Is this NSBM? Does anyone have the skinny on that? Do we need to dig into the various “Is this band sketch” subreddits and descend into that 9th Circle of gossip-mongering and reaction? Lucifer smiles; so does Advance Publications. Is that a distinction without a difference? Meanwhile, we can note that Incipient Chaos has released this record on a politically reliable label, and while it’s unusual not to get a lyric sheet from I, Voidhanger (uh oh…), that may just be typical black metal shtick: the words are obscured because they are sooooo evil. Whatevs. The riffs are strong, if not world-changing, and the compositions have drama, if not overwhelming tragedy. Check out the guitar-centric middle portion of “Ominous Acid,” which is hugely satisfying. The down-tempo opening minutes of “Dragged Back from the Abyss” will remind you of the best of Aosoth. It’s all a lot of…fun?

Jonathan Shaw

Infinite River — Tabula Rasa (Birdman)

First came the space, now comes the rock. Infinite River’s first couple recordings had a definite COVID-era vibe to them. The Detroit-based ensemble started out as a trio, with Joey Mazzola and Gretchen Gonzales playing guitars and Warren Defever contributing tambura and a place to record. But a bliss-oriented drone might make less sense in a time when you can get out and play shows than it did when clubs were shut down and people didn’t want to go out than it does when stages are available and Steve Nistor, who drums for Sparks, is available to join in. Last year, Bryon Hayes invoked Windy & Carl and Mountains when describing Infinite Rivers’ Prequel; “Sky Diamon Raga,” the track that kicks off Infinite River, is more like an arena rock dream of Chris Forsyth’s “The Paranoid Cat.” Much of the time this record feels rather like the Raybeats negotiating production ideas of the 1990s and 2010s, which means that the guitar tones will have you scratching your head to remember what’s being reference and how it’s been changed, but that the snare drum takes up entirely too much sonic real estate. Tellingly, the best moments come when the production is dialed back and the melodies take over, as on a Ventures-does-Coltrane interpretation of “My Favorite Things.”

Bill Meyer

Will Laut — Will Laut (Wavetrap)

Producer Ivan Pavlov AKA COH has collaborated with John Balance and Cosey Fanni Tutti, and the sounds of Coil and Throbbing Gristle are clear influences on his new EP with singer William Laut. Shot through with the feeling of dancing towards doomsday, Laut’s haunted murmur wavers just on the right side of cynicism and sleaze as he sings of living through hate, looking for the redemption of love or at least an opportunity to forget even for a few moments. COH lays down a minimalist carpet of synths and drum machines that use TG’s “United” and Daniel Miller’s “Warm Leatherette” as templates. Most effective are the slow burn sarcasm of “Cryptoman” and the weary tango of “Wine of Love.” These are songs Brecht and Weill might have written if they had access to cheap keyboards and a primitive drum machine. Noirish, knowing and smart, the four songs on Will Laut are a speakeasy floorshow for the modern world. Highly recommended and hoping to hear more from this duo.

Andrew Forell

Niels Lyhne Løkkegaard and Quatuor Bozzini — Colliding Bubbles: Surface Tension and Release (Important)

Niels Lyhne Løkkegaard is a composer based in Copenhagen. On his latest EP he joins forces with the premiere Canadian string quartet for new music, Quatuor Bozzini, to create a piece that deals with the perception of bubbles replicating the human experience. In addition to the harmonics played by the strings, the players are required to play harmonicas at the same time. At first blush, this might sound like a gimmick, but the conception of the piece as instability and friction emerging from continuous sound, like bubbles colliding in space and, concurrently, the often tense unpredictability of the human experience, makes these choices instead seem organic and well-considered. As the piece unfolds, the register of the pitch material makes a slow decline from the stratosphere to the ground floor with a simultaneous long decrescendo. The quartet are masterful musicians, unfazed by the challenge of playing long bowings and long-breathed harmonica chords simultaneously. The resulting sound world is shimmering, liquescent, and, surprising in its occasional metaphoric bubbles popping.

Christian Carey

#dusted magazine#dust#avalanche kaito#jennifer kelly#ayal senior#bryon hayes#beams#deltaphase#andrew forell#Taylor Deupree#christian carey#emma dj#incipient chaos#jonathan shaw#infinite river#bill meyer#will laut#Niels Lyhne Løkkegaard

2 notes

·

View notes

Text

aizawa: if you’re considering coming out to your adoptive son, go for it. just be aware, he’ll probably judge you.

bakugou: i still don’t get it, honestly.

aizawa: we’re gay, bakugou.

bakugou: i got that part.

yamada: then why are you confused?

bakugou: you’re LOUD. HOW DOES HE PUT UP WITH YOU

yamada:

yamada: well i could ask YOU the same question, asshole

#bnha#mha#my hero academia#boku no hero academia#bakugou katsuki#katsuki bakugou#mha shitposts#bnha shitpost#mha memes#bnha memes#aizawa shouta#shouta aizawa#hizashi yamada#yamada hizashi#erasermic#yamazawa family#eraser head#present mic#yeah this is about incipient#i’m revising ch4 and this was funnier in my head than it is on paper#incorrect quotes#bnha incorrect quotes#mha incorrect quotes

873 notes

·

View notes

Text

I have 100% become a metatron-is-fucking-with-reality truther after reading that one essay. I keep seeing new things in the rewatch:

- Maggie somehow not guessing that Nina wouldn’t have a record player despite her previous comments? (Maggie’s not real)

- their phones going dead when the power goes out, and coming back on immediately when it’s restored? Phones don’t work like that, metatron.

- the ominous music at Aziraphale’s (imo) out of character resistance to Crowley’s questions before the beginning, the same music that op noticed at several other ooc places

- Crowley’s depression and little speech at the park about how everything is pointless. It’s such a clear sign that things in general are Wrong. He’s an optimist, and he usually cares about the world for its own sake (the point is the point is dolphins etc). He’s lost his grounding here, and it makes everything feel eerie.

More than anything, there are just too many continuity gaps and red herrings (like the Eccles cakes). They initially made me feel like the season simply wasn’t very good, but they’re too consistent and look too purposeful on the rewatch, and frankly it strains belief that neil gaiman would be that haphazard with his storytelling.

(I think I was primed to expect this season to be not-good because the new beelzebub, the re-casting of previous actors, and Crowley’s target box dye lookin hair color felt sloppy or shoestring to me. But those are totally different issues from story structure, so unless neil really dropped the ball or john finnemore is a loose cannon, I think the continuity gaps are plot relevant. And given the story’s long arc about who gets to shape reality, from god and adam in the first season to the archangels and the metatron now, all versus humans + crowley and aziraphale—well, I’m convinced anyway. I think the metatron is editing bits of reality here and there to break up the min. 25-lazari power couple.)

Here’s the link to the original post (read it, it’s incredible):

#good omens meta#good omens#got my red string and cork board; reconciled to my incipient madness; focused; flourishing

14 notes

·

View notes

Text

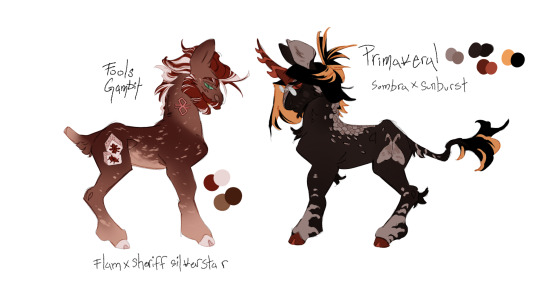

Just realized I never posted these two actually?? So uh here they are ig

more abt them laterrrrr

8 notes

·

View notes

Text

i was about to make a post talking about how mw seems a lot sweeter and more level headed compared to the other mikeys and then i realised i got ty betteridge'd.

#the incipient urge to be nicer to the kind eyed cowboy...#who was talking about cowboys as a performance of gender because this episode was so good for it#also MIKE'S BACK MIKE'S BACK MIKE'S BAAAAACK I was talking just a couple of days ago abt how I missed him so bad#i've been relistening to paul blart movies w michael bc I missed their dynamic so much lmao#woe.begone#woe.begone spoilers#e speaks#everyone has such interesting opinions about iterations and i'm glad we're getting to see more abt what mw thinks

17 notes

·

View notes

Text

The antitrust Twilight Zone

Funeral homes were once dominated by local, family owned businesses. Today, odds are, your neighborhood funeral home is owned by Service Corporation International, which has bought hundreds of funeral homes (keeping the proprietor’s name over the door), jacking up prices and reaping vast profits.

Funeral homes are now one of America’s most predatory, vicious industries, and SCI uses the profits it gouges out of bereaved, reeling families to fuel more acquisitions — 121 more in 2021. SCI gets some economies of scale out of this consolidation, but that’s passed onto shareholders, not consumers. SCI charges 42% more than independent funeral homes.

https://pluralistic.net/2022/09/09/high-cost-of-dying/#memento-mori

SCI boasts about its pricing power to its investors, how it exploits people’s unwillingness to venture far from home to buy funeral services. If you buy all the funeral homes in a neighborhood, you have near-total control over the market. Despite these obvious problems, none of SCI’s acquisitions face any merger scrutiny, thanks to loopholes in antitrust law.

These loopholes have allowed the entire US productive economy to undergo mass consolidation, flying under regulatory radar. This affects industries as diverse as “hospital beds, magic mushrooms, youth addiction treatment centers, mobile home parks, nursing homes, physicians’ practices, local newspapers, or e-commerce sellers,” but it’s at its worst when it comes to services associated with trauma, where you don’t shop around.

Think of how Envision, a healthcare rollup, used the capital reserves of KKR, its private equity owner, to buy emergency rooms and ambulance services, elevating surprise billing to a grotesque art form. Their depravity knows no bounds: an unconscious, intubated woman with covid was needlessly flown 20 miles to another hospital, generating a $52k bill.

https://pluralistic.net/2022/03/14/unhealthy-finances/#steins-law

This is “the health equivalent of a carjacking,” and rollups spread surprise billing beyond emergency rooms to

anesthesiologists, radiologists, family practice, dermatology and others. In the late 80s, 70% of MDs owned their practices. Today, 70% of docs work for a hospital or corporation.

How the actual fuck did this happen? Rollups take place in “antitrust’s Twilight Zone,” where a perfect storm of regulatory blindspots, demographic factors, macroeconomics, and remorseless cheating by the ultra-wealthy has laid waste to the American economy, torching much of the US’s productive capacity in an orgy of predatory, extractive, enshittifying mergers.

The processes that underpin this transformation aren’t actually very complicated, but they are closely interwoven and can be hard to wrap your head around. “The Roll-Up Economy: The Business of Consolidating Industries with Serial Acquisitions,” a new paper from The American Economic Liberties Project by Denise Hearn, Krista Brown, Taylor Sekhon and Erik Peinert does a superb job of breaking it down:

http://www.economicliberties.us/wp-content/uploads/2022/12/Serial-Acquisitions-Working-Paper-R4-2.pdf

The most obvious problem here is with the MergerScrutiny process, which is when competition regulators must be notified of proposed mergers and must give their approval before they can proceed. Under the Hart-Scott-Rodino Act (HSR) merger scrutiny kicks in for mergers when the purchase price is $101m or more. A company that builds up a monopoly by acquiring hundreds of small businesses need never face merger scrutiny.

The high merger scrutiny threshold means that only a very few mergers are regulated: in 2021, out of 21,994 mergers, only 4,130 (<20%) were reported to the FTC. 2020 saw 16,723 mergers, with only 1.637 (>10%) being reported to the FTC.

Serial acquirers claim that the massive profits they extract by buying up and merging hundreds of businesses are the result of “efficiency” but a closer look at their marketplace conduct shows that most of those profits come from market power. Where efficiences are realized, they benefit shareholders, and are not shared with customers, who face higher prices as competition dwindles.

The serial acquisition bonanza is bad news for supply chains, wages, the small business ecosystem, inequality, and competition itself. Wherever we find concentrated industires, we find these under-the-radar rollups: out of 616 Big Tech acquisitions from 2010 to 2019, 94 (15%) of them came in for merger scrutiny.

The report’s authors quote FTC Commissioner Rebecca Slaughter: “I think of serial acquisitions as a Pac-Man strategy. Each individual merger viewed independently may not seem to have significant impact. But the collective impact of hundreds of smaller acquisitions, can lead to a monopolistic behavior.”

It’s not just the FTC that recognizes the risks from rollups. Jonathan Kanter, the DoJ’s top antitrust enforcer has raised alarms about private equity strategies that are “designed to hollow out or roll-up an industry and essentially cash out. That business model is often very much at odds with the law and very much at odds with the competition we’re trying to protect.”

The DoJ’s interest is important. As with so many antitrust failures, the problem isn’t in the law, but in its enforcement. Section 7 of the Clayton Act prohibits serial acquisitions under its “incipient monopolization” standard. Acquisitions are banned “where the effect of such acquisition may be to substantially lessen competition between the corporation whose stock is so acquired and the corporation making the acquisition.” This incipiency standard was strengthened by the 1950 Celler-Kefauver Amendment.

The lawmakers who passed both acts were clear about their legislative intention — to block this kind of stealth monopoly formation. For decades, that’s how the law was enforced. For example, in 1966, the DoJ blocked Von’s from acquiring another grocer because the resulting merger would give Von’s 7.5% of the regional market. While Von’s is cited by pro-monopoly extremists as an example of how the old antitrust system was broken and petty, the DoJ’s logic was impeccable and sorely missed today: they were trying to prevent a rollup of the sort that plagues our modern economy.

As the Supremes wrote in 1963: “A fundamental purpose of [stronger incipiency standards was] to arrest the trend toward concentration, the tendency of monopoly, before the consumer’s alternatives disappeared through merger, and that purpose would be ill-served if the law stayed its hand until 10, or 20, or 30 [more firms were absorbed].”

But even though the incipiency standard remains on the books, its enforcement dwindled away to nothing, starting in the Reagan era, thanks to the Chicago School’s influence. The neoliberal economists of Chicago, led by the Nixonite criminal Robert Bork, counseled that most monopolies were “efficient” and the inefficient ones would self-correct when new businesses challenged them, and demanded a halt to antitrust enforcement.

In 1982, the DoJ’s merger guidelines were gutted, made toothless through the addition of a “safe harbor” rule. So long as a merger stayed below a certain threshold of market concentration, the DoJ promised not to look into it. In 2000, Clinton signed an amendment to the HSR Act that exempted transactions below $50m. In 2010, Obama’s DoJ expanded the safe harbor to exclude “[mergers that] are unlikely to have adverse competitive effects and ordinarily require no further analysis.”

These constitute a “blank check” for serial acquirers. Any investor who found a profitable strategy for serial acquisition could now operate with impunity, free from government interference, no matter how devastating these acquisitions were to the real economy.

Unfortunately for us, serial acquisitions are profitable. As an EY study put it: “the more acquisitive the company… the greater the value created…there is a strong pattern of shareholder value growth, correlating with frequent acquisitions.” Where does this value come from? “Efficiencies” are part of the story, but it’s a sideshow. The real action is in the power that consolidation gives over workers, suppliers and customers, as well as vast, irresistable gains from financial engineering.

In all, the authors identify five ways that rollups enrich investors:

I. low-risk expansion;

II. efficiencies of scale;

III. pricing power;

IV. buyer power;

V. valuation arbitrage.

The efficiency gains that rolled up firms enjoy often come at the expense of workers — these companies shed jobs and depress wages, and the savings aren’t passed on to customers, but rather returned to the business, which reinvests it in gobbling up more companies, firing more workers, and slashing survivors’ wages. Anything left over is passed on to the investors.

Consolidated sectors are hotbeds of fraud: take Heartland, which has rolled up small dental practices across America. Heartland promised dentists that it would free them from the drudgery of billing and administration but instead embarked on a campaign of phony Medicare billing, wage theft, and forcing unnecessary, painful procedures on children.

Heartland is no anomaly: dental rollups have actually killed children by subjecting them to multiple, unnecessary root-canals. These predatory businesses rely on Medicaid paying for these procedures, meaning that it’s only the poorest children who face these abuses:

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

A consolidated sector has lots of ways to rip off the public: they can “directly raise prices, bundle different products or services together, or attach new fees to existing products.” The epidemic of junk fees can be traced to consolidation.

Consolidators aren’t shy about this, either. The pitch-decks they send to investors and board members openly brag about “pricing power, gained through acquisitions and high switching costs, as a key strategy.”

Unsurprisingly, investors love consolidators. Not only can they gouge customers and cheat workers, but they also enjoy an incredible, obscure benefit in the form of “valuation arbitrage.”

When a business goes up for sale, its valuation (price) is calculated by multiplying its annual cashflow. For small businesses, the usual multiplier is 3–5x. For large businesses, it’s 10–20x or more. That means that the mere act of merging a small business with a large business can increase its valuation sevenfold or more!

Let’s break that down. A dental practice that grosses $1m/year is generally sold for $3–5m. But if Heartland buys the practice and merges it with its chain of baby-torturing, Medicaid-defrauding dental practices, the chain’s valuation goes up by $10–20m. That higher valuation means that Heartland can borrow more money at more favorable rates, and it means that when it flips the husks of these dental practices, it expects a 700% return.

This is why your local veterinarian has been enshittified. “A typical vet practice sells for 5–8x cashflow…American Veterinary Group [is] valued at as much as 21x cashflow…When a large consolidator buys a $1M cashflow clinic, it may cost them as little as $5M, while increasing the value of the consolidator by $21M. This has created a goldrush for veterinary consolidators.”

This free money for large consolidators means that even when there are better buyers — investors who want to maintain the quality and service the business offers — they can’t outbid the consolidators. The consolidators, expecting a 700% profit triggered by the mere act of changing the business’s ownership papers, can always afford to pay more than someone who merely wants to provide a good business at a fair price to their community.

To make this worse, an unprecedented number of small businesses are all up for sale at once. Half of US businesses are owned by Boomers who are ready to retire and exhausted by two major financial crises within a decade. 60% of Boomer-owned businesses — 2.9m businesses of 11 or so employees each, employing 32m people in all — are expected to sell in the coming decade.

If nothing changes, these businesses are likely to end up in the hands of consolidators. Since the Great Financial Crisis of 2008, private equity firms and other looters have been awash in free money, courtesy of the Federal Reserve and Congress, who chose to bail out irresponsible and deceptive lenders, not the borrowers they preyed upon.

A decade of zero interest rate policy (ZIRP) helped PE grow to “staggering” size. Over that period, America’s 2,000 private equity firms raised buyout warchests totaling $2t. Today, private equity owned companies outnumber publicly traded firms by more than two to one.

Private equity is patient zero in the serial acquisition epidemic. The list of private equity rollup plays includes “comedy clubs, ad agencies, water bottles, local newspapers, and healthcare providers like hospitals, ERs, and nursing homes.”

Meanwhile, ZIRP left the nation’s pension funds desperate for returns on their investments, and these funds handed $480b to the private equity sector. If you have a pension, your retirement is being funded by investments that are destroying your industry, raising your rent, and turning the nursing home you’re doomed to into a charnel house.

The good news is that enforcers like Kanter have called time on the longstanding, bipartisan failure to use antitrust laws to block consolidation. Kanter told the NY Bar Association: “We have an obligation to enforce the antitrust laws as written by Congress, and we will challenge any merger where the effect ‘may be substantially to lessen competition, or to tend to create a monopoly.’”

The FTC and the DOJ already have many tools they can use to end this epidemic.

They can revive the incipiency standard from Sec 7 of the Clayton Act, which bans mergers where “the effect of such acquisition may be substantially to lessen competition, or to tend to create a monopoly.”

This allows regulators to “consider a broad range of price and non-price effects relevant to serial acquisitions, including the long-term business strategy of the acquirer, the current trend or prevalence of concentration or acquisitions in the industry, and the investment structure of the transactions”;

The FTC and DOJ can strengthen this by revising their merger guidelines to “incorporate a new section for industries or markets where there is a trend towards concentration.” They can get rid of Reagan’s 1982 safe harbor, and tear up the blank check for merger approval;

The FTC could institute a policy of immediately publishing merger filings, “the moment they are filed.”

Beyond this, the authors identify some key areas for legislative reform:

Exempt the FTC from the Paperwork Reduction Act (PRA) of 1995, which currently blocks the FTC from requesting documents from “10 or more people” when it investigates a merger;

Subject any company “making more than 6 acquisitions per year valued at $70 million total or more” to “extra scrutiny under revised merger guidelines, regardless of the total size of the firm or the individual acquisitions”;

Treat all the companies owned by a PE fund as having the same owner, rather than allowing the fiction that a holding company is the owner of a business;

Force businesses seeking merger approval to provide “any investment materials, such as Private Placement Memorandums, Management or Lender Presentations, or any documents prepared for the purposes of soliciting investment. Such documents often plainly describe the anticompetitive roll-up or consolidation strategy of the acquiring firm”;

Also force them to provide “loan documentation to understand the acquisition plans of a company and its financing strategy;”

When companies are found to have violated antitrust, ban them from acquiring any other company for 3–5 years, and/or force them to get FTC pre-approval for all future acquisitions;

Reinvigorate enforcement of rules requiring that some categories of business (especially healthcare) be owned by licensed professionals;

Lower the threshold for notification of mergers;

Add a new notification requirement based on the number of transactions;

Fed agencies should automatically share merger documents with state attorneys general;

Extend civil and criminal antitrust penalties to “investment bankers, attorneys, consultants who usher through anticompetitive mergers.”

#pluralistic#american economic liberties project#jonathan kantor#doj#clayton act#hart-scott-rodino act#zirp#financial engineering#monopoly#consolidation#rollups#debt financing#private equity#hedge funds#serial acquirers#antitrust#incipiency standard#Celler-Kefauver Act#vons#brown shoe#boomers#silver wave#labor#monopsony#pricing power#kkr#envision#funeral homes#surprise billing#sci

103 notes

·

View notes

Text

I admire this pattern's commitment to No Seaming Ever, but my god I came close to screaming at times

loved the bounciness of the rib stitch here, did not love the pattern's weirdly baffling way of describing everything

#knitting#stitch witchery#I am obsessed with these buttons that I got on sale#I went back and bought three more for my incipient button collection#I will admit that the buttonband is actually very nice (once I'd stared at it for two hours,watched about six videos and phoned a friend#to figure out how it worked)#now let's find out if royal mail lose it en route to my mum

15 notes

·

View notes