#low interest

Text

How to Borrow Money at Zero Interest!

Although it’s best to be financially equipped, at all times, life has a tendency to throw curveballs at you when you least expect it. In cases like these, where you’re caught off guard financially, borrowing money seems to be one of the doorways you can enter through to get a resolution to your financial difficulties. That is not to imply that you cannot borrow money when you need it for other kinds of expenses like buying a car, a house, a trip, to pay for education, etc. You can have numerous financial needs to cater to, and one should know how to borrow money, especially at zero interest or low interest. Here's how you can borrow money at zero interest:

1) Personal loan: One of the most popular ways you can borrow money from a bank or a financial institute that offers to give you a personal loan at zero interest or at a lower interest rate. There is however a catch to it, unless it’s a secured loan, it’s not so easy to get low-interest personal loans. To avail zero-interest loans, you need to have good creditworthiness to prove yourself to be trustworthy enough, for the lender to take risks. There are various ways in which you can build a good credit score.

2) Friends & Relatives: Although, it’s not always a good idea to borrow money from friends and family. However, when times are tough it’s possible to get willing and helpful friends and family to lend you money and, in that case, you don’t have to pay interest. You only need to return the amount you’ve borrowed. That’s one of the easiest ways to get zero-interest loans.

3) Loan Apps Offering Zero Interest: The digitalization of the world is leading to more and more services going online. Personal loans also have hopped on this bandwagon and people are becoming more comfortable and confident about using online apps for their financial concerns. The lines of credit and quick loans online are available to us at just a click. Some of these apps offer quick loans online at zero interest rates. All you have to do is simply apply on these apps to avail zero-interest loans. If the next question that comes up is- which are the best loan apps with zero interest?

The answer lies in this list:

1. Stashfin

2. Viva Money

3. Casheapp

4. Moneytap

One can adopt any of these methods to borrow money when the need arises. However, it’s important to weigh in all the risks and liabilities that may come with it.

0 notes

Text

Securing Low-Interest Personal Loans with Lenders

In a world where financial stability is quite significant, securing a low-interest personal loan is very crucial. One can take a personal loan for various reasons like debt consolidation, covering unexpected expenses, etc.. However, it’s crucial to take it from the right place. In this article, we’ll cover the steps that one can take to secure low-interest personal loans.

How to Secure a Low-Interest Personal Loan?

There are various lenders available, each offering different interest rates for personal loans. These lenders have different requirements and criteria for providing the loan which can make the loan amount higher. This is why one can follow the below-mentioned steps to get a loan at the lowest interest rate.

1) Assess Credit Score

Low interest rate loans are generally offered to people with a decent credit score. So, before applying for a loan, check your credit score, and try to improve if it’s not good. One of the ways to increase your credit score is to make the remaining payments as quickly as possible.

2) Try to Reduce Debt

When banks offer loans, they check for the debt-to-income ratio (DTI) of an individual. So, it’s essential that you check your DTI ratio by adding all your debts and dividing them by your gross monthly income. A higher DTI often leads to higher interest rate. Some of the ways to do this include the following.

Seeking debt counselling from banks or other financial institutions to get personalised guidance on managing your finances.

Lowering the debt-to-income ratio by repaying your debt quickly.

3) Check for Offers

Nowadays, lenders often offer loans online, and sometimes, they even give discounts on the existing rates. They also provide discounts if applied with a qualified co-borrower. You may also look for potential discounts from a bank or credit union which helps to get benefits like extended grace periods, etc. Reach out to reputed firms like Tata Capital, which provides several options to choose from.

4) Apply for the required amount only

Sometimes, we get approved for higher loan amounts than what we actually need. In such situations, one must ask the lender to lower the amount. This is because higher loans will make you pay higher interest rates.

5) Request Prequalification

Prequalification indicates the amount of loan you’ll be eligible for and the interest that you might have to pay. This step helps in securing a low-interest personal loan by allowing you to compare offers from different lenders without affecting your credit score significantly.

Conclusion

We often need personal loans for various reasons like debt consolidation, home renovation etc. But due to a shortage of time or due to delay in decision making we end up taking personal loans without proper research. This leads to paying higher interest rates. So, in order to secure loans at lower interest rates one must check different options. Reduction in debts and comparing offers availed by different lenders are crucial. Also, one can try prequalification, which lets you compare prequalified loans to know the estimated interest rate different institutions might charge.

0 notes

Text

Low interest credit cards offer several rewards and benefits that make them an attractive choice for individuals looking to manage their finances wisely. These cards come with a lower annual percentage rate (APR) compared to standard credit cards, which can lead to significant savings over time. The rewards provided by low interest credit cards can be broadly categorized into financial savings, debt management, and improved credit scores.

Financial Savings: One of the primary rewards of low interest credit cards is the potential for substantial financial savings. With a lower APR, cardholders pay less interest on their outstanding balances, which is especially beneficial for those who carry a balance from month to month. This translates to lower monthly interest charges, allowing individuals to save money over the long term. Whether for unexpected expenses or planned purchases, the reduced interest rate can make a significant difference in overall financial stability.

Debt Management: Low interest credit cards can be a valuable tool for managing and reducing existing credit card debt. Individuals carrying high-interest debt on other cards can transfer their balances to a low interest card, often at a promotional or even 0% introductory rate for a certain period. This allows them to consolidate their debt and focus on paying it off faster without accruing additional interest charges. This approach can lead to quicker debt repayment and improved financial health.

Improved Credit Scores: Timely payments and responsible credit utilization are key factors in building and maintaining a good credit score. Low interest credit cards can help in this regard by offering lower financing costs, making it easier for cardholders to manage their balances and make on-time payments. Consistently paying down balances and staying within credit limits can positively impact credit scores over time.

Flexible Rewards Programs: Some low interest credit cards also offer rewards programs, albeit usually with a focus on simplicity. These rewards might include cash back on purchases, points that can be redeemed for travel or merchandise, or statement credits. While the rewards might not be as robust as those from dedicated rewards cards, they still provide additional value for cardholders.

Peace of Mind: The combination of reduced interest rates and potential rewards can provide cardholders with peace of mind. They can manage their financial obligations more effectively, reduce the burden of high-interest charges, and focus on achieving their financial goals without the constant worry of escalating debt.

In conclusion, low interest credit cards offer a range of rewards that extend beyond just the financial aspect. They provide opportunities for savings, debt consolidation, credit score improvement, and simpler rewards programs. As with any financial product, it's crucial to carefully review the terms and conditions of these cards to fully understand the benefits and any potential fees.

0 notes

Text

John

#captain john price#captain price#john price#call of duty#modern warfare 3#cod mw3#i'm going to take that break now#my motivation and interest is at an all time low ;p#and has been for a while#🫶🫶#yumecodgif

2K notes

·

View notes

Text

Someone needs to do an analysis on the way the Kung Fu Panda movies use old-fashioned vs. modern language ("Panda we meet at last"/"Hey how's it going") and old-fashioned vs. modern settings (forbidden-city-esque palaces/modern-ish Chinese restaurant) to indicate class differences in their characters, and how those class differences create underlying tensions and misunderstandings.

#This is neither a criticism nor a compliment of that artistic choice#I just think it's really interesting#Like even looking at the Five:#Tigress talks in an older style than the others because she was mainly raised at the Jade Palace#While Mantis talks like Joe-schmo off the street because he *was* a streetfighter and an ordinary guy#Shifu and even Tai Lung talk like they're from an old-fashioned novel or kung fu movie#Po talks like a modern guy you'd meet working in a twenty-first century family restaurant#Part of Tigress's initial disdain for him in the first movie is clearly because she considers him to be low-class/a commoner#(And therefore an intruder into the world of the Jade Palace and the rest of the Kung Fu masters which appears to be semi-noble).#Shen looks genuinely off-put and disgusted when he has to respond to Po's greeting with a “...hey.”#And when Po wants to appear more legitimate as a warrior he adopts a more “legendary”/old-fashioned way of speaking.#In the aesthetic language of KFP old fashioned=noble/upper class and modern=common/lower class.#This translates entirely naturally—I think especially to an American audience—but it is wild once you notice it#Because you realize: “Hang on—shouldn't *all* these characters be talking like they're living in the medieval era?”#“And what does it mean that they're not? What is the movie attempting to convey with this—probably entirely subconscious—artistic choice?”#kung fu panda

3K notes

·

View notes

Text

its dangerous to go alone! take thisヾ(≧▽≦*)o

the PNGs 🥺🤲💕

#dc comics#dick grayson#jason todd#tim drake#damian wayne#batfam#bat boys#please look at them#i spent way too long trying to make the video sync with the audio#these are the phone charms i have for preorder before!!#if theres interests... ill draw other designs/characters 🧍♂️#idk why the png so blurry... is it bcs the resolution too low??? question mark#first art in months. please have my offerings#(will open order again once the charms arrived) ((if you care))#sugargrinds

916 notes

·

View notes

Text

i really and truly love the internet

#might restore some more g-men covers for upload this site hosts them all in low-ish quality (and bear magazine if anyone's interested)#below this there's a little banner saying we've been running for over 25 years! these corners of the internet are such a labor of love

517 notes

·

View notes

Text

Listen, I know we're all exhausted, but we gotta get better about adding image descriptions to disability related stuff. Everyone should be IDing everything anyways, but there's a particularly cruel irony in disability related stuff not being accessible to folks with low/no vision.

#disability#actually disabled#you can ask people for help if you don't have the spoons or aren't good at it#Also in case anyone reading this says “hey you don't ID everything” I know I'm so tired. But if everyone on this site IDed as much as I do#I'm pretty sure we'd collectively get everything#Also I try my hardest to make sure anything disability related is IDed bc of the particularly cruel irony#(But also I do things that are funny or interesting bc low/ no vision folks deserve to enjoy the fun stuff too!!)

416 notes

·

View notes

Note

My auntie keeps Golden Guernsey goats on our island, like many of our local unique breeds of livestock they nearly went extinct in the starving during ww2 occupation surviving by only one smuggled flock. They're super friendly and energetic and their colouration might be of interest :eyes:

Oh OH these are very pretty

#it's extremely cool and admirable that your aunt is helping to preserve a rare heritage breed of livestock#these goats are gorgeous#wonderful caramel colors#they look highly pettable#answered#anonymous#also this is beside the point but a few years back I was really interested in the history and cultures of the Channel Islands Isle of Man#and the archipelagos of Scotland#I remember thinking that I've never interacted with anyone who lives in any of those places at least to my knowledge#and my chances of coming across someone organically are fairly low so I probably never will#maybe it's weird to say but I just think it's terribly neat that there's at least one Channel Islander in existence who has seen my art

384 notes

·

View notes

Text

unsurprisingly i read a lot of comics and manhwa n shit but ill let you know now, if your female protagonist has brown/black eyes or brown hair I like it 50% more

#i KNOW the comics are supposed to be brightly colored#all fun and fantastical#but honestly. my eyes... will ache#i like characters with plain colors. or muted coloring#i like low saturation too#and mAYBE i'm just tired of all the side characters or secondary love interests having plain colors#embrace it. embrace it. baby brown eye supremacy

660 notes

·

View notes

Text

Duchess has just such a pretty design, I love her 🦢💜

#and her character is just so interesting#the girl just wants a happy ending#even if she has to take one#low key could have paralleled Raven if they’d wanted to go that route#and in the Next Top Villain book headmaster Grimm wanted Duchess to be the new Evil Queen instead of Raven#and Duchess and Raven both have bird imagery!!#Duchess is very neat lol#ever after high#duchess swan#eah#ever after high art#ever after high books#eah royals#eah rebels#eah duchess

2K notes

·

View notes

Text

🌔

#ofmd#our flag means death#suggestive#ed teach#stede bonnet#do i have a predictable type and interest? oh definitely#have I basically drawn this theme before? might as well've#but when my mind is allowed to roam where is will it tends to come back to ed vulnerable in low light#drawn on a voice call after I finished my dtiys submission for the raac fan video#the theme i chose for that piece is also one I have pursued before and will pursue again because it's not my fault they put him in a catbel#anyway you should go submit a coloring for the renew as a crew video if you haven't#art i'm proud of

1K notes

·

View notes

Text

SOUKOKU & SHIN SOUKOKU | Illustrations by Sango Harukawa for Bungo Stray Dogs Second Exhibition

#I didn't see this illustration being posted besides the low quality / watermark one so I thought I would. I like this art#I mean I really like Atsushi and his outfit. And the sskk look like on a fancy date soooo#Btw this version is upscaled if you're interested in the original quality one just hmu#atsushi nakajima#ryūnosuke akutagawa#osamu dazai#chūya nakahara#bsd#bungou stray dogs#my edit#Just a bit#mine#This made me notice how similar Akutagawa and Dazai's poses are when put side by side.#It makes me picture it like Akutagawa was trying to look cool by imitating Dazai it's... Kind of adorable.

964 notes

·

View notes

Note

you are so whimsical i qant to check out this mdzs (..??) because of your whimsical nature thank you sorry im very high and your art moved me emotionally

This is simultaneously the sweetest and funniest thing someone has sent me, thank you.

#ask#non-mdzs#I have a hunch you will not recall sending this to me but I wish to immortalize it.#The progression of me going 'aw' to 'barking with laughter' at the last bit of this message was a delight.#Oh man what to say about getting into MDZS...#I admit I'm probably low on the list of people who should be recommending it.#I enjoy it! But there are also a ton of different adaptations that each do a slightly different thing with the story and characters.#Personally I loved The Untamed (Netflix live action) for how campy the action was. It got emotional but really...It made me laugh.#And I love watching it with people because it also makes them laugh.#(The Untamed changes a lot of plot elements so it isn't looked upon very favourably by many fans. I love it as its own thing)#Don't get me wrong; it *is* a story with interesting things to say and I certainly have written tons of analysis on it.#But it's also a series I spent over a year making parody comics of. It comes from a place of love!#The audio drama is really good and I think it might be the best form of mdzs...however finding episodes is not easy.#The audio drama is also what I'm basing all these comics on!#There is a book (the primary source) An animated series and a comic to check out as well.#Someone probably has a better pitch and recommendation list than I do. I just make the funny comics.

342 notes

·

View notes

Text

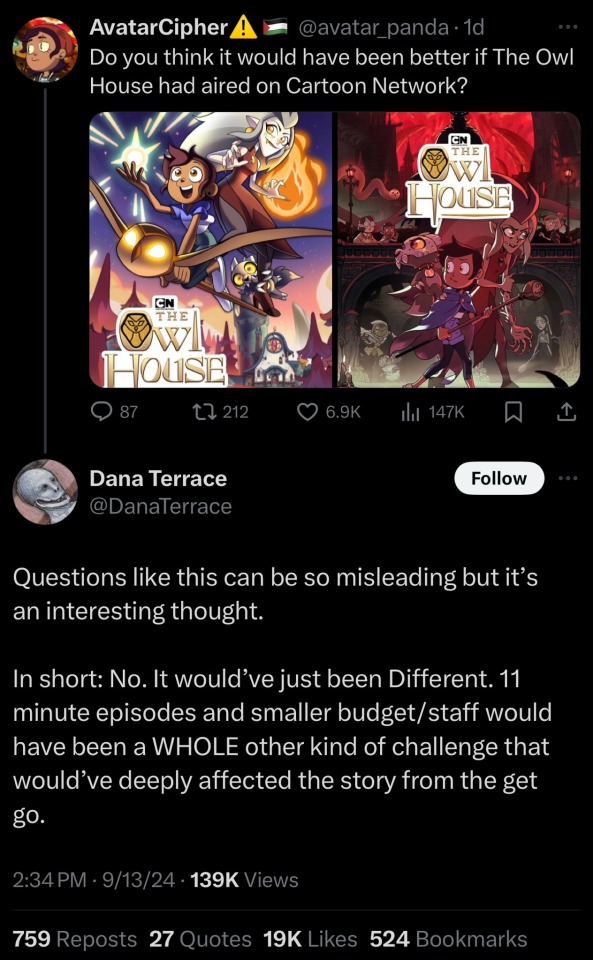

i saw this tweet and found it interesting for two reasons. one is that some people base how good cartoon network would be to toh by how it treated su, and despite the fact that su’s treatment by the network was considered poor at the time, now its thought to be exceptionally good in comparison to modern shows.

two is how exactly su got impacted by a limited budget. a common criticism is how characters like connie, peridot, and lapis are left out of missions. but balancing a lot of characters is not only hard but also costly (extra animation, extra voices—it’s been revealed that the show is limited to a set number of characters per episode otherwise they’re over budget). animation mistakes are not uncommon since retakes cost extra. the entire reason the original show got cut short was due to loss of funding!

#i don’t know if pay rates differ per networks#but a.ivi and s.urrashu have said that they needed to work outside of su in order to make sufficient funds#it only makes me wonder what other ways su suffered from a lower budget#that we as the audience never got to see#in the vein of the too-little characters complaint#another part of that is that low-stakes episodes should’ve been abt the main cast instead of the townies#like last one out of beach city and too short to ride vs restaurant wars and kiki’s pizza delivery service#i definitely see that especially since that isn’t budget related#nor would it seem to be network related (even if cn had an ‘episodic episodes’ quota it could still be abt the gems#(another side note: /would/ cn even have a requirement that the show make episodes that can be watched standalone?#this is a question for the people who were around when su was airing#what episodes often got rerun?#was it the townie eps or the lore eps?#for example i heard that su once did a ‘peridot event’ where they just reran peridot episodes#which had eps that skip around in the show#did they even care about airing the story so that it made sense anyways?#id get it if the low stakes townie episodes were the ones getting rerun))#but i have such a boring view on that which is i think it’s simply because the creators like townie eps#like in interviews r.ebecca s.ugar has said she’s the type to be really invested in background characters#answers in interviews have been crafted in ways to hide what’s really going on though tbf#prime example of this is rebecca and ian saying the wedding being interrupted was meant to follow the common trope#when later in the art book they said that it was bc cn rejected the ep bc it ‘wasn’t interesting enough’#both could simultaneously be true! it’s a psychology thing though where people make up nice-sounding explanations behind what they create#in retrospect because they want it to be thought out in such a nice way they believe in it#the bigger problem is that not matter how many episodes there are of them#it can be hard for ppl to be invested in the townies the same way they are invested in the main cast#i’m sure that a million writers have made surefire advice on how to get an audience to care about characters#but off the top of my head i think it’s because 1. most don’t have strong motivations to get truly invested in#(exception is ronaldo but people find him too annoying to care about him)#okay i had more points and explanations but i hit the tag limit and idk if anyone is actually reading this so bye

167 notes

·

View notes

Text

"that you could be so cruel" ok correct me if i'm wrong but does penelope featherington not run a gossip rag that exist solely to publish unsubstantiated rumors about women she doesn't like for various reasons that have profoundly negative repercussions on those women (didn't the publication of marina's pregnancy lead to marina almost dying in her quest to terminate said pregnancy??????) and has in fact used that same rag to put not just colin's entire family but also specifically colin's sister, her best friend, through a significant amount of grief and strife that came as a direct result of that rag?

but colin's the cruel one? because she happened to eavesdrop on a conversation where he said he doesn't wanna date her? that's cruelty but all the other stuff isn't?

#personal#bridgerton#anti penelope featherington#i'm gonna be honest i skim the absolute fuck out of this show whenever i force myself to watch it#but from what i remember that is literally what penelope does as lady whistledown#but yeah sure a guy who'd never shown any interest in her continuing to not show interest is the worst thing ever done to a human woman#like girl fix yourself!!!#it's you you're the problem!#(also typing that just led me to a horrible realization that at some low point for penelope in the show)#(we're gonna get a vitamin string quartet cover of antihero by taylor swift)#anyway eloise should be allowed to slap girlie across the face once an episode until she begs forgiveness#i'm only interested in that and if jonathan bailey's character has more sad scenes i can use in gifsets about louis philippe of france

480 notes

·

View notes