#Capital One Financial Corp

Text

JetBlue to build airport lounges in New York, Boston

JetBlue planes at JFK’s Terminal 5 in New York.

Leslie Josephs | CNBC

JetBlue Airways will open its first airport lounges in its more than two decades of flying, a major shift for the low-cost airline as it chases high-spending travelers.

The lounges will open at New York’s JFK Airport late next year followed by Boston, JetBlue said Thursday.

The airline is also planning to launch a new…

#Aerospace and defense industry#Airlines#American Airlines Group Inc#American Express Co#Boston#Breaking News: Business#Breaking News: Markets#Business#business news#Capital One Financial Corp#Delta Air Lines Inc#Frontier Group Holdings Inc#JetBlue Airways Corp#JPMorgan Chase & Co#Life#Markets#New York#Southwest Airlines Co#Spirit Airlines Inc#Transportation#Travel#United Airlines Holdings Inc

0 notes

Text

BOYCOTTING FOR PALESTINE

The Official BDS Boycott Targets

Campaigns

Block the boat: End maritime arms transfer to Israel

Ban Apartheid Israel from Sports (FIFA, Olympics)

Consumer Boycotts - a complete boycott of these brands

Disney (SPECIFICALLY MARVEL)

Intel

Axa

Puma

Carrefour

HP

Cevron

Caltex

Israeli produce

Re/max

Ahava

Texaco

Siemens

Sodastream

Intel

Organic Boycott Targets - boycotts not initiated by BDS but still complete boycott of these brands

Macdonald's

Dominos

Papa Johns

Burger King

Pizza Hut

Wix

Divestments and exclusion - pressure governments, institutions, investment funds, city councils, etc. to exclude from procurement contracts and investments and to divest from these

Elbit Systems

CAF

Volvo

CAT

Barclays

JCB

HD Hyundai

TKH Security

HikVision

Pressure - boycotts when reasonable alternatives exist, as well as lobbying, peaceful disruptions, and social media pressure.

Google

Amazon

AirBnb

Booking.Com

Expedia

Teva

Here are some companies that strongly support Israel (but are not Boycott targets). There is no ethical consumption under capitalism and boycotting is a political strategy - not a moral one. If you did try to boycott every supporter of Israel you would struggle to survive because every major company supports Israel (as a result of attempting to keep the US economy afloat), that being said, the ones that are being boycotted by masses and not already on the organic boycott list are coloured red.

5 Star Chocolate

7Days

7Up

Apple

Arsenal FC

ALDO

Arket

Axe

Accenture

Ariel

Adidas

ActionIQ

Aquafina

Amika

AccuWeather

Activia

Adobe

Aesop

Azrieli Group

American Eagle

Amway Corp

Axel Springer

American Airlines

American Express

Atlassian

AdeS

Aquarius

Ayataka

Audi

Barqs

Bain & Company

Bayer

Bank Leumi

Bank Hapoalim

BCG (Boston Consulting Group)

Biotherm

Bershka

Bloomberg

BMW

Boeing

Booz Allen Hamilton

Burberry

Bath & Body Works

Bosch

Bristol Myers Squibb

Capri Holdings

Costa

Carita Paris

CareTrust REIT

Caterpillar

Coach

Cappy

Caudalie

CeraVe

Check Point Software Technologies

Cerelac

Chanel

Chapman and Cutler

Channel

Cheerios

Cheetos

Chevron

Chips Ahoy!

Christina Aguilera

Citi Bank

Carrefour

Codral

Cosco

Canada Dry

Citi

Clal Insurance Enterprises

Clean & Clear

Clearblue

Clinique

Champion

Club Social

Coca Cola

Coffee Mate

Colgate

Comcast

Compass

Caesars

Conde Nast

Cooley LLP

Costco

Côte d’Or

Crest

CV Starr

CyberArk Software

Cytokinetics

Crayola

Cra Z Art

Daimler

Dr Pepper

Del Valle

Daim

Doctor Pepper

Dasani

Doritos

Daz

Dior

Dell

Deloitte

Delta Air Lines

Deutsche Bank

Deutsche Telekom

DHL Group

David Off

Disney

DLA Piper

Domestos

Domino’s

Douglas Elliman

Downy

Duane Morris LLP

Dreft Baby Detergent & Laundry Products

Dreyer’s Grand Ice Cream

eBay

Edelman

Eli Lilly

Evian

Empyrean

Ericsson

Endeavor

EPAM Systems

Estee Lauder

Elbit Systems

EY

Forbes

Facebook

Fairlife

Fanta

First International Bank of Israel

Fiverr

Funyuns

Fuze

Fox News

Fritos

Fox Corp

Gatorade

Gamida Cell

GE

Glamglow

General Catalyst

General Motors

Georgia

Gold Peak

Genesys

Goldman Sachs

Grandma’s Cookies

Garnier

Guess

Greenberg Traurig

Guerlain

Givenchy

H&M

Hadiklaim

Huggies

Hanes

HSBC

Head & Shoulders

Hersheys

Herbert Smith Freehills

Hewlett Packard

Hasbro

Hyundai

Henkel

Harel Insurance Investment & Financial Services

Hewlett Packard Enterprise

HubSpot

Huntsman Corp

IBM

Innocent

Insight Partners

Inditex Group

IT Cosmetics

Instacart

Intermedia

Interpublic Group

Instagram

ICL Group

Intuit

Jazwares

Jefferies

John Lewis

JP Morgan Chase

Jaguar

Johnson & Johnson

JPMorgan

Kenon Holdings

Kate Spade

Kirks’

Kinley Water

KKR

KFC

KKW Cosmetics

Kurkure

Keebler

Kolynos

Kaufland

Kevita

Knorr

KPMG

Lemonade

Lidl

Loblaws

Levi Strauss

Louis Vuitton

Life Water

Levi’s

Levi’s Strauss

LinkedIn

Land Rover

L’Oréal

Lego

Levissima

Live Nation Entertainment

Lufthansa

La Roche-Posay

Lipton

Major League Baseball

Manpower Group

Marriott

Marsh McLennan

Maison Francis Kurkdjian

Mastercard

Mattel

Minute Maid

Monster

Monki

Mainz FC

Mellow Yellow

Mountain Dew

Migdal Insurance

Marks & Spencer

Mirinda

McDermott Will & Emery

Motorola

McKinsey

Merck

Michael Kors

Mizrahi Tefahot Bank

Merck KGaA

Micheal Kors

Milkybar

Maybelline

Mount Franklin

Meta

MeUndies

Mattle

Microsoft

Munchies

Miranda

Morgan Lewis

Moroccanoil

Morgan Stanley

MRC

Nasdaq

Naughty Dog

Nivea

Next

NOS

Nabisco

Nutter Butter

No Frills

National Basketball Association

National Geographic

Nintendo

New Balance

Nutella

Newtons

NVIDIA

Netflix

Nescafe

Nestle

Nesquick

Nike

Nussbeisser

Oreo

Oral B

Old spice

Oysho

Omeprazole

Oceanspray

Opodo

P&G (Procter and Gamble)

Pampers

Pull & Bear

Pepsi

Pfizer

Popeyes

Parker Pens

Philadelphia Cream Cheese

Pizza Hut

Powerade

Purina

Phoenix Holdings

Propel

Ponds

Pure Leaf Green Tea

Power Action Wipes

PwC

Prada

Perry Ellis

Prada Eyewear

Pringles

Payoneer

Procter & Gamble

Purelife

Pureology

Quaker Oats

Reddit

Royal Bank of Canada

Ruffles

Revlon

Ralph Lauren

Ritz

Rolls Royce

Royal

S.Pellegrino

Sabra Hummus

Sabre

Sony

SAP

Simply

Smart Water

Sprite

Schwabe

Shell

Soda Stream

Siemens

StreamElements

Schweppes

Sunsilk

Signal

Skittles

Smart Food

Sobe

Smarties

Sephora

Sam’s Club

Superbus

Samsung

Sodastream

Sunkist

Scotiabank

Sour Patch Kids

Starbucks

Sadaf

Stride

Subway

Tang

Tate’s Bake Shop

The Body Shop

Tesco

Twitch

The Ordinary

Tim Hortons

Tostitos

Timberland

Topo Chico

Tapestry

Tropicana

Tommy Hilfiger

Tommy Hilfiger Toiletries

Turbos

Tom Ford

Taco Bell

Triscuit

TUC

Twix

Tottenham Hotspurs

Twisties

Tripadvisor

Uber

Uber Eats

Urban Decay

Upfield

Unilever

Vicks

Victoria’s Secret

V8

Vaseline

Vitaminwater

Volkswagen

Volvo

Walmart

Wegmans

WhatsApp

Waitrose

Woolworths

Wheat Thins

Walkers

Warner Brothers

Warner Chilcot

Warner Music

Wells Fargo

Winston & Strawn

WingStreet

Wissotzky Tea

WWE

Wheel Washing Powder

Wrigley Company

YouTube

Yvel

Yum Brands

Ziyad

Zara

Zim Shipping

Ziff Davis

#free palestine#palestine#free gaza#israel#gaza#long post#from river to sea palestine will be free#palestinian lives matter#palestinian genocide#free free palestine#current events#fuck israel#anti zionisim#isntreal#defund israel#ceasefire#boycott israel#boycott divest sanction#boycott starbucks#boycott disney#boycott mcdonalds#boycotting#boycott divestment sanctions#my post#boycotts work

754 notes

·

View notes

Text

This is it. Generative AI, as a commercial tech phenomenon, has reached its apex. The hype is evaporating. The tech is too unreliable, too often. The vibes are terrible. The air is escaping from the bubble. To me, the question is more about whether the air will rush out all at once, sending the tech sector careening downward like a balloon that someone blew up, failed to tie off properly, and let go—or more slowly, shrinking down to size in gradual sputters, while emitting embarrassing fart sounds, like a balloon being deliberately pinched around the opening by a smirking teenager.

But come on. The jig is up. The technology that was at this time last year being somberly touted as so powerful that it posed an existential threat to humanity is now worrying investors because it is apparently incapable of generating passable marketing emails reliably enough. We’ve had at least a year of companies shelling out for business-grade generative AI, and the results—painted as shinily as possible from a banking and investment sector that would love nothing more than a new technology that can automate office work and creative labor—are one big “meh.”

As a Bloomberg story put it last week, “Big Tech Fails to Convince Wall Street That AI Is Paying Off.” From the piece:

Amazon.com Inc., Microsoft Corp. and Alphabet Inc. had one job heading into this earnings season: show that the billions of dollars they’ve each sunk into the infrastructure propelling the artificial intelligence boom is translating into real sales.

In the eyes of Wall Street, they disappointed. Shares in Google owner Alphabet have fallen 7.4% since it reported last week. Microsoft’s stock price has declined in the three days since the company’s own results. Shares of Amazon — the latest to drop its earnings on Thursday — plunged by the most since October 2022 on Friday.

Silicon Valley hailed 2024 as the year that companies would begin to deploy generative AI, the type of technology that can create text, images and videos from simple prompts. This mass adoption is meant to finally bring about meaningful profits from the likes of Google’s Gemini and Microsoft’s Copilot. The fact that those returns have yet to meaningfully materialize is stoking broader concerns about how worthwhile AI will really prove to be.

Meanwhile, Nvidia, the AI chipmaker that soared to an absurd $3 trillion valuation, is losing that value with every passing day—26% over the last month or so, and some analysts believe that’s just the beginning. These declines are the result of less-than-stellar early results from corporations who’ve embraced enterprise-tier generative AI, the distinct lack of killer commercial products 18 months into the AI boom, and scathing financial analyses from Goldman Sachs, Sequoia Capital, and Elliot Management, each of whom concluded that there was “too much spend, too little benefit” from generative AI, in the words of Goldman, and that it was “overhyped” and a “bubble” per Elliot.

As CNN put it in its report on growing fears of an AI bubble,

Some investors had even anticipated that this would be the quarter that tech giants would start to signal that they were backing off their AI infrastructure investments since “AI is not delivering the returns that they were expecting,” D.A. Davidson analyst Gil Luria told CNN.

The opposite happened — Google, Microsoft and Meta all signaled that they plan to spend even more as they lay the groundwork for what they hope is an AI future.

This can, perhaps, explain some of the investor revolt. The tech giants have responded to mounting concerns by doubling, even tripling down, and planning on spending tens of billions of dollars on researching, developing, and deploying generative AI for the foreseeable future. All this as high profile clients are canceling their contracts. As surveys show that overwhelming majorities of workers say generative AI makes them less productive. As MIT economist and automation scholar Daron Acemoglu warns, “Don’t believe the AI hype.”

6 August 2024

#ai#artificial intelligence#generative ai#silicon valley#Enterprise AI#OpenAI#ChatGPT#like to charge reblog to cast

183 notes

·

View notes

Text

Intel Corp (INTC.O), opens new tab is halting plans for a $25-billion factory in Israel, Israeli financial news website Calcalist said on Monday, in a report that the chipmaker did not confirm or deny.

The U.S. company, asked about the report, cited the need to adapt big projects to changing timelines, without directly referring to the project.

"Israel continues to be one of our key global manufacturing and R&D sites and we remain fully committed to the region," Intel said in a statement.

"Managing large-scale projects, especially in our industry, often involves adapting to changing timelines. Our decisions are based on business conditions, market dynamics and responsible capital management," it said.

Israel's government in December agreed to give Intel a $3.2-billion grant to build the $25-billion chip plant in southern Israel.

Intel has previously said that the factory proposed for its Kiryat Gat site, where it has an existing chip plant, was an "important part of Intel’s efforts to foster a more resilient global supply chain" alongside the company’s investments in Europe and the United States.

Intel operates four development and production sites in Israel, including its manufacturing plant in Kiryat Gat called Fab 28. The factory produces Intel 7 technology, or 10-nanometer chips.

The planned Fab 38 plant was due to open in 2028 and operate through 2035.

Intel employs nearly 12,000 people in Israel.

https://www.reuters.com/world/middle-east/intel-halting-25-billion-factory-expansion-israel-israeli-media-report-2024-06-10/

269 notes

·

View notes

Text

Pick a photo tarot readingg

1 2

3 4

Group one

I feel like you all are struggling financially or dealing with some sort of insecurity in terms of your stability. I think this is a phase you're going through in a way, and from a spiritual perspective it seems like you all are learning something or many things from this somehow. And it's coming out really positive here actually. It seems like you're all on a spiritual journey and this is a part of that. One thing, it seems like if you had the money aspect of life figured out as of now, you wouldn't grow as much as a person. It seems like a few of you here are needing to know and or realize something about how money works when it comes to maybe the economy or just other people. Maybe you're meant to end up helping other people in regards to money. It also seems like for a lot of you, somehow , you wouldn't meet the people you're supposed to if you weren't on this path. I think you all are definitely gonna be alright no matter what and that spirit won't let you fall if that makes sense. I'm really picking up on that you all should embrace the rawness of not having or needing much at all and to let that help you grow and shine as a person. Soul speaks louder than say fancy clothes or anything. If any of you are worried about food specifically there are definitely places and people around that would help you out if the situation is that severe especially if you're in America ok. I'm really feeling that they just want you all to sort of relax, especially at night. Just appreciate the moment. A person could have nothing to their name and nowhere to go, but they still have stars to look at every night.

Group two

You guys are definitely going somewhere, or something is happening. I'm really getting something about the word destination. It seems like whatever is going on with or around you might have some more negative side effects. I'm kind of thinking about turbulence, like when you're in a plane and it starts shaking. And you all might be a bit sad or something. I heard on edge. I saw one of your guys fish tank very cool. So it seems like spirit wants you all to find some form of peace somewhere somehow in some way. Maybe meditation. I feel almost frustrated like, you may be past this and trying your best and don't know about anything that might help or even what you really need. One thing, I see if you go outside or to a store or stores and possibly talk to strangers there, or for some of you someone who is stable minded or you get along with conversationally.. and also just being outside would help. Sitting in the grass. Also getting good sleep and doing everything you can to feel mellow before bed time. I'm seeing you may need to have patience with either yourself or a individually for most of you I'm getting they're female if that's the case. If someone in your life is trying to bribe you or something like that, I would say stick to your morals and stand very strong and be punk about who you are. F em . Seriously. But it's your decision to make. I just feel like this person kinda sucks for that. Like that's manipulation. And why hold out on giving someone something if u can just to bribe them or whatever it is. Not cool if you ask me. I think spirit wants you to just make whatever decision makes you feel the most empowered. But don't screw yourself over if possible. I don't know.

Group three

I'm already picking up on a fence so some of you either live in the suburbs, have , or will, or want to I suppose. Or someone here there's a dude in your life that wants to. You guys either wants to, are, or are being encouraged to do something out of the norm in a way. Maybe leaving and going somewhere new. Maybe doing something new. Are you serious sorry everyone one of you is younger trying to stain a store for fun lol I will not say anything more about that but it's funny. Go for big corps capitalism is evil anyway. Regardless. Sorry. One of you has a dog they're encouraging you to not do some type of idk if it's surgery or something that could possibly be cruel or just you don't know if you want to do it it could even just be a shock collar I know I never liked those. But yeah don't do it whatever it is. If you know someone is abusing an animal then do something /say something about it please . So yeah one of you is going to be or is at a place where there is a older fence I think right, and when you leave you should be careful. Just cautious Incase anything might happen. If a dog is barking a lot that's a sign. If there is a kid playing with a hose by a fence for one of you I saw that I don't know why but it might be sort of like deja Vu, as in that moment is just significant somehow and maybe we don't get to know why. One of us I'm ngl you're under threat of being initiated into some bad group you really don't want to get involved with so lay low and if you're a loner keep being a loner for a while there's nothing wrong with that. Someone has a mom she's older I think she is latina or something but I'm not sure. hug her and mean it the next time you see her it will mean a lot.

Group four

(could be other pets. I'm now picking up on a bird. General message a pet is trying to communicate something to you.) So y'all have dogs. This is the dog lover group. Oddly a lot about dogs in this whole reading for everyone but y'all have a pet dog I think the relationships y'all all have are super cute and sweet. Ok so someone here you go to school you love to come home and chill with and see your dog right I heard sweetheart maybe that's just how your dog is or you call someone that or someone calls someone that I have no clue just heard the word ok. Basically though about the person that goes to school your dog wishes to tell you that something is going on when you're gone and it's not good and I'm not sure what it is but you ought to get to the bottom of it . I'm mainly feeling neighbor maybe it's a roommate I don't really know what's going on I think you have to find a way to find out or just take steps to protect your dog. If they don't like loud noises if that's the case someone has a neighbor that makes loud noises this could be a different person, and your dog doesn't like it. I'm getting construction stuff. I would hope there's some type of thing you can get to cover their ears maybe??, I don't know..

If someone's dog has been acting weird like unruly in any way they're also trying to tell you something ,reminds me of so many movies like say a movie a pet is acting out and the owner is like dang it stop and the whole time the pet is like no dude your girlfriend is evil. I don't know. Just pay better attention I suppose.

If you're dog is more than usually lately having problems regarding a door in your house front back whatever. You might want to invest in some security for the door.

If you don't have any pets and you read this far it's either another pet you should pay attention to their behavior or most likely you should uhh think about getting a new pet 🥲or you'll find a stray or something. Dude keep it. That's like, destiny. Peace.

#free tarot readings#pac reading#pick a card reading#pick a picture#pick a pile#tarot reading#pick a card#pac#tarot pac#pac tarot#pick a photo#pick an image

109 notes

·

View notes

Text

Ok I should do an actual thoughtful post on this but instead I’m just gonna go off on a ramble. (I’m not a historian or a financial expert btw)

So I have always been interested in the discrepancy between Mitya’s assertion to Alyosha near the beginning that Grushenka “liked to make a bit of dough and made it by lending at wicked rates of interest, the cunning vixen, the rogue, without mercy.” (McDuff translation 1.3.5) and the narrator’s assertion in 3.7.3 “Not that she ever lent money on interest”. At first I chalked it up to Mitya just making assumptions about her, since he does say some things that are incorrect (for instance that Samsonov will leave her a considerable sum of money when he dies, when it is well known that he said he wouldn’t and, sure enough, did not even mention her in the will). However, I did think it was odd that a profit-motivated professional moneylender would never lend money on interest, and it feels even more odd now that I know there was a legal annual interest limit (6%). If it was legal to lend on interest, why wouldn’t she?

Well. I’m now reading the very fascinating Bankrupts and Usurers of Imperial Russia: Debt, Property, and the Law in the Age of Dostoevsky and Tolstoy by Sergei Antonov. And it’s fascinating getting context on all of this—and, bear in mind, context that Dostoevsky’s audience would have taken for granted.

There were a lot of regulatory laws that existed around moneylending and debt collecting, as usury was extremely frowned-upon legally, religiously, and socially. But these laws were very difficult to enforce, especially since moneylenders had all kinds of ways of skirting around them and hiding their more predatory practises. Besides, according to the above-mentioned reference work, “even at the highest levels the government realized that it was both impossible and undesirable to eliminate interest rates that exceeded the legally mandated maximum.” So, Antonov goes on to relate:

For example, an 1861 memo prepared by one of the tsar’s closest aides and a general in the Corps of Gendarmes, Ivan Annenkov, recognized that usurers in Russia enjoyed “complete immunity” but urged that “we must not [condemn as usurers] all persons who loan money for interest, even if under private agreements such interest would exceed the limit defined by the law. Everybody knows that no one has so far placed his capital in private hands in return for the legal 6% . . . [government’s policies] must not touch upon those private obligations and conditions that are founded upon mutual benefit.” Annenkov proposed a systematic procedure of identifying as many individual lenders as possible and then focusing on those known to engage in particularly abusive practices.

So this guy was like “yeah, even though what they’re doing is technically not legal, we kind of agree with it actually, and so instead of going after people based on the letter of the law, let’s just keep an eye on known moneylenders and go after the ones who are really crossing the line and hurting people.

Which meant that the police did keep detailed records of known moneylenders, and to the shock of absolutely no one, the notes beside the names in these records were heavily interested in the personal character of each lender. Political leanings, religion, whether they had a family, whether they were landowners, their morals and conduct, etc. I’m sure none of this led to any kind of discrimination in terms of who was allowed to get away with predatory moneylending practises and who was prosecuted for the very same. (Heavy sarcasm)

Since Grushenka did not have a powerful family behind her and was widely known to be a fallen woman and Kuzma Samsonov’s mistress (despite the fact that she was definitively known not to be promiscuous and to reject the advances of any other men who tried it), it’s very likely to me that she would be under special scrutiny, especially in a small town where there weren’t as many moneylenders to keep an eye on as there were in, say, St. Petersburg. Given that she received a lot of business advice from Samsonov, and some of this advice might very likely have included those methods of getting away with practises of dubious legality without leaving a paper trail, and given the necessity of her being extra careful in order not to be prosecuted, it would make sense that the narrator (being himself a character and resident of the town, and thus only able to report things to us based on the information he has available and how it appears to him,) would not have any information or records available to him which would suggest that she was lending on interest at all, let alone above the legal rates. Given the strong negative feelings against usury, making such an accusation or implication without evidence would be highly slanderous, and the narrator would be unwise to risk that, thus his statement that Grushenka did not lend on interest at all.

Whereas it is possible that, given Mitya’s close association with Grushenka during the past month and the fact that she does confide some things in him (her feelings about Alyosha, letting him read the letter her officer sent, laughing about Fyodor’s scheme to have him jailed, etc.), he may have known something the narrator didn’t. Of course, it’s also possible that he was just making an assumption that happened to be correct, or at least more plausible than the narrator’s.

And I think that Dostoevsky meant for the narrator’s assertion that she never lent on interest to seem highly improbable, even implausible, given that his audience would have been very familiar with the widespread business of moneylending across all classes of society, and how it operated. Again, if there was a legal maximum interest rate, and plentiful ways to get away with illegally lending above that maximum rate, then why would a professional moneylender consistently lend money on no interest at all? She would at the very least be lending on legal rates to make a profit off of the interest, and more than likely at illegal rates as well, simply taking care to do so covertly. And I think the original audience would have understood this implicitly.

Hope this was somewhat coherent.

#grushenka and her capitalist hashtag-girlboss crimes#the brothers karamazov#grushenka#agrafena alexandrovna svetlova#kuzma kuzmich samsonov#tbk#russian lit#russian literature#russian history#historical context#tbk meta#братья карамазовы#brothers karamazov#fyodor dostoevsky#dostoevsky#imperial russia#moneylending in imperial russia#ruslit

14 notes

·

View notes

Text

youtube

The Biden administration announced a rule Tuesday to cap all credit card late fees, the latest effort in the White House push to end what it has called junk fees and a move that regulators say will save Americans up to $10 billion a year.

The Consumer Financial Protection Bureau’s new regulations will set a ceiling of $8 for most credit card late fees or require banks to show why they should charge more than $8 for such a fee.

The rule would bring the average credit card late fee down from $32. The bureau estimates banks brought in roughly $14 billion in credit card late fees a year.

“In credit cards, like so many corners of the economy today, consumers are beset by junk fees and forced to navigate a market dominated by relatively few, powerful players who control the market,” said Rohit Chopra, director of the bureau, in a statement.

President Joe Biden planned to highlight the proposal along with other efforts to reduce costs to Americans at a meeting of his competition council on Tuesday. The Democratic president is forming a new strike force to crack down on illegal and unfair pricing on things like groceries, prescription drugs, health care, housing and financial services.

The strike force will be led by the Justice Department and the Federal Trade Commission, according to a White House statement.

The Biden administration has portrayed the White House Competition Council as a way to save people money and promote greater competition within the U.S. economy.

The White House Council of Economic Advisers produced an analysis indicating that the Biden administration’s efforts overall will eliminate $20 billion in annual junk fees. The analysis found that consumers pay about $90 billion a year in junk fees, including for concerts, apartment rentals and auto dealers.

The effort appears to have done little to help Biden politically ahead of this year’s presidential election. Just 34 percent of U.S. adults approve of Biden’s economic leadership, according to a new survey by The Associated Press-NORC Center for Public Affairs Research.

Sen. Tim Scott, R-South Carolina, criticized the CFPB cap on credit card late fees, saying that consumers would ultimately face greater costs through higher interest rates and less access to credit.

“It will decrease the availability of credit card products for those who need it most, raise rates for many borrowers who carry a balance but pay on time, and increase the likelihood of late payments across the board,” Scott said.

Americans held more than $1.05 trillion on their credit cards in the third quarter of 2023, a record, and a figure certain to grow once the fourth-quarter data is released by the Federal Deposit Insurance Corp. next month. Those balances are now carrying interest on them, which is the highest it has been since the Federal Reserve started tracking the data back in the mid-1990s.

Further, more Americans are falling behind on their credit card debts as well. Delinquency rates at the major credit card issuers such as American Express, JPMorgan Chase, Citigroup, Capital One and Discover have been trending upward for several quarters. Some analysts have become concerned Americans, particularly poorer households hurt by inflation, might be taking on too much debt.

“Overall, the consumer is credit healthy. However, the reality is that there are starting to be some significant signs of stress,” said Silvio Tavares, president and CEO of VantageScore, one of the country’s two major credit scoring systems, in an interview last month.

The growth of the credit card industry is partly why Capital One announced it would buy Discover Financial last month for $35 billion. The two companies, which are two of the largest credit card issuers, are also two companies whose customers regularly carry a balance on their accounts.

This is not the first time policymakers have weighed in on credit card fees. Congress in 2010 passed the CARD Act, which banned credit card companies from charging excessive penalty fees and established clearer disclosures and consumer protections.

The Federal Reserve issued a rule in 2010 that capped the first credit card late fee at $25, and $35 for subsequent late payments, and tied that fee to inflation. The CFPB, which took over the regulation of the credit card industry from the Fed after it was established, is proposing going further than the Fed.

The bureau’s proposal is similar in structure to what the bureau announced in January when it proposed capping overdraft fees to as little as $3. In that proposed regulation, banks would be required to either accept the bureau’s benchmark or show regulators why they should charge more, a method that few bank industry executives expect to use.

Biden has made the elimination of junk fees one of the cornerstones of his administration’s economic agenda heading into the 2024 election. Fees that banks charge customers have been at the center of that campaign, and the White House directed government regulators last year to do whatever is in their power to further curtail the practice.

In another move being highlighted by the White House, the Agriculture Department said it has finalized a rule to stop what it deems to be deceptive contracts by meat processors and to ban retaliation against small farmers and ranchers that work together in associations.

#us politics#news#pbs#president joe biden#2024#Consumer Financial Protection Bureau#credit cards#late fees#junk fees#Rohit Chopra#Federal Trade Commission#department of justice#White House Competition Council#White House Council of Economic Advisers#Sen. Tim Scott#Federal Deposit Insurance Corp#federal reserve#youtube#videos#economy#economics

13 notes

·

View notes

Text

Chipmaker Intel to halt $25-billion Israel plant, news website says

JERUSALEM, June 10 (Reuters) – Intel Corp (INTC.O)

, opens new tab is halting plans for a $25-billion factory in Israel, Israeli financial news website Calcalist said on Monday, in a report that the chipmaker did not confirm or deny.

The U.S. company, asked about the report, cited the need to adapt big projects to changing timelines, without directly referring to the project.

“Israel continues to be one of our key global manufacturing and R&D sites and we remain fully committed to the region,” Intel said in a statement.

“Managing large-scale projects, especially in our industry, often involves adapting to changing timelines. Our decisions are based on business conditions, market dynamics and responsible capital management,” it said.

Israel’s government in December agreed to give Intel a $3.2-billion grant to build the $25-billion chip plant in southern Israel.

Intel has previously said that the factory proposed for its Kiryat Gat site, where it has an existing chip plant, was an “important part of Intel’s efforts to foster a more resilient global supply chain” alongside the company’s investments in Europe and the United States.

Intel operates four development and production sites in Israel, including its manufacturing plant in Kiryat Gat called Fab 28. The factory produces Intel 7 technology, or 10-nanometer chips.

The planned Fab 38 plant was due to open in 2028 and operate through 2035.

Intel employs nearly 12,000 people in Israel. {read}

2 notes

·

View notes

Text

Magnetic Attraction

Wandering around Paseo del Prado in Madrid, on an area named as the Golden Triangle of Art with the vertices settled at the Prado Thyssen-Bornemisza Reina Sofía museums – furthermore can be found a singular smaller museum The Caixa Forum (in a literal translation a bank safe-box), designed by Herzog & de Meuron symbolically inaugurating the new millennium with grandiloquent aspirations at the Spanish capital.

Belonging to a banking company, also converted into an arts patronage foundation, that novel and emblematic museum’s building assumes the character of a bank safe-box in which those cultural investments are deposited, preserved as tax-exempt financial assets, and also being exposed to the public. Since the Renaissance and baroque the subjective high value of art-works began to be used for those purposes, also being increased and magnified by a competitive furore between capital cities as “attractive poles” for “finantial investors”.

Those attractive aspirations seem to be implicitly figured in the character of the building, both conceptually and materially, a magnet as its authors characterised it: “The CaixaForum is conceived as an urban magnet attracting not only art-lovers but all people of Madrid and from outside. The attraction will not only be CaixaForum’s cultural program, but also the building itself, insofar that its heavy mass, is detached from the ground in apparent defiance of the laws of gravity and, in a real sense, draws the visitors inside.”

Being sealed to the outside-world in all exhibition floors, also justified for avoiding natural lighting due to conservation requests of some art-works, the building merely opens fiscally and visually to the city respectively below and up: by the street level, where all that constructive mass rises up as if levitating, for sitting a discrete entry below; and on the rooftop, in the restaurant and cafeteria, opening to the panoramic views over the city.

The intended magnetic character of the building, starting at the street level and driving the visitors to the inside of that massive corps(e) –lodged and filling an ancient industrial building, like an embalmed corpse, of which only his bricks skin remains– by walking through a short but in-tense promenade, that leads to a cavernous public entrance and the following ascendance by those cinematic staircases as if levitating to the reception hall on the upper floor, are the subject and the focus of this short writing quest and of this photographic record.

Cinematic motion in space (and in spatial) representation

A century before, Marcel Duchamp presented one of his most emblematic paintings "Nude Descending a Staircase, No. 1" (1911) and the version “No.2” (1912).

Marcel Duchamp's Nude Descending a Staircase, No. 1" (1911) © Philadelphia Museum of Art

At that time Duchamp’s work was ridiculed for not fitting either into futurism or at cubism movements. Against a dark background the figure is represented by multiple triangles with hinges, trailed through a sequence of overlaid images like frozen in time (photograms / frames) transmitting the impression of the descending movement of a body, traversing a given space –a fragmentary representation of a staircase.

Marcel Duchamp's Nude Descending a Staircase (No. 2), 1912 © Philadelphia Museum of Art

On one hand appears to be a cubist representation with multi overlayed viewpoints, at the represented background space of action. On the other hand it re-presents a trailed figure with a vibrant combination of reflected lights and projected shadows emphasizes a futurist motion action. Despite those allusions, the alluded motion is not linear as in the futurism speedy representations but rather circular, as an elliptical motion on space over time –as well can be seen on the vertical accesses of the museum – more in accordance with an oriental conception of space-time that just was admitted in Western culture after Einstein’s theory of relativity (first proposed in 1905) with the refutation of an absolute linearity of space and time.

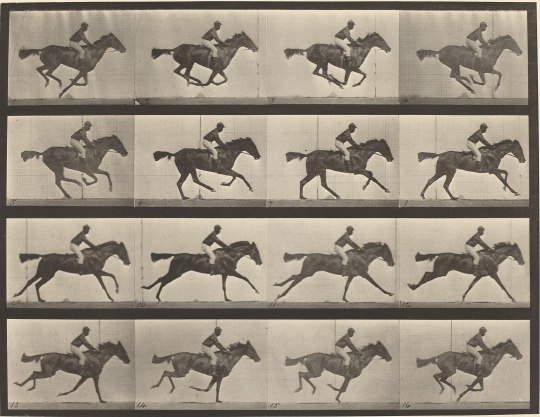

Eadweard Muybridge's Animal Locomotion: Plate 92 (Nude Woman Ascending Staircase), 1887 © Huxley-Parlour

Those Duchamp art-works seems also to be implicitly in line with the primordial photographic studies on locomotion behind the beginnings of cinema, still so far as in 19th Century, mainly with Eadweard Muybridge’s female nude motion study (Woman walking downstairs, 1887) or the Horse Racing (1887) considered the first movie ever, based on the zoetrope and praxinoscope animations, or as well with the wonderful works of Étienne-Jules Marey on cinematic movement of different animals including man.

The Horse in Motion by Eadweard Muybridge show a sequential series of six to twelve "automatic electro-photographs" depicting the movement of a horse (1878).

Nearby Caixa Forum, crossing the great avenue just 500m away at Museo Nacional del Prado, can be found a major painting of Diego Velazquez, “Filipe IV, by horse” (1635), in which the horse's legs are represented with a sequence of faded frames alluding to motion in space-time, on that two-dimensional representation. Leonardo da Vinci on a commissioned project for an equestrian monument (1482) also produced a series of study sketches (1488-90) with a cinematic like representation of a horse, trough overlapping layers.

At Caixa Forum’s staircases not a simple person multiplies in mirror reflections while ascending or descending, as in the magnific Loos Haus staircases in Vienna (also completed in 1912 like the described Duchamp’s painting), but rather the stairs and surrounding walls de-composing materially in space (with multiple folds and angles) as well perceptually in the promenade’s time with a changing game between tangible matter (steps, and steel walls bent into triangles) and the given illusion by reflection of lights, shadows, and color nuances, while as/descending that staircase.

4 notes

·

View notes

Text

On the possibility of ML companies scraping AO3 for training sets

Like many, I’ve also seen the concerning recent discussions of commercial AI trained on datasets scraped from fanfiction.

Why do you care about this?

I've always felt that the fic-writing side of fandom existed beyond the reach, mostly, of capitalism. It's a community formed around developing a cultural commons. We write for ourselves, and for each other. We write for the communities we’re in. We write out of love rather than in pursuit of financial gain.

While money is an aspect of paying for servers (I certainly donate to AO3 when I can), and other aspects like zine printing, and some people turn fandom fame into careers, it’s just nice to have a place that’s not about that. Fandom is a place of joy and sharing. It has always felt special to me for this reason.

It makes me sad to think of a corp taking the flourishing garden of fandom communities and using it to profit, even if it doesn't hurt me directly in any way.

Is this actually happening?

In terms of fanfic being used to train research AIs, yes. In terms of the same at commercial firms, probably.

The best-documented example of fanfiction used to train AI that I've found has been from Redwood Research, a nonprofit research group. They wrote a recent article here: https://arxiv.org/abs/2205.01663 which used the FFN fic pack that was made a while back during concerns of FFN’s site instability.

4.3 Initial data sources

Our initial, baseline classifier training set consisted of “snippets” derived from a dataset of fan fiction stories. We sourced our prompts from an archive of approximately 300 GB of stories from fanfiction.net

A.1.4 Fan fiction distribution

Our source dataset was a 300GB archive of stories from fanfiction.net13.

13 https://archive.org/details/FanficRepack_Redux

It seems this research group considers an archive of scraped fanfic to be a good source of training set content. Their method of training is to first get content for a baseline, then use mechanical turk-style gig economy work to retrain the model after that. It seems that this works pretty well for their purposes.

Commercial groups are not far off from trying things like this, if they aren't already.

What steps can be taken?

I would guess that any fic that was previously available to the wide internet has already been scraped by at least one company. For new fics and chapters, one could definitely take steps like:

Any new fics you publish could be made viewable only to registered viewers

If you update an old fic with new chapters, change its status to be viewable only to registered videos

There are some downsides: if you do this to a fic, you will make it inaccessible to people without AO3 accounts. While it is not difficult to get an AO3 account these days, this still will reduce the number of people who can enjoy your fic.

I am curious about how datasets are generated, shared, sold, leased, etc in the ML industry (and in ML academia, where there's some overlap). If new firms sometimes start from scratch and scrape new data sets, then that's something that locking existing fic would avoid.

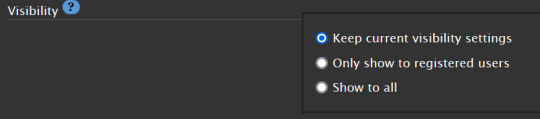

How do I hide my fic from scrapers?

To hide one fic: edit it, then check the box under Privacy for “Only show your work to registered users” to hide your fic from scrapers.

If you want to edit multiple fics at once, follow the guide here: https://archiveofourown.org/faq/posting-and-editing?language_id=en#editmultipleworks and select your works. In the multiple-edit screen, the option you want will look like this:

Set this to “Only show to registered users” to hide your fic from scrapers.

What are you going to do?

I’m still thinking about what I want to do.

To some degree, it feels like the horse is already out of the barn and corps have already gathered my own fics for themselves. If I restrict all my current fics to registered users, that will cut off future attempts, and if I restrict new fics to registered users, I can be assured that they won’t contribute to corporate profits. But it would also make it harder for some people to find my fics.

I like it when I can share my work with others, and that people enjoy them, and limiting that would make me sad.

2 notes

·

View notes

Text

Mega Schemes

Huge hydraulic schemes are made possible by advanced modern civil engineering techniques. They require vast international contracts that are only possible at the level of central governments, international free floating capital and supranational government organisations. The financiers borrow money and lend it at commercial rates, so they favour largescale engineering projects that promise increasing production for export markets at the expense of local subsistence economies, with disastrous social and environmental effects. Cash crops destroy settled communities and cause pollution of soil and water. For instance, Ethiopia’s Third Five-Year Plan brought 60% of cultivated land in the fertile Awash Valley under cotton, evicting Afar pastoralists onto fragile uplands which accelerated deforestation and contributed to the country’s ecological crisis and famine. There’s a vicious circle at work. Development needs money. Loans can only be repaid through cash crops that earn foreign currency. These need lots more water than subsistence farming. Large hydraulic schemes to provide this water are development. Development needs money. And so it goes.

Large-scale projects everywhere are the consequence and justification for authoritarian government: one of America’s great dam-building organisations is the US Army Corps of Engineering. Stalin’s secret police supervised the construction of dams and canals. Soldiers such as Nasser of Egypt and Gadafi of Libya and military regimes in South America have been prominent in promoting such projects. Nasser built the Anwar High dam in 1971. The long-term consequences have been to stop the annual flow of silt onto delta land, requiring a growing use of expensive chemical fertilisers, and increased vulnerability to erosion from the Mediterranean. Formerly the annual flooding washed away the build-up of natural salts; now they increase the salt content of irrigated land. The buildup of silt behind the dam is reducing its electricity generating capacity; the lake is also responsible for the dramatic increase in water-borne diseases. Nationalism leads to hydraulic projects without thought to what happens downstream in other countries. The 1992 floods of the Ganga-Brahmaputra-Barak system killed 10,000 people. 500m people live in the region, nearly 10% of the world’s population, and they are constantly at risk from water exploitation and mismanagement. Technological imperialism has replaced the empire building of the past: large-scale hydro projects are exported to countries despite many inter-related problems – deforestation, intensive land use and disputes and so on. Large-scale water engineering projects foment international disputes and have become economic bargaining counters, for example the Pergau dam in Malaysia. The British Government agreed to spend £234m on it in 1989 in exchange for a £1.3bn arms deal. In 1994 the High Court ruled that the aid decision was unlawful but these kinds of corrupt deals continue.

In Sri Lanka the disruption caused by the Mahawelli dams and plantation projects resulted in the forcible eviction of 1 million people and helped maintain the insurgency of the Tamil Tigers that resulted in thousands of deaths as they fought government forces from the late 1980s onwards. In 1993 the Marsh Arabs of southern Iraq were threatened by Saddam Hussein’s plans to drain the area – the most heavily populated part of the region. Many of the 100,000 inhabitants fled after being warned that any opposition risked death. Selincourt estimated that 3 million people would lose their homes, livelihoods, land and cultural identity by giant dam projects in the 1990s. The Kedung Ombo dam (Indonesia) displaced 25,000; the Akasombo dam (Ghana) 80,000; Caborra Bassa (South Africa) 25,000. Three dams in Laos alone will have displaced 142,000 people. The proposed Xiao Langdi dam in China would displace 140,000; the Three Gorges project 1.1 million people. Only war inflicts a similar level of human and environmental destruction, yet large dam projects have a chronic record in delivering water and power, or eliminating flooding in downstream valleys.

#freedom#ecology#climate crisis#anarchism#resistance#community building#practical anarchy#practical anarchism#anarchist society#practical#revolution#daily posts#communism#anti capitalist#anti capitalism#late stage capitalism#organization#grassroots#grass roots#anarchists#libraries#leftism#social issues#economy#economics#climate change#climate#anarchy works#environmentalism#environment

0 notes

Text

How to Navigate Legal Issues in a Startup Business

Starting a new business is an exciting venture, but it also comes with numerous legal challenges that, if not properly addressed, can jeopardize the success and longevity of your startup. Legal issues can arise at any stage of your business, from formation to expansion, and understanding how to navigate them is crucial. Here’s a guide to help you manage the legal landscape as you build your startup.

1. Choosing the Right Business Structure

One of the first legal decisions you'll need to make is choosing the appropriate business structure for your startup. The structure you choose will impact your personal liability, taxation, and the ability to raise capital. Common business structures include:

Sole Proprietorship: Simple and easy to set up, but the owner has unlimited personal liability for business debts.

Partnership: Involves two or more individuals, with shared profits and liabilities.

Limited Liability Company (LLC): Offers flexibility and limits the owners' personal liability.

Corporation (C-Corp or S-Corp): More complex, but provides the strongest protection against personal liability and has more options for raising capital.

It's important to consult with a legal professional to determine the best structure for your specific business needs and long-term goals.

2. Drafting a Solid Business Plan

A comprehensive business plan is not only essential for securing investors and financing but also serves as a legal roadmap for your startup. Your business plan should outline your business model, market analysis, organizational structure, and financial projections. Additionally, it should address any potential legal issues, such as intellectual property protection, compliance with regulations, and risk management strategies.

3. Intellectual Property Protection

Protecting your intellectual property (IP) is critical, especially in industries where innovation and branding are key. Intellectual property includes:

Trademarks: Protects your brand name, logo, and slogan.

Patents: Protects your inventions and unique processes.

Copyrights: Protects original works of authorship, such as software code, designs, and content.

Trade Secrets: Protects confidential business information, such as formulas or customer lists.

It's essential to file for the appropriate protections as early as possible to prevent others from using or profiting from your ideas without permission. Working with an IP attorney can ensure that your assets are adequately protected.

4. Employment Law Compliance

As your startup grows and you begin to hire employees, it's crucial to understand and comply with employment laws. This includes:

Employee Contracts: Clearly define the terms of employment, including job responsibilities, compensation, and termination conditions.

Non-Disclosure Agreements (NDAs): Protect your sensitive information from being shared by employees.

Non-Compete Clauses: Prevent former employees from competing with your business after leaving the company (though enforceability varies by state and country).

Fair Labor Standards: Ensure compliance with minimum wage, overtime, and working condition regulations.

Anti-Discrimination Laws: Comply with laws prohibiting discrimination based on race, gender, age, religion, and other protected characteristics.

Consulting with an employment law attorney can help you create policies and agreements that protect your business while ensuring compliance with the law.

5. Contracts and Agreements

Contracts are the backbone of business relationships, providing legal protection and outlining the expectations of all parties involved. Essential contracts for startups include:

Supplier and Vendor Agreements: Define the terms of goods or services provided by third parties.

Customer Contracts: Protect your business in transactions with clients or customers.

Partnership Agreements: Establish the rights, responsibilities, and profit-sharing arrangements between business partners.

Lease Agreements: Detail the terms of any physical space your business rents.

It's important to have a legal professional review or draft these contracts to avoid potential disputes and ensure they are enforceable.

6. Understanding Tax Obligations

Navigating the complexities of tax law is crucial for any startup. Depending on your business structure, you may be subject to different tax obligations, including income tax, payroll tax, sales tax, and self-employment tax. It's important to:

Register for an Employer Identification Number (EIN): Required for tax filing and hiring employees.

Understand Sales Tax Requirements: Varies by state and locality, especially for online businesses.

File Taxes on Time: Avoid penalties and interest by meeting all tax deadlines.

Working with a tax professional or accountant who specializes in startups can help you manage your tax obligations and take advantage of any tax benefits or deductions available to your business.

7. Navigating Regulatory Compliance

Depending on your industry, your startup may be subject to specific regulations and compliance requirements. These may include:

Health and Safety Regulations: Particularly important in industries like manufacturing, food service, and healthcare.

Environmental Regulations: Compliance with environmental laws if your business impacts natural resources or generates waste.

Data Protection and Privacy Laws: Especially relevant for tech startups dealing with personal data.

Failure to comply with these regulations can result in fines, legal action, or even the shutdown of your business. It's essential to stay informed about the regulations affecting your industry and consult with legal experts as needed.

8. Raising Capital and Securing Funding

If you're seeking investment, you'll need to navigate the legal aspects of raising capital. This includes:

Understanding Securities Law: Comply with regulations when issuing shares or offering investment opportunities.

Drafting Investor Agreements: Clearly define the terms of investment, ownership rights, and exit strategies.

Venture Capital and Angel Investments: Understand the legal implications of different types of funding sources.

A legal advisor can help you structure your fundraising efforts to ensure compliance with the law and protect your interests as a business owner.

9. Managing Risk and Liability

Every business faces risks, and it's essential to have a plan in place to manage them. This includes:

Insurance: Protect your business with the right types of insurance, such as general liability, professional liability, or product liability insurance.

Risk Management Policies: Implement procedures to minimize risks, such as data breaches or workplace accidents.

Legal Defense Plan: Be prepared for potential legal disputes by having a lawyer on retainer or a legal defense strategy in place.

By proactively managing risks, you can reduce the likelihood of legal issues arising and protect your business from potential losses.

10. Seeking Legal Advice

Finally, navigating legal issues in a startup business can be complex, and seeking professional legal advice is crucial. Whether you're dealing with intellectual property, contracts, employment law, or regulatory compliance, having an experienced attorney on your side can help you avoid costly mistakes and ensure that your business is set up for success.

Starting and growing a business comes with a myriad of legal challenges, but by understanding the key areas of concern and seeking the right legal support, you can navigate these issues effectively. From choosing the right business structure to managing risks and liabilities, each legal decision you make will play a crucial role in the long-term success of your startup. By being proactive and informed, you can build a strong legal foundation that allows your business to thrive.

0 notes

Text

Gucci: A Journey Through Triumph and Turmoil in Luxury Fashion

Humble Beginnings

Guccio Gucci, the founder of the renowned luxury brand, started his journey in his parents' straw hat shop.However, when the family business went bankrupt, he found himself penniless and in need of a fresh start.

Guccio moved to London, where he worked at the prestigious Savoy Hotel. There, he noticed the affluent guests carrying expensive luggage and wearing fine leather goods as symbols of status. This inspired him to dream of opening his own leather shop catering to high-end customers.

After serving in World War I, Guccio returned to Italy with a wealth of knowledge about the leather goods industry. In 1921, he opened a small shop in Florence. As demand for his unique designs grew, he expanded his operations by opening a workshop and hiring employees. Despite financial struggles, Guccio taught his sons the intricacies of the business. With their encouragement, he expanded to Rome, Milan, and eventually New York City.

Image credit : https://www.vecteezy.com/vector-art/23871111-gucci-logo-brand-clothes-with-name-symbol-design-fashion-vector-illustration

Family Feuds and Expansion

The history of Gucci is marked by family turmoil and power struggles. Guccio's sons inherited the company after his death, but conflicts over control of the brand soon emerged. The third generation of the Gucci family had different visions for the company's future. Tensions escalated when Maurizio Gucci married Patricia Regiani against his father's wishes and took ownership of 50% of the company.

Maurizio's decision to eliminate Gucci's licensing deals initially cost the brand over $100 million. However, this move ultimately helped establish Gucci as an exclusive luxury brand. Meanwhile, Paulo Gucci's attempts to create his own fashion line were costly and unsuccessful. The family's constant drama kept them in the public eye but tarnished the brand's image.

The Downfall of Maurizio Gucci

Under Maurizio's leadership, Gucci faced significant challenges. He convinced the family to sell their shares to Invest Corp, and with the company now 50% owned by Invest Corp, Maurizio implemented major changes.

He aimed to make Gucci an exclusive brand for the wealthy by reducing the number of stores, cutting the accessories line, and eliminating the classic GG logo.

While some of his decisions did elevate Gucci's status, the company began losing $30 million annually. Unable to pay salaries or suppliers, Gucci was on the brink of bankruptcy. Invest Corp, growing nervous, suggested appointing a new CEO. Maurizio refused, leading Invest Corp to buy out his 50% share for $150 million. Although Maurizio's predictions eventually came true and the brand's fortunes turned around, it was too late for him. In a tragic turn of events, he was murdered by a hitman hired by his ex-wife, Patricia Reggiani, who was later imprisoned.

The Tom Ford Era and Beyond

After the tumultuous period of family control, Gucci entered a new era under the creative direction of Tom Ford. By 1996, Gucci's sales had nearly doubled from $263 million to $500 million. With the Gucci family no longer involved, the brand was free from internal power struggles. Invest Corp capitalized on this success, making Gucci a publicly traded company and reaping a $2 billion profit from their investment.

However, in 1997, a drop in Gucci's stock price, coupled with an economic crisis in the Japanese luxury market, created an opportunity for LVMH to buy shares at a discount. Bernard Arnault, CEO of LVMH and known for his aggressive acquisition strategies, saw potential in Gucci.

The iconic Tom Ford and Domenico De Sole duo eventually resigned from the company in 2004. Despite this, Gucci has continued to thrive, becoming one of the most popular luxury brands worldwide, with over 500 stores and about 50 million followers on Instagram. The brand's journey from humble beginnings to global dominance is a testament to its enduring appeal and resilience.

#gucci#luxury fashion#fashion history#gucci marketing strategy#italian fashion brands#luxury brands#sustainable luxury#celebrity#endorsement#gucci fashion

0 notes

Text

Top Stock Picks of 2024: Insights from WikiStock

Top Stock Picks of 2024: Insights from WikiStock

As we move into 2024, investors are keen to identify the best stock picks that promise robust returns. WikiStock has provided valuable insights into the top-performing stocks for the year. This article delves into some of the most promising stocks, highlighting their potential and the factors driving their performance.To get more news about WikiStock, you can visit our official website.

1. Super Micro Computer (SMCI)

Super Micro Computer (SMCI) has been a standout performer in 2024, riding the wave of artificial intelligence (AI) advancements. The company’s focus on high-performance computing solutions has positioned it well to capitalize on the growing demand for AI and machine learning applications. With a strong balance sheet and innovative product offerings, SMCI is poised for continued growth1.

2. Constellation Energy (CEG)

Constellation Energy (CEG) has emerged as a top pick due to its strategic investments in renewable energy. As the world shifts towards sustainable energy sources, CEG’s portfolio of clean energy assets, including wind and solar, has gained significant traction. The company’s commitment to reducing carbon emissions and its robust financial performance make it a compelling investment.

3. Nvidia (NVDA)

Nvidia (NVDA) continues to be a favorite among investors, thanks to its leadership in the graphics processing unit (GPU) market. The company’s GPUs are essential for AI, gaming, and data centers, driving strong revenue growth. Nvidia’s strategic acquisitions and partnerships further enhance its competitive edge, making it a top stock pick for 2024.

4. Anglo American (AAL)

Anglo American (AAL) presents an attractive value proposition for 2024. Despite concerns about the Chinese economy and commodity demand, the diversified miner is priced for a scenario much worse than expected. With a PE ratio of just 5x trailing earnings, Anglo American is likely to see a rerate as market conditions improve.

5. Ashtead Group (AHT)

Ashtead Group (AHT) has been one of the FTSE 100’s best performers over the past decade. The plant hire company’s substantial infrastructure spending in North America and strategic acquisitions have driven its growth. Although sales growth slowed in 2023, Ashtead’s cash-rich position and acquisition strategy make it a promising stock for 2024.

6. NextEnergy Solar Fund (NESF)

NextEnergy Solar Fund (NESF) is an excellent example of a renewable energy asset offering both capital appreciation and a robust dividend yield. The trust invests in solar energy generation assets and has a diverse portfolio across the globe. As interest rates stabilize, the trust’s valuation is expected to improve, making it an attractive investment.

7. Tekcapital (TEK)

Tekcapital (TEK) is a technology investment company set for a promising 2024. The company is preparing to list its portfolio company, MicroSalt, which has secured contracts with major snack food businesses. Tekcapital’s focus on early-stage companies with high growth potential makes it a top stock pick for the year.

8. Meta Platforms (META)

Meta Platforms (META) remains a strong contender in the tech sector. The company’s investments in the metaverse and virtual reality (VR) technologies are expected to drive future growth. With a solid user base and innovative product pipeline, Meta Platforms is well-positioned for continued success in 2024.

9. Johnson & Johnson (JNJ)

Johnson & Johnson (JNJ) is a reliable choice for investors seeking stability and growth. The company’s diverse product portfolio, including pharmaceuticals, medical devices, and consumer health products, provides a steady revenue stream. JNJ’s strong financial performance and commitment to innovation make it a top pick for 2024.

10. Costco Wholesale Corp (COST)

Costco Wholesale Corp (COST) continues to be a favorite among investors due to its strong business model and loyal customer base. The company’s focus on providing high-quality products at competitive prices has driven consistent revenue growth. Costco’s expansion plans and efficient operations make it a compelling investment for 2024.

Conclusion

The stock market in 2024 presents numerous opportunities for investors. The stocks highlighted in this article, based on insights from WikiStock, offer a mix of growth potential, stability, and innovation. Whether you are a seasoned investor or just starting, these top stock picks provide a solid foundation for building a successful investment portfolio.

0 notes

Text

From Dust Bowl to Economic Boom: A Look at Lubbock's Past

Introduction

Lubbock, Texas is a urban with a wealthy heritage, from its humble beginnings as a small contract at the prairie to its transformation right into a bustling fiscal hub. The story of Lubbock's prior is one in every of resilience, perseverance, and boom. In this newsletter, we're going to delve into the attention-grabbing background of Lubbock, exploring how it went from being a sufferer of the devastating Dust Bowl to experiencing an remarkable financial boom. Join us in this ride as we uncover the secrets and techniques behind Lubbock's spectacular transformation.

From Dust Bowl to Economic Boom: A Look at Lubbock's Past

Lubbock, like many other towns inside the Southern Plains, used to be seriously plagued by the Dust Bowl within the Nineteen Thirties. This environmental catastrophe added about by drought and terrible farming practices ended in huge dirt storms that ravaged the land. The fertile soil became great debris of dirt that were carried by way of robust winds for 1000's of miles. The have an effect on on agriculture became devastating, ideal to enormous poverty and melancholy.

The Great Depression and Its Effects on Lubbock

The Dust Bowl hit Lubbock for the duration of the already problematical times of the Great Depression. The mixture of monetary difficulty and environmental crisis created a really perfect typhoon of difficulties for the citizens of Lubbock. Many households lost their farms and livelihoods, forcing them emigrate trying to find paintings some other place.

Resilience and Community Spirit

Despite these hardships, the other people of Lubbock displayed unimaginable resilience https://writeablog.net/freadhlxjf/experience-the-magic-of-coolsculpting-at-lubbocks-top-centers and a potent feel of group spirit. They banded together to toughen each other with the aid of these powerful times. Local organizations and churches presented meals and defend for these in want, offering a glimmer of desire amidst the desolation.

Government Intervention and New Beginnings

Recognizing the dire subject faced through groups like Lubbock, the federal executive stepped in to provide advice. Programs comparable to the Works Progress Administration (WPA) and the Civilian Conservation Corps (CCC) sold employment alternatives to these suffering from the Dust Bowl. These initiatives helped rebuild infrastructure and preserve normal resources, offering a miles-obligatory lifeline for the folk of Lubbock.

The Agricultural Revolution

As the dust settled and the land all started to heal, Lubbock skilled a amazing shift in its agricultural practices. Farmers adopted new procedures reminiscent of contour plowing and crop rotation to keep soil erosion and expand productiveness. The advent of mechanized farming system further improved potency, permitting farmers to cultivate bigger parts of land.

youtube

Emergence of Texas Tech University

One of the most important elements contributing to Lubbock's monetary boom used to be the established order of Texas Tech University in 1923. This school grew to become a catalyst for improvement, attracting scholars from all around the kingdom and past. The institution added highbrow capital to Lubbock and acted as a breeding ground for innovation and entrepreneurship.

youtube

Oil Discovery and Economic Transformation

In the early 1950s, oil used to be found inside the Permian Basin close to Lubbock. This discovery ushered in a new technology of economic prosperity for the metropolis. Oil

youtube

1 note

·

View note

Text

The FSM SCHEME

Online trading scam broker called FSM Smart is part of an incredibly large scam group, rarely spoken of or systematically exposed, due to many illegal unconnected brands and quite complicated and fluid network of shells, off-shores, PSPs and BPOs worldwide. Indeed smartly put, the name serves them well. At the time, the Fintelegram did a good job in exposing some parts and initiating the public attention, that was previously restricted to warnings to particular brands and occasional info scattered across many different forums. Apparently, they had problems because of it. However, the full story is yet to be told. We hope to bring more clarity and tie the missing parts. For sure it will not be a complete report, but joint efforts bear fruits, eventually. The full story should be revealed by the Law, not us or others. So far, the representatives of the law have done very little, mainly due to scheme’s multi jurisdictional and transnational nature.

The beneficial owner(s) are well hidden and this vast group obviously has no intention to stop. We shall try to do our best to unmask this ‘giant’ as much as possible. For the purpose of clarity, we shall generically call them ‘’the FSM scheme’’ since its brand FSM Smart is probably the biggest and longest standing one. This thread will be quite long and posted in successive parts, due to the size on info we aim to display on FPA, so you are warned that it will take patience and attention to follow. No shortcuts here or easy solutions.

The named ‘FSM scheme’ is comprised of (up to now known) following scam brands/trading styles: 1. MTI Markets www.mtimarkets.com 2. TradingBanks www.grizzly-ltd.com also t/a www.tradingbanks.com (own trade platform+TradingBanks) 3. MX Trade www.mxtrade.com 4. Trade12 www.trade12.com 5. HQBroker www.hqbroker.com (up to this thread, probably never associated to FSM Smart brand before) 6. FSM Smart www.fsmsmart.com, www.fsmsmarts.com, www.it.fsmsmart.net, www.fsmsmart-ltd.com

We are positive that more brands are involved or were a part of this. This organization is truly like an Octopus. But as any other such group, made the same mistakes when registering various companies and using 3rd parties providers, leaving traces behind. Now days, scammers are much more cautious, in general, as there is more focus on scams, narrowing down their operating boundaries. First brand operator of MX Trade scam appeared to be a 2014 est.&CySEC regulated/FCA-passport company R Capital Solutions Ltd, FCA, CySEC, CY registrar. Owner was a Romanian citizen residing in Cyprus, Mr. Victor Florin Safta, who had another linked company in the UK, F Capital Solutions LtdCompanies House Reg. CySEC regulated R Capital Solutions claimed they never operated MX Trade by issuing a public statement:

Anyhow, whoever the scam operator was, once compromised, quickly switched to 2014 est.&Belize incorporated Lau Global Services Corpwww.lgs-corp.com (now defunct BZ reg.search) operating MX Trade as of April 2015 (per T&C archive) which is a standard next step that all scammers make, when the brand is exposed. Lau Global was a full scam from day one, FB page still online, ASIC warning, CySEC warningIFSC warning, FSMA warning revealing that deposits went to Taris Financial Corp, not present in offshore leaks, Cypriot, Vanuatu, Belize or Marshal Islands registers, but with bank account in Cyprus, meaning it had to be incorporated somewhere to obtain a bank account. Possible best match via google search would be a few companies named Taris from Riga, Latvia, or Sofia, Bulgaria, but it’s just a random speculation with no actual meaning, or any insinuation towards those companies. Whatever it is, it’s obvious that they continued a scam. Lau Global, thanks to ICIJ offshore leaks, can be de-masked fully: Offshoreleaks-LauGlobal. Lau Global was the sole shareholder of 2014 Malta-incorporated Grizzly Ltd. Looks like the entire structure from the start was prepared in 2014 and, once the time came, just relocated, implying a plan/intention, from the start. Grizzly Ltd has one owner, Mr. Shlomo Matan Shalom Avshalom, an Israeli national, with Philippines address, per offshore leaks. This was very indicative to us, as we had the information some time ago to pursue some lawyers and Philippines call centers direction, to get to the bottom of this scheme setup. So we did. Others who looked into this information just continued with having a name from offshore leaks, but no more. Let’s have a look at this Mr Avshalom more, shall we?