#financial tools and calculators

Text

5 Must-Have Financial Tools and Calculators for Making Smart Investment Decisions

From invoices to cryptocurrency networks, daily expenses, and investment decisions, entrepreneurs need to deal with plenty of work on a regular basis. Fortunately, technology has brought a multitude of financial tools and calculators to save ample time and headaches.

0 notes

Photo

#The Ultimate Guide to Successful Rental Property Investing: A Bloggers Perspective#I recently finished reading The Book on Rental Property Investing by Brandon Turner#and I must say it's a fantastic resource for anyone looking to delve into the world of real estate investing. Turner#an experienced investor and co-host of the BiggerPockets podcast#shares practical advice#strategies#and insights that can help both novice and experienced investors build wealth through rental properties.

The book is divided into several#each focusing on a specific aspect of rental property investing. Turner covers a wide range of topics#from the fundamentals of real estate investing to more advanced strategies for growing and managing a rental property portfolio. One of the#you'll find valuable information and actionable tips in this book.

One of the key takeaways from The Book on Rental Property Investing is#understand the local rental market#and calculate the potential returns on a property before making a purchase. He also provides practical guidance on negotiating deals#managing properties effectively#and dealing with common challenges that landlords may face.

Throughout the book#Turner shares personal anecdotes and real-world examples to illustrate his points#making the content engaging and easy to digest. He also includes helpful visuals#case studies#and checklists that readers can refer to as they navigate their own rental property investments. Whether you're interested in buy-and-hold#house hacking#or Airbnb rentals#there's something in this book for everyone.

One of the aspects of The Book on Rental Property Investing that I found particularly valuabl#establishing a budget#and managing personal finances in a responsible manner. By laying the groundwork for financial stability and understanding the basics of in#readers can set themselves up for success in the world of rental property investing.

Overall#I highly recommend The Book on Rental Property Investing to anyone who is interested in building wealth through real estate. Brandon Turner#real-world experience#and accessible writing style make this book a must-read for both aspiring and seasoned real estate investors. Whether you're looking to sup#build a retirement nest egg#or achieve financial freedom through rental properties#this book provides the tools and knowledge you need to get started on your investment journey. So

0 notes

Text

ZATCA VAT & Tax Return System in ALZERP Cloud ERP Software

The ALZERP Cloud ERP Software offers a comprehensive tax return system designed to facilitate the calculation, moderation, and finalization of VAT and tax returns. This system ensures businesses comply with the Saudi Arabian tax regulations set by the Zakat, Tax, and Customs Authority (ZATCA). By automating and streamlining the tax return process, ALZERP helps businesses achieve accuracy and…

View On WordPress

#Automated tax compliance#Real-time tax monitoring KSA#Real-time VAT reporting KSA#Saudi business financial compliance#Saudi business tax management#Saudi corporate tax software#Saudi tax audit software#Saudi tax compliance software#Saudi VAT reconciliation software#Tax analytics for Saudi businesses#tax filing software#Tax management system#tax optimization tool#tax planning software#VAT fraud detection#VAT invoice management#VAT management#VAT management for Saudi SMEs#VAT reporting software KSA#VAT return automation Saudi#Zakat and income tax software#Zakat and tax automation#Zakat and tax consultation tool#Zakat and tax filing deadline alerts#Zakat and tax regulations update#Zakat and VAT calculator#Zakat and VAT compliance check#Zakat assessment tool#Zakat calculation software#Zakat declaration software

0 notes

Text

In India, EMI calculators help you estimate monthly loan payments for education and home loans. This free tool allows you to compare loan options, plan your finances, and manage expectations. By entering loan amount, interest rate, and tenure, you can see how changes impact your EMI. Remember, EMI calculators provide estimates and don't account for all loan fees. Consider your overall financial situation and explore tax benefits before applying for a loan.

#best emi calculator#emi calculator#online emi calculator#emi#loans#financial calculators#Loan Planning#Manage Your Budget#loan calculator#financial tools#Estimate Your EMI#Smart Borrowing

1 note

·

View note

Text

Mastering Trading with the Parabolic SAR: A Comprehensive Guide

Introduction

In the dynamic world of financial markets, traders are constantly seeking tools and indicators to assist them in making informed decisions. One such tool that has gained popularity among traders is the Parabolic Stop and Reverse (SAR) indicator.

Developed by Welles Wilder, the Parabolic SAR is a versatile indicator that can help traders identify potential trend reversals, set…

View On WordPress

#Financial market trading indicators#Financial Markets#learn technical analysis#moving average#Moving average and Parabolic SAR#Parabolic SAR#Parabolic SAR reversal strategy#Parabolic SAR trading strategies#Risk Management#SAR calculation#SAR interpretation#Stop-Loss#Stop-loss with Parabolic SAR#technical analysis#technical analysis tools#Trading Indicators#Trading Strategies#Trading with SAR indicator#Trend Following#Trend following with Parabolic SAR#Trend Reversal

0 notes

Text

In the current rapidly evolving digital currency market, decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop, as a leading decentralized lending platform, not only provides a safe and transparent lending environment, but also opens up new passive income channels for users through its innovative sharing reward system.

Personal links and permanent ties: Create a stable revenue stream

One of the core parts of Bit Loop is its recommendation system, which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bit Loop, but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanently tied to the recommender, ensuring that the sharer can continue to receive rewards from the offline partner’s activities.

Unalterable referral relationships: Ensure fairness and transparency

A significant advantage of blockchain technology is the immutability of its data. In Bit Loop, this means that once a referral link and live partnership is established, the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders, but also brings a stable user base and activity to the platform, while ensuring the fairness and transparency of transactions.

Automatically distribute rewards: Simplify the revenue process

Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner completes the circulation cycle, such as investment returns or loan payments, the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This automatic reward distribution mechanism not only simplifies the process of receiving benefits, but also greatly improves the efficiency of capital circulation.

Privacy protection and security: A security barrier for funds

All transactions and money flows are carried out on the blockchain, guaranteeing transparency and traceability of every operation. In addition, the use of smart contracts significantly reduces the risk of fraud and misoperation, providing a solid security barrier for user funds. Users can confidently invest and promote boldly, and enjoy the various conveniences brought by decentralized finance.

conclusion

As decentralized finance continues to evolve, Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent financial services while also earning passive income by building and maintaining a personal network. Whether for investors seeking stable passive income or innovators looking to explore new financial possibilities through blockchain technology, Bit Loop provides a platform not to be missed.

#In the current rapidly evolving digital currency market#decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop#as a leading decentralized lending platform#not only provides a safe and transparent lending environment#but also opens up new passive income channels for users through its innovative sharing reward system.#Personal links and permanent ties: Create a stable revenue stream#One of the core parts of Bit Loop is its recommendation system#which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bi#but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanent#ensuring that the sharer can continue to receive rewards from the offline partner’s activities.#Unalterable referral relationships: Ensure fairness and transparency#A significant advantage of blockchain technology is the immutability of its data. In Bit Loop#this means that once a referral link and live partnership is established#the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders#but also brings a stable user base and activity to the platform#while ensuring the fairness and transparency of transactions.#Automatically distribute rewards: Simplify the revenue process#Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner complet#such as investment returns or loan payments#the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This au#but also greatly improves the efficiency of capital circulation.#Privacy protection and security: A security barrier for funds#All transactions and money flows are carried out on the blockchain#guaranteeing transparency and traceability of every operation. In addition#the use of smart contracts significantly reduces the risk of fraud and misoperation#providing a solid security barrier for user funds. Users can confidently invest and promote boldly#and enjoy the various conveniences brought by decentralized finance.#conclusion#As decentralized finance continues to evolve#Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent fin

1 note

·

View note

Text

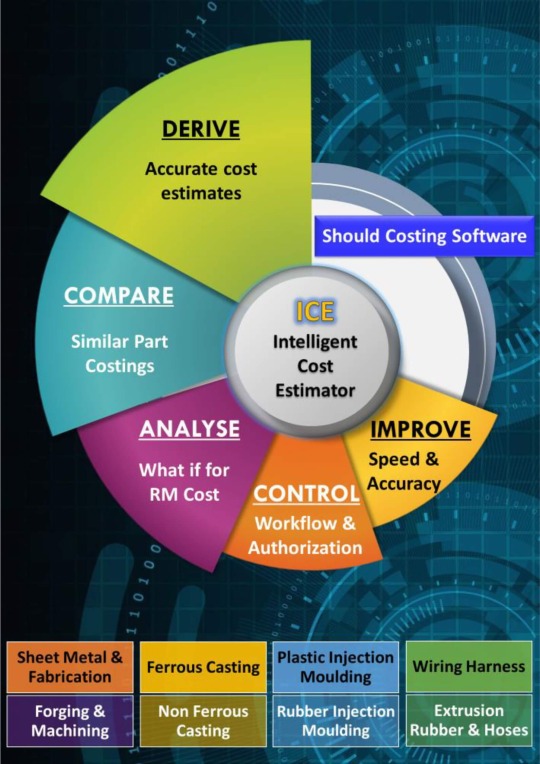

Best Estimating and Costing Software - Cost Masters

Find reliable project cost estimation and optimization with Cost Masters – a trusted provider of estimating and costing software. Streamline your budgeting process with our precise and efficient tools. Eliminate errors and simplify cost management. Learn more about Cost Masters today.

#Estimation and costing software#Cost management tools#Project cost estimation software#Budgeting software solutions#Cost optimization software#Price tracking and analysis tools#Procurement management software#Material cost estimation solutions#Cost calculation software#Project budgeting solutions#Pricing analysis tools#Expense management software#Cost forecasting and planning tools#Profitability analysis software#Resource allocation solutions#Financial planning and analysis software#Cost control and management tools#Spend analysis software

1 note

·

View note

Text

HDFC Securities Calculator - Online Financial Tools for Investment Planning

Use the HDFC Securities calculator to make informed investment decisions. Calculate returns, risk factors, and other financial metrics to plan your investments effectively.

0 notes

Text

Creating a Loan Amortization Schedule with Prepayments using Python and Pandas

Creating a Loan Amortization Schedule with Prepayments using Python and Pandas

Introduction

Managing a loan can be a complex task, especially when it comes to tracking payments, interest, and prepayments. In this article, we’ll explore a Python script that generates a loan amortization schedule with the ability to apply prepayments. The script utilizes the Pandas library for data manipulation and Excel export.

Loan Amortization Schedule

A loan amortization schedule is a…

View On WordPress

#Compound interest#Excel export#Financial management#Financial planning#Loan amortization schedule#Loan analysis#Loan interest savings#Loan management tool#Loan optimization#Loan payment breakdown#Loan payoff calculator.#Loan payoff strategy#Loan repayment#Loan schedule generation#Loan tenure reduction#Loan tracking#Pandas library#Personal finance#Prepayments#Python loan calculator

0 notes

Text

How To Become A Brand New Person ✨✨

Self Reflect:

Journal daily.

Think about past decisions and how they impacted your life.

Meditate regularly.

Create a vision board to visualize your goals.

Review your strengths and weaknesses.

Identify your core values and beliefs.

Figure out your passions and interests.

Think about your childhood dreams and aspirations.

Evaluate your current state of happiness and fulfillment.

Set Clear Goals:

Define specific career goals, like "Get promoted within two years."

Set health goals, like "Lose 20 pounds in six months."

Create financial goals such as "Save $10,000 for a vacation."

Establish personal development goals, like "Read 24 books in a year."

Set relationship goals, such as "Improve communication with my partner."

Define education goals, like "Complete a master's degree in three years."

Set travel goals, like "Visit five new countries in the next two years."

Create hobbies and interests goals, such as "Learn to play a musical instrument."

Set community or volunteer goals, like "Volunteer 100 hours this year."

Establish mindfulness or self-care goals, such as "Practice meditation daily."

Self Care:

Exercise for at least 30 minutes a day.

Follow a balanced diet with plenty of fruits and vegetables.

Prioritize getting 7-9 hours of quality sleep each night.

Practice in relaxation techniques like deep breathing or yoga.

Take regular breaks at work to avoid burnout.

Schedule "me time" for activities you enjoy.

Limit exposure to stressors and toxic people.

Practice regular skincare and grooming routines.

Seek regular medical check-ups and screenings.

Stay hydrated by drinking enough water daily.

Personal Development:

Read a book every month from various genres.

Attend workshops or seminars on topics of interest.

Learn a new language or musical instrument.

Take online courses to acquire new skills.

Set aside time for daily reflection and self improvement.

Seek a mentor in your field for guidance.

Attend conferences and networking events.

Start a side project or hobby to expand your abilities.

Practice public speaking or communication skills.

Do creative activities like painting, writing, or photography.

Create a Support System:

Build a close knit group of friends who uplift and inspire you.

Join clubs or organizations aligned with your interests.

Connect with a mentor or life coach.

Attend family gatherings to maintain bonds.

Be open and honest in your communication with loved ones.

Seek advice from trusted colleagues or supervisors.

Attend support groups for specific challenges (e.g., addiction recovery).

Cultivate online connections through social media.

Find a therapist or counselor for emotional support.

Participate in community or volunteer activities to meet like minded people.

Change Habits:

Cut back on sugary or processed foods.

Reduce screen time and increase physical activity.

Practice gratitude by keeping a daily journal.

Manage stress through mindfulness meditation.

Limit procrastination by setting specific deadlines.

Reduce negative self-talk by practicing self-compassion.

Establish a regular exercise routine.

Create a budget and stick to it.

Develop a morning and evening routine for consistency.

Overcome Fear and Self Doubt:

Face a specific fear head-on (example: public speaking).

Challenge your negative thoughts with positive affirmations.

Seek therapy to address underlying fears or traumas.

Take small, calculated risks to build confidence.

Visualize success in challenging situations.

Surround yourself with supportive and encouraging people.

Journal about your fears and doubts to gain clarity.

Celebrate your accomplishments, no matter how small.

Focus on your strengths and accomplishments.

Embrace failure as a valuable learning experience.

Embrace Change:

Relocate to a new city or country.

Switch careers or industries to pursue your passion.

Take on leadership roles in your workplace.

Volunteer for projects outside your comfort zone.

Embrace new technologies and digital tools.

Travel to unfamiliar destinations.

Start a new hobby or creative endeavor.

Change your daily routine to add variety.

Adjust your mindset to see change as an opportunity.

Seek out diverse perspectives and viewpoints.

Practice Gratitude:

Write down three things you're grateful for each day.

Express gratitude to loved ones regularly.

Create a gratitude jar and add notes of appreciation.

Reflect on the positive aspects of challenging situations.

Show gratitude by volunteering or helping others in need.

Send thank-you notes or messages to people who've helped you.

Keep a gratitude journal and review it regularly.

Share your gratitude openly during family meals or gatherings.

Focus on the present moment and appreciate the little things.

Practice gratitude even in times of adversity.

Be Patient:

Set realistic expectations for your progress.

Accept that personal growth takes time.

Focus on the journey rather than the destination.

Learn from setbacks and view them as opportunities to improve.

Celebrate small milestones along the way.

Practice self-compassion during challenging times.

Stay committed to your goals, even when progress is slow.

Keep a journal to track your personal growth.

Recognize that patience is a valuable skill in personal transformation.

Celebrate Small Wins:

Treat yourself to your favorite meal or dessert.

Reward yourself with a spa day or self-care activity.

Share your achievements with friends and loved ones.

Create a vision board to visualize your successes.

Acknowledge and congratulate yourself in a journal.

Give yourself permission to take a break and relax.

Display reminders of your accomplishments in your workspace.

Take a day off to celebrate a major milestone.

Host a small gathering to mark your achievements.

Set aside time to reflect on how far you've come.

Maintain Balance:

Set clear boundaries in your personal and work life.

Prioritize self care activities in your daily routine.

Schedule regular breaks and downtime.

Learn to say "no" when necessary to avoid overcommitment.

Evaluate your work life balance regularly.

Seek support from friends and family to avoid burnout.

Be kind to yourself and accept imperfections.

Practice mindfulness to stay present and grounded.

Revisit your priorities and adjust them as needed.

Embrace self love and self acceptance as part of your daily life.

#personal improvement#personal development#personal growth#self help#self awareness#self reflection#self improvement#level up journey#self love journey#dream girl guide#dream girl journey#dream girl tips#becoming that girl#that girl#it girl#glow up tips#glow up#clean girl#pink pilates girl#divine feminine#femininity#femme fatale#feminine journey

7K notes

·

View notes

Text

Financial Tools and Calculators | The Investors Coliseum

Financial tools and calculators provide easy-to-use resources for individuals and businesses to make informed decisions about their money. They help users understand their current financial situation, plan for the future, and make the most of their money.

0 notes

Text

#Zerodha Brokerage#Fyers Brokerage#Fyers#Zerodha#Brokerage Calculator#Financial Analysis#Fyers Trading Tools#Zerodha Trading Strategies

0 notes

Text

The Power of Compound Interest: How to Make Your Money Grow

Are you looking for ways to make your money work harder for you? If so, you’ve come to the right place! In this blog post, we’ll explore the concept of compound interest and how you can leverage it to make your money grow over time. So, let’s dive in and unlock the secrets of this powerful financial tool!

Compound Interest

First things first, let’s understand what compound interest is. Compound…

View On WordPress

#Compound Interest#Compound Interest Account#Continuous compound interest formula#Financial Goals#Financial Growth#Financial Literacy#Financial Planning#Financial security#Financial tools#Future value calculation#How to open a compound interest account#Investing#Investment Strategy#Money Management#Money multiplication#Personal Finance#Retirement Planning#Saving and investing#Savings Account#Wealth Accumulation#Wealth Building

1 note

·

View note

Text

Position Size Calculator: Your Risk Manager

Risk management is an essential factor in trading as it helps traders minimize potential losses and protect their capital. A position size calculator is a useful tool for managing risk in trading.

Try our FREE Position Size Calculator and share it with others.

#risk management#position size calculator#risk manager#position size tool#stocktrading#finance#money management#money mind method#financial planning

0 notes

Text

What is the importance of retirement planning?

Advice Only Retirement planning is important for a number of reasons. Some of the key benefits of retirement planning include:

Ensuring financial security: Planning for retirement helps you to ensure that you will have enough financial resources to live on during your retirement years.

Managing your finances: Retirement planning involves creating a financial plan and budget, which can help you to manage your money more effectively and make informed decisions about your financial well-being.

Meeting your retirement goals: Retirement planning allows you to set specific goals for your retirement and take steps to achieve them. This may include saving a certain amount of money, paying off debt, or planning for specific expenses or activities.

Reducing stress: By planning for retirement, you can feel more confident and secure about your financial future, which can help to reduce stress and anxiety about your retirement years.

Maximising your savings: Retirement planning can help you to maximize your savings and investment returns, so you can have more financial resources during retirement.

Overall, retirement planning is an important process that can help you to achieve financial security and meet your retirement goals. By taking the time to plan for retirement, you can feel more confident and secure about your financial future.

#retirement planning#retirement planning calculator#retirement planning near me#retirement planning guide#goldstone financial group retirement planning#retirement income planning#software for retirement planning#guide to retirement planning#what is retirement planning#retirement planning guides#retirement planning service#retirement planning advisor#retirement planning spreadsheets#retirement planning ira#ira retirement planning#retirement planning advisors#retirement planning software#retirement planning tools#best retirement planning companies#retirement planning services#planning for retirement#retirement planning spreadsheet#best retirement planning books#retirement tax planning#employee retirement planning#retirement planning books#best retirement planning book#best books on retirement planning#military retirement planning#tax planning in retirement

0 notes

Text

Ulcer Index

Unraveling the Ulcer Index: A Comprehensive Guide to Understanding and Utilizing Market Volatility

Introduction:

In the fast-paced world of investing, understanding market volatility is paramount to success. One tool that aids investors in this endeavor is the Ulcer Index.

This comprehensive guide aims to demystify the Ulcer Index, shedding light on its significance, calculation, and practical…

View On WordPress

#Asset allocation#Behavioral Finance#Downside Risk#Drawdown Analysis#Financial Literacy#Financial Markets#Financial Planning#How to Calculate Ulcer Index#Importance of Ulcer Index in Investing#Investment Analysis#Investment education#Investment Performance#Investment Strategies#Investment Tools#Managing Drawdowns with Ulcer Index#Market Risk#Market Volatility#Peter Martin#Portfolio Management#Portfolio Optimization#Risk assessment#Risk Management#Stop-Loss Strategies#Ulcer Index#Ulcer Index and Risk Tolerance#Ulcer Index Applications#Ulcer Index Calculation#Ulcer Index Calculation Method#Ulcer Index in Fund Evaluation#Ulcer Index Interpretation

0 notes