#Document Management System for Finance

Explore tagged Tumblr posts

Text

Documents Management in ALZERP Cloud ERP Software

In today’s fast-paced business environment, managing and organizing documents effectively is crucial for operational efficiency. ALZERP Cloud ERP Software offers a robust Documents Library or File Storage feature, designed to streamline document management and ensure your business remains agile, compliant, and efficient. This article delves into the comprehensive capabilities of the Documents…

#Affordable Letter Printing Solutions#AI-powered Document Management#Audit Trails#AuditTrail#Automated Letter Generation with Merge Fields#Automated Letter Printing ERP#Best Cloud Document Management Systems#Best Letter Printing System for ERP#Business Letter Automation#Centralized Document Storage ERP#Cloud Document Storage#Cloud ERP Compliance Document Management#Cloud ERP Document Management#Cloud-Based Document Audit Trail#Cloud-Based Document Collaboration#Cloud-Based Document Management#Cloud-based File Management ERP#Cloud-based Letter Printing for ERP#CloudDocumentManagement#Compliance Management#Custom Letter Printing ERP#Customizable Letter Templates in ERP#Digital Document Management#Digital Document Management ERP#Document Generation ERP#Document Lifecycle Management Cloud#Document Management System (DMS)#Document Management System for Finance#Document Management System for Healthcare#Document Process Automation Cloud

0 notes

Text

#account opening process#account opening#trade finance operations#trade finance automation#document management system#low code#low code application development

0 notes

Text

Fintech bullies stole your kid’s lunch money

I'm coming to DEFCON! On Aug 9, I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On Aug 10, I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Three companies control the market for school lunch payments. They take as much as 60 cents out of every dollar poor kids' parents put into the system to the tune of $100m/year. They're literally stealing poor kids' lunch money.

In its latest report, the Consumer Finance Protection Bureau describes this scam in eye-watering, blood-boiling detail:

https://files.consumerfinance.gov/f/documents/cfpb_costs-of-electronic-payment-in-k-12-schools-issue-spotlight_2024-07.pdf

The report samples 16.7m K-12 students in 25k schools. It finds that schools are racing to go cashless, with 87% contracting with payment processors to handle cafeteria transactions. Three processors dominate the sector: Myschoolbucks, Schoolcafé, and Linq Connect.

These aren't credit card processors (most students don't have credit cards). Instead, they let kids set up an account, like a prison commissary account, that their families load up with cash. And, as with prison commissary accounts, every time a loved one adds cash to the account, the processor takes a giant whack out of them with junk fees:

https://pluralistic.net/2024/02/14/minnesota-nice/#shitty-technology-adoption-curve

If you're the parent of a kid who is eligible for a reduced-price lunch (that is, if you are poor), then about 60% of the money you put into your kid's account is gobbled up by these payment processors in service charges.

It's expensive to be poor, and this is no exception. If your kid doesn't qualify for the lunch subsidy, you're only paying about 8% in service charges (which is still triple the rate charged by credit card companies for payment processing).

The disparity is down to how these charges are calculated. The payment processors charge a flat fee for every top-up, and poor families can't afford to minimize these fees by making a single payment at the start of the year or semester. Instead, they pay small sums every payday, meaning they pay the fee twice per month (or even more frequently).

Not only is the sector concentrated into three companies, neither school districts nor parents have any meaningful way to shop around. For school districts, payment processing is usually bundled in with other school services, like student data management and HR data handling. For parents, there's no way to choose a different payment processor – you have to go with the one the school district has chosen.

This is all illegal. The USDA – which provides and regulates – the reduced cost lunch program, bans schools from charging fees to receive its meals. Under USDA regs, schools must allow kids to pay cash, or to top up their accounts with cash at the school, without any fees. The USDA has repeatedly (2014, 2017) published these rules.

Despite this, many schools refuse to handle cash, citing safety and security, and even when schools do accept cash or checks, they often fail to advertise this fact.

The USDA also requires schools to publish the fees charged by processors, but most of the districts in the study violate this requirement. Where schools do publish fees, we see a per-transaction charge of up to $3.25 for an ACH transfer that costs $0.26-0.50, or 4.58% for a debit/credit-card transaction that costs 1.5%. On top of this, many payment processors charge a one-time fee to enroll a student in the program and "convenience fees" to transfer funds between siblings' accounts. They also set maximum fees that make it hard to avoid paying multiple charges through the year.

These are classic junk fees. As Matt Stoller puts it: "'Convenience fees' that aren't convenient and 'service fees' without any service." Another way in which these fit the definition of junk fees: they are calculated at the end of the transaction, and not advertised up front.

Like all junk fee companies, school payment processors make it extremely hard to cancel an automatic recurring payment, and have innumerable hurdles to getting a refund, which takes an age to arrive.

Now, there are many agencies that could have compiled this report (the USDA, for one), and it could just as easily have come from an academic or a journalist. But it didn't – it came from the CFPB, and that matters, because the CFPB has the means, motive and opportunity to do something about this.

The CFPB has emerged as a powerhouse of a regulator, doing things that materially and profoundly benefit average Americans. During the lockdowns, they were the ones who took on scumbag landlords who violated the ban on evictions:

https://pluralistic.net/2021/04/20/euthanize-rentier-enablers/#cfpb

They went after "Earned Wage Access" programs where your boss colludes with payday lenders to trap you in debt at 300% APR:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

They are forcing the banks to let you move your account (along with all your payment history, stored payees, automatic payments, etc) with one click – and they're standing up a site that will analyze your account data and tell you which bank will give you the best deal:

https://pluralistic.net/2023/10/21/let-my-dollars-go/#personal-financial-data-rights

They're going after "buy now, pay later" companies that flout borrower protection rules, making a rogues' gallery of repeat corporate criminals, banning fine-print gotcha clauses, and they're doing it all in the wake of a 7-2 Supreme Court decision that affirmed their power to do so:

https://pluralistic.net/2024/06/10/getting-things-done/#deliverism

The CFPB can – and will – do something to protect America's poorest parents from having $100m of their kids' lunch money stolen by three giant fintech companies. But whether they'll continue to do so under a Kamala Harris administration is an open question. While Harris has repeatedly talked up the ways that Biden's CFPB, the DOJ Antitrust Division, and FTC have gone after corporate abuses, some of her largest donors are demanding that her administration fire the heads of these agencies and crush their agenda:

https://prospect.org/power/2024-07-26-corporate-wishcasting-attack-lina-khan/

Tens of millions of dollars have been donated to Harris' campaign and PACs that support her by billionaires like Reid Hoffman, who says that FTC Chair Lina Khan is "waging war on American business":

https://prospect.org/power/2024-07-26-corporate-wishcasting-attack-lina-khan/

Some of the richest Democrat donors told the Financial Times that their donations were contingent on Harris firing Khan and that they'd been assured this would happen:

https://archive.is/k7tUY

This would be a disaster – for America, and for Harris's election prospects – and one hopes that Harris and her advisors know it. Writing in his "How Things Work" newsletter today, Hamilton Nolan makes the case that labor unions should publicly declare that they support the FTC, the CFPB and the DOJ's antitrust efforts:

https://www.hamiltonnolan.com/p/unions-and-antitrust-are-peanut-butter

Don’t want huge companies and their idiot billionaire bosses to run the world? Break them up, and unionize them. It’s the best program we have.

Perhaps you've heard that antitrust is anti-worker. It's true that antitrust law has been used to attack labor organizing, but that has always been in spite of the letter of the law. Indeed, the legislative history of US antitrust law is Congress repeatedly passing law after law explaining that antitrust "aims at dollars, not men":

https://pluralistic.net/2023/04/14/aiming-at-dollars/#not-men

The Democrats need to be more than The Party of Not Trump. To succeed – as a party and as a force for a future for Americans – they have to be the party that defends us – workers, parents, kids and retirees alike – from corporate predation.

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/07/26/taanstafl/#stay-hungry

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#fintech#ed-tech#finance#usury#payment processing#chokepoints#corruption#monopoly#cfpb#consumer finance protection bureau

215 notes

·

View notes

Note

Juno, out of curiosity, what does an accountant DO? What does it mean to be one? Because I know there's math involved. I've heard it's very boring. But I don't know anything else and I'm curious because you're very good at putting things to words.

Okay first of all, I cannot express just how excited I got when I first saw this message. There is nothing I love more than talking about things I know about, and usually when my career is mentioned I don't get questions so much as immediate "Oh, bless you" and "I could never"s. Which- totally fair! For some people, accounting would be boring as all hell! But for a multitude of reasons, I adore it.

There are multiple types of accounting. The type most people tend to be more familiar with is that done by CPAs- CPAs, or Certified Public Accountants, are those that have done the lengthy and expensive process to be certified to handle other peoples' tax documents and submit taxes in their name, amongst other things. Yawn, taxes, right? Well, the thing with that is that there's a lot of little loopholes that tax accountants have to remain familiar with, because saving their clients a little more here or getting a little more back there can really add up, and can do a lot for people who, say, have enough money to afford to hire someone to do their taxes but not necessarily enough to be going hog wild with. Public accountants can work for large firms or by themselves, and also do things like preparing financial statements for businesses, auditing businesses to ensure all of their financial transactions are true and accurately reported to shareholders and clients, and consulting on how finances can be managed to maximize profit (money in - money out = profit, in very simple terms).

The type of accounting I do is private accounting! That basically just means that I work for a company in their in-house accounting/finance department. Private accounting tends to get split up into several different areas. My company has Payroll, Accounts Receivable, and Accounts Payable.

Payroll handles everyone's paychecks, PTO, ensuring the correct amount of taxes are withheld from individuals per their desires, and so on. Accounts Receivable handles money flow into the company- so when our company sells the product/service, our Accounts Receivable people are the ones who review the work, create the invoices, send the invoices to the clients, remind clients about overdue invoices, receive incoming payments via ACH (Automatic Clearing House- direct bank-to-bank deposits), Wire (Usually used for international transactions), or Check, and prepare statements that show how much revenue we are expected to gain in a period of time, or have gained in a period of time. This requires a lot of interfacing with clients and project managers.

My department is Accounts Payable. Accounts Payable does basically the other side of the coin from what Accounts Receivable does. We work mostly with vendors and our purchasing/receiving departments. We receive invoices from people and companies that have sold us products/services we need in order to make our own products/perform our services, enter them into our ERP (Enterprise Resource Planning, a system that integrates the departments in a company together- there are many different ERPs, and most people simply refer to their ERP as "the system" when talking internally to other employees of the same company that they work at, because saying the name of the system is redundant) using a set of codes that automatically places the costs into appropriate groups to be referenced for later financial reports, and run the payment processing to ensure that the vendors are being paid.

To break that down because I know that was a lot of words, here's some things I do in my day-to-day at work:

- Reconciliations, making sure two different statements match up: the most common one is Credit Card reconciliations, ensuring that there are appropriately coded entries in the system that match the payments made on our credit line in our bank.

- Invoice entry: this is basic data entry, for the most part. This can have two different forms, though

- Purchase Order Invoice entry: Invoices that are matched both to the service/product provided from the vendor and the purchase order created by our Purchasing/Receiving department. We ensure that the item, the quantity, and the price all match between our records, the purchase order, and the invoice, before we enter this.

- Hard Coded Invoice entry: Invoices that we enter manually due to there being no Purchase Order for them. This is often recurring services, like cleaning or repairs, that may happen too often or have prices vary too much for Purchase Orders to be practical.

- Cleaning up old purchase orders: sometimes Purchase Orders are put in the system and then never fulfilled. Because this shows on financial statements as being a long-standing open commitment, it looks bad, so we have to periodically research these and find out if the vendor simply didn't send us the invoice, if the order was cancelled, or if something else is going on.

- Forensics! This is my personal favorite part of the job, where someone has massively borked something that is affecting my work, and so I go dig into it, sometimes going back as four or five years in records to find the origin point of the first mistake, and untangling the threads of what happened following that mistake to get us to where we are today. There's an entire field called Forensic Accounting that is basically just doing This but for other companies (it's a subset of auditing, and often is done via the IRS) and that's my dream position to be totally honest. I loooove the dopamine hit i get with solving the mystery and getting praised for doing so faster than anyone else has even begun to realize the problem to start with.

- Balancing Credits/Debits: This is more of a Main Accountant role thing, but the long and short of it is that every business has Assets, Liabilities, and Equity. Liabilities and Equity are what we put into the company/what we owe, and assets are what we have received/what we are owed. Anything that increases Assets or lowers Liabilities or Equity is a Debit. Anything that decreases Assets or raises Liabilities or Equity is a Credit. Every monetary change we process has to include an equal Debit and Credit. This is its own whole lecture, so if you wanna know more about double-entry accounting, let me know, but it's yawnsville for most people.

- Actually cutting checks or initiating bank payments to vendors for amounts we owe them.

- Vendor communication: I'm on the phones and email a lot with vendors who are wondering where their payment is, or why something was short-paid, or if I can change some of their info in our system, and so on and so on. Every job is customer service, unfortunately. I don't love it, but I do a lot less of it in private accounting than I would have to do in public accounting.

- Spreadsheets: I make so many spreadsheets I am a goddamn Excel wizard. I love spreadsheets. This isn't necessarily accounting-specific though, most people in Finance jobs love spreadsheets, or at least use them to make their lives easier. I make them just for fun, because I'm a giant fucking nerd who finds that kind of thing enjoyable lol. So if you ever need a spreadsheet made for anything, hit me up.

As for math, that's a pretty common misconception. While there is math, it is very rarely more complicated than "I paid $3 of the $8 I owe, now I owe $5" for me. There are some formulas you learn in school (Business Administration with a focus in Accounting is what I studied), but they're also pretty standard and rarely include more than like... basic algebra. Which. Thanks @ god because I flunked so hard out of pre-calc in college. I could not have done accounting if it really were all that math heavy.

Aaaand yeah! That's all I've got off the top of my head- if you have any more questions about it, do let me know, I'm happy to ramble on for hours, but I'm cutting it here so I don't start meandering on without direction lol.

45 notes

·

View notes

Text

On February 10, employees at the Department of Housing and Urban Development (HUD) received an email asking them to list every contract at the bureau and note whether or not it was “critical” to the agency, as well as whether it contained any DEI components. This email was signed by Scott Langmack, who identified himself as a senior adviser to the so-called Department of Government Efficiency (DOGE). Langmack, according to his LinkedIn, already has another job: He’s the chief operating officer of Kukun, a property technology company that is, according to its website, “on a long-term mission to aggregate the hardest to find data.”

As is the case with other DOGE operatives—Tom Krause, for example, is performing the duties of the fiscal assistant secretary at the Treasury while holding down a day job as a software CEO at a company with millions in contracts with the Treasury—this could potentially create a conflict of interest, especially given a specific aspect of his role: According to sources and government documents reviewed by WIRED, Langmack has application-level access to some of the most critical and sensitive systems inside HUD, one of which contains records mapping billions of dollars in expenditures.

Another DOGE operative WIRED has identified is Michael Mirski, who works for TCC Management, a Michigan-based company that owns and operates mobile home parks across the US, and graduated from the Wharton School in 2014. (In a story he wrote for the school’s website, he asserted that the most important thing he learned there was to “Develop the infrastructure to collect data.”) According to the documents, he has write privileges on—meaning he can input overall changes to—a system that controls who has access to HUD systems.

Between them, records reviewed by WIRED show, the DOGE operatives have access to five different HUD systems. According to a HUD source with direct knowledge, this gives the DOGE operatives access to vast troves of data. These range from the individual identities of every single federal public housing voucher holder in the US, along with their financial information, to information on the hospitals, nursing homes, multifamily housing, and senior living facilities that HUD helps finance, as well as data on everything from homelessness rates to environmental and health hazards to federally insured mortgages.

Put together, experts and HUD sources say, all of this could give someone with access unique insight into the US real estate market.

Kukun did not respond to requests for comment about whether Langmack is drawing a salary while working at HUD or how long he will be with the department. A woman who answered the phone at TCC Management headquarters in Michigan but did not identify herself said Mirksi was "on leave until July." In response to a request for comment about Langmack’s access to systems, HUD spokesperson Kasey Lovett said, “DOGE and HUD are working as a team; to insinuate anything else is false. To further illustrate this unified mission, the secretary established a HUD DOGE taskforce.” In response to specific questions about Mirski’s access to systems and background and qualifications, she said, “We have not—and will not—comment on individual personnel. We are focused on serving the American people and working as one team.”

The property technology, or proptech, market covers a wide range of companies offering products and services meant to, for example, automate tenant-landlord interactions, or expedite the home purchasing process. Kukun focuses on helping homeowners and real estate investors assess the return on investment they’d get from renovating their properties and on predictive analytics that model where property values will rise in the future.

Doing this kind of estimation requires the use of what’s called an automated valuation model (AVM), a machine-learning model that predicts the prices or rents of certain properties. In April 2024, Kukun was one of eight companies selected to receive support from REACH, an accelerator run by the venture capital arm of the National Association of Realtors (NAR). Last year NAR agreed to a settlement with Missouri homebuyers, who alleged that realtor fees and certain listing requirements were anticompetitive.

“If you can better predict than others how a certain neighborhood will develop, you can invest in that market,” says Fabian Braesemann, a researcher at the Oxford Internet Institute. Doing so requires data, access to which can make any machine-learning model more accurate and more monetizable. This is the crux of the potential conflict of interest: While it is unclear how Langmack and Mirski are using or interpreting it in their roles at HUD, what is clear is that they have access to a wide range of sensitive data.

According to employees at HUD who spoke to WIRED on the condition of anonymity, there is currently a six-person DOGE team operating within the department. Four members are HUD employees whose tenures predate the current administration and have been assigned to the group; the others are Mirski and Langmack. The records reviewed by WIRED show that Mirski has been given read and write access to three different HUD systems, as well as read-only access to two more, while Langmack has been given read and write access to two of HUD’s core systems.

A positive, from one source’s perspective, is the fact that the DOGE operatives have been given application-level access to the systems, rather than direct access to the databases themselves. In theory, this means that they can only interact with the data through user interfaces, rather than having direct access to the server, which could allow them to execute queries directly on the database or make unrestricted or irreparable changes. However, this source still sees dangers inherent in granting this level of access.

“There are probably a dozen-plus ways that [application-level] read/write access to WASS or LOCCS could be translated into the entire databases being exfiltrated,” they said. There is no specific reason to think that DOGE operatives have inappropriately moved data—but even the possibility cuts against standard security protocols that HUD sources say are typically in place.

LOCCS, or Line of Credit Control System, is the first system to which both DOGE operatives within HUD, according to the records reviewed by WIRED, have both read and write access. Essentially HUD’s banking system, LOCCS “handles disbursement and cash management for the majority of HUD grant programs,” according to a user guide. Billions of dollars flow through the system every year, funding everything from public housing to disaster relief—such as rebuilding from the recent LA wildfires—to food security programs and rent payments.

The current balance in the LOCCS system, according to a record reviewed by WIRED, is over $100 billion—money Congress has approved for HUD projects but which has yet to be drawn down. Much of this money has been earmarked to cover disaster assistance and community development work, a source at the agency says.

Normally, those who have access to LOCCS require additional processing and approvals to access the system, and most only have “read” access, department employees say.

“Read/write is used for executing contracts and grants on the LOCCS side,” says one person. “It normally has strict banking procedures around doing anything with funds. For instance, you usually need at least two people to approve any decisions—same as you would with bank tellers in a physical bank.”

The second system to which documents indicate both DOGE operatives at HUD have both read and write access is the HUD Central Accounting and Program System (HUDCAPS), an “integrated management system for Section 8 programs under the jurisdiction of the Office of Public and Indian Housing,” according to HUD. (Section 8 is a federal program administered through local housing agencies that provides rental assistance, in the form of vouchers, to millions of lower-income families.) This system was a precursor to LOCCS and is currently being phased out, but it is still being used to process the payment of housing vouchers and contains huge amounts of personal information.

There are currently 2.3 million families in receipt of housing vouchers in the US, according to HUD’s own data, but the HUDCAPS database contains information on significantly more individuals because historical data is retained, says a source familiar with the system. People applying for HUD programs like housing vouchers have to submit sensitive personal information, including medical records and personal narratives.

“People entrust these stories to HUD,” the source says. “It’s not data in these systems, it’s operational trust.”

WASS, or the Web Access Security Subsystem, is the third system to which DOGE has both read and write access, though only Mirski has access to this system according to documents reviewed by WIRED. It’s used to grant permissions to other HUD systems. “Most of the functionality in WASS consists of looking up information stored in various tables to tell the security subsystem who you are, where you can go, and what you can do when you get there,” a user manual says.

“WASS is an application for provisioning rights to most if not all other HUD systems,” says a HUD source familiar with the systems who is shocked by Mirski’s level of access, because normally HUD employees don’t have read access, let alone write access. “WASS is the system for setting permissions for all of the other systems.”

In addition to these three systems, documents show that Mirski has read-only access to two others. One, the Integrated Disbursement and Information System (IDIS), is a nationwide database that tracks all HUD programs underway across the country. (“IDIS has confidential data about hidden locations of domestic violence shelters,” a HUD source says, “so even read access in there is horrible.”) The other is the Financial Assessment of Public Housing (FASS-PH), a database designed to “measure the financial condition of public housing agencies and assess their ability to provide safe and decent housing,” according to HUD’s website.

All of this is significant because, in addition to the potential for privacy violations, knowing what is in the records, or even having access to them, presents a serious potential conflict of interest.

“There are often bids to contract any development projects,” says Erin McElroy, an assistant professor at the University of Washington. “I can imagine having insider information definitely benefiting the private market, or those who will move back into the private market,” she alleges.

HUD has an oversight role in the mobile home space, the area on which TCC Management, which appears to have recently wiped its website, focuses. "It’s been a growing area of HUD’s work and focus over the past few decades," says one source there; this includes setting building standards, inspecting factories, and taking in complaints. This presents another potential conflict of interest.

Braesemann says it’s not just the insider access to information and data that could be a potential problem, but that people coming from the private sector may not understand the point of HUD programs. Something like Section 8 housing, he notes, could be perceived as not working in alignment with market forces—“Because there might be higher real estate value, these people should be displaced and go somewhere else”—even though its purpose is specifically to buffer against the market.

Like other government agencies, HUD is facing mass purges of its workforce. NPR has reported that 84 percent of the staff of the Office of Community Planning and Development, which supports homeless people, faces termination, while the president of a union representing HUD workers has estimated that up to half the workforce could be cut The chapter on housing policy in Project 2025—the right-wing playbook to remake the federal government that the Trump administration appears to be following—outlines plans to massively scale back HUD programs like public housing, housing assistance vouchers, and first-time home buyer assistance.

16 notes

·

View notes

Text

Astrology Testimonials (I)

Hey y'all! I'm doing a new series on my blog where I document my personal testimonials of how I have experienced my particular placements. This way, other people can gain insight on how astrology manifests for the individual and those who share similar placements may compare.

On being Jyeshta Moon

A big theme with Jyeshta is authority and power. Jyeshta often rises to some position of authority over the course of their lives (Naomi Campbell, Donald Trump) and if they don't this theme of power/authority will present itself somehow.

For me, I have always witnessed power being abused! Whether it was in my own home or in work environments, this has repeatedly come up in my life. My father controlled the emotional climate in my home but was cold and emotionally absent. He misused his authority as a parent to control and constrict his home and failed to fulfill the duties of his role (no shade, Dad! Love you!)

When he passed away, I learned about his secrets from my mother and through the events that took place after. Mismanagement of our finances, adultery, and other scandals emerged, which continued this theme in my life. More happenings of my father misusing, abusing his authority. My mother isn't entirely innocent either but I won't shade her here (lol).

I was hungry for money when I came of working age and came in and out of a lot of different fast food positions. I would rise to the position of manager quite easily (another Jyeshta theme) and constantly witness my bosses and fellow managers mishandle or abuse their power. (iykyk, ff industry can be very toxic and abusive)

Because my father passed away at 13 and I learned his secrets between that age and 15, I spent much of my teenage years having this deep awareness that power could be misused. I would see it in institutions, in my teachers, at school, among my peers. In the world...hell, everywhere! Also, as a black person, I am no stranger to systemic oppression--another abuse of power. This too has given me a lens to engage these Jyeshta themes.

Such experiences then manifested as a deep mistrust of authority and by extension, my own authority. I have a difficult time believing people in power and at times have an unhealthy amount of skepticism within my mind. I feel at times I have seen too much. It can make me hopeless and almost corrosive inside. Thankfully, my Pisces sidereal placements (Revati) balance out my cold pragmatism.

All that being said, I am changing. And I am making space for a different framing of power. I am reclaiming my own now as I enter young adulthood (I am 22 years old!). I will always have a bit of a thirst for power. I can't describe it. I just know I'm meant for it. It suits me. And I know that all these insights on how power has been abused has cultivated a deep belief that if power chooses me, I will try to wield it responsibly.

So, I do everything with intention. Everything. I lead with intention. I love with intention. I speak with intention. I pray with intention. I manifest with intention. I do my best to be mindful and aware.

Those who use their power over others do not understand themselves. There is something in their hearts that is wounded and something in their minds that distorts their cognition. Wielding your power to abuse, lie, cheat, manipulate, hide, extort, abandon, indulge, etc. is an indication that healing is necessary. Rehabilitation is necessary. A change is needed--more love, is needed. And if that change is not sought, karma will come. This, I believe.

-jyeshindra

#jyeshta#jyeshtha#vedic astrology#vedic astro observations#vedic astro notes#vedicknowledge#sidereal astrology#sidereal zodiac#natal astrology#astrology signs#astrology notes#scorpio#nakshatras#jyotish#zodiac#writing#creative writing#biography#testimonial#testimony#personal#thoughts#memories#life#reflection#self reflection#intention

84 notes

·

View notes

Text

My goals

I'm going to be listing my long term goals and revisit this post in a years time to review and see if I've managed to keep up with them

Sticking to a proper skin care routine. Being really depressed makes taking care of myself hard so I want to put more effort into it and hopefully this time next year things that feel impossible to do will be easy parts of my routine

Keeping my space clean. Another thing with being depressed is that I find it hard to keep my space clean so I want to try and keep it organised

Sticking to a workout routine. I've been on and off working out but I want to really commit to a workout routine to tone up and build muscle

Work on skills and hobbies. I don't have many hobbies or skills so I want to work on both of those things. There are a lot of things that I want to do but keep putting off so hopefully this time next year I'll have done at least some of those things

Being more social. I want to document my life on social media so I can see how far I've come. I also want to try making more friends and go out a lot more

Budgeting. My finances are a mess and I'm always broke so I really want to sort out a proper budgeting system

My dms are open if anyone wants to say hi

My discord is C0udysk1eees

#cloudy yearly review#self development#self improvement#self love#self care#my dms are always open#looking for friends#positive thinking#make friends#positive thoughts#positivity#mindset#positive mental attitude#inspiration#self impowerment#mental health#wellbeing#health and wellness#healthylifestyle#fix my life#fixing my life#improving#happiness#get motivated#motivation#motivating quotes#ispirational#slide into my dms#open dms#hit my dms

13 notes

·

View notes

Text

My Gamified Life Framework

So below the cut is the general framework I followed to gamify my life that's been working (for the most part).

I hope to have my own system with (some of) its details up in the next few days as an example.

Please let me know if y'all need any kinda clarification or have any questions about the system - I'd be happy to share more!

Phase One - Assessment

1. Look over your current life and decide how/what you want to improve upon using this system - it could be large swaths of your life or smaller, more targeted areas.

2. Look at your overall life and divide it into general areas (I call them domains) and those general areas into sub-areas if needed (I call them sub-domains). Ex. Household into Chores and Maintenance. Household is the main life area, while Chores and Maintenance are the sub-areas.

3. Dream big about where you want to be and who you want to be in the future. This is a huge brainstorm of everything you can think of. It doesn't matter how large or how small.

4. Honestly decide how happy or fulfilled you are in each of your listed life areas (and sub-areas) using a list of your own objectives/questions specific to your end goals and ideal self. Ex. Finances - "I successfully budget my money" with a score of 4/10

Phase Two - Planning Systems

1. Look at your ideal future self and create a general plan/goals and list of milestones for a journey to get there.

2. Sort goals and milestones into life areas and sub-areas, along with prioritizing (or ordering) each of them.

3. For each life area (and sub-area), create or form Quests in the form of goals to advance yourself - the focus life areas are the larger goals and called Main Quests, the non-focus areas don't each need a goal, but if they do they're smaller and maybe more project focused and are called Side Quests.

4. Break down each of your brainstormed Main and Side Quests into actionable steps, projects, and/or milestones to take those bigger goals into manageable chunks.

5. Using the manageable chunks, break them down into XP values, gold rewards, and pick deadlines.

6. Create habits to surround and encourage your progress.

7. *Optional* Create a “shop” to give yourself rewards as you gain XP and Gold - as well as giving yourself breaks when needed.

8. Create a list of “Mandatory” tasks to be done every day - things that should be part of your routine already and need to be done daily. *Optional* Make each mandatory daily task worth 1 point, then multiply that by 2 weeks (14 days). That’s how much HP you should have for the month. Each month it resets to full HP.

9. *Optional* Plan for what happens if a “Player Death” occurs. Ex. For me it’s a shop close for 3 days and losing a randomized amount of loot and gold (decided by my husband).

Phase Three - Action

1. For each quarter or season, pick no more than 3 domains (maybe 4, depending) to focus on and advance the most.

2. Keep track of your HP and XP daily and your Gold weekly - however it works best for you.

3. Tweak your systems and assessments, and therefore your goals, as needed to get the best system for you. Originally, I didn’t have a gold/shop and an HP/”Player Death” system set up, but when I realized I needed a more immediate reward and punishment system they got added.

Notes

○ Always take what works for you and leave what doesn't - don't try to force things that don't work for you!

○ If this is popular, I can also create a pdf/document to share as well!

#planning#planner#goals#goalsetting#gamifiedlife#creativity#game#gamification#productivity#productivity system#organization#life organization#life#lifestyle

27 notes

·

View notes

Text

Billionaire fossil fuel mogul David Koch died August 23, 2019. Though he will rightfully be remembered for his role in the destruction of the earth, David Koch’s influence went far beyond climate denial. Ronald Reagan may have uttered the famous words, “Government is not the solution to our problem, government is the problem” back in 1981—but it was David Koch, along with his elder brother Charles and a cabal of other ultrarich individuals, who truly reframed the popular view of government. Once a democratic tool used to shape the country’s future, government became seen as something intrusive and inefficient—indeed, something to be feared.

“While Charles was the mastermind of the social reengineering of the America he envisioned,” said Lisa Graves, co-director of the corporate watchdog group Documented, “David was an enthusiastic lieutenant.”

David Koch was particularly instrumental in legitimizing anti-government ideology—one the GOP now holds as gospel. In 1980, the younger Koch ran as the vice-presidential nominee for the nascent Libertarian Party. And a newly unearthed document shows Koch personally donated more than $2 million to the party—an astounding amount for the time—to promote the Ed Clark–David Koch ticket.

“Few people realize that the anti-American government antecedent to the Tea Party was fomented in the late ’70s with money from Charles and David Koch,” Graves continued. “The Libertarian Party, fueled in part with David’s wealth, pushed hard on the idea that government was the problem and the free market was the solution to everything.”

In fact, according to Graves, “The Koch-funded Libertarian Party helped spur on Ronald Reagan’s anti-government, free-market-solves-all agenda as president.”

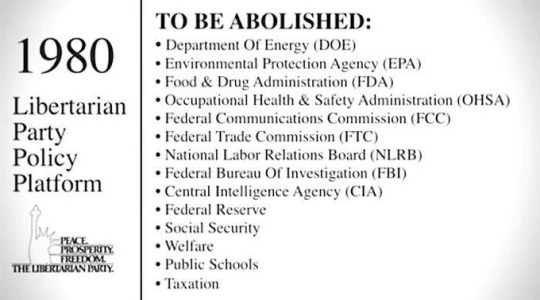

Even by contemporary standards, the 1980 Libertarian Party platform was extreme. It called for the abolition of a wide swath of federal agencies, including the Food and Drug Administration, the Department of Energy, the Environmental Protection Agency, the Nuclear Regulatory Commission, the Federal Aviation Administration, the Bureau of Land Management, the Federal Election Commission, the Bureau of Alcohol, Tobacco, and Firearms, the Federal Trade Commission, and “all government agencies concerned with transportation.” It railed against campaign finance and consumer protection laws, the Occupational Safety and Health Act, any regulations of the firearm industry (including tear gas), and government intervention in labor negotiations. And the platform demanded the repeal of all taxation, and sought amnesty for those convicted of tax “resistance.”

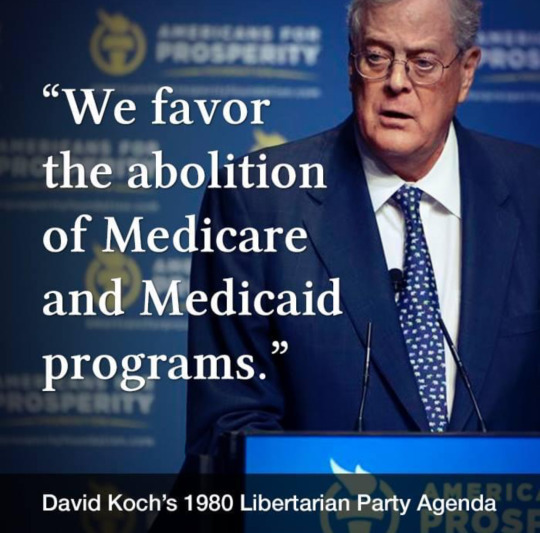

Koch and his libertarian allies moreover advocated for the repeal of Social Security, Medicare, Medicaid, and other social programs. They wanted to abolish federally mandated speed limits. They opposed occupational licensure, antitrust laws, labor laws protecting women and children, and “all controls on wages, prices, rents, profits, production, and interest rates.” And in true libertarian fashion, the platform urged the privatization of all schools (with an end to compulsory education laws), the railroad system, public roads and the national highway system, inland waterways, water distribution systems, public lands, and dam sites.

The Libertarian Party never made much of a splash in the election—though it did garner almost 12 percent of the vote in Alaska—but doing so was never the point. Rather, the Kochs were engaged in a long-term effort to normalize the aforementioned ideas and mainstream them into American politics.

(continue reading)

#politics#republicans#libertarians#koch brothers#koch bros#libertarianism#conservatism#ronald reagan#reaganism#charles koch#david koch#libertarian party

58 notes

·

View notes

Text

SSI & SSDI: What are they, who qualifies, and how to apply?

Prefacing this with "For USAmericans only" because our system is a special kind of fucked up. I'm sorry to say that this may not apply to people that are undocumented, either. The feds suck that way and I really wish life was easier for all of us. This is also gonna be a very long post.

I see a lot of USAmerican tumblr users in dire straights trying to scrape by with art auctions, selling homemade stuff, or straight-up begging (no shame intended; poverty fucking sucks and our system is broken), that really seem to qualify for the same benefits that I have, but underutilize or otherwise don't know they can apply. This post is my attempt to explain the differences between our federal benefits programs, who can qualify, and what you need to do to apply in the gentlest, most hand-holding way I can for those of you feeling daunted or scared.

First off:

1: What's the difference between SSI and SSDI? SSI is short for "Social Security Income", and SSDI is just the same thing but with "Disability" thrown in. SSI pays into benefits for elder care and retired seniors, but what a lot of USAmericans don't realize is that you can apply for SSI at any time if you are disabled and have never had a job because of it. SSI isn't the same as a 401k or a retirement plan through your bank/finance manager. SSI is the federal system through which people who, either through age or disability, cannot work receive federal compensation through tax dollars. I got approved when I was 30 due to the severity of my disabilities when the average American doesn't usually have to worry about SSI until they're nearing retirement age. SSI is also the system that people who have never been able to work due to being disabled can apply for life-long benefits through.

SSDI is specifically for the benefit of people who have worked before, but have become too disabled to keep working for whatever reason. I'm personally, actually, on SSI because I've never been able to work due to my disabilities and have been living with them since very early childhood. I had odd jobs at stables working with horses in my teens, but no paystubs to prove it since it was all in cash. If you've never worked a formal job and are too disabled to work now, you want SSI. If you've been able to work before and can prove it through pay stubs/taxes/employment contracts but are now too disabled to, you want SSDI.

2: How do I know if I qualify? By getting tired of struggling to work because of your disability and giving the process a real look. Are you making less money than if you were working a barely minimum-wage part-time job and still struggling with Being Okay? Then you're probably, to some degree, legally disabled and entitled to help. The threshold to apply for assistance is surprisingly low considering how much I've seen barely-hanging-in-there tumblr users suffering from their respective chronic issues toughing it out with nothing but duct tape, ibuprofen, and etsy shops, and SS(D)I programs really take a lot of care to pay attention to your psychological welfare when you have to work as well as your physical welfare when defining what "disabled" really means.

You can even call the SSA help line, reach an agent, describe your situation, and ask if it sounds like you should pursue an application and how to start at absolutely no cost and with no commitment; these are programs you have a legal right to access and apply for, and calling is completely free - there are no consultation fees, ever. A lot of Social Security agents WANT to help people get on benefits when they need them, but it's actually harder to get approved if you try to do the entire process digitally vs. keeping in contact over the phone with a real human.

While you can apply and get approved with 0 contact necessary up until a certain point with applying for federal benefits, you are much more likely to get denied and have to appeal multiple times, miss documents that you didn't notice you needed to have ready, or not hear about other benefit programs or assistance that you can simultaneously be applying for. Even if you're scared of phones, you want a good agent to advocate for you and advise you when it comes to SSI/SSDI.

For the record, it's NORMAL to be denied at least once, if not several times when you apply, and does not mean that you aren't disabled, or aren't "disabled enough". This is a tactic intentionally used by the SSA to filter out those "truly" in need from those that aren't by using the logic "truly desperate people won't quit applying while people with options will". It's bullshit, classist, ableist, and takes advantage of people with anxiety and social phobias, but that's the way it's been built to be, so you MUST be persistent and keep appealing if you get denied. There are no limits to how many times you can appeal your case when it comes to SS(D)I. Some people can be stuck with being denied and appealing for years, which is why I strongly advise keeping the names and contact information of SSA agents and resources you've been in contact with for help. Once you get people to see you as a person rather than an applicant, you'll start getting a lot more good advice and tips for how to get approved faster and even how to maximize your monthly benefit rates.

If you're struggling to hold down your life in a stable way because of having one or more disabilities that interfere with a regular, "average" person's expected work day (9-5, usually commuting at least a little by car, usually working with other people/customers, spending at least some prolonged times on your feet or sitting at a desk/computer), you may already qualify for more benefits than you're aware of. There are absolutely no legal ramifications for applying for SSI or SSDI and getting turned down, or applying multiple times. It's not a "three strikes and you're out" kind of deal. You will not be arrested or fined for applying or inquiring about what you're entitled to from our federal government. Go to the official Social Security Administration website and poke around! However, my protip is to first read what benefits are available, and then CALL THEIR HELP LINE DIRECTLY to talk to an actual human being. The person who answers the phone can listen to you describe your circumstances precisely and guide you through applying, as well as inform you of any programs you may not know about that you can apply for simultaneously.

My SSA rep was a champion that got me through the process while also dropping hints about how to write and describe my situation in the forms I had to fill out. Because I live with my family, I don't have to pay rent, but my representative loudly asked, "YOU PAY RENT, RIGHT?" as a heavy-handed way of telling me, "I can get you more in your paycheck if you at least say you're paying rent," which got me an additional $300 added to my monthly checks now. I actually do pay that $300 in rent now, because it makes me feel better and helps my family with other expenses, including a brand-new not-even-on-the-market-yet power chair that my mom bought for me recently so I don't have to limp along with a cane anymore.

3: How do I apply?

Go to http://www.ssa.gov/ and research based upon your situation (if you've ever worked before or not). I got so overwhelmed by the online application process that my mom, who does bureaucracy for a living, helped relieve a load of anxiety from me by filling out my paperwork for me as well as she could (she's legally my Power of Attorney and so having her handle my paperwork was totally fine) and then calling their help-line.

Generally, the hardest part about applying is the waiting and resisting becoming discouraged, because Social Security is a slow ass process, and you're lucky if you hear back within several months of an application for an update, much less approval. However, depending on your situation, you may be required to go to an SSA-approved doctor or therapist to review your records and verify that you're still as disabled as you were when you first started your application as a last step before your application process is officially complete. For me, all I had to do was answer a therapist's questions about what my quality of life was like (my answer was "What quality of life?" because I was That Miserable), how my mobility was, how well I functioned around strangers and peers, what chronic pain/problems I dealt with, how long I could stand to be on my feet, and generally gave a rundown of what I could and couldn't handle about an "average" person's daily life and typical expected work load in your stereotypical office or retail setting.

The most important thing about applying is getting the application started as early as possible and making contact with an actual SSA representative! Even if you never follow through with applying (again, you are not penalized if you drop out! You can pick up where you left off or start completely over at any time when you're applying for federal benefits like SSI), after you reach a certain point in being Acknowledged By SSA As An Applicant For Assistance, the clock starts. Your clock starts - and I mean that in a very, very good way.

Once the SSA receives your initial request for SSI or SSDI, they automatically begin calculating any and all back-pay THEY owe YOU when you get approved as long as you're still applying and appealing. For me, my first SSI check came in at almost $6,000, because it took me around 10 months or so after my initial application to get approved, and the absolute basest rate for SSI benefits at that time was about $600/mo. I now make a little under $1k/mo with SSI alone, with my payments increasing automatically with inflation or if a single billionaire bothered to pay any taxes this year. If a major financial problem occurs in my life, like if my mom were to suddenly want more rent, I can report it to the SSA and they'll compensate me for at least some of that increased rent.

SSI/SSDI is not going to make you rich or solve all of your financial issues, and you are not legally allowed to work without special permission and circumstances while receiving benefits, but it can help take some of the pressure off if you literally have no other way of getting financial help. Because they're both federal programs, you're able to receive SSI/SSDI benefits along with many of your state's local benefit programs, like state-funded insurance, welfare, and food stamps to further stretch your budget and help you financially.

Little things that helped me along the way:

I cried a lot. At first it was humiliating to feel my emotions drop out from under me in the middle of a conversation with an SSA rep, but when he heard me beginning to lose it and sob at how hard everything is all the time, he became even more helpful with my case. He was a very sweet man named Dennis from Georgia. The same went with anyone else I had to see or speak to; if I just broke down crying and showed my actual feelings of resentment and humiliation at being so broken down and disabled that I officially needed Federal Government Daddy's money, they'd be a lot more compassionate and helpful. Show your emotions. Be upset. Let the people you speak to know that you feel like crap because, in spite of all your years of trying and trying to Be A Normal Person, things haven't gotten any better and maybe have even gotten worse.

I spoke my truth. I had a lot of suicidal ideology going on when I started applying, and as difficult and scary as it was, admitting that I was feeling like I had no other way out or way to help my family not be burdened by me was through suicide. I said that I would rather be talking to a doctor about assisted suicide than talking to the person I was talking to about asking for basic federal assistance. The therapist I said that to was alarmed and heartbroken that I preferred the thoughts of suicide to the thoughts of pursuing SSI, and was very, very quick to reassure me that I wasn't a failure, and that she was there to see me and help me get what I needed now that I was asking for it. She praised me for telling the truth and being brave enough to keep applying and trying.

I let myself be symptomatic. No masking, no pain meds, nothing; when I had to deal with people assessing me for SSI (which weren't many, but the stakes to me were too high to try to mask even once), I went in exhausted, in pain, stinking from not showering because I was struggling, rushing to and from the bathroom with stress IBS, and very vocally in favor of dying rather than continuing to fuss around with paperwork. When the exhaustion and fatigue made me want to cry, I cried. When someone wanted to touch me - like to take my blood pressure at the doctor's - I allowed myself to jolt away and need to be asked if it was okay before I was touched by anyone. I allowed my Neurotypical Tolerance Level to reach 0, and to be the goddamn mess I really was inside, and still am.

I did not express optimism or hope. I made it clear that I was going through the motions because I "knew I was going to get denied anyway". I knew most people never get approved, and I was honest that I knew it and expected nothing but wasted time while I went through the application process as one final attempt to not be such a hindrance to the people around me.

That following October, I got a snail-mail letter in my mailbox congratulating me for being approved for SSI, and that if I was reading the letter and had not received my first payments, I would after a short time and was asked to call them if I didn't. It took about 10 months total to get through all of it once my mom teamed up with me to help me with the Official Process, and checked my bank account to find not only my very first payment sitting in my checking account, but the past 10 months' worth of payments I would've received if I'd already been on benefits. I used it to decorate my bedroom, which was so spare and empty it looked like nobody lived there, get new clothes I desperately needed (I was 30 and still relying on hand-me-down clothes and underwear from when I was a teenager), started paying my mom rent so I felt less like a leech and more like an investor in our family home, and am now in the process of getting a brand new power wheelchair, because my problems with walking and standing were what got me to start applying, and life has gotten better enough that I can now afford the mobility aids I need.

#long post#very long post#ssi#social security#ssdi#disability#disability income#ssi/ssdi#financial assistance#getting on disability

9 notes

·

View notes

Text

AI’s Role in Business Process Automation

Automation has come a long way from simply replacing manual tasks with machines. With AI stepping into the scene, business process automation is no longer just about cutting costs or speeding up workflows—it’s about making smarter, more adaptive decisions that continuously evolve. AI isn't just doing what we tell it; it’s learning, predicting, and innovating in ways that redefine how businesses operate.

From hyperautomation to AI-powered chatbots and intelligent document processing, the world of automation is rapidly expanding. But what does the future hold?

What is Business Process Automation?

Business Process Automation (BPA) refers to the use of technology to streamline and automate repetitive, rule-based tasks within an organization. The goal is to improve efficiency, reduce errors, cut costs, and free up human workers for higher-value activities. BPA covers a wide range of functions, from automating simple data entry tasks to orchestrating complex workflows across multiple departments.

Traditional BPA solutions rely on predefined rules and scripts to automate tasks such as invoicing, payroll processing, customer service inquiries, and supply chain management. However, as businesses deal with increasing amounts of data and more complex decision-making requirements, AI is playing an increasingly critical role in enhancing BPA capabilities.

AI’s Role in Business Process Automation

AI is revolutionizing business process automation by introducing cognitive capabilities that allow systems to learn, adapt, and make intelligent decisions. Unlike traditional automation, which follows a strict set of rules, AI-driven BPA leverages machine learning, natural language processing (NLP), and computer vision to understand patterns, process unstructured data, and provide predictive insights.

Here are some of the key ways AI is enhancing BPA:

Self-Learning Systems: AI-powered BPA can analyze past workflows and optimize them dynamically without human intervention.

Advanced Data Processing: AI-driven tools can extract information from documents, emails, and customer interactions, enabling businesses to process data faster and more accurately.

Predictive Analytics: AI helps businesses forecast trends, detect anomalies, and make proactive decisions based on real-time insights.

Enhanced Customer Interactions: AI-powered chatbots and virtual assistants provide 24/7 support, improving customer service efficiency and satisfaction.

Automation of Complex Workflows: AI enables the automation of multi-step, decision-heavy processes, such as fraud detection, regulatory compliance, and personalized marketing campaigns.

As organizations seek more efficient ways to handle increasing data volumes and complex processes, AI-driven BPA is becoming a strategic priority. The ability of AI to analyze patterns, predict outcomes, and make intelligent decisions is transforming industries such as finance, healthcare, retail, and manufacturing.

“At the leading edge of automation, AI transforms routine workflows into smart, adaptive systems that think ahead. It’s not about merely accelerating tasks—it’s about creating an evolving framework that continuously optimizes operations for future challenges.”

— Emma Reynolds, CTO of QuantumOps

Trends in AI-Driven Business Process Automation

1. Hyperautomation

Hyperautomation, a term coined by Gartner, refers to the combination of AI, robotic process automation (RPA), and other advanced technologies to automate as many business processes as possible. By leveraging AI-powered bots and predictive analytics, companies can automate end-to-end processes, reducing operational costs and improving decision-making.

Hyperautomation enables organizations to move beyond simple task automation to more complex workflows, incorporating AI-driven insights to optimize efficiency continuously. This trend is expected to accelerate as businesses adopt AI-first strategies to stay competitive.

2. AI-Powered Chatbots and Virtual Assistants

Chatbots and virtual assistants are becoming increasingly sophisticated, enabling seamless interactions with customers and employees. AI-driven conversational interfaces are revolutionizing customer service, HR operations, and IT support by providing real-time assistance, answering queries, and resolving issues without human intervention.

The integration of AI with natural language processing (NLP) and sentiment analysis allows chatbots to understand context, emotions, and intent, providing more personalized responses. Future advancements in AI will enhance their capabilities, making them more intuitive and capable of handling complex tasks.

3. Process Mining and AI-Driven Insights

Process mining leverages AI to analyze business workflows, identify bottlenecks, and suggest improvements. By collecting data from enterprise systems, AI can provide actionable insights into process inefficiencies, allowing companies to optimize operations dynamically.

AI-powered process mining tools help businesses understand workflow deviations, uncover hidden inefficiencies, and implement data-driven solutions. This trend is expected to grow as organizations seek more visibility and control over their automated processes.

4. AI and Predictive Analytics for Decision-Making

AI-driven predictive analytics plays a crucial role in business process automation by forecasting trends, detecting anomalies, and making data-backed decisions. Companies are increasingly using AI to analyze customer behaviour, market trends, and operational risks, enabling them to make proactive decisions.

For example, in supply chain management, AI can predict demand fluctuations, optimize inventory levels, and prevent disruptions. In finance, AI-powered fraud detection systems analyze transaction patterns in real-time to prevent fraudulent activities. The future of BPA will heavily rely on AI-driven predictive capabilities to drive smarter business decisions.

5. AI-Enabled Document Processing and Intelligent OCR

Document-heavy industries such as legal, healthcare, and banking are benefiting from AI-powered Optical Character Recognition (OCR) and document processing solutions. AI can extract, classify, and process unstructured data from invoices, contracts, and forms, reducing manual effort and improving accuracy.

Intelligent document processing (IDP) combines AI, machine learning, and NLP to understand the context of documents, automate data entry, and integrate with existing enterprise systems. As AI models continue to improve, document processing automation will become more accurate and efficient.

Going Beyond Automation

The future of AI-driven BPA will go beyond automation—it will redefine how businesses function at their core. Here are some key predictions for the next decade:

Autonomous Decision-Making: AI systems will move beyond assisting human decisions to making autonomous decisions in areas such as finance, supply chain logistics, and healthcare management.

AI-Driven Creativity: AI will not just automate processes but also assist in creative and strategic business decisions, helping companies design products, create marketing strategies, and personalize customer experiences.

Human-AI Collaboration: AI will become an integral part of the workforce, working alongside employees as an intelligent assistant, boosting productivity and innovation.

Decentralized AI Systems: AI will become more distributed, with businesses using edge AI and blockchain-based automation to improve security, efficiency, and transparency in operations.

Industry-Specific AI Solutions: We will see more tailored AI automation solutions designed for specific industries, such as AI-driven legal research tools, medical diagnostics automation, and AI-powered financial advisory services.

AI is no longer a futuristic concept—it’s here, and it’s already transforming the way businesses operate. What’s exciting is that we’re still just scratching the surface. As AI continues to evolve, businesses will find new ways to automate, innovate, and create efficiencies that we can’t yet fully imagine.

But while AI is streamlining processes and making work more efficient, it’s also reshaping what it means to be human in the workplace. As automation takes over repetitive tasks, employees will have more opportunities to focus on creativity, strategy, and problem-solving. The future of AI in business process automation isn’t just about doing things faster—it’s about rethinking how we work all together.

Learn more about DataPeak:

#datapeak#factr#technology#agentic ai#saas#artificial intelligence#machine learning#ai#ai-driven business solutions#machine learning for workflow#ai solutions for data driven decision making#ai business tools#aiinnovation#digitaltools#digital technology#digital trends#dataanalytics#data driven decision making#data analytics#cloudmigration#cloudcomputing#cybersecurity#cloud computing#smbs#chatbots

2 notes

·

View notes

Text

Company Establishment in Turkey

Company establishment in Turkey has become a popular avenue for both foreign and domestic investors, offering numerous benefits such as a young population, favorable currency rates, and decreasing production and labor costs. The dynamic economy, strategic location, and favorable regulatory framework have made Turkey an attractive destination for businesses aiming to expand in the region.

Legal Framework

The foundation of company registration in Turkey is governed by the Turkish Commercial Code (Law No. 6102). This key legislation outlines the legal requirements for forming a company, regardless of whether the business is owned by domestic or foreign entrepreneurs. Complementary laws, such as the Turkish Code of Obligations (No. 6098) and Turkish Civil Code (No. 4721), also play a role in specific aspects of company operations.

Under the law, companies in Turkey acquire legal personality upon registration with the Trade Registry, meaning they are recognized as separate legal entities. This legal separation allows companies to enjoy rights and undertake obligations in their own name, and protects investors from personal liability in many cases.

Foreign Investment in Turkey

Foreigners are allowed to establish companies in Turkey with the same rights as Turkish citizens. The Foreign Direct Investment Law (No. 4875), enacted in 2013, eliminated the legal distinctions between foreign and domestic investors, providing equal treatment to both. This legal framework makes it easier for foreign investors to enter the Turkish market and benefit from its growing opportunities.

Recent legislative developments, such as the 2024 FATF Decision on Türkiye, have further improved Turkey’s attractiveness as an investment hub, particularly with the enactment of new laws like the Turkish Crypto Law (No. 7518). This law addresses critical areas such as digital assets, cryptocurrencies, and peer-to-peer platforms, providing clarity and structure for investors interested in emerging technologies.

Company Types and Registration Process

Investors have the option to establish five types of companies in Turkey, as stipulated in the Turkish Commercial Code:

Collective Companies

Commandite Companies

Cooperatives

Limited Companies

Joint-Stock Companies

The incorporation process can be efficiently completed through MERSİS, the Central Registry System, allowing businesses to finalize registration electronically. One notable advantage in Turkish company law is the ability to establish a single-shareholder joint-stock company or a single-member limited liability company.

To register a company, several steps must be followed:

Draft and sign the company contract,

Prepare signature declarations of company officials,

Pay relevant fees, including the Competition Authority share and capital,

Submit required documents to the Trade Registry Office.

Taxation and Corporate Governance

In Turkey, companies are generally subject to a 20% corporate income tax, while finance-related businesses like banks face a higher rate of 25%. Investors should stay updated on tax changes, including the 2024 amendments to Turkish tax laws, as they can significantly impact business operations.

Once a company is established, the proper management of corporate governance becomes crucial. The Turkish Commercial Code includes specific provisions on how the board of directors should function, ensuring that businesses operate smoothly and in compliance with national laws. Companies must adhere to these corporate governance rules to maintain their legal standing and avoid potential legal issues.

Investment Opportunities and Methods

In addition to direct company establishment, foreign investors may consider other investment options in Turkey, such as:

Share Acquisition: Buying shares of an existing company instead of establishing a new one,

Liaison Offices: Setting up representative offices that handle non-commercial activities,

Franchising: Turkey’s franchising market is open to foreign entrepreneurs, though it is governed by general contract law rather than specific franchising regulations.

Moreover, the Investment Incentive Regime provides significant benefits for businesses in various sectors, including tax reductions, exemptions, and subsidies, making it an appealing option for entrepreneurs considering long-term investments in Turkey.

Additional Steps and Requirements

Beyond the formal registration process, businesses must fulfill several other requirements to begin operations, including:

Opening a bank account,

Obtaining a tax identification number,

Registering for social security if employees are hired,

Acquiring relevant licenses and permits based on the industry.

For example, businesses in the health sector are subject to additional licensing requirements, and recent updates to the 2024 Medical Laboratories Regulation have made significant changes in this field.

Liquidation Process

Companies in Turkey may undergo liquidation through either a voluntary or compulsory process. Liquidation involves selling the company’s assets, collecting receivables, and paying off debts. The liquidation procedure is governed by the Enforcement and Bankruptcy Code (No. 2004) and requires careful management to ensure that the legal entity is properly dissolved.

Conclusion

Turkey’s favorable legal environment, strategic location, and recent regulatory developments offer substantial opportunities for investors. Whether establishing a new company, acquiring shares, or exploring franchising opportunities, Turkey’s business-friendly framework provides a solid foundation for growth. By navigating the legal and bureaucratic processes with the help of experienced legal professionals, foreign and domestic entrepreneurs can successfully establish and expand their businesses in Turkey.

For more information about this topic, please click to https://www.pilc.law/establishment-of-a-company-in-turkey/

5 notes

·

View notes

Text

China Recruitment Results 2025: Trends, Insights, and Analysis

As the arena's second-biggest economy, China is still a primary player within the international exertions marketplace. The today's recruitment effects from 2025 display key trends and insights across industries, demographics, and regions. Companies, activity seekers, and policymakers alike can gain from know-how these shifts, as they replicate China's evolving economic landscape, expertise priorities, and marketplace demands.

Recruitment Process In China

1. Strong Recovery in Recruitment Activity

In 2025, China’s recruitment market noticed a incredible rebound, following years of pandemic-associated disruptions and financial uncertainty. According to statistics from a couple of human resources and exertions market tracking agencies, general job openings in China increased through about 12% 12 months-on-12 months. This growth turned into frequently driven via sectors which include generation, renewable power, superior production, and modern-day offerings, which includes finance and healthcare.

The surge in recruitment pastime is basically attributed to China’s push closer to monetary modernization and innovation, aligning with the government’s "14th Five-Year Plan" and its vision for incredible development. Furthermore, easing COVID-19 restrictions inside the past two years has revitalized domestic demand, especially in urban centers like Shanghai, Shenzhen, and Beijing, wherein expertise demand stays high.

2. Sector-by using-Sector Breakdown

Technology Sector

China’s tech enterprise stays one in every of the most important recruiters in 2025, with hiring increasing with the aid of 15% in comparison to 2024. Companies running in regions such as synthetic intelligence (AI), semiconductor production, cloud computing, and 5G/6G network infrastructure are main the demand. In precise, the AI and automation sectors skilled document-breaking recruitment, as agencies throughout numerous industries put into effect virtual transformation techniques.

Manufacturing and New Energy

Advanced manufacturing—together with robotics, aerospace, and electric vehicles (EVs)—recorded an eleven% uptick in hiring. With China striving to grow to be a global leader in EV production and inexperienced technology, recruitment in battery generation, renewable energy engineering, and environmental technology has also elevated. The expansion of sun and wind electricity initiatives in inland provinces which include Inner Mongolia and Xinjiang has opened new activity opportunities out of doors main metropolitan hubs.

Financial and Business Services

Financial offerings confirmed a moderate but consistent 7% increase in hiring, in particular in fintech, funding banking, and risk management roles. The fast adoption of virtual finance systems and the growth of inexperienced finance initiatives contributed to this upward fashion. Similarly, prison and compliance departments saw a surge in call for, as stricter regulatory requirements and international exchange dynamics precipitated corporations to strengthen their internal controls.

Healthcare and Life Sciences

China’s growing old populace and the authorities's focus on enhancing healthcare infrastructure have boosted hiring within the medical and pharmaceutical sectors. Hospitals, biotech firms, and healthtech startups elevated recruitment via nine% yr-on-12 months. Special emphasis become placed on roles associated with scientific research, clinical trials, and public fitness management, reflecting China's ambitions to beautify its healthcare resilience.

Three. Regional Disparities in Recruitment

While Tier 1 towns like Beijing, Shanghai, Guangzhou, and Shenzhen hold to dominate in phrases of activity vacancies, there was a major uptick in hiring in Tier 2 and Tier 3 towns, which includes Chengdu, Hangzhou, Xi’an, and Suzhou. The government’s urbanization strategy and nearby improvement rules are riding this shift. Inland provinces and less-advanced regions are actually attracting extra investment, main to activity advent in industries along with logistics, e-trade, and smart production.

This geographic diversification is also related to the upward thrust of far off work, as agencies come to be more bendy in hiring talent from diverse locations. As a end result, skilled specialists are now not limited to standard financial hubs and are finding competitive possibilities in rising cities.

4. Recruitment Challenges: Skills Gaps and Talent Shortages