#Secure transaction processing

Explore tagged Tumblr posts

Text

How to Reduce Cart Abandonment and Close More Sales with the Right Payment Gateway

Cart abandonment is a major challenge for online businesses. A slow or complicated checkout process can turn potential customers away. Choosing the right payment gateway ensures a smooth, secure, and hassle-free payment experience—boosting conversions and sales.

Here’s how the right payment gateway helps: ✅ Faster Checkout – Reduce friction with quick and easy payment processing. ✅ Multiple Payment Options – Accept cards, wallets, and local UAE payment methods. ✅ Secure Transactions – Build customer trust with PCI DSS compliance. ✅ Seamless Integration – Connect with your website or app effortlessly.

💳 Boost Conversions with Foloosi! Start Accepting Payments Now

#Best payment gateway in uae#Foloosi payment gateway#Secure transaction processing#Top payment gateway in UAE#Digital payment solutions UAE#Secure online payments#Online payment solutions in sharjah#Payment gateway UAE#Best payment gateway for businesses#payment solution in abu dhabi#Businesses UAE

0 notes

Text

#eCheck#Electronic checks#ACH (Automated Clearing House)#Digital payments#Payment processing#Merchant services#Payment solutions#Secure transactions#Business payments#Online payments#Payment gateway#Payment technology#Financial services#E-commerce#Retail business#Small business#USA businesses#American merchants#Payment methods#Payment processing company#Payment processing solutions#Electronic payment options#Payment security#Card processing#Payment terminals#Mobile payments#Payment software#Point of sale (POS)#Payment integration#Business growth

7 notes

·

View notes

Text

#IoT Testing#Internet of Things#Device Testing#Functional Testing#Performance Testing#Security Testing#Interoperability Testing#Usability Testing#Regression Testing#IoT Security#Smart Devices#Connected Systems#IoT Protocols#GQATTech#IoT Solutions#Data Privacy#System Integration#User Experience#IoT Performance#Compliance Testing#POS Testing#Point of Sale#Retail Technology#Transaction Processing#System Reliability#Customer Experience#Compatibility Testing#Retail Operations#Payment Systems#PCI DSS Compliance

0 notes

Text

Cash Against Documents: A Practical Tool for Global Trade

In international trade, doing business across borders brings both opportunity and risk. One of the biggest concerns for exporters is getting paid, especially when dealing with buyers in new markets. At the same time, buyers don’t want to pay before goods are shipped. A practical solution that balances both sides is Cash Against Documents (CAD). CAD is a payment method where the seller ships the…

#balanced payment method#bank-to-bank communication#Bill of Lading#CAD#cash against documents#Commercial Invoice#cross-border business#document collection#document-based payment#export strategy#exporters#freight forwarding#Global Commerce#global supply chain#global trade#import-export#importers#international shipping#International Trade#international transactions#payment control#Payment Terms#secure payment method#shipping documents#simple trade method#trade assurance#trade documentation#Trade Finance#trade process#trade protection

0 notes

Text

Build the Future of Gaming with Crypto Casino Development Solutions

#In a world where innovation drives the gaming industry#the rise of crypto casino game development is reshaping the way players and developers think about online gambling. This is because blockch#allowing developers and entrepreneurs to create immersive#secure#and decentralized casino experiences in unprecedented ways. This is not a trend; it's here to stay.#The Shift towards Crypto Casinos#Imagine a world that could be defined by transparency#security#and accessibility for your games. That's precisely what crypto casino game development is trying to bring to the table. Traditionally#online casinos have suffered because of trust issues and minimal choices for payment options. This changes with blockchain technology and c#Blockchain in casino games ensures that all transactions are secure#transparent#and tamper-proof. Thus#players can check how fair a game is#transfer money into and out of the account using cryptocurrencies#and maintain anonymity while playing games. It is not only technologically different but also culturally. This shift appeals to a whole new#What Makes Crypto Casino Game Development Unique?#Crypto casino game development offers features that set it apart from traditional online casinos. Let’s delve into some of these groundbrea#Decentralization and TransparencyBlockchain-powered casinos operate without centralized control#ensuring all transactions and game outcomes are verifiable on a public ledger. This transparency builds trust among players.#Enhanced SecurityWith smart contracts automating processes and blockchain technology securing transactions#crypto casinos significantly reduce the risk of hacking and fraud.#Global AccessibilityCryptocurrencies break the barriers that traditional banking systems have#making it possible for players from around the world to participate without having to think about currency conversion or restricted regions#Customizable Gaming ExperiencesDevelopers can customize crypto casino platforms with unique features such as NFT rewards#tokenized assets#and loyalty programs#making the game more interesting and personalized.#Success Story of Real Life#Crypto casino game development has already brought about success stories worldwide. Among them

1 note

·

View note

Text

Billing Software Development Services IBR Infotech

IBR Infotech specializes in providing custom billing software development services designed to streamline your invoicing, payment processing, and transaction management. Our solutions offer seamless integration with existing systems, ensuring accurate, automated billing processes that enhance financial operations.

With a focus on user-friendly interfaces and robust security, our billing software helps businesses reduce manual errors, improve cash flow, and maintain compliance. Whether you're a small business or a large enterprise, our scalable solutions can be tailored to meet your specific needs, ensuring efficiency and accuracy across your billing cycles. Let IBR Infotech transform your billing system into a powerful tool for financial management and business growth. Read more -https://www.ibrinfotech.com/solutions/custom-billing-software-development #BillingSoftware #SoftwareDevelopment #CustomBilling #InvoicingSoftware #PaymentProcessing #TransactionManagement #AutomatedBilling #FinancialManagement #SecureBilling #BillingSolutions #ScalableSoftware #BusinessSoftware #CashFlowManagement #BillingSystem #TechSolutions #EnterpriseSoftware #BillingServices #FinancialTech #SoftwareDevelopmentServices

#billing software development#custom billing software#invoicing software solutions#payment processing software#transaction management system#automated billing#secure billing software#financial management software#billing system integration#custom invoicing software#user-friendly billing system#billing software for businesses#financial operations software#automated invoicing solutions

0 notes

Text

Are you ready to streamline your operations and elevate your business? At JustForPay, we provide everything you need under one roof—from payment solutions and invoicing to inventory management and customer support.

For more info visit at: https://www.justforpay.co.in

#Payment Solutions#Online Payments#Secure Transactions#Digital Payment Gateway#Payment Processing#E-commerce Solutions

0 notes

Text

In the current rapidly evolving digital currency market, decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop, as a leading decentralized lending platform, not only provides a safe and transparent lending environment, but also opens up new passive income channels for users through its innovative sharing reward system.

Personal links and permanent ties: Create a stable revenue stream One of the core parts of Bit Loop is its recommendation system, which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bit Loop, but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanently tied to the recommender, ensuring that the sharer can continue to receive rewards from the offline partner’s activities.

Unalterable referral relationships: Ensure fairness and transparency A significant advantage of blockchain technology is the immutability of its data. In Bit Loop, this means that once a referral link and live partnership is established, the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders, but also brings a stable user base and activity to the platform, while ensuring the fairness and transparency of transactions.

Automatically distribute rewards: Simplify the revenue process Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner completes the circulation cycle, such as investment returns or loan payments, the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This automatic reward distribution mechanism not only simplifies the process of receiving benefits, but also greatly improves the efficiency of capital circulation.

Privacy protection and security: A security barrier for funds All transactions and money flows are carried out on the blockchain, guaranteeing transparency and traceability of every operation. In addition, the use of smart contracts significantly reduces the risk of fraud and misoperation, providing a solid security barrier for user funds. Users can confidently invest and promote boldly, and enjoy the various conveniences brought by decentralized finance.

conclusion As decentralized finance continues to evolve, Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent financial services while also earning passive income by building and maintaining a personal network. Whether for investors seeking stable passive income or innovators looking to explore new financial possibilities through blockchain technology, Bit Loop provides a platform not to be missed.

#In the current rapidly evolving digital currency market#decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop#as a leading decentralized lending platform#not only provides a safe and transparent lending environment#but also opens up new passive income channels for users through its innovative sharing reward system.#Personal links and permanent ties: Create a stable revenue stream#One of the core parts of Bit Loop is its recommendation system#which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bi#but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanent#ensuring that the sharer can continue to receive rewards from the offline partner’s activities.#Unalterable referral relationships: Ensure fairness and transparency#A significant advantage of blockchain technology is the immutability of its data. In Bit Loop#this means that once a referral link and live partnership is established#the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders#but also brings a stable user base and activity to the platform#while ensuring the fairness and transparency of transactions.#Automatically distribute rewards: Simplify the revenue process#Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner complet#such as investment returns or loan payments#the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This au#but also greatly improves the efficiency of capital circulation.#Privacy protection and security: A security barrier for funds#All transactions and money flows are carried out on the blockchain#guaranteeing transparency and traceability of every operation. In addition#the use of smart contracts significantly reduces the risk of fraud and misoperation#providing a solid security barrier for user funds. Users can confidently invest and promote boldly#and enjoy the various conveniences brought by decentralized finance.#conclusion#As decentralized finance continues to evolve#Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent fin

1 note

·

View note

Text

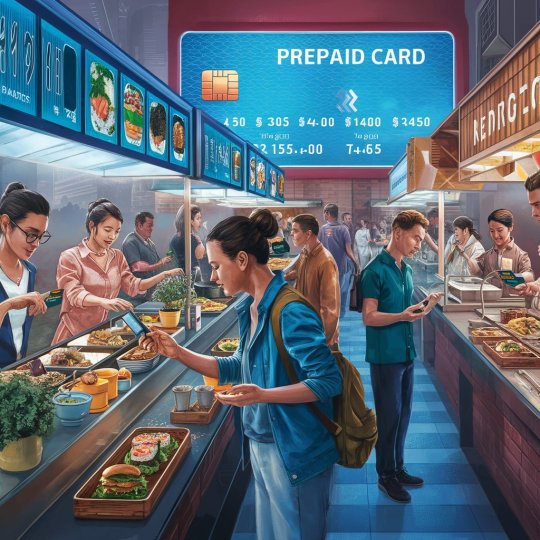

Prepaid Cards Revolutionize Cashless Dining in Food Courts

Introduction to Prepaid Cards

In today's fast-paced world, convenience is paramount, especially when it comes to dining out. Prepaid cards have emerged as a revolutionary solution, offering a seamless and efficient way to enjoy cashless dining experiences. The concept of prepaid cards is not new, but their integration into food courts has sparked a significant shift in consumer behavior.

Cashless Dining Trends

The global trend towards cashless transactions has gained momentum in recent years, driven by advancements in technology and changing consumer preferences. In food courts, where speed and convenience are key, the adoption of cashless payment methods has become increasingly prevalent.

Challenges in Traditional Payment Methods

Traditional payment methods, such as cash or credit/debit cards, pose several challenges in food court settings. Cash transactions can lead to long queues and delays, while credit/debit card payments may be inconvenient for both consumers and vendors due to processing fees and minimum purchase requirements.

The Emergence of Prepaid Cards in Food Courts

To address these challenges, food courts are embracing prepaid card systems, revolutionizing the way customers pay for their meals. By preloading funds onto a card, customers can enjoy quick and hassle-free transactions, eliminating the need for cash or physical cards.

How Prepaid Cards Work

Prepaid cards operate on a simple premise: customers load funds onto their cards either online or at designated kiosks within the food court. They can then use these funds to make purchases at any participating vendor within the food court.

Advantages of Prepaid Cards in Food Courts

The benefits of prepaid cards in food courts are manifold. For consumers, they offer unmatched convenience and speed, allowing them to make purchases with a simple tap or swipe. Additionally, prepaid cards provide consumers with greater control over their spending, helping them stick to their budgets more effectively.

For food court operators, prepaid cards streamline transaction processing, reducing wait times and enhancing overall efficiency. By centralizing payments through a single platform, vendors can also gain valuable insights into consumer behavior and preferences, enabling them to tailor their offerings accordingly.

Enhanced Customer Experience

One of the key advantages of prepaid cards in food courts is the enhanced customer experience they provide. By minimizing wait times and offering seamless transactions, prepaid cards ensure that customers spend less time queuing and more time enjoying their meals.

Moreover, prepaid cards enable food court operators to implement customized loyalty programs, rewarding customers for their continued patronage. By offering incentives such as discounts or freebies, operators can further enhance the overall dining experience and foster customer loyalty.

Security and Safety Measures

Security is a top priority in any payment system, and prepaid cards are no exception. With robust encryption protocols and built-in fraud detection mechanisms, prepaid card systems offer consumers peace of mind knowing that their financial information is safe and secure.

Additionally, prepaid cards eliminate the need for consumers to carry large amounts of cash, reducing the risk of theft or loss. In the event that a card is lost or stolen, most prepaid card providers offer 24/7 customer support and the ability to freeze or deactivate the card remotely.

Adoption and Acceptance

The adoption of prepaid cards in food courts is steadily increasing, driven by the growing demand for cashless payment options. As more consumers become accustomed to the convenience and benefits of prepaid cards, food court vendors are increasingly recognizing the need to offer these payment methods to remain competitive.

Impact on Business Operations

From a business perspective, the integration of prepaid card systems can have a transformative impact on operations. By automating transaction processing and streamlining administrative tasks, vendors can reduce overhead costs and improve overall efficiency.

Moreover, prepaid card systems provide vendors with valuable data insights, allowing them to track sales trends, identify popular menu items, and target specific customer demographics more effectively. This data-driven approach enables vendors to make informed decisions that drive business growth and profitability.

Future Trends and Innovations

Looking ahead, the future of prepaid cards in food courts looks promising, with continued advancements in technology driving innovation and customization. From mobile payment solutions to personalized loyalty programs, vendors are constantly seeking new ways to enhance the customer experience and stay ahead of the competition.

Challenges and Concerns

Despite the many benefits of prepaid cards, there are also challenges and concerns that must be addressed. Chief among these is the need to ensure consumer privacy and data security. As prepaid card systems become more sophisticated, it is essential for vendors to implement robust privacy policies and security measures to protect customer information.

Additionally, accessibility remains a concern for some consumers, particularly those who may not have access to smartphones or digital payment methods. To address this issue, food courts must ensure that alternative payment options are available to accommodate all customers.

Case Studies and Success Stories

Numerous food courts around the world have already embraced prepaid card systems with great success. From small-scale vendors to large multinational chains, businesses of all sizes have reported significant improvements in transaction processing times, customer satisfaction, and overall revenue.

For example, a recent case study conducted by a major food court operator found that the implementation of prepaid card systems resulted in a 30% increase in sales and a 20% reduction in wait times. These impressive results demonstrate the tangible benefits that prepaid cards can

offer to both consumers and businesses alike.

Consumer Education and Awareness

Despite the growing popularity of prepaid cards, there is still a need for consumer education and awareness. Many consumers may be unfamiliar with how prepaid cards work or may have misconceptions about their usage and benefits. As such, food courts must invest in educational campaigns to inform consumers about the advantages of prepaid cards and how to use them effectively.

Conclusion

In conclusion, prepaid cards are revolutionizing the way consumers pay for their meals in food courts. By offering unmatched convenience, speed, and security, prepaid cards are transforming the dining experience for both customers and vendors alike. As the adoption of prepaid cards continues to grow, food courts are poised to reap the benefits of improved efficiency, increased revenue, and enhanced customer satisfaction.

We hope you enjoyed reading our blog posts about food court billing solutions. If you want to learn more about how we can help you manage your food court business, please visit our website here. We are always happy to hear from you and answer any questions you may have.

You can reach us by phone at +91 9810078010 or by email at [email protected]. Thank you for your interest in our services.

FAQs

1. Are prepaid cards accepted at all vendors in the food court?

Yes, prepaid cards can typically be used at any participating vendor within the food court.

2. Can I reload funds onto my prepaid card?

Yes, most prepaid card systems allow users to reload funds either online or at designated kiosks within the food court.

3. Is my personal information secure when using a prepaid card?

Yes, prepaid card systems employ robust security measures to protect customer information and prevent unauthorized access.

4. Are there any fees associated with using a prepaid card?

Some prepaid card providers may charge nominal fees for certain services, such as reloading funds or replacing lost or stolen cards.

5. Can I earn rewards or loyalty points with a prepaid card?

Yes, many prepaid card systems offer rewards or loyalty programs that allow users to earn points or discounts on their purchases.

#prepaid cards#cashless dining#food courts#payment methods#prepaid card systems#consumer convenience#customer experience#cashless transactions#digital payments#financial security#loyalty programs#transaction processing#data analytics#customer education#privacy concerns#business efficiency#innovation#technology integration#consumer awareness#case studies#success stories#FAQs#blogging#digital trends#restaurant industry#financial technology#prepaid card benefits#prepaid card acceptance

0 notes

Text

Cardano (ADA): Sell it for Solana?

New Post has been published on https://www.ultragamerz.com/cardano-ada-sell-it-for-solana/

Cardano (ADA): Sell it for Solana?

Cardano (ADA): Sell it for Solana?

Cardano (ADA), the brainchild of Ethereum co-founder Charles Hoskinson, has been a hot topic in the crypto space. However, with a recent barrage of bearish news and influencer skepticism, some are questioning whether ADA is all it’s cracked up to be. Let’s delve into the world of Cardano, separating hype from reality.

Influencer FOMO and the Solana Shadow:

Social media is flooded with “Cardano killers” like Solana (SOL) boasting lightning-fast transaction speeds and lower fees. Influencers, often swayed by short-term gains, are hyping SOL to the moon, leaving Cardano seemingly stuck in the dust.

Cardano’s Different Path:

However, Cardano takes a much different approach than the “move fast and break things” mentality of some competitors. Cardano prioritizes meticulous research and a peer-reviewed development process. This methodical approach, while slower, aims to deliver a more secure and scalable blockchain in the long run.

Cardano vs. The Hype Machine:

Recent bearish articles highlight Cardano’s slow development progress and missed deadlines. While these criticisms hold some weight, it’s important to remember Cardano is building a complex ecosystem.

The ADA Price:

Cardano’s Bullish Trajectory: A Technical Analysis Glimpse

Cardano (ADA) has been on a tear lately, and technical analysts are using charting tools to predict its potential price path. Here’s a breakdown of three possible targets based on different timeframes:

Short-Term (1-2 Months): Applying the Fibonacci retracement tool to ADA’s recent price surge suggests a first target of around $2.20. This level represents the 61.8% retracement of the current upswing, a common support zone after a price increase.

Mid-Term (3-6 Months): If the bullish momentum continues, a more ambitious target could be $14. This aligns with the 161.8% Fibonacci extension level, indicating a potential doubling of the current price within the next half year. However, reaching this target zone would require sustained buying pressure and positive news surrounding the Cardano ecosystem.

Long-Term (1+ Years): For the long-term hodlers (holders on for a dear life), some analysts are charting a much more aggressive target – a staggering $55. This aligns with the 261.8% Fibonacci extension, signifying a potential 25x return on investment from current levels. However, reaching this price point would require significant adoption of Cardano’s blockchain technology and widespread recognition of its functionalities.

Remember: This is for informational purposes only and should not be considered financial advice. Technical analysis is just one tool, and market conditions can change rapidly. Always conduct your own research before making any investment decisions.

Is ADA a Worthy Investment?

While some influencers are quick to dismiss ADA, it’s crucial to conduct your own research and understand Cardano’s unique value proposition. Here are some key aspects to consider:

Scalability: Cardano’s Ouroboros proof-of-stake consensus mechanism aims to achieve high transaction throughput without sacrificing decentralization, a challenge faced by many blockchains.

Smart Contracts: Cardano’s smart contract platform, Plutus, is built with security and formal verification in mind, aiming to minimize bugs and vulnerabilities.

Interoperability: Cardano’s vision includes interoperability with other blockchains, allowing seamless transfer of data and assets across different ecosystems.

Bearish News and Price Performance:

Despite the recent bearish sentiment, it’s worth noting that ADA started the current market cycle at around $0.20 and reached a peak of over $3.00, a significant increase. This demonstrates that long-term investors still see value in Cardano’s long-term vision.

Is ADA Right for You?

The decision to invest in ADA depends on your risk tolerance and investment horizon. If you’re looking for a quick pump based on influencer hype, Cardano might not be the best choice. However, if you believe in Cardano’s long-term vision of a secure and scalable blockchain platform, ADA could be a worthwhile investment for your portfolio.

Remember:

The cryptocurrency market is notoriously volatile and prone to hype cycles. Always conduct thorough research, understand the risks involved, and never invest more than you can afford to lose.

#bearish news#Cardano (ADA)#Cardano killers#Charles Hoskinson#consensus mechanism#Cryptocurrency Market#decentralization#Ethereum (ETH)#Ethereum co-founder#fees#formal verification#hype#hype cycles#influencer FOMO (Fear of Missing Out)#interoperability#investment#long-term vision#Ouroboros proof-of-stake#peer-reviewed development process#Plutus#price performance#research#risk#risk tolerance#scalability#secure blockchain#security#smart contracts#Solana (SOL)#transaction speeds

0 notes

Text

SHOPIFY PAYMENTS: SIMPLIFYING TRANSACTIONS FOR YOUR CUSTOMERS

In the dynamic world of e-commerce, the ability to provide a seamless and secure payment experience is paramount. Shopify, a leading e-commerce platform, understands this necessity and has introduced Shopify Payments as an integrated solution to streamline transactions for both merchants and customers.

Understanding Shopify Payments:

Shopify Payments is a payment gateway designed to simplify the online purchasing process for businesses operating on the Shopify platform. It eliminates the need for third-party payment processors, offering an all-in-one solution that seamlessly integrates with the Shopify ecosystem.

Seamless Integration:

One of the key advantages of Shopify Payments is its seamless integration with the Shopify platform. Merchants can set up and manage their payment processes directly within their Shopify dashboard, eliminating the need for additional third-party accounts or complex integrations. This streamlines the entire process, allowing businesses to focus on their products and customer experience.

Diverse Payment Options:

Shopify Payments supports a wide range of payment methods, catering to the diverse preferences of customers globally. Whether it’s credit cards, debit cards, or alternative payment methods, Shopify Payments ensures that businesses can offer a variety of options to their customers, enhancing convenience and accessibility.

Enhanced Security:

Security is a top priority in online transactions, and Shopify Payments prioritizes the protection of sensitive information. It is fully PCI compliant, adhering to industry standards for secure payment processing. With end-to-end encryption and fraud prevention measures, customers can have confidence in the safety of their transactions.

Streamlined Checkout Experience:

Shopify Payments contributes to a smooth and efficient checkout process. The integration allows customers to complete their transactions without being redirected to external websites, reducing friction and increasing the likelihood of successful purchases. This user-friendly experience can lead to higher conversion rates and improved customer satisfaction.

Automatic Updates and Reporting:

Shopify Payments provides merchants with automatic updates on transactions and settlements directly within their Shopify admin. The platform also offers detailed reports and analytics, giving businesses valuable insights into their sales performance, customer behavior, and payment trends.

Multi-Currency Support:

For businesses with a global customer base, Shopify Payments supports transactions in multiple currencies. This feature allows merchants to sell internationally without the hassle of currency conversions, providing a more transparent and convenient shopping experience for customers around the world.

Customer Trust and Brand Loyalty:

By utilizing Shopify Payments, businesses can build trust with their customers. The integration of a reliable and secure payment system enhances the overall brand image, fostering customer loyalty and encouraging repeat business.

In conclusion, Shopify Payments stands out as a robust and user-friendly solution for handling transactions in the e-commerce realm. From its seamless integration with the Shopify platform to its diverse payment options and emphasis on security, Shopify Payments plays a crucial role in simplifying the payment process for both merchants and customers, contributing to a more efficient and trustworthy online shopping experience. To know more visit us at https://magnigeeks.com

#Shopify Payments#E-commerce Transactions#Simplified Payments#Secure Online Payments#Shopify Payment Gateway#Integrated Payment Solutions#Online Store Payments#Shopify Merchant Services#Simplify Customer Transactions#Shopify POS Payments#Secure and Easy Online Transactions#Integrated Payment Processing#magnigeeks

1 note

·

View note

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Text

How I got scammed

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/02/05/cyber-dunning-kruger/#swiss-cheese-security

I wuz robbed.

More specifically, I was tricked by a phone-phisher pretending to be from my bank, and he convinced me to hand over my credit-card number, then did $8,000+ worth of fraud with it before I figured out what happened. And then he tried to do it again, a week later!

Here's what happened. Over the Christmas holiday, I traveled to New Orleans. The day we landed, I hit a Chase ATM in the French Quarter for some cash, but the machine declined the transaction. Later in the day, we passed a little credit-union's ATM and I used that one instead (I bank with a one-branch credit union and generally there's no fee to use another CU's ATM).

A couple days later, I got a call from my credit union. It was a weekend, during the holiday, and the guy who called was obviously working for my little CU's after-hours fraud contractor. I'd dealt with these folks before – they service a ton of little credit unions, and generally the call quality isn't great and the staff will often make mistakes like mispronouncing my credit union's name.

That's what happened here – the guy was on a terrible VOIP line and I had to ask him to readjust his mic before I could even understand him. He mispronounced my bank's name and then asked if I'd attempted to spend $1,000 at an Apple Store in NYC that day. No, I said, and groaned inwardly. What a pain in the ass. Obviously, I'd had my ATM card skimmed – either at the Chase ATM (maybe that was why the transaction failed), or at the other credit union's ATM (it had been a very cheap looking system).

I told the guy to block my card and we started going through the tedious business of running through recent transactions, verifying my identity, and so on. It dragged on and on. These were my last hours in New Orleans, and I'd left my family at home and gone out to see some of the pre-Mardi Gras krewe celebrations and get a muffalata, and I could tell that I was going to run out of time before I finished talking to this guy.

"Look," I said, "you've got all my details, you've frozen the card. I gotta go home and meet my family and head to the airport. I'll call you back on the after-hours number once I'm through security, all right?"

He was frustrated, but that was his problem. I hung up, got my sandwich, went to the airport, and we checked in. It was total chaos: an Alaska Air 737 Max had just lost its door-plug in mid-air and every Max in every airline's fleet had been grounded, so the check in was crammed with people trying to rebook. We got through to the gate and I sat down to call the CU's after-hours line. The person on the other end told me that she could only handle lost and stolen cards, not fraud, and given that I'd already frozen the card, I should just drop by the branch on Monday to get a new card.

We flew home, and later the next day, I logged into my account and made a list of all the fraudulent transactions and printed them out, and on Monday morning, I drove to the bank to deal with all the paperwork. The folks at the CU were even more pissed than I was. The fraud that run up to more than $8,000, and if Visa refused to take it out of the merchants where the card had been used, my little credit union would have to eat the loss.

I agreed and commiserated. I also pointed out that their outsource, after-hours fraud center bore some blame here: I'd canceled the card on Saturday but most of the fraud had taken place on Sunday. Something had gone wrong.

One cool thing about banking at a tiny credit-union is that you end up talking to people who have actual authority, responsibility and agency. It turned out the the woman who was processing my fraud paperwork was a VP, and she decided to look into it. A few minutes later she came back and told me that the fraud center had no record of having called me on Saturday.

"That was the fraudster," she said.

Oh, shit. I frantically rewound my conversation, trying to figure out if this could possibly be true. I hadn't given him anything apart from some very anodyne info, like what city I live in (which is in my Wikipedia entry), my date of birth (ditto), and the last four digits of my card.

Wait a sec.

He hadn't asked for the last four digits. He'd asked for the last seven digits. At the time, I'd found that very frustrating, but now – "The first nine digits are the same for every card you issue, right?" I asked the VP.

I'd given him my entire card number.

Goddammit.

The thing is, I know a lot about fraud. I'm writing an entire series of novels about this kind of scam:

https://us.macmillan.com/books/9781250865878/thebezzle

And most summers, I go to Defcon, and I always go to the "social engineering" competitions where an audience listens as a hacker in a soundproof booth cold-calls merchants (with the owner's permission) and tries to con whoever answers the phone into giving up important information.

But I'd been conned.

Now look, I knew I could be conned. I'd been conned before, 13 years ago, by a Twitter worm that successfully phished out of my password via DM:

https://locusmag.com/2010/05/cory-doctorow-persistence-pays-parasites/

That scam had required a miracle of timing. It started the day before, when I'd reset my phone to factory defaults and reinstalled all my apps. That same day, I'd published two big online features that a lot of people were talking about. The next morning, we were late getting out of the house, so by the time my wife and I dropped the kid at daycare and went to the coffee shop, it had a long line. Rather than wait in line with me, my wife sat down to read a newspaper, and so I pulled out my phone and found a Twitter DM from a friend asking "is this you?" with a URL.

Assuming this was something to do with those articles I'd published the day before, I clicked the link and got prompted for my Twitter login again. This had been happening all day because I'd done that mobile reinstall the day before and all my stored passwords had been wiped. I entered it but the page timed out. By that time, the coffees were ready. We sat and chatted for a bit, then went our own ways.

I was on my way to the office when I checked my phone again. I had a whole string of DMs from other friends. Each one read "is this you?" and had a URL.

Oh, shit, I'd been phished.

If I hadn't reinstalled my mobile OS the day before. If I hadn't published a pair of big articles the day before. If we hadn't been late getting out the door. If we had been a little more late getting out the door (so that I'd have seen the multiple DMs, which would have tipped me off).

There's a name for this in security circles: "Swiss-cheese security." Imagine multiple slices of Swiss cheese all stacked up, the holes in one slice blocked by the slice below it. All the slices move around and every now and again, a hole opens up that goes all the way through the stack. Zap!

The fraudster who tricked me out of my credit card number had Swiss cheese security on his side. Yes, he spoofed my bank's caller ID, but that wouldn't have been enough to fool me if I hadn't been on vacation, having just used a pair of dodgy ATMs, in a hurry and distracted. If the 737 Max disaster hadn't happened that day and I'd had more time at the gate, I'd have called my bank back. If my bank didn't use a slightly crappy outsource/out-of-hours fraud center that I'd already had sub-par experiences with. If, if, if.

The next Friday night, at 5:30PM, the fraudster called me back, pretending to be the bank's after-hours center. He told me my card had been compromised again. But: I hadn't removed my card from my wallet since I'd had it replaced. Also, it was half an hour after the bank closed for the long weekend, a very fraud-friendly time. And when I told him I'd call him back and asked for the after-hours fraud number, he got very threatening and warned me that because I'd now been notified about the fraud that any losses the bank suffered after I hung up the phone without completing the fraud protocol would be billed to me. I hung up on him. He called me back immediately. I hung up on him again and put my phone into do-not-disturb.

The following Tuesday, I called my bank and spoke to their head of risk-management. I went through everything I'd figured out about the fraudsters, and she told me that credit unions across America were being hit by this scam, by fraudsters who somehow knew CU customers' phone numbers and names, and which CU they banked at. This was key: my phone number is a reasonably well-kept secret. You can get it by spending money with Equifax or another nonconsensual doxing giant, but you can't just google it or get it at any of the free services. The fact that the fraudsters knew where I banked, knew my name, and had my phone number had really caused me to let down my guard.

The risk management person and I talked about how the credit union could mitigate this attack: for example, by better-training the after-hours card-loss staff to be on the alert for calls from people who had been contacted about supposed card fraud. We also went through the confusing phone-menu that had funneled me to the wrong department when I called in, and worked through alternate wording for the menu system that would be clearer (this is the best part about banking with a small CU – you can talk directly to the responsible person and have a productive discussion!). I even convinced her to buy a ticket to next summer's Defcon to attend the social engineering competitions.

There's a leak somewhere in the CU systems' supply chain. Maybe it's Zelle, or the small number of corresponding banks that CUs rely on for SWIFT transaction forwarding. Maybe it's even those after-hours fraud/card-loss centers. But all across the USA, CU customers are getting calls with spoofed caller IDs from fraudsters who know their registered phone numbers and where they bank.

I've been mulling this over for most of a month now, and one thing has really been eating at me: the way that AI is going to make this kind of problem much worse.

Not because AI is going to commit fraud, though.

One of the truest things I know about AI is: "we're nowhere near a place where bots can steal your job, we're certainly at the point where your boss can be suckered into firing you and replacing you with a bot that fails at doing your job":

https://pluralistic.net/2024/01/15/passive-income-brainworms/#four-hour-work-week

I trusted this fraudster specifically because I knew that the outsource, out-of-hours contractors my bank uses have crummy headsets, don't know how to pronounce my bank's name, and have long-ass, tedious, and pointless standardized questionnaires they run through when taking fraud reports. All of this created cover for the fraudster, whose plausibility was enhanced by the rough edges in his pitch - they didn't raise red flags.

As this kind of fraud reporting and fraud contacting is increasingly outsourced to AI, bank customers will be conditioned to dealing with semi-automated systems that make stupid mistakes, force you to repeat yourself, ask you questions they should already know the answers to, and so on. In other words, AI will groom bank customers to be phishing victims.

This is a mistake the finance sector keeps making. 15 years ago, Ben Laurie excoriated the UK banks for their "Verified By Visa" system, which validated credit card transactions by taking users to a third party site and requiring them to re-enter parts of their password there:

https://web.archive.org/web/20090331094020/http://www.links.org/?p=591

This is exactly how a phishing attack works. As Laurie pointed out, this was the banks training their customers to be phished.

I came close to getting phished again today, as it happens. I got back from Berlin on Friday and my suitcase was damaged in transit. I've been dealing with the airline, which means I've really been dealing with their third-party, outsource luggage-damage service. They have a terrible website, their emails are incoherent, and they officiously demand the same information over and over again.

This morning, I got a scam email asking me for more information to complete my damaged luggage claim. It was a terrible email, from a noreply@ email address, and it was vague, officious, and dishearteningly bureaucratic. For just a moment, my finger hovered over the phishing link, and then I looked a little closer.

On any other day, it wouldn't have had a chance. Today – right after I had my luggage wrecked, while I'm still jetlagged, and after days of dealing with my airline's terrible outsource partner – it almost worked.

So much fraud is a Swiss-cheese attack, and while companies can't close all the holes, they can stop creating new ones.

Meanwhile, I'll continue to post about it whenever I get scammed. I find the inner workings of scams to be fascinating, and it's also important to remind people that everyone is vulnerable sometimes, and scammers are willing to try endless variations until an attack lands at just the right place, at just the right time, in just the right way. If you think you can't get scammed, that makes you especially vulnerable:

https://pluralistic.net/2023/02/24/passive-income/#swiss-cheese-security

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

10K notes

·

View notes

Text

Letters of Credit: A Lifeline for Global Trade

In the global economy, international trade is both an opportunity and a challenge. Opportunities come in the form of expanding markets, diversifying customer bases, and boosting profits. The challenges, however, lie in distance, regulations, currency differences, and most importantly, trust. One of the most effective tools used to bridge that trust gap is the letter of credit.A letter of credit,…

#Asia trade#bank guarantee#bank-issued guarantee#business growth#confirmed letter of credit#cross-border trade#distributor#emerging markets#European supplier#export#export documentation#financial instrument#freight forwarding#Global Commerce#global supply chain#import#international buyer#international deals#international shipping#International Trade#LC#LC process#Letter of Credit#Middle East trade#payment security#Payment Terms#secure payments#secure transactions#South America trade#supplier

0 notes

Text

on today's episode of "i only pay attention and pretend that i give two shits about the sanctity of human rights when there's a freaking Cheeto in the white house"

“While the administration should be lauded for its efforts to provide children and families access to the court system, its failure to ensure legal representation has produced a massive due process crisis,” said Talia Inlender, Deputy Director of the Center for Immigration Law and Policy (CILP) at the UCLA School of Law. “It should be obvious that immigration court proceedings are far too complex for children to navigate without legal representation, especially when the consequences are so dire. The Biden administration must take swift action to ensure legal representation for all children in immigration court.”

The report’s key findings include:

In a five-month period in FY 2022 alone, almost one third of immigration court cases initiated by the Biden administration–more than 80,000 in all–were against children, over 30,000 of whom were under the age of 5, according to the Transactional Records Access Clearinghouse (TRAC).

Studies show that unrepresented unaccompanied children are at least five times more likely to be ordered removed than children with access to counsel.

By the government’s own account, 44% of unaccompanied children and 51% of families on the Dedicated Docket lack legal representation.

The vast majority of removal orders entered against children are for failure to appear: Approximately 72% of removal orders against families on the Los Angeles and Boston Dedicated Dockets were issued in absentia, with over 48% against children, many under the age of six. Worse yet, 86% of removal orders issued against unaccompanied children were for failure to appear.

Immigration courts under the Biden administration ordered more than 13,000 unaccompanied children removed in absentia between Fiscal Years 2022 and 2023.

The report details how the Biden administration’s treatment of children in immigration court is unlawful, and calls on the Biden administration to: prohibit in absentia removal orders against unrepresented children; terminate the Dedicated Docket; and ensure legal representation for all unrepresented children in removal proceedings.

In handwritten cursive, a Russian immigrant named Marina wrote out the story of the day U.S. Customs and Border Protection agents took away her 1-year-old baby while she was being held in a detention facility in southern California. “I cried and begged, kneeling, not to do this, that this was a mistake, not justice and not right,” she wrote. “She was so little that no one knew anything about her. I was very afraid for her and still am!” This didn’t happen during the Trump administration, which separated more than 4,000 migrant children from their families under its controversial “zero tolerance” policy. Marina was separated from her baby in April of this year. The 40-year-old former restaurant manager came to the U.S.-Mexico border with her husband, mother-in-law and child to seek asylum. More than eight months later, she and her mother-in-law remain in federal immigration custody in Louisiana. Her husband is detained at a different Louisiana immigration facility. And Aleksandra is over a thousand miles away, being cared for by strangers in foster care in California. Aleksandra is one of around 300 children the Biden administration has separated from their parents or legal guardians this year, according to two government sources who asked not to be identified because they hadn’t been authorized to speak about the separations. Most of the cases involved families crossing the southwestern border, the sources said. These numbers haven’t previously been reported. Similarly, 298 children were separated from their parents in 2023, according to a government report to Congress published on Tuesday, even as overall migrant crossings have declined. According to the report, the average amount of time children separated between April 2018 and October 2024 have spent in federal custody before being released to a sponsor is 75 days.

Biden responds to Bernie Sanders' immigration plan: "We shouldn't abolish ICE. We should reform the system. ICE is not the problem. The policies behind ICE are the problem, and that's easy enough to fix if the President knows what he or she is doing."

unfortunately Joe never got around to fixing the Gestapo agency but he tried his gosh darndest and he isn't Drumpf so i guess the pride in being an American was still secure at that point for most liberals. i'm sure that when the next charlatan says the same thing that they'll retain this energy, right? right??

2K notes

·

View notes

Text

𝐣𝐮𝐧𝐨

— a rafe cameron one shot (popstar!reader)

✰ when wheezie drags her older brother as her chaperone to the famous ‘short n sweet’ tour to see y/n, her favorite popstar.

rating: sfw — cw: suggestive, mentions drug usage

“rafe!” wheezie called out as her fist repeatedly rapped against his door — no answer. “raaafe!” she called out again before letting out an impatient huff, crossing her arms across her chest as she impatiently waited. suddenly, the large door swung open to reveal her stoic-faced brother, a highly annoyed expression adorning his face. “what d’you want?” he mumbled, staring down at her expectantly with dull blue eyes.

“dad said you have to take me to a concert tonight,” she replied simply, a smug tone in her voice as she brushed past him into his room, dropping herself down onto his unmade bed. rafe spun on his heels in mild bewilderment at her action while mulling over her statement.

“what’re you talkin’ about, wheezie?” he sighed, simply wanting the conversation to be over with already. “got tickets for a concert tonight and you’re takin’ me,” she shrugged as if it was the most obvious thing in the world. “and what makes you think that?” rafe laughed sarcastically, his long bangs shifting as he tilted his head condescendingly.

“well, i asked dad a couple weeks ago ‘n he said he can’t take me ‘cause he’s got plans with rose tonight or whatever — said he’d only get me tickets if you went with me so i told him you would,” she explained, a small smile pulling at the corners of her lips. “why—why would you do that?” rafe scoffed, “s’not happening.”

“figured you’d say that,” wheezie informed, pushing herself off his mattress and standing to her feet, “which is why i’ll just have to tell dad about your little… transaction.” she almost giggled to herself as she watch his eyebrows furrow together, knowing she was about to back him into a tight corner.

“what ‘transaction’ are you talkin’ about? can you make sense for, like, two seconds?” rafe insisted, leaning against the wall before letting out an annoyed sigh. “the one you made down at the pawn shop with dad’s rolex explorer — y’know, the one you said you’ve never seen a day in your life,” the girl countered.

rafe visibly tensed, unsure as to how his little sister knew anything about what he had done. “how d’you know ‘bout that?” he murmured, tongue poking at the inside cheek as he awaited an answer. “maybe don’t leave the receipt on the counter next time,” she sarcastically advised with a shrug before heading for the door and rafe silently cursed himself for such an obvious mistake.

“so, you’ll be ready by five?” she asked sweetly, smiling up at her brother as he pursed his lips, quirking his head to the side as he tightly shut his eyes for a moment, knowing he was between a rock and an extremely hard place.

“yeah, whatever… okay.”

an instant headache — rafe felt it as soon as they pulled into the parking lot of the overly-packed arena; hundreds of cars resulting in them walking nearly ten straight minutes to reach the entrance, and thousands of people to weave through in the process of security screenings, ticket scannings and merchandise purchasing for a crazily expensive t-shirt wheezie just had to have.

the trip alone was hell within itself; the concert was at a venue two-hundred miles away from home, so they had no other choice but to take the jet to avoid a three hour drive — courtesy of their father. though the trip was narrowed down to less than an hour, wheezie still spent the entire time blaring the exact songs she was about to hear in person, while simultaneously gushing to all her friends over the phone about how excited she was for that night. it was fair to say, rafe was already beyond over it.

finding their spot was fairly simple, seeing as their father purchased the best ones available — front row baracade, merely feet away from the main stage. simply leaving his sister to go wait in the car until the migraine of an event was over crossed his mind once or twice, but even he knew that was far from a sound idea. so, there he was, pressed between his sister and a plethora of random fangirls, all screaming at the top of their lungs as the lights began to dim.

he’d be lying if he said he’d never heard of y/n before — her name was everywhere online and her music played on the radio all too often, to which rafe would (almost) always turn off. despite the mild familiarity, he’d never truly seen what she looked like until that very night.

her voluminous, long locks bounced as she emerged from a stage door and skipped to the edge of the stage, sparkly microphone in hand as she greeted the massive crowd.

"welcome to the 'short 'n sweet tour', everybody!" she beamed, rosy cheeks complimenting her bright, white smile as her glossy eyes grazed over the thousands of faces staring back at her. she was stunning, rafe couldn't deny that, though her attire definitely confused him.

"why's she wearin' pajamas?" he yelled over the music as he leaned down towards his sisters ear, genuinely confused while also acknowledging just how well the corset hugged her figure underneath the sheer top. wheeze only rolled her eyes at her painfully clueless brother before averting her attention back to the stage where the show was finally beginning.

rafe felt as though hours had passed before he mentally checked back in to reality. though, here and there, he found himself ogling at her smooth legs as she pranced across the large stage, frequently widening his blue eyes in mild surprise whenever she’d pose suggestively or make a comment that almost had him wanting to cover his sister’s ears.

maybe it was the mind numbing commotion of the concert or simply the bump he took before boarding the jet that caused rafe not to notice the woman on stage staring down directly at him until his sister violently elbowed his ribcage. he let out a groan, holding a hand to his side before his blue eyes landed up on y/n gazing at him with a flirtatious grin on her face.

"guys, there's someone in the audience and i just— god, i'm getting flustered and super hot, right now," y/n gawked, fanning herself with her free hand while two of her equally sparkly dancers stood at either of her sides, one holding a fuzzy set of pink handcuffs that dangled from the tip of her finger.

the large screen behind her lit up with rafe's wide-eyed face and the crowd erupted into cheers and rather intense screams, undoubtably just as aware as y/n at just how attractive the man was. his crystal blue eyes were heavily dilated, jawline prominent from his clenched teeth, and curtain bangs messily splayed over his forehead — nothing short of perfection.

all the while, rafe felt as though his heart had suddenly fallen into the pit of his stomach, his blown out pupils darting from the screen, to her face, down to his sister who was jittering with sheer excitement, back to y/n who was now standing at the very edge of the stage.

"oh my god, i think i just found the love of my life," she fawned, eyes twinkling from the spotlight as she smiled, "what's your name?" rafe was completely frozen; the mixture of drugs in his system and bewilderment from the interaction as a whole causing him not to process the question fast enough to even try to respond.

"rafe!" wheezie yelled on his behalf, averting y/n's attention down to her. "ray?" y/n questioned, lightly furrowing her brows as she extended her microphone in the siblings' direction. "rafe!" wheezie shouted again, enunciating each syllable with her hands cupped around her mouth.

"rafe?" the pop-star asked, causing wheezie to nod enthusiastically, beyond ecstatic that her idol was actually speaking to her. "rafe," she repeated, a smile stretching across her glossy lips, "is he your brother?" wheezie nodded again, finding herself almost happy to be related to him for the first time in her life.

"well, rafe," y/n purred, a fluorescent stream of blue and red lights suddenly encasing the stadium, a loud siren sounding that quickly jolted him back into reality, the sound being all-too familiar, "i just love a family man, but unfortunately, you're under arrest for being too hot." rafe felt his cheeks heat up slightly at the comment and silently prayed wasn't visible on the big screen while a small smile pulled at his pink lips.

"you're so hot it's making me hot! and when i get too hot sometimes my clothes just—," y/n continued before the bottom half of her pink rhinestoned skirt fell down her legs, pooling around her matching boots, "oh, god, that's so embarrassing — you made my clothes come off, rafe."

rafe slowly nodded to himself, licking his pursed lips to keep from grinning like an idiot which only cause the packed stadium to roar even louder than before. rafe was never one to seek much validation from women, as he knows who he is and what he has to offer, but there was no denying that catching the attention of the pop icon had already boosted his ego (at least just a little).

a chime like tune of yet another song began to play as y/n grabbed the infamous fluffy cuffs before crouching down, handing them off to a security guard who passed them off to rafe himself. of course, wheezie snatched them from his hands just as soon as they graced his fingers and screamed about how y/n had just touched them.

for the remainder of the event, rafe found himself paying much more attention than before. maybe it was the way she said his name or the fact that she chose him out of everyone there, but his focus fully remained on her; the way her bottoms were way too small to cover much of anything, the way she looked so short even with 5-inch boots on, the way that every so often she would shoot a quick glance his way as if she didn't want him to catch her — maybe that part was all in his head, though he wasn't fully convinced that it was.

eventually, the end of the show came around and although rafe enjoyed watching the star prance around in a mini-skirt, he was also ready to get the hell home. y/n waved lovingly at the crowd, gratitude glistening in her doe eyes as she smiled before thanking them all for coming, wishing them a good night and disappearing behind the same door she emerged from hours before, leaving her fans to all buzz in the midst of the aftermath.

merely minutes passed as the arena slowly began to empty before a burly man dressed similarly to the security guards suddenly appeared in front of the siblings. "miss y/l/n requested i bring this to you. have a good one," he yelled over the commotion, placing a small envelope in rafe's hand before disappearing just as quickly as he had arrived.

"oh my god, open it," wheezie gushed, watching as her brother fumbled the paper between his long fingers with furrowed brows. his heart began to thump a little faster at the realization that she'd sent something for him — specifically for him. he slid out a small white card decorated with fresh, black ink and squinted as he read the calligraphy;

thank you for coming! your sister is the absolute cutest. i have a show coming up in charlotte, dm me on ig @ yourinstahandle if you'd both like to come!

xox — y/n

“no fucking way,” wheezie gawked, before jumping up and down as she squealed, “no way, she said i’m cute, oh my god, oh my god — rafe, text her right now, oh my god, i’m gonna pass out, like, actually.”

“wheeze, chill out,” rafe urged, slightly grimacing at her strong language, though he, too, was a bit overwhelmed with all that had happened; the entire night was beginning to feel like a fever dream, for both rafe and his little sister. “are we going? we’re going,” she rushed out, causing rafe to quickly slide the note into his pocket. “look, let’s just get home, alright?” he mumbled.

“are you gonna message her? you have to, i’m not kidding,” wheezie questioned as the pair weaved their way through hundreds of bodies, slowly but assuredly making their way towards the flooded exit. “dunno, wheezie,” he muttered dismissively, “c’mon, hurry up.”

the walk to the car, as well as the drive to the jet, consisted of wheezie’s persistent nagging and begging for her brother to do what she called a ‘once in a lifetime thing that will literally never happen again… like, ever’. rafe didn’t want to come off as some ‘fanboy’ by actually messaging the popstar just for the sake of some tickets to her concert, though he’d be lying if he said he wouldn’t like to see her again.

it was all confusing for him, to say the least. he wasn't big on celebrities or fame, but was well aware of how insane what had happened was. after nearly half an hour of sitting slouched in his seat on the plane, head thrown back with his eyes squeezed shut as wheezie gave him (almost literally) a hundred-and-one different reasons as to why he needed to message y/n and take her up on her offer — some of which being subtle threats of what exactly she would do if rafe 'messed this up' for her.

"alright, wheeze, please," he begged, desperate for just a moment of silence, "if i do it you gotta shut up already — m'brains gonna fuckin' explode." with that, wheezie was mute as rafe pulled the device from his pocket, searching up the username that honestly didn't need to be given, before tapping on her profile and shooting her a quick, yet definitely overthought, message.

"done," rafe murmured, lightly shaking his phone in wheezie's direction before tossing it onto the table in front of him, leaning his head against the window with closed eyes. his sister smiled wordlessly to herself, covering her mouth to keep from squealing before rapidly typing on her phone to everyone she knew to tell them all about the best night of her life.

a day passed before y/n finally found her way to rafe's message. thousands upon thousands of dm's awaited unopened in her inbox, so much so that she knew it'd be nearly impossible to find him, assuming he decided to message her at all. luckily, his name was rather uncommon and had stuck in her brain all night, so with a quick search and a few seconds of scrolling, she came across a profile that sparked her interest.

"wait, is this him?" y/n gasped, a small smile making it's way to her face as she quickly padded across the hotel room with bare feet before shoving her phone into her manager's face, "i mean, that looks like him, right?"

"oh, for sure," the other girl confirmed, grabbing the device and zooming in on his profile picture. “stop, i’m gonna throw up,” y/n halfheartedly joked while leaning over her managers shoulder, “ahh, can you check if he dm’d me? i’m nervous.”

“you’re nervous?” the older woman questioned, genuinely curious as to how it was even possible that the same woman who performed in front of tens of thousands every night could be so worked up over some random guy.

“yes, just look, please,” y/n whined, dropping herself flat onto the large bed before burying her face into the pristine pillows with a huff. “he’s so hot,” she cried out into the cotton, her voice muffled against it.

“okay,” her manager laughed, tapping the screen a couple of times with manicured nails before letting out a soft gasp. “stop,” y/n gasped as well, lifting her head from the pillow with disheveled hair before bouncing off the bed and sprinting back to the other girl’s side, “what’d he say?!”

“he said, and i quote, ‘yo, it’s rafe’,” the woman recited in a monotone voice before looking up at y/n with a less than enthused expression, “wow… a modern day romeo.”

“okay, he’s not trynna woo me,” y/n laughed softly, gently taking her phone back and reading over the message. “clearly,” her manager muttered, “is he coming tomorrow?”

“i don’t know, maybe,” y/n mumbled as her thumbs hovered over the screen, unsure of what to do next. “well,” the other woman concluded, standing to her feet and straightening out her blouse, “let me know as soon as you do so i can get them their backstage tickets. and remember, we’ve got to leave here by five for the premiere — not a second later.”

with that, she exited the room in silence, leaving y/n to stare down at her phone as she chewed anxiously at the inside of her lip. why was she struggling so much? she’s talked to guys before and never was it ever that hard. she didn’t even know the guy, yet he somehow already had her stomach fluttering at the thought of him.

time was wasting with each passing second, and with a long night full of interviews and appearances, she decided she was simply giving it way too much thought and decided to finally pull the trigger.

she grimaced as soon as she hit send — definitely not her best work but it was something. she locked her phone and tossed it onto the duvet, letting out a groan before deciding it was time to do something other than stress over a man.

instead, she turned on some music and began the lengthy process of getting ready for a huge event such as the one she had that night. she showered, blow dried her infamous locks and even ironed her sleek, black dress in preparation — something she never does. the morning was casual, productive, and slow; all until she heard her phone chime from across the room. she bolted over to it, almost tripping over her own feet, before scooping it up to find rafe had responded.

as soon as their conversation ended, y/n called her manager and squealed out the information as she bounced giddily on her feet, even more excited for the following day's show than she thought possible. her manager assured her that everything would be situated before the next day, and to focus on the night ahead first, but y/n felt as though it would be virtually impossible — how could she? she was going to see rafe again.

extras:

personapeters 2025 — all rights reserved • masterlist

#rafe cameron imagine#rafe outer banks#outer banks rafe#rafe cameron outer banks#rafe cameron#rafe x you#rafe fanfiction#rafe x reader#rafe imagine#rafe fic#obx rafe cameron#outerbanks rafe#rafe cameron angst#rafe cameron blurb#rafe cameron fanfic#rafe cameron fanfiction#rafe cameron imagines#rafe cameron x reader#rafe obx#outer banks x you#outer banks rafe cameron#obx fanfiction#obx

3K notes

·

View notes