#mortgage document processing

Explore tagged Tumblr posts

Text

Enhance Operational Efficiency with Document Processing Services

Document processing is the critical service for any business to extract important data from the documents to generate insights for understanding market scenarios and remaining ahead in the market. Reading in detail document processing enhances operational efficiency.

#document processing services#data processing services#business document processing#document processing company#document processing management#document processing companies#mortgage document processing#document processing specialist

2 notes

·

View notes

Text

Avoid costly penalties and errors with Orchestrate's 100% accurate and compliant property tax reporting services. Stay ahead of deadlines and eliminate guesswork. Visit https://www.orchestrate.com/ for more details!

#Mortgage services#Loan processing#Mortgage underwriting#Loan origination#Mortgage closing#Title search#Title insurance#Title examination#Title clearance#Title report#Property tax assessment#Property tax services#Title documentation#Property valuation#Tax lien resolution#Escrow services#Real estate title services

2 notes

·

View notes

Text

Need Urgent Cash? Unlock Your Property’s Value with a Low-Interest LAP!

Struggling with high-interest loans? Switch to a Loan Against Property!

If you're burdened with high-interest loans or need a substantial amount for an emergency, a Loan Against Property (LAP) is a smarter alternative. It offers lower interest rates and higher loan amounts because it is secured against your property. Let’s explore how you can unlock your property's true value!

Facing a Cash Crunch? Here’s How Loan Against Property Works

A mortgage loan against property allows you to borrow money by pledging your home, office, or commercial space. Banks assess your property’s value and offer a loan of 50-75% of its market price. This lump sum can be used for business expansion, medical expenses, education, or even a wedding.

Finding the Best LAP Deals: Where to Get the Lowest Interest Rates

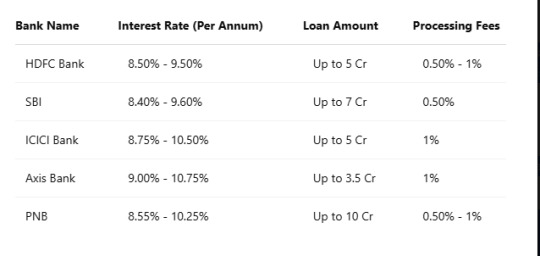

Banks and NBFCs offer different property mortgage loan interest rates based on credit score, property type, and income. Here’s a comparison of the best banks for loans against property in India:

Not Sure If You’re Eligible? Check the Loan Against Property Criteria

Many people miss out on LAP because they think they won’t qualify. Here’s what you need:

Age: Minimum 21 years old

Employment: Salaried or self-employed

Income Stability: A steady source of income to repay the loan

Property Ownership: Must be in your name with clear legal titles

Confused About Paperwork? These Are the Documents You Need

Applying for a loan against property is easy if you have the right documents:

Identity Proof: Aadhar, PAN, Passport, Voter ID

Address Proof: Utility bills, Rent agreement, Passport

Income Proof: Salary slips, IT returns, Bank statements

Property Papers: Title deed, Sale deed, Property tax receipt

Business Owner? Consider a Loan Against Commercial Property

If you own a commercial property, you can get a higher loan amount with more flexible repayment terms. A loan against commercial property is ideal for:

Expanding your business

Buying machinery or equipment

Managing working capital needs

Hidden Charges? Here’s What You Should Know About LAP Fees

Many borrowers forget to check the loan against property processing fees and end up paying more. Here’s what to expect:

Processing Fees: 0.5% - 1% of the loan amount

Legal Charges: For property verification and valuation

Prepayment Penalty: Some banks charge if you repay early

Want to know your EMI? Use a Loan Against Property EMI Calculator

Before taking a LAP, check how much you’ll pay monthly with an EMI calculator. Enter:

Loan Amount

Interest Rate

Repayment Tenure: The tool will show your exact EMI so you can plan your finances better.

Insider Tips to Secure the Best Loan Against Property Deal

Banks won’t tell you these tricks, but we will!

Compare Multiple Lenders—Never settle for the first offer you get.

Improve Your Credit Score—A score above 750 gets you better rates.

Negotiate Processing Fees—Some banks may reduce or waive charges.

Choose the Right Tenure—Longer tenure means lower EMI, but higher interest.

Understand Fixed vs. Floating Rates—Fixed rates provide stability; floating rates can be cheaper in the long run.

FAQs: What People Ask Before Taking a Loan Against Property

1. What is the maximum loan amount I can get?

Banks usually offer 50-75% of your property’s market value as a loan.

2. Is LAP cheaper than a personal loan?

Yes! Loan against property interest rates are much lower than personal loans, making it a cost-effective option.

3. How long does it take for LAP approval?

The process takes 5-15 days, depending on documentation and verification.

4. Can I get a LAP on agricultural land?

No, banks do not provide secured property loans on agricultural land. Only residential and commercial properties qualify.

5. Can I transfer my LAP to another bank for a lower interest rate?

Yes! You can do a balance transfer to a bank offering lower rates and save on interest costs.

Conclusion: Is a Loan Against Property Right for You?

If you own a property and need a big loan at low interest rates, then a loan against property is an excellent choice. Just make sure to compare lenders, check for hidden processing fees, and use an EMI calculator before applying. Need expert help? Get started today and make the most of your property’s value!

Check out the best loan against property option in quick approval in just 2 minutes!

#LAP#Loan Against Property#Loan Against Property Interest Rate#Mortgage loan against property#Property mortgage loan interest rates#Secured property loans#Home equity loan in India#Loan against commercial property#LAP eligibility criteria#Loan against property processing fees#Best banks for loan against property#Loan against property documents required#Loan against property EMI calculator

0 notes

Text

What is Government Allocation C of O

What is Government Allocation C of O? Understanding Government Allocation C of O in Nigeria In Nigeria, land ownership and documentation are crucial for real estate investors, developers, and home buyers. One of the most recognized titles in property ownership is the Government Allocation Certificate of Occupancy (C of O). But what does it mean, and why is it important? If you are a property…

#buying land in Nigeria#C of O application process#Certificate of Occupancy#government allocated land#Government Allocation C of O#government land allocation#how to get C of O#Lagos land documentation#Lagos land titles#land investment Nigeria#land ownership Nigeria#land registration process#land title in Nigeria#mortgage and land title#property documentation Nigeria#property security Nigeria#property verification Nigeria#real estate investment#real estate legal documents#types of land titles in Nigeria#What is C of O in Nigeria

0 notes

Text

Managing financial documents with AI

Are you aware that in the world of finance and accounting, properly managing a vast array of documents can save delays and errors?

It is here that AI plays a critical role in mitigating both and thereby streamlining the finance and accounting processes of an organization.

The Problem

The two most critical factors that hinge on regulatory penalties and future business opportunities are the elimination of – Delays – Errors – Non-accuracy

But before we proceed further, let us first look a bit more closely into these two areas.

(a) Factors causing delays in financial documentation

The retrieval of information from a vast array of data takes more time as the number and scale of documents increase in volume.

Complexities arising from different document structures and formats invariably cause a longer processing time.

The evolving landscape of regulatory requirements for compliance adds to the delays.

(b) Factors causing errors in financial documentation

Multiple stages of processing, review, and approval before arriving at the acceptance stage involve multiple human interventions, leading to a higher scope of errors.

Regulatory authorities‘ pressure for quick compliance requires a faster turnaround time, leading to more human errors in documentation.

(c) Factors causing inaccuracy in financial data

Inaccuracy in financial documentation often stems from two primary factors.

Firstly, the lack of data validation mechanisms results in the inclusion of incorrect or inconsistent data, compromising accuracy.

Secondly, incomplete or inaccurate data entry, often due to human errors like misinterpretation or typographical mistakes, further contributes to the problem. These factors highlight the critical need for robust validation processes and meticulous data entry procedures to ensure the integrity and reliability of financial documentation, ultimately enhancing decision-making and organizational transparency.

(d) Effects of these two factors on the organization’s functioning

Delays in Invoice processing are one area that affects the finance and accounts department but has a wider ramification across the entire revenue generation of the organization.

Another direct effect of the delay in invoice processing is rising processing costs. According to an estimate by the Institute of Finance and Management (IOFM), it has been found that the expenses linked with invoice processing range from $1 to $21. Therefore, any delay will eventually increase the cost and affect the revenue of the business.

The Solution

(a) Integrating various components of AI technologies for a complete transformation

Natural Language Processing (NLP) serves as a transformative force, enabling machines to not only comprehend but also interpret human language with precision. By extracting nuanced meanings from unstructured text, identifying entities such as names, dates, and financial figures, and grasping contextual nuances, NLP algorithms contribute significantly to the automation of tasks and the improvement of user experiences in diverse applications.

Machine learning (ML) algorithms, trained on extensive historical datasets, exhibit a remarkable ability to discern intricate document structures, accurately extract relevant information, and proficiently categorize the content. This capacity enables ML systems to streamline processes across various industries, enhancing efficiency and decision-making.

Optical Character Recognition (OCR) technology plays a pivotal role in the digital transformation of physical documents. This process involves the accurate identification of characters, digits, symbols, and structural elements, ensuring the conversion of physical documents into actionable and searchable digital data. OCR’s ability to precisely capture and interpret complex textual and graphical content elevates its importance in modern document management systems, enhancing accessibility, efficiency, and data accuracy.

By leveraging OCR, organizations can automate invoice data extraction, significantly reducing manual data entry efforts and minimizing the risk of human errors. This advancement enables the integration of paper-based invoices into digital workflows, streamlining the entire invoicing process. This enhanced efficiency accelerates invoice processing times, enabling timely payments to vendors and optimizing financial operations within the organization.

Thus, OCR technology plays a crucial part in modernizing invoice management processes, enhancing productivity, and improving financial decision-making capabilities.

(b) Turnaround with AI: critical outcomes

Ensuring scalability with increased financial data and thereby being able to maintain operational efficiency over time.

Safeguarding confidential financial information throughout the document lifecycle is ensured with automated document processing done with the power of AI.

Smooth integration with existing software and workflows allows more operational flexibility without the need for a complete overhaul of legacy systems.

Efficiency in information retrieval is significantly enhanced by AI, as it automates the extraction of relevant information from financial documents. This not only reduces the need for manual effort but also leads to a concurrent improvement in data accuracy. By leveraging AI technology, organizations can streamline their information retrieval processes, resulting in more efficient operations and better decision-making capabilities.

AI models exhibit heightened accuracy and consistency at scale, showcasing their adeptness in extracting and categorizing data with precision. This proficiency not only reduces human errors but also guarantees uniformity across financial documents. By harnessing their ability to comprehend and generate human-like text, generative models significantly enhance the accuracy of data extraction and improve contextual comprehension within financial documents. This enhanced accuracy and understanding pave the way for more reliable and insightful analysis of financial data, leading to better decision-making and risk management strategies.

Conclusion:

Incorporating AI into financial document processing represents a significant transformation in the financial industry. AI-powered tools and methodologies have fundamentally changed traditional approaches, empowering finance professionals with advanced capabilities for document analysis, information extraction, compliance management, and strategic decision-making. This evolution towards AI-driven solutions has not only streamlined operations but also enhanced the accuracy, efficiency, and agility of financial institutions, ultimately leading to more informed and effective business strategies.

Experience the transformative power of AI with DocVu.AI by connecting with us.

#intelligent document processing#mortgage#automation#document processing#idp#mortgage processing#finance and accounting

0 notes

Text

I am very stressed and anxious about making this post but today on top of having to emergency pay to stop the electricity from being shut off to my grandmother's home (I have no idea if it even has water still) - tomorrow I am having to travel a couple hours to file her will and I have no way to pay those court filing fees.

I normally would be already stressed financially about this process but I have yet to pay my own electricity, rent, or internet + on top of the fact that it's going to be several days before I'll get reimbursement for travel I needed to do for work I was counting on to help make it even slightly more manageable.

I've maxed out my credit card, I have no savings left because these past couple months I've had one emergency/unexpected bill after another.

I'm already doing probate myself without a lawyer because I cannot afford one - but I told the bank her mortgage is through I'd have some kind of documentation tomorrow because they're starting to get worried about the lack of progress. if I can't pay those filing fees and get that paperwork filed, I don't know what will happen to her house.

if anyone is capable of/willing to help me get through/literally just survive this incredibly stressful month, I would really appreciate it, truly. anything I get will go to filing that paperwork, paying my rent and keeping my electricity on, and then paying her water bill, in that order. thank you so much.

235 notes

·

View notes

Text

NeXT on A Day in a Life—Dating Nanami Kento: A Love Story in Financial Planning Pt. 6 | Nanami x Reader

Months go by..

It happens on a random Tuesday.

You're curled up on the couch, half-asleep, watching some random documentary. Nanami is next to you, one arm draped over the back of the couch, scrolling through his phone like the world isn't completely peaceful right now.

The only sound is the TV droning in the background.

And then—without warning—Nanami shifts slightly, adjusting his position. His hand lands on your thigh.

Not in a sexy way. Not in a casual way. Just...there. Like it belongs. Like it's always belonged.

You blink, glancing at him. He doesn't even look up.

He's still reading something, completely focused, totally normal—except his thumb starts moving absently, rubbing slow, subconscious circles into your skin.

Your chest tightens.

It's such a small thing.

A tiny, thoughtless motion.

But it's everything.

Because this isn't new. It's not an intentional touch. It's just second nature to him now—like he doesn't even have to think about it. Like you're already his.

You bite your lip, watching him for a long moment, warmth creeping up your neck.

And then—because you can't help yourself—you hum, shifting slightly so his hand presses more firmly against you.

Nanami pauses.

His eyes flick to you, slow and knowing, and you swear you see a ghost of a smirk before he looks back at his phone.

But he doesn't move his hand.

Doesn't stop the slow, steady circles.

And in that moment, you realize—this man has already decided you were permanently his.

He just hasn't said it out loud yet.

Nanami, The Accidental Husband

One day, you'll wake up and realize you didn't just get a boyfriend. You got a husband. And you didn't even notice it happening.

He:

Pays your bills

Tells you when your taxes are due

Remembers your dentist appointments

Brings you coffee exactly how you like it

Knows your social security number

And now you're just standing there, staring at him like:

"...Did we get married and I just missed it?"

Nanami doesn't even propose.

Weeks later, after he's been oddly quiet about 'future plans,' you’re both sitting at the kitchen table when he slides a fully paid mortgage agreement of the house he just purchased for the two of you across the table like it's a love letter.

At first, you don't process it.

You blink.

Look at the document.

Look at him.

Look back at the document.

Read it again.

Then flip to the second page—just to make sure this isn't some kind of lease renewal scam. Your eyes trail down to the second page, where two names are already printed—his and yours.

You turn the page again, looking for some kind of catch, but there isn't one.

Just a blank signature line.

You slowly look up at him, heart stuttering.

"Nanami... are we... getting married?"

He doesn't blink.

"It's a joint property ownership agreement."

And you're staring down at this document, eyes wide and heart beating, before slowly looking up at him once more.

Oh.

OH.

...So basically, yes.

You can see him starting to get nervous. He's actually tapping his fingers nervously on the table, and you realize this is the first time you've seen his composure drop. His glasses slide a bit, and his dark blond eyebrows pull together as his pale lips part.

"What do you think?" he asks, and your cheeks burn because this man did not prepare a speech.

He didn't need to. The very fact he felt nervous enough to tap the table gave away the fact that Nanami is scared that you will say no.

"Four bedrooms. Three and a half baths. Two stories."

Nanami exhales, removing his glasses and rubbing his eyes like he's mentally bracing himself.

"A pool. A big backyard. More closet space than you'll ever need." He pauses, hesitates. "We can renovate, if you want. The schools are all national blue ribbon award winning schools. There's also a nice park nearby..."

He clears his throat. Then, softer—

"Do you like it?"

He lets out a frustrated exhale through his nose, and runs a hand over his face before turning back toward you.

He simply hands you a pen without a single word. And for the longest time, you're just blinking, before nodding. You press the pen to the line of the page. You sign your name in your handwriting right under his as the second owner. And when you look up to see him, he is biting down hard on his lower lip in the biggest effort not to smile like an idiot.

You set the pen down, staring at him as a smile creeps across your face, slow and warm. It's catching—he tries to fight it, but you catch the twitch at his cheek, the faintest pull of a half-smile softening his sharp edges. Your grin stretches wider and your chest feels tight with it.

You scoot the chair back, the scrape loud in the quiet, and climb into his lap. His breath hitches—just for a second—but you feel it against your cheek.

"Are we dating, or married now?" you ask, voice teasing but softer than you mean it to be. Nanami exhales through his nose, head tipping back against the wall like he's bracing himself.

"Perhaps. Does it matter? Legally, there are no tax benefits. All my assets are in a trust, but—" he starts, and you cut him off, burying your face in his shoulder. The scent of his cologne hits you, steady and familiar, and you're not sure if it's his words or his warmth making your eyes sting.

You feel his soft laugh shake his torso. You can sense his heart beating quickly as his strong arms wrap around your back. And for a moment, you smile because he cannot see you. You start to twist that simple band on your finger—the 'placeholder' from months ago, seemed more like an engagement ring in all but its name, grinning—he's halfway to husband already. Because apparently this man cannot function in a non-monogamous relationship.

"Can I call you hubby?"

There's a pause.

A long pause.

Nanami exhales slowly, like he's recalculating the stock market in his head.

Then—without making eye contact—

"...If it makes you happy." he mutters, a sigh slipping out like he's surrendering his soul. His ears flush pink, barely noticeable, and you swear his lips twitch again, caught between a grimace and a grin.

Oh.

OH.

He's embarrassed.

You can practically see the faint pink dusting his ears.

You grin. "Okay, hubby."

Nanami clears his throat. Adjusts his glasses.

Then immediately leaves the room.

"Wait come back," you run after him.

He doesn't move.

Doesn't speak.

Just leans against the doorframe, eyes slowly trailing over you.

Like he's reassessing his entire life.

And then, finally—after what feels like an eternity—

He exhales.

A soft, almost helpless smile tugs at his lips.

Then, before you can say anything else, he's closing the distance, pressing a slow, deliberate kiss to your lips. When his fingers slide into your hair and gently grasp the strands, he sighs happily into your mouth.

And when he pulls back his lips graze your cheek and he finally says "call me whatever you like," and it makes your toes curl in your socks because there is no better feeling than realizing the most stoic man you know will be tamed by the one he loves.

"And I suppose we can get that ring upgraded at some point," he murmurs, voice low and warm.

"Really," You barely manage to blink at him before he tilts your chin up, brushing a slow kiss against your jaw.

"Whenever you're ready, darling." the happiness is apparent in his voice, making your eyes water at just his words.

CONGRATULATIONS LADIES. NANAMI HAS JUST PROPOSED WITHOUT ACTUALLY PROPOSING.

AND HE THINKS HE'S BEING SMOOTH.

HE THINKS THIS IS JUST A CONVERSATION.

BUT WE ALL KNOW HE'S ALREADY PICKED OUT THE DAMN RING.

SIR, JUST ADMIT YOU'RE MADLY IN LOVE.

YOU'RE MARRIED IN EVERYTHING BUT NAME.

-

In case you missed Part 3, Part 4 & Part 5

All rights reserved © 2025 KawaiiBlossoms. Do not copy, translate, or modify my works on any platform.

Next on Dating Nanami Kento: Do we get a wedding with Nanami adjusting his tie too perfectly and a honeymoon where he still packs a briefcase? Or straight to a married-life day with him handing you coffee at 6 a.m. sharp? Maybe both—I’m not sure yet, so stay tuned!

#fanfic#jujutsu kaisen#nanami kento#fluff#jjk men#x reader#domestic fluff#this is canon to me#sukuna#gojo satoru#megumi fushiguro#yuji itadori#toji x reader#getou suguru x reader#jjk smut#nanami x reader#nanami x y/n

39 notes

·

View notes

Text

Writing Notes: Death & Dying

Death - the end of life, a permanent cessation of all vital functions.

Dying - the body’s preparation for death. This process may be very short in the case of accidental death, or it can last weeks or months, such as in patients suffering from cancer.

DEATH PREPARATION

Although it is not always possible, death preparation can sometimes help to reduce stress for the dying person and their family. Some preparations that can be done beforehand include:

Inform one or more family members or the executor of the estate about the location of important documents, such as social security card, birth certificate, and others.

Take care of burial and funeral arrangements (such as cremation or burial, small reception or full funeral) in advance of death, or inform family members or a lawyer what these arrangements should be.

Discuss financial matters (such as bank accounts, credit card accounts, and federal and state tax returns) with a trusted family member, lawyer, estate executor, or trustee.

Gather together all necessary legal papers relating to property, vehicles, investments, and other matters relating to collected assets.

Locate the telephone numbers and addresses of family and friends that should be contacted upon the death.

Discuss outstanding bills (such as utilities, telephone, and house mortgage) and other expenses that need to be paid.

Collect all health records and insurance policies.

Identify the desire to be an organ donor, if any.

MOURNING & GRIEVING

The death of a loved one is a severe trauma, and the grief that follows is a natural and important part of life.

No two people grieve exactly the same way, and cultural differences play a significant part in the grieving process.

For many, the immediate response may be shock, numbness, or disbelief.

Reactions may include:

Shortness of breath, heart palpitations, sweating, and dizziness.

Other reactions might be a loss of energy, sleeplessness or increase in sleep, changes in appetite, or stomach aches.

Susceptibility to common illnesses, nightmares, and dreams about the deceased are not unusual during the grieving period.

Emotional reactions are as individual as physical reactions.

A preoccupation with the image of the deceased or feelings of hostility, apathy, emptiness, or even fear of one’s own death may occur.

Depression, diminished sex drive, sadness, and anger at the deceased may be present.

Bereavement may cause short- or long-term changes in the family unit or other relationships of the bereaved.

It is important for the bereaved to work through their feelings and to not avoid their emotions.

Support groups are often available.

If a person does not feel comfortable discussing emotions and feelings with family members, friends, or primary support groups, they may wish to consult a therapist to assist with the process.

Various cultures and religions view death in different manners and may conduct mourning rituals according to their own traditions.

Visitors often come to express their condolences to the family and to bid farewell to the deceased.

Funeral services may be public or private.

Family or friends of the deceased may host a gathering after the funeral to remember and celebrate the life of the deceased, which also helps the bereaved to begin the mourning process positively.

Knowing how much a loved one is cherished and remembered by friends and family can provide comfort to those who experienced the loss.

Other methods of condolences include sending flowers or cards to the home or the funeral parlor, sending a donation to a charity that the family has chosen, or bringing a meal to the family during the weeks after the death.

Source ⚜ More: Writing Notes & References ⚜ Pain ⚜ Bereavement Death & Cheating Death ⚜ Pain & Violence ⚜ Death & Sacrifice

#writing notes#color blindness#writeblr#dark academia#spilled ink#literature#writers on tumblr#writing reference#poets on tumblr#writing prompt#poetry#creative writing#writing inspiration#writing ideas#light academia#jacques louis david#writing resources

90 notes

·

View notes

Text

On February 10, employees at the Department of Housing and Urban Development (HUD) received an email asking them to list every contract at the bureau and note whether or not it was “critical” to the agency, as well as whether it contained any DEI components. This email was signed by Scott Langmack, who identified himself as a senior adviser to the so-called Department of Government Efficiency (DOGE). Langmack, according to his LinkedIn, already has another job: He’s the chief operating officer of Kukun, a property technology company that is, according to its website, “on a long-term mission to aggregate the hardest to find data.”

As is the case with other DOGE operatives—Tom Krause, for example, is performing the duties of the fiscal assistant secretary at the Treasury while holding down a day job as a software CEO at a company with millions in contracts with the Treasury—this could potentially create a conflict of interest, especially given a specific aspect of his role: According to sources and government documents reviewed by WIRED, Langmack has application-level access to some of the most critical and sensitive systems inside HUD, one of which contains records mapping billions of dollars in expenditures.

Another DOGE operative WIRED has identified is Michael Mirski, who works for TCC Management, a Michigan-based company that owns and operates mobile home parks across the US, and graduated from the Wharton School in 2014. (In a story he wrote for the school’s website, he asserted that the most important thing he learned there was to “Develop the infrastructure to collect data.”) According to the documents, he has write privileges on—meaning he can input overall changes to—a system that controls who has access to HUD systems.

Between them, records reviewed by WIRED show, the DOGE operatives have access to five different HUD systems. According to a HUD source with direct knowledge, this gives the DOGE operatives access to vast troves of data. These range from the individual identities of every single federal public housing voucher holder in the US, along with their financial information, to information on the hospitals, nursing homes, multifamily housing, and senior living facilities that HUD helps finance, as well as data on everything from homelessness rates to environmental and health hazards to federally insured mortgages.

Put together, experts and HUD sources say, all of this could give someone with access unique insight into the US real estate market.

Kukun did not respond to requests for comment about whether Langmack is drawing a salary while working at HUD or how long he will be with the department. A woman who answered the phone at TCC Management headquarters in Michigan but did not identify herself said Mirksi was "on leave until July." In response to a request for comment about Langmack’s access to systems, HUD spokesperson Kasey Lovett said, “DOGE and HUD are working as a team; to insinuate anything else is false. To further illustrate this unified mission, the secretary established a HUD DOGE taskforce.” In response to specific questions about Mirski’s access to systems and background and qualifications, she said, “We have not—and will not—comment on individual personnel. We are focused on serving the American people and working as one team.”

The property technology, or proptech, market covers a wide range of companies offering products and services meant to, for example, automate tenant-landlord interactions, or expedite the home purchasing process. Kukun focuses on helping homeowners and real estate investors assess the return on investment they’d get from renovating their properties and on predictive analytics that model where property values will rise in the future.

Doing this kind of estimation requires the use of what’s called an automated valuation model (AVM), a machine-learning model that predicts the prices or rents of certain properties. In April 2024, Kukun was one of eight companies selected to receive support from REACH, an accelerator run by the venture capital arm of the National Association of Realtors (NAR). Last year NAR agreed to a settlement with Missouri homebuyers, who alleged that realtor fees and certain listing requirements were anticompetitive.

“If you can better predict than others how a certain neighborhood will develop, you can invest in that market,” says Fabian Braesemann, a researcher at the Oxford Internet Institute. Doing so requires data, access to which can make any machine-learning model more accurate and more monetizable. This is the crux of the potential conflict of interest: While it is unclear how Langmack and Mirski are using or interpreting it in their roles at HUD, what is clear is that they have access to a wide range of sensitive data.

According to employees at HUD who spoke to WIRED on the condition of anonymity, there is currently a six-person DOGE team operating within the department. Four members are HUD employees whose tenures predate the current administration and have been assigned to the group; the others are Mirski and Langmack. The records reviewed by WIRED show that Mirski has been given read and write access to three different HUD systems, as well as read-only access to two more, while Langmack has been given read and write access to two of HUD’s core systems.

A positive, from one source’s perspective, is the fact that the DOGE operatives have been given application-level access to the systems, rather than direct access to the databases themselves. In theory, this means that they can only interact with the data through user interfaces, rather than having direct access to the server, which could allow them to execute queries directly on the database or make unrestricted or irreparable changes. However, this source still sees dangers inherent in granting this level of access.

“There are probably a dozen-plus ways that [application-level] read/write access to WASS or LOCCS could be translated into the entire databases being exfiltrated,” they said. There is no specific reason to think that DOGE operatives have inappropriately moved data—but even the possibility cuts against standard security protocols that HUD sources say are typically in place.

LOCCS, or Line of Credit Control System, is the first system to which both DOGE operatives within HUD, according to the records reviewed by WIRED, have both read and write access. Essentially HUD’s banking system, LOCCS “handles disbursement and cash management for the majority of HUD grant programs,” according to a user guide. Billions of dollars flow through the system every year, funding everything from public housing to disaster relief—such as rebuilding from the recent LA wildfires—to food security programs and rent payments.

The current balance in the LOCCS system, according to a record reviewed by WIRED, is over $100 billion—money Congress has approved for HUD projects but which has yet to be drawn down. Much of this money has been earmarked to cover disaster assistance and community development work, a source at the agency says.

Normally, those who have access to LOCCS require additional processing and approvals to access the system, and most only have “read” access, department employees say.

“Read/write is used for executing contracts and grants on the LOCCS side,” says one person. “It normally has strict banking procedures around doing anything with funds. For instance, you usually need at least two people to approve any decisions—same as you would with bank tellers in a physical bank.”

The second system to which documents indicate both DOGE operatives at HUD have both read and write access is the HUD Central Accounting and Program System (HUDCAPS), an “integrated management system for Section 8 programs under the jurisdiction of the Office of Public and Indian Housing,” according to HUD. (Section 8 is a federal program administered through local housing agencies that provides rental assistance, in the form of vouchers, to millions of lower-income families.) This system was a precursor to LOCCS and is currently being phased out, but it is still being used to process the payment of housing vouchers and contains huge amounts of personal information.

There are currently 2.3 million families in receipt of housing vouchers in the US, according to HUD’s own data, but the HUDCAPS database contains information on significantly more individuals because historical data is retained, says a source familiar with the system. People applying for HUD programs like housing vouchers have to submit sensitive personal information, including medical records and personal narratives.

“People entrust these stories to HUD,” the source says. “It’s not data in these systems, it’s operational trust.”

WASS, or the Web Access Security Subsystem, is the third system to which DOGE has both read and write access, though only Mirski has access to this system according to documents reviewed by WIRED. It’s used to grant permissions to other HUD systems. “Most of the functionality in WASS consists of looking up information stored in various tables to tell the security subsystem who you are, where you can go, and what you can do when you get there,” a user manual says.

“WASS is an application for provisioning rights to most if not all other HUD systems,” says a HUD source familiar with the systems who is shocked by Mirski’s level of access, because normally HUD employees don’t have read access, let alone write access. “WASS is the system for setting permissions for all of the other systems.”

In addition to these three systems, documents show that Mirski has read-only access to two others. One, the Integrated Disbursement and Information System (IDIS), is a nationwide database that tracks all HUD programs underway across the country. (“IDIS has confidential data about hidden locations of domestic violence shelters,” a HUD source says, “so even read access in there is horrible.”) The other is the Financial Assessment of Public Housing (FASS-PH), a database designed to “measure the financial condition of public housing agencies and assess their ability to provide safe and decent housing,” according to HUD’s website.

All of this is significant because, in addition to the potential for privacy violations, knowing what is in the records, or even having access to them, presents a serious potential conflict of interest.

“There are often bids to contract any development projects,” says Erin McElroy, an assistant professor at the University of Washington. “I can imagine having insider information definitely benefiting the private market, or those who will move back into the private market,” she alleges.

HUD has an oversight role in the mobile home space, the area on which TCC Management, which appears to have recently wiped its website, focuses. "It’s been a growing area of HUD’s work and focus over the past few decades," says one source there; this includes setting building standards, inspecting factories, and taking in complaints. This presents another potential conflict of interest.

Braesemann says it’s not just the insider access to information and data that could be a potential problem, but that people coming from the private sector may not understand the point of HUD programs. Something like Section 8 housing, he notes, could be perceived as not working in alignment with market forces—“Because there might be higher real estate value, these people should be displaced and go somewhere else”—even though its purpose is specifically to buffer against the market.

Like other government agencies, HUD is facing mass purges of its workforce. NPR has reported that 84 percent of the staff of the Office of Community Planning and Development, which supports homeless people, faces termination, while the president of a union representing HUD workers has estimated that up to half the workforce could be cut The chapter on housing policy in Project 2025—the right-wing playbook to remake the federal government that the Trump administration appears to be following—outlines plans to massively scale back HUD programs like public housing, housing assistance vouchers, and first-time home buyer assistance.

16 notes

·

View notes

Text

Significance of Document Processing for Banking and Finance Industry

The banking and financial sector generates a large amount of documents that are hard to manage. Document processing services ensure structured and organized management that results in positive outcomes. Read in detail about document processing for the banking and finance sector.

#document processing services#data processing services#business document processing#document processing company#document processing management#document processing companies#mortgage document processing#document processing specialist

3 notes

·

View notes

Text

Speed, accuracy, and efficiency delivered. Orchestrate empowers mortgage professionals with scalable data entry, document tracking, and streamlined workflows. Work smarter and optimize your operations today with Orchestrate’s precision-driven solutions.

#Mortgage services#Loan processing#Mortgage underwriting#Loan origination#Mortgage closing#Title search#Title insurance#Title examination#Title clearance#Title report#Property tax assessment#Property tax services#Title documentation#Property valuation#Tax lien resolution#Escrow services#Real estate title services

0 notes

Text

life update!!!!

got overwhelmed, didn't look at tumblr for several days. i've had a list of Tasks that is not long but is nevertheless full of fiddly annoying multiple step things, let me give you an example:

need to get my driver's license renewed before i leave the country

fine, easy. wait, not fine. gotta physically go to dmv. wait, gotta get my fucking real ID. click to list of things needed to apply for that. i keep the tab open in my browser for weeks bc looking at it is a step.

passport, fine.

two documents proving i live where i've lived for the past 13 years? sure. utility bill. wait, like on paper? why, because it's 1925 and i believe there are infinite trees? you want me to upload a copy of this before i go but ALSO bring in a physical bill on paper which i do not receive because it's 2025 and why would i get something in the mail when i don't have to?

okay, another document. amazing list of options most of which i do not have. mortgage bill, lol. imagine. 'medical document'? i fucking guess? well here's the bill i received in error from my last psychiatrist. i...hope that's fine? i like literally don't have anything else? i don't have anything else. i don't get bills in the mail. it's 2025.

i finally complete the process online and they're like okay go ahead and make an appointment. bring paper copies of your documents, they'll be right in front of us onscreen but you're probably lying about living in the place where we've sent you renewal notices for the last thirteen years so go fuck yourself lol. also there are no appointments until july so just show up and cross your fingers lmao.

well it says to bring the 'original document or a certified copy' of my bills so i guess i'll go to walgreens and pay 25 cents for a printed out copy of the pdf they'll have right in front of their fucking faces. don't know how i'm supposed to certify it. it is the original document i downloaded from the website. why is this happening to me

upload it to the walgreens website for same day pickup of the printed out document. i'll go get it tonight and then go to the dmv tomorrow. cool.

walgreens calls. their printer isn't working lol.

is THIS where i go fuck myself? i love it when i put something off bc i know it's going to be unnecessarily stressful and frustrating and inefficient and stupid and make me very angry and then i finally do the thing and it's WOOOOOOORSE and not even over! guess i'll go to the library tomorrow? and print an unnecessary copy of a thing they might not even end up accepting at the dmv 🥳✨

okay! so, anyway. that felt cathartic to write out. otherwise i've been working on planning my trip which has been an undertaking entirely of my own making so that's on me and it will be great in the end. (this morning my roommate told me she had an anxiety nightmare about losing her passport and missing her international flight...i'm contagious 😭) but it's taken up a lot of brain space and i stilllllll don't have it planned entirely yet but, you know. it's fine.

so far we got paris may 6-10th, then aix-en-provence through the 13th, down to cannes through the 16th, walking distance to the beach i've been daydreaming about for an entire year (ref. every single other universe south of france besties 4eva! timeline) hell yeah. then, stay with me i swear this makes sense, after trying to do the amalfi coast for my birthday and giving up after days of research about how much of a pain in the ass it is to get there and then get around there, i decided on santorini and bc it is also hard to get to what i'm doing is taking the train from cannes to milan, spending one night there, then flying out to santorini in the morning. then a week in santorini which will hopefully be seismically chill out of respect for me turning 42. the ultimate meaning of life, the universe, and everything in the most beautiful place on earth. YES!!! then i'm not entirely sure where i'm going from there! syros? then athens!

BUT THEN! the big new exciting thing is that a friend/old situationship i've been talking to again hit me up bc he'd been talking about wanting to go to barcelona and i was like well surprise i'll be in europe soon and he was like oh great come to bali. and i was like what. and he was like i'll get a villa. and i was like okay. so now instead of flying home on june 11th i'm flying to singapore and then we'll spend a day there and then head to bali for a couple weeks, probably visit thailand for a couple days. and then we'll go to barcelona for at least 10 days. 😭 sooo...i won't be coming back to the united states until mid-july. well, i've been saying i needed a long-ass vacation after these last several months!!!!

i would not be doing all of this had grammy's house not pretty much immediately sold 😅 hilariously it will not close until probably the day i leave so i'll be coming back to that check (it was a mobile home in fresno and i'm getting 1/3rd. we are not talking set for life money lol) but i at least have enough to cover everything in the meantime. and then i'll come back and reevaluate my life bc doing my taxes this year was pretty fucking devastating, my income from my shop was waaaaaay down last year and i can't live on savings/unexpected windfalls forever. i talked to my friend who i've been covering for at the vintage shop and she surprised me with the lousy news that she is MOVING which is awful and i hate, so she probably won't be selling there so i probably won't have that to come back to, which i wasn't expecting to anyway bc i offered to keep doing it when i got back when my return date was still june 11th and they were like oh well we'll let you know~~ so i was like well then i'm going to bali lmao if nobody's committing to anybody. i don't know. it's all fine. i would like to be better at being a real human person who exists in late stage capitalism. maybe 42 will be my year?!

a couple of months ago i had this dream that i was on santorini and the world was ending. everything was shaking, and the island started to sink, the sea began to rise. gwyneth paltrow was there and we were sticking close to each other trying to get to safety. (i don't know. it was a dream.) i remember looking up at the night sky and there were thousands of falling stars crowding every inch of the deep blue dark like the sky was reaching back for me. like everything was ending at once, the whole galaxy. and i wasn't scared. i thought it was beautiful. do you think that was a prophecy?

#scenes from a life#just adhd things!!!!#and travel things!#and a meteor-strewn dream!!#the cat just came to sit next to me and waited patiently until i said 'what can i do for you ma'am?'#and then she demonstratively head-butted my elbow to indicate it was paying attention to the cat time#marvelous interaction. what a wonderful world

11 notes

·

View notes

Text

Free Falling

Chapter One

1.6k / (eventual) husband!joel x f!reader /minors dni

‘I felt very still and very empty, the way the eye of a tornado must feel’

Summary: you take the leap to leave your stagnant relationship, and end up falling into the arms of a man who will give you the life you always dreamed of.

Content: loveless relationship, TW: domestic violence, emotional abuse, age gap (reader is mid-late 20s, Joel is late 30s-mid 40s), angst, allusions of cheating, sad sad sad but Joel will save the day, slow burn, smut, fluff, oc(reader’s boyfriend and friends/family), mention of reader grieving loss of her dad, swearing, smoking, alcohol consumption, no outbreak!au

🧸🪷🧸🪷🧸🪷🧸🪷🧸🪷🧸🪷🧸🪷

The front door slammed. The alarm clock showed 4:47am. James was meant to leave for work at 5:30 am, but he had clearly made a point of leaving early and waking you up in the process.

You swallowed, forcing the lump in your throat back down as you regained awareness and the ringing in your ears reminded you of the reason for the spite behind your boyfriend’s exit. The hole in the wall and the dull aching in your wrist served as an ugly reminder, just as much as the echoes of James’ yells.

Your mum hated James, and if your dad was still here, James would have been given the boot, whether it was down to you or not. However, you had settled. You were soft spoken, kind, caring, beautiful. Any guy would be lucky to have you and deep down you knew this, but again, you were too kind to ever say no.

James had moved in with you after you bought your home with the inheritance from your dad. His name was on no legal document, and he had no financial input to the running of your home, yet you let him encroach, and you felt more of a guest than he did. Things were really good at the start, he treated you okay and you got on well most of the time, then came the messages from girls on Instagram and the late nights smelling of alcohol and perfume. You slowly detatched yourself from him, mentally learned to not feel any sort of way. You weren’t interested in anyone else, but you just didn’t love him anymore. He sure as hell didn’t love you anymore.

🧸🪷🧸🪷🧸🪷🧸🪷🧸🪷🧸🪷🧸🪷

Last night was the final straw:

You had got home from work, beaming with pride for the new promotion and set of responsibilities that came with it. The inheritance money from your dad help set you up in your home, but you worked damn hard to keep up with the cost of running the place. Mortgage payments and bill payments came out of your own pocket.

‘James?’ You shouted, half defeated. You hung your bag up on the back of the barstools in the kitchen, and preheated the oven for dinner.

Your phone rang.

‘Hi, I’m not about for dinner. Don’t worry about me’ James slurred down the phone.

‘Okay, be safe. See you when you’re home. Love you.’ You may as well have spoken to a brick wall, as James hung up and the line went down.

Your eyes stung, but you shook it off and continued with your dinner and ran a bath and got into bed. You had a huge day of meetings tomorrow and were determined to make a good impression on your new team.

James eventually stumbled in, waking you up as usual and treating the house as a rage room.

You held your eyes tight, and your palms sweated as your body froze. Remember the feeling when you were seven and thought you heard a ghost, or a monster under the bed?

He bounded up the stairs and shouted your name. He grabbed your wrists and woke you up.

‘Where’s my dinner?’ He slurred.

‘You told me you weren’t about.’ You meekly defended yourself.

‘Fucking useless’ he hissed.

You sobbed. ‘We’re done.’ You had finally snapped. You couldn’t even give an argument or any other words. Just that.

James punched the wall, inches away from the television opposite the bed, then proceeded to stumble backwards and pass out on the bed.

You set his alarm an hour earlier, out of spite, knowing he’d hate being woken up and would probably not be able to go back to sleep. As you unlocked his phone:

1 new message from Lottie:

See you in the office tomorrow, thanks for the drink!💋

You chuckled dryly, and got back to sleep. You felt a weight had lifted and you could finally live life on your own terms and be your own person.

🧸🪷🧸🪷🧸🪷🧸🪷🧸🪷🧸🪷🧸🪷

You had finished getting ready for work, and decided to call your mum on the way to the office.

‘Hey Mumma,’ you whispered softly.

‘Baby, are you okay? James texted me asking if I could get his stuff ready for his mum to collect,’ your mum sounded concerned but also slightly hopeful.

‘I ended it. It was too much, he broke my wall, he hurt me. I owed it to you, Daddy and myself to do better,’ your voice cracked, but you reminded yourself of how much you deserved this life you worked so hard to finally be able to live.

‘I’ll kill him. Motherfucker.’ Your mum scoffed.

‘I’m fine Mum. I got my promotion, I wanted to throw a celebration at mine this weekend to tell you. Why don’t you and the girlies come round for drinks and we’ll debrief.’

‘I’m so proud of you, plum’ your mum sniffled, and you wanted to reach out and cuddle her, ‘ I hope you’re dressed to the nines for the meeting today.’

‘I dug out the Speedy and she is back in business’ you laughed.

‘That’s my girl.’

James hated your designer hand bags. He thought it was pretentious and he hated the way people looked at him after the conversation stuck at the fact you had bought everything for yourself. His money went on boys nights.

🧸🪷🧸🪷🧸🪷🧸🪷🧸🪷🧸🪷🧸🪷

You made it through the day. Everyone in the office loved you, and you were so hardworking and intelligent. Admittedly though, you cried over a glass of rosé with your ultimate hypeman and bestfriend Lottie at lunchtime. If anyone was going to give your praise, it was her and your mum. Your little sisters were too young to give you adult praise, but they had their own ways of expressing their pride, as well as 12 year old girls can.

You stopped off at your Uncle and Auntie’s florist as you did every Friday, for your fresh bouquet of weekend flowers. Rufus was your dad’s best friend, and his wife Clara was like a second Mum to you, hence the Auntie and Uncle title, as they earned it.

They had your sunflowers wrapped in brown paper, with a polaroid of your dad tucked in the fold. Every week they would surprise you with a new picture of your dad, which you hung as a trophy on the inside of your wine glass cabinet. Your dad loved his wine, and you knew he’d be best remembered when people were getting their tipple.

You choked up, like you always do when you see your dad, and Clara held you tight. Rufus came up behind you and swept your soft curls off your shoulder and cuddled you both in his arms.

‘I love you both so much’ you sniffled, wiping your tears, ‘I wanted to tell you both i broke up with James. I wish Daddy was here so we could pop a bottle.’

Clara cackled, and Rufus waited to see if you were going to cry anymore or if it was safe territory to joke along.

‘I’m gonna need a number of someone to fix my wall and change my locks though,’ you shuffled a stone across the florist floor, looking down out of fear of being interrogated.

Rufus rolled his eyes and lit a cigarette, you took a drag and Clara gave you a number of an old friend.

‘Your mum would kill both of us,’ Rufus pointed at you, as you held onto the cigarette and blew the smoke in his face with a wink.

‘Mum’d let me off, I’ve been through a whirlwind.’ No one could tell you no. As much as people could take advantage of your softness, you knew how to wrap people around you little finger. ‘I’m having drinks at mine tomorrow, come. Mum and the twins will be there, so will a couple of the girls. I’d love you there.’

‘Don’t need to ask us twice, plum’ Rufus kissed your head, and Clara kissed your cheek as she held your head tightly.

Your heart was full, and for once there was no dread or fear.

🧸🪷🧸🪷🧸🪷🧸🪷🧸🪷🧸🪷🧸🪷

You got to your front door, and crossing the threshold, inhaled a deep breath. The smell of your perfume lingered, and there was no sign of James. All his stuff was gone, and his car wasn’t there. His set of keys was on the side, with a note that said ‘thank you for everything, I’m sorry I couldn’t be the man for you.’

It was bittersweet, as you used to love him, but this was a chapter that needed to end. He didn’t want kids, or marriage or the picket fence. This was convenient and you had too much love in your heart, which needed reciprocating.

You twiddled the card in your fingers, with a number and the name Mr Joel Miller written on it.

You sat in your lounge, legs tucked up on the sofa beneath you, and you boldy texted.

‘Hey Joel. My auntie Clara gave me your number. Are you okay to do some work on my place tomorrow, I know it’s Saturday but I have evening plans and need it fixed or my mum will flip her shit. I’ll pay double and provide coffee🤸🏻’

Joel smirked upon reading the text, and somehow, his heart skipped a beat.

‘Hey darling, how could I forget about Clara’s girl. I’m so sorry to hear about your dad. I’ll be there tomorrow. Thanks for asking😘.’

Your bit your lip, you vaguely remembered Joel from family parties, and he was a good friend of your family’s, but you had never really said a word to him, always too occupied with not winding James up.

You left the message as read, and decided to have an evening of housework to get the house somewhat presentable for Joel.

You snuggled up in bed after showering and doing your fake tan Friday routine. Leo, your British Blue kitten, pounced upon your satin sheets and eventually settled for the night with you.

You dozed off, with nothing but hope and positivity in your mind.

Next Chapter

Main Masterlist

Series Masterlist

#joel miller#joel miller fanfiction#joel miller tlou#joel miller x reader#joel miller x you#joel miller x f!reader#pedro pascal#pedrohub#joel miller smut#no outbreak au#boyfriend!joel#dad!joel miller#joel miller fluff#joel miller fic#husband!joel#joel the last of us#no outbreak!joel miller#joel miller pedro pascal#pascalispunk#pedrito#soft!joel miller#joel miller x y/n

46 notes

·

View notes

Text

Mitigating mortgage application processing woes

Introduction

In today’s world, where digital transformation is enhancing customer experiences across various industries, the mortgage sector often tells a different story. Here, manual processes and unexpected delays frequently result in customer dissatisfaction. For instance, according to ValuePenguin, mortgage lenders spend an average of 24 to 72 hours underwriting each loan . Additionally, Ellie Mae, a leading mortgage software company, reports that the average time to close a mortgage loan in the United States is currently 47 days.

However, with the advent of artificial intelligence making waves everywhere, the mortgage industry isn’t immune. Today, AI has transformed the way compliance review, fraud detection, property valuation, underwriting data verification, processing, and so on and so forth used to be.

The Problem

While the quest for a mortgage offer unfolds against a backdrop of potential hurdles, understanding and addressing the factors that influence processing times can help aspiring homeowners navigate the mortgage maze with confidence, inching closer to the keys of their dream abode.

Unveiling the Secrets Behind Mortgage Application Delays

Let’s delve into the intricate web of factors that could potentially slow down your mortgage application, shedding light on a question that has echoed through the corridors of homebuying for over a decade: How many man-hours does it take to receive your mortgage offer?

At the very onset, one can classify these factors into two broad categories:

A. Factors involving the lender’s side B. Factors involving the borrower’s side

Factors involving the lender’s side

Lender’s Service Levels: Mortgage lenders face significant service level delays due to multifaceted challenges in the loan origination process. Accurately assessing borrower credit risk, adhering to complex and evolving regulations, and preventing fraud are critical tasks that hinder operational efficiency. These delays negatively impact customer satisfaction, as timely service is essential in the fiercely competitive mortgage industry.

The lender’s underwriting process: Each lender boasts a distinct underwriting process, ranging from meticulous document scrutiny to embracing digital tools for streamlined verification. Embracing automation can accelerate offer issuance, highlighting the significance of leveraging a knowledgeable broker who can navigate these nuances for a swifter outcome.

Involvement of Third Parties: Beyond the lender-applicant dynamic, third-party stakeholders like surveyors and accountants can influence the speed of your mortgage offer. Surveyor availability for property valuation or accountant responsiveness in verifying financial details can introduce additional variables, warranting proactive engagement and realistic expectations.

Factors involving the borrower’s side

Personal Circumstances and Credit History: Your unique circumstances, from employment stability to credit history intricacies, play a pivotal role in shaping the mortgage application timeline. While a straightforward financial profile can expedite document processing, complexities such as self-employment or past credit challenges may necessitate thorough affordability assessments, potentially elongating the process.

The Solution

The process of mortgage loan application processing can be quite time-consuming, yet customers expect swift results. Outsourcing mortgage processing stands out as a highly effective strategy for reducing turnaround times. Mortgage application processing service providers boast qualified teams, advanced technology, and round-the-clock operations, ensuring speedy turnarounds.

The integration of AI and machine learning technologies has significantly transformed the lending landscape, offering various benefits and opportunities for lenders.

Revolutionizing Application Processing

Speedy Approvals

Traditionally, obtaining mortgage approval could take weeks or even months as documents were reviewed, validated, and authorized by multiple departments.

But with AI-driven IDP systems one can quickly and accurately extract relevant information from a variety of documents required in mortgage applications, such as tax returns, pay stubs, and bank statements. By automating data extraction and validation, AI minimizes the need for manual data entry and reduces the risk of errors. This speeds up the loan approval process significantly, allowing lenders to provide quicker responses to applicants.

2. Risk Assessment

The speed at which IDP processes documents drastically reduces the time required for risk assessment. What once took days or even weeks can now be accomplished in a matter of hours. This accelerated process not only improves operational efficiency but also enhances the customer experience by providing faster loan approvals. Applicants receive quicker responses, reducing the uncertainty and stress associated with the mortgage application process.

3. Revamping the Underwriting Process

Intelligent Document Processing (IDP) is transforming the mortgage underwriting process by automating the extraction, classification, and validation of information from various documents. This advanced technology leverages AI and machine learning to accurately and swiftly process data, reducing the manual workload for underwriters. As a result, the time required to review and approve mortgage applications is significantly shortened, enhancing efficiency and reducing the risk of errors. By streamlining these tasks, IDP ensures faster and more reliable mortgage application processing, benefiting both lenders and borrowers.

In conclusion, the reason for longer man hours in mortgage application processing is due to several lengthy procedures and formalities such as title checks, verifications, valuations, and tax reports. To enhance the borrower experience, lenders are under pressure to expedite loan processing while staying compliant with regulations.

It is here that technology like intelligent document processing plays a crucial part in reducing turnaround times

Intelligent Document Processing or what is popularly called IDP is revolutionizing the mortgage loan application process by significantly improving efficiency and reducing costs. By leveraging advanced technologies like artificial intelligence (AI), machine learning, and optical character recognition (OCR), IDP automates the extraction, classification, and validation of data from various documents. This automation minimizes manual data entry errors and speeds up the processing time, allowing lenders to handle a higher volume of applications with greater accuracy. Consequently, the streamlined process reduces operational costs and enhances customer satisfaction by providing faster loan approvals and a smoother overall experience.

To know more about this transformative power of AI, connect with us to experience DocVu.AI.

#intelligent document processing#mortgage processing#document processing#idp#automation#mortgage#finance and accounting

0 notes

Text

E-Stamp India Guide: How to Use E-Stamp for Real Estate Deals

E-Stamping is an electronic method of paying stamp duty, which is a mandatory tax levied on legal documents such as property sale deeds, lease agreements, and mortgage documents. This system was introduced to reduce the risks associated with counterfeit stamp papers and to streamline the documentation process.

The India e-stamp system was developed by the Stock Holding Corporation of India Limited (SHCIL), which acts as the central record-keeping agency. E-stamping ensures that the stamp duty is paid securely and transparently, offering an alternative to traditional physical stamp papers.

2 notes

·

View notes

Text

How Company Directors Can Secure the Best Deals in 2025

In 2025, the financial landscape for limited company directors and business owners continues to evolve. While opportunities to build wealth through homeownership remain strong, many entrepreneurs still struggle to get mortgage approvals that accurately reflect their income potential. This challenge doesn't stem from a lack of earnings, but rather from how those earnings are structured—and how lenders interpret them.

Whether you're applying for a mortgage as a limited company director or a self-employed professional, understanding the nuances of mortgages with company profit, net profit mortgages, and other specialised options is essential.

Why 2025 is a Turning Point for Company Director Mortgages

As lending regulations modernise, there’s a clear shift away from "one-size-fits-all" underwriting. Many lenders embrace flexible assessment models, designed to serve applicants with non-traditional income. This is especially true for:

Limited company directors

Business owners with retained profit

Self-employed individuals

Directors are drawing low salaries/dividends for tax efficiency.

Previously, these groups were forced to take out lower mortgage amounts based solely on declared personal income. Now, lenders are more open to assessing broader financial indicators, like company net profit and retained earnings, to determine borrowing capacity.

The Rise of Net Profit and Retained Earnings Mortgages

Net Profit Mortgages

Instead of focusing on salary or dividends, net profit mortgages use your company’s bottom line to measure affordability. If your business earned £100,000 in profit last year—even if you only drew £30,000 personally—a net profit-based lender may assess your affordability based on the full figure.

This approach benefits:

Directors reinvesting in growth

Those planning for retirement

Entrepreneurs keep income within the business for stability.

Mortgages with Company Profit

Some lenders go one step further by considering mortgages with company profit, including retained earnings over several years. This allows for higher borrowing limits without forcing business owners to restructure their income or draw larger dividends.

Specialist advisers at The Mortgage Pod note that more clients are now approved using their profit figures, allowing them to borrow what they can truly afford, not just what they’ve withdrawn on paper.

Why Standard Brokers May Not Be Enough

Mainstream mortgage advisers may not have the tools or knowledge to effectively present a director’s income. Many company owners are turning to brokers specialising in business owners' and self-employed mortgages.

According to Strive Mortgages, the ability to interpret tax documents, understand company structures, and liaise with lenders who offer manual underwriting makes a substantial difference in approval rates.

Documents You’ll Need in 2025

Lenders in 2025 still require documentation, but open banking and digital account sharing have streamlined the process. Here’s what most lenders will ask for when evaluating directors or self-employed applicants:

1–2 years of company accounts (certified)

Tax calculations (SA302S) and tax year overviews

Business bank statements

Details of retained profits and dividend schedules

Accountant’s confirmation of income

Even if revenue dips during a past tax year, a strong current year or a clear explanation may help mitigate lender concerns, especially with brokers who know how to present the data correctly.

Two Trusted Specialists for Business Owners

We’ve seen a clear shift in how lenders treat business owners, and that’s good news for our clients, says Steve Humphrey, founder of The Mortgage Pod. His team focuses exclusively on helping professionals with complex income structures find the right mortgage solutions.

Likewise, Jamie Elvin, Director at Strive Mortgages, adds, “Too many directors are being held back by systems that don’t reflect modern income realities. Our job is ensuring their applications tell the full financial story.”

Both firms emphasise education, transparency, and lender-matching to increase the chances of approval and the size of the mortgage available.

2025 Opportunities: Business-Friendly Lenders & Better Terms

As competition among lenders increases, some are actively seeking to grow their business customer base by offering:

Lower deposit options (as low as 10% in some cases)

Flexible affordability criteria

Faster underwriting using open banking

Cashback incentives for company directors

These new products are designed to help business owners compete in a fast-paced property market, especially in regions where demand still outpaces supply.

Conclusion: Take Control of Your Financial Narrative

In 2025, company directors have more power than ever to shape their mortgage outcomes—if they know where to look. Whether you're considering your first property or remortgaging for expansion, it’s essential to find advisers who understand the language of business.

By working with experienced mortgage brokers like The Mortgage Pod and Strive Mortgages, you can access lenders who recognise your company’s full financial strength, not just your payslip.

For business owners ready to invest in their future, the path to homeownership is no longer blocked by rigid income definitions. It's paved with tailored advice, strategic presentation, and financial partners who truly get it.

3 notes

·

View notes