#Financial Literacy For

Explore tagged Tumblr posts

Text

Financial Literacy For Kids - Empowerment Through Education | HeritageFCU

Heritage Financial Credit Union provides essential Financial Literacy For Kids. Our resources guide young minds towards smart money management, building a foundation for a secure financial future. Start their education today for lifelong skills.

#Financial Literacy For Kids#Financial Literacy For#Financial Literacy For Kid#Financial Literacy#Literacy For Kids

0 notes

Text

financial literacy⋆.ೃ࿔*:・✍🏽🎀

so i released a poll if you guys would like a post on financial literacy and the results are here. so im gonna share some things that i learned while taking a financial literacy course…💬🎀

WHAT IS FINANCIAL LITERACY ;

financial literacy is handling ur money wisely. the google definition of financial literacy is the ability to understand and apply different financial skills effectively, including personal financial management, budgeting, and saving.

ALL ABOUT BUDGETING ;

when u hear the word "budget" its rly easy to think "omg limiting belief" or think of it in a negative light but a budget is just a plan on how u manage ur money. its not always constrictive and negative like u may or may not think of it to be.

budgeting : keeping track of how much $ ur bringing in and how much ur spending…💬🎀

planning a budget is ez pz. you can use some paper and sparkly pink gel pens to create an adorable budget, or u can download different sheets online and just have your budget digitally. theres a plethora of resources out there so just choose whichever is easier for u.

something else that i learned about during this course was the 50:30:20 rule. its called the 50:30:20 rule because 50% of ur money goes towards ur needs, 30% goes towards wants and 20% goes towards ur savings. and this isnt concrete, its just a good framework and u can adjust to ur own specific needs and goals.

for example if u manifested $4000. ur 50% would be $2000, ur 30% would be $1200 and ur 20% would be $800…💬🎀

HOW DO U KNOW WHAT UR NEEDS/WANTS ARE ;

things like ur rent and groceries are ur needs and things like vacations and going out with ur girls are wants. and to apply the 50:30:20 rule you first have to...

♡ calculate ur needs, wants and savings budget

♡ compare ur expenses to ur budget

the way u do this is to subtract your expenses from your budget. this is your budget balance. if your budget balance is zero or positive, that means you are living within your means and have some extra money. if your budget balance is negative, that means you are spending more than you should and may have a budgeting problem.

let me know if u guys want more content about this cuz i had a lot of fun writing this…💬🎀

#honeytonedhottie⭐️#law of assumption#it girl#becoming that girl#self concept#that girl#self care#it girl energy#advice#dream girl tips#dream girl#dream life#beauty and brains#financial literacy#investments#personal finance#information#pink academia#girly#hyper femininity#hyper feminine#girl blog#fabulous#fabulously feminine#glamor#glamorous#self improvement#self growth#maintenance#rich and pretty

672 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Repairing Our Busted-Ass World

On poverty:

Starting from nothing

How To Start at Rock Bottom: Welfare Programs and the Social Safety Net

How to Save for Retirement When You Make Less Than $30,000 a Year

Ask the Bitches: “Is It Too Late to Get My Financial Shit Together?“

Understanding why people are poor

It’s More Expensive to Be Poor Than to Be Rich

Why Are Poor People Poor and Rich People Rich?

On Financial Discipline, Generational Poverty, and Marshmallows

Bitchtastic Book Review: Hand to Mouth by Linda Tirado

Is Gentrification Just Artisanal, Small-Batch Displacement of the Poor?

Coronavirus Reveals America’s Pre-existing Conditions, Part 1: Healthcare, Housing, and Labor Rights

Developing compassion for poor people

The Latte Factor, Poor Shaming, and Economic Compassion

Ask the Bitches: “How Do I Stop Myself from Judging Homeless People?“

The Subjectivity of Wealth, Or: Don’t Tell Me What’s Expensive

A Little Princess: Intersectional Feminist Masterpiece?

If You Can’t Afford to Tip 20%, You Can’t Afford to Dine Out

Correcting income inequality

1 Easy Way All Allies Can Help Close the Gender and Racial Pay Gap

One Reason Women Make Less Money? They’re Afraid of Being Raped and Killed.

Raising the Minimum Wage Would Make All Our Lives Better

Are Unions Good or Bad?

On intersectional social issues:

Reproductive rights

On Pulling Weeds and Fighting Back: How (and Why) to Protect Abortion Rights

How To Get an Abortion

Blood Money: Menstrual Products for Surviving Your Period While Poor

You Don’t Have to Have Kids

Gender equality

1 Easy Way All Allies Can Help Close the Gender and Racial Pay Gap

The Pink Tax, Or: How I Learned to Love Smelling Like “Bearglove”

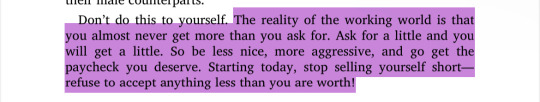

Our Single Best Piece of Advice for Women (and Men) on International Women’s Day

Bitchtastic Book Review: The Feminist Financial Handbook by Brynne Conroy

Sexual Harassment: How to Identify and Fight It in the Workplace

Queer issues

Queer Finance 101: Ten Ways That Sexual and Gender Identity Affect Finances

Leaving Home before 18: A Practical Guide for Cast-Offs, Runaways, and Everybody in Between

Racial justice

The Financial Advantages of Being White

Woke at Work: How to Inject Your Values into Your Boring, Lame-Ass Job

The New Jim Crow, by Michelle Alexander: A Bitchtastic Book Review

Something Is Wrong in Personal Finance. Here’s How To Make It More Inclusive.

The Biggest Threat to Black Wealth Is White Terrorism

Coronavirus Reveals America’s Pre-existing Conditions, Part 2: Racial and Gender Inequality

10 Rad Black Money Experts to Follow Right the Hell Now

Youth issues

What We Talk About When We Talk About Student Loans

The Ugly Truth About Unpaid Internships

Ask the Bitches: “I Just Turned 18 and My Parents Are Kicking Me Out. How Do I Brace Myself?”

Identifying and combatting abuse

When Money is the Weapon: Understanding Intimate Partner Financial Abuse

Are You Working on the Next Fyre Festival?: Identifying a Toxic Workplace

Ask the Bitches: “How Do I Say ‘No’ When a Loved One Asks for Money… Again?”

Ask the Bitches: I Was Guilted Into Caring for a Sick, Abusive Parent. Now What?

On mental health:

Understanding mental health issues

How Mental Health Affects Your Finances

Stop Recommending Therapy Like It’s a Magic Bean That’ll Grow Me a Beanstalk to Neurotypicaltown

Bitchtastic Book Review: Kurt Vonnegut’s Galapagos and Your Big Brain

Ask the Bitches: “How Do I Protect My Own Mental Health While Still Helping Others?”

Coping with mental health issues

{ MASTERPOST } Everything You Need to Know about Self-Care

My 25 Secrets to Successfully Working from Home with ADHD

Our Master List of 100% Free Mental Health Self-Care Tactics

On saving the planet:

Changing the system

Don’t Boo, Vote: If You Don’t Vote, No One Can Hear You Scream

Ethical Consumption: How to Pollute the Planet and Exploit Labor Slightly Less

The Anti-Consumerist Gift Guide: I Have No Gift to Bring, Pa Rum Pa Pum Pum

Season 1, Episode 4: “Capitalism Is Working for Me. So How Could I Hate It?”

Coronavirus Reveals America’s Pre-existing Conditions, Part 1: Healthcare, Housing, and Labor Rights

Coronavirus Reveals America’s Pre-existing Conditions, Part 2: Racial and Gender Inequality

Shopping smarter

You Deserve Cheap Toilet Paper, You Beautiful Fucking Moon Goddess

You Are above Bottled Water, You Elegant Land Mermaid

Fast Fashion: Why It’s Fucking up the World and How To Avoid It

You Deserve Cheap, Fake Jewelry… Just Like Coco Chanel

6 Proven Tactics for Avoiding Emotional Impulse Spending

Join the Bitches on Patreon

#poverty#economics#income inequality#wealth inequality#capitalism#working class#labor rights#workers rights#frugal#personal finance#financial literacy#consumerism#environmentalism

784 notes

·

View notes

Text

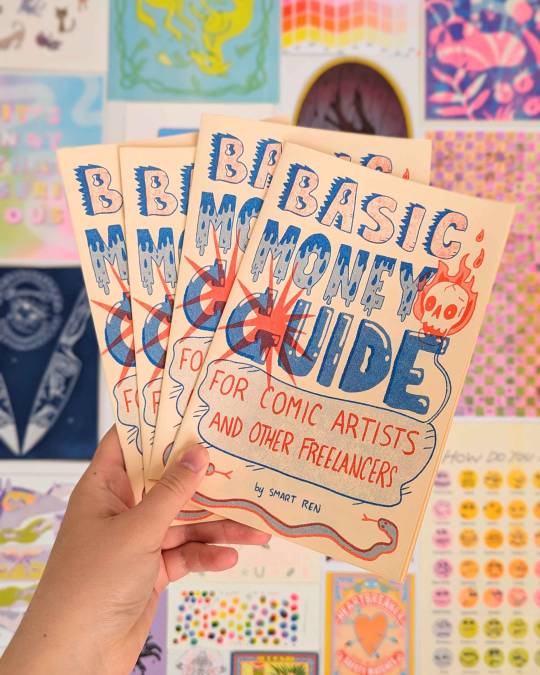

"Basic Money Guide for Comic Artists and Other Freelancers" [PRINT EDITION] is here, available in my shop!

One of the best gifts I gave myself before becoming full time self employed was a Roth IRA, so if you're interested in self employment (or even if you aren't but you want an emergency savings account) check out this zine!

Give a copy to the freelancer in ur life <3

Read for free here <3

Check out Secret Room Press! They printed this zine for me.

286 notes

·

View notes

Text

Ok, tumblr -- economic literacy lesson of the day is the difference between Net Worth and Liquidity.

Net Worth, for a person or company, is the total value of one's assets minus the total value of one's liabilities. This means: how much all of your shit is worth, after you subtract any debts you have.

Liquidity by contrast is how much of your assets you have readily available as spending money, or can quickly and easily convert to spending money (selling stocks or bonds, for instance).

For example: meet Bob. Bob owns a house worth $300k. His car is worth $5k. He has about $15k in the bank and $50k in a retirement fund that he can't pull from until he's 60. Bob has a mortgage on the house and still owes $100k, and has about $5k in other debts he's paying off, such as credit cards.

Bob's total assets (house, car, retirement fund, bank account) are worth $370k, with debts of $105k, leaving him with a Net Worth of $265k.

Now you may be saying "$265,000 is a lot of money! Bob is pretty wealthy!"

But Bob's assets are largely not liquid. He can't quickly and easily convert them into spending cash -- for physical objects, like a house or a car, you need to line up a buyer and negotiate a deal and it takes time to liquidate those assets (and leaves Bob with nowhere to live and nothing to drive). The retirement fund is not accessible money because of the limits on withdrawals based on age. In fact, the only money Bob has that's liquid for him to spend on bills, living expenses, and any emergency that might come up is the $15,000 in the bank.

Now imagine Bob gets injured and gets rushed to the hospital in an out-of-network ambulance because Bob has the misfortune to live in the US, and after the bills, Bob's $15k in the bank is completely wiped out. Bob still has a Net Worth of $250k, but he is now completely broke and getting hit with overdraft fees and still in debt.

Now, I wanna be clear -- this isn't a defense of the ultra-wealthy; billionaires whose net worth is largely accounted for by the businesses and assets they own still have more cash in their overseas bank accounts than you and I will probably ever see in our lifetimes, and have ability to borrow absurd amounts of money against their stock as collateral for easy liquidity without paying taxes, which is a whole other mess. Those guys operate by different rules than the rest of us (look up the Billionaire Borrowing Loophole, or 'Buy, Borrow, Die') so if you see people using this argument for why Jeff Bezos isn't actually all that rich because he can't just liquidate Amazon-- yeah, doesn't quite work that way when we're on that level. But that's a whole 'nother bag of cats.

Anyway; I hope this helps clarify what people mean when they talk about Net Worth versus someone's actual accessible money, and hopefully helps you feel more informed!

58 notes

·

View notes

Text

Nails, TV, Moving

Rendacted paints your nails and 'asks' you to move in. 1.3k words, GN reader c:

14 Days With You is an 18+ Yandere Visual Novel. MINORS DNI

~

"Unfortunately for our contestant—" the host’s words get cut off as you press a button on the remote.

"Booooo," you jeered at the TV from your spot on the floor and changed the channel.

Ren hummed softly at your voice, but didn't look up. Despite the dark bangs that obscure their eyes, you can tell they’re focused. He was happily painting your nails—the same shade of black as his own—at your request. He insisted you sit as close as possible on the blanket he laid down, instead of across the coffee table. He'd only ever painted his own nails after all, so the angle was very important to keep him from messing up. You were certain he just said that because he wanted the closeness.

The screen barely flashes a few frames before you're changing it again. A football game, a cartoon, a drama, and then—you finally stop. There's a couple wandering through a cabin, with a disembodied voice narrating all it had to offer. One of the many house hunting shows that came on every so often.

"Oh, this one's pretty." You put down the remote to watch. The couple head upstairs where the master bedroom is and your excitement quickly dies. "Maybe not. The bathroom is a huge let down."

Ren casts a glance up at the TV as the camera pans over the room once more. He took in the slanted ceiling, with the tub stationed on the lower end, lit up by an angled skylight. He didn't really see whatever problem you had. "What's wrong with it?" he asked.

"The ceiling is already so low. You'd have to fold yourself in half to get in that tub, tall as you are. And you'd probably hit your head every time you got out. We couldn't live there," you grumbled and rested your chin on your free hand, eyes never straying from the screen. "No way I'd put you through that."

You didn't notice how he perked up when your concerns involved him—you even said ‘we.’ A miniscule drop of polish fell on the paper towel under your hand. He wasn't sure if you were being considerate, or if your perfectly normal relationship was at the point of buying a home together. He hoped it was the latter. Either way, including them already planted ideas in their mind. "So then, what's our—your ideal home have?"

"My ideal home…" You’d only really thought about things you didn’t want, thanks to your current apartment. "I can't say I'm very picky. No holes in the walls, enough room to breathe, no rats," you paused for a bit—now they were in a rather awkwardly shaped second bedroom. "When I was little I wanted to live in a bounce house. Or have a freezer dedicated to ice cream."

Ren smiled while he carefully painted the nail of your pinky. "One of those is doable."

"True, but I'd rather not blow up my house every day," you joked and continued pondering. "The location is probably the most important, right?" He silently nodded in agreement as you went on. "Corland Bay's nice and all—having everything so close together makes things easy. Except sometimes I wanna fall asleep without hearing cars pass by or Violet playing games. It's much quieter here. Plus your bed is comfy."

"You're more than welcome to live here, Angel," he innocently offered. “Although maybe you’d enjoy somewhere more secluded.”

“Like just out of town? Not too far from civilization. I'd still wanna be near the beach." You watched the couple fuss about the kitchen in another house before you really processed what he just said. You turned to look at him for the first time since the show caught your interest. "Are you asking me to move in with you?"

"Oh, is that what it sounded like?" His tone was full of shock, but you could see the way his snake bites pulled up in a faint grin. He examined your nails and lifted your hand once he deemed it finished. "I do have all this space, though. The library’s close by. Beach is a short walk away, too. No neighbors, no noise. I've never had a rat problem. I guess it hits all the marks f’you, doesn’t it, Angel?"

"Ren…" You rolled your eyes at his antics.

"If you really want to move in that badly, I'm not opposed," he said teasingly. "Other hand."

You didn't respond just yet, merely giving them a playful side eye and placing your hand flat on the table. Gently, you blew air on your wet nails while he went to work. The noise of the TV faded into the background as you thought about his offer.

It was a big step to take. You already spent a fair amount of your time at his place. The ever-dwindling amount of laundry you did at home served as proof. Cohabitating with them wouldn't be much different from now. Ren always gave you space when you asked, even with his clingy personality. He was tidy, quiet, and never made a fuss—the perfect roommate on paper. The real issue was money. A place like this would cost way more than a librarian’s salary could pay.

"As much as I want to, I have to consider rent first," you thought aloud, causing him to stop and look up.

"Angel, you don't need to pay anything." His answer was almost immediate and it surprised you how firm he sounded about it.

You shook your head. "I know I probably can't do half, but I’d like to do my fair share. How much is your rent each month?"

"Well, actually," he stalled and idly rolled the nail brush in his fingers before putting it back in the bottle. The rent was one thing he couldn’t be bothered to keep track of. "...I have no idea?"

"How—what?"

"It's an automatic payment so I never think about it," he admitted, explaining further at your incredulous expression. "I mean I definitely saw it when I found the listing—and when I signed the lease. But I can't remember it off the top of my head."

You had a hard time believing what you were hearing. You knew your own rent by heart—it mocked you every time it took a chunk out of your bank account. A question about how he budgeted weighed in your mind, although the rather calm way Ren spoke clearly answered it: he didn't. It seemed obvious now; he'd been a frivolous spender from the beginning.

The blank look on your face made him a little worried. "Honestly, Angel, it’s not an issue. I’ve been paying it on my own just fine," he insisted. "You don’t have t’worry about any cost if you stay here, I promise.” He’d be happy as a clam to pay triple whatever he already was if it meant you'd move in. Hell, he’d even pay for you to live in one of the empty units next door.

"Fine then," you sighed in defeat, glancing towards the TV screen for a moment. The show was already ending. "If I tried to give you money you'd just find a way to give it back anyways.”

Ren let out a faint breath as if he was holding back laughter, but didn’t disagree. "So, how about it? Gonna move in?” he asked with a sincere smile.

You couldn’t help but smile the same in return. “Yeah, why not? I’d be crazy to say no. I can talk to my landlord and be out in a few weeks, probably.”

His excitement only seemed to grow at your words. He was radiating silent joy, fingers tapping rhythmically on the table as he uncapped the bottle of polish once more. You could almost imagine a tail wagging behind him as he tried to make steady brushstrokes over your nail.

“Are you really that happy?” you laughed and he nodded. “Maybe I should just move in tomorrow.” His hand barely slipped, leaving the tiniest streak of polish on the side of your ring finger.

“Oops,” he muttered.

#14 days with you#14dwy#14dwy redacted#14dwy ren#momo writing#he's a lil silly#dude just yoinks more money if his account looks “low”#but low is 6 digits#your school taught financial literacy but he skipped that lesson to spy on you#bad title hehe

711 notes

·

View notes

Text

Excerpt from Smart Women Finish Rich by David Bach

#high value woman#leveling up#elegance#hypergamy#affluence#luxury#goals#level up#divine feminine#financialeducation#financial literacy#finance#bookblr#bookworm#books#hot and educated#hot girls read#dream girl journey#Dream girl#glow up diaries#glow up journey#glow up guide#glow up#powerful woman#self development#self improvement#becoming that girl#becoming her#beneficiaryblr#spoiledblr

58 notes

·

View notes

Note

male suicide stats being cited consistently legitimately drives me up a wall because it is based on a completely false premise. Men are not more depressed than women. Women attempt suicide at a higher rate, men just complete at a higher rate. If you’re using the stat to make some grand claim about the effects of male loneliness you’re just wrong, full stop.

oh absolutely. women are more depressed and attempt more often, it’s just we usually choose less violent and therefore less reliable methods. so like if they actually wanted to make the male suicide rate lower they would try to make it harder for men to access their main suicide methods (namely guns) by supporting gun control and similar measures. instead they are trying to guilt women into fucking them bc they don’t actually care about men dying, just about controlling women.

#also iirc most men kill themselves bc they are in sticky financial situations. not bc they don’t have a mommygf.#so lets teach them financial literacy lol

37 notes

·

View notes

Text

At work my bosses keep bringing up a position I really really want but im not qualified for it and their bosses definitely won't greenlight me for the position so whenever they bring up me being a media specialist I just look at them like this

#LET ME BE THE SCHOOL LIBRARIAAANNNNN#my DREAM JOOOBBBBB#id be happy as a classroom teacher in the meantime and tbh probably more engaged however i want control of that library so bad#id run weekly digital literacy seminars#and bring in the county library#and community resources for financial literacy#and teach them so much about zines and self publishing and ARRHHHHH

22 notes

·

View notes

Text

Anti-literacy laws in many slave states before and during the American Civil War affected slaves, freedmen, and in some cases all people of color. Some laws arose from concerns that literate slaves could forge the documents required to escape to a free state. According to William M. Banks, "Many slaves who learned to write did indeed achieve freedom by this method. The wanted posters for runaways often mentioned whether the escapee could write." Anti-literacy laws also arose from fears of slave insurrection, particularly around the time of abolitionist David Walker's 1829 publication of Appeal to the Colored Citizens of the World, which openly advocated rebellion, and Nat Turner's Rebellion of 1831.

The United States is the only country known to have had anti-literacy laws.

Significant anti-African laws include:

1829, Georgia: Prohibited teaching Africans to read, punished by fine and imprisonment

1830, Louisiana, North Carolina: passes law punishing anyone teaching Africans to read with fines, imprisonment or floggings

1832, Alabama and Virginia: Prohibited Europeans from teaching Africans to read or write, punished by fines and floggings

1833, Georgia: Prohibited Africans from working in reading or writing jobs (via an employment law), and prohibited teaching Africans, punished by fines and whippings (via an anti-literacy law)

1847, Missouri: Prohibited assembling or teaching slaves to read or write

Mississippi state law required a white person to serve up to a year in prison as "penalty for teaching a slave to read."

A 19th-century Virginia law specified: "[E]very assemblage of negroes for the purpose of instruction in reading or writing, or in the night time for any purpose, shall be an unlawful assembly. Any justice may issue his warrant to any office or other person, requiring him to enter any place where such assemblage may be, and seize any negro therein; and he, or any other justice, may order such negro to be punished with stripes."

In North Carolina, African people who disobeyed the law were sentenced to whipping while whites received a fine, jail time, or both.

AME Bishop William Henry Heard remembered from his enslaved childhood in Georgia that any slave caught writing "suffered the penalty of having his forefinger cut from his right hand." Other formerly enslaved people had similar memories of disfigurement and severe punishments for reading and writing.

Arkansas, Kentucky, and Tennessee were the only three slave states that did not enact a legal prohibition on educating slaves.

It is estimated that only 5% to 10% of enslaved African Americans became literate, to some degree, before the American Civil War

#afrakan#african#kemetic dreams#brownskin#afrakans#african culture#africans#brown skin#afrakan spirituality#anti literacy#media literacy#financial literacy#digital literacy#information literacy#early literacy#ban books#ban#united states#united states of america#geopolitics#america#usa#politics#slavery#prison abolition#abolition#american history#african american history#civil rights

117 notes

·

View notes

Text

financial literacy continued⋆.ೃ࿔*:・👛💵

so i released a poll if you guys would like a post on financial literacy and the results are here. so im gonna share some things that i learned while taking a financial literacy course…💬🎀

HOW TO SAVE MONEY ;

automatically deposit a certain percentage of ur income into ur savings account so that u dont even have to think about it

to do something more FUN tho, (at least in my opinion) is to make a challenge where u have to save every $10 dollar bill, or $20 dollar bill or whatever. just something to make saving money seem like a game if u wanna have some fun with it.

EMERGANCY FUND ;

most experts will tell u that ur emergency fund should be 3-6 months of ur needed expenses. so calculate ur needed expenses and multiply that by 6 to figure out how much you'd need to have in ur emergency fund.

PAYING YOURSELF FIRST ;

you should always put urself first in every single situation including financially. so to pay urself first simply means to put ur future and needs before anything else. FOR EXAMPLE... let's say u wanna buy an ipad by the end of the year, an ipad is $345.

lets also say that u get paid weekly, so you'd divide $345 by the number of weeks in a year (52) you'd get 6.6. so you'd have to save roughly $6-$6.50 a week which isnt a lot at all. and you'd be getting what u want.

INTEREST AND CREDIT ;

interest is like a reward that the bank gives you for trusting them to look after your money. the more money you have in your account, and the longer you keep it there, the more interest you can earn…💬🎀

so the bank calculates interest as a percentage of the total amount in a bank account. so if the bank pays a 1% interest you'll earn $1 for every $100 in ur bank account over the course of a year. so if u have $500 in ur account you'll get $5. its not a lot, but interest builds on itself.

credit is the ability of the consumer to acquire goods or services prior to payment with the faith that the payment will be made in the future…💬🎀

for example missing payment deadlines can negatively affect ur credit score. why is this important? if u wanna go to college and wanna use student loans, u might not be able to if ur credit history is bad. as ur credit history grows you'll get a credit score. the higher ur score, the better ur credit is.

BUILDING CREDIT ;

get a secured card. a secured credit card is a special type of credit card with a down payment. when you open the card, you will give the credit card company a deposit to hold. it can be as little as $100. the company holds the money for you and gives you a credit card with a line of credit equal to your deposit

sign up for victoria's secret direct paper mailers. you'll get a coupon each month for 1 free panty for every purchase. when u go to the mall, get urself a panty and a sweet treat 🧁 (DO NOT PUT ANYTHING ON THE CARD THAT U CANT IMMEDIATELY PAY OFF)

and then go home and pay ur credit card bill off, and then dont use it again until the next month.

#honeytonedhottie⭐️#law of assumption#it girl#becoming that girl#self concept#that girl#self care#it girl energy#advice#dream girl tips#dream girl#dream life#beauty and brains#financial literacy#investments#personal finance#information#pink academia#girly#hyper femininity#hyper feminine#girl blog#fabulous#fabulously feminine#glamor#glamorous#self improvement#self growth#maintenance#rich and pretty

837 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Saving Money and Being Frugal

We’re all in this together. Don’t give up.

On food and groceries:

How to Shop for Groceries like a Boss

Why Name Brand Products Are Beneath You: The Honor and Glory of Buying Generic

If You Don’t Eat Leftovers I Don’t Even Want to Know You

You Are above Bottled Water, You Elegant Land Mermaid

You Should Learn To Cook. Here’s Why.

On entertainment and socializing:

The Frugal Introvert’s Guide to the Weekend

7 Totally Reasonable Ways To Save Money on Cheap Entertainment

Take Pride in Being a Cheap Date

The Library Is a Magical Place and You Should Fucking Go There

Your Library Lets You Stream Audiobooks and eBooks FOR FREEEEEEE!

What’s the Effect of Social Media on Your Finances?

You Won’t Regret Your Frugal 20s

On health:

How to Pay Hospital Bills When You’re Flat Broke

Run With Me if You Want to Save: How Exercising Will Save You Money

Our Master List of 100% Free Mental Health Self-Care Tactics

Why You Probably Don’t Need That Gym Membership

How to Get DIRT CHEAP Pet Medication, Without a Prescription

On other big expenses:

Businesses Will Happily Give You HUGE Discounts if You Ask This Magic Question

Understand the Hidden Costs of Travel and Avoid Them Like the Plague

Other People’s Weddings Don’t Have to Make You Broke

You Deserve Cheap, Fake Jewelry… Just Like Coco Chanel

3 Times I Was Damn Grateful for My Emergency Fund (and Side Income)

When (and How) to Try Refinancing or Consolidating Student Loans

The Real Story of How I Paid Off My Mortgage Early in 4 Years

Season 2, Episode 2: “I’m Not Ready to Buy a House—But How Do I *Get Ready* to Get Ready?”

The Most Impactful Financial Decision I’ve Ever Made… and Why I Don’t Recommend It

On buying secondhand and trading:

Almost Everything Can Be Purchased Secondhand

I Am a Craigslist Samurai and so Can You: How to Sell Used Stuff Online

The Delicate Art of the Friend Trade

On giving gifts and charitable donations:

How Can I Tame My Family’s Crazy Gift-Giving Expectations?

In Defense of Shameless Regifting

Make Sure Your Donations Have the Biggest Impact by Ruthlessly Judging Charities

The Anti-Consumerist Gift Guide: I Have No Gift to Bring, Pa Rum Pa Pum Pum

How to Spot a Charitable Scam

Ask the Bitches: How Do I Say “No” When a Loved One Asks for Money… Again?

On resisting temptation:

How to Insulate Yourself From Advertisements

Making Decisions Under Stress: The Siren Song of Chocolate Cake

The Magically Frugal Power of Patience

6 Proven Tactics for Avoiding Emotional Impulse Spending

On minimalism and buying less:

Don’t Spend Money on Shit You Don’t Like, Fool

Everything I Know About Minimalism I Learned from the Zombie Apocalypse

Slay Your Financial Vampires

The Subscription Box Craze and the Mindlessness of Wasteful Spending

On saving money:

How To Start Small by Saving Small

Not Every Savings Account Is Created Equal

The Unexpected Benefits (and Downsides) of Money Challenges

Budgets Don’t Work for Everyone—Try the Spending Tracker System Instead

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

The Magic of Unclaimed Property: How I Made $1,900 in 10 Minutes by Being a Disorganized Mess

We will periodically update this list with newer articles. And by “periodically” I mean “when we remember that it’s something we forgot to do for four months.”

Bitches Get Riches: setting realistic expectations since 2017!

Start saving right heckin’ now!

If you want to start small with your savings, consider signing up for an Acorns account! They round up your every purchase to the nearest dollar and save and invest the change for you. We like them so much we’ve generously allowed them to sponsor us with this affiliate link:

Start investing today with Acorns

#frugal#saving money#personal finance#money tips#financial tips#financial literacy#financial freedom#money#debt#money management#how to save money

872 notes

·

View notes

Text

youtube

Treasury Secretary Scott Bessent Launches Nationwide Push for Financial Literacy, WATCH

~~~

SMH

Aside from the tone-deaf nature of someone worth half a billion dollars preaching to struggling families the importance of financial literacy, the deeper issue here is that this guy is preaching bootstraps precisely as his team (trump et al) are f*cking the market and economy. (As of today, 4/22/25, the Nasdaq is down over 15% from the start of the year!) The "personal responsibility" chants of the GOP were always about avoiding the need for "social responsibility" or "governmental responsibility". It's a way of dismissing environmental circumstances and insisting that if you are poor and suffering, it's entirely your fault. But this is next level. While it's true that personal responsibility is *part* of what causes our life outcomes, it is only part. (The tariff nonsense is a good example. So was Covid. One can think of a thousand more that operate on smaller scales as well.) But it's amazing how much the GOP is pushing the bootstraps narrative even while the economy is crashing, clearly beyond our control, and is being caused by this dude and his team. Even further, they're dismantling the systems that help people when we fall on hard times. It's just so blatantly wrong. They're pissing on us and saying it's raining - and that it's our fault we can't farm in it!

Sadly, most of their base (and frankly, most of the country) buys into this personal responsibility and "meritocracy" narrative (by which I mean, ignoring the role of external factors in causing and mitigating such issues), which is precisely how they justify doing whatever they want. If you lose all your money in the stock market bc they crashed it - it's entirely your own fault. If you are bankrupted by a medical emergency - that's also your fault. If you lose your job due to tariffs - that's your fault. And if you can't get back on your feet, esp as social safety nets are gone - that's also your fault. If you die of poverty - yeah, your fault. oh well.

Personal responsibility for all - expect those on top making the decisions that affect everyone else.

p.s. Unsurprisingly, the video I found which is shared above is hosted by the Daily Caller, a rightwing site. No sense of irony from them about this post as the market crashes.

Pps. All that being said, do make sure you're working on your financial literacy (e.g. @bitchesgetriches ) bc we're all gonna be broke due to trump and co.

18 notes

·

View notes

Text

We NeEd BiLliOnAiReS fOr ThE eConOmy

MAGA fantasy land billionaires:

Billionaires in real life:

I guess No Face is realistically like a billionaire; uses the promise of wealth and then eats the people lol. But it feels like libel slander to taint No Face's name by associating him with Musk and the like.

#The lack of financial literacy is both tragically sad and frustrating as fuck#fuck elon musk#fuck trump#us politics#donald trump#elon musk#project 2025#jeff bezos#fuck bezos#fuck zuckerberg

20 notes

·

View notes

Text

Overconsumption of Luxury Goods Without Investing in Wealth-Building: A Garveyite Perspective

Introduction: The Illusion of Wealth and the Reality of Economic Enslavement

One of the most damaging financial habits in the Black world is the overconsumption of luxury goods without prioritizing investment, savings, and wealth-building. Instead of focusing on land ownership, business development, or financial education, many Black individuals spend excessive amounts of money on designer brands, expensive cars, jewellery, and other depreciating assets.

From a Garveyite perspective, this pattern of consumption is not just a personal choice—it is a direct result of mental colonization and economic control. White supremacy and capitalism have conditioned Black people to:

Spend money on symbols of wealth instead of building real economic power.

Measure success through materialism rather than collective financial independence.

Continue enriching non-Black corporations while Black businesses and communities suffer.

If Black people do not shift from consumerism to investment, they will remain at the bottom of the global economic system, with no real control over their future. Economic power is the foundation of liberation—without it, political and social progress are illusions.

1. The Historical Roots of Black Consumerism and Financial Dependency

A. The Psychological Impact of Slavery and Colonialism

During slavery and colonialism, Black people were:

Denied the ability to build wealth through land ownership or business creation.

Taught to associate success with what white society approved of.

Restricted from financial education, keeping them economically vulnerable.

Example: After the abolition of slavery, Black people in the U.S. and the Caribbean were often blocked from acquiring land and property, forcing them into sharecropping and low-wage labour.

Key Takeaway: Black people were systematically denied economic freedom, making consumerism one of the few available ways to express social status.

B. The Impact of White-Owned Corporations on Black Spending Habits

As Black people gained access to money, white-owned corporations targeted them as consumers rather than investors.

Companies:

Marketed expensive fashion, cars, and luxury items to Black audiences as symbols of success.

Used celebrities and media to push materialism over financial responsibility.

Encouraged debt-based spending rather than investment in real assets.

Example: The rise of hip-hop culture in the 1990s and 2000s saw luxury brands like Gucci, Louis Vuitton, and Rolex become status symbols in Black communities—despite these companies doing nothing to support Black wealth-building.

Key Takeaway: Black consumerism is not accidental—it was strategically created to keep Black money flowing into white-owned industries.

C. The Myth of "Looking Successful" Instead of Being Successful

Because of centuries of economic oppression, many Black people see luxury spending as proof of success.

Without generational wealth, many Black individuals feel pressure to “show” their achievements through material goods.

Instead of building financial security, money is spent on temporary status symbols.

Debt is normalized, making wealth-building impossible.

Example: Many Black athletes, entertainers, and professionals earn millions but end up broke within years because they spend recklessly instead of investing.

Key Takeaway: Real wealth is not in what you wear—it is in what you own.

2. The Modern Consequences of Overconsumption Without Wealth-Building

A. The Loss of Generational Wealth

Instead of passing down wealth to the next generation, many Black families:

Pass down debt and financial instability.

Do not own land, stocks, or businesses.

Leave their children starting from zero while white families pass down property and investments.

Example: Studies show that the average Black family's wealth is far lower than the average white family's wealth, largely due to a lack of investment in assets.

Key Takeaway: If Black people do not invest, future generations will remain economically enslaved.

B. The Strengthening of Non-Black Economies

Because Black people spend heavily on non-Black-owned luxury brands, their wealth:

Strengthens white and non-Black businesses while Black-owned businesses struggle.

Fails to circulate in Black communities, preventing collective wealth-building.

Makes Black economies dependent on outsiders instead of self-sufficient.

Example: Black people spend billions on luxury brands like Louis Vuitton, Nike, and Chanel, yet Black-owned businesses struggle to find investors.

Key Takeaway: If Black people’s money do not stay in Black communities, Black communities will always be poor.

C. The Perpetuation of Financial Illiteracy

Black communities lack financial education, leading to:

Poor credit management and high debt.

Lack of investment knowledge.

A cycle of paycheck-to-paycheck survival, preventing true financial growth.

Example: Many Black people do not invest in stocks, real estate, or business ownership because they were never taught how.

Key Takeaway: Economic power starts with financial education—without it, wealth-building is impossible.

3. The Garveyite Solution: Economic Self-Sufficiency and Financial Discipline

A. Prioritizing Investment Over Consumption

Black communities must shift from being consumers to being investors by:

Buying land and real estate instead of expensive clothes.

Starting businesses instead of wasting money on luxury brands.

Investing in stocks, cryptocurrency, and other financial assets.

Example: Instead of spending two grand on a designer bag, that money could be used to buy shares in a Black-owned company or real estate.

Key Takeaway: Wealth is built through ownership, not consumption.

B. Supporting Black-Owned Businesses First

Black communities must:

Make it a priority to spend money within the Black economy before buying from non-Black companies.

Fund Black startups and businesses instead of giving money to white corporations.

Encourage Black entrepreneurs and invest in Black-led innovations.

Example: If Black consumers spent just 10% more in Black-owned businesses, it would create millions of jobs and generate generational wealth.

Key Takeaway: Economic liberation starts when Black dollars stay in Black hands.

C. Creating a Culture of Financial Literacy

Financial education must become a core part of Black community development through:

Teaching financial literacy in Black schools and households.

Encouraging budgeting, credit management, and investment from a young age.

Rejecting debt-based consumerism in favor of disciplined financial planning.

Example: Black families should focus on teaching children about business ownership, investing, and financial independence instead of materialism.

Key Takeaway: A financially educated community is an economically powerful community.

Conclusion: Will Black People Build Wealth or Keep Making Others Rich?

Marcus Garvey said:

“A race that is solely dependent upon another for its economic existence sooner or later dies.”

Will Black people continue spending billions on luxury brands that do nothing for their communities?

Will we invest in land, businesses, and financial growth, or stay trapped in consumerism?

Will we build generational wealth or leave our children with nothing but debt?

The Choice is Ours. The Time is Now.

#black history#black people#blacktumblr#black tumblr#black#pan africanism#black conscious#africa#black power#black empowering#financial literacy#financialfreedom#finance#marcus garvey#garveyism#Garveyite#black economics#InvestInBlack#PanAfricanWealth#blog

16 notes

·

View notes

Text

Ok I thought corporations were just being greedy by offering all those Buy Now, Pay Later/Klarna/Affirm type shit. But it turns out that they are targeted at the youths, and the youths are actually using them???!!!!!!

Noooo. Nooo. My darlings, only spend what you actually have-- especially for things like a burrito order or concert tickets. Do not finance these things!!

Credit cards suck too. I get it. They have interest and there are late fees. But BNPL companies are not your friends either. They have late fees too. They also sell your data and your debt. And they don't offer benefits or even contribute to your credit score.

Credit scores are dumb but if you are in America, a good one can help you like, get a car loan or an apartment.

Please. Just. Do not go into debt for unserious things. And if it's for something larger/necessary like a phone, use a credit card. BNPL companies use a lot of tricks to steer you to use their system. Ignore their tricks that want you to make them more money. Because that is what this is.

Use a credit card, pay it off like you would have to pay off the BNPL, and at least get the benefits of the card. Like rewards cash back or airline miles or cheaper hotel stays, and also contribute to having a good credit score, which you can use for things like loans in the future if you need them.

The system is already stacked against you. You don't need to make it easier for them to take your money.

Tl;dr don't spend money you don't have

Edited to add: and, fuck, do not leave a balance on your credit card. Pay it in full every month. And if you can't do that, then don't use it or spend that money.

And remember that Republicans passed legislation this year to basically let banks do what they want.

7 notes

·

View notes