#Lot size

Text

supporting communities & people impacted by the Southport attack and the far-right riots in the UK

here is a list of community fundraisers I found, starting with those aiming to support the Southport community after the appalling attack at a children dance party, to the fundraisers helping those affected by the subsequent racist and Islamophobic far-right/nazi riots

Edited on 5 August to include Middlesbrough fundraisers. Edited on 6 August to correct the link on the Books for Spellow Lane fundraiser, to adjust the name change for the Belfast fundraiser, and to adjust the wording in the second last paragraph.

Southport:

Southport Strong Together Appeal - organised by the community foundation for Merseyside, for those affected by the Southport knife attack

United for Southport families - the funds will be distributed among the nine families of the children who were at the party

Swifties for Southport - a fundraiser for the Alder Hey Children's charity, which supports the victims and the affected families, as well as first responders and clinicians. Extra funds will also support the wider Southport community

Fundraiser for the Southport Mosque - a fundraiser to aid rebuilding or possibly re-locating the Southport Mosque after the damages it suffered during the riots

Rebuilding Windsor Mini Mart - fundraiser to rebuild the locally-owned grocery store that was targeted during the attacks, broken into, and looted

Liverpool:

Fundraiser for the Spellow Hub - the Spellow Hub was broken into, looted and set on fire at night during the riots. The Spellow Hub is a newly created one-of-a-kind (in the UK) institution, which consists of a library as well as a community centre with a mission to help people get education and pathways to work

Books for Spellow Lane - another fundraiser for the library in the Spellow Hub, to replace the books and rebuild the library there edit: included the correct link

Hartlepool:

Fundraiser for the Nasir Mosque - the Nasir Mosque was attacked following Southport riots; this fundraiser is organised by Hartlepool citizens to help the mosque deal with the damages as well as to show appreciation for the role of the mosque in the community. edit: the funds will be also distributed to the local community!

Rebuilding the Farm Shop - the shop was targeted during the riots, and when the owner and his son tried to protect it, they were also violently attacked. The fundraiser is to help fix the damages to the store.

Sunderland:

help rebuild Citizens Advice Sunderland offices after arson - two of the Citizens Advice Sunderland offices were set on fire during the riots, and one of them is completely destroyed.

Hull:

Hull Help for Refugees - a local fundraiser to support the Hull Help for Refugees charity, the donated money will be re-distributed to community members affected by the riots

Fundraiser for Hull Help for Refugees and Welcome House in Hull - collected money will be donated to the two charities

Belfast:

help fix racially motivated damages - originally the fundraiser for the Sahara Shisha Cafe which was targeted by the far right in Belfast during the riots, now a fundraiser for all affected businesses in the area. edited to reflect the change of the name of the fundraiser to avoid any confusion

Middlesbrough:

Supporting residents after the riots - Middlesbrough has suffered so much during the riots, lots of businesses as well as just regular family homes were vandalised, had their windows smashed or even were broken into. This fundraiser wants to distribute the funds between affected people to help them fix the damages, and to generally support the local community. the newest fundraiser, imo potentially the most urgent one

Fundraiser for a Care worker's car which was set on fire - a car belonging to an employee of a care agency was set on fire during the riots while he was on shift at a care home.

If you want to donate locally but there is no fundraiser to support where you live, consider donating to your local charities oriented towards Muslim or PoC communities, or towards anti-racist and refugee organizations! And go support your local Muslim/Arab/Black/Asian/Refugee owned businesses!

If you have any information about other local fundraisers, feel free to add to the post or don't hesitate to let me know and I will add them here! We have seen so much hate in the past few days, we have to stay strong and keep supporting each other!

Stay safe everyone 💛

#uk riots community fundraising#there is a lot more fundraisers for Southport but these are the major ones#it's difficult to find more local riot damages fundraisers however because those tend to be shared locally only and it hasn't been long#since the riots so i assume more will be created in the next few days#so if you know about any and want to add them here please feel free to drop me a link! It'd be good to have them in one place#tumblr has a decently sized uk community so if this post finds at least one person who learns about a local fundraiser i'd be happy#not that you have to donate locally of course. i encourage eveyrone to donate. you dont even have to be british!#southport#uk#uk riots#england#uk far right#far right extremism#uk news#uk politics#ukpol#racism#islamophobia#nationalism#fundraisers#octarine talks#there are other ways you can support your community through all this and i highly encourage that. i thought about writing about that here#but ultimately this is a fundraiser post and you know your community best - just go talk to people and give your support#or help clean up#or attend the antifacist marches and demos and vigils

6K notes

·

View notes

Text

FirstMeridian Business services IPO Date, Price, GMP, Review, Company Profile, Financials, Risk, Allotment Details 2023

New Post has been published on https://wealthview.co.in/firstmeridian-business-services-ipo/

FirstMeridian Business services IPO Date, Price, GMP, Review, Company Profile, Financials, Risk, Allotment Details 2023

FirstMeridian Business Services IPO: FirstMeridian Business Services Ltd. (FBSL) is a leading Mumbai-based human resource (HR) and staffing company, operating in a booming Indian outsourcing market. They’re the third-largest in terms of revenue (FY21) and offer a wide range of services, including:

General staffing: Temporary and permanent staffing solutions for various industries.

Allied services: Payroll management, training and development, and compliance solutions.

Global technology solutions: IT staffing and recruitment services for MNCs and Indian companies.

Other HR services: Managed services, background verification, and HR consulting.

FirstMeridian Business services IPO Details:

The FBSL IPO was originally planned for May 2022 with an offer size of Rs. 800 crore. However, after reshaping the proposal, the company received SEBI approval in February 2023 for a slightly smaller IPO of Rs. 740 crore. Here’s the updated breakdown:

Issue Size: Rs. 740 crore

Components:

Fresh Issue: Rs. 50 crore

Offer for Sale (OFS): Rs. 690 crore (by promoters and investors)

Price Band: Rs. 277 – Rs. 291 per share

Dates (tentative):

Issue Open: Not yet announced

Issue Close: Not yet announced

Listing: Not yet announced

Recent News Updates:

The FBSL IPO has garnered moderate attention in the market. Recent developments that might impact investor sentiment include:

Positive market sentiment: The Indian markets have rallied over the past few months, creating a favorable environment for IPOs.

Growing HR outsourcing market: The Indian HR outsourcing market is expected to reach USD 5.7 billion by 2027, offering significant growth potential for FBSL.

Competition: FBSL faces stiff competition from established players like ManpowerGroup and TeamLease Services. Additionally, several tech-enabled startups are disrupting the market.

FirstMeridian Business Services IPO Offer Details

Securities Offered:

Equity Shares: The FBSL IPO will only offer equity shares of the company. No bonds or debentures will be issued.

Face Value: Rs. 10 per share

Reservation Percentages:

The total offer size of Rs. 740 crore will be divided among different investor categories as follows:

Retail Individual Investors (RII): 35%

Qualified Institutional Buyers (QIBs): 50%

Non-Institutional Investors (NIIs): 15%

Minimum Lot Size and Investment Amount:

Minimum Lot Size: One lot will comprise 50 equity shares.

Minimum Investment Amount: Based on the price band of Rs. 277 to Rs. 291 per share, the minimum investment amount per lot will range from approximately Rs. 13,850 to Rs. 14,550.

FirstMeridian Business Services Company Profile:

History and Operations:

Founded in 1997, FirstMeridian boasts over 25 years of experience in the Indian HR and staffing space.

Originally known as ‘InnovSource,’ it rebranded to encompass its growing portfolio of established brands:

V5 Global Services: Focuses on IT and non-IT staffing for MNCs and Indian companies.

Affluent Global Services: Specializes in professional recruitment and executive search.

CBSI Global: Offers business process outsourcing (BPO) and managed services.

RLabs Enterprise Services: Provides tech-enabled HR solutions and automation.

Operates through a network of 3500+ branch offices across India, serving 1200+ clients and placing over 126,000 associates annually.

Market Focus: Key sectors include Telecom, Retail, BFSI, IT, ITES, E-Commerce, Manufacturing, Engineering, and Logistics.

Market Position and Share:

Ranked as the 3rd largest Indian staffing company by revenue (FY21) with a market share of approximately 7%.

Faces competition from established players like ManpowerGroup and TeamLease Services, as well as tech-enabled startups.

Prominent Brands and Partnerships:

Collaborates with global brands like Amazon, Microsoft, Samsung, and Coca-Cola.

Partnered with government initiatives like National Skill Development Corporation (NSDC) to upskill the workforce.

Key Milestones and Achievements:

Awarded the “Best Employer Brand Award” by Aon Hewitt in 2018 and 2019.

Featured in the “Great Place to Work® India” list for over 8 consecutive years.

Received the “Fastest Growing Staffing Company” award by Frost & Sullivan in 2020.

Competitive Advantages and USP:

Diversified Service Portfolio: Offers a one-stop solution for diverse HR needs across various industries.

Strong Track Record: Established brand with over 2 decades of experience and consistent growth.

Nationwide Network: Extensive reach through an expansive network of branch offices.

Focus on Technology: Investing in HR tech solutions to enhance efficiency and service delivery.

Social Impact: Committed to skilling the workforce and creating employment opportunities.

FirstMeridian Business Services Financials:

Recent Financial Performance:

Revenue Growth: While the exact figures for FY23 are not yet available, FBSL reportedly achieved significant revenue growth compared to FY22. Sources indicate a year-on-year increase of around 40%, exceeding pre-pandemic levels.

Profitability: The company has shown consistent profitability with operating margins hovering around 4-5% in recent years. However, net profit margins are lower due to finance costs associated with debt.

Debt Levels: FBSL maintains a moderate debt level with a debt-to-equity ratio around 0.7 as of March 2023. While the upcoming IPO aims to further reduce debt, investors should continue to monitor this aspect.

Key Financial Ratios (as of March 2023):

Price-to-Earnings (P/E) Ratio: Not yet available due to pending IPO and lack of post-issue market price.

Earnings per Share (EPS): INR 3.74 for FY23 (estimated).

Debt-to-Equity Ratio: 0.70.

Industry Benchmarks:

The average P/E ratio for staffing companies in India is around 20-25.

The average EPS for comparable companies is in the range of INR 6-8.

The industry standard for debt-to-equity ratio in the staffing sector is typically below 1.

Objectives of the FirstMeridian Business Services IPO:

Reasons for Going Public:

FirstMeridian Business Services (FBSL) has outlined several key reasons for pursuing an IPO:

Capital Raising: The primary objective is to raise Rs. 740 crore, with Rs. 50 crore from a fresh issue and Rs. 690 crore from an offer for sale (OFS) by promoters and investors. This capital will be used to fuel future growth initiatives.

Brand Visibility and Credibility: Public listing can enhance FBSL’s brand image and recognition in the market, potentially attracting new clients and talent.

Improving Liquidity and Shareholder Base: Access to public markets can create investor interest and liquidity for existing shareholders, facilitating easier exits and value realization.

Facilitating Future Acquisitions and Partnerships: Publicly traded status can make FBSL a more attractive partner for potential mergers, acquisitions, or strategic collaborations.

Utilization of Raised Funds:

FBSL plans to utilize the proceeds from the fresh issue as follows:

Debt Repayment: A portion of the funds will be used to reduce existing debt, lowering financing costs and improving financial stability.

Expansion and Investments: The company aims to invest in technology infrastructure, digital initiatives, branch network expansion, and new service offerings to drive organic growth.

Working Capital Requirements: The remaining funds will be used to meet working capital needs and support ongoing operations.

Alignment with Future Growth Strategy:

FBSL’s stated objectives for the IPO clearly align with its future growth strategy, which focuses on:

Organic Growth: Expanding core staffing and allied services businesses, diversifying into adjacent HR solutions like RPO and managed services.

Geographic Expansion: Exploring potential entry into new domestic markets and collaborating with global players for international reach.

Technology Adoption: Investing in AI, automation, and other HR tech solutions to improve efficiency, productivity, and client service.

Enhanced Brand and Talent Acquisition: Leveraging the public company status to attract and retain top talent and strengthen brand reputation.

FirstMeridian Business Services IPO Risks:

While the FirstMeridian Business Services IPO offers promising prospects, it’s crucial to acknowledge and carefully consider the associated risks before investing. Here are some key areas to examine:

Industry Headwinds:

The HR outsourcing industry in India faces potential headwinds like automation and technology replacing some traditional staffing roles.

Dependence on certain sectors like IT and BFSI can expose the company to vulnerabilities if these sectors experience downturns.

Increasing competition from established players and tech-enabled startups could put pressure on market share and profitability.

Company-Specific Challenges:

While FBSL boasts a track record, its reliance on its top management personnel raises concerns about succession planning and potential impact if key individuals leave.

The company’s moderate debt levels, though manageable, should be monitored closely, as high debt can restrict future growth or financial flexibility.

Dependence on temporary staffing services might be impacted by economic fluctuations or changes in labor laws and regulations.

Financial Health Analysis:

While FBSL demonstrates consistent profitability, its net profit margins are lower due to finance costs associated with debt.

The upcoming IPO aims to reduce debt, but investors should monitor the post-issue debt-to-equity ratio to assess financial stability.

The recent financial performance (FY23) is still preliminary, and investors should wait for the final audited reports before making investment decisions.

Red Flags for Investors:

High dependence on specific sectors and limited geographic diversification.

Moderate debt levels and reliance on traditional staffing services.

Lack of clarity on the final lead managers and their track record in similar offerings.

FirstMeridian Business Services Limited – DRHP

Also Read: How to Apply for an IPO?

#Allotment Details#Company Profile#Financial Performance#Financial risks#IPO#IPO date#Lead Managers#Lot Size#UPCOMING IPO#News

0 notes

Text

there should be an oscar category called “movie my dad completed without falling asleep on the couch” and it’s more prestigious and contentious than best picture

#he would protest if he saw this and say he was ‘resting his eyes’ but i digress#here are the movies my dad watched for the first time this year and didn’t fall alseep:#top gun: maverick sunset boulevard there will be blood witness for the prosecution glass onion edge of tomorrow#i suspect avatar will be on the list but we’re not seeing that until the 18th#we watch a lot of movies so the sample size can be considered significant#but at the end of the day dads just really love top gun and tom cruise idk what to tell you

44K notes

·

View notes

Text

Out of options

FIRST - PREVIOUS - NEXT

MASTERPOST (for the full series / FAQ / reference sheets)

#deltarune#undertale#crossover#utdr#crossover comic#undertale fanart#deltarune fanart#twin runes#twin runes comic#susie deltarune#ralsei#chara#so that answers the question#yes#naturally chara did not turn to stone because they were made by castle town's grand fountain#also they are a lot different from regular darkners#reason for that we might find out sooner or later#but fact is ralsei had no ulterior motives after all#he just didn't want to risk this kid turning to stone#and hey#plenty of people figured it out#the flower dragon is actually a hydra#a pretty big one at that#it's almost final boss sized#but it's too early for final bosses

3K notes

·

View notes

Text

Something that I've personally wondered about for a long time.

You know the drill. Reblog for sample size.

Part Two

#hopefully this was comprehensible#im really curious so i hope this gets lots of votes#polls#poll#sample size#dark chocolate#red wine#coffee#food and drink#personally i only enjoy a tiny amount of red wines if theyre on the more aromatic side

12K notes

·

View notes

Text

Lot Size Calculator is a calculator in Forex that gives you a value of a lot you open with a trade defined by you with the acceptable risk and trading account size.

This means you can define how much money you are willing to risk per trade. And to do that you define risk which is the number of pips also known as Stop Loss.

Video:

https://youtu.be/KA-CbYwdUSo

0 notes

Note

I hope you take this as the compliment it is intended to be, but you strike the same chord of irreverence-as-love, jokes-to-showcase-sencerity that I get from Chuck Tingle, and I adore both of you.

You have bestowed the greatest honour upon me.

#poorly drawn mdzs#mdzs#lan wangij#wei wuxian#digital art#ask#Thank you very much; I do take it as the compliment you intended it to be B*)#Mr. Tingle is a legend in both grindset and vibes. To be even 0.1% striking a similar chord is an aspiration of mine.#I also want to honour the effort I put into this parody book cover. Which was a *lot* more than one would think.#Covers were analyzed. I did research and took notes. I learned how to download fonts. 4 different programs were used.#This file is also poster sized (A4 dimensions)! I thought It would make the joke funnier for some reason.#Chuck Tingle's style is very iconic and fun to replicate. Despite the time intensive labour - I had a blast making this!#I admit to skimming most of the chapter this is based off of just to fact check a few details but boy did I learn things.#Wei Wuxian canonically has CAKE. Tiny waist and a fat ass.#I took several more notes but I will warn you now that I can't *not* find smut writing to be very funny.#This was pure chaos. Unbridled chaos. WWX really did shove a sword up his ass to bully dream-LWJ.#The need to be a little shit trumps saftey I guess.#There is a 99.9% chance I will not cover the extras so this is likely all the fans of those chapters will get from PD-MDZS.

2K notes

·

View notes

Text

once more around the sun!! :3

#mine#cats#happy new year!!! a little late but alas#i didnt like th colours here but now i love them hehehehehheheh#i hope everyone had a good holidays life development for me is i now like ice hockey#in my sports fan era...these greasy sweaty bloody white men...intrigue me#also i got a new diary!! im using th hobonichi cousin in kinda alarmed by it ngl a5 is a lot of space to fill#i tried the hobonichi techo a couple years ago n found it a rlly weird size 2 work in but now.........big page scawwy#im trying not 2 b too insane about it . like relax who cares#if i do cute spreads i will share them :3#also in th same vein im not setting a book goal this year !! tbh i surpassed my goal last year by a lot and wasnt stressed about it at All#but i get so guilty about not reading sometimes like girl . guilty to who? god? are we catholic now? get a grip#anyway anway im going to toot on my flute and then eat my weight in mac n cheese#love how i had to get a new cork in my flute bc i didnt play for like 10 months n th guy was like play regularly! n i was like yeh will do!#and then did not do that#alas...time escapes me

3K notes

·

View notes

Text

Vermis I & II (hardcover edition)

#hollow press recently decided to release hardcover versions of both books : ) ! They’re nice looking#this versions only vary on the cover and the size; the contents are the same#thanks a lot for the support. I’m currently working on more stuff I hope you like it.

2K notes

·

View notes

Text

Shiny Mew & Giratina (Origin Form) ko-fi doodle for Quickpaint!

#artists on tumblr#pokemon#giratina#mew#shiny mew#gotchibam arts#ko-fi doodle#thank you sm for requesting!! ;w; <3#I know mew should be smaller but let's just say giratina is farther & mew is closer to the viewer hhhhdjgjhdf#ngl one of the tricky things abt doing the pokedoodles is figuring out their size differences#I actually have to look up each one of their heights before I start working#and sometimes there's inconsistency bet. the height in games vs. the height you see in anime so yeah ._.#it's a lot more work than ppl might think 🥲

3K notes

·

View notes

Text

Hey hey hey may 31th anon! How's 2024 going? ☆ヾ(*´▽`)ノ This year I have for you a leaked Sherlock season 5 image. Thinking of you!! And everyone!!

#may 31th anon#Hello hello hello friends!! How are you!!#I miss you all I miss tumblr I miss drawing these silly men#work was soooo boring today I was really happy that I got to draw John in a baby carrier afterwards (*´︶`*)#what have you been up to??#my job is very boring most of the time unfortunatly!! I want to have a new job a little bit but I also never want to have a job interview#ever again and also I might get a lamp this year (!) I have heard that someone has already printed out the lamp form#are you excited for good omens season 3??#I am!! I have also been watching a lot of x-files#(*´▽`*) we also have moths in the kitchen#I do not know what they are eating we have been storing all of our food in the fridge since last week but new moths keep coming#yesterday one flew out of the forks and spoon drawer#it's her kitchen now#I also got a mole removed#now instead of the mole I have a scar the exact same size an color of the mole#I have also been working on a longer comic project!! I think it will be ready to be shared this summer and I really hope you will like it#it's about the old dragon bros characters and their life with the princesses (◍•ᴗ•◍)❤#I'm having a lot of fun drawing again!!#I hope you're having fun too#also I had to write an email today and I had to attach a pdf file but it was upside down#I could not fix it#I just hit send

1K notes

·

View notes

Text

Agilus Diagnostics IPO Date, Price, GMP, Company profile, financials & risks: Dec 23

New Post has been published on https://wealthview.co.in/agilus-diagnostics-ipo/

Agilus Diagnostics IPO Date, Price, GMP, Company profile, financials & risks: Dec 23

Agilus Diagnostics IPO: Agilus Diagnostics Limited, formerly known as SRL Limited, is a leading diagnostics service provider in India. It boasts the largest network of laboratories in the country, offering a comprehensive range of tests across various specialties. Agilus operates in a rapidly growing Indian diagnostics market, fueled by rising healthcare awareness, increasing disposable income, and an aging population.

Agilus Diagnostics IPO Key Details:

Offer type: Offer for Sale (OFS) by existing shareholders (International Finance Corporation, NYLIM Jacob Ballas India Fund III LLC, and Resurgence PE Investments Ltd) – no fresh capital being raised by the company.

Issue Dates: Yet to be announced.

Offer Size: Up to 142.3 million equity shares.

Price Band: Not yet determined.

Recent News Updates:

Agilus filed its Draft Red Herring Prospectus (DRHP) with SEBI in September 2023, seeking approval for the IPO.

The company reported a consolidated revenue of Rs 1,347 crore for FY23, down from Rs 1,604 crore in FY22. However, profitability remained relatively stable at Rs 116 crore, suggesting potential resilience.

The Indian diagnostics market is projected to reach USD 27 billion by 2026, providing significant growth opportunities for Agilus.

Agilus Diagnostics IPO: Offer Details

Securities Offered:

This is an Offer for Sale (OFS) by existing shareholders. Therefore, no new securities (equity shares, bonds, etc.) will be issued by Agilus Diagnostics Limited. Existing shareholders, namely International Finance Corporation, NYLIM Jacob Ballas India Fund III LLC, and Resurgence PE Investments Ltd, will be offloading a portion of their holdings through the IPO.

Reservation Percentages:

The specific reservation percentages for different investor categories are yet to be finalized by the Securities and Exchange Board of India (SEBI). However, the typical distribution in Indian IPOs follows this pattern:

Retail Individual Investors (RIIs): 35%

Qualified Institutional Buyers (QIBs): 50%

Non-Institutional Investors (NIIs): 15%

The final percentages might vary depending on regulatory requirements and investor demand.

Minimum Lot Size and Investment Amount:

The minimum lot size for the IPO, which determines the number of shares you can subscribe to in a single application, will be announced closer to the issue date. It is typically set at a level affordable for retail investors, ranging from 100 to 200 shares.

The minimum investment amount will depend on the minimum lot size and the final issue price, which are yet to be confirmed. For example, if the minimum lot size is 100 shares and the issue price is Rs 100 per share, then the minimum investment amount would be Rs 10,000 (100 shares * Rs 100).

Agilus Diagnostics Limited Company profile:

History and Operations:

Founded in 1995, Agilus boasts a rich legacy of over 28 years in the Indian diagnostics landscape.

Initially known as SRL Limited, it rebranded to Agilus Diagnostics in 2023.

Operates a vast network of over 413 laboratories spread across 25 states and 5 union territories in India, as of March 2023.

Offers a comprehensive range of diagnostic tests catering to various medical specialties, including pathology, biochemistry, microbiology, immunology, and genetics.

Provides services directly through its own labs, partnerships with hospitals and clinics, and home sample collection facilities.

Market Position and Market Share:

Ranked second in terms of revenue from operations among diagnostic companies in India for Fiscal 2023 (Source: CRISIL Report).

Holds the title of India’s largest chain of diagnostic laboratories by geographic presence (Source: Agilus Diagnostics website).

As of March 2023, boasts the largest network of NABL accredited laboratories in India with 43 accredited labs (Source: CRISIL Report).

Prominent Brands, Subsidiaries, and Partnerships:

The “SRL” brand still enjoys strong recognition in many regions, even post-rebranding.

In April 2023, acquired Lifeline Laboratory, a reputed player in Delhi NCR, further strengthening its reach.

Partners with various hospitals and clinics across India to provide diagnostic services within their premises.

Key Milestones and Achievements:

Pioneered the concept of standardized and affordable diagnostic services in India.

Achieved significant growth through organic expansion and strategic acquisitions.

Awarded prestigious certifications like NABL for its labs, demonstrating commitment to quality standards.

Recognized for its contribution to healthcare by various industry bodies and publications.

Competitive Advantages and Unique Selling Proposition (USP):

Vast network: Reaches a broader patient base, providing accessibility and convenience.

NABL accreditation: Ensures high-quality and reliable diagnostic tests.

Comprehensive service range: Caters to diverse medical needs under one roof.

Technology focus: Implements cutting-edge technology for accurate and efficient testing.

Strong brand recognition: Builds trust and customer loyalty.

Future Growth Prospects and Earnings Drivers:

Market growth: The Indian diagnostics market is projected to reach USD 27 billion by 2026, offering substantial growth potential for Agilus.

Expansion plans: The company aims to expand its network further, targeting geographically under-penetrated areas and strategic acquisitions.

Focus on preventive care: Increasing awareness of preventive healthcare is expected to drive demand for diagnostic services, benefiting Agilus’ comprehensive offerings.

Technology adoption: Continued investment in automation and advanced testing technologies will improve efficiency and attract tech-savvy customers.

Potential Risks and Concerns for Agilus Diagnostics IPO:

Investing in any IPO, including Agilus Diagnostics Limited, involves inherent risks that investors should carefully consider before making a decision. Here are some key areas of concern:

Industry Headwinds:

The Indian diagnostics industry faces potential challenges like regulatory changes, pricing pressures from government healthcare initiatives, and competition from new players. These factors could affect Agilus’ growth and profitability.

Company-Specific Challenges:

While Agilus boasts a strong network and financial position, there are some aspects to consider:

The recent revenue decline raises questions about future growth momentum.

Reliance on existing tests might limit diversification and exposure to newer, high-growth segments.

Integration of acquired entities like Lifeline Laboratory needs careful management to maintain operational efficiency.

Financial Health:

Although debt-free, Agilus’ financial performance in FY23 showed a revenue decline. The final P/E ratio after the issue price is determined will be crucial to assess valuation and potential risks.

Investors should thoroughly analyze the company’s financial statements and future projections provided in the DRHP before making a decision.

Red Flags:

Any unexpected negative news about the company or the industry during the pre-IPO or listing period could raise red flags and impact investor sentiment.

A significantly high GMP compared to industry benchmarks might indicate unrealistic expectations and potential for price correction after listing.

Agilus Diagnostics Limited Draft Offer Documents filed with SEBI

Also Read: How to Apply for an IPO?

#Allotment Details#Company Profile#Financial Performance#Investment#IPO date#Lot Size#UPCOMING IPO#IPO#News

0 notes

Text

my friends gave me sum doodle ideas using expression memes for the creeps + mh chars so here they are :-3 links to the templates r at the bottom

template 1

template 2

template 3

#there are a Lot of these guys!!!!!!!!!!! Wowie#maybe i'll line and colour them one day idk..#ignore the lack of brush size consistency for some of these LMFOAOOOOO i did this over multiple days and forgor#i used my friend @crocodiiia's design for nina btw:3#creepypasta#creepypasta fanart#marble hornets#pokepasta#jeff the killer#ben drowned#tim wright#brian thomas#ticci toby#toby rogers#eyeless jack#homicidal liu#laughing jack#lost silver#glitchy red#the puppeteer#jonathan blake#bloody painter#helen otis#clockwork#natalie ouellette#jane the killer#nina the killer#kate the chaser#dr smiley#dark link

1K notes

·

View notes

Text

in action (part 2)

early access + nsfw on patreon

#what a show off#ghost seeing johnny literally double in size: hm. i see#anyway everyone please say hello to puppy soap and give him lots of good scratches#he loves the validation#monster 141 au#simon ghost riley#john soap mactavish#cod mw2#giragi art

6K notes

·

View notes

Text

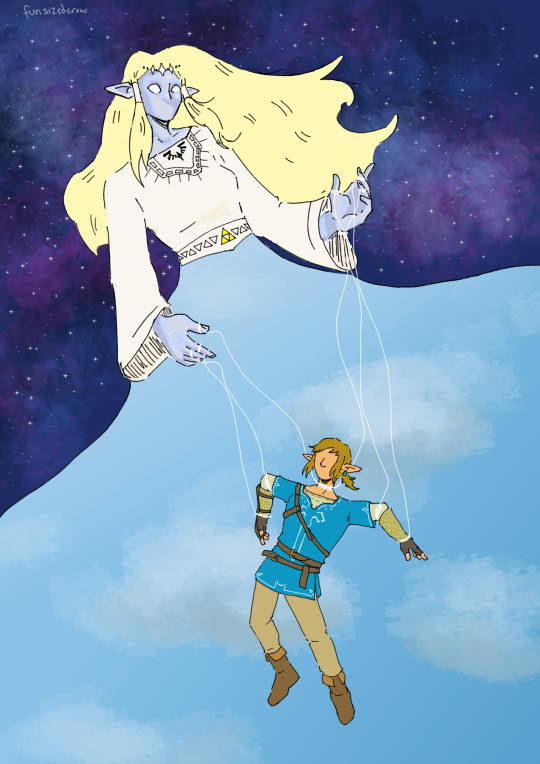

Link is Hylia's specialist little boy (this is not a good thing for him)

(stills under the cut)

#screw you tumblr gif size limit btw. i had to compress it to get it to work but its fine. luckily its not super detailed.#next time i do something like this im doing pixel art. tiny canvas. this was a lot of fun though :)#my art#the legend of zelda#loz#link loz#artists on tumblr#gif warning#legend of zelda#tloz#tloz fanart#wind waker#loz fanart#twilight princess#a link to the past#botw#breath of the wild#ocarina of time#skyward sword#had a lot of fun designing hylia btw <3 took ideas from skyward sword game + manga and also the goddess statues from both botw and ss#need to make designs of the golden goddesses next....#color picked a lot of the colors and then adjusted them but. all of the games are so saturated except for twilight princess it is so funny.#it literally looked like he was in black and white compared to them.#sorry to the links that i did not draw. i was not drawing any more than i had to. 8 was already a lot this took me forever#(two weeks. not that long actually but long enough)

676 notes

·

View notes

Text

I mean this gently but I have to say somethin' here-

I've been getting so much "make your skirts cheaper" "I love this but why are they soooo expensive" etc lately and like look, I know a lot of this is because times are hard.. (otherwise why would I be hearing this more & more this year when prices haven't changed compared to last year) but I just wanna say that one of the only ways I could lower prices (if I was ruthless and didn't care) would be to cut sizing options. Like idk how to word what I'm trying to say, but just know when you shout stuff like this at other brands & they decide they need to find a way to cut costs to lower prices, being size inclusive is gonna be one of the first things to go.

I have no plans to do this myself, but for example, a D Size Skater costs me almost twice as much (talking about only the direct from the manu cost, there are other factors too such as that they weigh more so that adds more shipping costs as well) as an A Size Skater. Say I cut D Size altogether.. and many companies would have by now while also not even lowering the price.. I could increase my profit margins significantly right away. Now lets say I cut both C and D and become a shop that only offers the standard range of SM-XL. Wow! Suddenly profits are up so much!! Or maybe going not full corporate greed, I could handle lowering skater prices by like $10 (random number not based on real math idk what things would actually work out to because I'm not gonna do it). But now no one over a size XL can order from me.

I fear none of what I'm trying to get across is getting across but I just mean to say, in order to offer what I offer, the prices need to be what they are. They aren't set arbitrarily high & lowering them would mean needing to make choices that I will not make (becoming less size inclusive or making my business unsustainable in the sense that it would not survive long).

#long post#ramblings#witch vamp#size inclusive fashion#my size range is a significant factor in the pricing#and i just want to make that clear#would having no D Size be worth it to have lower skirt prices? no C or D to have much lower prices?? ya'll tell me..#because i don't think it is#but that's one thing that a lot of other fashion brands do to have lower prices :[#if you've ever wondered why so many shops don't offer beyond an XL now you know#(also tho it's just hard to find manus or suppliers that will go above XL/2X range)#text post#behind the scenes#idk i hope this makes sense

643 notes

·

View notes