#accounting consulting

Text

What Factors Differentiate Premier Accounting Consulting Firms?

Premier accounting consulting firms are distinguished by several key factors that set them apart in the competitive landscape of financial advisory services. These factors encompass a combination of expertise, industry knowledge, client-centric approach, technological proficiency, and reputation for excellence. Among these, PKC Management Consulting stands out as a prime example of a premier firm that embodies these distinguishing qualities.

Expertise and Specialization:

Premier accounting consulting firms boast a team of highly skilled professionals with extensive expertise in various aspects of accounting, finance, and business advisory. They often specialize in niche areas such as tax planning, audit services, financial analysis, and regulatory compliance, allowing them to offer tailored solutions to clients' specific needs.

Industry Knowledge:

Distinguished firms possess in-depth knowledge of diverse industries, enabling them to understand the unique challenges and opportunities faced by businesses operating in different sectors. This industry insight allows them to provide strategic guidance and actionable recommendations that drive value and foster growth for their clients.

Client-Centric Approach:

Premier accounting consulting firms prioritize client satisfaction and success above all else. They take a personalized approach to client engagements, taking the time to understand their objectives, challenges, and aspirations. By forging strong relationships built on trust and collaboration, these firms deliver customized solutions that address clients' evolving needs effectively.

Technological Proficiency:

In today's digital age, premier accounting consulting firms leverage advanced technologies and innovative tools to enhance efficiency, accuracy, and productivity in their service delivery. From cloud-based accounting software to data analytics platforms, they harness cutting-edge technology to streamline processes, optimize workflows, and deliver real-time insights to clients.

Reputation for Excellence:

Finally, premier accounting consulting firms are distinguished by their sterling reputation for excellence in the industry. They have a track record of delivering exceptional results, garnering accolades, and earning the trust and loyalty of clients over the years. Their commitment to quality, integrity, and professionalism sets them apart as leaders in the field.

In conclusion, premier accounting consulting firms differentiate themselves through a combination of expertise, industry knowledge, client-centric approach, technological proficiency, and reputation for excellence. PKC Management Consulting exemplifies these distinguishing factors, standing out as a trusted advisor and partner to businesses seeking top-tier accounting and financial advisory services. With a focus on delivering tailored solutions and driving tangible results, PKC Management Consulting remains a beacon of excellence in the realm of accounting consulting.

Contact: +91 9176100095

Email: [email protected]

Address: 27/7, Alagappa Rd ,Purasaiwakkam ,Chennai, Tamil Nadu 600084

Know more: https://pkcindia.com/

0 notes

Text

Accounting firm

Website: https://alnaccounting.com/

Address: 9110 N Loop 1604 W, San Antonio, TX 78249

Phone: +1 210-294-9730

Welcome to A.L.N Accounting Services, PLLC! We are a full-service accounting firm that provides bookkeeping, tax preparation, and payroll processing services to businesses in service-based industries such as construction, real estate and security.

We understand the complexities of growing and managing a business, which is why we take pride in being able to provide tailored accounting solutions to help your business succeed.

Our team of experienced tax professionals and accountants are passionate about helping businesses grow and manage their finances. Whether you’re looking to outsource your bookkeeping, prepare tax returns or need help with payroll processing, our team is here to help.

At A.L.N Accounting Services, PLLC we specialize in working with service-based businesses with revenues of over $2,000,000. Our team is well-versed in the laws and regulations that govern these industries and we make sure to stay up-to-date with changes in legislation.

Our services are designed to give you peace of mind, knowing that your finances are in order and compliant with the relevant laws. We keep everything organized, so you can focus on running your business without having to worry about the details.

Facebook: https://www.facebook.com/alnaccountingservices

Instagram : https://www.instagram.com/alnaccounting/

#tax preparation#Bookkeeping Service#Accounting Services#Accounting firm#payroll services#tax returns#Tax Planning#Payroll Processing#Accounting Consulting#Bookkeeping near me

0 notes

Text

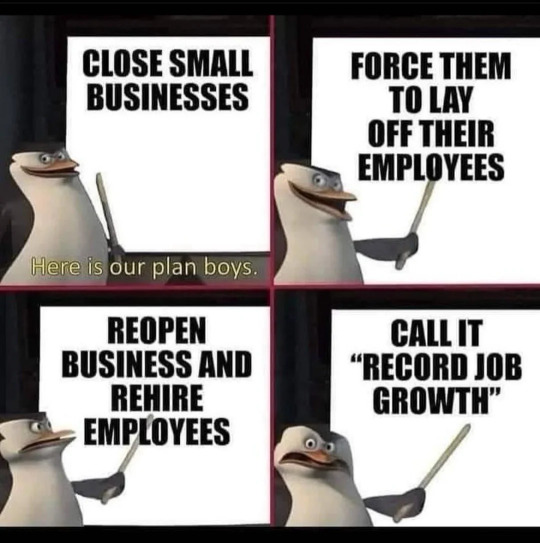

#Communism#Antisocialism#Anticommunism#Economics#Minimum Wage#Living Wage#Eat the Rich#Republican#Democrat#Libertarian#Conservative#Liberal#Finance#Business#Work Meme#Work Humor#Excel#Hilarious#funny meme#funny memes#funny#capitalism#accounting#socialism#office humor#consulting#dark humor#politics#anticapitalism

569 notes

·

View notes

Text

really a lot of the time i am onto something big.

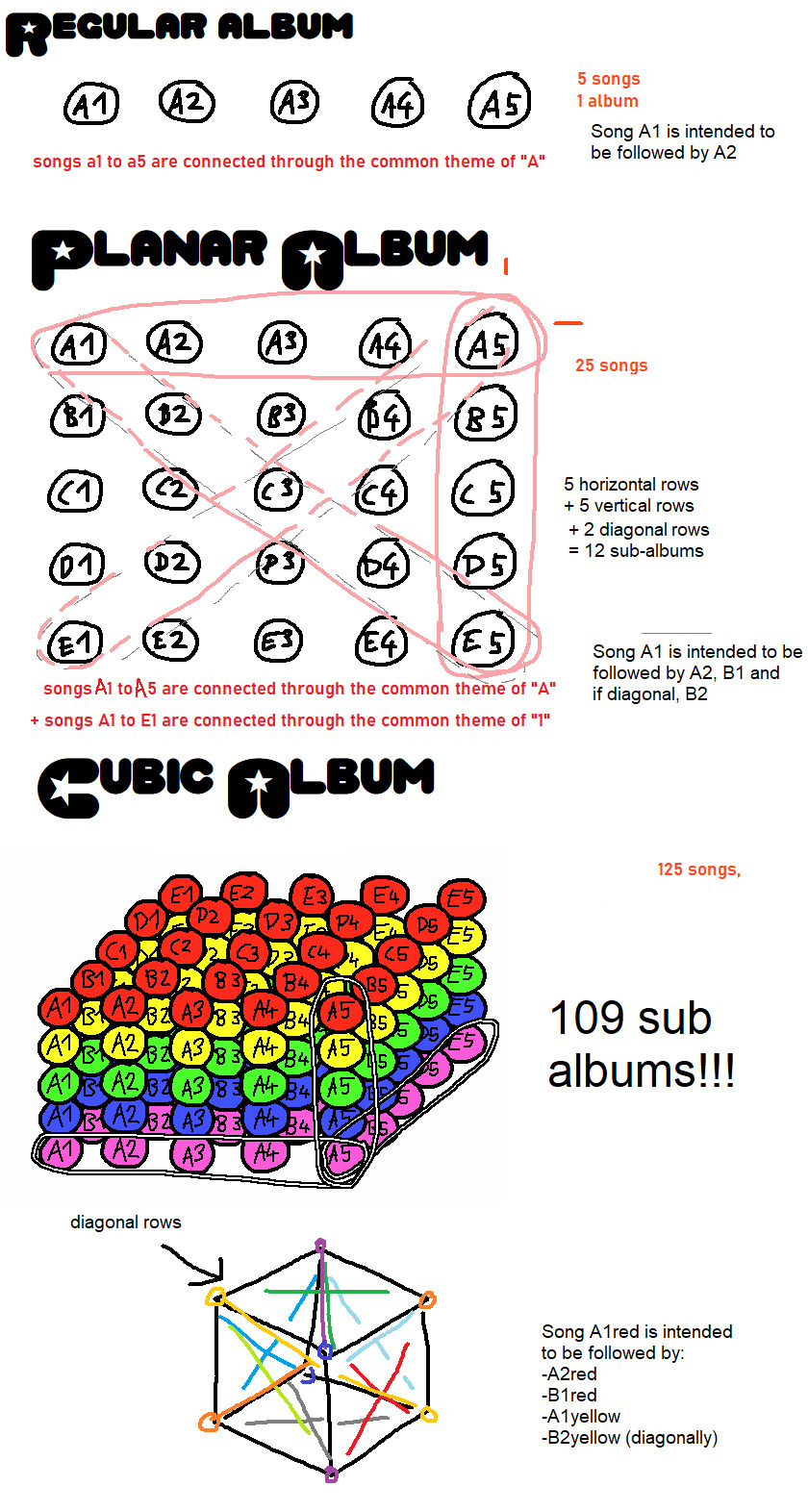

my idea for revolutionizing music:

#you have to account for the fact that in the cubic one you cant just multiply by 3 dimensions cuz a lot of them will intersect#like a1red to a5red will appear in multiple axis'#so (5 x 5 x 3 ) for all straight rows + ( 2 x 5 x 3 ) for all diagonal rows + 4 for the corner to corner rows = 109#i consulted 4 different people with the math on this thanks all#i hope noone will argue math with me

2K notes

·

View notes

Text

[read along with this]

DAVE: ..................... [𝓈𝒾𝓃𝑔𝓁𝑒 𝒻𝓁𝓊𝓉𝑒 𝓃𝑜𝓉𝑒]

ROSE: On the horizon of this forest path, you see a group of dark cloaked figures slowly trudging toward you. What do you do?

JOHN: my half-orc barbarian braces her greathammer and-- that's a one.

ROSE: Critical fail. Jade, what do you do?

JADE: well!! i believe in anticipation my rogue would try and hide behind a tree-- ok i rolled a one :(

ROSE: That's another... critical fail. Dave, what does your human bard do?

DAVE: [𝓉𝒽𝓇𝑒𝑒 𝒻𝓁𝓊𝓉𝑒 𝓃𝑜𝓉𝑒𝓈] active perception check

ROSE: ...That's a natural twenty.

DAVE: lets fuckin go [𝒮𝐼𝒞𝒦 𝐹𝐿𝒰𝒯𝐸 𝑅𝐼𝐹𝐹]

DAVE: i feel it in my fingers ⁽ˢⁿᵃᵖ⁾ i feel it in my toes ⁽ᶠˡᵘᵗᵉ⁾ these motherfuckers mean to harm us...........and theyve got to go

𝐒𝐎 𝐂𝐌𝐎𝐍 𝐆𝐄𝐓 𝐄𝐌 𝐍𝐎𝐖

you picked the wrong day. to fuck around with my

TIGHT CREW ⁽ᵒʰ ᵒʰ⁾

theres no escaping it (i can perceive you) heres what were gonna do [𝒶𝓃𝑜𝓉𝒽𝑒𝓇 𝓈𝒾𝒸𝓀 𝒻𝓁𝓊𝓉𝑒 𝓇𝒾𝒻𝒻]

ME AND MY BOYS ARE GONNA MESS YOU UP

JOHN: i rolled a one.

JADE: i rolled a one :(

DAVE:

FUCK

my boys are otherwise engaged. so im gonna bring it ALL MYSELF

hhey i forgot youre supposed to tell me what i see right

ROSE: Yes, thank you. Let's just slow it all down a bit. So, you notice that one of the hooded figures is a little shorter--

DAVE: 𝐢 𝐜𝐚𝐬𝐭 𝐯𝐢𝐜𝐢𝐨𝐮𝐬 𝐦𝐨𝐜𝐤𝐞𝐫𝐲 𝐧𝐚𝐭 𝐭𝐰𝐞𝐧𝐭𝐲 𝐥𝐞𝐭𝐬 𝐠𝐨

YOURE A SHORT MOTHERFUCKER AND NOBODY LIKES YOU

[𝓈𝒾𝒸𝓀 𝒻𝓁𝓊𝓉𝑒]

SHORT

everybody says "look how fuckin short that guy is" and it stops you from forming 𝓶𝓮𝓪𝓷𝓲𝓷𝓰𝓯𝓾𝓵 𝓻𝓮𝓵𝓪𝓽𝓲𝓸𝓷𝓼𝓱𝓲𝓹𝓼

when you were born everybody thought that you were just a head but THEN THE DOCTOR SAID "WAIT. this 𝐬𝐭𝐮𝐩𝐢𝐝 𝚖𝚘𝚝𝚑𝚎𝚛𝚏𝚞𝚌𝚔𝚒𝚗 tiny ꜱʜᴏʀᴛ ᴀꜱꜱ ʙᴀʙʏ got a tiny little ɪᴛᴛʏ ʙɪᴛᴛʏ ʙᴏᴅʏ and i 𝐇𝐀𝐓𝐄 it"

ROSE: Your attack lands and absolutely SHATTERS the mind of the cloaked figure; perception check, please?

DAVE: nat twenty lets go

ROSE: You perceive the figure was so short because it was a CH--

DAVE: --ild. its always a kid

ROSE: Specifically the child you've been looking for for the last fifteen days game time and five days of our actual lives.

DAVE: ok im sorry i didnt know ill be better. ᵘᵍᵍʰʰfuck his bodys just lying there right

ROSE: ...

DAVE: right

ROSE: ...Yes... ...!! Don't--

DAVE:

LOOT THAT BODY

gotta 𝓛𝓞𝓞𝓣 𝓣𝓗𝓐𝓣 𝓑𝓞𝓓𝓨 𝓝𝓞𝓦

LOOT THAT BODY

gotta loot that motha𝐅𝐔𝐂𝐊ᴬᴬᴬ !!! playin my flute when i 𝙻𝙾𝙾𝚃 ᴛʜᴀᴛ 𝔻𝔼𝔸𝔻 𝕂𝕀𝔻𝕊 𝓑𝓞𝓓𝓐𝓐𝓐𝓨

[𝓕𝓛𝓤𝓣𝓔 𝓜𝓞𝓜𝓔𝓝𝓣]

BITCH

#hi am i allowed to just post on this account#lol what if i became an active mod again would that be sick or what#id have to consult the new mods tho i dunno whats going on#whos on this blog. hi guys whats up#homestuck#incorrect homestuck quotes#quote#long quote#dave strider#rose lalonde#john egbert#jade harley

437 notes

·

View notes

Text

quick poll, i'm curious and going insane

what would you estimate you spend each week on takeout + groceries? amounts in USD because i'm USAmerican

#amounts because $200-300 and $300-400 were the amounts people tossed around#and because small budgets seem more nuanced to me than large ones#feel free to comment infinitely nuanced answers tho#i'm not including under $25 because i don't know anyone currently on that budget#and i have no way of accounting for school meal plans/restaurant jobs/work cafeterias/consulting dinners or w/e here#this is about household groceries and personal takeout expenses#polls#reference#my polls#ghost speaks

110 notes

·

View notes

Text

i’m so easily influenced by older women especially if i have no fucking clue what they’re talking about i’ll just agree wholeheartedly and do exactly what they tell me to it’s an issue

86 notes

·

View notes

Text

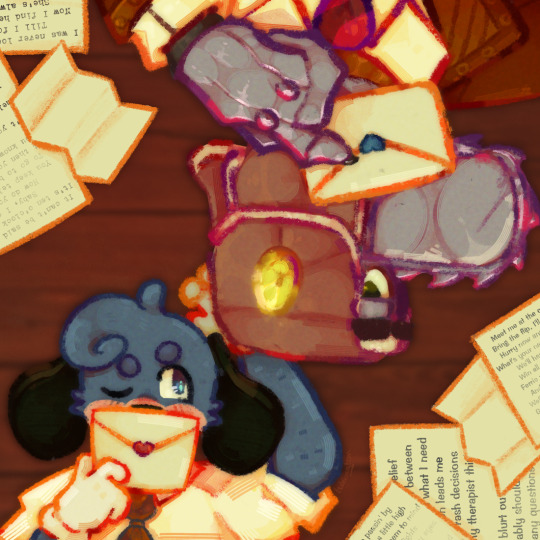

write me letters, ink on paper, i'm so mixed up i could cry!

#toontown#ttcc#toontown corporate clash#corporate clash#chip revvington#chainsaw consultant#result of me staring in mirror and thinking “ive Got to get worse about that gay dog”#all the notes are songs on the playlist i made for the two of them n_n#blurt + boggle by mega mango & can you keep up by blue kid for feather#and then too sweet by hozier and ghost of chicago by noah floersch for chip#AND THEN the actual idea came from listening to the song in the caption (write me letters by hot freaks)#why yes my spotify account never sleeps how can you tell#ted draws#featherhopper

35 notes

·

View notes

Text

The long sleep of capitalism’s watchdogs

There are only five more days left in my Kickstarter for the audiobook of The Bezzle, the sequel to Red Team Blues, narrated by @wilwheaton! You can pre-order the audiobook and ebook, DRM free, as well as the hardcover, signed or unsigned. There's also bundles with Red Team Blues in ebook, audio or paperback.

One of the weirdest aspect of end-stage capitalism is the collapse of auditing, the lynchpin of investing. Auditors – independent professionals who sign off on a company's finances – are the only way that investors can be sure they're not handing their money over to failing businesses run by crooks.

It's just not feasible for investors to talk to supply-chain partners and retailers and verify that a company's orders and costs are real. Investors can't walk into a company's bank and demand to see their account histories. Auditors – who are paid by companies, but work for themselves – are how investors avoid shoveling money into Ponzi-pits.

Attentive readers will have noticed that there is an intrinsic tension in an arrangement where someone is paid by a company to certify its honesty. The company gets to decide who its auditors are, and those auditors are dependent on the company for future business. To manage this conflict of interest, auditors swear fealty to a professional code of ethics, and are themselves overseen by professional boards with the power to issue fines and ban cheaters.

Enter monopolization. Over the past 40 years, the US government conducted a failed experiment in allowing companies to form monopolies on the theory that these would be "efficient." From Boeing to Facebook, Cigna to InBev, Warner to Microsoft, it has been a catastrophe. The American corporate landscape is dominated by vast, crumbling, ghastly companies whose bad products and worse corporate conduct are locked in a race to see who can attain the most depraved enshittification quickest.

The accounting profession is no exception. A decades-long incestuous orgy of mergers and acquisitions yielded up an accounting sector dominated by just four firms: EY, KPMG, PWC and Deloitte (the last holdout from the alphabetsoupification of corporate identity). Virtually every major company relies on one of these companies for auditing, but that's only a small part of corporate America's relationship with these tottering behemoths. The real action comes from "consulting."

Each of the Big Four accounting firms is also a corporate consultancy. Some of those consulting services are the normal work of corporate consultants – cookie cutter advice to fire workers and reduce product quality, as well as supplying dangerously defecting enterprise software. But you can get that from the overpaid enablers at McKinsey or BCG. The advantage of contracting with a Big Four accounting firm for consulting is that they can help you commit finance fraud.

Remember: if you're an executive greenlighting fraud, you mostly just want to be sure it's not discovered until after you've pocketed your bonus and moved on. After all, the pro-monopoly experiment was also an experiment in tolerating corporate crime. Executives who cheat their investors, workers and suppliers typically generate fines for their companies, while escaping any personal liability.

By buying your cheating advice from the same company that is paid to certify that you're not cheating, you greatly improve your chances of avoiding detection until you've blown town.

Which brings me to the idea of the "bezzle." This is John Kenneth Galbraith's term for "the weeks, months, or years that elapse between the commission of the crime and its discovery." This is the period in which both the criminal and the victim feel like they're better off. The crook has the victim's money, and the victim doesn't know it. The Bezzle is that interval when you're still assuming that FTX isn't lying to you about the crazy returns they're generating for your crypto. It's the period between you getting the shrinkwrapped box with a 90% discounted PS5 in it from a guy in an alley, and getting home and discovering that it's full of bricks and styrofoam.

Big Accounting is a factory for producing bezzles at scale. The game is rigged, and they are the riggers. When banks fail and need a public bailout, chances are those banks were recently certified as healthy by one of the Big Four, whose audited bank financials failed 800 re-audits between 2009-17:

https://pluralistic.net/2020/09/28/cyberwar-tactics/#aligned-incentives

The Big Four dispute this, of course. They claim to be models of probity, adhering to the strictest possible ethical standards. This would be a lot easier to believe if KPMG hadn't been caught bribing its regulators to help its staff cheat on ethics exams:

https://www.nysscpa.org/news/publications/the-trusted-professional/article/sec-probe-finds-kpmg-auditors-cheating-on-training-exams-061819

Likewise, it would be easier to believe if their consulting arms didn't keep getting caught advising their clients on how to cheat their auditing arms:

https://pluralistic.net/2023/05/09/dingo-babysitter/#maybe-the-dingos-ate-your-nan

Big Accounting is a very weird phenomenon, even by the standards of End-Stage Capitalism. It's an organized system of millionaire-on-billionaire violence, a rare instance of the very richest people getting scammed the hardest:

https://pluralistic.net/2021/06/04/aaronsw/#crooked-ref

The collapse of accounting is such an ominous and fractally weird phenomenon, it inspired me to write a series of hard-boiled forensic accountancy novels about a two-fisted auditor named Martin Hench, starting with last year's Red Team Blues (out in paperback next week!):

https://us.macmillan.com/books/9781250865854/redteamblues

The sequel to Red Team Blues is called (what else?) The Bezzle, and part of its ice-cold revenge plot involves a disillusioned EY auditor who can't bear to be part of the scam any longer:

https://www.kickstarter.com/projects/doctorow/the-bezzle-a-martin-hench-audiobook-amazon-wont-sell

The Hench stories span a 40-year period, and are a chronicle of decades of corporate decay. Accountancy is the perfect lens for understanding our modern fraud economy. After all, it was crooked accountants who gave us the S&L crisis:

https://scholarworks.umt.edu/cgi/viewcontent.cgi?article=10130&context=etd

Crooked auditors were at the center of the Great Financial Crisis, too:

https://francinemckenna.com/2009/12/07/they-werent-there-auditors-and-the-financial-crisis/

And of course, crooked auditors were behind the Enron fraud, a rare instance in which a fraud triggered a serious attempt to prevent future crimes, including the destruction of accounting giant Arthur Andersen. After Enron, Congress passed Sarbanes-Oxley (SOX), which created a new oversight board called the Public Company Accounting Oversight Board (PCAOB).

The PCAOB is a watchdog for watchdogs, charged with auditing the auditors and punishing the incompetent and corrupt among them. Writing for The American Prospect and the Revolving Door Project, Timi Iwayemi describes the long-running failure of the PCAOB to do its job:

https://prospect.org/power/2024-01-26-corporate-self-oversight/

For example: from 2003-2019, the PCAOB undertook only 18 enforcement cases – even though the PCAOB also detected more than 800 "seriously defective audits" by the Big Four. And those 18 cases were purely ornamental: the PCAOB issued a mere $6.5m in fines for all 18, even though they could have fined the accounting companies $1.6 billion:

https://www.pogo.org/investigations/how-an-agency-youve-never-heard-of-is-leaving-the-economy-at-risk

Few people are better on this subject than the investigative journalist Francine McKenna, who has just co-authored a major paper on the PCAOB:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4227295

The paper uses a new data set – documents disclosed in a 2019 criminal trial – to identify the structural forces that cause the PCAOB to be such a weak watchdog whose employees didn't merely fail to do their jobs, but actually criminally abetted the misdeeds of the companies they were supposed to be keeping honest.

They put the blame – indirectly – on the SEC. The PCAOB has three missions: protecting investors, keeping markets running smoothly, and ensuring that businesses can raise capital. These missions come into conflict. For example, declaring one of the Big Four auditors ineligible would throw markets into chaos, removing a quarter of the auditing capacity that all public firms rely on. The Big Four are the auditors for 99.7% of the S&P 500, and certify the books for the majority of all listed companies:

https://blog.auditanalytics.com/audit-fee-trends-of-sp-500/

For the first two decades of the PCAOB's existence, the SEC insisted that conflicts be resolved in ways that let the auditing firms commit fraud, because the alternative would be bad for the market.

So: rather than cultivating an adversarial relationship to the Big Four, the PCAOB effectively merged with them. Two of its board seats are reserved for accountants, and those two seats have been occupied by Big Four veterans almost without exception:

https://www.pogo.org/investigations/captured-financial-regulator-at-risk

It was no better on the SEC side. The Office of the Chief Accountant is the SEC's overseer for the PCAOB, and it, too, has operated with a revolving door between the Big Four and their watchdog (indeed, the Chief Accountant is the watchdog for the watchdog for the watchdogs!). Meanwhile, staffers from the Office of the Chief Accountant routinely rotated out of government service and into the Big Four.

This corrupt arrangement reached a crescendo in 2019, with the appointment of William Duhnke – formerly of Senator Richard Shelby's [R-AL] staff – took over as Chief Accountant. Under Duhnke's leadership, the already-toothless watchdog was first neutered, then euthanized. Duhnke fired all four heads of the PCAOB's main division and then left their seats vacant for 18 months. He slashed the agency's budget, "weakened inspection requirements and auditor independence policies, and disregarded obligations to hold Board meetings and publicize its agenda."

All that ended in 2021, when SEC chair Gary Gensler fired Duhnke and replaced him with Erica Williams, at the insistence of Bernie Sanders and Elizabeth Warren. Within a year, Williams had issued 42 enforcement actions, the largest number since 2017, levying over $11m in sanctions:

https://www.dlapiper.com/en/insights/publications/2023/01/pcaob-sets-aggressive-agenda-for-2023-what-to-expect-as-agency-enforcement-expands

She was just getting warmed up: last year, PCAOB collected $20m in fines, with five cases seeing fines in excess of $2m each, a record:

https://www.dlapiper.com/en/insights/publications/2024/01/pcaobs-enforcement-and-standard-setting-rev-up-what-to-expect-in-2024

Williams isn't shy about condemning the Big Four, publicly sounding the alarm that 40% of the 2022 audits the PCAOB reviewed were deficient, up from 34% in 2021 and 29% in 2020:

https://www.wsj.com/articles/we-audit-the-auditors-and-we-found-trouble-accountability-capital-markets-c5587f05

Under Williams, the PCAOB has enacted new, muscular rules on lead auditors' duties, and they're now consulting on a rule that will make audit inspections much faster, shortening the documentation period from 45 days to 14:

https://tax.thomsonreuters.com/news/pcaob-rulemaking-could-lead-to-more-timely-issuance-of-audit-inspection-reports/

Williams is no fire-breathing leftist. She's an alum of the SEC and a BigLaw firm, creating modest, obvious technical improvements to a key system that capitalism requires for its orderly functioning. Moreover, she is competent, able to craft regulations that are effective and enforceable. This has been a motif within the Biden administration:

https://pluralistic.net/2022/10/18/administrative-competence/#i-know-stuff

But though these improvements are decidedly moderate, they are grounded in a truly radical break from business-as-usual in the age of monopoly auditors. It's a transition from self-regulation to regulation. As @40_Years on Twitter so aptly put it: "Self regulation is to regulation as self-importance is to importance":

https://twitter.com/40_Years/status/1750025605465178260

Berliners: Otherland has added a second date (Jan 28 - THIS SUNDAY!) for my book-talk after the first one sold out - book now!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/01/26/noclar-war/#millionaire-on-billionaire-violence

Back the Kickstarter for the audiobook of The Bezzle here!

Image:

Sam Valadi (modified)

https://www.flickr.com/photos/132084522@N05/17086570218/

Disco Dan (modified)

https://www.flickr.com/photos/danhogbenspics/8318883471/

CC BY 2.0:

https://creativecommons.org/licenses/by/2.0/

#pluralistic#big accounting#auditing#marty hench#martin hench#big four accountants#management consultants#corruption#millionaire on billionaire violence#long cons#the bezzle#conflicts of interest#revolving door#self-regulation#gaap#sox#sarbanes-oxley#too big to fail#too big to jail#audits#defective audits#Public Company Accounting Oversight Board#pcaob#sec#scholarship#Francine McKenna#William Duhnke#administrative competence#photocopier kickers#NOCLARs

67 notes

·

View notes

Text

he still has his tonsils. by the way if you even care

#sorry this is fucking UNINTELLIGIBLE but unfortunately i’m still on my bullshit about dr. daddyissues. yeah it’s gonna be all month#i am rotating episode 2.8 ‘the mistake’ in my head at breakneck speed. i am gnawing on it i want to swallow it#oh he’s such a lying liar who lies. charming little bastard. would rather die/lose his license than express one wholly unaffected emotion#‘he thinks not giving a crap makes him like house. like it’s something to aspire to’ quick question HOW serious do the daddy issues have to#be before you start latching on to fucking GREGORY HOUSE as a paternal figure and role model. really#even cameron is not down this bad. even WILSON is not down this bad.#the daddy issues of it all are very understandable though because even setting aside whatever went down back in childhood that shit his#father did to him in seasons 1-2 is SO messed up. jesus#imagine traveling all the way across the world to the hospital your son works in for a consult which confirms what you already knew: you’re#going to die of cancer in like 2 months. making a whole point out of stopping by to visit your son. not telling him what’s going on.#letting him spend a whole episode’s worth of time gradually coming to terms with his complicated feelings towards you (complicated on#account of a whole childhood of objectively awful parenting). the kid finally is able to try reaching back out to you. after YOU initiated#the contact in the first place. how do you react? well obviously by telling him ‘oh sorry i actually have to get in a taxi right now’ and#fucking back off to the other side of the world without giving him a chance to actually talk to you at all and resolve any of the emotions#you just dredged up. oh by the way you still haven’t fucking told him you’re about to die and in fact actively mislead him into thinking#he’s going to have the chance to try meeting with you again next time he visits your home country.#especially fucked up given that the whole reason it DID take your son so long to come around THIS time is that he feels like every time#he’s tried reaching out to you in the past you’ve just disappointed him by refusing to put in the effort to meet him there.#And Now Here We Are Again.#rowan what the FUCK is wrong with you. i want to dig you up and kill you again#house md#robert chase#caseyposting

35 notes

·

View notes

Note

Hi sooo How to begin?

Until some time ago a week or so I didn't know of everything that happened because I stopped following roleplay previous year in the December I think? I was still sometimes checking but actively I stopped following storyline. I was really horrified whit what happened because just everything that happened was strait up cruel towards you and Gregory mod and I'm really sorry. For me you will always be one and only Sherlock Holmes ) All my love

Boop

Thank you for your kind words and support, I highly appreciate it. And I agree with your assessment, but I do hope that we can leave all of this baggage behind and proceed to better times.

Please refer any further questions about this topic to my consulting assistant @veritassempervincit who is taking care of the situation for me. They also provide further information about the topic on their blog if something is still unclear or if you want to know more in detail.

#thank you#veritassempervincit is the mod account#like a consulting assistant#they answer all the questions and provide further informations#the posts on the account provide much important information if you are curious and want to have more information about it#please refer all questions to this account and not to sherlock to separate those topics#roleplay#rp#sherlock roleplay#sherlock rp#sherlock#sherlock holmes#bbc sherlock#a scandal in tumblr#sherlock replies#sherlock holmes replies#sherlock holmes roleplay#sherlock holmes rp#support#kind asks

21 notes

·

View notes

Text

Guys, the bipolar hypomania shame hangover is real.

#what a day#im so stupid#i did not consult my bipolar accountability buddy and the consequence is shame#karfy kaws

10 notes

·

View notes

Text

#Communism#Antisocialism#Anticommunism#Economics#Minimum Wage#Living Wage#Eat the Rich#Republican#Democrat#Libertarian#Conservative#Liberal#funny#capitalism#socialism#accounting#office humor#consulting#politics#anticapitalism

642 notes

·

View notes

Text

rifleman harris all pronouns swag...

#em draws stuff#em is posting about sharpe#sharpe#rifleman harris#as the languages expert of the gang she quite literally has more pronouns than everyone else!#teens I have consulted say that harris does not (as the poets say) Serve on account of the receding hairline but I beg to disagree

28 notes

·

View notes

Text

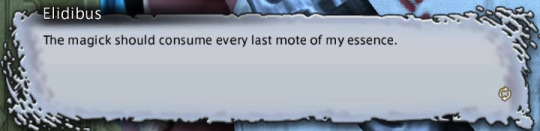

Question for anyone who finished panda, and especially for anyone who can read Japanese (I think I got the right screengrabs...I remember maybe 3 words from my two semesters of japanese sadly :'))

Back when elidibus opens the portal to Elpis I took what he said as his soul was getting consumed by that act (similar to what happens to hydaelyn later though she is clearer that her soul will be gone), though I see looking at it now that he might have just meant whatever part was left of him in the tower. Basically no soul = no aetherial sea and chance of being born again in a new life

Which sure, I could have misinterpreted that easily or maybe it was just unclear.

Now in the latest panda Elidibus says two vastly different things:

First:

And then later:

I think there might have been some other mentions but they're not in the cs you can watch in the inn.

Also you see him in the aetherial sea bubble, though he does fade away from it:

So my question is, what is the truth? And, does the Japanese text offer any clarity?

#ffxiv#elidibus#themis#ffxiv spoiler#6.4 spoilers#patch 6.4#ffxiv 6.4#ffxiv 6.4 spoilers#6.4#ffxivmp#mp#consulting the fandom hive mind since my one friend who might be able to read it hasn't played it yet#someone feel free to ask on twitter if you want i don't have a public account on there#this all ties into my fascination that there are now a whoooole bunch of unsundered ancient souls in the aetherial sea that can be reborn#that should be interesting

145 notes

·

View notes