#in house financing

Text

In-House Financing Car Dealerships Near Me | Second Chance Auto

We are experts; we are the very best, in CREDIT REPAIR. Second Chance Auto is the most trusted In House Financing Dealerships in St. George and the surrounding areas. Visit us now to receive the best value for Used Cars in St George Utah.

Know More:- https://www.getasecondchanceauto.com/financing2

#Buy Here Pay Here Utah#2nd Chance Financing Auto Dealerships#In House Financing Car Dealerships Near Me#In House Financing

0 notes

Text

Eddie, posting to Tiktok: Raise your hand if you and your husband had a long discussion about not needing to do renovations to your kitchen every time you’re bored and you both agree that it’s too soon to get new cabinets only for him to get new cabinets anyways. Raise your hand if you’ve ever done that?

Steve: Oh ho ho, Daddy Warbucks, why don’t you tell everybody that your cheap ass has so much money that you didn’t even notice thirty thousand dollars come out of your bank account?

Eddie: You spent thirty thousand dollars on cabinets?

Steve: No…. I spent twenty thousand.

Eddie, accepting facts: When did you even have them installed?

Steve: When your ‘long weekend in Los Angeles’ turned into two weeks

Eddie:

Eddie: Call me daddy again

Steve: No

#Eddie does not look at his bank statement. He never has and he never will#Steve pays their bills#Steve was one of those kids that collected commemorative coins (his dad’s hobby) so Eddie just assumed he’s good with finances#Steve’s just like: Do you want to live in a house or home Eddie??#Steve: A home has nice cabinets#Eddie: … a home#eddie munson tiktok saga#eddie munson#steve harrington

2K notes

·

View notes

Video

youtube

How Wall Street Priced You Out of a Home

Rent is skyrocketing and home buying is out of reach for millions. One big reason why? Wall Street.

Hedge funds and private equity firms have been buying up hundreds of thousands of homes that would otherwise be purchased by people. Wall Street’s appetite for housing ramped up after the 2008 financial crisis. As you’ll recall, the Street’s excessive greed created a housing bubble that burst. Millions of people lost their homes to foreclosure.

Did the Street learn a lesson? Of course not. It got bailed out. Then it began picking off the scraps of the housing market it had just destroyed, gobbling up foreclosed homes at fire-sale prices — which it then sold or rented for big profits.

Investor purchases hit their peak in 2022, accounting for around 28% of all home sales in America.

Home buyers frequently reported being outbid by cash offers made by investors. So called “iBuyers” used algorithms to instantly buy homes before offers could even be made by actual humans.

If the present trend continues, by 2030, Wall Street investors may control 40% of U.S. single-family rental homes.

Partly as a result, homeownership — a cornerstone of generational wealth and a big part of the American dream — is increasingly out of reach for a large number of Americans, especially young people.

Now, Wall Street’s feasting has slowed recently due to rising home prices — even the wolves of Wall Street are falling victim to sticker shock. But that hasn’t stopped them from specifically targeting more modestly priced homes — buying up a record share of the country’s most affordable homes at the end of 2023.

They’ve also been most active in bigger cities, particularly in the Sun Belt, which has become an increasingly expensive place to live. And they’re pointedly going after neighborhoods that are home to communities of color.

For example, in one diverse neighborhood in Charlotte, North Carolina, Wall Street-backed investors bought half of the homes that sold in 2021 and 2022. On a single block, investors bought every house but one, and turned them into rentals.

Folks, it’s a vicious cycle: First you’re outbid by investors, then you may be stuck renting from them at excessive prices that leave you with even less money to put up for a new home. Rinse. Repeat.

Now I want to be clear: This is just one part of the problem with housing in America. The lack of supply is considered the biggest reason why home prices and rents have soared — and are outpacing recent wage gains. But Wall Street sinking its teeth into whatever is left on the market is making the supply problem even worse.

So what can we do about this? Start by getting Wall Street out of our homes.

Democrats have introduced a bill in both houses of Congress to ban hedge funds and private equity firms from buying or owning single-family homes.

If signed into law, this could increase the supply of homes available to individual buyers — thereby making housing more affordable.

President Biden has also made it a priority to tackle the housing crisis, proposing billions in funding to increase the supply of homes and tax credits to help actual people buy them.

Now I have no delusions that any of this will be easy to get done. But these plans provide a roadmap of where the country could head — under the right leadership.

So many Americans I meet these days are cynical about the country. I understand their cynicism. But cynicism can be a self-fulfilling prophecy if it means giving up the fight.

The captains of American industry and Wall Street would like nothing better than for the rest of us to give up that fight, so they can take it all.

I say we keep fighting.

570 notes

·

View notes

Photo

#nintendo#animal crossing#funny#finances#money#gaming#video games#home#house#mortgage#dog#new horizons#acnh#villagers#tom nook#switch#nintendo switch#lol#humor#meme#relatable#economy#animal crossing new horizons#ac

883 notes

·

View notes

Text

We ask your questions so you don’t have to! Submit your questions to have them posted anonymously as polls.

#polls#incognito polls#anonymous#tumblr polls#tumblr users#questions#polls about jobs#submitted dec 8#polls about relationships#housing#money#finance#personal finance

260 notes

·

View notes

Text

Placements in the natal chart that can indicate bad financial habits 📉

2nd house in Aries

MARS in the 2nd house

Uranus in the 2nd house

Neptune in the 2nd house

Neptune in the 6th house

Uranus in the 8th house

Neptune in the 8th house

Uranus in the 10th house

MC in Aries

MC in Sagittarius

2nd house in Sagittarius

Neptune in the 10th house

MC square/opposite Pluto

MC square/opposite Uranus

Lack of earth signs in the natal chart

Chiron square/opposite MC

Ruler of the 2nd house badly aspected

Ruler of the 8th house badly aspected

Ruler of the 10th house badly aspected

Dm me for a natal chart reading!

#astrology#natal chart#horoscope#astro notes#zodiac#astrology witch#astro witch#like#follow#astro community#finances#money#10th house#midheaven#reading#professional astrologer#paid natal chart readings#paid birth chart readings#reading birth charts#placements in astrology

125 notes

·

View notes

Text

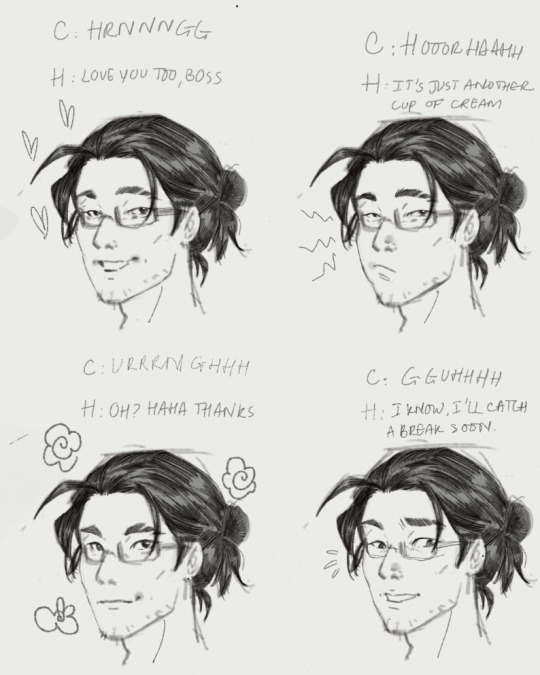

Hades Charmes brain rot dump

Domestic Charmes Modern Au for my needs bc there’s not enough art of them HNNNNG (bless you AO3 writers)

Some designs for Hermes. (Charon’s still in the backlog in my head rn). Hermes with glasses anyone??? 😭

I’m in the deep trenches of making my own Au where Hermes and Charon are finance bros (god of commerce and the god who collects gold, duh, ain’t no way they’re dirt poor).

There’s plenty of fics that display Hermes as the black sheep of the family who’s running his own life away from his family doing odd jobs and barely hangs on (no hate I love them!!!) but there’s not enough Rich! Hermes out there so I just gotta insert my own brain rot. Charon and Hermes working for rival finance companies (one deal with future investment and one deal with settlement money/clauses after one’s death (idk if it’s a real thing but meh)

Check the tags for the synopsis lol AO3 style

Bless Jen Zee for long hair Hermes bc all the hairstyle I can conjure from this 😩🙏

The glasses started as a goofy accessory and ended up staying. Longsighted-Hermes who can’t see things that are close to him and uses contact lenses at work 👁️👁️. Only wears glasses at home (with Charon). Grows very little beard and is perpetually tired bc overworked! Hermes is so canon.

#hades game#hades 2#charmes#hermes hades#charon hades#enemies to lovers#alternative universe#office au#modern au#finance bros Charmes#domestic fluff#using Hermes other aspects as god of commerce and trickster#Hermes is a smart boy#he’s his own boss#dude went behind his company to usurp his Father and unite with his lover#dickbag daddy Zeus is still canon#from hades 2 dialogue where he disses Hermes#but no worries Charon is there for Hermes#so does house of hades#other olympians are chill tho#including Hera bc that woman needs a fucking break#angst with happy ending

62 notes

·

View notes

Note

How common is it to receive money from family members to put towards buying a home? Cause I’ve been talking to various lenders and real estate agents lately and a bunch of them have mentioned I could borrow from family members. I’m not sure if it’s cause I’m maybe a bit younger to be buying my own place so they assume I’m from generational wealth or if it’s cause they think I can’t afford anything and rather than tell me that just say I could borrow from family or maybe it’s just a super common thing to do and I’m out of the loop or a fourth option maybe they all have generational wealth. Idk it’s just an annoying thing to be asked because I would feel out of pocket even suggesting it and they all bring it up like it’s no biggie.

When we were in the process of house shopping 9 years ago, my beloved grandfather lost his battle with lung cancer. I emailed our real estate agent to ask her to cancel the next couple days of showings while my husband and I flew back East for the memorial service. Her response basically boiled down to "Sorry. But let me know if this changes your budget because you'll be inheriting a bunch of money!" If she'd said it to my face I would've punched her.

We did not, in fact, inherit any money from my grandfather. But her callous comment made me think that either

a) inheriting does happen from time to time during house-hunting

b) the only people able to afford their first homes these days are those who get help from older family because the market is currently insane

c) real estate agents want to do anything possible to increase buying costs because they personally benefit from a larger commission.

All of which is to say... I think these agents are being dickheads and you should either ignore them, tell them to stop being assholes, or fire them.

The Rent Is Too Damn High: The Affordable Housing Crisis, Explained

Season 2, Episode 2: “I'm Not Ready to Buy a House---But How Do I *Get Ready* to Get Ready?”

Did we just help you out? Tip us!

121 notes

·

View notes

Text

Solar Return : Finances (2nd House)

Solar Return 2nd House in Aries: You may find yourself eager to invest in entrepreneurial ventures or take on new financial risks that could yield immediate returns, but it's important to ensure these ventures are well-thought-out and align with your long-term financial goals.

Solar Return 2nd House in Taurus: Focus on building a steady savings plan or exploring stable investment opportunities that provide a reliable and predictable income source, allowing you to feel financially secure and prepared for any unexpected expenses that may arise.

Solar Return 2nd House in Gemini: Explore various freelance opportunities or part-time jobs that leverage your diverse skill set and offer flexible earning potential, ensuring that you maintain clear and organized records of your income and expenses to manage your finances effectively.

Solar Return 2nd House in Cancer: Consider investing in real estate or other stable long-term assets that provide both financial security and emotional comfort, ensuring that you create a well-structured budget that allows for both practical saving and occasional indulgences that bring you joy.

Solar Return 2nd House in Leo: Channel your creativity into monetizing your passions, such as starting a side business or pursuing artistic endeavors that have the potential to generate additional income, while also being mindful of creating a sustainable financial plan that supports your creative ambitions.

Solar Return 2nd House in Virgo: Focus on organizing your financial records and exploring investment opportunities that are based on thorough research and careful analysis, ensuring that you prioritize practical and cost-effective solutions that align with your long-term financial stability and personal values.

Solar Return 2nd House in Libra: Collaborate with trusted partners or consider investment opportunities that emphasize fairness and mutual benefits, ensuring that you maintain transparent communication and legal clarity in any financial agreements to maintain a harmonious and balanced financial portfolio.

Solar Return 2nd House in Scorpio: Evaluate high-potential investment options that involve calculated risk-taking and in-depth research, ensuring that you remain aware of the potential for financial fluctuations and have contingency plans in place to manage any unexpected changes in your financial situation.

Solar Return 2nd House in Sagittarius: Embrace opportunities for professional growth and consider investing in educational pursuits or travel experiences that can expand your skill set and open up new income streams, while also maintaining a well-planned financial strategy that supports your adventurous endeavors.

Solar Return 2nd House in Capricorn: Focus on building a strong financial foundation through disciplined saving and conservative investments that prioritize long-term stability over short-term gains, ensuring that you approach financial planning with a pragmatic and realistic mindset to achieve sustainable wealth.

Solar Return 2nd House in Aquarius: Explore innovative investment options or consider contributing to socially responsible projects that align with your values and have the potential for long-term financial growth, while also maintaining a balance between your progressive financial approach and the need for practical financial security.

Solar Return 2nd House in Pisces: Trust your intuition when making financial decisions, and consider investing in charitable causes or artistic pursuits that bring you emotional fulfillment, while also maintaining a realistic and well-organized financial plan that balances your compassionate nature with the need for practical financial stability.

#astrology#astrology aspects#astrology observations#astrology finance#finances#solar return#astrology solar return#solar return 2nd house#2nd house

146 notes

·

View notes

Text

There's something interesting I've realized about the concept of a "living wage" in the US that has only really occurred to me since I got a better job that.. you know, pays a living wage. (Just for the sake of what I mean, I earn over $20 USD/hr, I work full time, and I live in Nebraska. My partner is the same as far as wages.)

This fall, my partner and I got our first house. It's 3 bedrooms, 2 bath, small but finished basement. It took a lot of negotiation and stress but with the help of an A+ realtor and loan expert, we got it. Yay!

Now, we were used to paying rent, but paying a mortgage was going to be almost double. This was fine, we could afford it. While we recover financially from some things we had to do (replace a deck, fix a cracked pipe, you know the usual) we have been a little more careful about our spending. Even with that though, we're still able to get groceries and eat at a restaurant once a week and buy holiday gifts for our friends and families. It might be a couple years until we can shell out for a little vacation, but that's okay.

My point here though is that... this is what it should be like for everyone. A two-income household should be able to get a decent little house and have a few fun luxuries and still have enough in savings if you need an emergency car or home repair or veterinarian bill or the like. A living wage needs to be more than just a roof over your head and food on your table. You should be able to invest in things that make you happy (like a nice bike or video game console) and things that make life easier (like a toaster oven or snowblower).

We both work desk jobs. It's stressful but we can work from home and that also saves money. But for everyone in every kind of job, or even if you can't work, you should still be able to live. And that's why it's important to support higher wages, better disability support, and universal basic income. Everyone deserves the opportunity to be happy and feel safe and secure.

So when you see local petitions out to raise the minimum wage, when you see workers striking for an income they can actually live on, and when you see measures that will help people on the ballot, remember that when you support them, things DO change for the better.

#personal ish#honestly what made all the difference was when my job bumped everyone to a starting wage of 20/hr#they did it to be more competitive with the rest of the field#and that's when i was able to save up enough for my half of the closing costs on our house#us politics#finance

120 notes

·

View notes

Text

If i am totally honest I kind of don't like how harsh some of the fandom is at Greg sometimes for being literally homeless and having a magical gem son at the same time. For sure there are places where Greg actually messed up but I feel like in the case of Steven partially growing up in a van and not really having access to medical care and lacking structure because of it is like. Homeless and poor people have kids and its not a moral failing on their part for our society not helping them meet their needs, yknow?

#plus obviously once he could afford housing for his son he clearly did it#I always assumed that he financed the construction of the gem house and paid all the energy bills and stuff#but its always taken up most of his paycheck#and it probably took those like. idk 10+ years after steven's birth to actually save up enough to do it#then he didn't even get to LIVE in it because the gems had beef with him at the time and it was awkward#and i dont like the whole ''he could have gone back to his family'' thing because a) his family was literally abusive#he's not in the wrong for protecting steven from them#and b) his family didn't even open his god damn letters. i think thats enough to assume they would not help and didn't care#hell andy admits as much that he could have taken initiative and visited everyone and that was an UNCLE#clearly nobody in his family cared enough to finacially support Greg unless he like. joined the military or something

83 notes

·

View notes

Text

my christmas gift to myself is finishing up my 80s wall street stockbroker hob x goth musician morpheus fic, at last. five thousand words and i think we've FINALLY got past the existentialism and onto the smut 😂

“Hmm.” Morpheus rests his cheek on the couch cushion. The tips of his hair brush Hob’s hip. His eyes are so liquid in this light. Hob wonders if he’s hallucinating.

He reaches out, mesmerized, to touch Morpheus’s hair. Morpheus doesn’t stop him. He lets Hob pet his hair, eyes falling shut. His hair is tacky on the ends with hair spray, but soft underneath.

“I’ll tell you a secret,” Hob says, and Morpheus hums. “All those self-important traders trying to impress you with their convoluted financial instruments… they just want to hide that it’s all really a scam.”

“Is it now?” says Morpheus. “I was under the assumption it was legal.”

“Something can be a scam and technically legal. Oh, it’s all very clever. But it’s just building money on top of money with nothing real to support it. Kick out the base of the tower and it’ll all go into free fall.” He makes a whistling, falling sound, and Morpheus smirks.

“And I suppose you are better than all this.”

Hob chuckles. “Oh, no. I’m a money-grubbing little vermin, too. Just letting you in on the game. How it’s not so serious.”

“Hmm. I am a musician,” says Morpheus. As Hob figured, then. “I’m afraid it’s as serious as death.”

#i should NOT be allowed to discuss finance in fics but no one was around to stop me so yall are gonna learn about the housing market crash#just a LITTLE bit though. just a tiny bit#my writing#80s dreamling

75 notes

·

View notes

Text

October 2023: I was so productive but, boy (gn), was it a stressful month!

#I have really no intention of ever writing a spontaneous financing application again#Esp when there is also spontaneous construction work going on inside my house#studyinglaurel#studyblr#gradblr#phdblr#honest academia#adventures in academia#astudentslifebuoy#randomstudyblr#starlighttracks

95 notes

·

View notes

Text

Serious question:

Do ya'll think the WoL is at least somewhat moderately wealthy as a direct result of being the Warrior of Light? Gameplay-wise, we receive currency for completing most quests, and five expansions worth of quests adds up to a few million gil, but do you consider that canon? And does it go directly to the WoL or to the Scions' coffers? Do you think the Scions receive some kind of salary?

Like yeah 9000 gil for a hair tie sounds outrageous, but the WoL probably makes that much brushing their teeth in the morning so is it really?

#ffxiv#ff14#warrior of light#i have questions re: the wol's finances#related thought: if you own a house or apartment are you still a murder hobo#or does that make you a murder landed gentry

306 notes

·

View notes

Text

The Quantum Financial System (QFS) is a theoretical financial system that aims to challenge the existing banking system and address issues like corruption and manipulation in the financial sector.

It's believed that the QFS would use artificial intelligence (AI) and quantum computing to revolutionize financial transactions and eliminate the need for traditional systems like SWIFT.

The QFS is designed to resist encryption-breaking attempts by quantum computers, which could redefine data security in the digital world.

While direct investment in the QFS is possible, some believe that ISO 20022-compliant may play an important role in the new system.

Quantum-based technologies in finance offer benefits like enhanced computational power, advanced data analysis, increased security, portfolio optimization, and more.

QFS is the Future, Trump is Fighting for the Future and for the betterment of United States of America.

Move your funds into the QFS ledger account and be safe from the incoming bank crash. I will be here to navigate you onto your transition into the QFS ledger account

#donald trump#wells fargo#bank of america#breaking news#bank crash#bad government#world news#qfs#bank clash#new york#decentralized#bad omens#decentralisation#decentralised finance#marine life#quantum financial system#nesara#gesara#stay woke#washington dc#white house#veterans#patriotic#politics#trump 2024#republicans#educate yourself#reeducation#reeducate yourself#be aware

45 notes

·

View notes

Text

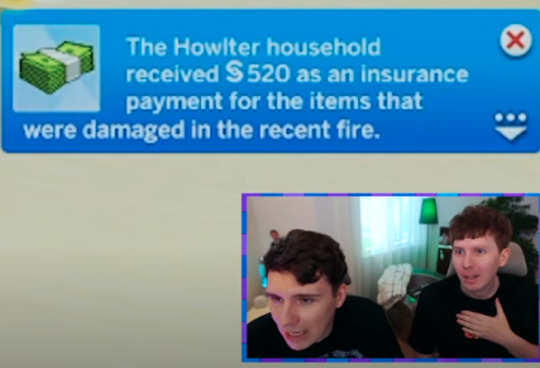

did Dalien commit insurance fraud???

#I'd be worried about finances in that house too to be fair#dan and phil#phil lester#dan howell#amazingphil#danandphil#dnp#dnpgames#dan and phil games#dapgames#dan and phil play the sims#danandphilgames#tabitha also doing questionable things#breaching the NDA and lying about it#getting off scot-free and even getting paid for it

46 notes

·

View notes