#Banking/Credit

Text

Are we ready for sustainably higher real yields?

…financial system would struggle to avoid accidents for very long with real yields sustainably positive. This is because we live in a much higher debt world than in the past ….

Total debt/GDP is slightly lower now than it was at the peak of the GFC even as government debt soared. The private sector managed to de-lever to some extent, albeit from record high levels. Both groups were helped by negative real yields and economy-wide defaults were very low.

However in aggregate debt/GDP is still very high and at similar levels to when QE and zero/negative rates were deemed essential.

-dB

3 notes

·

View notes

Text

God, I fucking love money….. my one true love 💪 the grind never ends!!!!

#banking#banking and finance#banking/credit#bankruptcy#federal reserve bank#investment#private banking#money#world bank

3 notes

·

View notes

Text

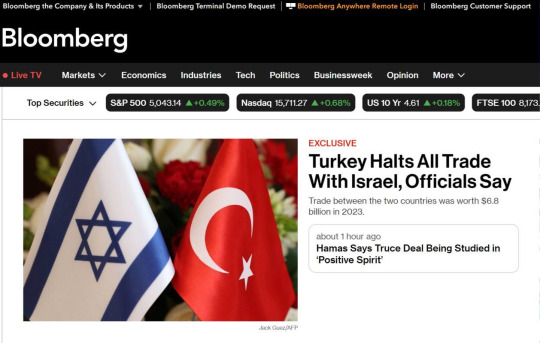

GREAT NEWS

turkey halted trade with israel.

for context: trade between the two was worth 6.8 Billion dollars in 2023

KEEP SPEAKING, KEEP PROTESTING. push for your government to also cut ties with israel. this is what we need

#credit to @miskinh4na for notifying me#israel#colombia university#turkey#jerusalem#free gaza#gaza#free palestine#palestine news#iran#united nations#palestine#gaza strip#social justice#yemen#colonialism#tel aviv#current events#news on gaza#news update#war news#war on gaza#west bank#apartheid#end the occupation#end the apartheid#free west bank#israel is an apartheid state#israel is a terrorist state

15K notes

·

View notes

Text

Unlock Exclusive Newcomer Bank Account Offers in Canada for a Smooth Financial Transition

Discover the best newcomer bank account offers in Canada that are tailored to meet the unique needs of immigrants. Settle into your new life with ease and take advantage of special perks, low fees, convenient banking services, and valuable financial resources. Whether you're looking for seamless fund transfers, credit building opportunities, or personalized financial guidance, these exclusive offers will help you establish a solid foundation for your financial journey in Canada. Don't miss out on these exceptional opportunities—explore the top newcomer bank account offers today at SettleCanada.ca!

0 notes

Text

Root Causes of the US and Europe Banking Crisis

1 note

·

View note

Text

Unstoppable Finance Announces Europe's First Compliant DeFi-Native Bank

Hold on to your hats, because Unstoppable Finance is shaking up the European crypto market with its launch of Europe’s first compliant “DeFi-native bank” and a fiat-backed Euro-pegged stablecoin! This Berlin-based fintech startup is offering a broad suite of banking and financial services on both traditional and DeFi rails, providing a legally compliant solution that bridges the gap between traditional finance and the decentralized economy.

Key Highlights

Unstoppable Finance plans to roll out Europe’s first compliant “DeFi-native bank” and a fiat-backed Euro-pegged stablecoin.

The DeFi bank will ensure that the stablecoin is fully backed by reserves, deposited to a European Central Bank (ECB) account, maximizing the stability of the stablecoin.

Unstoppable Finance’s founders include Peter Grosskopf, Maximillian von Wallenberg-Pachaly, and Omid Aladini, with experience in launching Germany’s first regulated crypto exchange and Solarisbank, the first tech company to get a German digital banking license.

Unstoppable Finance’s first product, the DeFi wallet “Ultimate,” launched in 2022, offering smartphone users to custody and trade their crypto assets in a non-custodial manner.

In August 2022, Unstoppable Finance raised a €12.5 million ($12.8 million) Series A financing round led by Lightspeed Venture Partners, with participation from Rockaway Blockchain Fund and Fabric Ventures.

The bank’s founders, Peter Grosskopf, Maximillian von Wallenberg-Pachaly, and Omid Aladini, have a wealth of experience in the crypto and tech space, including launching Germany’s first regulated crypto exchange and the first tech company to get a German digital banking license. Their expertise is exactly what’s needed to navigate the new MiCA legislation and provide legally compliant solutions to the European market.

Unstoppable Finance’s DeFi-native bank is using stablecoins to make money programmable, settle transactions in seconds, and provide transparency into transaction ledgers. And with the stablecoin backed by fiat reserves, customers can be sure of stability and compliance with the new legislation.

But that’s not all — Unstoppable Finance’s first product, the DeFi wallet “Ultimate,” allows smartphone users to custody and trade their crypto assets in a non-custodial manner, offering three protocols for trading, liquid staking, and stablecoin swapping. And with the recent €12.5 million ($12.8 million) Series A financing round led by Lightspeed Venture Partners, Unstoppable Finance is well-funded to develop the DeFi wallet and build the fully regulated DeFi-native bank and stablecoin.

Overall, Unstoppable Finance’s launch is a game-changer for the European cryptocurrency market, providing greater clarity and certainty for businesses operating in the sector and rebuilding the financial system. Get ready for a new era of DeFi banking! To get more insights on blockchain, crypto, NFTs, subscribe to my newsletter and check out my Twitter and Medium accounts. I post valuable content on these platforms regularly.

Recommended for you

How ChatGPT Is Fueling Fake News In China And What You Need To Know

Liechtenstein Says Yes To Bitcoin: What You Need To Know

The Future Of Cars Is Here: Renault Unveils Digital Twin NFTs And Shoe5 Sneakers

How Yuga Labs CEO Went From Gaming To NFTs And Created The Bored Ape Yacht Club Phenomenon

0 notes

Text

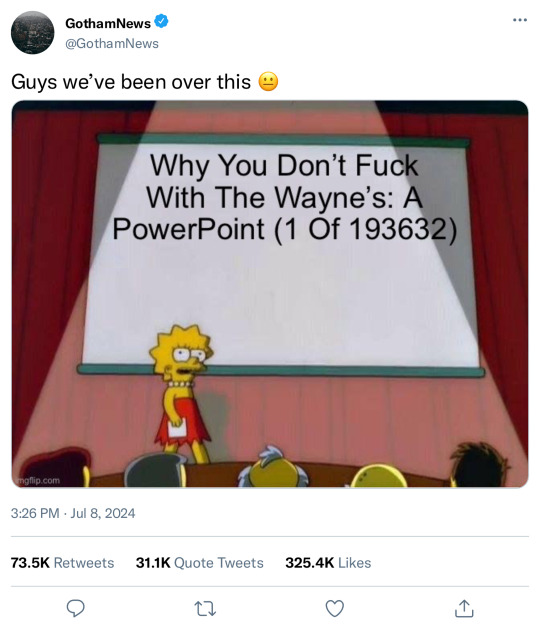

Part 20 masterpost

#batman twitter au#jason todd#red hood#dick grayson#nightwing#damian wayne#robin#tim drake#red robin#stephanie brown#spoiler#duke thomas#singel#bruce wayne#Batman#he wasn’t on twitter today because he was busy ruining JThater bank account#and credit#batman family#batfamily#batfam#batbros#batboys#bat boys#bat brothers#batbrats

2K notes

·

View notes

Text

Bisakah pinjam uang di BRI untuk bangun rumah?

Anda bisa mengajukan pinjaman di Bank BRI untuk membiayai pembangunan rumah.

Bank BRI menawarkan berbagai jenis produk pinjaman online yang dapat digunakan untuk membiayai pembangunan rumah, termasuk KPR (Kredit Pemilikan Rumah) dan KKB (Kredit Kepemilikan Bangunan).

KPR BRI adalah produk pinjaman yang ditujukan bagi masyarakat yang ingin memiliki rumah dengan cara mengajukan pinjaman kepada Bank BRI.

Pinjaman ini bisa digunakan untuk membeli atau membangun rumah, termasuk renovasi atau perluasan rumah.

KPR BRI menawarkan fasilitas seperti bunga rendah, tenor yang fleksibel, dan biaya administrasi yang terjangkau.

Sementara itu, KKB BRI adalah produk pinjaman yang ditujukan bagi masyarakat yang ingin membiayai pembangunan bangunan, termasuk pembangunan rumah.

KKB BRI menawarkan fasilitas seperti bunga rendah, tenor yang fleksibel, dan proses pengajuan yang mudah.

Namun, perlu diingat bahwa proses pengajuan pinjaman untuk membiayai pembangunan rumah melalui Bank BRI melalui proses survei dan verifikasi yang ketat.

Bank BRI akan melakukan penilaian kelayakan peminjam, termasuk pengecekan legalitas lahan dan bangunan, kemampuan finansial, dan kelayakan usaha.

Selain itu, peminjam juga diwajibkan menyediakan dokumen yang dibutuhkan, seperti surat-surat kepemilikan tanah, IMB, dan sebagainya.

0 notes

Text

Treasury yields plunge as SVB fallout seen slowing Fed rate hikes

Bond yields fell sharply on Monday as investors bet that the failures of Silicon Valley Bank and Signature Bank would cause the Federal Reserve to raise borrowing costs more slowly as it battles inflation.

What’s happening

The yield on the 2-year Treasury

TMUBMUSD02Y,

4.326%

tumbled 38 basis points to 4.213%. Yields move in the opposite direction to prices.

The yield on the 10-year…

View On WordPress

#article_normal#banking#Banking/Credit#Commercial Banking#credit#economic news#Financial services#Monetary policy

0 notes

Text

Stress in the #banking sector is diminishing. 🔻

#investor #ennovance

0 notes

Text

Cash is king: "I will never risk getting caught short of cash." — Warren Buffett

0 notes

Text

Imma do one of these note things

20 notes - I'll try to post more gravity falls content more often

30 notes - I'll drink more water daily

50 notes - I'll start drawing everyday

100 notes - I'll start writing my book everyday

150 notes - I'll continue learning Violin (but I can only in September :( )

300 notes - I'll touch grass more

500 notes - I'll ask my dad for a credit card

@sucheonstherapist, @fishy--friend tagged ya because I need people to see this

#btw spamming is allowed >:3#I actually want you to#one of those note thingies#if this post gets __ notes#note thingies#note post#gravity falls#i'll drink more water#more water#violin#drawing#artwork#digital illustration#artists on tumblr#sketch#grass#touch grass#credit cards#banking#holy moses

519 notes

·

View notes

Text

This chart shows how companies have become quieter in cryptocurrencies

This year, not only cryptocurrency prices are falling. Companies that were once eager to publicize their participation in digital assets have also become more relaxed about these efforts.

In the first two months of the fourth quarter, there were 146 corporate teleconferences mentioning cryptocurrency and other related terms – this is somewhat more than 141 such transcripts in the first two months…

View On WordPress

#actual filters#article_normal#Banking#Banking/Credit#beverages#bitcoin us dollars#BTCUSD#C&E industry news filter#Consumer goods#Content types#corporate#Corporate/industry news#credit#Cryptocurrencies#earnings#Ethereum US dollar#ETHUSD#Factive Filters#Financial indicators#Financial services#financial technology#Food#Food/drink#Income#industrial news#Technology#virtual currencies#Virtual currencies/cryptocurrencies

1 note

·

View note

Text

Will there not be penalty on those who do not keep the minimum balance in the bank account? Government replied

#factifiedhindi#world news#digital world#top news#latest news#omg#banking/credit#latestinformation#latestnews#amazingfacts#amazing news#australia news#amazing facts#news and trends#today trending#tech#viralnews#factifiedhindidaily#america news#america#business news#did you know#facts#google news#news#today news#viral updates#trends

1 note

·

View note

Text

Uang 100 Juta dapat bunga berapa?

Besarnya bunga yang akan Anda dapatkan dari uang 100 juta tergantung pada jenis produk investasi atau simpanan yang Anda pilih.

Ada beberapa produk investasi atau simpanan yang menawarkan bunga yang berbeda-beda, seperti deposito, reksadana, obligasi, atau tabungan.

Jika Anda memilih untuk menyimpan uang di deposito, bunga yang diberikan biasanya lebih tinggi dibandingkan dengan tabungan biasa.

Besarnya bunga deposito bank tergantung pada jangka waktu simpanan yang Anda pilih, semakin lama jangka waktu simpanan, semakin tinggi bunga yang diberikan. S

aat ini, bunga deposito di Indonesia berkisar antara 2-5% per tahun, tergantung pada bank dan jangka waktu simpanan.

Jika Anda memilih untuk berinvestasi di reksadana atau obligasi, bunga yang Anda dapatkan akan tergantung pada tingkat suku bunga di pasar.

Suku bunga yang ditawarkan di pasar dapat berubah-ubah tergantung pada kondisi ekonomi dan kebijakan moneter yang diterapkan oleh bank sentral.

Sebagai gambaran, tingkat suku bunga obligasi pemerintah Indonesia saat ini berkisar antara 4-8% per tahun.

Namun, perlu diingat bahwa investasi atau simpanan yang menawarkan bunga yang lebih tinggi juga biasanya memiliki risiko yang lebih tinggi.

Sebelum memutuskan untuk berinvestasi atau menyimpan uang di bank, sebaiknya lakukan penelitian dan analisis terlebih dahulu serta konsultasikan dengan ahli keuangan atau bank terpercaya.

Sumber: jnetracking.com

0 notes