#How to Use Home Loan Calculator

Explore tagged Tumblr posts

Text

⋆ ambessa headcanons but it's a modern au & she's a ruthless business mogul.

business mogul!ambessa x wife!reader. men & minors dni.

synopsis: what it says on the tin.

cw: implied age difference! explicit sexual content below the cut!

notes: i need her. i am going to lose it. the theme of this marriage is definitely cherry by lana del rey ( listen here. ) and bordersz by zayn ( listen here. )

getting together

one night, a little tipsy and feeling bold, you post a video to social media. you don’t care about the controversy, you declare—you need ambessa so badly.

despite the chaos that follows, your words are so heartfelt, so sweet, that the video practically goes triple platinum overnight.

later, at a restaurant opening, you both happen to be there. she spots you sitting in a corner, all soft warmth and radiant energy.

you look lovely, your wide smile lighting up the room. she notices how your nose scrunches when you laugh and how your dress—loaned as a favor to a designer you adore—dips elegantly at your hips.

with a little... maneuvering, ambessa secures the seat next to you and strikes up a conversation.

you’re so vivacious, so intelligent, and for the first time in a long time, she meets someone who doesn’t greet her with judgment or disapproval.

when you speak, you lean in, your hand occasionally brushing her arm. you’re so intentional, and it utterly endears her to you.

after the event, she goes home haunted by your perfume and the sound of your laughter.

the next morning, her PA reaches out with a dinner invitation to one of your dream restaurants. ambessa had spent the night scrolling through your socials, watching videos over and over.

the married life.

you’ve become a media darling—everyone adores you.

sometimes, ambessa can’t handle sharing you with the world, so she’s left her mark: photos of you often feature dark hickeys blooming across your neck like wildflowers.

your ring is massive, but she insisted you pick it out yourself—she wanted to make sure it was exactly what you wanted.

you call her “bessa,” and she alternates between “my love,” “baby,” or “sweet girl” when speaking to you.

when you leave for trips, whether for work or to visit family, she secretly diffuses perfume oils that mimic your scent throughout the house.

the playlist you share is ridiculously long—so long, in fact, it almost crashed your phone once, but neither of you care.

her desk is cluttered with framed photos of you, and your house has a photo wall that stretches up the staircase.

even when she’s annoyed or upset, she’s impossibly soft with you.

she gets genuinely upset if you don’t use her card to make purchases. like pissed.

“you will want for nothing” was one of the first promises she made to you.

you have to sneak birthday and christmas gifts for her because she always checks to make sure you’re spending her money “as the Lord intended.”

“i didn’t add this card to your apple wallet for decoration.”

she’s deeply affectionate, both in public and private.

she adores nonsexual intimacy—massaging your feet as you tell her about your day, pulling you into her lap while she works, and just sitting quietly together.

when you cup her face during conversations to focus her, it often leads to... wonderful outcomes.

if she catches you pouting, she pinches your lips into a duckbill and laughs. you let it slide because her laughter is so full-bodied, so infectious, you can’t help but love it.

her humor is so dry and witty it takes you a minute to register sometimes, but when you do, you’re in stitches.

she’s always close—sharing water, joining you in baths and showers. you’re rarely apart.

ambessa loves to provide for you. she’s your dictionary, bank account, calculator, calendar, dild—

her gift-giving is unmatched. she remembers things you mentioned wanting years ago, down to the minute you said it. it could've been mentioned 6 years, 2 months, 3 days, 1 hour, 6 minutes, and 23 seconds ago. she still remembers.

she keeps a lawyer on retainer because you’re fiercely protective of her. she acts exasperated but secretly loves it.

if you get sick, she’s terrifying—she’ll track down whoever got you sick and sue them into the ground. when you had pneumonia once, she nearly had a breakdown. it is now referred to as the crashout of the century in your household.

she’s serious about keeping you healthy, even if it drives you crazy. workouts with her are intense.

“just a little more, my love.” “you said that two rounds ago!"

her countdowns are the worst. she swears there’s ten seconds left, but it feels like eternity.

speaking of households, you don’t play when it comes to your family.

you’re fiercely protective and, let’s be honest, a little conniving when necessary.

the pta? you run it like the navy. everyone falls in line when you walk in the room.

once, a kid at mel’s school thought it was a good idea to bully her. you pulled up, found the kid, and made sure they’d never even think about messing with her again.

after that, everyone was a little afraid of mel and kino’s stepmom. you never heard another peep of bullying.

when it's good—it usually is—it's wonderful. but there were compliated moments in the beginning.

ambessa’s rise to the top wasn’t exactly clean. there were deals in shadows, strategies that left her enemies ruined. you should’ve felt more conflicted, but you found it difficult to care.

but then she announced she was running for office, and everything changed. you hated what she was doing to win—how ruthless she was, how far she was willing to go.

it led to the biggest fight you’d ever had. you left, heartbroken, and stayed with your parents for weeks.

mel had never seen her mother so undone. ambessa was quiet, distracted, a shadow of herself.

mel flew out to see you, desperate to fix things. when you saw her, the grief on her face mirrored your own, and it shattered you.

you forgave ambessa immediately—not because she was blameless, but because you hated what it had done to both of you.

she will always choose you and the kids above anything.

the marriage bed.

it's a workout in here, too.

she gon’ put that baby inside of you.

you are a bit of a perfectionist and stressed about doing it wrong and she literally could not have cared less.

she loves to lace your hands together when you fuck.

the first couple times you sleep together she treats your body like a land she needs to learn, to map.

she prefers to be dominant but sometimes you just need it and she allows you to take control.

you adore her strength and you are not slick about it because your favorite positions reflect it: mating press and amazon press, specifically.

she’s a munch and she likes humiliating you so that usually entails spreading the lips of your pussy to watch it drool for her, spiting into your cunt, pushing your legs out or up so that it’s completely bare to her.

you're enamored with her breasts.

even outside of sex sometimes you just squeeze or hold them.

she says you’re being ridiculous but then will take off her top and reveal the most insanely tight sports bra. her tits are practically spilling into your mouth all on their own.

you can no longer go to the gym with her bc it will get crazy.

impact play.

straps you down. you are not walking for at least two days.

once she begins, she will be finishing. no breaks. so don't tease unless you can commit.

will most definitely keep fucking you even she gets a work call + sometimes if you try to be quiet she’ll loop a hand under the thin fabric of your g-string and bounce you fast and hard on her cock until you’re moaning shamlessly.

you love kissing her so she’ll make out with you until your lips are so swollen and your words are slurred.

the best sex you had was in the bathtub one evening.

you were slipping and sliding but a swat team couldn’t have pulled her out of you.

you held onto her tightly, felt her back ripple, and to this day you swear you saw the gates of heaven. you knew if you came to be before them without her, you'd hold the gates to let her in.

she’s always telling you to take it and forces you to look at the ring you’re making around her cock.

when you’re ass up she’ll consume you until you’re shaking.

she loves making you squirt; it’s like a challenge for her.

when it happens she’ll drop her mouth open and moan so loudly it makes you flush.

she then begins to finger you and the overstimulation really works you up.

she loves to put you on your side with a leg raised so she can snap her hips hard against your ass and hear the squelch.

you love when she does this because her tits are against your back and she’s just so fucking big and warm. you feel safe.

you’re usually so sweet but during these moments you curse like a sailor.

“fuck fuck fuuuuuck. holy shit, bessa.” “such a dirty girl.”

one thing about her fingers? they’re going in your mouth and you’re gonna gag on them.

super thoughtful with aftercare.

massages every part of your body and intersperses the pressure with tender kisses.

you always fall asleep to affirmations of how beautiful and loved you are.

you are her angel, fallen and found by her hands.

© hcneymooners.

#ambessa x you#ambessa x reader#ambessa medarda#arcane ambessa#ambessa league of legends#wlw smut#lesbian#sapphic#rough smut#arcane smut#arcane headcanon#headcanons#mine ; 🐎.#mel medarda#kino medarda#female!reader#f!reader

1K notes

·

View notes

Text

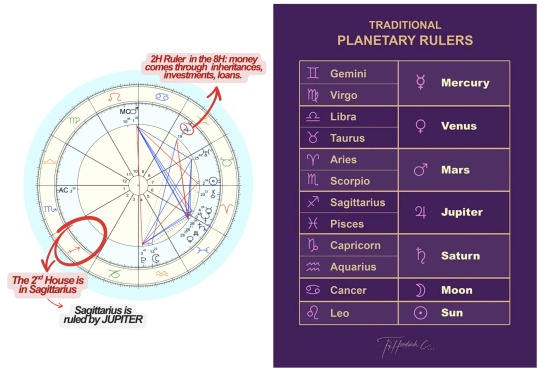

💸₊˚⊹Your 2H Ruler = How to Become a Money Magnet 💵₊˚⊹

If you’re not making the kind of money you want, you need to start using your 2H ruler. This placement shows how you can earn more money & the people/situations that will bring huge financial opportunities in your life.

If you ignore your 2nd House ruler, you risk chasing the wrong goals and wasting time. This planet shows your natural path to wealth: not the path others tell you to take. The more you align with it, the easier money flows.

So, let's figure out together how to use your birth chart to become a money magnet.

HOW TO FIND THE 2H RULER:

1) Locate the sign in your 2H. Calculate your chart HERE!

2) The planet that rules that sign is your 2H ruler (see table below for planetary rulerships.)

3) Locate the house the 2H ruler occupies in the birth chart. The house it's in, shows HOW you can make more money.

Example: Sagittarius 2H=Sagittarius is ruled by JUPITER=8H Gemini Jupiter is the 2H Ruler

2H RULER IN THE 1H: Build skills and image. Start a personal brand or business. Be seen, heard, and remembered. Who gives you money: Clients who like your energy. Followers, fans, loyal buyers.

2H RULER IN THE 2H: Invest in goods, land, or things that grow. Focus on slow, steady gains. Sell tangible services. Who gives you money: Bankers, traders, investors. People who deal in tangible assets (like gold, land, supplies). Buyers who want lasting value.

2H RULER IN THE 3H: Write, sell, teach, speak. Trade goods locally. Use phones, emails, short trips to build cash. Who gives you money: Siblings, neighbors, close friends. Writers, messengers, teachers. Local businesses or delivery services.

2H RULER IN THE 4H: Buy or sell real estate. Work in land, farming, food, or tradition. Build home-based businesses. Inherit wisely and protect it. Who gives you money: Parents, grandparents, elders. Real estate agents or property managers. Family businesses or ancestral wealth.

2H RULER IN THE 5H: Create art, games, entertainment. Start passion businesses. Teach kids, coach sports, organize events. Take smart risks. Who gives you money: Artists, athletes, performers. Gamblers, investors, venture capitalists. Lovers or romantic partners.

2H RULER IN THE 6H: Offer daily services people need. Heal, repair, clean, or fix. Focus on health, pets, or crafts. Build strong work habits. Who gives you money: Nurses, vets, cleaners, tech workers. Bosses who value hard workers. Clients who need regular help.

2H RULER IN THE 7H: Negotiate smart contracts. Form joint ventures. Sell directly to clients one-on-one. Who gives you money: Business partners, spouses, clients. Lawyers, agents, deal-makers. People who invest in long-term relationships.

2H RULER IN THE 8H: Manage inheritances, investments, loans. Work with taxes, banking, insurance. Handle mergers, estates, or debts. Trade trust for power. Who gives you money: Investors, lenders, financiers. Heirs, trustees, executors. Partners who share assets.

2H RULER IN THE 9H: Teach, publish, preach, or coach. Sell services across borders. Work with law, spirituality, philosophy, or higher education. Follow faith or big missions. Who gives you money: Professors, clergy, travelers, publishers. Foreigners. Legal workers or academic institutions.

2H RULER IN THE 10H: Build a public name. Climb career ladders. Start visible businesses. Become an expert people recognize. Who gives you money: Bosses, governments, CEOs. Industry leaders and high-status clients. Customers who respect titles and results.

2H RULER IN THE 11H: Launch group projects. Build big communities. Fund dreams through social support. Join causes that matter. Who gives you money: Friends, followers, donors. Clubs, political groups, online communities. Social movements and public funds.

2H RULER IN THE 12H: Work behind the scenes. Heal, help, or create art quietly. Invest in royalties, patents, hidden streams. Protect secrets and serve faithfully. Who gives you money: Monasteries, charities, hospitals, hidden patrons. Spiritual teachers, artists, healers. Quiet supporters or secret allies.

Thank you for taking the time to read my post! Your curiosity & engagement mean the world to me. I hope you not only found it enjoyable but also enriching for your astrological knowledge. Your support & interest inspire me to continue sharing insights & information with you. I appreciate you immensely.

• 🕸️ JOIN MY PATREON for exquisite & in-depth astrology content. You'll also receive a free mini reading upon joining. :)

• 🗡️ BOOK A READING with me to navigate your life with more clarity & awareness.

#astro community#astro observations#astrology#astrology signs#horoscope#zodiac#money#abundance#abundancemindset#manifest abundance#financial abundance#law of abundance#prosperity#astrology observations#astrology notes#astrology blog#natal chart#birth chart#astro notes

520 notes

·

View notes

Text

financial literacy continued⋆.ೃ࿔*:・👛💵

so i released a poll if you guys would like a post on financial literacy and the results are here. so im gonna share some things that i learned while taking a financial literacy course…💬🎀

HOW TO SAVE MONEY ;

automatically deposit a certain percentage of ur income into ur savings account so that u dont even have to think about it

to do something more FUN tho, (at least in my opinion) is to make a challenge where u have to save every $10 dollar bill, or $20 dollar bill or whatever. just something to make saving money seem like a game if u wanna have some fun with it.

EMERGANCY FUND ;

most experts will tell u that ur emergency fund should be 3-6 months of ur needed expenses. so calculate ur needed expenses and multiply that by 6 to figure out how much you'd need to have in ur emergency fund.

PAYING YOURSELF FIRST ;

you should always put urself first in every single situation including financially. so to pay urself first simply means to put ur future and needs before anything else. FOR EXAMPLE... let's say u wanna buy an ipad by the end of the year, an ipad is $345.

lets also say that u get paid weekly, so you'd divide $345 by the number of weeks in a year (52) you'd get 6.6. so you'd have to save roughly $6-$6.50 a week which isnt a lot at all. and you'd be getting what u want.

INTEREST AND CREDIT ;

interest is like a reward that the bank gives you for trusting them to look after your money. the more money you have in your account, and the longer you keep it there, the more interest you can earn…💬🎀

so the bank calculates interest as a percentage of the total amount in a bank account. so if the bank pays a 1% interest you'll earn $1 for every $100 in ur bank account over the course of a year. so if u have $500 in ur account you'll get $5. its not a lot, but interest builds on itself.

credit is the ability of the consumer to acquire goods or services prior to payment with the faith that the payment will be made in the future…💬🎀

for example missing payment deadlines can negatively affect ur credit score. why is this important? if u wanna go to college and wanna use student loans, u might not be able to if ur credit history is bad. as ur credit history grows you'll get a credit score. the higher ur score, the better ur credit is.

BUILDING CREDIT ;

get a secured card. a secured credit card is a special type of credit card with a down payment. when you open the card, you will give the credit card company a deposit to hold. it can be as little as $100. the company holds the money for you and gives you a credit card with a line of credit equal to your deposit

sign up for victoria's secret direct paper mailers. you'll get a coupon each month for 1 free panty for every purchase. when u go to the mall, get urself a panty and a sweet treat 🧁 (DO NOT PUT ANYTHING ON THE CARD THAT U CANT IMMEDIATELY PAY OFF)

and then go home and pay ur credit card bill off, and then dont use it again until the next month.

#honeytonedhottie⭐️#law of assumption#it girl#becoming that girl#self concept#that girl#self care#it girl energy#advice#dream girl tips#dream girl#dream life#beauty and brains#financial literacy#investments#personal finance#information#pink academia#girly#hyper femininity#hyper feminine#girl blog#fabulous#fabulously feminine#glamor#glamorous#self improvement#self growth#maintenance#rich and pretty

836 notes

·

View notes

Note

Congrats on your new dream car!!! Thats really impressive and I hope you enjoy it as much as you can!!!

I don't want you to say about your private life and what you do, but can you share some tips or things you did that helped you to save money for something like that? Did you did something else than just saving into an account? Thank you so much, and congrats!!!

First thing I did was get a personal loan to pay off my credit card debts. My loan was $6000 to get that out of the way. Paid all my credit cards off, so I only have a monthly loan payment of $150. Be careful, and ensure the loan interest isn’t high. I went through my credit union so it isn’t ridiculously high like some online lenders like onemain financial or lending club. Do an unsecured loan! Do not use a car or other valid thing as collateral. Try your best to get an unsecured loan with a high amount as possible to try and pay as much of your debts off as possible.

Second, this may not pertain to you or whoever will be reading this. I sold my truck. I wanted a Supra so bad that I decided to get rid of my main transportation. Sounds terrible but selling the truck would make a huge down payment for a $65k car. My truck was still in great condition and low mileage (I only drive to work and home). I did hop to different car dealerships for a good price. I used Kelly Blue Books as my main source for the price of my truck. This is where I had to use my fallout barter skills to raise prices lol. A lot of dealerships are buying used due to tariffs coming to USA soon, so they are trying to raise their used car stock for people wanting a “new” car they can afford. Lucky for me, my truck is in high demand here in Hawaii LOL.

Third, live frugally. I went beyond saving, and lived like I had “no money”. I only paid my monthly bills, and moved the remainder of my check into savings. The sooner I can put 20% down on my new car, then I won’t have to uber to and from work. My job luckily grants me 20 free rides per month with uber or Lyft. Other than that my mom drove me to and from work with her car, thankfully she works close to me! Money saving was my hardest part. I kept my credit cards at home so I wouldn’t use them either.

Fourth, I recycle cans and bottles. Been doing that forever! If you don’t spend what money you get from recycling, it does add up. My piggy bank from recycling and tips from work added up to around $500 in total. Takes a while for it to add up, but I would toss the cash in a jar and forget about it.

To note: my credit is good, not great, but a bigger down payment would help tremendously with financing the car to have a lower interest rate and monthly payment. I am only paying $600 for the car since I paid a little over 20% of the car.

To summarize because I’m a yapper:

Pay off debts.

Commit to living frugally.

Save every nickel and dime you can.

Over compensate how much the total of the car is (like fees, taxes, insurance, add-ons) so you can calculate how much money you can put down/save for it.

Use a car loan calculator online to help you!

Hope this helps. It did help me a lot. I have managed to do this within 3 months by the way. I waited for the next credit report refresh so my credit score did go up, and made the car buying process a lot easier. The best time to buy a car as well is around this time, a lot of dealerships are bringing in their new year vehicles and are trying to sell through their current stock! Another reason I did this quickly was because the Supra will be discontinued after the 2026 models. I lost my chances at the Nissan GTR, so I was determined to get the Supra before it was too late.

28 notes

·

View notes

Text

Girls Night

“You owe me 200!”

“Fine! Just take all my money!”

You laughed, throwing the paper money at her and taking a sip of your wine. It was safe to say that you sucked at playing Monopoly. Ellie had ownership of all the railroads and utilities, Abby had at least 2 hotels on each of her properties, and Alex spent most of her time in jail.

It still wasn’t a match for you, who had 25 dollars to your name, 2 properties that only generated around 30.00 total in rent, and would miss the free parking space every chance you got. When your time came and you rolled the cursed dice, the Monopoly Gods decided to end your pathetic gaming reign by putting you in jail.

“Alright, well I’m out,” you stated defeatedly, taking a long sip of wine as your confirmation.

“Aw, it’s alright Y/N. Maybe you’ll do better the next game!” Abby tried but you shook your head with a quickness.

“Absolutely not. Not only is this game rigged to make me realize how terrible of a homeowner I am, but it lasts forever! Alex knows, she’s been in jail for the last three turns.”

“Hey, I don’t mind it. I just collect all my rent money while I’m in here,” Alex retorted.

You laughed as you heard the front door open and saw Jethro walk in with a grocery bag and a bottle of whiskey. You got up from your spot immediately, happy to see him home finally and walked over as he set the stuff down on the kitchen counter. He had let the team go home earlier in the night but told you he needed to stay behind to do some paperwork on their latest case. Abby was the first one to suggest the girls game night and it didn’t take much convincing of Ellie or Alex when the promise of wine, snacks, and a warm fire were included.

“Hey hun. You just missed my embarrassing defeat in Monopoly. Remind me to never play this game with your team again, they’re entirely too good. And I think Abby’s been hiding all the good chance cards up her sleeve.”

He chuckled as you gave him a welcome home kiss and started noisily poking around in the goods he had brought home.

“Ooh. Chips, dip and whiskey? You trying to butter me up sir?”

He smiled and pried the bottle from your hands. “Whiskeys mine. And it sounds to me like you’re already buttered up,” he teased softly, not wanting his special agents to hear your two’s playful PDA. With another small kiss, he walked out to the group of girls and surveyed the real estate war.

“Doing well Abbs. Bishop, I like your strategy. And Quinn, stop hiding in jail.”

“I’m not hiding! I’m just taking my time,” she defended as everyone laughed.

“I’ll be downstairs if you girls need me. Good night.”

They called out their farewells as he made his way into his little woodworking dungeon and you took your spot back, bringing the new snacks with you.

“Alright Banker Abby. I need a loan,” you pleaded.

————

The clock read 11 pm once the girls left and you cleaned up your game space. In the end, it was Ellie who won, most likely due to her incredible NSA analysis skills and you had ended up with at least more than the small loan Banker Abby gave you. Once you put all the furniture back and glassware in the dishwasher, you made your way downstairs to see Jethro.

There was light country music and a muted tv playing as you watched him slowly move the sandpaper over his newest project. He had finished the boat a while back and offered to build you some beautiful planter boxes for the garden you wanted to start once spring came around.

It was always a treat for you when you watched him work. His movements were smooth and calculated, knowing just how much pressure to apply or what angle to use and seeing him wearing his tool belt and covered in sawdust just did it for you.

“You gonna stand there all night?” he called out with a smirk.

Walking over, you hopped up on one of the counters and took a small sip of his mason jar whiskey, slightly cringing at the taste.

“You know who would be really great for Ellie? Nick. I think their different personalities would really even each other out.”

“Rule number 12, sweetheart.”

You rolled your eyes at his comment. Since when do any of his subordinates follow it, including himself. You knew all about his past with the director and Sloan, he wasn’t fooling anyone.

“Rule number 83. Don’t be a hypocrite,” you quipped, making up your own rule.

He gave you the look that you see from him to his team all the time but it didn’t work on you so you just smiled cheekily back at him. He stopped sanding and came over, taking the glass from your hands and finishing the awful brown liquor, your arms snaking around his neck. He smelt like a lumbermill mixed with a distillery and you loved it. You loved it even more when you pulled him in for a kiss and tasted the leftover vapors of his whiskey on his tongue. The effect of drinking your 3 glasses of wine had you feeling warm and fuzzy and made Jethro’s touch electric.

When you two pulled away, he tucked a loose strand of hair behind your ear before speaking. “Let’s go to bed.”

Not needing any convincing, you nodded and he helped you down, taking off his toolbelt and carelessly dropping it on one of the tables before following you back upstairs.

#gibbs x reader#leroy jethro gibbs#ncis#ncis fanfiction#agent gibbs#mark harmon#ncis request#jethro gibbs x reader#ncis imagine#jethro gibbs fanfiction

198 notes

·

View notes

Text

Confrontation - Stardew Valley Elliott x Player

(or: Elliott has a shitty father, but you are there to protect him)

It’s a late morning in Pelican Town. You just sold some fish to Willy and earned quite a big amount of cash - at least, compared to what you’re used to. You were lucky both with your fishing rod and your crab pots.

“Ain’t you gonna sell me that one too? Very nice piece of lobster, it is.” Asks Willy, but you already have plans for that particular lobster.

“It’s a gift.” You answer with a mysterious smile.

As you head towards Elliott’s cabin, you start hearing something strange. There’s two voices coming from the hut. One you know and - dare you say it - love. It’s the voice of your favourite writer, with whom you’ve spent countless hours talking, flirting and helping him with his chapters. And precisely because you know it so well, you can tell that Elliott is in huge distress, even before you can understand the words.

The other voice belongs to an older man. You don’t know him, but you quickly piece the puzzles together. Now, that you came closer to the doors and can hear the voices clearly, you have a nasty feeling that you know exactly who is causing your friend to squirm and stutter, like he almost never does.

“I’ve told you, I’ll get you your stupid money next month!” Elliott raises his voice.

“My stupid money” The other person is calm, but you can sense the storm underneath. “was what paid for your university. Which you didn’t even finish.”

“Only because, as I always told you, I didn’t want to go to medical school!”

“Well, maybe if you’ve spent more time thinking realistically about your future, and less time chasing your unrealistic childhood dreams, you’d have a better living conditions than… this.”

You don’t see the person talking, but you know for sure that they just made a gesture around Elliott’s small, dusty home.

“Father…” Elliott tries as hard as he can to be calm. “I will get you the money. I’ve been commissioned to write a few commercials for the local newspaper. Just as I told you in a letter, your 2000g will be ready to pick up next month.”

The man scoffs, not even trying to hide contempt. “Commission for a commercial? Oh yes, I see that your goal about being an author is just about to be reached. I hope that the local newspaper pays well, because when I return to you next month you will be owing me 3000 gold.”

There is a moment of silence in the cabin. Elliott is speechless. You are too. What kind of % is this?! Even Joja Corp has a more lenient policy of collecting their debts.

“You can’t be serious.” Says finally Elliott. He sounds hopeless.

“Oh, I can assure you I am dead serious. If you don’t like my conditions, you shouldn’t have signed on that loan document.”

“You have made me sign it…” Elliott’s voice is now trembling with anger. “When I WAS EIGHTEEN! Barely a legal adult, and you screw me into some sick agreement that makes me pay you thousands of g if I don’t go the career path that you chose for me?! You call that fair?!”

“Absolutely.” The voice is still very calm, very cold and very… cruel. “Had you been paying attention on business class I and your mother payed extra for, you would have known how to properly read the contract. Instead you wanted to… scribble some nonsense. And where have that brought you?”

You look into your wallet and bite your lip. Inside are almost all your savings - the money you just got from Willy and most of what you had at home. The plan was to buy seeds and a reserve supply of hay for it… But as you’re making calculations in your head, you already know what you’re going to do.

Well, thank Yoba for the theatre club in high school.

“Hello Elliott!” You walk in without knocking, pretending to be in the highest spirits and to not even notice the stress and terror on your friend’s face. You pass the tall man in a suit (ridiculous choice for this warm weather) ignoring him completely, which brings you some semblance of satisfaction.

“Elliott, sorry that it’s so late” You put a big block of cash on his wooden table. “but I brought back the money you’ve lend me.”

Writer must have also attended theatre classes at some point, because the pace with which his expression changes from confused to absolutely serious could win him an Oscar.

“Thank you, y/n…” He reaches for the money, but his father snatches it before him. He looks at you and at the banknotes with distrust, licks his long, thick fingers and starts counting.

“Hundred and fifty… three hundred… Hmm.” He rises his eyebrows in surprise, the first genuine sign of emotion that he let out in your presence. “You can call yourself very lucky, son, this money is enough to pay off your debt… this instalment of it.”

You feel your insides boiling.

“So tell me… y/n, was it?” He acknowledges your presence for the first time, giving you the most fake, vicious smile you ever saw. “It is a frequent habit of my offspring to lend people such a significant sums of money?”

“Actually,” You lie without skipping a beat. “these are profits from Elliott’s investment.”

The man raises his eyebrows again.

“Investment?”

“Of course!” You smile cheerfully, while focusing all your thoughts on wishing that Elliott’s father would be struck by a lightning bolt, right then and there. “In the last season, Elliott encouraged me to take a risk and plant a certain cropp. The cropp he advised proved to be very profitable, and now I’m returning what Elliott gave me. With interest.”

“My son actually had enough of a brain to lend with interest? Pray, tell me, farmer… what were the cropps he so wisely advised you to plant?”

“Strawberries.” You still smile sweetly and don’t let yourself be caught on a lie in such an obvious way.

“Hmf.” Elliott’s father clearly isn’t happy that he can’t rub his deduction skills in your face. He turns to his son again. “Perhaps the hardships of rural life brought some manliness out of you. Let’s see, you ow me this much, so what’s left for you is….”

He takes a single banknote out of the bunch and drops it on the floor under Elliott’s shoes. He smirks, watching a helpless fury in his son’s eyes.

“Invest it wisely and maybe you can afford the next payment.” He says as he turns to open the door.

You can’t stand it.

“Excuse me, sir.” You say still sweetly smiling, but now letting a note of anger into your voice. “Didn’t you forget about something?”

The man looks at you with irritation, which for you means a small victory.

“What?”

“To congratulate your son.” Both Elliott and his father seem like they want to say something, but you don’t let yourself be interrupted. “You just witnessed him making a very smart, very profitable financial decision. Shan’t you congratulate him on that?”

“Little… farmer.” The man hunches over you in almost a threatening way. This time you have to try harder to maintain your self-confident face expression. “Making half-responsible decisions with his money is a bare minimum I would expect for an average man his age. Average. And being my son, he dropped below the bare minimum the moment he decided to pick up this stupid writing project of his.” Anger shows on your face and you attempt to say something, but this time the older man is on a dominant position. “He has to learn his place. And so, apparently, should you.”

Elliott’s father leaves in silence, leaving you both stunned for a moment. Writer is first to break the silence.

“T-thank you.” He says shyly and quietly, and it pains you to hear his voice brought down to this level. “You didn’t have to…”

“Don’t mention it.” You still boil with anger at the old man, wishing he was one of the skull cavern monsters you could unleash your sword upon. “This… this piece of shit. This garbage of a human!” You start walking around the cabin, your body can’t contain it’s energy. “The way he talked to you! That…”

Suddenly you stop all actions. Not only your steps and waving your hands, but it seems like your heart and lungs froze in time as well. You put your arms down, very calmly, looking at the writer with wide eyes. The reason is clear.

He flinched.

“Elliott…?” You say, suddenly in very calm voice. “Elliott, did you think that I…?

“N-no, of course not!” Despite the hot weather, Elliott is shaking. He clearly tries to stop his body from making that movement, but he is unable to. Instead he looks at you apologetically, as if he had anything to apologize for. “It’s nothing. I-it’s just…”

“Elliott.” You feel the cold fury flooding all of your insides. “Did he hit you?”

Writer shakes his head.

“Ever?”

No response.

You see red.

You don’t even know when you storm out of the cabin, rushing towards the street in which this poor excuse of a human left his expensive, fancy car. You want to run but something is stopping you, through the blood flow in your ears you hear Elliott’s voice, first very dimly, and then, as he manages to hold you in one place for longer, a little more clear.

“No! Y/n, please don’t go there! Please!”

You push forward, stopping only when you feel warm stream of tears on the back of your shirt.

“Please, y/n, don’t make it worse…” He whimpers. “Don’t make it worse…”

You snap out of your anger. What were you doing? Now the most important thing in the world is to make sure Elliott’s okay!

“I’m sorry…” You whisper and hug him as you both start to withdraw to his cabin. Behind you there’s a loud sound of a car engine and then you hear a leaving vehicle.

Despite the walk to his cabin being very short, by the end of it you practically carry Elliott. You help him sit on his bed, try to make sure he’s okay, ask if he needs anything. He barely responds, manely with nodding or shaking his head. Eventually all you can do is hug him tightly through his panic attack.

Luckily, it’s short. After about ten minutes Elliott’s breath is getting more even, and he is able to caress you gently with his hand.

“Thank you.” He whispers.

“I’m sorry.” You respond, unable to hold in tears any longer. “I f-feel like I’ve only made everything worse.”

“Are you kidding me?” You look in his face. It’s still bit pale, and you can still see dried remains of tears in the corners of his eyes, but the face he makes is pretty close to his usual, confident expression. “I’ve never had anyone so… chivalrously defend me.”

You smile through tears.

“Of course I did defend you, I…” you stop yourself a little. Maybe it isn’t the best idea to add the four-letter word into the mix of emotions you both are currently going through. “… I care about you. Very much.”

He smiles and hugs you tighter, and you can feel the strength coming back into his arms.

“I care about you too.” He whispers in your ear.

#stardew elliott#stardew valley#stardew valley angst#stardew valley fanfic#stardew valley oc#sdv farmer#sdv elliott#sdv headcanons#sdv art#sdv fanfic#hurt/comfort#sdv angst#angst#emotional damage#parental abuse

24 notes

·

View notes

Text

♱⃓ 𝐝𝐨𝐦𝐞𝐬𝐭𝐢𝐜 𝐝𝐢𝐬𝐭𝐮𝐫𝐛𝐚𝐧𝐜𝐞𝐬 ♱⃓

word count: (2.7k)

warnings: mild language use, mentions of weird/uncomfortable texts

⚝ return to masterlist ⚝

𝐜𝐡𝐚𝐩𝐭𝐞𝐫 𝐨𝐧𝐞: 𝐝𝐚𝐦𝐧 𝐭𝐡𝐞 𝐞𝐜𝐨𝐧𝐨𝐦𝐲!

damn the economy. honestly? let's just abolish capitalism itself at this point.

i glared at my bills spread across my table they had personally wronged me. rent. utilities. student loans. grocery reciepts. they all sneered at me, the numbers mocking my rapidly depleting bank account. the numbers didn’t even feel real anymore—just abstract threats in black ink.

i sighed to myself as i stabbed the calculator buttons like it had something to prove, finding the total of my costs for the month. i was hunched over the calculator, paper, and pen in front of me, sat down in my apartment's living room, slumping further into my couch as i saw the number on the small screen: $1,220 total. for one month.

i slumped further into my couch like it might swallow me whole. how was i even alive? no, seriously. i’m a nineteen year old college student with a part-time waitressing job that pays in crumbs and kind-of-okay tips if i smile enough. and somehow, that’s supposed to cover rent, tuition, food, and the occasional mental breakdown? it’s criminal. i should sue.

my mug of tea had gone cold an hour ago, abandoned on my coffee table as i spiraled into financial crisis. my laptop screen had dimmed, buried under a flood of passive-aggressive reminder emails from my professor and unread discussion posts. i was mid-rant to one of my friends from back home—something about capitalism, and student loans. as i was considering the idea of taking on stripping as a night job, she gave me an almost painfully logical answer: a roommate.

why didn't i think of it before? i mean, sure, i'm not exactly the most social person, but, if someone is just kinda in my apartment doing their own thing, and we split rent... hey, doesn't sound that bad to me. after i took a while to think about it, i set up an ad online:

[ad]

🏡 roomie wanted: cheap rent, good times (i hope)🏡

hey stranger :p i’m currently looking for a roommate to split rent with because, well… life is expensive and i’d rather not sell my kidney to afford groceries.

the apartment is decent—small, but cozy. there’s one available bedroom, a shared bathroom, and a living space that’s great for collapsing in after pretending to have your life together all day. rent is reasonable, utilities are split, and i’m close to campus (like a 15-minute walk if you’re aggressively late to class).

about me:

- 19, employed, college student

- primarily introverted, but i’ll talk your ear off about weird dreams and conspiracy theories if you let me

- i mind my business. you mind yours. just peace and harmony.

about you:

- preferably not a serial killer (non-negotiable)

- pays rent on time

- doesn’t force awkward small talk while i’m microwaving leftovers at 2am

general info:

rent: $900/mo (your half = $450) + utilities

available: november 5th

if you’re interested, shoot me a txt: (812) 789-4989

if this turns out to be a disaster, hey, at least we'll have a good story right?

[end of ad]

in all honesty, i wasn’t expecting anyone sane to respond. i mean, have you seen the internet? it’s like craigslist and tinder had a cursed lovechild. but hey, it was worth a shot, right?

a few hours later, the responses started rolling in. and let me tell you—nightmare fuel.

some highlights:

- one man asked if he could bring his pet rats. plural.

- a girl wanted to know if i was okay with “frequent overnight visitors” (translation: random hookups).

- guy who seemed halfway decent casually dropped on me that he was on house arrest for the next six months. i'd be lying if i said i wasn't interested in his backstory.

- one message just said “u up?” at 2am. spiritually? i wasn't.

don't even get me started on the degenerates. i didn't realize how low some people's self-respect can be until now.

my phone buzzed against the counter—here we go, another text. another stranger responding to my roommate ad like it was some kind of dating profile on plenty o' creeps.

seriously, i was two seconds away from tossing the damn thing into the garbage disposal, even though it would probably survive just to spite me. the thing had survived being dropped down three flights of stairs and left out in the rain once. a little white iphone 3g with not a single crack, the screen only covered by a veil of scratches and scuffs. i'll take whatever the hell steve jobs was on when he was making these things.

this text was... interesting, to say the least. here it is:

[unknown number]

7:26PM

💬👀: hey baby. not only can i bring you cheaper rent, but i can also bring you some romance, and a good time. a real good time. ;)

i blinked.

this wasn’t craigslist personals. it was a roommate ad. for housing.

what part of 'quiet, clean, non-creepy individual' translated to 'yes, please sext me'?

before i could even mentally formulate an insult, more messages popped up.

💬👀: just give me a chance. please.

💬👀: i just can't be alone anymore. i can't.

the screen stayed lit in my hand, thumb frozen. i stared, slack-jawed, while the next one rolled in:

💬👀: ...i'm a feminist? if that's your thing?

my first instinct was to throw my phone before this guy sends me something else i would want eye bleach over. second instinct was to screenshot it.

then, after a full minute of silence from me:

💬👀: fine then. you don't have to be such a bitch about it.

blocked.

that was my cue. so long, cassanova.

i felt like i needed to move. i definitely needed some fresh air after... whatever that was.

that was my first thought after blocking that number. not scream, not laugh, not dramatically throw my phone into traffic—just move. sitting still felt like suffocating. and when i felt like that, chores were my go-to. repetitive, mindless. today, it was laundry day. warm machines. detergent that smelled like fake lavender and something mundane.

i tossed my laundry basket in the backseat and drove with the windows down. the air was sharp and cold in that familiar indiana way—like it was daring me to roll them back up. it smelled like smoke, dry leaves, and someone’s horrible idea of pumpkin spice.

bloomington in the fall sometimes made me feel like a background character in someone else’s coming-of-age film. the trees were loud in color. people wore scarves and uggs unironically. there was laughter somewhere in the distance and it wasn’t mine.

i passed my work, lou’s diner on kirkwood—ben’s car was there. i could spot that rusted-out chevy anywhere. i remember he briefly told me it was his uncle's way back when, and it definitely shows. might as well stop in and say hi, right? not like i have much better to do on a sunday besides mope in the laundromat all by myself.

the bell above the door jingled as i stepped inside, dragging a gust of cold air with me. the smell of coffee and grease hit me instantly—familiar and comforting, like old flannel. the place was half-full, locals mostly, all hunched over pancakes and toast like it was a sacred ritual.

i spotted ben almost immediately—i mean, it's impossible not to with that firey head of his. he sat at a booth by the window, hunched over a plate of fries he probably didn’t even order, wearing that same faded brown flannel he always wore when he didn’t know what else to wear. he was halfway through doodling something in the margins of a notepad—little stars, planets, and constellations. he truly was a dork at heart. i casually slid into the booth across from him.

"y'know, it should be illegal to park something that ugly so close to a food establishment. think it'll start making the regulars vomit uncontrollably." i said sarcastically with a smug grin as i looked over at him.

his mouth twitched like he was fighting a smile. he was still looking down at his notebook with tired brown eyes, his wild ginger curls a mess. "y'know, if you insult her again, she'll get pissed off at you. maybe your airbag won't go off."

“excuse me?” i blinked. “her? oh my god. you named the van.”

"she's earned it," he finally looked at me, with that usual boyish smile he had on his face. "and for the record, i didn’t name her. the previous owner did."

i tilted my head slightly. “let me guess. your weird uncle.”

“yep, that's doug. toured with a pink floyd cover band in the eighties.”

i stared at him for a long beat. “that explains so much.”

he grinned and popped a couple of lukewarm fries into his mouth. "so, what brings you here anyway? you're not on shift." he says, his voice slightly muffled on account of the soggy mash of potato in his mouth.

"well, looks like you aren't either." i quipped, a trace of a chuckle in my voice as i spoke. "i saw your shaggin' wagon out front and decided to stop in. was on the way to the old laundromat."

"meg," ben groaned. "don't call it that ever again, i beg of you. besides, her name is betty."

i snorted. "betty?"

"betty," he confirmed with a nod, like it was the most obvious thing in the world. "as in white walls, brown vinyl, smells vaguely like cigarettes and broken dreams betty."

"oh, so she’s a classy woman?" i chuckled, as i pictured the ugly-as-sin van i've come to know and love as some deeply troubled, esoteric woman chainsmoking and sadly sipping on some prestigious martini.

he shrugged, smirking. "of course she is. she’s got character. spunk."

i leaned back in the booth, arms crossed. "you’re one flat tire away from becoming a cautionary tale, you know that?"

"oh meg, you wound me," he said, placing a hand over his chest dramatically. "i’ll have you know she passed inspection last spring."

"right. and i’m the queen of england."

ben just laughed, low and easy, and went back to doodling in the corner of his notepad. he’d already drawn a little spaceship abducting what looked suspiciously like a cow grazing in the grass.

“so, laundry. you heading to that creepy laundromat on walnut?” he asked without looking up.

i nodded, pulling my sleeves over my hands. “yeah. figured i’d be productive. maybe stare into the industrial dryers and reflect on my many life choices.”

he glanced up again, that smile softening. “sounds cozy.”

“it’s something.”

we lingered in that weird, comfortable quiet for a few seconds—the kind that only ever came with ben. no pressure to fill the silence. no awkwardness. just the hum of the old diner lights, the jukebox, and the soft clink of silverware in the background.

i glanced out the window. the sky was starting to go gray, that muted indiana kind of gray where you couldn’t tell if it was 4pm or 9 in the morning. leaves scraped along the pavement like they were trying to get out of town before winter hit.

"i should get going," i said finally, sliding out of the booth. "before someone tries to use the good washers."

ben nodded. "tell betty i said hi."

i raised an eyebrow. "you want me to talk to your van?"

"i want you to respect her."

"not happening, ben."

he grinned. "drive safe, meg."

"you too, cowboy."

───── ⋆⋅☆⋅⋆ ─────

the laundromat was quiet when i got there. not dead, just sleepy. a kid was sliding around on the tile floors in socks while his mom tried to feed quarters into a jammed machine. some guy in the corner was reading the book of psalms like he’d read it a thousand times already—softly mouthing along, underlining a verse with a yellow highlighter that looked like it was running out of ink.

i shook off the memory of kokomo. my bible-belt hometown, all fire and brimstone and well-rehearsed smiles. sunday school stained glass and whispering women in floral skirts.

nope. not today.

i made my way toward a machine in the far back corner, the one with the dent in the side that nobody ever seemed to want. it was cheap and barely functional—perfect.

i dropped my laundry basket down beside it and started sorting through the pile. hoodies, socks, jeans.

i wonder how mom’s doing.

the thought came and went before i could stop it. i tried to stuff it down like the rest of the dirty laundry.

meg, you should really call her more. my hand hovered over the detergent for a second too long.

i hadn’t called her since the beginning of this school year. it wasn’t that i didn’t want to—it was just that hearing her voice always brought everything back, and i wasn’t sure i could face that again. i guess i just hadn’t wanted to hear that soft, tired voice laced with all the things she didn’t say. she always sounded like she was waiting for me to come home. not in a clingy way—just… like she still held space for me, waiting for me with open arms. sorry, mom.

the washer beeped. i snapped back into the room.

coins in. start button. spin cycle. move on.

the hum of the dryers filled the air like static. i sat on the little wooden bench by the window and watched the red leaves outside twist in the wind like they were trying to dance their way off the branches.

it was always like this.

bloomington in october. beautiful. lonely. loud in the ways that didn’t matter.

i stared into the washer drum as it spun, letting it hypnotize me. socks and hoodies and pillowcases tumbled like they didn’t have a care in the world.

must be nice, i thought. somewhere between the suds and spin cycles, i let myself breathe once again.

after reloading my clothes into a different machine, the dryer hummed behind me, its rumble rattling gently through the old laundromat floor. i sat on the cold bench by the wall, thumb absently tracing the edge of my phone, mind somewhere else entirely.

across the room, the kid in socks had finally tired himself out. he now sat curled up beside his mom, watching the dryers spin with the kind of wide-eyed wonder you only get before the world fucks you up.

i kept glancing at my phone, not because i was expecting anything, but because hope’s a stupid little habit you can’t quite quit.

i thought back to earlier today, being hunched over my coffee table, feeling the dollars in my bank account withering away with each number i punched into that damn calculator.

the hours at the diner weren’t cutting it, and neither were the uncomfortable couch sleeps at liza’s. i needed a roommate, and soon.

preferably one who didn’t sext me immediately or try to convert me to pyramid schemes.

a heavy sigh left my chest before i could stop it.

this wasn’t what i pictured when i thought about college. i thought i’d be in some dorm room with a cork board full of polaroids and twinkly lights, having the time of my life. not... whatever this is.

i reached for my laundry basket just as the dryer clicked off with a soft thunk.

the kid smiled at me as he left.

i smiled back.

i looked at my phone once again, skimming through the notifications i've recieved from the puddle of unsaved numbers of strangers i didn't even know the names of.

maybe this was all just a big mistake on my end.

okay, fuck it. a week. i’d give it one more week.

and if no one normal showed up by then, i’d delete the damn ad, burn my phone, and move into a cave somewhere. become the next small town urban legend or something.

and at that point, maybe i’d even start enjoying being the joke.

and if the universe had a sense of humor? it was about to make me its favourite punchline.

───── ⋆⋅☆⋅⋆ ─────

next chapter coming soon! thank you for reading, xoxo <3

#rdr2#red dead redemption 2#jack marston#miley writes#rdr fic#domestic disturbances#modern#college au#red dead fandom#red dead redemption#john marston#arthur morgan#dutch van der linde#abigail marston#charles smith#fanfiction#fanfic#jack marston my beloved

18 notes

·

View notes

Text

Fuck it! US Private Student Loans Guide!

DISCLAIMER: while I have worked in private loans specifically for five+ years, this isn't ‘financial’ advice and is just a heavily summarized guide on how to navigate them. Yes, these loans suck, but complain to your legislators not me. I’m just trying to help you know what you’re doing. Additional info for each section is under the cut!

1) Who are you and who are all the companies constantly running around with my money?

I work in loan SERVICING, which is basically the billing department. If you’ve got a new company asking you for money, it's probably a new servicer and your debt is still owned by the bank. We enforce the terms in the promissory note, the document you sign telling the bank “yeah I'll play by your rules if you give me the money.” If your loan defaults, you’ll get contacted by a third (fourth?) party, but how that works is beyond my wheelhouse. The bank or your servicer should be able to confirm what happens in case of default.

2) What am I looking for in a ‘good’ loan?

Generally, you’re going to want SIMPLE instead of compound interest, a FIXED RATE opposed to a variable one, and you’ll want to go for FULL DEFERMENT while in school and make manual payments when you can. Also ask up front about stuff like if disability forgiveness or co-signer release (getting your parents off it) is offered.

3) This loan sucks! How do I make it better?

Student loans are NOTORIOUSLY hard to get out of, unfortunately. If the interest rate/payment relief options suck, you can try to REFINANCE where you take out a new loan to pay off the old one. This gives you a new promissory note, interest rate, and terms/conditions. If you’re trying to erase the debt entirely, ask for the promissory note (if they can't provide a copy, we have to forgive the debt. I've only seen this happen ONCE.) or try to go through social security disability.

DO NOT USE FREEDOM DEBT RELIEF OR OTHER SERVICES. DO NOT. THEY ARE SCAMS.

More in depth information for each point!

1) Lenders and Servicers

The lender is the person who provides the funds in the debt - the bank who pays the school or the hospital or the home contractor fixing your sink. The servicer is the company that is your point of contact when you need to make payments, ask for payment relief, or otherwise manage the loan that exists. Think of us as the mechanic (we keep the car running) where the bank is the manufacturer (they make the car). Some different servicers are SoFi, Zuntafi, Great Lakes, Nelnet and Firstmark Services; their names will be on the billing statements. Some different banks are Citizens, US Bank, NorthStar; their names will be on the promissory note and the disclosures.

Sometimes banks do sell the debt, however! A couple years ago Wells Fargo sold an enormous chunk of their loans off somewhere (an investment group, maybe?) but! The promissory note will still be the EXACT same if your debt gets sold. You’ll only get a new promissory note if you refinance the loan yourself.

2a) Interest Accrual and Rates

Interest is how banks profit off the loans they give out and/or ‘ensure they don't end up with a loss if the loan defaults’. (It's profit.) Most, but not all, loans calculate interest with the simple daily interest formula, shown below:

[(Current loan balance) x (interest rate)] divided by 365

If your loan’s balance is $10,000 and your interest rate is 6% you’ll be charged $1.64 each day. SIMPLE INTEREST means that this interest just kind of floats around on the account until a payment comes in and pays it off, where COMPOUND adds that interest to the balance at the end of the month/day/whatever. Compound charges you more over the life of the loan.

FIXED INTEREST is a set percent that doesn't change, where VARIABLE will change usually based on whatever the economy is doing. There’s a minimum and maximum value to the variable interest rates, so if you’re doing a variable ASK WHAT THE MINS AND MAXES ARE. A fixed rate might be 8% and a variable might be 3.25% the day you take it out, but that variable could have a maximum interest rate of 25% so be VERY, VERY CAREFUL. If you get stuck in a real bad variable interest rate, your best solution is probably a refinance.

2b) Deferment and Payment Allocation

So interest is gonna be accruing on your loan from the day the money leaves the bank. Sucks. And you may not be able to make payments while you're in school, so opting to DEFER your payments will stop them from billing you so you can skip a month or whatever without penalty. At the END of that deferment, though, whatever interest that accrued will be added to your current balance. If we use the example from above (10k loan with 1.64 daily interest) four years of school will add $2,400 to your balance and then your daily interest will jump up to $2.03 a day.

Solution? Make payments of what you can while you’re in school to chip away at that floating interest. Usually when you make a payment, it’s gonna go towards the interest first and then the rest drops the balance. (E.g. if you make a $20.00 payment ten days after your loan is disbursed, $16.40 will go towards interest and $3.60 towards your 10k balance). There is NO PENALTY for making extra payments or making early payments, but it might make your bills look a little weird if you’re being billed each month for just the interest.

3) Why are these loans so horrible? Can’t I find anything to help me?

Blame Reagan and the republicans who enabled him.

No, but really. The problem with these loans is that those promissory notes are VERY legally binding and have lots of fine print in there designed to make it as hard as possible for someone to skimp out on their debt without having their credit score decimated. Some lenders might even dip into your paychecks if you're crazy behind or default; again, that's not my wheelhouse and I've only maybe seen that once. Your best bet is just to pay it off as fast as possible (again, no penalty for paying the loan off early) or refinance into better terms.

And I get it. I really do. I hate how we’ve made so many incredibly important things in our society locked behind a paywall that charges poor people more to climb than the rich. But if you’ve made it this far, please don't turn your anger at me for not giving you the answers you want. The best I can do is vote for people who are willing to crack down on predatory lending, keep fighting for student loan forgiveness… and at my own job, make sure that my coworkers aren't making mistakes.

If you have a more specific question, I can try to answer as best I can without breaking any information privacy laws. And take care, okay? You are never fighting alone.

#private loans#student loans#school loans#loan forgiveness#long post#credit score#credit services#debt relief#debt consolidation#I spent like two weeks off and on with this PLEASE REBLOG but also PLEASE BE NICE

194 notes

·

View notes

Text

After graduating, a boy asked his father, "Dad, what is a successful life?"

The father did not answer directly, but said, "Come with me, today we will fly a kite. Then I will answer your question."

The boy was surprised and said, "What are you talking about, dad! You will fly a kite at this age!"

The father then took his son by the hand and took him to the field behind the house. There were some children flying kites. The father asked one of them for his kite and started flying. He was untying the thread from the spool and the boy was watching intently. After the kite had risen quite a bit in the sky, the father said, "Look, how the kite is floating in the air even at such a high altitude. Don't you think that the tension of this thread is preventing the kite from going higher?"

The boy said, "That's right, if there was no thread, it could have gone higher!"

The father cut the thread in a hurry. The kite was freed from the string and at first rose a little, but after a while it descended and disappeared into the distance.

Now the father patted his son's back and said, "Listen, my son, from the height or level we are or have reached in life, it often seems that some bonds like the string of a kite prevent us from going higher. Such as home, parents, wife, children, family, friends, discipline, etc. And we also want to be free from those bonds sometimes. In reality, those bonds are what keep us high; they give us stability, they prevent us from falling down. Without these bonds, we may be able to go up a little for a moment, but in a short time we too will fall like that stringless kite! If you want to stay high in life, never break those bonds. Just as the combined bond of the string and the kite gives the kite its balance in the sky; similarly, social and family bonds give us the balance to stay at the peak of success. And this is the real successful life.

Life is a strange battle! The older you get, the more you will realize this truth. This battle is also not fair.

You will see before your eyes someone born with an extraordinary brain, turning the pages of the book the night before the exam and getting brilliant results, and you study like crazy day after day, but you are not getting any benefit.

In the meantime, you will see that some people are born in a family full of money. They do not lack for anything. And your father sweats while collecting your semester fees. Then you will be very proud of the world. But as I said, the battle of life is not fair.

Someone with worse results than you will get a job worth lakhs of taka. Maybe that interview was better, maybe he had references, maybe he had skills — I don't know, something will happen! Someone will have a company with a valuation of crores of taka through startups. Seeing the millions of taka of YouTubers or Facebookers, questions will arise about your career choice every day.

Some will get promotions year after year, some will complete their PhD in New York and give life events. On the other hand, some will end up in jail after losing their business and not being able to repay their loans. Some will not get a job despite their efforts — after giving twenty-two interviews, they will feel that there is nothing more cruel than life.

If you want, you can compare yourself with others all day long. If you think about those who have come forward in the battle of life, nothing will happen except regret. You will not be able to reconcile the calculations. Luck, talent, skill, hard work, destiny — life's equation cannot be reconciled with so many variables.

There is no end to being good. Those who have no place to live want a house. The person hanging on the bus dreams of a car and the person riding in a sedan car looks through the catalog of SUV cars. The person in the SUV again finds a 2,000 square foot apartment.

The battle of being good is like this. A never-ending, uneven race with no finish line. Just keep running, keep running, every day, every moment!

Shampa........ ✍️

#writers on tumblr#love poem#creative writing#poetic#poem#original poem#poets on tumblr#writers#writeblr#poetry#writing community#writing#writers and poets

5 notes

·

View notes

Text

The adoption of the euro in Bulgaria is not expected to cause fast loans to become more expensive, and borrowers already have the tools to track and understand how their loans will be repaid after the currency transition.

The Association for Responsible Non-Bank Lending has issued several recommendations for consumers. At the top of the list is a reminder to rely solely on the official exchange rate of the Bulgarian National Bank (BNB) when recalculating amounts, rather than trusting third-party or unofficial rates. Many non-bank lenders have already integrated automatic calculators into their systems, which allow borrowers to see how their loans will convert using the BNB's fixed rate.

Roughly one in four Bulgarians has taken out a fast loan at least once. However, the association does not anticipate a spike in borrowing. These loans are typically used for manageable short-term needs - home repairs, vacations, or electronics purchases - rather than major financial commitments.

Nikolay Tsvetanov, chairman of the association, emphasized on Nova TV that the cost of these loans is capped by the Consumer Protection Act, which ties the maximum cost to a percentage of the principal. This means the cost limit remains unchanged regardless of whether amounts are expressed in leva or euros.

He underlined that there’s no financial basis for lenders to increase interest rates simply because of the euro’s introduction. Should any company attempt to do so under false pretenses, it would be in violation of the law and subject to sanctions.

4 notes

·

View notes

Text

A Step-by-Step Guide to Home Loan Application Processes in India

Buying a home is a dream for many people in India, and taking a home loan is often the most practical way to make this dream come true. While the process may seem complicated initially, breaking it down into simple steps can help you understand what to expect and prepare accordingly. Whether purchasing an apartment, a villa, or a plot in a large project like Godrej MSR City in Shettigere, knowing how to apply for a home loan can save time, reduce stress, and even help you get better loan terms.

Step 1: Check Your Eligibility

Before applying for a home loan, check your eligibility based on your age, income, job type, existing liabilities, and credit score. Most banks and NBFCs (Non-Banking Financial Companies) offer online eligibility calculators. A good credit score (typically 750 and above) increases your chances of approval and may help you get better interest rates.

Tip: If you're buying a plot or home in a reputed project like Godrej MSR City in Devanahalli, lenders are usually more willing to approve loans due to the builder's credibility and clear legal documentation.

Step 2: Choose the Right Lender

Compare banks and housing finance institutions based on interest rates, processing fees, prepayment terms, and customer service. Consider both fixed and floating interest rate options and choose what suits your long-term goals.

Step 3: Gather the Required Documents

Prepare the following documents before applying:

Identity Proof: PAN card, Aadhaar card, or passport

Address Proof: Utility bill, voter ID, passport

Income Proof: Salary slips (for salaried) or IT returns (for self-employed)

Bank Statements: Last 6 months' statements

Property Documents: Agreement to sell, allotment letter, or builder-buyer agreement

Employment Proof: Offer letter or employment certificate (for salaried individuals)

If you're purchasing a home in an established township like Godrej MSR City in Bangalore, the builder often assists with documentation and coordination with banks, making this step easier.

Step 4: Submit the Loan Application

You can apply online or visit the bank branch. Fill out the home loan application form and attach all necessary documents. Pay the processing fee, which typically ranges from 0.25% to 1% of the loan amount.

Step 5: Loan Processing and Verification

Once the application is submitted, the lender will verify your documents and may conduct a personal discussion to confirm your repayment ability. They will also evaluate your credit score and verify your employment and income details.

Step 6: Property Valuation and Legal Check

The bank will inspect the property to ensure it has a clear title and matches the legal and construction norms. This includes a site visit and checking RERA registration, building approvals, and sale agreements. Reputed projects like Godrej MSR City already have these legal clearances, which speed up the process.

Step 7: Loan Sanction and Offer Letter

Once everything checks out, the lender will issue a sanction letter mentioning the loan amount, interest rate, tenure, EMI, and terms. Read this carefully before accepting.

Step 8: Loan Agreement and Disbursement

After you accept the offer, the bank will ask you to sign the loan agreement. Once signed, the loan is disbursed — either in full (for ready-to-move homes) or in stages (for under-construction projects). The disbursement is often linked to construction progress if you're buying in a phased township like Godrej MSR City in Shettigere.

Bonus Tips for a Smooth Home Loan Experience

Keep Your Credit Score Healthy: Avoid delays in existing EMIs or credit card payments.

Plan Your Budget Wisely: Factor in down payment, registration charges, and interior costs.

Use Builder Tie-Ups: Many top builders, including Godrej Properties, have tie-ups with leading banks for quick processing and better rates.

Read the Fine Print: Before signing, understand prepayment, foreclosure, and late payment charges.

Conclusion

Applying for a home loan in India is a well-defined process; being prepared can make it much easier. If you are considering a home or plot in Bangalore, especially in fast-developing areas like Devanahalli and Shettigere, choosing a project like Godrej MSR City can simplify the home loan process due to its transparency, clear documentation, and builder-bank relationships.

youtube

#godrej properties#apartments#real estate#bangalore#north bangalore#Youtube#godrej msr city#godrej shettigere#godrej devanahalli#godrej msr city shettigere#godrej msr city devanahalli

2 notes

·

View notes

Text

Avoid Costly Mistakes: Use an Expat Mortgage Calculator Before You Buy

If you're an expat thinking about buying property in the UK—especially for buy-to-let purposes—there’s a lot to get excited about. But before you jump in, let’s be honest: it’s not always as straightforward as it looks. Between fluctuating exchange rates, different lending rules, and the sheer logistics of buying from abroad, it’s all too easy to make expensive mistakes.

One of the smartest things you can do early on? Use an expat mortgage calculator.

It might sound simple, but this one tool can help you sidestep hidden costs, get realistic about your budget, and ultimately save you thousands. Whether you're browsing your first investment flat in Manchester or lining up multiple buy-to-let properties across the North, getting your numbers right is essential.

Why Expat Mortgages Are a Different Beast

Buying a home in the UK as an expat isn’t the same as buying one as a local. Not even close.

You’re dealing with different currencies, unfamiliar lending policies, and stricter lending criteria from UK banks. Most expat mortgage lenders UK will want a larger deposit—often 25% or more—and might not accept your full overseas income when assessing how much you can borrow. Some won’t even lend to expats unless you're earning in a specific currency.

It’s no surprise, then, that many people misjudge how much they can actually afford. That’s where a down payment and loan calculator designed for expats becomes essential. It helps you figure out exactly how much capital you’ll need upfront, and what your repayments might look like over time.

So, What Does an Expat Mortgage Calculator Actually Do?

Put simply, an expat mortgage calculator gives you a clearer picture of what you’re getting into financially.

You can use it to:

Estimate how much you might be able to borrow

Work out your monthly repayments

Test different interest rates and loan durations

See how your deposit size impacts your loan

Check how rental income affects buy-to-let affordability

And if you’re going down the investment route, a specialist expat buy to let mortgage calculator UK can help you understand the relationship between potential rental income and your loan requirements—something most lenders assess very closely.

Avoiding Costly Mistakes Before They Happen

Let’s walk through a few common slip-ups that trip up overseas buyers, and how using a calculator can help you dodge them.

1. Misjudging Monthly Costs

A big mistake? Assuming your monthly mortgage repayments will be manageable—then realising too late that the interest rate for expats is significantly higher than for UK residents. This can add hundreds of pounds to your monthly outgoings.

With a calculator, you can play around with different rate scenarios and get a true sense of what your repayments could look like. No nasty surprises.

2. Overestimating Borrowing Capacity

It’s easy to assume that if you earn £100,000 abroad, lenders will treat that the same as if you earned it in the UK. But in reality, many expat mortgage lenders UK apply what’s called "income shading" — only counting 70–80% of your income, depending on the currency and country.

A decent mortgage calculator built for expats can account for this, giving you a more realistic loan estimate right from the start.

3. Forgetting the Buy-to-Let Rules

If you're planning to rent out the property, you’ll need to meet certain rental income thresholds. Most lenders require the expected rent to cover at least 125–145% of the mortgage repayments.

This is where an expat buy to let mortgage calculator UK shines. It helps you figure out whether your chosen property will meet the affordability criteria before you even approach a lender.

4. Assuming a Small Deposit Is Enough

Unlike standard UK buyers, expats often need to put down a larger deposit. It’s not unusual for banks to ask for 30–35%, especially if you’re earning in a non-sterling currency.

Using a down payment and loan calculator helps you model how your deposit size impacts your loan terms and repayments—so you can plan accordingly and avoid scrambling for extra funds later.

5. Picking the Wrong Mortgage Product

There’s a variety of mortgage types available to expats—fixed-rate, variable, interest-only, tracker loans, and more. Each one has pros and cons depending on your risk tolerance and investment goals.

A good calculator lets you simulate different mortgage types and see how they perform over time. It’s a great way to compare options and identify the one that fits best with your long-term plans.

Don’t Skip the Human Advice

While a calculator is brilliant for getting the basics down, it’s not a substitute for expert guidance. Once you’ve run your numbers, speak to a seasoned expat mortgage broker UK.

A good broker knows which expat mortgage lenders UK are currently active in the market, what their criteria look like, and how to position your application for success. Better yet, they can access deals that aren’t available to the general public.

When you walk into that conversation already armed with solid estimates from a calculator, you’re ahead of the game.

What to Look for in a Quality Calculator

Not all calculators are made equal. Some are too basic, others aren’t designed for expat scenarios.

Here’s what to look for:

Ability to adjust interest rates, loan terms, and currency types

Support for buy-to-let affordability checks

Options to compare different deposit levels

Compatibility with international income types

Integration with current UK mortgage market trends

Choose a calculator that reflects real-world lending practices and you’ll save yourself hours of backtracking and rework.

Final Thought: Get the Numbers Right, Then Take Action

Buying property as an expat doesn’t need to be risky or stressful—but it does require planning. Whether you're buying a flat in Leeds to rent out, or thinking about long-term capital gains in Liverpool, your first step should always be to crunch the numbers.

Using an expat mortgage calculator helps you prepare, budget, and invest smartly. It’s not just about getting a rough idea—it’s about avoiding big financial mistakes that could eat into your returns.