#Red Spectrum

Explore tagged Tumblr posts

Text

Lunar Eclipse

#lunar eclipse#blood moon#night sky#astronomy#nocturnal#phenomenal#total eclipse#red spectrum#Toronto#Ontario#Canada#celestial#vivid#night photography#14 March 2025

9 notes

·

View notes

Text

Gen 3

#rwby#ruby rose#may zedong#emerald sustrai#precious gems#gemstone#jewelry thief#quickscope#shades of red#red spectrum#may x emerald#may x ruby#ruby x emerald#emerald x ruby#gen 3

34 notes

·

View notes

Text

Beyond Loans: How Strong Business Credit Can Unlock Grants and Government Contracts

How to Use Business Credit to Secure Grants and Government Contracts

Imagine this: You’ve poured your heart and soul into your business. You have a vision, a solid plan, and the drive to succeed. But when you apply for that game-changing grant or that lucrative government contract, you’re met with a disappointing denial. Why?

It’s a question many small business owners face, and the answer often lies in a place they may not have fully considered: their red spectrum business credit.

We all know that good business credit is essential for securing loans and lines of credit. Lenders want to see a history of responsible financial management before they entrust you with their funds. But the truth is, strong red spectrum business credit is a silent key that can unlock so much more.

The Untapped Potential of Your Business Credit

Forget the old notion of business credit as just a score for loans. It’s a dynamic, compelling narrative of your company’s financial prowess. It’s the story that speaks volumes to potential partners, investors, and agencies about your reliability, stability, and capacity to handle responsibility.

Think of it this way:

It’s not just about if you can borrow money.

It’s about who wants to invest in your vision.

This article will show you how to make that story a bestseller and how services from companies like Red Spectrum can help.

Unlocking Doors You Didn’t Know Existed

Here’s how strong business credit acts as your ultimate key:

Grants: The Credibility Factor

Grant-awarding organizations, whether government agencies or private foundations, aren’t just giving away money. They’re investing in outcomes. They need to know that their funds will be used responsibly and effectively to achieve the intended goals.

A strong red spectrum business credit profile demonstrates that you have a proven track record of financial responsibility. It tells them:

“We manage our finances with precision.”

“We are accountable for our obligations.”

“We are a safe investment.”

In essence, you’re not just asking for funds; you’re offering a partnership built on trust and a solid foundation.

Government Contracts: Your Foot in the Door

Government agencies aren’t looking for the cheapest bidder; they’re seeking reliable partners. They award contracts to businesses that can demonstrate the capacity to handle the project’s financial demands, from initial investment to long-term execution.

A positive business credit history, especially one built with tools like Red Spectrum’s net 30 accounts, signals that your company possesses:

Stability: You can weather economic fluctuations.

Reliability: You consistently meet your obligations.

Capacity: You have the resources to handle the contract.

In a competitive bidding process, this translates to a significant advantage. It’s the assurance that you’re not a risk, but a sound investment.

Turning Your Business Credit into Your Greatest Asset

Building this powerful financial narrative isn’t complicated, but it requires a proactive and strategic approach. Here’s how to lay the groundwork for success, with a focus on how Red Spectrum can assist you:

1. Lay the Groundwork: Establish Your Identity

Ensure your business has a distinct legal structure (LLC, corporation, etc.). This establishes your business as a separate entity, demonstrating professionalism and commitment.

Obtain an Employer Identification Number (EIN). This is your business’s unique tax ID, further solidifying its separate identity.

2. Separate Your Finances: The Golden Rule

Open dedicated business bank accounts. This is non-negotiable. It’s not just about accounting; it’s about demonstrating that you treat your business as a serious financial entity.

3. Establish Trade Credit: Building the Story

Begin building credit by establishing relationships with vendors who report to business credit bureaus.

Leverage net 30 accounts. Companies like Red Spectrum specialize in providing these accounts, which aren’t just about buying supplies; they’re about building a positive credit history with every transaction. You purchase goods/services, and you have 30 days to pay. This demonstrates responsible short-term debt management and is a core offering of Red Spectrum (theredspectrum.com/net-30-accounts).

4. Stay Informed and Proactive: Your Ongoing Strategy

Regularly monitor your business credit reports to ensure accuracy. This isn’t a one-time thing; it’s like checking the pulse of your business.

Track your progress and identify areas for improvement. This allows you to course-correct and continuously strengthen your financial narrative. Red Spectrum provides resources and tools to help you with this process (theredspectrum.com/business-credit-builder).

By taking these steps, you’re not just building a credit score; you’re crafting a compelling story that resonates with potential investors, grantors, and government agencies. You’re showcasing a business that is:

Organized

Responsible

Stable

Ready for growth

Your Credit, Your Opportunity

In today’s competitive landscape, those who demonstrate both capability and credibility win. Strong business credit provides that credibility, differentiating you from the competition and significantly increasing your chances of securing the funding and contracts you need to take your business to the next level.

For more information on how Red Spectrum can help you establish and strengthen your business credit, including information on net 30 accounts and our business credit builder program, please visit our website: theredspectrum.com

Don’t let your business credit be an afterthought. Make it a strategic priority, and unlock a world of opportunities you never thought possible. Your future success may depend on it.

#startup#red spectrum#business credit#smb#business#small business enterprise#credit score#strategies#entrepreneur#finance#financial#credit cards#net 30 account#credit

1 note

·

View note

Note

For your gay little dogs

.

#principal skinner pride flag for my gay little dogs#you see this is why my dog people need to see the same spectrum of colors we do#I feel like their literal world view would be drastically altered if they couldn't distinquish between orange and green#I'd argue that red is a significant color in practically every culture#it's instinctual associations with danger food and fertility make it attention grabbing on a visceral monkey brain level#I strongly suspect the impact would be at least somewhat negated if it was a muted brownish khaki instead#meaning it wouldn't be used in visual communication nearly as much#I would have to center my art and worldbuilding more around yellow and blue because those would be the colors the dogs would see clearly#right? is that sound logic?#and that would just make me immensely sad because warm colors are my favorites :<#answered#m0notropa-uniflora#something that continues to boggle my mind is that there are animals that see more colors than humans#we like to assume that our color vision is the best we can see it ALL look at that rainbow there that's the full set#yes primates are well equipped in this regard compared to many other mammals like dogs#but most birds for example have more color receptors in their eyes they have more tools to work with and their rainbow is even wider#it's like sound everyone knows we can't hear sounds that are impossibly low or too high#and we can't process wavelengths of light that are too long (infrared) or too short (ultraviolet)#only what lands between those bookends (called the visible spectrum) reads to our human eyes as “light” and subsequently “color”#I hope I've understood this correctly I'm trying to say that there's a whole layer of vision we don't have the hardware to get access to#and that's just wild to me like we are fundamentally unable to imagine a new color that isn't already included in our built-in selection#but they're definitely there the unimaginable colors are in the room with you and a common pigeon can see them#uv dlc not available for your system

598 notes

·

View notes

Text

reposted because i forgot dark's stupid bushy eyebrows im a fake fan </3 BUT HUMANS!! RAAAAAH

#animator vs animation#ava#animation vs minecraft#avm#alan becker#ava the second coming#ava tsc#avm the second coming#avm tsc#ava red#avm red#ava yellow#avm yellow#ava green#avm green#ava blue#avm blue#ava the chosen one#ava tco#avm purple#ava victim#avm king orange#avm mango#ava the dark lord#ava tdl#again. wanted to make more human designs after doing that one design spectrum post#and here we are!!

446 notes

·

View notes

Text

honestly i'm both

#hannibal lecter#bedelia du maurier#bedannibal#me and the devil#girlhood is a spectrum#gillian anderson#mads mikkelsen#lana del rey#sylvia plath#the silence of the lambs#female hysteria#hannibal#ethel cain#ultraviolence#kafkaesque#red academia#lobotomy chic#female rage#dark red#the sacred feminine#the secret history#twin peaks#girlhood#david lynch#delusional#fleabag#divine female#femme fatale#female manipulator#femcel

1K notes

·

View notes

Text

I’m obsessed with these two having completely different emotional journeys on the same fucking relationship.

Shout out to this post that gave me such intense brainworms I dropped everything to draw this.

#one piece#shuggy#buggy the clown#red haired shanks#these two be the whole spectrum of Taylor swift and I’m LIVING FOR IT#obsessed with buggy and his long-ass mental list of reasons he should not let Shanks fuck him and giving in cause he’s too far gone#vs. Shanks who is just YEARNING and IN LOVE

2K notes

·

View notes

Text

sorry but Nicholas Galitzine going from playing a serious conservative asshole Marine (Purple Hearts) to the bottoming homosexual prince of England (Red White & Royal Blue) to a campy narcissistic high school quarterback in a lesbian fight club rom com (Bottoms) is absolutely insane I applaud this man's range and the audacity of his agent

#he's literally him#props to him for creating the spectrum of acting#I just want to put all his characters in a room together and see what happens#ALSO he was in that shitty cinderella remake with Camila cabello#nicholas galitzine#red white and royal blue#also I can't wait for bottoms it looks SO GOOD#rw&rb

1K notes

·

View notes

Text

They all don’t know that I find this mf peak bodytype

All rights of this picture belong to its respective owners. I‘m just using it for entertainment purposes only.

#outlast#outlast whistleblower#outlast game#chris walker#chris walker outlast#red barrels#mount massive asylum#ramblings#autistic things#autism spectrum disorder#autistic spectrum#actually autistic#autism#adhd stuff#living with adhd#adhd things#adhd brain#adhd#actually adhd#live laugh love#live laugh girlblog#girlblogging hehe#girlblog aesthetic#gaslight gatekeep girlblog#gaslight gatekeep girlboss#this is a girlblog#girlblogging#lol#idk what else to tag#idk what to tag this as

149 notes

·

View notes

Text

Cloud Strife stimming hours

#FF7#FF7 Remake#FF7 Rebirth#Cloud Strife#Red XIII#Nanaki#Cait Sith#Yuffie Kisaragi#Dumb Doodles#Sketches#Jooj Arts#Was gonna line and color these but it just wasn't happening asdfijwe#I hc him as autistic or on the spectrum and these are just some of my stuff as an adhd person

487 notes

·

View notes

Text

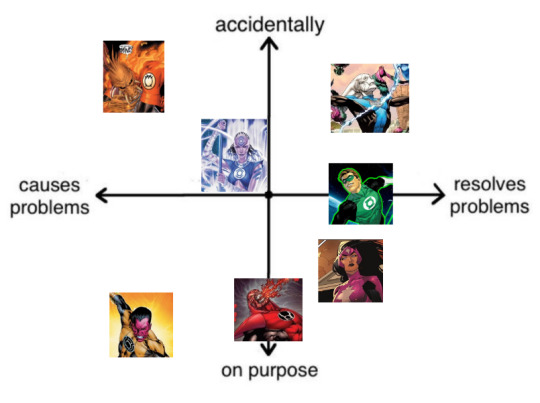

The Rainbow Rodeo re: problems

#hal jordan#carol ferris#sinestro#saint walker#atrocitus#larfleeze#indigo 1#rainbow rodeo#emotional spectrum#green lantern#yellow lantern#red lantern#star sapphire#blue lantern#indigo lantern#orange lantern#dc comics

87 notes

·

View notes

Text

Red Spectrum & Factiiv: A Partnership That’s Redefining Business

How Two Industry Leaders Are Creating Unprecedented Transparency in Business Credit Building.

In today’s challenging economic landscape, small businesses face tightening lending standards and rising interest rates, making access to funding more difficult than ever. Recent Federal Reserve data shows that nearly 40% of small business loan applications are rejected due to poor or limited business credit profiles. Building business credit remains one of the most challenging and misunderstood aspects of financial management for entrepreneurs, especially those just starting out. Red Spectrum and Factiiv have seized this opportunity to revolutionize how business credibility is built, reported, and showcased through their groundbreaking partnership.

The Current Business Financing Crisis

Post-pandemic, the economic landscape for small businesses has shifted dramatically. Inflation concerns, supply chain disruptions, and increasing operational costs have made access to capital a make-or-break factor. Traditional financial institutions have tightened lending requirements, making it harder for new businesses to secure funding.

According to the Small Business Administration, 27% of businesses struggle to access adequate financing, with that number rising to 54% for companies less than two years old. The Federal Reserve’s Small Business Credit Survey found that businesses with strong credit profiles are three times more likely to be approved for financing than those without established credit.

The Personal Liability Trap

Entrepreneurs face a paradox: lenders demand established business credit before extending financing, yet building that credit requires initial financing opportunities. This dilemma forces many business owners to rely on personal credit instruments, creating vulnerability and constraining their venture’s potential.

Industry statistics reveal that over 65% of small business owners use personal credit cards for business operations, with 46% reporting that personal guarantees have negatively impacted their personal credit scores. This over-reliance on personal credit creates a dangerous liability scenario where business challenges can devastate an entrepreneur’s personal finances.

Red Spectrum’s leadership team recognizes the flaws in the conventional approach to business credit building. As pioneers in business credit development, they empower small businesses with the tools, education, and resources needed to establish robust business credit profiles, creating accessible pathways to legitimate business credit.

A Transformative Partnership for Transparent Credit Building

Red Spectrum, known for helping small businesses establish and strengthen their business credit, has partnered with Factiiv, a sophisticated business credibility platform. This collaboration bridges the gap between business credit activity and real-time reporting, allowing Red Spectrum clients to visualize their Net 30 accounts, credit utilization, and performance metrics directly within their Factiiv dashboards. This innovation eliminates uncertainty and fosters accountability throughout the credit-building journey.

The partnership goes beyond simple tradeline reporting, empowering small businesses to own their credibility narrative, enhance visibility to funding sources, and access capital while preserving their personal credit profiles.

Why Business Credit Transparency Matters Now More Than Ever

In an era of economic uncertainty and algorithmic lending decisions, transparency in business credit reporting is crucial. Here’s why:

Alternative lending models are rising: Fintech solutions and alternative lenders are gaining market share, requiring businesses to showcase their creditworthiness across multiple platforms.

Decision timelines are shrinking: Modern lenders make decisions quickly, necessitating real-time access to credit data.

Supply chain resilience requires strong vendor relationships: Post-pandemic disruptions highlight the importance of strong vendor relationships and Net 30 terms for cash flow management.

Economic pressures increase funding competition: With venture capital funding down, businesses need every advantage when seeking financing.

The Red Spectrum-Factiiv collaboration delivers key benefits:

Direct tradeline reporting with monthly updates.

Complete transparency over credit limits, payment history, and milestones.

Shareable credibility profiles for lenders, partners, and investors.

Clear pathways to visibility with major credit bureaus like Equifax, D&B, and Experian.

Supplementary tools including business credit training and funding roadmaps.

This streamlined reporting solution allows entrepreneurs to monitor and share their progress in real-time, enhancing their credibility with potential funding sources.

Beyond Credit Scores: The Evolution of Business Credibility

The business financing landscape is evolving beyond traditional credit scores. Modern lenders consider various factors, including payment histories with vendors, cash flow patterns, and social proof. The Red Spectrum and Factiiv partnership embraces a holistic concept of business credibility, providing business owners with verifiable evidence of financial responsibility.

This evidence-based approach represents a paradigm shift, allowing entrepreneurs to actively manage and showcase their financial responsibility through transparent profiles, rather than relying solely on traditional credit bureaus.

Understanding the Business Credit Building Timeline

Entrepreneurs often misunderstand the timeline for building business credit. It typically takes an average of 7–10 vendor relationships reporting consistently to establish a meaningful profile, and traditional bureaus only update information every 30–90 days. Without intentional strategies, many businesses won’t reach fundable credit profiles until their 3rd or 4th year of operation, contributing to the high failure rate of startups.

Red Spectrum’s Business Builder Membership makes credit building accessible at all stages, offering strategically selected Net 30 accounts, educational resources, personalized coaching, and credit reference documentation to accelerate credibility development.

The Future of Business Financing: Data Ownership and Portability

The financial world is moving toward greater data portability and ownership. This collaboration signals a shift toward data sovereignty and visibility in the small business sector. Factiiv’s platform functions as a comprehensive hub for entrepreneurial insight, allowing users to visualize, share, and manage their credit data efficiently.

For emerging businesses, the Red Spectrum-Factiiv partnership provides a pathway to credibility, liberating entrepreneurs from dependence on personal credit histories or extended waiting periods.

The Bottom Line: Practical Steps for Entrepreneurs

To strengthen their business credit position, entrepreneurs should:

Separate business and personal finances with dedicated business banking relationships and legal entities.

Cultivate relationships with vendors offering Net 30 terms that report to credit bureaus.

Monitor business credit across all major bureaus.

Develop a strategic credit-building roadmap with specific milestones.

Document credit-building progression in shareable formats.

By emphasizing transparency, education, and accessible credit-building pathways, this partnership is redefining business credibility reporting.

To learn more about Red Spectrum and their innovative business credit-building programs, visit theredspectrum.com.

#business credit#red spectrum#credit#credit cards#credit score#net 30 account#smb#small business enterprise

0 notes

Note

So turtles don't need a flashlight to see in the dark? Is that why their eyes are glowing?

So….it’s complicated.

Technically, irl turtles do not have eye glow, which is a reflective film over a creatures’ eyes. Animals such as dogs, cats, and raccoons have this which is why flash photography photos makes them look super cursed/demonic.

It’s technically not an actual glow like fireflies (which use bioluminescence) either, it’s more like how street signs or bicycle reflectors “glow” when a car’s headlights flash over them.

Also important to note that while yes turtles do have a second eyelid, it’s purely for keeping junk out of their eyes while swimming and applying fluid. There’s no reflective property to the membrane.

Now, turtles are said to have better night vision than humans despite lacking eye glow. This is because (at least from what I read) turtles and other types of reptiles are what’s called “tetrachromatic.” Humans are trichromatic: we can see red, green and blue light, however turtles are able to see a fourth light spectrum that’s lower in the reds zones (some creatures it’s higher in the ultraviolet spectrum).

At least from what I’ve read, this helps increase their night vision and would mean that, while it’s hard for us to envision a color that we can see, their nighttime would look sorta reddish but mildly brighter than what we see?

Now, all this said, I’m not sure why the turtle’s eyes glow in most TMNT incarnations—the obvious reason being because it looks cool, but no real in-universe reason exists. My best guess is it’s because of the mutagen’s energy dimly dissipating and is visible through the fine veins in the turtles’ eyes. However, their blood doesn’t glow, just their eyes, so I don’t really know, maybe it’s just a mutant thing or something 🤷♀️

I don’t connect their glowing eyes to better night vision per se, but that would make sense so…sure?

I have no idea.

Good question! :]

#tmnt#q&a#indie tmnt#indie’s turtles#Can you tell I spent way too researching this? 💀#I had exactly the same question#also fun fact#Television probably looks like crap to them because our cameras only record and our TVs only produce light in the red-green-blue scale#So when they watch tv it’d be like us watching tv without one color spectrums#It be like if your tv didn’t produce red light or something#Everything would look so stupid#But anyway…yeah#please correct me if i'm wrong#like seriously#I’m such a nerd I want to hear if I got something wrong

90 notes

·

View notes

Text

Did color see the red of killers soul for the first time and assume that what happened to him also happened to killer initially.

#with the reveal of what happened in the othertale scripts and all#color spectrum duo#cw possession#killer sans#utmv#sans au#color sans#sans aus#othertale sans#othertale#undertale au#killer!sans#killertale#killertale sans#something new#something new sans#something new au#colour sans#color!sans#them both potentially being uncomfortable with the color red#color bc of what happened to gain that color/trait#killer bc of the color of papyrus’ scarf#grow to love the color on eachother#utmv headcanons#utmv hc#undertale something new#undertalesomethingnew#othertale player#othertale her#something new chara

57 notes

·

View notes

Text

At the speed I'm going, all the batfam is going to be asexual.

I read Batgirl (2000) and Cass shows being uncomfortable with being sexualized, something I relate to? She's asexual now.

I read great fics where Bruce was written as asexual? He's asexual now.

I see some good fanart where Jason is wearing a small ace pin, and when I point it out the artist is so excited about their "Asexual Jason Supremacy"? He's asexual now.

I read a post about Dick and how he used to be written uncomfortable with being sexualized and why op hc him as asexual? He's asexual now.

I read and see panels of Jean-Paul being uncomfortable with people (women) being into him or finding him attractive? He's asexual now.

Y'all cannot stop me.

#batfam#bruce wayne#cassandra cain#dick grayson#jason todd#jean paul valley#batman#batgirl#nightwing#red hood#robin#azrael#dc comics#my ramblings#asexuality#lgbtq+#REMEMBER THAT ASEXUALITY IS A SPECTRUM SO YES SOME OF THESE CHARACTERS DID HAVE SEX IN CANON AND STILL BE ACE#also don't come at me with “well they were uncomfortable with this gender so they could be gay and not ace”#because wtf do you need to “protect” them from being hc as asexual??? you would hate that if I did it for your hc#dick grayson being painted as a playboy because people found him sexy is a crime he is not live him alone!!!

103 notes

·

View notes